Admiral Group Bundle

Who are Admiral Group's Customers?

Unveiling the intricacies of Admiral Group SWOT Analysis is crucial, but understanding its customer base is equally vital. Discover the demographics and target market that fuel this financial services giant's success. This analysis delves into the specifics of who Admiral Group serves and how it tailors its offerings to meet their needs.

By examining the Admiral Group customer base, we can gain insights into insurance customer profile characteristics, including age, income, and location. This exploration of Admiral Group target market and target audience analysis will reveal the strategies Admiral Group employs to attract and retain customers, ultimately shaping its competitive advantage in the dynamic insurance industry. Understanding the demographics of Admiral car insurance customers is key to grasping the company's market position.

Who Are Admiral Group’s Main Customers?

Understanding the customer demographics and target market of the company is crucial for assessing its business strategy. The company, a prominent player in the financial services sector, primarily focuses on consumers (B2C), offering a variety of insurance products and personal loans. Analyzing the customer base provides insights into the company's market positioning and growth potential.

As of December 31, 2024, the company's total customer base reached 11.1 million, marking a 14% increase from the previous year. This growth indicates a successful customer acquisition strategy and a strong market presence. The company's strategic decisions, such as acquisitions and pricing adjustments, reflect an effort to cater to a broad customer base.

The company's primary customer segments are largely driven by its UK Motor insurance business, which saw a 19% increase in customers, reaching 8.8 million in 2024. This segment remains a key driver of revenue and growth. Despite a slight decrease in international insurance customers, the company's personal loan business, Admiral Money, experienced significant growth, suggesting an expansion into new financial product segments.

The company's customer base is primarily composed of consumers, with a strong emphasis on insurance products. The company's total customer base reached 11.1 million as of December 31, 2024. The UK Motor insurance business is the largest segment, with 8.8 million customers in 2024.

The UK Motor insurance business drives a significant portion of the company's revenue and growth. Admiral Money, the personal loan business, reported a 23% increase in gross loan balances, reaching £1.17 billion. This indicates a growing interest in financial lending products.

The company's acquisition of the More Than household and pet insurance books in March 2024 demonstrates an effort to expand its customer segments. Price reductions in early 2024, in response to easing inflation, helped attract more customers in the UK motor segment. This shows responsiveness to cost-sensitive consumers.

The company's focus on personal lines insurance suggests a broad consumer demographic. The company's customer acquisition strategy, combined with its strategic initiatives, supports its growth and market position. To learn more about the company's growth, read the Growth Strategy of Admiral Group.

Analyzing the company's customer demographics reveals a broad consumer base, primarily focused on insurance products and personal loans. The company's strategic moves, such as acquisitions and price adjustments, show an effort to meet the needs of a diverse customer base. The UK Motor insurance segment remains the most significant, driving the majority of customer growth and revenue.

- The company's customer base reached 11.1 million in 2024.

- UK Motor insurance customers increased by 19% to 8.8 million.

- Admiral Money's gross loan balances grew by 23% to £1.17 billion.

- The company is expanding its customer segments through acquisitions and strategic pricing.

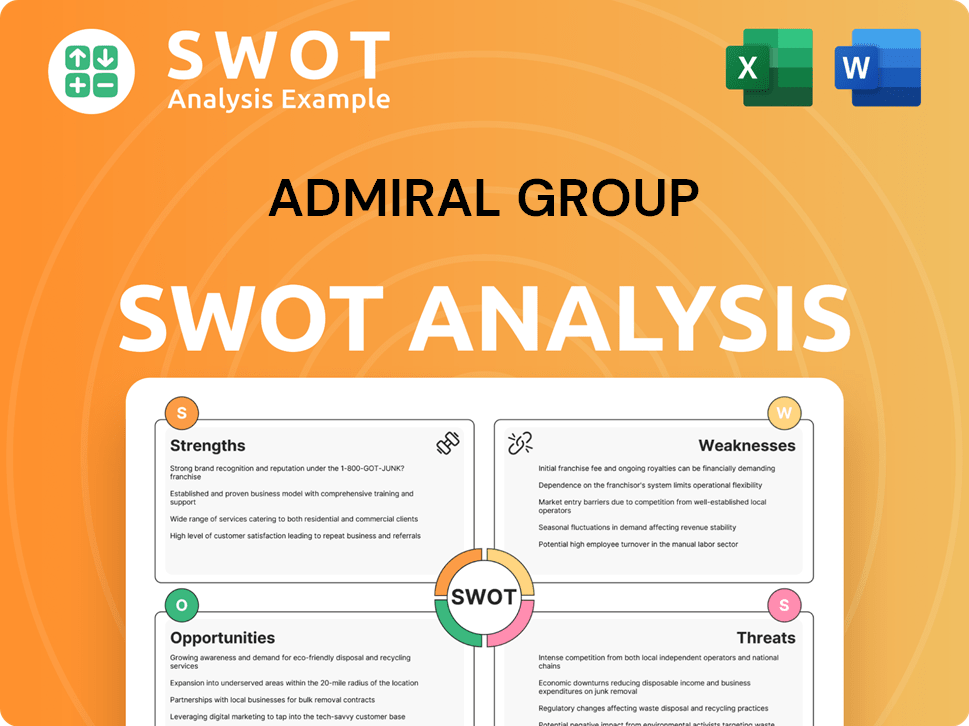

Admiral Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Admiral Group’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any insurance provider. For the case of the [Company Name], the primary customer need revolves around securing reliable and competitively priced insurance coverage, particularly for motor vehicles. The company's strategic responses to market dynamics, such as adjusting prices, show a deep understanding of customer demands for value and affordability.

Customers of [Company Name] also value ease of use and trust in their insurance providers. This is reflected in the company's focus on core technical competencies, leveraging new data and technology, and enhancing AI applications to provide faster service. This focus on customer-centricity has been a key driver in its ability to attract and retain customers.

The purchasing behaviors of [Company Name]'s customers are significantly influenced by factors like competitive premiums, clear policy terms, and efficient claims management. The company's strategic focus on these areas has contributed to its sustained growth in customer numbers. For example, in the first half of 2024, [Company Name]'s customer base grew by 12% to 10.5 million, driven by competitive pricing in UK Motor insurance.

Customers prioritize affordable premiums. [Company Name]'s responsiveness to market conditions, like reducing prices due to easing inflation in early 2024, highlights its commitment to value.

Customers seek straightforward processes and reliable service. [Company Name] focuses on core competencies, data-driven technologies, and AI to deliver faster and more efficient experiences.

Customers value quick and hassle-free claims processes. [Company Name]'s expertise in this area is a key factor in customer satisfaction and retention.

Customers appreciate a range of insurance and financial products. [Company Name]'s expansion into home, travel, pet insurance, and personal loans caters to evolving customer needs.

Customers value long-term relationships with their providers. [Company Name]'s focus on building synergies across businesses and products fosters customer loyalty.

Customers benefit from the use of data and technology to enhance their experience. [Company Name] leverages new data and technology and enhances capabilities in AI applications for faster delivery.

The expansion into various products, such as home, travel, and pet insurance, and personal loans, demonstrates a recognition of the evolving customer needs for a broader range of financial services from a trusted provider. The company's strategy to meet diverse customer demands and foster loyalty by offering a comprehensive suite of solutions is evident in its focus on building synergies across its various businesses and products. This approach is further supported by the company's commitment to customer satisfaction, which has been a key driver in its sustained growth in customer numbers. For more detailed insights, you can refer to an article about the [Company Name] customer base.

The core needs include affordable and reliable insurance, ease of use, and efficient claims management. Preferences are shaped by competitive premiums, clear policy terms, and a wide range of financial products.

- Affordable Premiums: Customers prioritize value for money, as seen in [Company Name]'s pricing strategies.

- Ease of Use: Customers want straightforward processes and efficient service.

- Efficient Claims Management: Quick and hassle-free claims are crucial for customer satisfaction.

- Product Variety: Customers appreciate a broad range of insurance and financial products.

- Trust and Reliability: Customers seek a provider they can trust for long-term relationships.

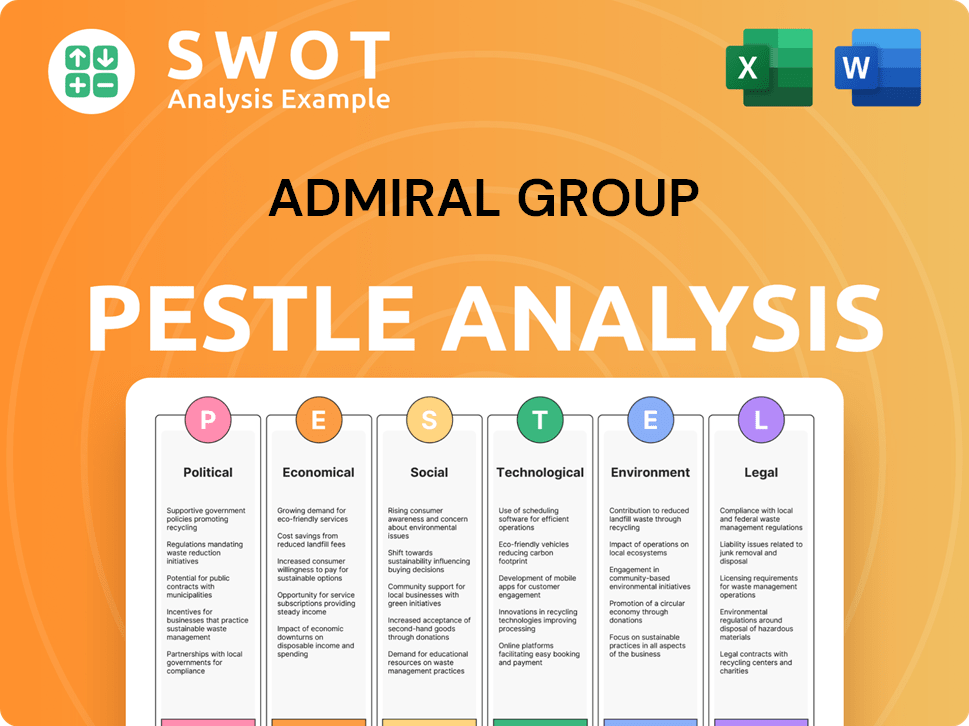

Admiral Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Admiral Group operate?

The geographical market presence of the company is primarily centered in the UK, with a significant international presence. The UK remains the strongest market for the company, driving much of its financial performance. The company also operates in several international markets, including France, Italy, Spain, and the US.

In 2024, the UK insurance customer base grew substantially. Although the international customer base saw a slight decrease, some international markets still demonstrated strong performance. The company's strategic focus is shifting to deliver long-term, sustainable growth, particularly in the UK and mainland Europe.

The company's strategic decisions reflect a focus on markets where it holds a strong market share or sees greater potential for growth and profitability. This strategic approach aims to optimize resource allocation and capitalize on opportunities for sustained success within its core markets.

The UK is the primary market for the company. In 2024, UK insurance customers increased by 19% to 8.8 million. The UK Motor business is a key driver of exceptional performance.

The company operates in France, Italy, Spain, and the US. International insurance customers saw a slight decline of 3% to 2.1 million in 2024. The French and US Motor businesses achieved double-digit profits.

The company is focusing on delivering long-term sustainable growth in the UK and mainland Europe. This strategic shift involves concentrating resources on markets with stronger market share and growth potential.

The company has agreed to sell its US motor insurance operations. This includes Elephant Insurance Company. The transaction is expected to be completed in the fourth quarter of 2025.

The company's strategic decisions are shaped by market performance and growth potential. The UK Motor business is a main driver of the company's exceptional performance. The company's focus is on delivering long-term sustainable growth.

- The UK Motor business is a key driver of exceptional performance.

- The French motor insurer, L'olivier, reported its highest profit of £11 million in 2024.

- The company is strategically withdrawing from the US motor insurance market.

- This strategic move reflects a focus on the UK and mainland Europe.

For more detailed insights into the company's structure, consider exploring the information about Owners & Shareholders of Admiral Group.

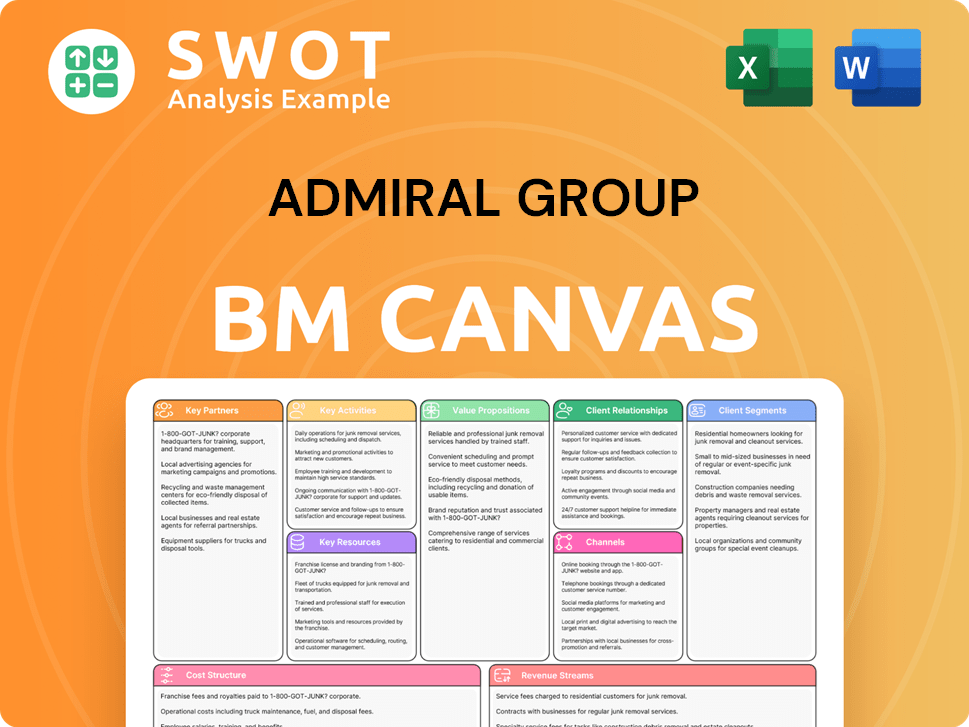

Admiral Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Admiral Group Win & Keep Customers?

Customer acquisition and retention are central to the success of the Admiral Group. Their strategies are built around competitive pricing, a diverse product range, and a strong focus on customer satisfaction. This approach has allowed them to attract and retain a large customer base, as evidenced by significant growth in recent years.

A key acquisition strategy observed in 2024 was the proactive reduction of prices in response to easing inflation. This strategic move significantly improved their competitive position. This agility in pricing allowed Admiral to gain a competitive edge in the market. This is a crucial element of their customer acquisition strategy.

For retention, Admiral Group leverages its diverse product portfolio, offering various insurance products, loans, and other financial services. This diversification allows for cross-selling opportunities and increases customer lifetime value. The acquisition of the More Than household and pet insurance books in March 2024 further strengthens its ability to offer a broader range of services and retain customers across multiple product lines.

Admiral Group strategically adjusts its pricing in response to market dynamics, such as inflation. In 2024, price reductions significantly improved their competitive position. This approach directly attracts new customers by offering more attractive insurance premiums.

Admiral Group offers a wide range of products, including car, home, travel, and pet insurance, and personal loans. This diversification allows for cross-selling and increases customer lifetime value. The acquisition of other insurance books enhances their ability to offer a broader range of services and retain customers.

Customer data and market insights play a crucial role in tailoring marketing efforts and product features to specific segments. The company continuously evolves its technical competencies and explores AI applications to enhance customer capabilities. This data-driven approach helps in understanding customer preferences and needs.

Admiral Group emphasizes customer satisfaction, which is reflected in its sustained customer growth. Efficient claims management and underwriting expertise are also important for maintaining customer loyalty. The company's focus on customer satisfaction is evident in its sustained customer growth.

The company's focus on customer satisfaction is also reflected in its sustained customer growth, with 1.4 million new customers welcomed to the Group in 2024, increasing the total customer base by 14% to 11.1 million. The ability to understand and respond to the needs of their target market is critical. Analyzing the Competitors Landscape of Admiral Group can also provide insights into their strategies.

Proactive price adjustments based on market conditions, such as inflation, are a key acquisition strategy. This helps to attract new customers by offering competitive premiums. The strategy includes leveraging market insights to tailor offerings effectively.

Diversified product offerings, including insurance and financial services, are used to retain customers. Cross-selling opportunities increase customer lifetime value. Focus on efficient claims management and underwriting expertise to maintain customer loyalty.

Customer data and market insights inform marketing efforts and product development. Continuous improvement of technical capabilities and exploration of AI applications enhance customer experience. This data-driven approach is central to their strategy.

Admiral Group prioritizes customer satisfaction, which is reflected in its growth. Efficient claims management and underwriting expertise are also important for maintaining customer loyalty. The focus on customer satisfaction is a key driver of retention.

While specific details on target market segmentation are not extensively detailed in recent reports, the emphasis on maintaining competitiveness, efficient claims management, and underwriting expertise underscores their commitment to customer loyalty. The company's focus on customer satisfaction is also reflected in its sustained customer growth.

Diversification of products allows for cross-selling opportunities, thus increasing customer lifetime value. The company's strategic approach to customer relationships boosts long-term profitability. Understanding customer preferences helps to tailor offerings.

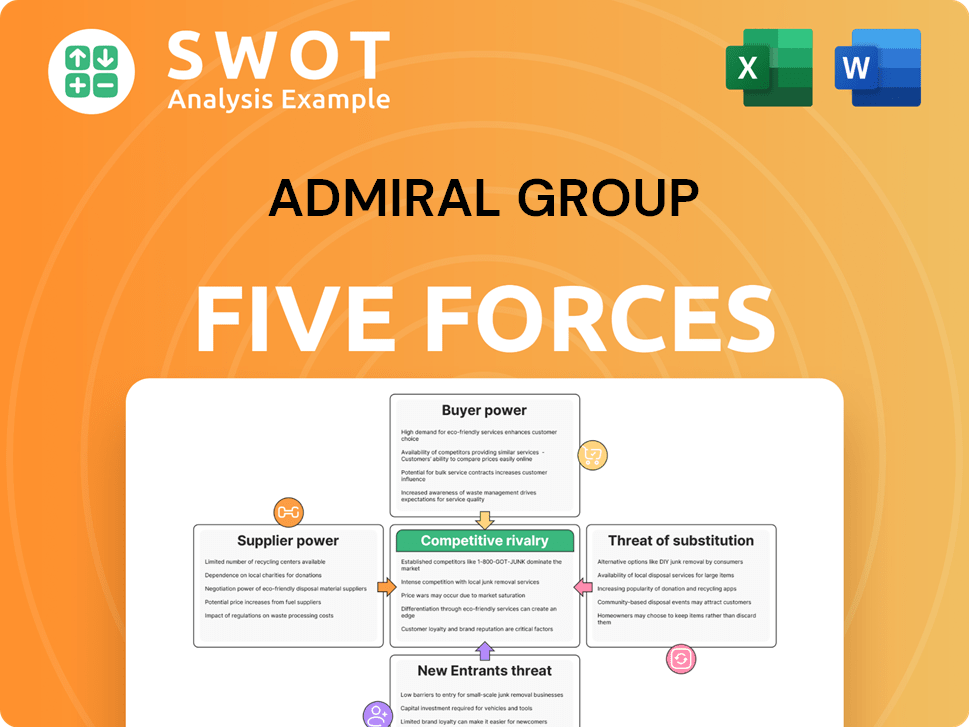

Admiral Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Admiral Group Company?

- What is Competitive Landscape of Admiral Group Company?

- What is Growth Strategy and Future Prospects of Admiral Group Company?

- How Does Admiral Group Company Work?

- What is Sales and Marketing Strategy of Admiral Group Company?

- What is Brief History of Admiral Group Company?

- Who Owns Admiral Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.