Ampol Bundle

Can Ampol Maintain Its Dominance in Australia's Fuel Market?

The Australian fuel market is a battleground, with Ampol, a legacy player, facing a wave of change. From its origins in 1936, Ampol has become a key player in refining and retail. Understanding the Ampol SWOT Analysis is crucial to grasp its position in this dynamic environment.

This analysis delves into the Ampol competitive landscape, examining its position within the Ampol industry and the strategies it employs. We'll explore the Ampol market analysis, identifying Ampol competitors and evaluating their impact on Ampol's business strategy. This investigation will provide insights into Ampol's fuel market dynamics, offering a comprehensive view of its strengths, weaknesses, and future prospects.

Where Does Ampol’ Stand in the Current Market?

Ampol holds a leading position in the Australian fuel and convenience retail sector, characterized by a vast network and integrated operations. The company consistently ranks as the largest player in the industry concerning retail sites and fuel volumes. Ampol's core business revolves around petrol, diesel, lubricants, and convenience store offerings, serving a broad customer base across Australia.

The company also has a significant presence in the commercial sector, supplying fuel to major industries such as mining, aviation, and marine, showcasing diversified revenue streams. Ampol's strategic focus includes enhancing its convenience retail offerings, expanding its AmpCharge electric vehicle (EV) charging network, and exploring new energy solutions. This indicates a move towards a more diversified energy company beyond traditional fuels.

Ampol's financial health remains strong, with recent reports indicating solid earnings and a commitment to capital expenditure for future growth initiatives. The company's integrated supply chain, encompassing refining, distribution, and retail, provides a significant advantage over smaller competitors. Ampol's strategic moves and market position are well-detailed in Revenue Streams & Business Model of Ampol.

Ampol consistently leads in the Australian fuel market. Its extensive retail network and substantial fuel volumes solidify its top-tier status. This strong market position is a key factor in its competitive advantage.

Ampol's integrated supply chain, from refining to retail, provides a significant competitive edge. This integration allows for greater control over costs and supply, enhancing profitability. The company's strategic approach supports its strong market position.

Ampol is diversifying beyond traditional fuels by expanding its EV charging network and exploring new energy solutions. This strategic shift positions the company for long-term growth. This diversification is crucial for adapting to changing market dynamics.

Ampol's financial health is robust, with solid earnings and a commitment to capital expenditure. This financial strength supports its expansion plans and investments in future growth. The company's strong financial position is a key competitive advantage.

Ampol's competitive advantages include its extensive retail network, integrated operations, and strategic diversification. These strengths enable Ampol to maintain a leading position in the Ampol competitive landscape. The company's focus on innovation and customer service further enhances its market position.

- Extensive retail network across Australia.

- Integrated supply chain from refining to retail.

- Diversification into EV charging and new energy solutions.

- Strong financial performance and capital expenditure.

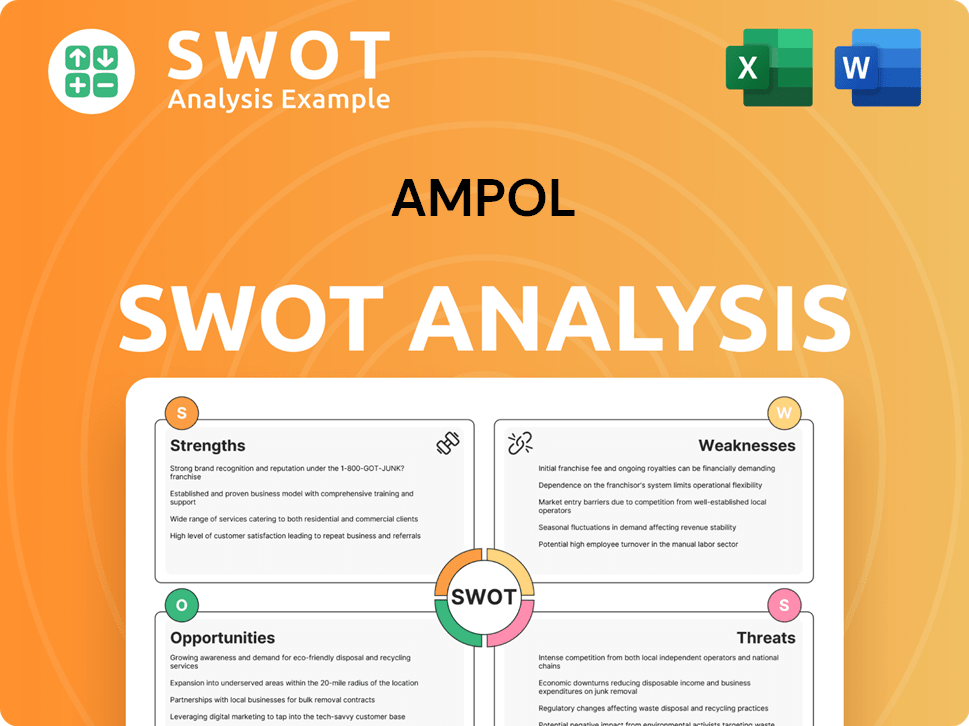

Ampol SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Ampol?

The Owners & Shareholders of Ampol face a complex and dynamic competitive environment. Understanding the Ampol competitive landscape is crucial for assessing its market position and future prospects. This analysis examines the key players and emerging trends shaping the company's business.

Ampol market analysis reveals a multi-faceted competitive arena. The company encounters both direct and indirect competitors across its various business segments, from retail fuel to commercial and aviation fuel. This competitive pressure necessitates continuous innovation and strategic adaptation to maintain and grow market share.

The Ampol industry is characterized by intense competition, particularly in the Australian fuel market. The company's strategic responses to these challenges are critical for its long-term success. Understanding these dynamics is key to evaluating the company's performance and future potential.

In the Australian retail fuel market, Ampol's main competitors in Australia include Viva Energy, operating the Shell brand, and BP Australia. These companies compete directly on price, network reach, and convenience offerings. The competition is fierce, with loyalty programs and store innovations playing a significant role.

In the commercial fuel sector, Ampol competes with global energy giants such as ExxonMobil and BP, particularly in aviation fuel. Independent fuel distributors and mining services companies also pose competition. Competitive dynamics often revolve around supply reliability and specialized services.

The emergence of electric vehicle (EV) charging networks, like Chargefox and Evie Networks, presents an indirect competitive threat. Smaller, independent fuel retailers and supermarket-owned petrol stations also contribute to competitive pressure, especially in localized markets.

Ampol's market share compared to rivals fluctuates based on pricing, promotions, and operational efficiency. The company's ability to maintain a competitive edge is crucial. In 2024, the Australian fuel market saw significant shifts due to these competitive pressures.

Ampol's pricing strategies compared to competitors are a key factor in attracting customers. Price wars and promotional offers are common. The company's ability to balance profitability with competitive pricing is crucial for maintaining market share.

Ampol's customer loyalty programs, such as Ampol Rewards, are designed to retain customers. These programs offer various benefits, including discounts and points, to encourage repeat business. Competitors also use similar strategies.

Ampol's competitive advantages in fuel retail include its extensive network and brand recognition. However, the company must continuously adapt to market changes. Ampol's response to market challenges involves strategic investments and operational improvements.

- Ampol's expansion plans and market positioning are focused on maintaining and growing its market share. These include potential acquisitions and strategic partnerships.

- Ampol's investment in renewable energy is a key part of its Ampol business strategy. This includes exploring alternative fuels and sustainable practices to meet evolving consumer demands.

- Ampol's sustainability initiatives and competition involve reducing emissions and promoting eco-friendly products. This is increasingly important in the current market.

- Ampol's digital transformation and competition include enhancing online services and customer experiences. Digital platforms are critical for staying competitive.

- Ampol's future outlook and competitive threats involve navigating the shift towards EVs and alternative fuels. The company must adapt to these changes to remain competitive.

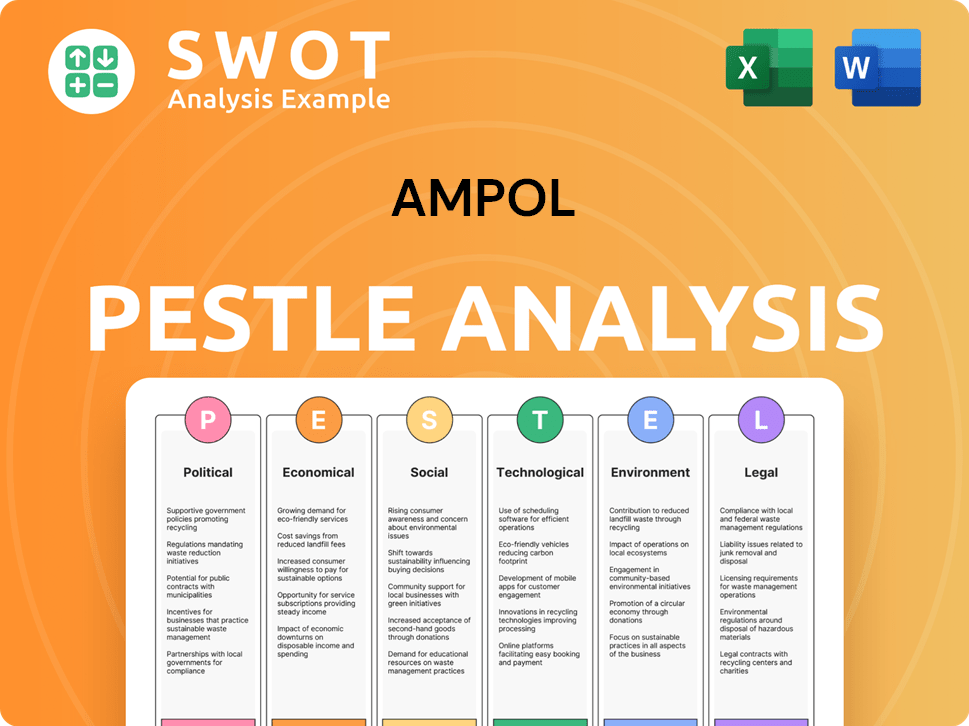

Ampol PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Ampol a Competitive Edge Over Its Rivals?

Understanding the Ampol competitive landscape requires a deep dive into its strategic advantages. The company, a major player in the Ampol industry, has cultivated a robust position through a combination of infrastructure, brand recognition, and forward-thinking initiatives. This comprehensive Ampol market analysis reveals the key elements that contribute to its sustained success in the dynamic Ampol fuel market.

Ampol's business strategy is centered around an integrated supply chain and extensive retail network. This approach allows for significant economies of scale, supporting competitive pricing and operational efficiency. Furthermore, the company's commitment to innovation and customer-centric services enhances its ability to adapt to evolving market conditions and maintain a strong competitive edge.

The company's competitive advantages are multifaceted, stemming from its extensive infrastructure, strong brand equity, and strategic diversification. A core advantage is its integrated supply chain, which encompasses refining capabilities at Lytton, a vast distribution network, and the largest retail service station footprint in Australia. This integration provides Ampol with significant economies of scale, allowing for efficient fuel procurement, processing, and delivery, which can translate into cost efficiencies and competitive pricing.

Ampol operates a fully integrated supply chain, including refining, distribution, and retail. This integration allows for greater control over costs and supply, providing a significant competitive advantage. The Lytton refinery is a critical component, ensuring a consistent supply of fuel.

Ampol boasts the largest retail service station network in Australia, with thousands of sites. This extensive reach ensures high visibility and accessibility for consumers. The widespread presence fosters brand recognition and customer loyalty, supporting strong market positioning.

The Ampol brand is well-established and trusted by Australian consumers. This strong brand equity enhances customer loyalty and attracts new business. The company's focus on convenience retail and loyalty programs further strengthens customer relationships.

Ampol is investing in digital platforms and the expansion of its AmpCharge EV charging network. These initiatives improve customer engagement and operational efficiency. These strategic investments position the company for the future of energy.

Ampol leverages several key advantages to maintain its strong market position. These advantages include a vertically integrated supply chain, a vast retail network, and a trusted brand. The company continuously innovates to meet evolving market demands.

- Integrated Supply Chain: This ensures control over costs and supply.

- Extensive Retail Network: Provides unparalleled reach and convenience.

- Strong Brand Equity: Enhances customer loyalty and trust.

- Technological Investments: Focus on digital platforms and EV charging.

The Ampol competitive landscape includes various players, and understanding its strengths is crucial. For instance, the company's financial performance compared to competitors is a key factor. To learn more about Ampol's strategic moves, consider reading about the Growth Strategy of Ampol.

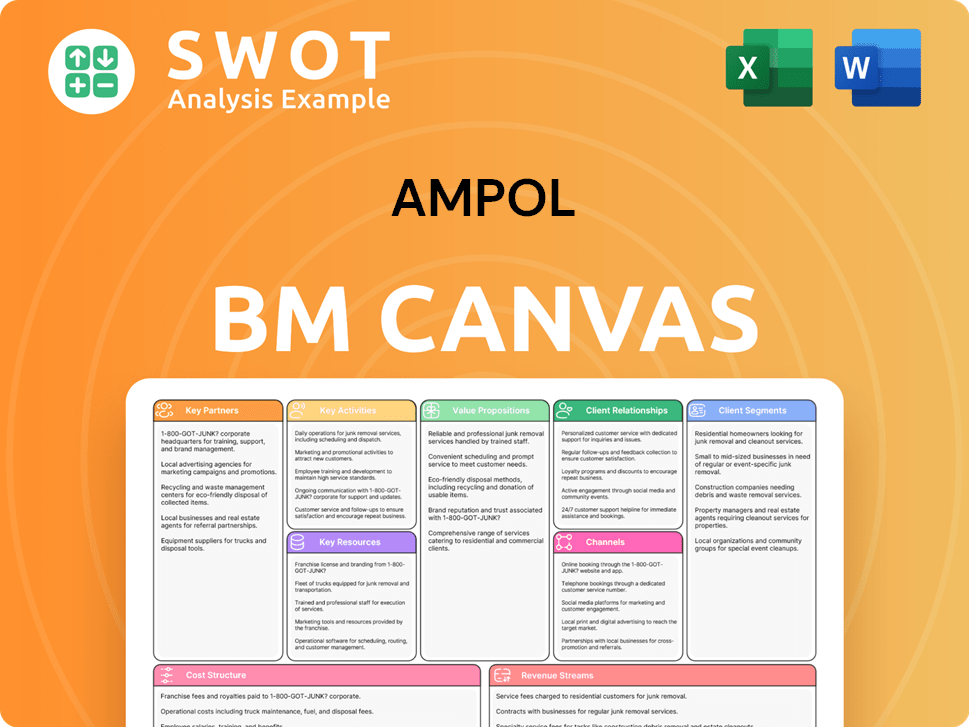

Ampol Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Ampol’s Competitive Landscape?

The Australian fuel and energy sector is experiencing a significant transformation, with Ampol's competitive landscape evolving rapidly. Key industry trends include the energy transition, shifting consumer preferences, and technological advancements. These factors present both challenges and opportunities for Ampol's business strategy and its position in the Ampol fuel market.

Ampol's market analysis reveals a need for strategic adaptation to maintain its competitive edge. The company faces the dual challenge of managing the decline in traditional fuel demand while investing in future energy solutions. Understanding Ampol's competitors and their strategies is crucial for navigating this dynamic environment. For a deeper dive into Ampol's overall approach, you can read about the Growth Strategy of Ampol.

The energy transition towards cleaner energy sources is a major trend, driven by environmental concerns and government regulations. Consumer demand for convenience, digital services, and sustainable options is also increasing. Technological advancements in areas like EV charging and alternative fuels are reshaping the industry.

Managing the decline in traditional fuel demand while scaling up new energy ventures poses a significant challenge. Intense competition from existing players and new entrants in the EV charging space is another hurdle. Geopolitical factors and global oil price volatility can impact profitability.

Emerging markets for new energy solutions, such as hydrogen and biofuels, offer growth potential. Strategic partnerships and acquisitions in renewable energy and EV infrastructure could strengthen Ampol's position. Expanding retail offerings to include premium convenience, diverse food options, and seamless digital solutions can attract customers.

Ampol's strategy focuses on optimizing its traditional fuels business for efficiency and profitability. Simultaneously, the company is aggressively investing in and developing future energy solutions. This dual approach aims to ensure its competitive position evolves in line with the changing industry landscape.

In 2024, the EV market in Australia is projected to continue its growth trajectory, with sales increasing by approximately 30%. Ampol's investment in its AmpCharge network is a strategic move to capitalize on this trend. The company's focus on expanding retail offerings beyond fuel, including premium convenience and digital solutions, aligns with evolving consumer preferences. The global oil price volatility remains a factor, with fluctuations impacting profitability. In 2025, Ampol is anticipated to increase its investment in renewable energy sources by 15%.

- The Australian government is providing incentives for renewable energy projects, creating opportunities for Ampol.

- Ampol's strategic partnerships in the EV charging space are aimed at expanding its market reach.

- The company is focusing on customer loyalty programs to retain and attract customers.

- Digital transformation initiatives are a key part of Ampol's strategy to enhance customer experience.

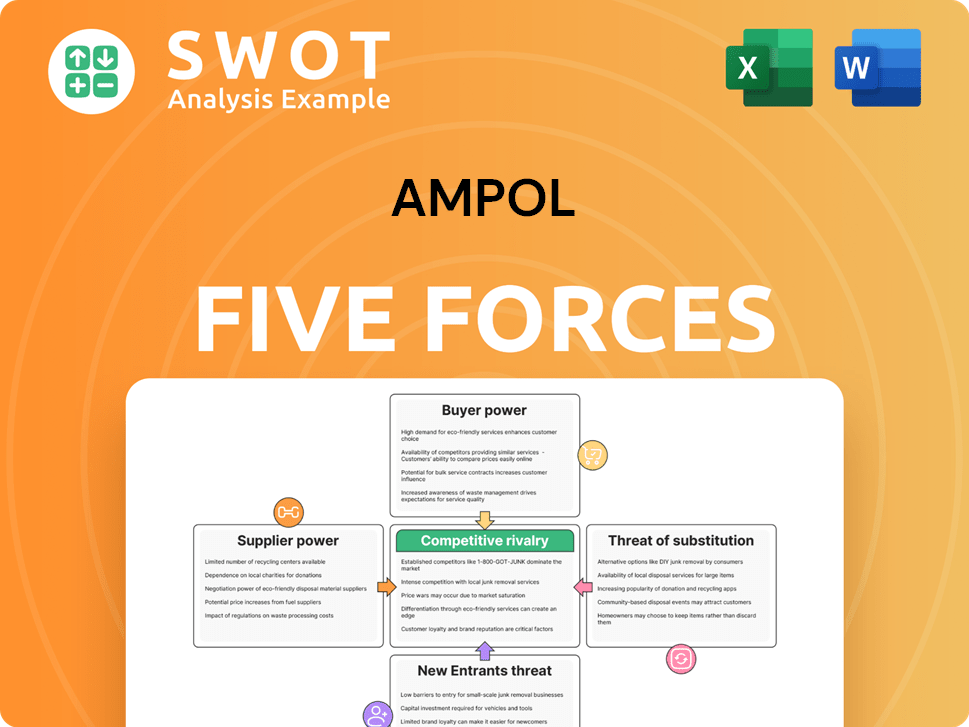

Ampol Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ampol Company?

- What is Growth Strategy and Future Prospects of Ampol Company?

- How Does Ampol Company Work?

- What is Sales and Marketing Strategy of Ampol Company?

- What is Brief History of Ampol Company?

- Who Owns Ampol Company?

- What is Customer Demographics and Target Market of Ampol Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.