AutoNation Bundle

How Does AutoNation Thrive in the Automotive Market?

AutoNation, Inc. stands as a giant in the automotive retail landscape, reshaping how Americans engage with car buying, selling, and servicing. With a staggering $26.9 billion in revenue reported for the full fiscal year 2023 and a robust $7.2 billion in the fourth quarter of 2024, the AutoNation SWOT Analysis reveals a company constantly evolving.

AutoNation's expansive network of AutoNation dealerships and online presence offers a comprehensive suite of services, from new cars and used cars to parts and service, adapting to consumer preferences. Understanding the AutoNation company's operational dynamics is essential, especially considering its ability to navigate supply chain fluctuations and capitalize on emerging trends like electric vehicles, impacting car sales. This exploration will illuminate the business model and future prospects of this industry leader, including insights into the AutoNation car buying process, and AutoNation service department reviews.

What Are the Key Operations Driving AutoNation’s Success?

The core operations of the AutoNation company revolve around a comprehensive business model that blends physical dealerships with a strong online presence. This approach allows the company to offer a wide range of services, including the sale of new and used cars, automotive repair, maintenance, and finance and insurance products. The company caters to a diverse clientele, encompassing individual buyers, fleet purchasers, corporate clients, and those seeking vehicle services and parts.

AutoNation's value proposition is centered on delivering a seamless and convenient experience for its customers. Through its extensive network of over 300 U.S. locations, the company ensures accessibility and convenience. The 'omnichannel' strategy, highlighted by AutoNation Express, enables customers to research, purchase, finance, and even arrange home delivery of vehicles online, complemented by in-store support.

AutoNation's operational efficiency is supported by its ability to procure vehicles from manufacturers and through trade-ins. The company's partnerships with vehicle manufacturers, auto parts suppliers, and financial institutions are crucial to its operations. Its scale allows for economies of scale in inventory management, marketing, and technology implementation, potentially leading to improved profit margins compared to smaller competitors. The after-sales service network not only generates recurring revenue but also cultivates customer loyalty, encouraging repeat business for vehicle purchases.

AutoNation provides a wide array of services, including new and used cars sales, comprehensive automotive repair, and maintenance services. They also offer finance and insurance products, catering to diverse customer needs. The company's offerings extend to both individual and corporate clients, ensuring a broad market reach.

The company leverages its extensive network of dealerships across the U.S. for accessibility. AutoNation's omnichannel approach, including AutoNation Express, allows customers to research, purchase, and finance vehicles online. This digital platform is enhanced by in-house tools like an 'Equity Mining Tool' and Customer 360 CRM.

AutoNation offers a wide selection of vehicles, transparent pricing, and comprehensive financing options. They provide a one-stop shop for vehicle care and maintenance, enhancing customer convenience. The company's scale enables economies of scale, potentially improving profit margins.

In 2023, AutoNation's vehicle acquisition costs were around $11.4 billion. Their extensive after-sales service network generates recurring revenue and cultivates customer loyalty. The company's core capabilities translate into customer benefits through a wide selection of vehicles, transparent pricing, and comprehensive financing options.

AutoNation's scale provides significant advantages in the automotive market. Their extensive network of dealerships and online platforms offers convenience and accessibility to customers. The company's focus on customer service and loyalty contributes to repeat business and brand recognition.

- Extensive Network: Over 300 U.S. locations for easy access.

- Omnichannel Approach: Seamless online and in-store experience.

- Data-Driven Tools: 'Equity Mining Tool' and Customer 360 CRM for personalized recommendations.

- Comprehensive Services: Offers sales, service, and financing under one roof.

For those interested in understanding the specific customer segments that AutoNation dealerships target, a deeper dive into the Target Market of AutoNation can provide valuable insights into the company's strategic focus and customer acquisition strategies.

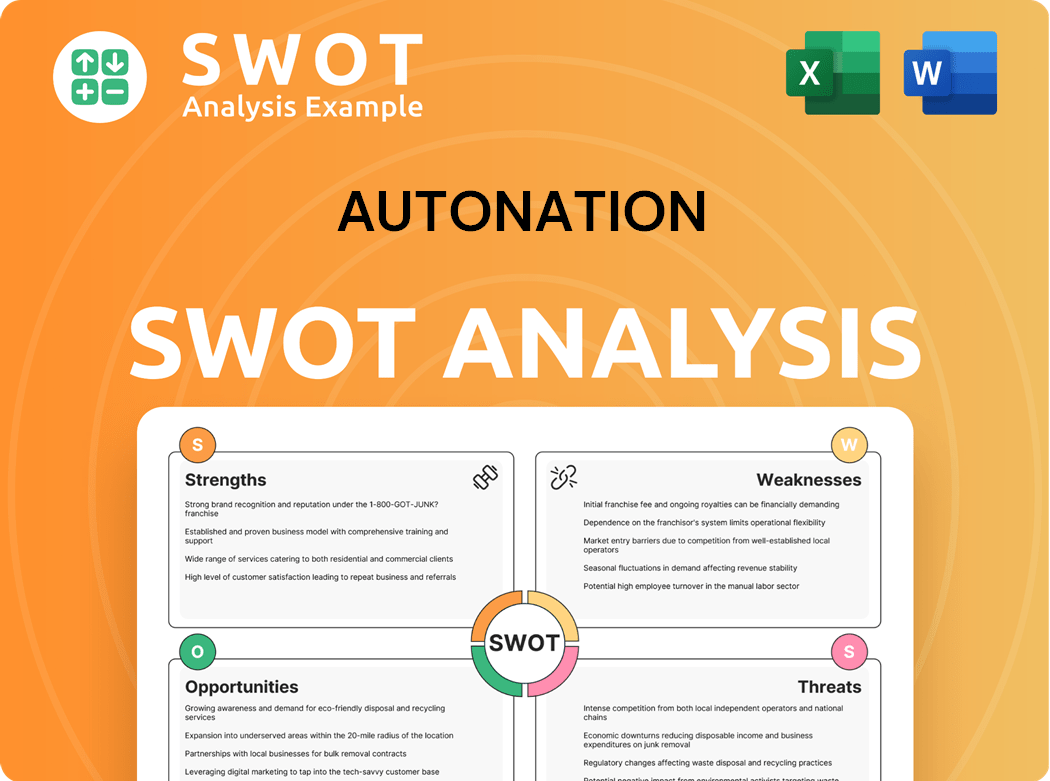

AutoNation SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does AutoNation Make Money?

The AutoNation company generates revenue through a diversified model, focusing on vehicle sales, finance and insurance (F&I) products, and after-sales services. This strategy allows the company to capture multiple revenue streams from each customer interaction, enhancing profitability and resilience. Understanding these revenue streams is key to evaluating the company's financial performance and strategic direction.

The company's monetization strategies include cross-selling, bundled services, and tiered pricing, all designed to maximize revenue per customer. The expansion of standalone used vehicle stores, like AutoNation USA, demonstrates a commitment to capturing a larger share of the used car market and improving profitability. These strategies, coupled with a focus on customer service, contribute to the company's overall financial success and market position.

The AutoNation dealerships have a robust revenue model that includes new, used, and certified pre-owned vehicle sales. In 2024, the company sold 254,715 new vehicles and 265,908 used vehicles. New vehicle sales increased by 4.2% compared to the previous year. For the first quarter of 2025, new vehicle revenue increased 10% to $3.2 billion, with same-store new vehicle retail unit sales up 7% to 62,379 units.

Finance and insurance (F&I) operations are a significant revenue stream for AutoNation. These services include financing options, extended service plans, and insurance products. The company's captive finance arm, AutoNation Finance, originated $1.1 billion in loans during 2024.

The parts and service division (After-Sales) is a crucial part of AutoNation's revenue model. This segment provides routine maintenance, repairs, and genuine parts, fostering repeat business. In Q4 2024, After-Sales same-store gross profit grew by 5%. For the full fiscal year 2024, parts and service revenues reached $5.29 billion. In Q1 2025, After-Sales gross profit reached a record $568 million.

AutoNation employs several monetization strategies to maximize revenue. These include cross-selling, bundled services, and tiered pricing. The 'One Price' pre-owned strategy aims for transparency and efficiency. The expansion of AutoNation USA used vehicle stores allows the company to tap into the growing market for pre-owned vehicles and retail more of its used vehicle trade-ins.

Several key financial metrics highlight AutoNation's performance and revenue streams. The After-Sales segment contributed significantly to overall profitability, constituting 46% of gross profit in 2024, despite representing only 17% of revenue. In Q4 2024, Customer Financial Services (CFS) same-store gross profit grew by 6%.

- Vehicle Sales: Revenue from new and used car sales.

- Finance and Insurance: Income from financing, extended warranties, and insurance products.

- Parts and Service: Revenue from maintenance, repairs, and parts sales.

- Strategic Initiatives: Expansion of AutoNation USA used car stores to increase market share and profitability.

To further understand the strategies employed by the company, you can explore the Marketing Strategy of AutoNation.

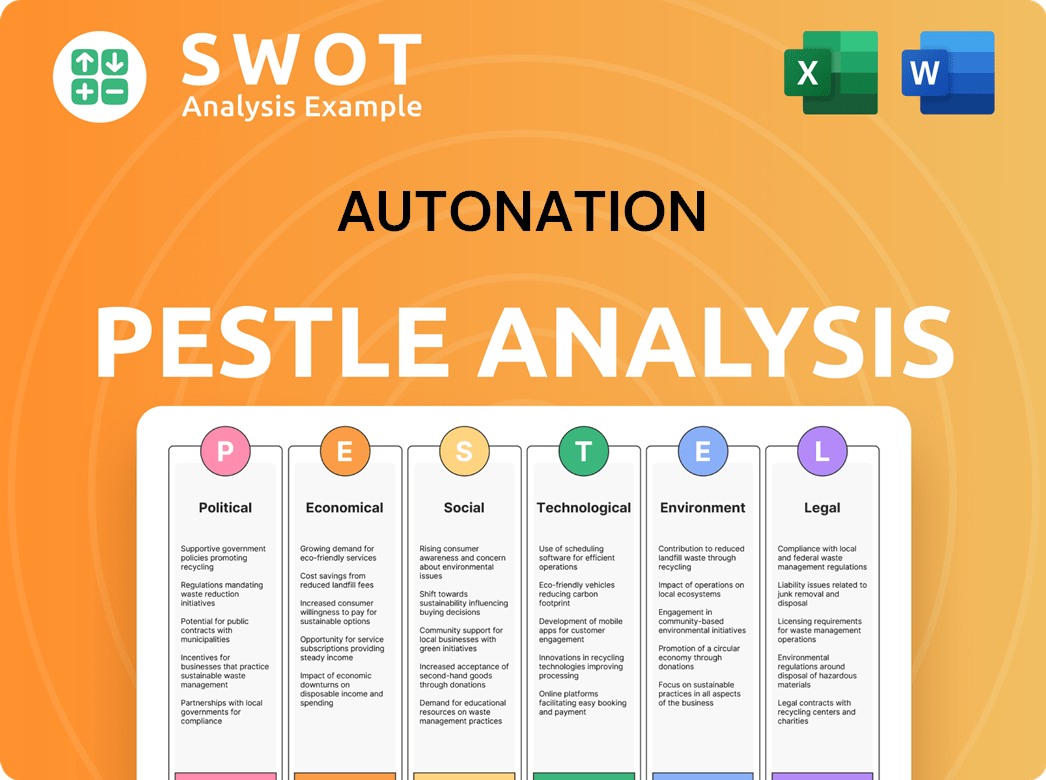

AutoNation PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped AutoNation’s Business Model?

The story of the AutoNation company is marked by significant milestones and strategic shifts that have shaped its operations and financial performance. Established in 1996, the company rapidly expanded through the acquisition of dealerships. It consolidated its brand under the AutoNation name by 1999, a move that established a strong national presence.

A key strategic decision was unifying dealership names under a single brand, completed around 2013. This move created significant marketing leverage and operational consistency. The company has also strategically diversified into complementary businesses to capture more customer value throughout the vehicle ownership lifecycle.

AutoNation's competitive advantages stem from its substantial operational scale and diversified revenue streams. The company continues to adapt to new trends, such as the electrification transition. Challenges are addressed through its agile business model and continued investment in digital capabilities.

AutoNation began in 1996 and quickly grew through acquisitions. By 1999, it had unified its brand. The consolidation of dealership names under a single national brand was completed around 2013, enhancing marketing and operational efficiency.

The creation of AutoNation Finance in 2022, through the acquisition of CIG Financial, was a key move. In 2023, the acquisition of RepairSmith expanded service offerings. The company is expanding its AutoNation USA used vehicle stores.

AutoNation benefits from its operational scale and diversified revenue streams. Its size provides economies of scale in inventory management, marketing, and technology. The company's broad geographic footprint, particularly in the Sun Belt region, mitigates risks.

AutoNation is adapting to the electrification transition by incorporating EVs and establishing EV service centers. The company addresses challenges like supply chain fluctuations through its agile business model. Continuous investment in digital capabilities is also a priority.

AutoNation Finance originated $1.1 billion in loans by the end of 2024 and is expected to reach profitability by the end of 2025. The company's 'One Price' strategy for pre-owned vehicles enhances transparency and customer trust. Digital channels accounted for over 50% of unit sales in 2021.

- AutoNation has a significant presence in the car sales market.

- The company's strategic moves include diversification into finance and service.

- Its competitive edge comes from its size, geographic reach, and digital investments.

- AutoNation is actively expanding its used car business and adapting to EVs.

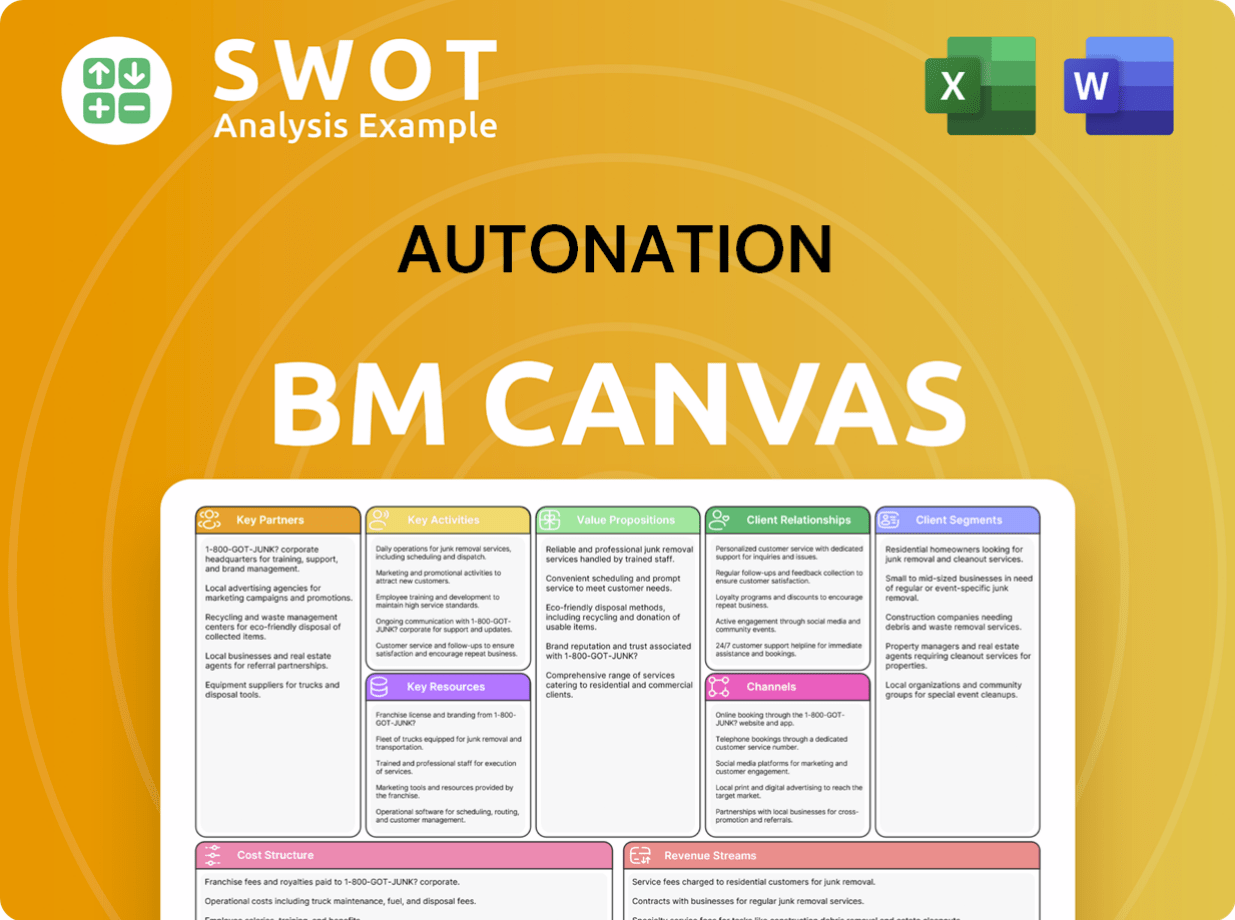

AutoNation Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is AutoNation Positioning Itself for Continued Success?

The AutoNation company holds a significant position in the U.S. auto retail sector, benefiting from its large operational scale and diversified revenue streams. As one of the largest automotive retailers, its size and brand recognition provide a competitive edge, enabling economies of scale in both operations and marketing. With 225 dealerships across the nation as of 2024, the company is a major player in the car sales market.

Despite its strong market position, AutoNation dealerships face various risks, including economic factors that influence vehicle affordability and demand. The automotive retail sector also deals with increased competition from manufacturers exploring direct-to-consumer sales models. Furthermore, regulatory changes and inventory management challenges add to the complexities of the industry. The cyclical nature of the automotive industry can also affect financial performance.

AutoNation's extensive network of AutoNation dealerships and brand recognition allows for economies of scale, giving it a competitive advantage. In 2024, the company sold 254,715 new vehicles and 265,908 used vehicles. The company's broad geographical presence and diversified revenue streams contribute to its strong industry position.

Economic downturns and high interest rates can negatively impact car sales. Competition from direct-to-consumer sales models and online car-buying platforms poses challenges. Regulatory changes and inventory management issues also present risks. The automotive industry's cyclical nature can affect financial results.

Analysts project modest growth in fiscal year 2025 and stronger growth in fiscal year 2026. Strategic initiatives include enhancing omnichannel capabilities and expanding the AutoNation USA used vehicle brand. The expansion of the AutoNation Finance business, which originated over $1 billion in loans in 2024, is expected to reach profitability by the end of 2025.

AutoNation plans to build at least 20 additional AutoNation USA stand-alone used vehicle stores over the next three years. The company is focused on expanding its AutoNation Finance business. Leadership is committed to customer experience, maintaining a strong balance sheet, and maximizing shareholder returns. For more details, see the Growth Strategy of AutoNation.

AutoNation is focusing on enhancing its omnichannel capabilities and expanding its used car business through the AutoNation USA brand. The company is also investing in its financing arm to boost revenue and profitability. These initiatives are designed to drive future growth and improve customer satisfaction.

- Expansion of AutoNation USA stores for used cars.

- Focus on expanding AutoNation Finance.

- Enhancing customer experience and satisfaction.

- Adapting to the transition towards electric vehicles.

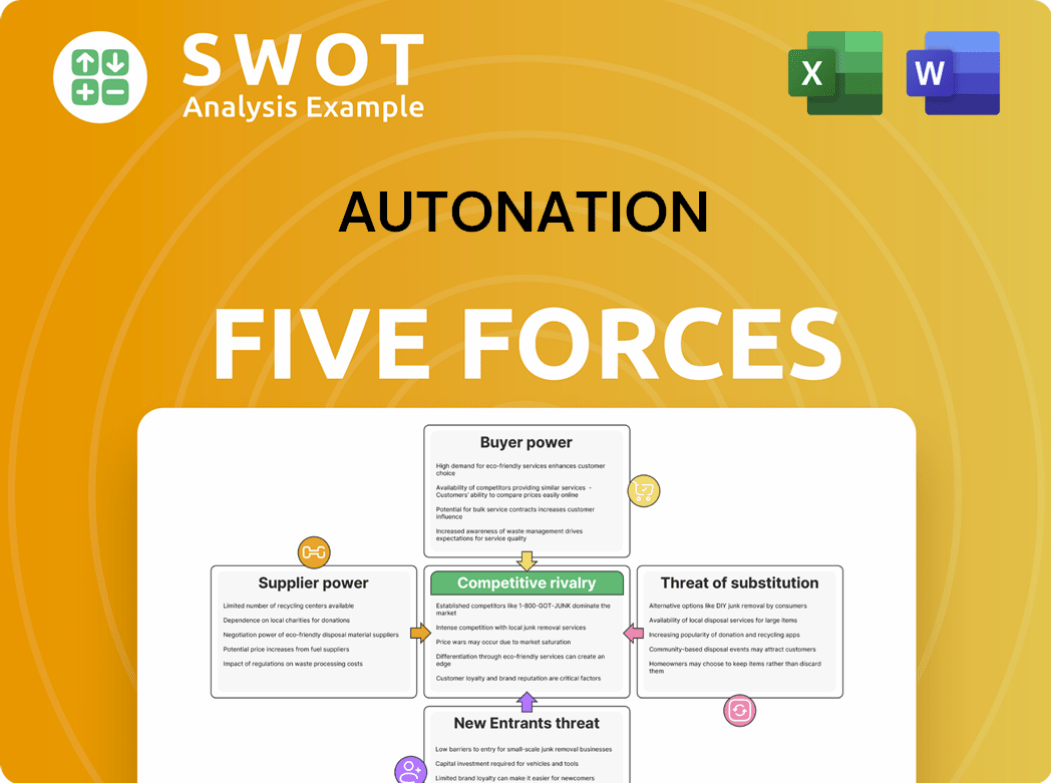

AutoNation Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AutoNation Company?

- What is Competitive Landscape of AutoNation Company?

- What is Growth Strategy and Future Prospects of AutoNation Company?

- What is Sales and Marketing Strategy of AutoNation Company?

- What is Brief History of AutoNation Company?

- Who Owns AutoNation Company?

- What is Customer Demographics and Target Market of AutoNation Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.