AutoNation Bundle

Who Really Controls AutoNation?

Understanding the ownership structure of a company is paramount to grasping its strategic direction and future prospects. AutoNation, a titan in the automotive retail industry, presents a compelling case study in corporate ownership dynamics. From its inception in 1996, AutoNation has reshaped the landscape of car dealerships, but who truly holds the reins?

This exploration into AutoNation SWOT Analysis will dissect the AutoNation ownership structure, examining the influence of major shareholders and the role of AutoNation's parent company. We'll trace the AutoNation history from its roots, considering the impact of key figures and the evolution of its AutoNation stock ownership. Unraveling who owns AutoNation is vital for anyone seeking a comprehensive understanding of this industry leader, including its AutoNation CEO and AutoNation executive team.

Who Founded AutoNation?

The story of AutoNation begins in 1996, with its formal establishment by H. Wayne Huizenga. Huizenga, known for his entrepreneurial ventures like Waste Management and Blockbuster Video, envisioned consolidating the fragmented auto dealership market. AutoNation initially operated as a subsidiary of Republic Industries, another company founded by Huizenga.

Huizenga's strategy for AutoNation involved aggressive acquisitions to rapidly expand its presence. This 'roll-up' strategy was a pioneering move in the auto retail industry. The company used its publicly traded stock to acquire numerous independent car dealerships across the United States.

At its inception, AutoNation launched with twelve retail locations. Republic Industries played a crucial role in facilitating the company's early growth. While specific ownership percentages for the founders are not publicly detailed, Huizenga, through Republic Industries, was the primary driving force behind AutoNation's initial expansion.

AutoNation's initial growth strategy centered on acquiring existing dealerships. This approach allowed for rapid expansion across the United States. The acquisitions were fueled by the company's publicly traded stock, reducing the need for substantial cash outlays.

Republic Industries, founded by Huizenga, served as the parent company of AutoNation in its early years. Republic Industries' financial backing and strategic direction were critical to AutoNation's early success. The company's structure enabled AutoNation to pursue its ambitious acquisition plans.

H. Wayne Huizenga's vision was to create a national network of auto dealerships. His previous successes in other industries provided the framework for AutoNation's strategy. This vision drove the company's rapid expansion and its impact on the auto retail sector.

Steve Berrard, the first CEO of AutoNation, played a key role in the company's early management. Berrard's leadership was important in guiding the company through its initial growth phase. His experience helped shape AutoNation's operational strategies.

Republic Industries expanded into the car rental business, acquiring companies like Alamo Rent A Car in 1996. This move was part of a broader strategy to integrate various aspects of the automotive and transportation sectors. The acquisitions were part of a larger plan to create a comprehensive automotive services company.

In 1997, Republic Industries acquired major dealership groups. The acquisition of the Maroone Automotive Group significantly scaled AutoNation's auto retail presence. These acquisitions were critical to establishing AutoNation's footprint in the market.

Understanding the AutoNation ownership structure and who owns AutoNation at its inception is key to grasping its early development. The AutoNation parent company, Republic Industries, facilitated the initial acquisitions that shaped the company's trajectory. For more insights into the company's evolution, you can explore the history of AutoNation. The company's early strategy, under the leadership of Huizenga and Berrard, set the stage for its future growth and its position in the automotive industry. As of 2024, AutoNation operates in over 100 markets, with approximately 300 locations. The company's revenue for 2024 was around $27 billion. AutoNation's history reflects a significant shift in the automotive retail landscape.

AutoNation's early success was driven by strategic acquisitions and a clear vision. The role of Republic Industries was crucial in providing the necessary resources. Huizenga's leadership and the early management team were instrumental in the company's formation.

- Founded in 1996 by H. Wayne Huizenga.

- Initially a subsidiary of Republic Industries.

- Focused on rapid acquisition of dealerships.

- Steve Berrard was the first CEO.

- Acquired Alamo Rent A Car and National Car Rental.

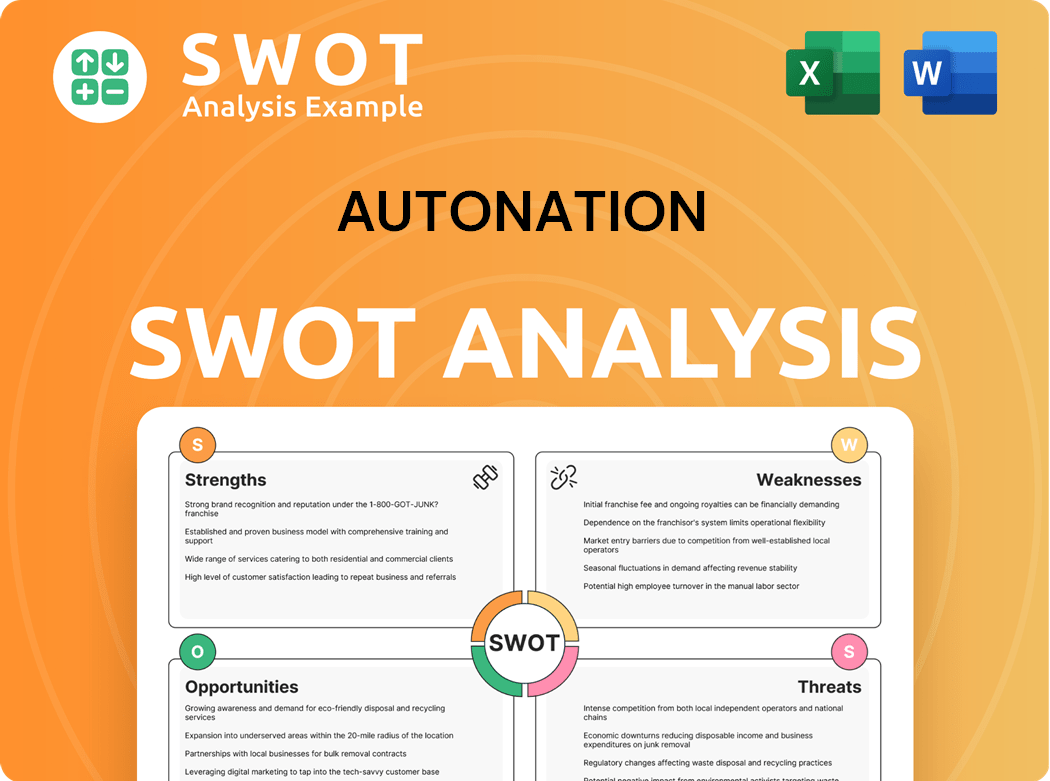

AutoNation SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has AutoNation’s Ownership Changed Over Time?

The ownership structure of AutoNation, a leading automotive retailer, has evolved significantly since its inception. A key shift occurred in 1999 when Republic Industries spun off its non-automotive businesses, rebranding the core auto retail operation as AutoNation, Inc. This strategic move, along with the 2000 spin-off of the car rental business as 'ANC Rental,' allowed AutoNation to focus exclusively on the automotive market, leading to the consolidation of dealership names under a unified national brand. This transformation was crucial in shaping the company's current ownership landscape, making it a publicly traded entity.

Today, AutoNation operates as a publicly traded company listed on the New York Stock Exchange (NYSE: AN). Its ownership is primarily held by institutional investors, reflecting confidence from the broader financial market. The evolution of the company's structure has also facilitated its strategic expansion into financial services and mobile services, enhancing its ability to capture customer value throughout the vehicle ownership lifecycle. These strategic shifts have been instrumental in shaping who owns AutoNation and its future direction.

| Key Event | Year | Impact on Ownership |

|---|---|---|

| Republic Industries Spin-off | 1999 | Focus on auto retail; AutoNation, Inc. established. |

| ANC Rental Spin-off | 2000 | Further concentration on core auto business. |

| Strategic Expansion | 2022-2023 | Diversification into finance and mobile services. |

As of June 6, 2025, AutoNation, Inc. has 901 institutional owners and shareholders, holding a total of 33,041,917 shares. Major institutional shareholders include Vanguard Group Inc., BlackRock, Inc., and State Street Corp. Individual insiders, as of December 30, 2024, hold approximately 7.95% of the company's shares, totaling 2,998,875 shares. Edward Lampert, a 10% owner, has been involved in significant insider selling in 2024. This demonstrates the current ownership structure and the interests of major stakeholders. For a deeper dive into the company's beginnings, you can explore the Brief History of AutoNation.

AutoNation's ownership is primarily institutional, reflecting market confidence. The company's strategic shifts have shaped its current structure.

- Publicly traded on NYSE (AN).

- Key shareholders include Vanguard and BlackRock.

- Insiders hold a significant percentage of shares.

- Strategic expansion into finance and mobile services.

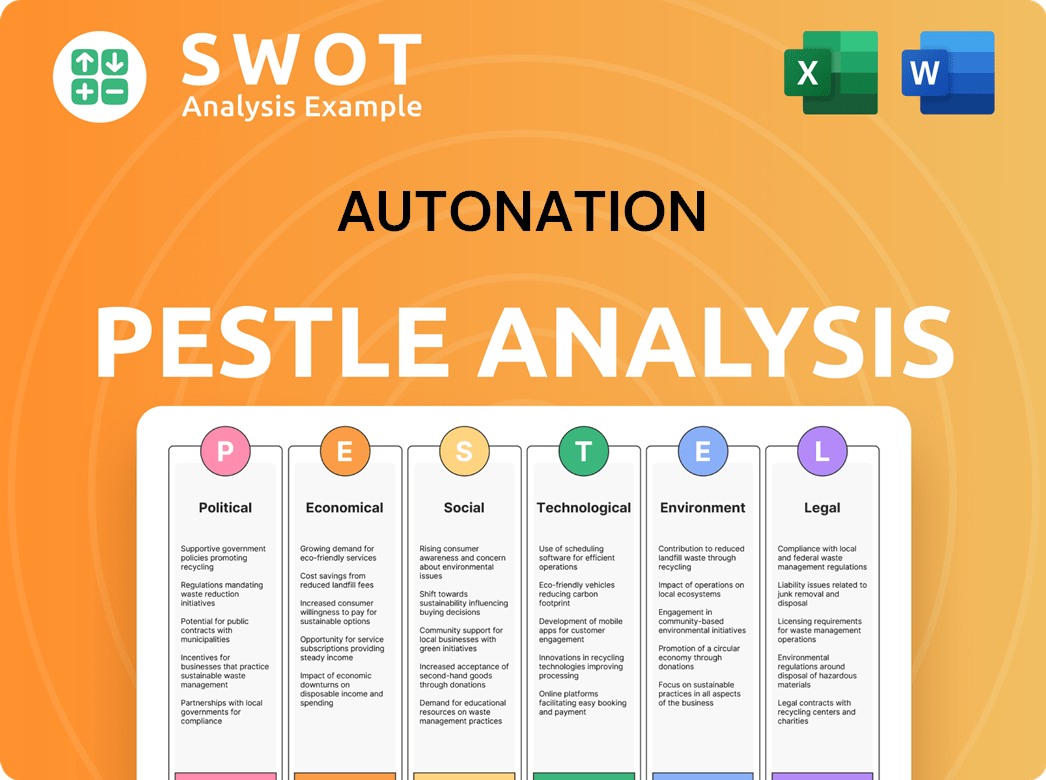

AutoNation PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on AutoNation’s Board?

The current Board of Directors at AutoNation, Inc. oversees the company's strategic direction and governance. As of late 2024, the board consists of twelve members, each bringing diverse experiences. Rick L. Burdick serves as the independent Chairman of the Board, a role he took on February 15, 2021, as part of a succession plan to separate the Chairman and Chief Executive Officer positions. Mr. Burdick has been a director since May 1991.

Key figures on the board include Mike Manley, who is the Chief Executive Officer and a director. Other independent directors include Norman K. Jenkins, who joined in December 2020, and Claire Bennett, appointed in July 2024. The board also includes David B. Edelson, G. Mike Mikan, Jacqueline A. Travisano, Ed.D., Robert R. Grusky, and Lisa Lutoff-Perlo. This composition reflects a commitment to strong corporate governance and alignment with shareholder interests. The separation of the Chairman and CEO roles is a move to enhance independent oversight.

| Director | Title | Since |

|---|---|---|

| Rick L. Burdick | Independent Chairman of the Board | 2021 |

| Mike Manley | Chief Executive Officer and Director | N/A |

| Norman K. Jenkins | Independent Director | 2020 |

The voting structure of AutoNation, reflecting its status as a publicly traded company on the NYSE, generally follows a one-share-one-vote principle. There is no public information suggesting dual-class shares or special voting rights that would give outsized control to specific individuals. Public filings, such as those detailing insider trading activity, including significant sales by Edward Lampert (a 10% owner), are available through SEC filings. This transparency allows shareholders to monitor ownership changes, which is crucial for understanding the company's Growth Strategy of AutoNation and overall direction.

Understanding who owns AutoNation is key to assessing its strategic direction and financial health. The company is publicly traded, with ownership distributed among various institutional investors and individual shareholders. The board of directors plays a crucial role in governance.

- AutoNation's stock is traded on the NYSE.

- The board includes independent directors for oversight.

- Insider trading is publicly reported.

- The company's structure is designed to protect shareholder interests.

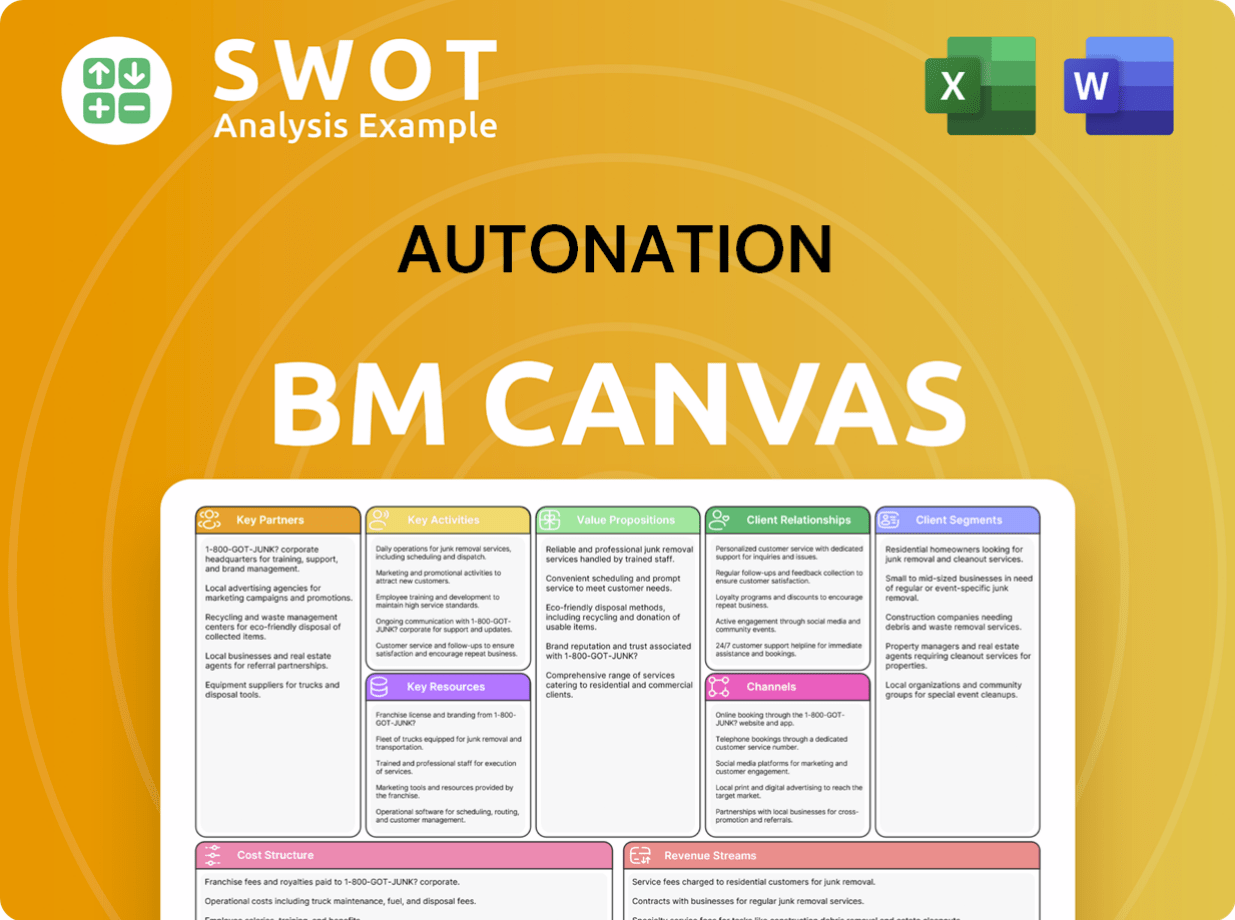

AutoNation Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped AutoNation’s Ownership Landscape?

Over the past few years, the ownership profile of AutoNation has been significantly shaped by strategic capital allocation decisions, including share repurchases and acquisitions. In the first quarter of 2025, the company repurchased 1.4 million shares of common stock for $225 million. This follows a trend of aggressive buybacks, with 2.9 million shares repurchased in 2024, representing 7% of outstanding shares at the beginning of the year. As of March 31, 2025, over $607 million remained under the current repurchase authorization, indicating a continued commitment to returning value to shareholders.

AutoNation's strategy also includes business diversification through mergers and acquisitions. In March 2025, the company acquired a Ford store and a Mazda store for $70 million. This aligns with the company's focus on reinvesting in the business and expanding its footprint. The acquisition of RepairSmith in 2023, rebranded as AutoNation Mobile Service, further demonstrates the company's expansion into after-sales services. The establishment of AutoNation Finance in 2022 and its anticipated profitability by the end of 2025, along with its first asset-backed securitization sale in 2025, highlights the company's strategic financial initiatives.

| Metric | Year | Value |

|---|---|---|

| Shares Repurchased (Q1 2025) | 2025 | 1.4 million |

| Shares Repurchased (2024) | 2024 | 2.9 million |

| Repurchase Authorization Remaining (March 31, 2025) | 2025 | Over $607 million |

The leadership of AutoNation has seen a transition, with Mike Manley becoming CEO and director in November 2021, succeeding Mike Jackson. Industry trends indicate increased institutional ownership, with 901 institutional owners holding over 33 million shares. The company focuses on reinvestment, acquisitions, and share repurchases rather than paying dividends. Public statements and analyst views suggest a continued emphasis on strategic acquisitions and expanding new initiatives, such as AutoNation USA used-car stores and AutoNation Finance. To gain a deeper understanding, you can explore the Competitors Landscape of AutoNation.

AutoNation has consistently repurchased shares, significantly reducing its diluted share count from 200 million in 2007 to 40.9 million at the end of 2024. This strategy is a key component of returning value to shareholders.

The company actively pursues acquisitions to expand its business, including the recent purchase of a Ford and a Mazda store in 2025. The RepairSmith acquisition in 2023 also expanded its service offerings.

The establishment of AutoNation Finance in 2022 and its expected profitability by the end of 2025, along with the first asset-backed securitization sale in 2025, will strengthen its financial position.

AutoNation plans to open 66 AutoNation USA stores between 2025 and 2029, indicating a focus on expanding its used-car business and overall market presence.

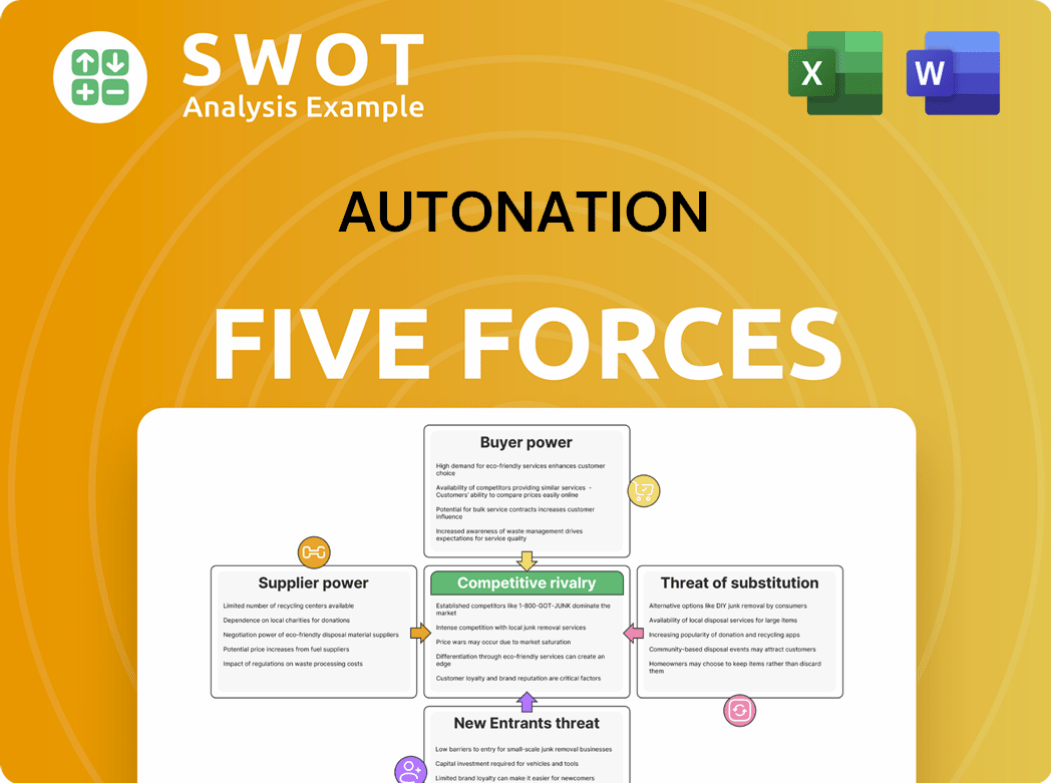

AutoNation Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AutoNation Company?

- What is Competitive Landscape of AutoNation Company?

- What is Growth Strategy and Future Prospects of AutoNation Company?

- How Does AutoNation Company Work?

- What is Sales and Marketing Strategy of AutoNation Company?

- What is Brief History of AutoNation Company?

- What is Customer Demographics and Target Market of AutoNation Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.