Admiral Group Bundle

How Did Admiral Group Achieve Such Remarkable Growth in 2024?

Admiral Group, a leading insurance provider, stunned the financial world with a 90% surge in pre-tax profits in 2024. This impressive feat, alongside a 28% increase in turnover, underscores the company's robust performance and strategic prowess. But what exactly fuels Admiral's success, and how does this Admiral Group SWOT Analysis reveal its strengths?

This analysis will dissect Admiral's operational model, revealing how the company generates revenue through its diverse insurance offerings, including car insurance and home insurance. We'll explore the key drivers behind its financial performance, from its UK Motor business to its international ventures, providing a comprehensive understanding of this financial services giant. Understanding Admiral company's strategies offers valuable insights for investors and anyone interested in the insurance industry.

What Are the Key Operations Driving Admiral Group’s Success?

The core operations of Admiral Group revolve around providing insurance products, with a strong emphasis on car insurance. They also offer home, travel, and pet insurance, along with personal loans and car finance through Admiral Money. This insurance provider serves a broad customer base across the UK, France, Italy, Spain, and the US.

Admiral's operational processes are centered on pricing, claims management, and underwriting. A key differentiator is their use of bespoke data analytics and machine learning tools. This proprietary technology helps them select profitable risks, contributing to a persistent loss-ratio advantage in the UK motor insurance market.

The company's strategy includes significant use of proportional risk-sharing agreements, such as co-insurance and quota share reinsurance contracts. These agreements with long-term partners like Munich Re allow Admiral to grow its customer base while retaining a significant portion of the underwriting profit. This approach allows them to be selective with risks and feed more data into their machine learning tools, supporting their market-leading performance.

Admiral Group's primary value proposition lies in its insurance products, particularly car insurance. They offer a range of insurance options, including home, travel, and pet insurance. The company's diverse offerings cater to a wide customer base across multiple countries.

Admiral's operational success is built on advanced data analytics and disciplined underwriting. They use sophisticated machine learning tools to assess risks and manage claims efficiently. This focus contributes to competitive pricing and sustained profitability.

The company strategically partners with reinsurance providers to manage risk effectively. These partnerships, such as the one with Munich Re, allow Admiral to grow while maintaining financial stability. This approach enhances their ability to offer competitive insurance products.

Admiral Group prioritizes customer satisfaction through competitive pricing and efficient service. They aim to provide value through their insurance products and maintain a strong market position. The company's focus on data-driven decision-making supports its customer-centric approach.

Admiral Group's operational model is characterized by its use of advanced data analytics, disciplined underwriting, and strategic reinsurance relationships. These elements combine to create a competitive advantage in the insurance market. The company's ability to leverage data and manage risk effectively drives its success.

- Data-Driven Underwriting: Utilizes machine learning to assess and price risks accurately.

- Strategic Reinsurance: Partners with major reinsurers to manage risk and capital efficiently.

- Customer-Centric Approach: Focuses on providing competitive pricing and excellent customer service.

- Geographic Diversification: Operates across multiple countries, including the UK, US, and several European nations.

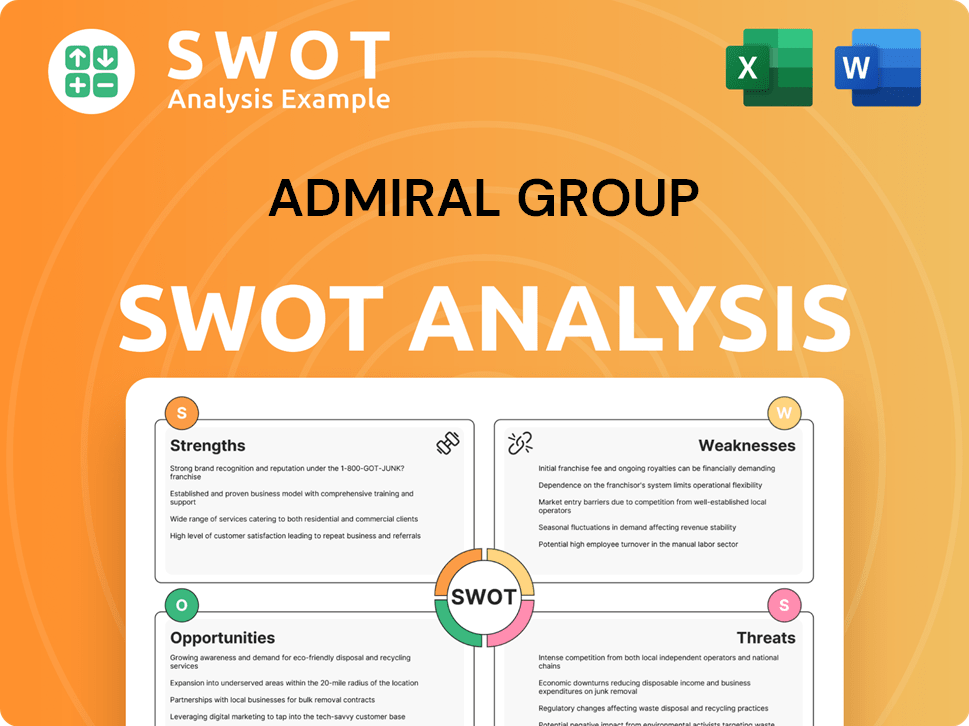

Admiral Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Admiral Group Make Money?

The primary revenue streams for the Admiral Group are insurance premiums and personal lending. In 2024, the company demonstrated strong financial performance, with significant growth in its insurance revenue and overall turnover. The company's strategic approach to pricing and product diversification further enhances its revenue generation and market position.

In 2024, Admiral insurance revenue increased substantially, reflecting the company's robust performance. This growth was a key driver of the overall group turnover, highlighting the effectiveness of its business strategies. The expansion into personal lending through Admiral Money also contributed to the revenue mix.

The company's financial success is underpinned by its strategic initiatives and market responsiveness. The proactive pricing strategies and expansion of product offerings support its revenue model. The company's ability to adapt to market conditions and customer needs further strengthens its financial outlook.

The core revenue stream, with insurance revenue increasing by 37% to £4.78 billion in 2024, up from £3.49 billion in 2023. This growth highlights the effectiveness of their insurance products and market strategies. This includes car insurance and home insurance.

Admiral Money, the personal loans and car finance business, reported a 23% increase in gross loan balances, reaching £1.17 billion. This expansion into lending diversifies revenue sources and caters to a broader customer base. The company's entry into personal lending complements its insurance offerings.

Being one of the first to reduce prices in response to easing inflation and favorable regulatory changes attracts and retains customers. This strategy is crucial for maintaining a competitive edge in the market. This helps them when people search for an Admiral Group car insurance quote online.

Profit commission terms within proportional risk-sharing agreements allow Admiral to retain a significant portion of profits from policies underwritten with reinsurance partners. This arrangement enhances profitability and risk management. This is a key part of how the Admiral company works.

Expansion through new products and services, including Insurtech propositions like Veygo and Homebrella, and legal services through Admiral Law. Diversifying the product portfolio helps to capture a wider market segment and increase revenue streams. This is important for Admiral Group insurance.

The UK Motor business saw its profit before tax increase to £955 million, which was a major contributor to the company's overall financial success. This segment's strong performance underscores the effectiveness of its operational strategies. This is the primary focus of the Admiral insurance business.

The company employs several strategies to monetize its operations effectively. These strategies include proactive pricing, profit commission agreements, and product diversification. These approaches are key to its financial success and market competitiveness. If you want to know more about the company, read the Brief History of Admiral Group.

- Proactive Pricing: Adjusting prices in response to market changes to attract and retain customers.

- Profit Commission: Utilizing profit commission terms to retain a significant portion of profits.

- Product Diversification: Expanding into new products and services to broaden revenue streams.

- Strategic Partnerships: Leveraging reinsurance partners for risk-sharing and profit-sharing arrangements.

- Customer Retention: Focusing on customer satisfaction and retention through competitive pricing and services.

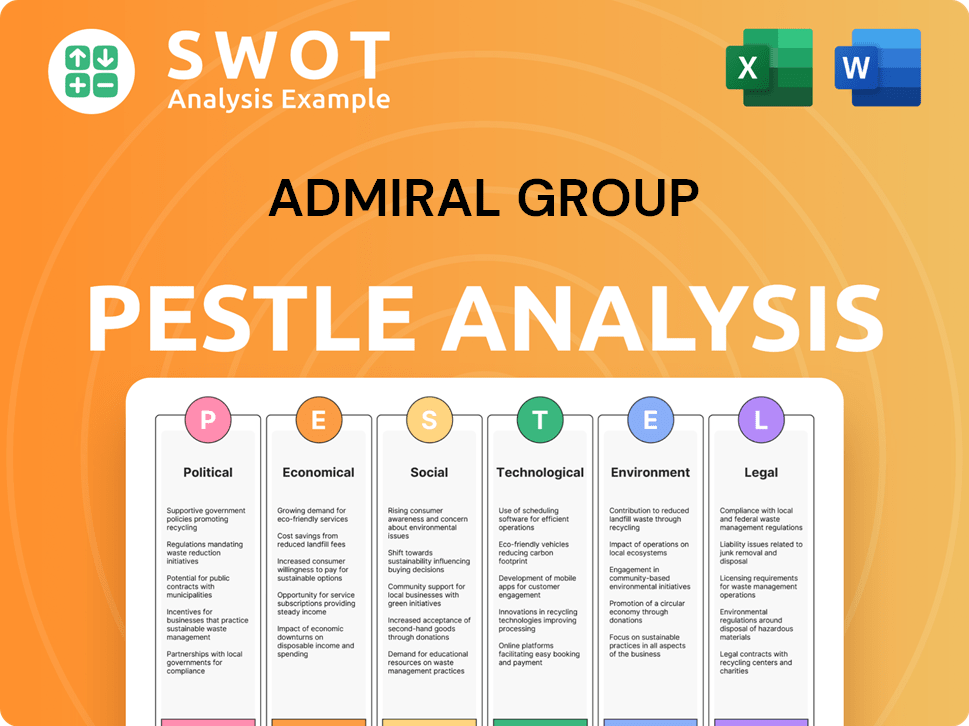

Admiral Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Admiral Group’s Business Model?

The journey of the Admiral Group has been marked by significant milestones and strategic decisions that have shaped its operations and financial outcomes. A key highlight in 2024 was the "remarkable" 90% surge in group profit before tax, reaching £839.2 million. This growth was largely driven by its UK Motor business, which also saw a 19% increase in UK insurance customers, totaling 8.8 million.

Admiral's agility in responding to market dynamics, such as being among the first to reduce prices in early 2024 due to easing inflation and the favorable Ogden rate change, underscores a key strategic advantage. The company has adeptly navigated challenges like the elevated inflation experienced in 2022 and 2023, maintaining financial resilience and sustainable growth through prudent reserving and risk management within its investment portfolio.

The company's competitive edge is multifaceted, stemming from proprietary technology and bespoke data analytics that enable it to select profitable risks. This approach has helped Admiral maintain a persistent loss-ratio advantage in the UK motor insurance market. Furthermore, strong relationships with reinsurers, such as Munich Re, allow for selective risk management and customer growth, even while ceding a significant portion of gross written premium.

In 2024, Admiral Group reported a substantial increase in profit before tax, reaching £839.2 million. This represents a "remarkable" 90% increase, driven by strong performance in the UK Motor business. The company's revenue streams are primarily from its insurance operations in the UK and internationally.

Admiral Group is focused on leveraging technology, including probability-based machine learning and artificial intelligence, to improve its UK motor loss ratio and fraud detection. It is also committed to ESG initiatives, with an upgraded MSCI ESG score to AAA and approved science-based targets. A recent strategic move involves the agreement to sell its US motor insurance operations to J.C. Flowers & Co.

Admiral Group holds a significant position in the UK insurance market, particularly in car insurance. Its ability to adapt to market changes, such as adjusting prices in response to inflation, and its strong relationships with reinsurers contribute to its competitive advantage. The company's focus on data analytics and risk selection helps it maintain profitability.

Admiral Group has a substantial customer base, with 8.8 million UK insurance customers in 2024. The company's focus on customer service and competitive pricing has helped it attract and retain customers. Its various insurance products, including car and home insurance, cater to a wide range of needs.

Admiral Group's competitive advantages include its data-driven approach, strong relationships with reinsurers, and technological investments. The company's ability to select profitable risks and manage its loss ratio effectively sets it apart in the market. Strong customer relationships and a focus on innovation also contribute to its success.

- Proprietary technology and data analytics for risk selection.

- Strong relationships with reinsurers, like Munich Re, for risk management.

- Focus on ESG initiatives and sustainable practices.

- Strategic focus on UK and European operations.

For a deeper understanding of the competitive landscape, you can explore the Competitors Landscape of Admiral Group.

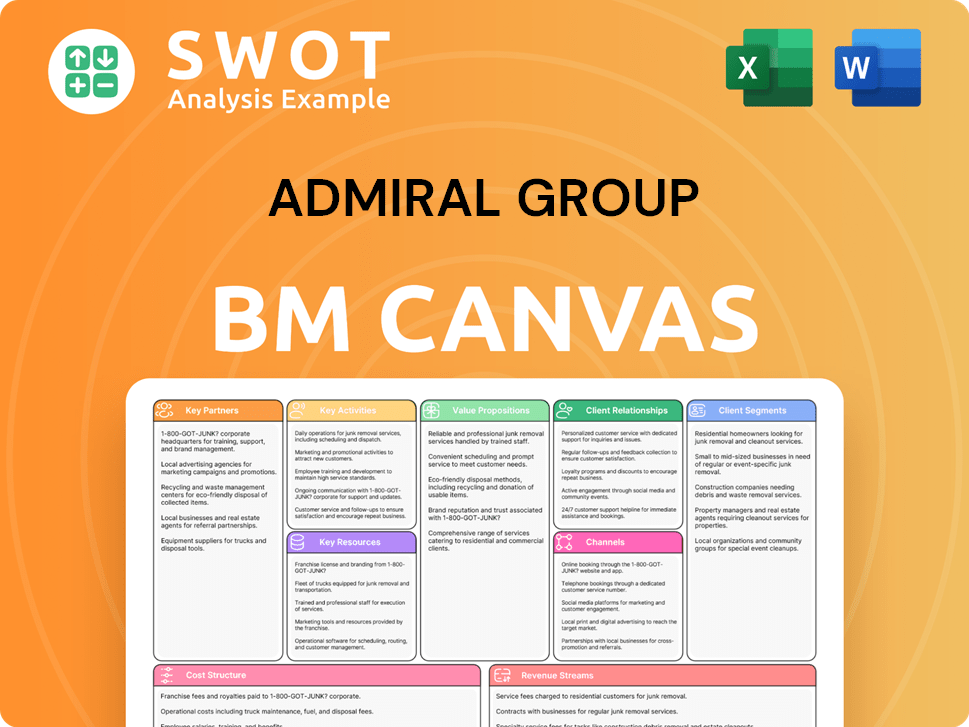

Admiral Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Admiral Group Positioning Itself for Continued Success?

Within the financial services arena, particularly the insurance sector, Admiral Group holds a prominent position. The company has a substantial market presence, especially in the UK and internationally. Admiral is recognized for its competitive pricing and commitment to customer satisfaction, which contribute to customer loyalty, making it a leading insurance provider.

As of December 31, 2024, the company's customer base expanded by 14% to 11.1 million. The UK insurance customer base rose by 19% to 8.8 million. While international insurance customers saw a slight decrease of 3% to 2.1 million, the UK Motor business remains a dominant force, driving substantial profit growth.

Admiral Group is a significant player in the insurance industry, especially in the UK. It is known for competitive pricing and strong customer satisfaction. This focus helps to maintain customer loyalty and market share.

The insurance market is highly competitive, with a "softening" and "uncertain" outlook for 2025. Regulatory changes and geopolitical instability also pose risks. These factors could impact revenue streams and the global economy.

Admiral is focused on strategic initiatives for revenue growth and market adaptation. Key strategies include Admiral 2.0, Motor Evolution, and Business Diversification. The company aims for long-term growth through enhanced data and technology.

The sale of US motor insurance operations allows a focus on UK and European markets. Leadership emphasizes a prudent approach to ensure sustainable growth. This approach aims to create value for all stakeholders.

Despite its strong position, Admiral faces key risks and headwinds. The insurance market is highly competitive, and the outlook for 2025 is described as 'softening' and 'uncertain' due to persisting economic, political, and regulatory uncertainty. Regulatory changes, particularly concerning product governance and add-on products, pose a potential risk to revenue streams. Geopolitical instability and the outcome of elections in the UK and US could also impact trade flows, financial markets, and the global economy.

Admiral is focused on ongoing strategic initiatives to sustain and expand its ability to generate revenue. The company aims to remain efficient and agile to adapt to market changes and deliver long-term growth.

- Admiral 2.0

- Motor Evolution

- Business Diversification

- Enhancing data and technology

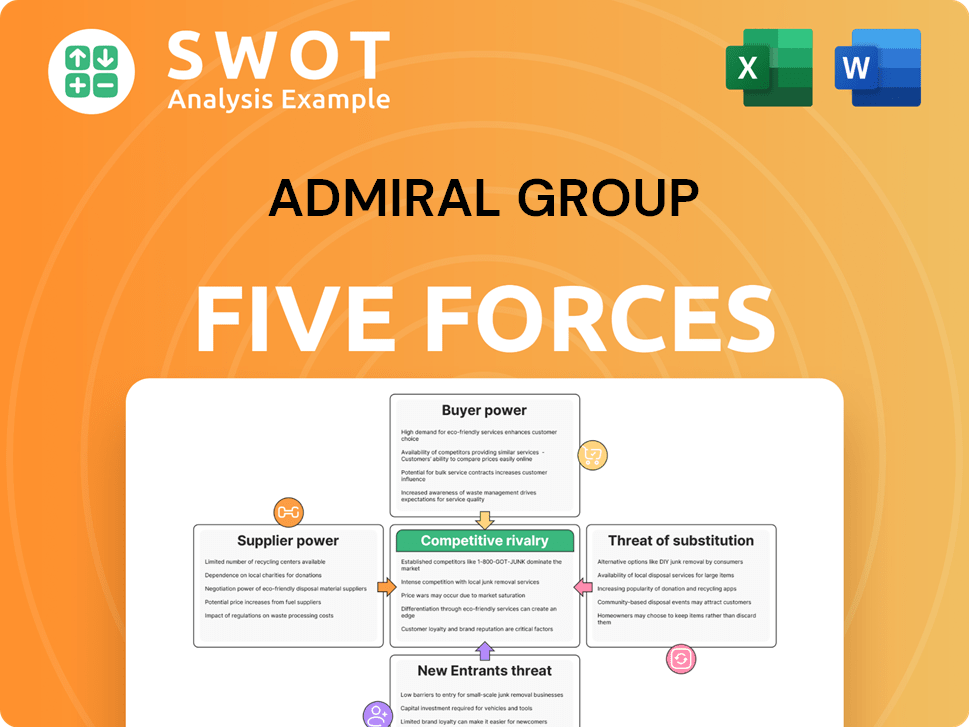

Admiral Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Admiral Group Company?

- What is Competitive Landscape of Admiral Group Company?

- What is Growth Strategy and Future Prospects of Admiral Group Company?

- What is Sales and Marketing Strategy of Admiral Group Company?

- What is Brief History of Admiral Group Company?

- Who Owns Admiral Group Company?

- What is Customer Demographics and Target Market of Admiral Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.