AutoNation Bundle

How Does AutoNation Navigate the Cutthroat Auto Retail Arena?

AutoNation, a titan in the automotive retail sector, emerged from a vision to revolutionize car buying. Founded by Wayne Huizenga, the company quickly grew through strategic acquisitions, becoming a nationwide powerhouse. Today, as the AutoNation SWOT Analysis indicates, understanding its competitive standing is vital.

Delving into the AutoNation competitive landscape unveils a dynamic environment shaped by digital disruption, evolving consumer expectations, and the shift towards electric vehicles. This AutoNation market analysis will explore its key competitors, dissect its strategic advantages, and assess its ability to maintain market leadership. Understanding the Auto industry competition and AutoNation's rivals is crucial for anyone seeking to make informed decisions in this sector.

Where Does AutoNation’ Stand in the Current Market?

AutoNation holds a prominent position in the U.S. automotive retail sector. It is consistently ranked as one of the largest automotive retailers by revenue. The company's operations include new and used vehicle sales and after-sales services.

In 2023, AutoNation reported total revenues of $27.0 billion. The company's strategic focus includes expanding its used vehicle market presence through stores like AutoNation USA. This diversification supports its financial health and market share.

AutoNation's financial strength is evident with a net income of $886.7 million in 2023. This financial performance, coupled with its extensive dealership network, positions AutoNation strongly within the automotive retail market. The company's strategic adjustments and geographic footprint are key to maintaining its competitive edge.

AutoNation's market leadership is reflected in its substantial revenue and extensive dealership network. The company's large scale allows it to serve a wide customer base across numerous states. This broad reach supports its ability to compete effectively in the automotive retail market.

The company strategically adapts to market trends, as seen with its focus on used vehicle sales. This move diversifies its offerings and captures a larger share of the pre-owned market. Such adaptations are crucial for maintaining a competitive advantage in the automotive retail market.

AutoNation's financial performance, with a net income of $886.7 million in 2023, underscores its strong market position. This financial health enables the company to invest in growth and maintain its competitive edge. The company's financial stability supports its strategic initiatives.

AutoNation's geographic presence, particularly in the Sunbelt region, is a key element of its market strategy. This extensive footprint allows the company to serve diverse customer segments. The strategic location of dealerships helps in maximizing market penetration.

AutoNation's competitive advantages include its large scale, diversified offerings, and strategic geographic presence. The company's focus on both new and used vehicle sales, along with after-sales services, provides multiple revenue streams. AutoNation's ability to adapt to market changes is also a key strength.

- Market Share: AutoNation consistently aims to increase its market share through strategic initiatives.

- Customer Service: The company focuses on providing excellent customer service to build loyalty.

- Acquisition Strategy: AutoNation uses acquisitions to expand its dealership network and market presence.

- Pricing Strategy: The company employs competitive pricing strategies to attract customers.

For more insights into the company's history and development, consider reading Brief History of AutoNation. The company's ability to adapt to the changing automotive retail landscape is critical for its future competitive position. The continuous evolution of the automotive retail market requires companies like AutoNation to innovate and respond effectively to market dynamics.

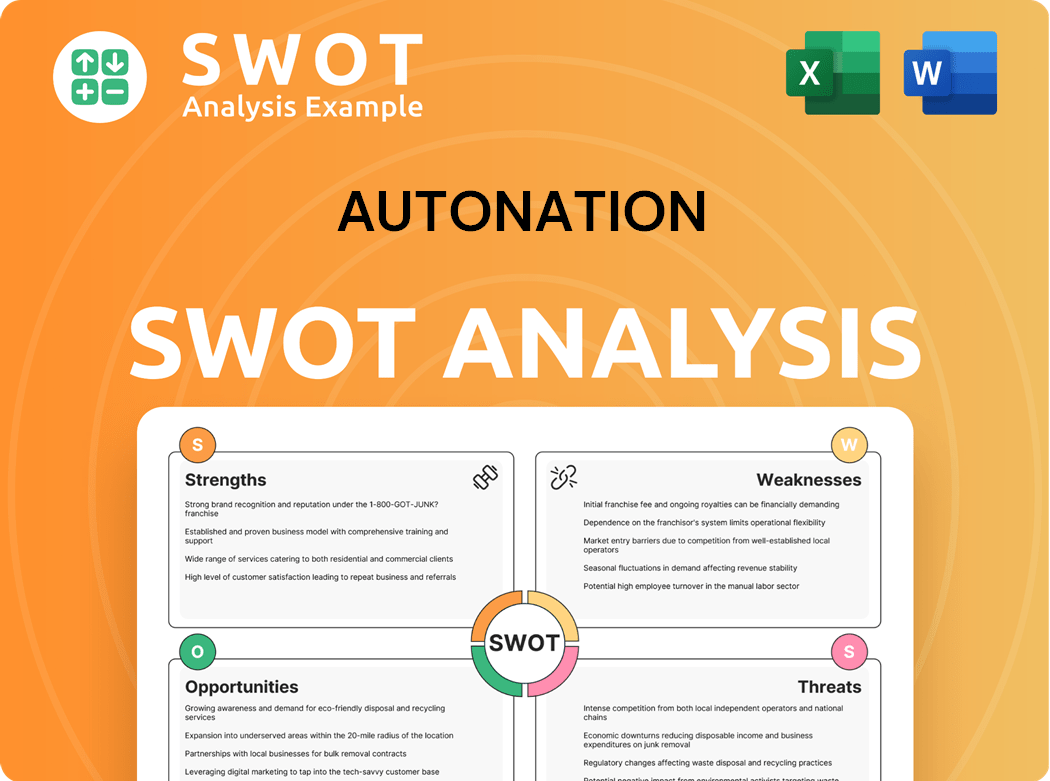

AutoNation SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging AutoNation?

The automotive retail market is a highly competitive arena, and understanding the AutoNation competitive landscape is crucial for any market analysis. Several factors influence the competitive environment, including the rise of online sales and shifting consumer preferences. This dynamic environment requires constant adaptation and strategic foresight.

AutoNation competitors face challenges and opportunities in this evolving landscape. The company must continuously assess its position relative to its rivals to maintain and improve its market share. A comprehensive understanding of the competitive dynamics is essential for strategic planning.

The Auto industry competition is fierce, with various players vying for market share. Several factors influence this competition, including brand loyalty, pricing strategies, and customer service. Understanding these dynamics is essential for assessing the competitive landscape.

The primary direct competitors include large, publicly traded dealership groups. These groups often compete directly with AutoNation across various brands and geographical regions.

Penske Automotive Group is a significant player, with a global presence in automotive retail. They often compete in the luxury vehicle segments, posing a direct challenge to AutoNation's market share.

Lithia Motors has been aggressively expanding through acquisitions, aiming to become a leading automotive retailer. This expansion directly impacts AutoNation's market share and acquisition opportunities.

Group 1 Automotive operates a large network of dealerships, competing with AutoNation across various brands and regions. They are a significant competitor in the automotive retail market.

Indirect competition comes from online used car retailers and direct-to-consumer sales models. These models disrupt the traditional car-buying experience.

Online retailers such as CarMax and Carvana offer alternative purchasing experiences. CarMax's no-haggle pricing and extensive inventory provide a strong competitive edge.

Several factors contribute to the competitive dynamics within the automotive retail market. These include pricing strategies, customer service, and the ability to adapt to changing consumer preferences.

- Market Share: AutoNation's market share is constantly challenged by its competitors. In 2024, Lithia Motors reported revenues of over $30 billion, underscoring the scale of competition.

- Acquisition Strategies: The acquisition strategies of competitors like Lithia Motors impact the market. These acquisitions can change the balance of power in the industry.

- Online Sales: The rise of online car sales continues to reshape the market. Companies like Carvana have seen significant growth, impacting traditional dealerships.

- Customer Experience: Providing excellent customer service is crucial. AutoNation's customer satisfaction ratings and reviews directly influence its competitive standing.

- Geographic Presence: AutoNation's geographic presence, particularly in key markets like Florida, is a factor. Competitors with a strong local presence pose a significant challenge. For example, Marketing Strategy of AutoNation shows how AutoNation adapts its strategies to maintain its position in specific regions.

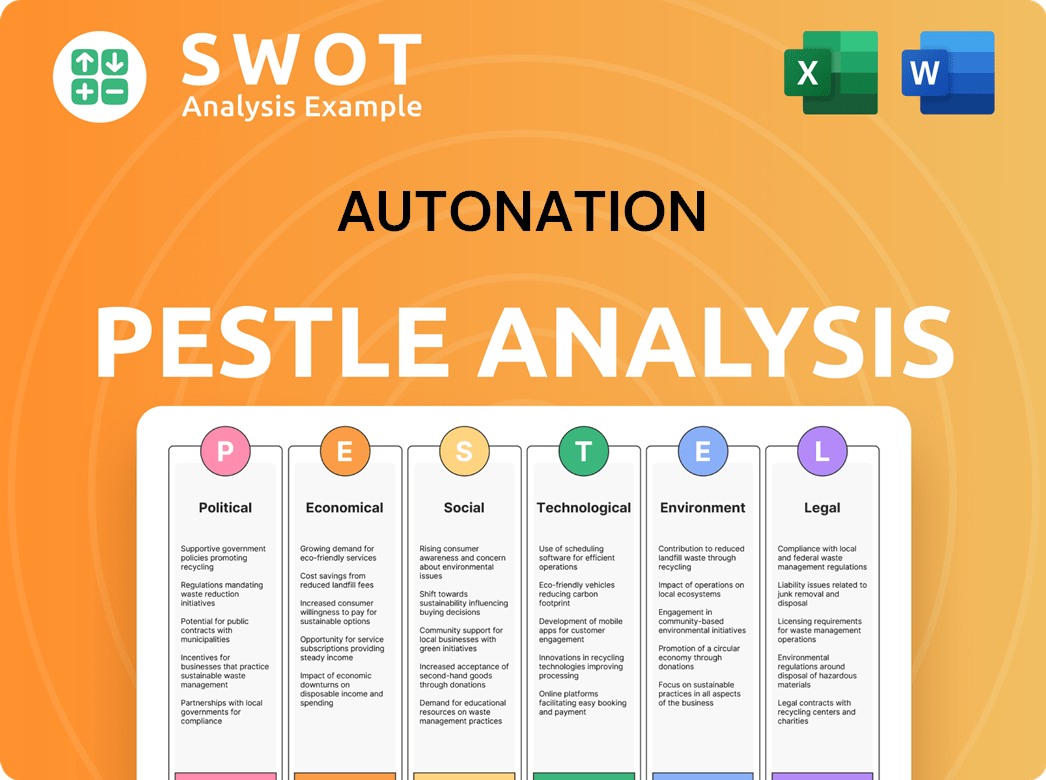

AutoNation PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives AutoNation a Competitive Edge Over Its Rivals?

The competitive landscape for AutoNation is shaped by its significant scale, brand recognition, and integrated business model, which have established it as a leading automotive retailer in the U.S. AutoNation's advantages stem from its ability to efficiently manage inventory, leverage purchasing power, and optimize operational costs due to its extensive network. This network provides a wide selection of vehicles, parts, and services, attracting a broad customer base, and the brand has cultivated customer trust and loyalty.

AutoNation's integrated model, encompassing new and used vehicle sales, financing, and after-sales services, creates multiple revenue streams and enhances customer lifetime value, differentiating it from more specialized competitors. The company has invested in technology and digital platforms to streamline the car-buying process, including online inventory browsing, financing applications, and service scheduling, which are crucial in today's digitally-driven market, and these advantages have evolved from its initial aggressive acquisition strategy to a focus on operational excellence and customer-centric approaches.

While scale and brand are sustainable, the industry's rapid technological shifts and evolving consumer preferences necessitate continuous adaptation and innovation to maintain these advantages against emerging threats and imitation. The company's strategic focus on customer service and digital innovation is essential for maintaining its competitive edge in the dynamic automotive retail market. Analyzing the AutoNation competitive landscape reveals a constant need to adapt to changing consumer behaviors and technological advancements.

AutoNation's expansive network allows for significant economies of scale, boosting efficiency in inventory management and purchasing. Its size enables favorable terms with manufacturers and optimized operational costs, contributing to its competitive advantage. This operational efficiency is crucial in maintaining profitability and market share within the automotive retail market.

The strong brand equity built by AutoNation fosters customer trust and loyalty, a significant advantage in the competitive auto industry competition. Standardized sales processes and customer service initiatives, such as the 'one price' model for used vehicles, enhance the customer experience. This focus is vital for retaining customers and attracting new ones.

AutoNation's integrated model, including sales, financing, and after-sales services, creates multiple revenue streams. This comprehensive approach enhances customer lifetime value and differentiates it from more specialized competitors. The ability to offer a full suite of services strengthens its market position.

Investment in technology and digital platforms streamlines the car-buying process, crucial in today's market. Online inventory browsing, financing applications, and service scheduling enhance customer convenience. This digital focus helps AutoNation stay competitive in a rapidly evolving market.

AutoNation's competitive advantages are rooted in its size, brand reputation, and integrated services. These factors allow it to efficiently manage operations, build customer loyalty, and offer a comprehensive suite of services. Continuous innovation and adaptation are key to maintaining its position in the AutoNation competitive landscape.

- Scale: Largest automotive retailer in the U.S., enabling economies of scale.

- Brand: Strong brand equity and customer loyalty.

- Integrated Model: Offers sales, financing, and after-sales services.

- Digital Innovation: Streamlines the car-buying process with online tools.

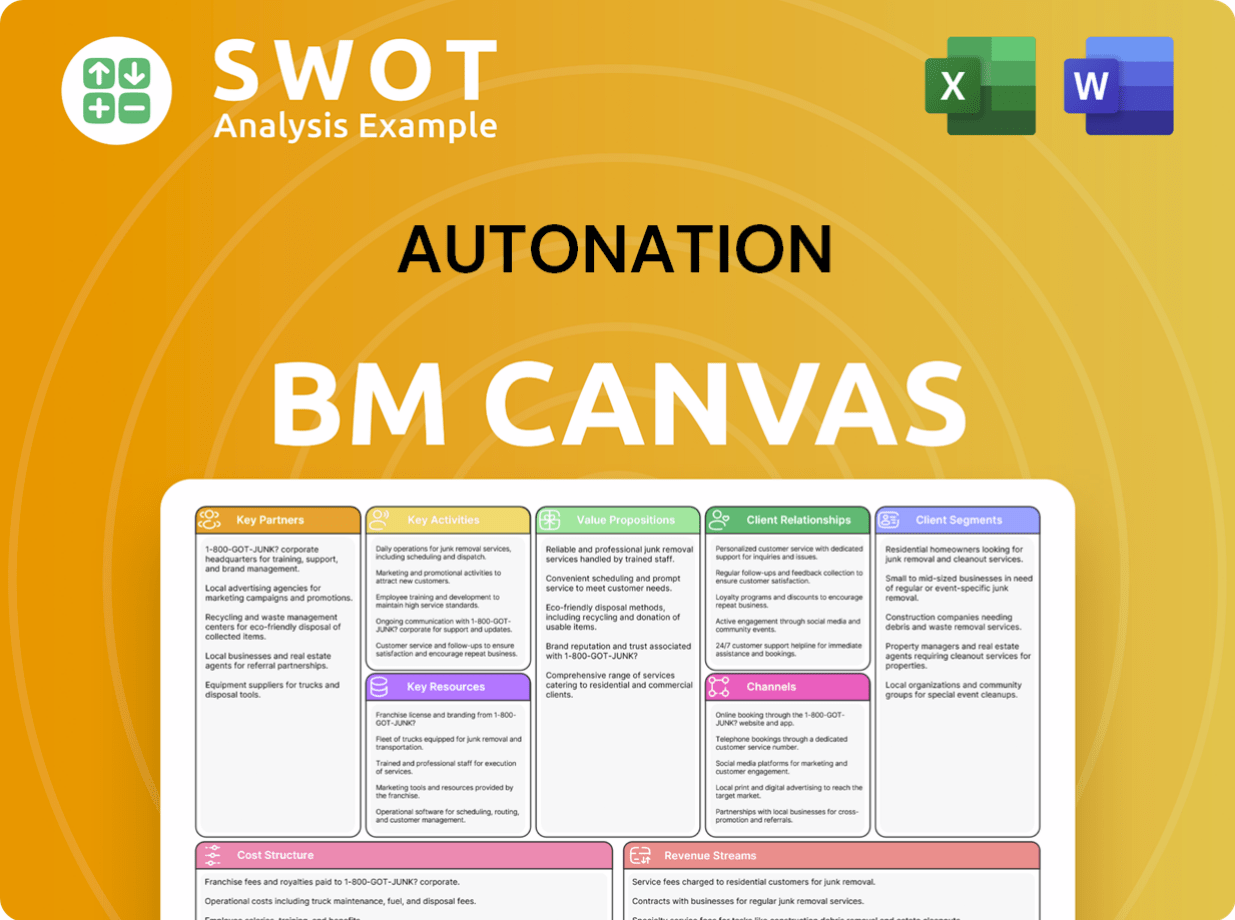

AutoNation Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping AutoNation’s Competitive Landscape?

The automotive retail sector is currently experiencing significant shifts, creating both challenges and opportunities for companies like AutoNation. The rise of electric vehicles (EVs) and the increasing importance of digital platforms are reshaping the landscape. Understanding the AutoNation competitive landscape requires a close look at these trends and how AutoNation is positioning itself within the automotive retail market.

Several factors influence AutoNation's position. These include the company's ability to adapt to changing consumer preferences, manage regulatory changes, and navigate supply chain disruptions. Analyzing the Auto industry competition is crucial for understanding the future outlook for AutoNation and its ability to maintain and grow its market share.

The automotive industry is rapidly changing, with electric vehicles (EVs) gaining momentum and online car buying becoming more prevalent. Consumer preferences are evolving, and regulatory changes are impacting operations. These trends present both challenges and opportunities for AutoNation and its car dealership rivals.

Key challenges include the transition to EVs, which necessitates infrastructure investments and technician training. Competition from direct-to-consumer models and supply chain disruptions also pose significant hurdles. These factors can impact vehicle availability and pricing, affecting profitability for AutoNation.

Opportunities for growth include expanding used vehicle sales, forging strategic partnerships, and consolidating the dealership network through acquisitions. Focusing on digital capabilities and adapting to the changing vehicle landscape are also key to success. These strategies can help AutoNation strengthen its market position.

AutoNation's future depends on its ability to adapt to market changes, optimize its physical and digital presence, and capitalize on emerging trends. The company's strategic initiatives and ability to manage risks will determine its success. The AutoNation market analysis indicates a need for continuous adaptation.

To remain competitive, AutoNation must focus on several key areas. Enhancing digital platforms, expanding EV offerings, and optimizing its dealership network are crucial. Understanding and responding to consumer demands and market dynamics are also important for long-term success. For more detailed insights, read about the Growth Strategy of AutoNation.

- Adapting to the EV Transition: Investing in charging infrastructure and technician training.

- Enhancing Digital Capabilities: Improving online sales and home delivery services.

- Expanding Used Vehicle Sales: Capitalizing on the demand for affordable transportation.

- Strategic Partnerships: Collaborating with technology companies and EV manufacturers.

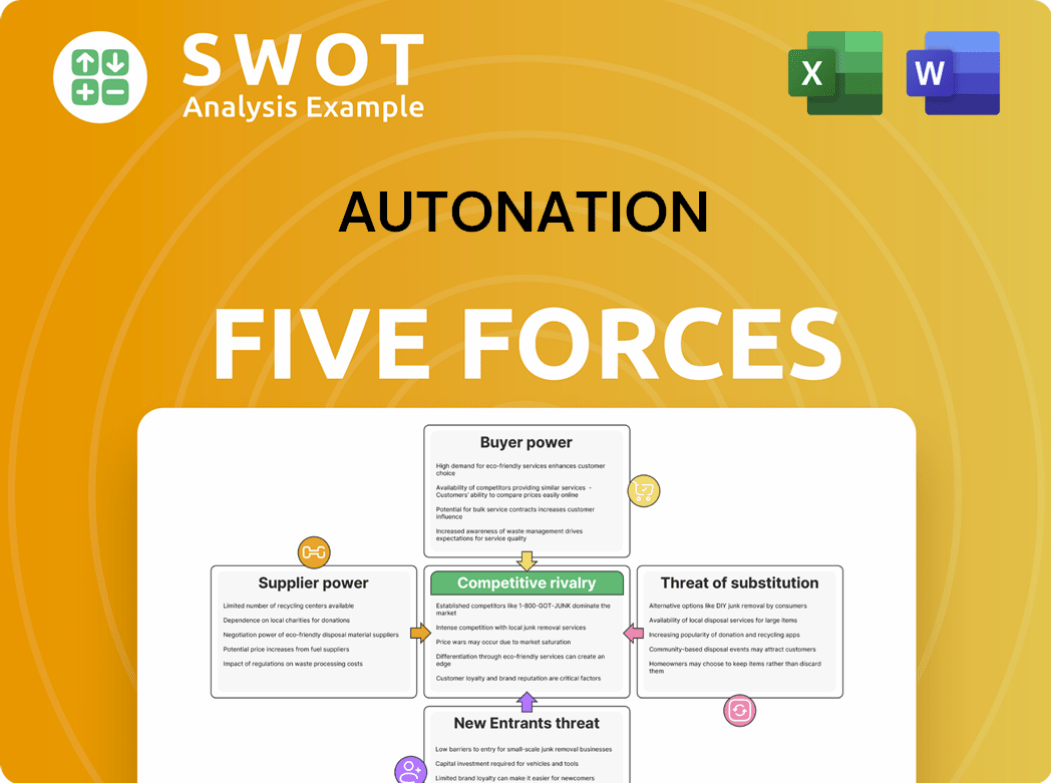

AutoNation Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AutoNation Company?

- What is Growth Strategy and Future Prospects of AutoNation Company?

- How Does AutoNation Company Work?

- What is Sales and Marketing Strategy of AutoNation Company?

- What is Brief History of AutoNation Company?

- Who Owns AutoNation Company?

- What is Customer Demographics and Target Market of AutoNation Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.