Ampol Bundle

Unraveling Ampol: How Does This Energy Giant Operate?

Ampol, a cornerstone of Australia's energy sector, powers the nation's mobility and industries. Its vast network and integrated supply chain make it a significant player in the market. Understanding the Ampol SWOT Analysis is key for investors, customers, and industry watchers alike.

This exploration into the Ampol Company goes beyond the Ampol service stations to reveal the intricate workings of Ampol operations. From refining crude oil to delivering Ampol fuel, we'll dissect the core processes, revenue streams, and strategic choices that define its success. Discover how Ampol Australia maintains its market leadership in a constantly evolving global landscape.

What Are the Key Operations Driving Ampol’s Success?

The core of the Ampol Company's operations revolves around creating and delivering value through an integrated supply chain. This encompasses refining, distribution, and marketing of fuels and lubricants. Ampol serves both individual consumers and commercial customers, offering a wide range of products and services.

Ampol's primary offerings include petrol, diesel, LPG, and lubricants. These products are distributed through an extensive network, ensuring accessibility for consumers and businesses alike. The company's operations are designed to provide a reliable supply of essential fuels across Australia.

Ampol operates approximately 1,900 service stations across Australia, with roughly 600 company-owned and 1,300 operated by franchisees. This extensive network is a key component of its distribution strategy, ensuring broad market coverage. The company’s refining capacity at the Lytton Refinery in Brisbane, which can process up to 109,000 barrels per day, is crucial for meeting a significant portion of Australia's fuel demands.

Ampol's refining process begins with sourcing crude oil, which is then processed at the Lytton Refinery in Brisbane. The refined products are distributed through a sophisticated logistics network. This network includes pipelines, coastal tankers, and road tankers, ensuring efficient delivery to terminals and retail sites.

Ampol serves two main customer segments: retail consumers and commercial clients. Retail customers access fuel and related services through the company's extensive service station network. Commercial customers, spanning sectors like mining, aviation, and agriculture, receive tailored fuel solutions and technical support.

Ampol's value proposition is built on its extensive reach, reliable supply, and diversified customer base. The retail network provides convenience, while commercial divisions offer specialized solutions. This integrated approach enables Ampol to effectively manage costs and respond to market demands.

Strategic partnerships enhance Ampol's supply chain. A notable example is the alliance with ExxonMobil for fuel import and storage. These collaborations strengthen Ampol's operational capabilities, ensuring a robust and efficient supply chain.

Ampol's operational efficiency and integrated model set it apart from competitors. The company's ability to manage costs effectively and respond to market demands is a significant advantage. This comprehensive approach ensures consistent product availability and fosters strong customer relationships.

- Extensive retail network providing convenience and accessibility.

- Integrated supply chain from refining to distribution.

- Strong customer relationships and tailored solutions for commercial clients.

- Strategic partnerships enhancing supply chain resilience.

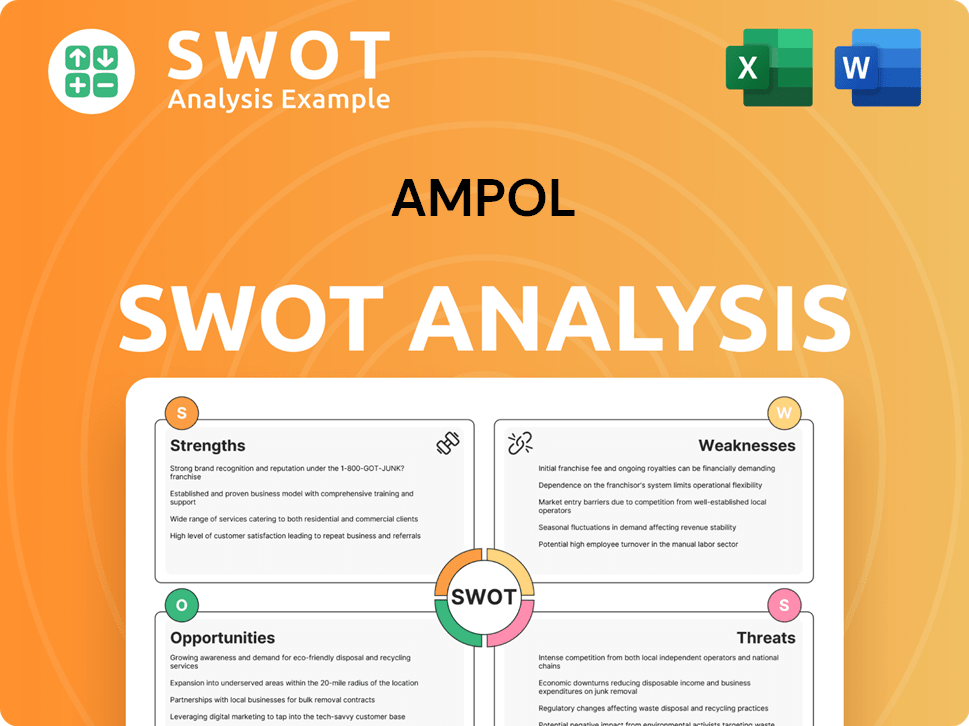

Ampol SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Ampol Make Money?

The Ampol Company primarily generates revenue through the sale of refined petroleum products and lubricants. Its business model is centered around the distribution of fuel and related products across both retail and commercial sectors. This includes direct sales through an extensive network of service stations and bulk sales to various industries.

The Ampol operations are diversified, encompassing fuel sales, convenience retail, and refining activities. The company's revenue streams are further enhanced by strategic acquisitions and customer loyalty programs. The acquisition of Z Energy in New Zealand, for instance, has expanded its geographical footprint and revenue base.

In the first half of 2024, the company demonstrated strong financial results. The Australian operations alone generated approximately A$365 million in earnings before interest and tax (EBIT). This highlights the significance of domestic fuel sales to the company's financial performance. The convenience retail segment also contributed significantly, with an EBIT of A$115 million in the same period.

The Ampol employs several strategies to maximize revenue and profitability. These strategies include direct sales of fuel through service stations, commercial sales to industries, and convenience retail. The company also focuses on refining and selling products to other distributors.

- Retail Fuel Sales: Direct sales of petrol, diesel, and other fuels through a vast network of service stations contribute significantly to revenue.

- Commercial Sales: Bulk fuel sales to industries like mining, aviation, and marine, often under long-term contracts, provide a stable revenue base.

- Convenience Retail: Sales of non-fuel products such as food, beverages, and other convenience items at service stations are an important revenue stream.

- Refining and Wholesale: Monetization of refining capabilities through the sale of refined products to other distributors.

- Strategic Acquisitions: Acquisitions, such as Z Energy, expand the company's geographical reach and revenue sources.

- Customer Engagement: Loyalty programs and digital payment solutions are used to enhance customer engagement and drive repeat business. For more insights, explore the Marketing Strategy of Ampol.

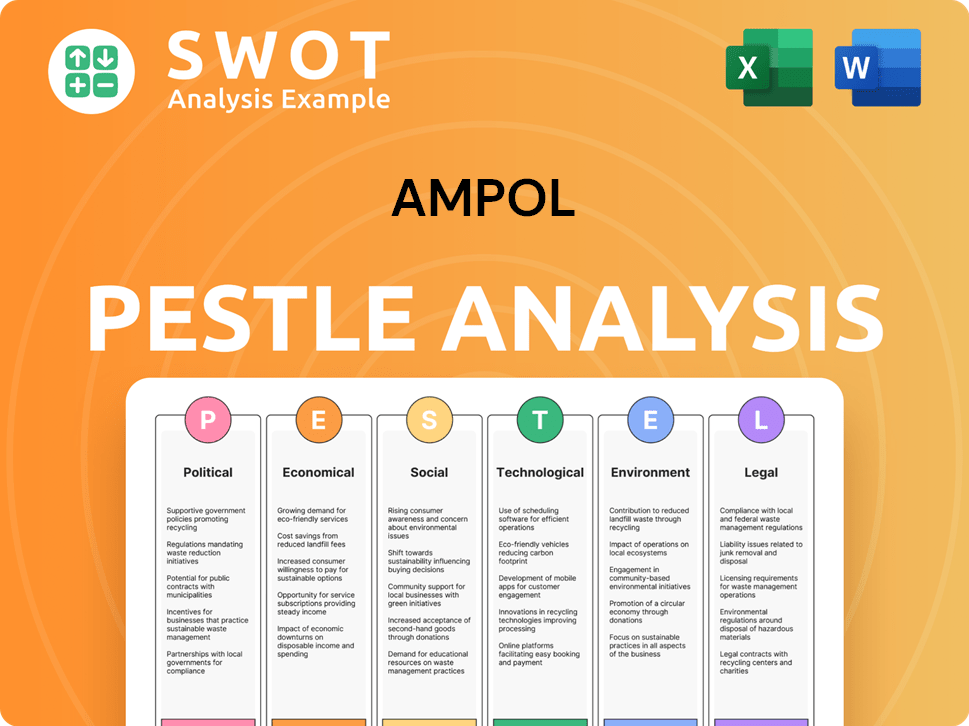

Ampol PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Ampol’s Business Model?

The Ampol Company has undergone significant transformations, shaping its operational landscape and financial outcomes. A key milestone was the 2020 rebrand from Caltex Australia to Ampol, a move that emphasized its Australian roots and commitment to an independent future. This rebrand was coupled with substantial investments in its retail network and brand presence. This strategic shift was crucial for reinforcing its market position.

Another pivotal strategic move was the acquisition of Z Energy in New Zealand in 2022 for approximately NZ$2 billion. This acquisition significantly broadened Ampol's international footprint, diversifying its earnings base and strengthening its position as a leading fuels and convenience retailer in the Asia-Pacific region. This expansion reflects Ampol's strategic vision for growth and market diversification.

Operationally, Ampol has navigated challenges like volatile crude oil prices and the ongoing energy transition. The company has focused on optimizing its refining operations and investing in future energy solutions, including electric vehicle charging infrastructure and hydrogen initiatives. These initiatives are crucial for adapting to evolving market trends and competitive pressures. For further insights into their target demographic, consider reading about the Target Market of Ampol.

The rebrand from Caltex Australia to Ampol in 2020 marked a significant shift. The acquisition of Z Energy in New Zealand in 2022 for approximately NZ$2 billion expanded Ampol's international presence. These moves reflect Ampol's strategic adaptation and growth initiatives.

The acquisition of Z Energy in New Zealand was a key strategic move. Investments in electric vehicle charging infrastructure and hydrogen initiatives show a commitment to future energy solutions. These strategic actions aim to diversify revenue streams and adapt to market changes.

Ampol's extensive retail network provides broad reach across Australia. Its integrated supply chain offers economies of scale and supply security. The brand strength of Ampol fosters customer loyalty, contributing to its competitive advantage.

The company faces challenges like volatile crude oil prices and the energy transition. In response, Ampol optimizes refining and invests in future energy solutions. These efforts are crucial for long-term sustainability and market adaptation.

Ampol's competitive advantages include a robust retail network and an integrated supply chain. The company is focused on diversifying its revenue streams through convenience retail and international expansion. Investments in new energy technologies position Ampol to adapt to market trends and competitive threats.

- Extensive and strategically located retail network across Australia.

- Integrated supply chain from refining to distribution.

- Strong brand reputation and customer loyalty.

- Focus on convenience retail and international expansion.

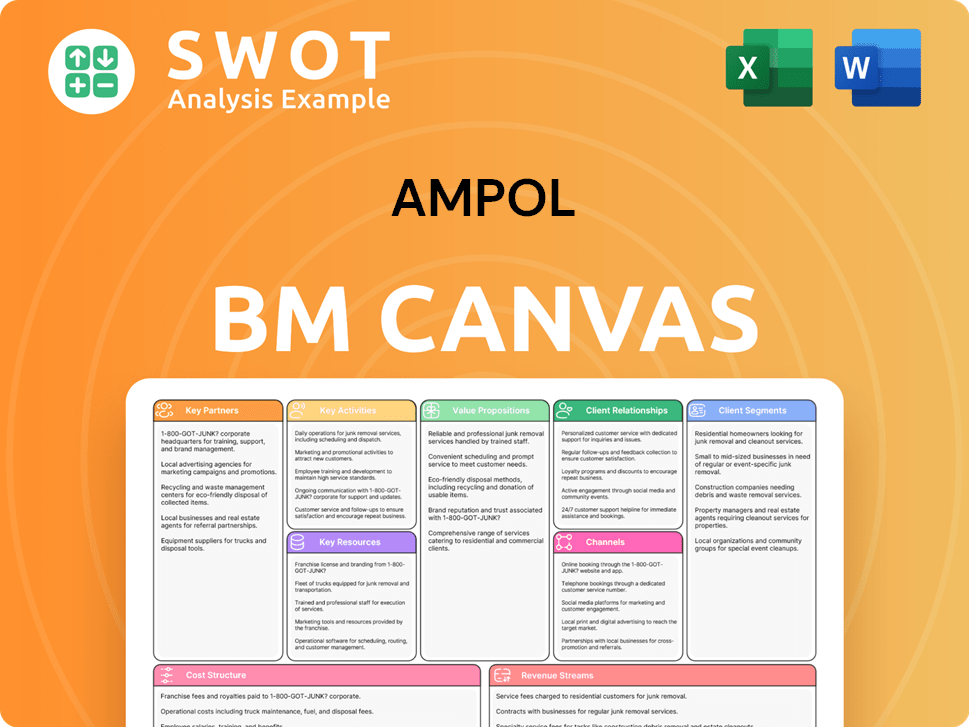

Ampol Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Ampol Positioning Itself for Continued Success?

The Ampol Company holds a strong position in the Australian fuels and convenience retail market, characterized by its extensive network and integrated operations. The company has a significant market share in both retail and commercial fuel supply, supported by strong brand recognition and customer loyalty built over decades. Its reach has expanded with the acquisition of Z Energy in New Zealand, strengthening its position in the Asia-Pacific region.

However, Ampol operations face several risks. These include regulatory changes, particularly those related to environmental policies and emissions standards. The rise of electric vehicles (EVs) presents a long-term challenge to traditional fuel demand. Fluctuations in global crude oil prices and refining margins also pose financial risks. Furthermore, competition from new market entrants, including those focusing on alternative energy solutions, could disrupt its established market position.

Ampol is a leading player in the Australian fuel market, with a significant retail and commercial presence. The company's extensive network of service stations and integrated operations provide a competitive edge. It has expanded its reach through acquisitions, such as Z Energy in New Zealand.

Ampol faces risks from regulatory changes, particularly regarding environmental policies and emissions. The increasing adoption of EVs poses a long-term challenge to fuel demand. Fluctuations in oil prices and refining margins also present financial risks. Competition from alternative energy solutions could disrupt its market position.

Ampol is actively pursuing strategic initiatives to mitigate risks and ensure its future. The company is investing in new energy solutions, including rolling out EV charging infrastructure. Ampol aims to install approximately 300 EV charging bays across 100 sites by the end of 2024. The company is also enhancing its convenience retail offerings.

Ampol is focusing on diversifying its energy offerings and expanding its EV charging network. The company is committed to evolving with the energy transition and optimizing its core assets. This involves maintaining supply chain resilience and capitalizing on opportunities in the evolving energy landscape.

To address these challenges, Ampol Australia is investing in new energy solutions, including EV charging infrastructure. It is also enhancing its convenience retail offerings to diversify revenue. The company's future outlook involves a strategic pivot towards a more diversified energy company.

- Investment in EV charging infrastructure.

- Enhancement of convenience retail offerings.

- Focus on supply chain resilience.

- Capitalizing on opportunities in the evolving energy landscape.

For more in-depth information on the company's ownership structure, consider reading the article about Owners & Shareholders of Ampol. This strategic shift aims to leverage its existing infrastructure and customer base to sustain profitability in the changing energy market. The company's financial performance will depend on its ability to successfully navigate these transitions and capitalize on emerging opportunities.

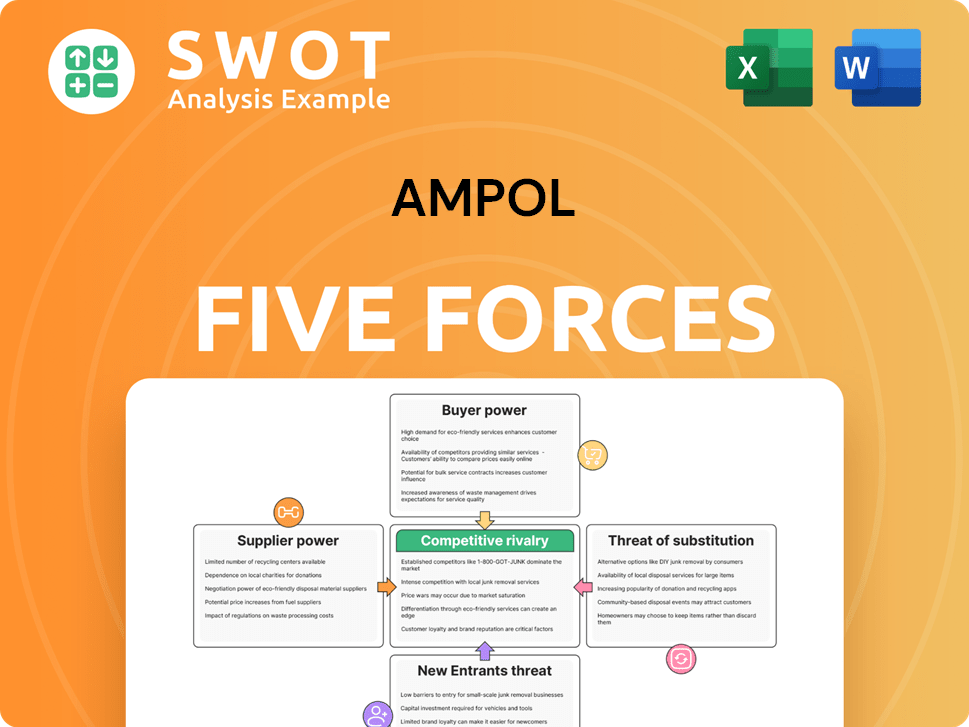

Ampol Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ampol Company?

- What is Competitive Landscape of Ampol Company?

- What is Growth Strategy and Future Prospects of Ampol Company?

- What is Sales and Marketing Strategy of Ampol Company?

- What is Brief History of Ampol Company?

- Who Owns Ampol Company?

- What is Customer Demographics and Target Market of Ampol Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.