Admiral Group Bundle

Can Admiral Group Maintain Its Dominance in the UK Insurance Market?

The insurance sector is undergoing a significant transformation, with mergers and acquisitions reshaping the competitive playing field. The potential acquisition of Direct Line Group by Aviva, a deal expected to finalize by late 2025, signals an escalating battle for market share in the UK. This dynamic environment demands a close examination of Admiral Group's position and its ability to compete.

Admiral Group, a major player in the Admiral Group SWOT Analysis, has demonstrated impressive financial performance, with a substantial increase in profit and turnover in 2024. This success, particularly in the UK Motor business, highlights the company's robust operational strategies and its ability to navigate the ever-changing insurance industry. A thorough Admiral Group market analysis is essential to understand its standing amidst its Admiral Group competitors and the broader Admiral Group competitive landscape, including the UK insurance market.

Where Does Admiral Group’ Stand in the Current Market?

Admiral Group holds a strong position in the UK insurance sector, particularly in car insurance. As of 2024, it is the largest car insurance provider in the UK. This strong market presence is a key factor in understanding the Marketing Strategy of Admiral Group.

The company offers a range of insurance products, including car, home, travel, and pet insurance. Additionally, it provides personal loans through Admiral Money. This diversification helps Admiral Group to cater to a broad customer base and reduce its reliance on any single product.

Geographically, Admiral's operations extend beyond the UK, with subsidiaries in France, Italy, Spain, and the US. However, the UK market remains its primary focus and the main driver of its financial results. This is reflected in the customer base, with a significant increase in UK insurance customers compared to international customers.

Admiral Group's market share in the UK car insurance market is substantial. As of 2024, it held an estimated market share of 11.3%. Other sources indicate a market share of around 15% as of June 2025.

Admiral Group generates significant revenue from gross written premiums. In 2024, the company generated over £1.8 billion from gross written premiums. By June 2025, this figure is expected to exceed £3.3 billion.

Admiral Group has experienced notable growth in its customer base. In 2024, the number of UK insurance customers increased by 19%, reaching 8.8 million. However, international insurance customers saw a slight decline of 3% to 2.1 million in 2024.

Admiral Group demonstrated strong financial performance in 2024. Group profit before tax surged by 90% to £839.2 million, and group turnover increased by 28% to £6.15 billion. The return on equity was 56%.

Admiral Group's financial health is evident in its key metrics. The company's solvency ratio, post-dividends, was 203% in 2024, indicating a strong balance sheet. Admiral Money also reported a 23% increase in gross loan balances, reaching £1.17 billion.

- Strong Market Position: Dominant in UK car insurance.

- Revenue Growth: Significant increase in gross written premiums.

- Profitability: Substantial growth in profit before tax and return on equity.

- Customer Growth: Increased customer base, particularly in the UK.

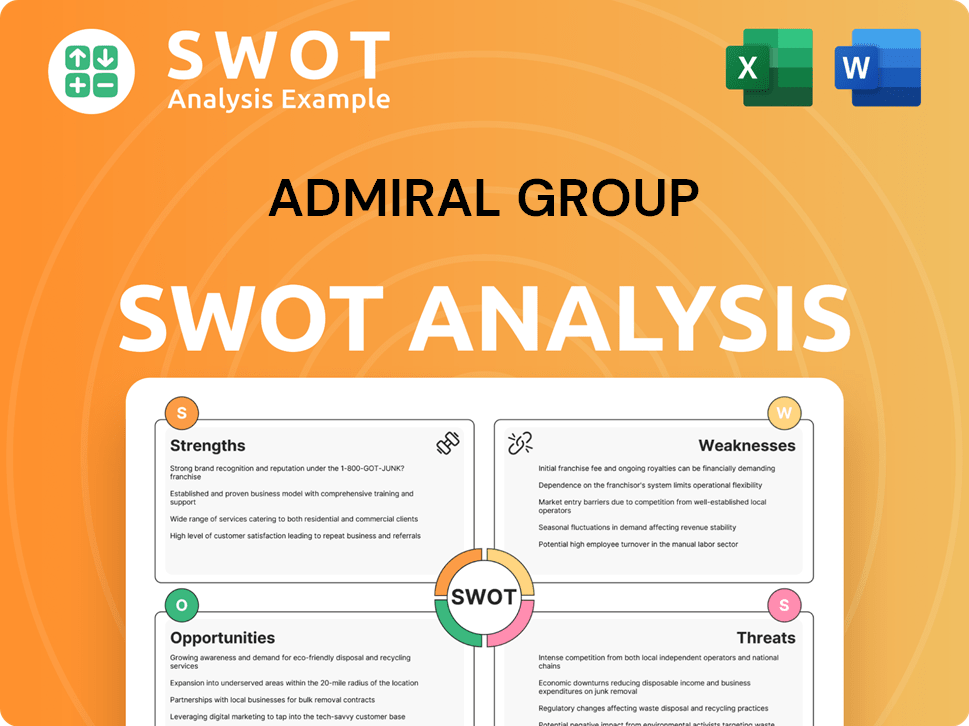

Admiral Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Admiral Group?

The Growth Strategy of Admiral Group faces a dynamic competitive landscape within the insurance and financial services sectors. Understanding the key players and their strategies is crucial for assessing its market position and future prospects. The UK car insurance market, where Admiral Group holds a significant share, is particularly competitive, with numerous direct and indirect rivals vying for market dominance.

The competitive environment is shaped by factors such as pricing, product innovation, brand recognition, and distribution channels. The industry is also experiencing consolidation through mergers and acquisitions, which can significantly alter the competitive dynamics. This overview provides a detailed look at the major competitors and their impact on Admiral Group's market position.

Admiral Group's main rivals include a mix of established insurance providers and emerging players. These competitors utilize various strategies to gain market share, including competitive pricing, innovative product offerings, and effective distribution networks. The ongoing shifts in the market landscape, driven by mergers and acquisitions, further intensify the competition, requiring Admiral Group to adapt and innovate to maintain its position.

The primary direct competitors of Admiral Group in the UK car insurance market include Aviva, Direct Line Group, Hastings Direct, AXA, LV=, esure, RSA, Ageas, and NFU Mutual. These companies compete directly with Admiral Group for market share by offering similar products and services.

As of 2024, Admiral Group held an 11.3% market share in the UK car insurance market. Aviva held 10.6% and Direct Line Group held 10.2%. The proposed acquisition of Direct Line Group by Aviva could lead to a combined market share exceeding 20%, potentially making them the largest car insurance provider in the UK.

Indirect competitors include those offering insurance products or financial services that overlap with Admiral Group's offerings. These may include comparison websites, other financial institutions, and companies providing specialized insurance products.

Competitors employ various strategies, including competitive pricing, product innovation, brand building, and efficient distribution channels. Price comparison websites are a key distribution channel, where many competitors, including Admiral Group, have a strong presence.

The insurance industry is witnessing consolidation through mergers and acquisitions. The potential Aviva-Direct Line deal and interest in esure are examples of this trend. These consolidations can intensify competition and reshape market dynamics.

Market conditions and responses from competitors can create volatility. For instance, Admiral Group has proactively reduced prices in response to market dynamics in 2024. This requires constant monitoring and adaptability.

Several key competitors pose significant challenges to Admiral Group. Each employs distinct strategies to gain market share and maintain customer loyalty. Understanding these strategies is crucial for assessing the competitive landscape.

- Direct Line Group: Operates brands like Direct Line, Churchill, and Darwin. Their proposed acquisition by Aviva signals a major shift in the competitive environment.

- Aviva: Actively expanding in the motor insurance market, using brands like Quotemehappy and leveraging price comparison websites.

- AXA: Sells auto insurance under its own brand and underwrites for others. AXA entered the top 5 for home insurance market share in 2022, gaining 0.4% of the total market.

- esure: Brands like esure and Sheila's Wheels held a 4.9% share of the private motor insurance market in 2023. Potential acquisitions by Allianz or Ageas could alter the landscape.

- Ageas: Actively exploring expansion in the UK personal lines insurance sector, including considering a bid for esure.

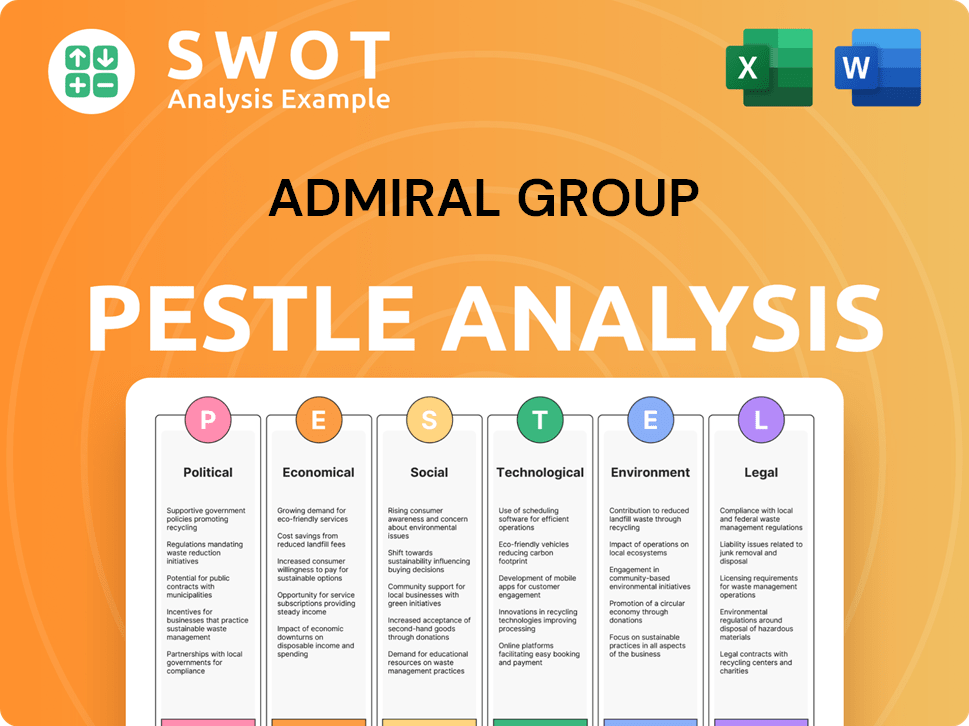

Admiral Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Admiral Group a Competitive Edge Over Its Rivals?

Understanding the Admiral Group competitive landscape requires a deep dive into its core strengths. The company has carved out a significant position in the UK insurance market through strategic moves and a focus on customer satisfaction. This approach has enabled it to maintain a competitive edge against its rivals.

Admiral Group's market analysis reveals a company that consistently adapts to market dynamics. Its ability to leverage data analytics and maintain strong relationships with reinsurers has been pivotal. These strategies, combined with a customer-centric approach, contribute significantly to its success.

The company's financial performance is a key indicator of its competitive standing. By focusing on operational efficiency and agility, Admiral has positioned itself well within the UK insurance market. This chapter will explore the specific advantages that set Admiral apart from its competitors.

Admiral utilizes advanced data analytics and machine learning to refine its pricing strategies. This enables the company to offer competitive rates while maintaining profitability. In 2024, Admiral was among the first to reduce prices in response to easing inflation, attracting more customers.

Admiral benefits from strong relationships with reinsurers, securing favorable reinsurance rates. This strategic approach allows the company to manage risk effectively. The company can be more selective in its risk exposure, which feeds valuable data back into its analytical models.

The company's focus on customer satisfaction and doing the right thing has fostered growth and long-term value. Admiral's robust retention rates have historically been significantly above the market average. The company operates multiple brands in the UK, catering to diverse customer segments.

Admiral's ability to adapt quickly to changing market dynamics and economic conditions is a key strength. This includes a disciplined approach to claims management and continuous efforts to improve efficiency. This agility allows Admiral to maintain a competitive position.

These competitive advantages are crucial for Admiral's sustained success. However, the company faces challenges, including imitation from competitors and potential regulatory changes. For a deeper understanding of the company's customer focus, explore the Target Market of Admiral Group.

Admiral's competitive advantages are multifaceted, encompassing pricing, risk management, and customer relations. The company's strategic approach has allowed it to maintain a strong position in the market.

- Data-Driven Pricing: Sophisticated analytics enable competitive and profitable rates.

- Strategic Reinsurance: Strong relationships secure favorable terms.

- Customer-Centric Approach: Focus on satisfaction drives loyalty and retention.

- Operational Efficiency: Adaptability and disciplined claims management.

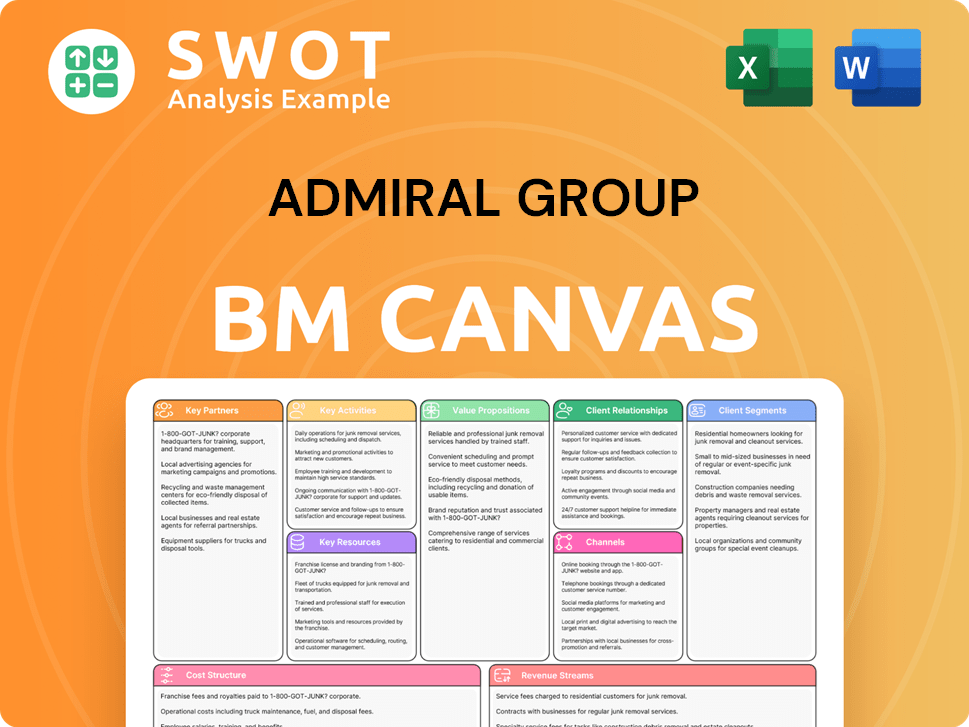

Admiral Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Admiral Group’s Competitive Landscape?

The insurance sector is currently undergoing significant shifts, influencing the Admiral Group competitive landscape. Market softening, especially in UK motor insurance, is a prominent trend, expected to persist into 2025. This situation presents both opportunities and challenges, as it allows for lower prices to attract customers but also creates headwinds for growth. Economic uncertainties, inflation, and regulatory changes further shape the UK insurance market.

Admiral Group's market analysis reveals the need to adapt to evolving customer expectations and technological advancements. The adoption of electric vehicles (EVs) and regulatory changes, particularly concerning add-on product sales, are key factors influencing the company's strategic direction. The company is focused on maintaining profitability while navigating these market dynamics. For a deeper understanding, explore the Revenue Streams & Business Model of Admiral Group.

The insurance industry is seeing a softening market, particularly in UK motor insurance, which impacts pricing and customer acquisition. Technological advancements are driving changes in service delivery, and the increasing adoption of EVs requires insurers to adapt their offerings. Regulatory changes and the scrutiny of practices like add-on product sales are also influencing the market.

Maintaining profitability in a softening market is a key challenge for Admiral. Navigating regulatory pressures and restoring profitability in international markets, such as Italy, are also significant hurdles. The strategic retreat from the US motor insurance market through the sale of Elephant Insurance reflects a focus on core profitable regions.

Admiral aims to grow across its operations, focusing on expanding its product range and leveraging technology for efficiency. Diversifying income streams, particularly in UK Household, Pet, Travel, and Van insurance, and through European franchises, represents a key strategic imperative. Admiral Money also provides a growth area, with a 23% increase in gross loan balances in 2024.

The company is focused on efficiency, agility, and building on strong foundations to deliver long-term growth and remain resilient. Sustainability initiatives and the Net Zero Transition Plan offer opportunities for enhanced brand reputation and alignment with consumer expectations. Admiral's strategy for 2025 and beyond emphasizes these key areas.

Admiral's strategic focus includes expanding its product offerings, leveraging technology for efficiency, and diversifying its income streams. The company is also committed to sustainability and its Net Zero Transition Plan, aligning with evolving consumer and regulatory expectations.

- Product Expansion: Growing within existing segments and exploring new insurance products.

- Technological Advancement: Implementing new technologies to improve efficiency and customer experience.

- Diversification: Broadening income streams through various insurance products and financial services.

- Sustainability: Focusing on environmental initiatives and aligning with Net Zero goals.

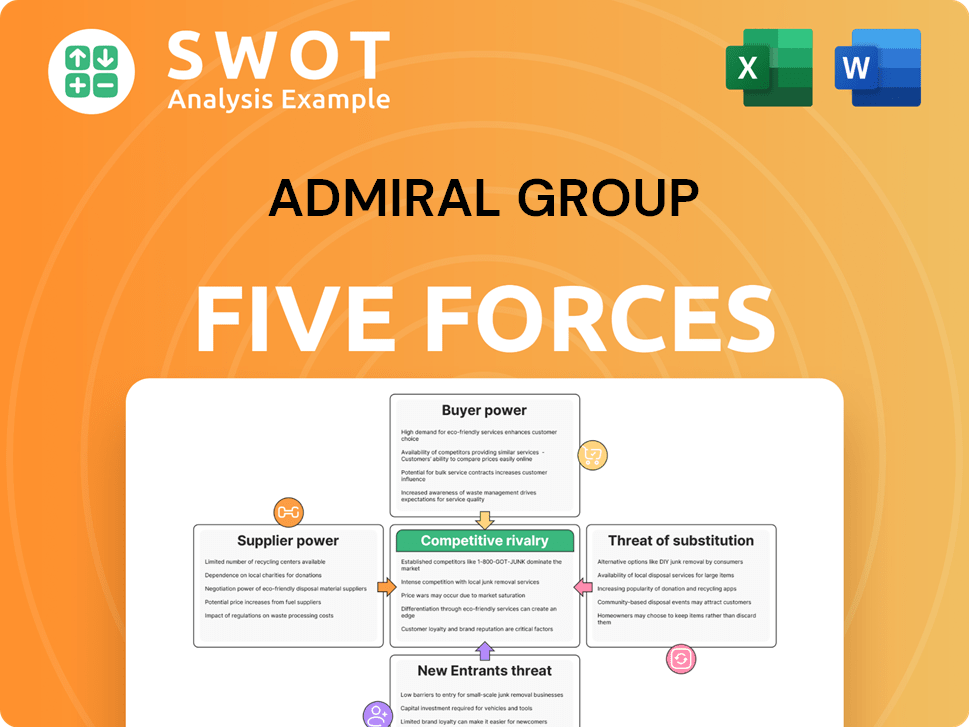

Admiral Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Admiral Group Company?

- What is Growth Strategy and Future Prospects of Admiral Group Company?

- How Does Admiral Group Company Work?

- What is Sales and Marketing Strategy of Admiral Group Company?

- What is Brief History of Admiral Group Company?

- Who Owns Admiral Group Company?

- What is Customer Demographics and Target Market of Admiral Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.