Admiral Group Bundle

How Did Admiral Group Outmaneuver the Insurance Market?

Admiral Group's impressive financial performance, including a remarkable profit surge in 2024, stems from its innovative Admiral Group SWOT Analysis and dynamic sales and marketing strategies. This report dives deep into the tactics that propelled this financial services giant to the forefront of the UK insurance industry. Discover how Admiral Group's agility and responsiveness to market changes have fueled its success.

This analysis will explore Admiral Group's customer acquisition strategy, dissecting its digital marketing initiatives and competitive analysis within the insurance market. We'll examine their brand positioning strategy, target audience, and the key marketing campaigns driving their growth. Understanding Admiral Group's sales performance metrics, pricing strategy, and distribution channels provides valuable insights into their effective business model.

How Does Admiral Group Reach Its Customers?

The sales and marketing strategy of Admiral Group centers on a multi-channel approach, blending digital and traditional methods to reach its customer base. The company's primary sales channels include its website and e-commerce platforms, which are crucial for direct customer acquisition and management. This digital focus is supported by direct sales teams, though the emphasis remains heavily on online engagement.

Admiral Group's strategy has evolved to prioritize digital adoption and omnichannel integration. This approach has been successful, as evidenced by consistent growth in customer numbers. The company's UK Motor business saw a 15% increase in motor policies in 2024, reaching a record of 5.7 million, driven by competitive pricing and strong service levels. The company's customer base increased by 14% to 11.1 million in 2024, with UK insurance customers rising by 19% to 8.8 million.

Admiral Group operates through various brands and subsidiaries in several countries, including France, Italy, Spain, and the US. Each entity likely adapts its sales channels to suit local market conditions. The company's strategic decisions, such as the agreement to sell its US motor insurance operations in April 2025, demonstrate its focus on optimizing channel performance and market focus. This strategic agility is a key component of the Brief History of Admiral Group.

The company's website and e-commerce platforms are essential for direct customer acquisition and management. These platforms provide a user-friendly interface for customers to compare quotes, purchase policies, and manage their accounts. The digital-first approach has been a key driver of growth, contributing significantly to the company's customer acquisition strategy.

While the emphasis is on online engagement, Admiral Group also utilizes direct sales teams. These teams likely support complex sales, provide personalized customer service, and assist with inquiries that require human interaction. This channel complements the digital platforms, offering a more comprehensive approach to customer engagement.

Admiral Group engages in key partnerships to further develop relationships and engagement. For example, joining FinTech West as an InsurTech partner in March 2025. These partnerships help to expand the company's reach and enhance its brand positioning strategy within the industry.

Admiral Group operates in multiple countries, adapting its sales channels to local market dynamics. Each brand and subsidiary likely tailors its approach to meet the specific needs and preferences of its target audience. This localized strategy is crucial for success in diverse markets.

Admiral Group's sales strategy is built on a foundation of digital platforms, supported by direct sales teams and strategic partnerships. The company's focus on digital channels has been instrumental in driving customer acquisition and growth, as seen in the significant increase in motor policies in 2024. The company's strategic decisions, such as the sale of its US motor insurance operations, indicate a continuous evaluation of channel performance and market focus.

- Digital Platforms: Core for direct customer acquisition.

- Direct Sales Teams: Support complex sales and personalized service.

- Partnerships: Expand reach and enhance brand positioning.

- Local Adaptation: Tailoring channels to local market dynamics.

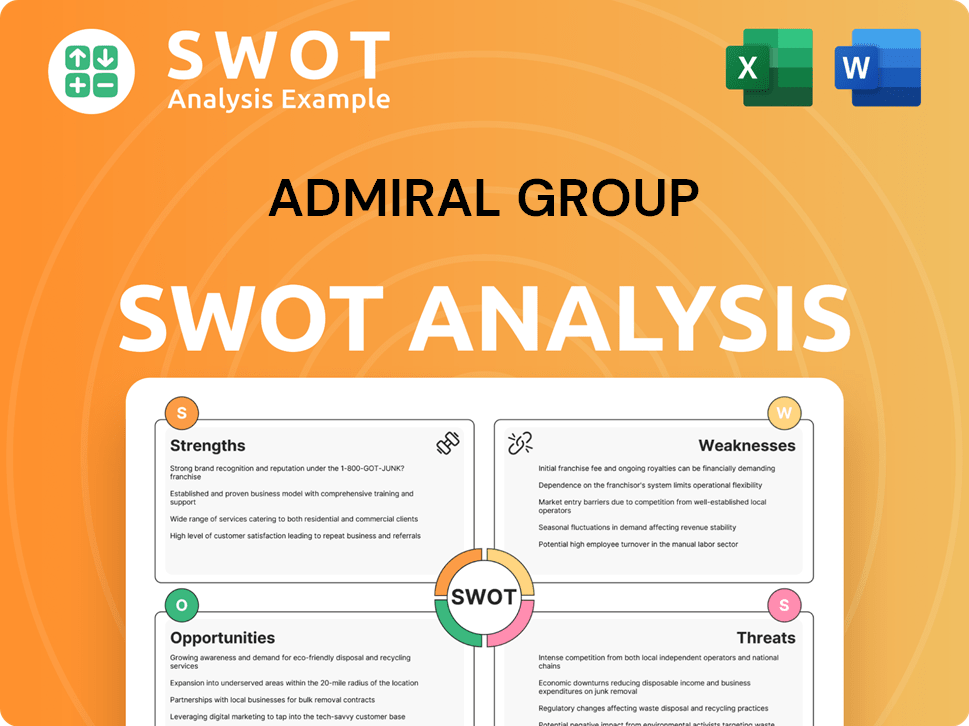

Admiral Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Admiral Group Use?

The marketing tactics of the [Company Name] are designed to boost brand awareness, generate leads, and drive sales. Their approach is heavily data-driven and focuses on digital channels. The company leverages its expertise in pricing, claims management, and underwriting to draw in and keep customers.

Digital marketing plays a crucial role in [Company Name]'s strategy. They likely use content marketing, SEO, paid advertising, email marketing, and social media to connect with their audience. The company is also investing in data and AI to improve customer segmentation and personalization in their marketing efforts.

While digital tactics are key, traditional media like TV, radio, and print may still be part of broad brand awareness campaigns, especially in the UK. The company's marketing mix is evolving to be more efficient and adaptable to changing market conditions. This allows them to respond quickly to market dynamics, such as reducing prices, which helped attract new customers.

The company's digital marketing initiatives are central to its customer acquisition strategy. These include content marketing, SEO, paid advertising, email marketing, and social media engagement. These efforts aim to increase brand visibility and drive traffic to the company's platforms.

Data analytics and AI are integral to the company's marketing approach. This data-driven strategy allows for customer segmentation and personalization. This approach enables the company to swiftly adjust to market changes, such as price adjustments, to attract customers.

Traditional media, such as TV, radio, and print, likely play a role in brand awareness campaigns. These campaigns help to maintain a strong market presence, particularly in the UK. The company aims to position itself as a 'great choice for customers' through its marketing efforts.

The company's pricing strategy is a key component of its marketing efforts. Adjustments to pricing, such as reductions in response to easing inflation, have proven effective in attracting new customers. This proactive approach helps maintain a competitive edge in the insurance market.

The company's marketing efforts are designed to meet customer needs and improve service. This customer-centric approach aims to enhance customer satisfaction and loyalty. Continuous improvements in service are implicitly supported by its marketing efforts.

The company's marketing mix is designed to be efficient and adaptable to changing market dynamics. This agility allows the company to respond quickly to market conditions. This adaptability is crucial for maintaining a competitive position in the UK insurance industry.

The company's marketing strategy is supported by its growth strategy, which focuses on data-driven insights and customer-centric approaches. The company's commitment to innovation and customer satisfaction is evident in its marketing tactics, which aim to enhance brand awareness and drive sales within the competitive UK insurance industry. The company's ability to adapt to market changes, such as reducing prices, has been crucial in attracting new customers. For example, in early 2024, price reductions helped attract approximately 1.4 million new customers.

The company uses a variety of marketing tactics to enhance brand awareness and drive sales. These tactics are data-driven and focus on digital channels, with traditional media also playing a role.

- Digital Marketing: Content marketing, SEO, paid advertising, email marketing, and social media.

- Data Analytics: Leveraging data and AI for customer segmentation and personalization.

- Brand Awareness: Traditional media campaigns, particularly in the UK.

- Pricing Strategy: Adjusting prices to attract customers and respond to market changes.

- Customer Focus: Improving service and meeting customer needs.

- Market Adaptation: Efficient and agile marketing mix to respond to market dynamics.

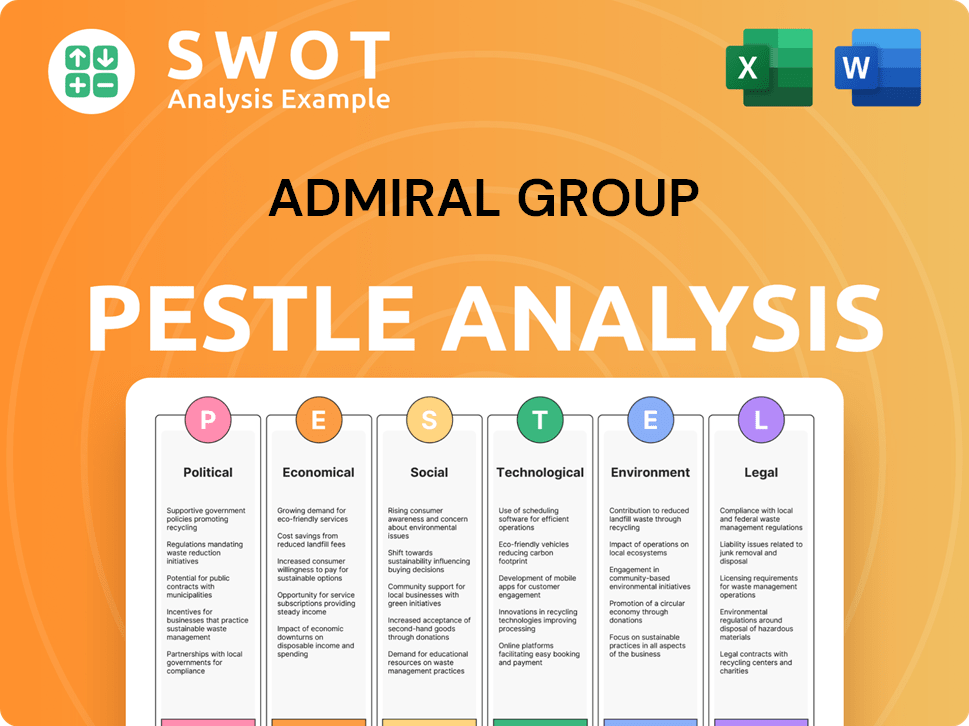

Admiral Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Admiral Group Positioned in the Market?

The brand positioning of the [Company Name] centers on being a competitive and customer-focused insurer. The company aims to be a 'great choice for customers' by leveraging its expertise in pricing, claims management, and underwriting. This approach is a key element of its Admiral Group sales strategy.

A core element of the brand's message is providing value and responding rapidly to market conditions. This strategy is demonstrated by proactive price reductions. This strategy has contributed to significant customer growth, with the company welcoming an additional 1.4 million customers in 2024, bringing its total customer base to 11.1 million. This growth reflects the effectiveness of the Admiral Group marketing strategy.

The brand's consistency across its UK brands and international operations suggests a unified identity focused on accessible and reliable insurance. The company's appeal to its target audience is primarily through value and competitive pricing, particularly in the motor insurance sector. This sector has been the main driver of its strong financial performance, which is a critical aspect of its Admiral Group business model.

The primary value proposition for [Company Name] is offering competitive pricing and accessible insurance products. This is particularly evident in the motor insurance sector, where it has achieved significant market share. The company also focuses on efficient claims management to enhance customer satisfaction.

The target audience for [Company Name] includes a broad range of customers seeking affordable and reliable insurance. This encompasses individuals and families looking for motor, home, and other insurance products. The company's digital presence and online sales strategy cater to a tech-savvy customer base.

The company's competitive advantage lies in its data-driven pricing models and efficient operational processes. Its ability to adapt to market changes, such as reducing prices, allows it to maintain a strong position in the UK insurance industry. The company also benefits from a diversified portfolio of insurance products.

The brand maintains consistency across its various brands and international operations, ensuring a unified customer experience. This includes consistent messaging, visual identity, and customer service standards. This unified approach strengthens the overall Admiral insurance brand.

The company is increasingly focusing on sustainability as part of its brand positioning. It received an upgraded MSCI ESG score to AAA and had its science-based targets officially approved in 2024. This demonstrates a commitment to environmentally conscious practices. The company's commitment to sustainability is also becoming an increasingly important aspect of its brand positioning.

- The company's Net Zero Transition Plan has been published.

- This effort appeals to environmentally conscious consumers.

- It helps differentiate itself through responsible business practices.

- The company's ability to adapt to shifts in consumer sentiment is evident.

The company's ability to adapt to shifts in consumer sentiment and competitive threats is evident in its strategic decisions, such as the sale of its US motor insurance operations to focus on core markets. For more insights into the company's financial structure and operational strategies, you can refer to Revenue Streams & Business Model of Admiral Group.

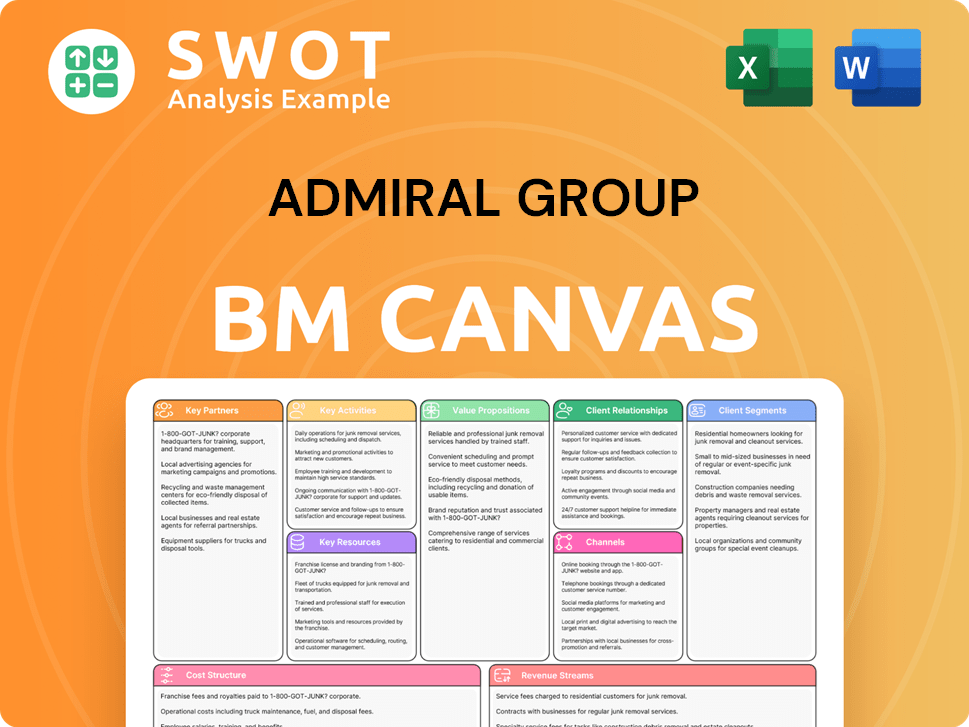

Admiral Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Admiral Group’s Most Notable Campaigns?

The core of the Admiral Group's sales and marketing strategy in 2024 revolved around a strategic pricing adjustment, particularly within its UK Motor business. This proactive move, which involved reducing prices ahead of the market, served as a primary 'campaign' to attract and retain customers. The objective was to maintain a competitive edge and expand its customer base in the UK insurance industry.

This pricing strategy proved highly effective. The company's UK motor policies increased by 15% to a record 5.7 million, and overall UK insurance customers grew by 19% to 8.8 million in 2024. These customer gains directly fueled a significant increase in financial performance, with group turnover rising by 28% to £6.15 billion and profit before tax surging by 90% to £839.2 million by the end of December 31, 2024. This highlights the effectiveness of the Admiral Group's approach to market dynamics, using competitive pricing as a key sales and marketing driver.

While large-scale advertising campaigns with influencers or celebrities are not the primary focus, the company's strategy emphasizes direct customer acquisition through competitive offerings and service. The continuous focus on leveraging its expertise in pricing, claims management, and underwriting acts as an ongoing 'campaign'. Moreover, the emphasis on environmental, social, and governance (ESG) initiatives, such as the upgraded MSCI ESG score to AAA and the publication of its Net Zero Transition Plan in 2024, contributes to building brand reputation and appealing to a broader customer base. For a deeper understanding of how Admiral Group positions itself against its rivals, you can explore the Competitors Landscape of Admiral Group.

The foundation of Admiral Group's Admiral Group sales strategy in 2024 was a proactive pricing strategy. This involved reducing prices in the UK Motor business to remain competitive and attract more customers. This decision was a key driver in the company's exceptional performance.

The competitive pricing directly contributed to a surge in customer numbers. UK motor policies increased to 5.7 million, and total UK insurance customers reached 8.8 million. This growth demonstrated the effectiveness of the Admiral Group customer acquisition strategy.

The strategic pricing led to substantial financial gains for 2024. Group turnover increased by 28% to £6.15 billion, and profit before tax grew by 90% to £839.2 million. These figures highlight the success of the Admiral Group business model.

Beyond pricing, Admiral Group marketing strategy includes brand building through ESG initiatives. An upgraded MSCI ESG score to AAA and the publication of its Net Zero Transition Plan in 2024 are examples of this approach. This helps to enhance the company’s reputation.

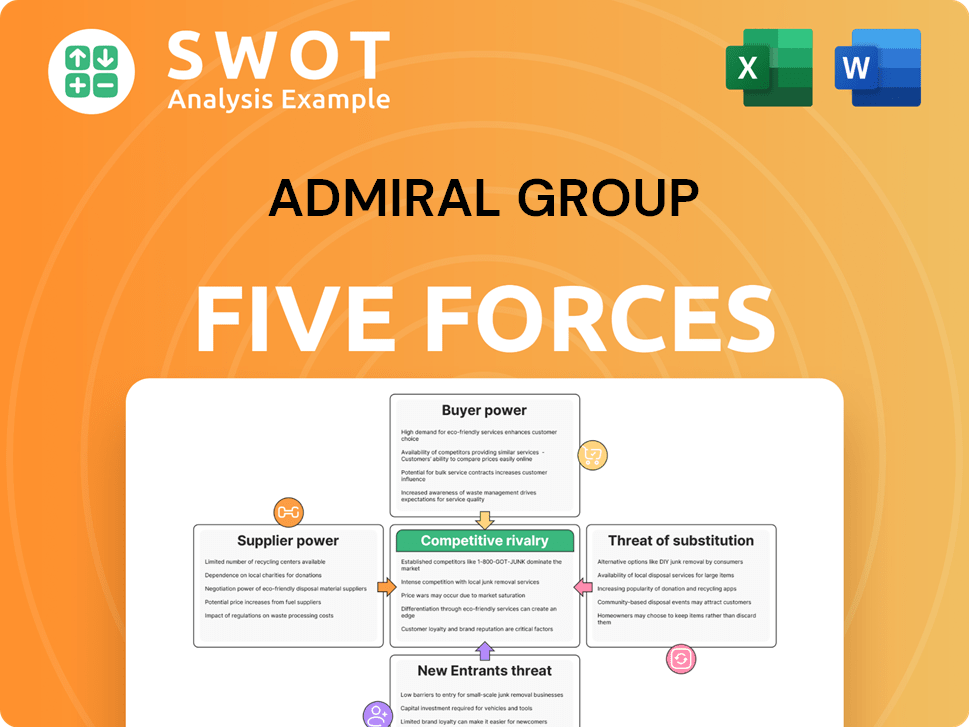

Admiral Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Admiral Group Company?

- What is Competitive Landscape of Admiral Group Company?

- What is Growth Strategy and Future Prospects of Admiral Group Company?

- How Does Admiral Group Company Work?

- What is Brief History of Admiral Group Company?

- Who Owns Admiral Group Company?

- What is Customer Demographics and Target Market of Admiral Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.