AutoNation Bundle

Can AutoNation Continue Its Dominance in the Evolving Auto Market?

AutoNation, a titan in the automotive retail sector, has consistently reshaped the industry since its inception. Founded in 1996, the company's journey from a disruptor to a market leader is a testament to its strategic prowess. Today, as the automotive landscape rapidly transforms, understanding AutoNation's AutoNation SWOT Analysis is crucial for investors and industry watchers alike.

This article provides a comprehensive AutoNation company analysis, dissecting its current growth strategy and future prospects. We'll explore how AutoNation is navigating the dynamic auto industry trends, including its approach to electric vehicles and online sales. Furthermore, we will examine AutoNation's financial performance and market share, offering insights into its strategic partnerships and long-term financial projections, helping you understand the future of AutoNation stock price and its competitive landscape.

How Is AutoNation Expanding Its Reach?

The AutoNation growth strategy is centered on expanding its operations and increasing its market share. This involves a dual approach: organic growth through optimizing existing dealerships and strategic acquisitions to broaden its reach. The company actively seeks opportunities to acquire dealerships, particularly in high-growth regions, to enhance its overall financial performance.

A significant part of AutoNation's expansion involves its used car business, specifically the AutoNation USA stores. These stores are designed to capture a larger share of the used vehicle market. Furthermore, the company is investing in its parts and service business, which is a stable and profitable revenue stream, to ensure customer retention and support the growing number of vehicles on the road.

AutoNation also explores new business models to meet changing consumer preferences and stay ahead of industry trends. This includes subscription services and enhanced digital retail platforms, which are designed to improve the customer experience and drive sales. These initiatives are crucial for maintaining a competitive edge in the evolving automotive market.

AutoNation actively acquires dealerships to expand its market presence. The company focuses on dealerships that align with its existing brand portfolio and geographic targets. This strategy helps increase

The expansion of AutoNation USA stores is a key component of the used vehicle strategy. The company aims to increase its footprint in the used car market. This expansion provides a wider selection of vehicles and a consistent customer experience. This initiative directly impacts

AutoNation invests in its parts and service business to ensure a stable revenue stream. Investments in service capacity and technician training are ongoing. This strategy supports the growing vehicle parc and enhances customer retention. This contributes to overall

AutoNation explores new business models, such as subscription services and enhanced digital retail platforms. These initiatives cater to evolving consumer preferences. The goal is to stay ahead of industry trends and improve the customer experience. This adaptation is crucial for

AutoNation's expansion initiatives are designed to drive revenue growth and increase market share. The company focuses on strategic acquisitions, expanding its used car business, and enhancing its service offerings. These efforts are supported by investments in technology and customer service.

- Strategic Acquisitions: Targeting dealerships in high-growth markets.

- AutoNation USA: Expanding the used car store network.

- Parts and Service: Investing in capacity and technician training.

- Digital Platforms: Enhancing online sales and customer experience.

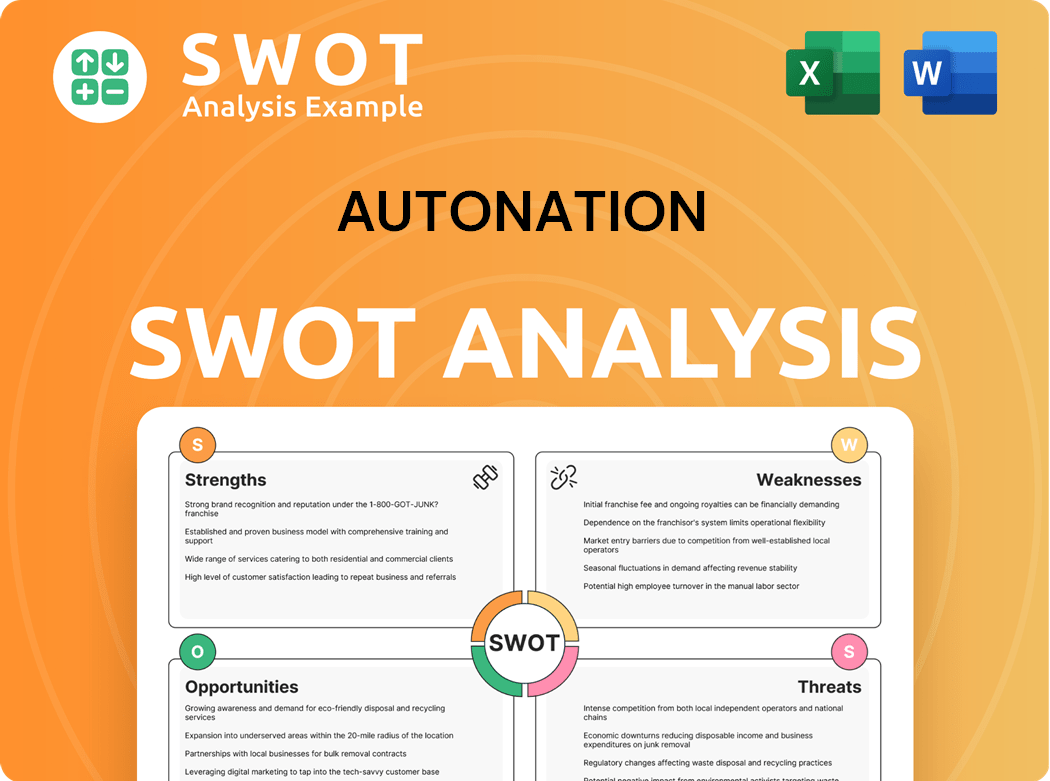

AutoNation SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does AutoNation Invest in Innovation?

AutoNation is actively leveraging innovation and technology to propel its growth strategy and enhance customer experiences. The company's focus centers on digital transformation, aiming to create a seamless, omni-channel experience that integrates online and in-store interactions. This approach addresses evolving consumer preferences for digital engagement, making the car-buying process more convenient and transparent.

The company is investing significantly in its e-commerce platforms, enabling customers to complete more of the car-buying process online. This includes vehicle selection, financing, and trade-in valuations. AutoNation's strategic initiatives are designed to cater to the modern consumer's demand for digital solutions, streamlining the overall car-buying journey.

Furthermore, AutoNation is exploring the application of cutting-edge technologies like artificial intelligence (AI) and data analytics to optimize its operations. These technologies are used for personalized marketing, predictive maintenance, and inventory management. This data-driven approach allows for better market trend understanding, optimized pricing, and tailored offerings, contributing to AutoNation's competitive advantage.

AutoNation's digital transformation focuses on creating a seamless omni-channel experience. This involves integrating online and in-store interactions to meet modern consumer preferences. The goal is to provide convenience and transparency throughout the car-buying process.

The company enhances its e-commerce platforms to allow customers to complete more of the car-buying process online. This includes vehicle selection, financing, and trade-in valuations. This strategy caters to the growing demand for digital solutions.

AutoNation utilizes artificial intelligence (AI) and data analytics to optimize operations. These technologies are applied in personalized marketing, predictive maintenance, and inventory management. This approach improves efficiency and customer satisfaction.

AutoNation is adapting to the shift towards electric vehicles (EVs) by investing in charging infrastructure. This includes training technicians to service EV powertrains and batteries. The company is preparing for the growing adoption of EVs.

The focus on data-driven decision-making allows AutoNation to better understand market trends. This helps in optimizing pricing and tailoring offerings. These efforts contribute to improved operational efficiency.

The integration of digital tools and operational efficiencies aims to enhance the customer experience. This includes providing convenience, transparency, and personalized services. AutoNation prioritizes customer satisfaction.

AutoNation is also adapting to the evolving automotive landscape, particularly the rise of electric vehicles (EVs). The company is investing in charging infrastructure and training its technicians to service EV powertrains and batteries. This proactive approach ensures that AutoNation remains competitive and can meet the growing demand for EVs. For a broader understanding of the competitive landscape, consider exploring the Competitors Landscape of AutoNation.

AutoNation's commitment to innovation is evident in its strategic investments in digital transformation and operational efficiency. These initiatives are designed to enhance customer experience and drive sustainable growth. The company's focus on technology ensures it remains competitive in the dynamic automotive retail market.

- Digital Transformation: Enhancing e-commerce platforms and integrating online and in-store experiences.

- AI and Data Analytics: Utilizing AI for personalized marketing, predictive maintenance, and inventory management.

- EV Infrastructure: Investing in charging stations and training technicians for EV service.

- Operational Efficiency: Using data to optimize pricing and tailor offerings.

- Customer Experience: Prioritizing convenience, transparency, and personalized services.

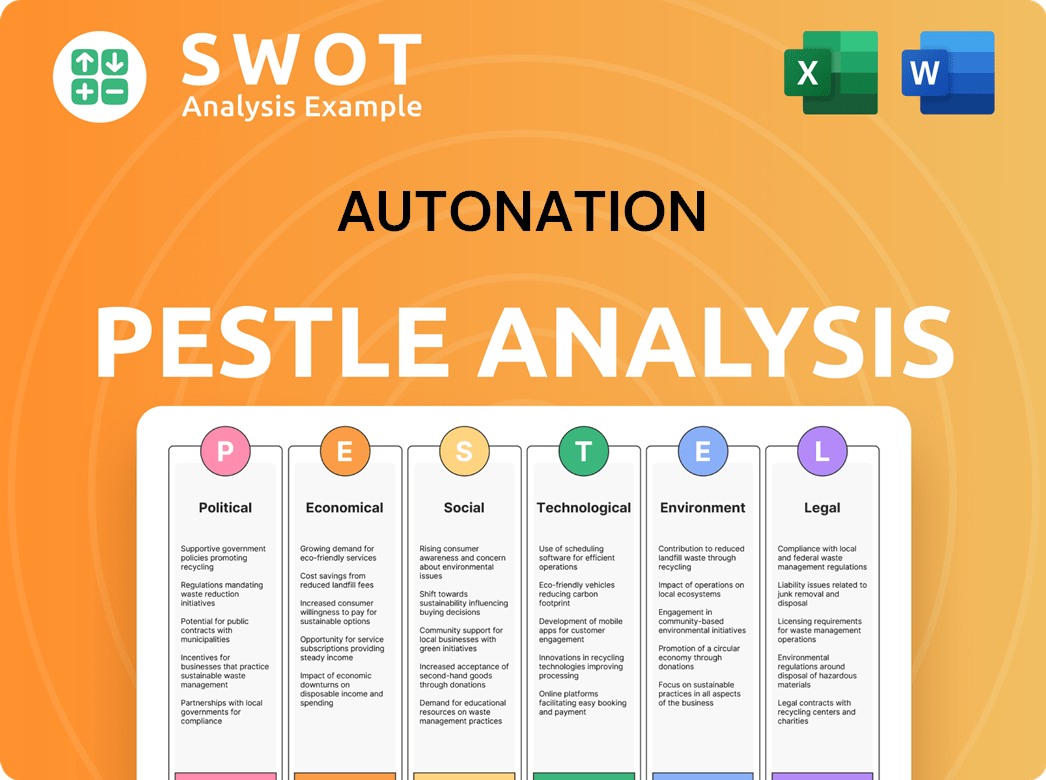

AutoNation PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is AutoNation’s Growth Forecast?

The financial outlook for AutoNation reflects a strategic focus on profitable growth, operational efficiency, and capital allocation designed to enhance shareholder value. The company has demonstrated consistent financial performance, underpinned by strong demand for both new and used vehicles, as well as robust parts and service revenue. In its Q1 2024 earnings report, AutoNation reported diluted earnings per share from continuing operations of $5.99, reflecting a solid start to the year despite some market headwinds. Total revenue for the first quarter of 2024 was $6.7 billion.

AutoNation's financial strategy includes optimizing its revenue mix, with a continued emphasis on higher-margin used vehicle sales and parts and service business. The company aims to achieve efficiencies through its scale and technology investments, which are expected to contribute to improved profit margins. Analysts' forecasts for AutoNation generally project stable revenue growth and strong profitability in the coming years, driven by its diversified business model and strategic expansions. This approach supports AutoNation's strategic plans for sustained market leadership and enhanced shareholder returns.

AutoNation has also been active in returning capital to shareholders through share repurchases, with $122.9 million of common stock repurchased in Q1 2024. This disciplined capital management strategy complements its organic growth initiatives. For a deeper understanding of the company's foundational principles, you can explore Mission, Vision & Core Values of AutoNation.

AutoNation's revenue growth is driven by several key factors. These include strong sales of both new and used vehicles, a robust parts and service business, and strategic expansions. The company's focus on higher-margin sales, such as used vehicles and service, contributes significantly to revenue growth.

AutoNation holds a significant market position in the U.S. auto retail industry. The company's extensive network of dealerships across the country allows it to capture a substantial share of the market. Its strategic locations and diverse brand offerings contribute to its strong market presence.

AutoNation is actively implementing strategies to enhance its online car sales. These include improving its digital platforms, offering online financing options, and providing virtual showroom experiences. The company aims to provide a seamless and convenient online buying experience for customers.

Economic downturns can impact AutoNation's financial performance. Reduced consumer spending, decreased demand for vehicles, and fluctuations in interest rates can affect sales and profitability. The company's diversified business model and focus on service revenue help mitigate some of these risks.

AutoNation's long-term financial projections generally include stable revenue growth and strong profitability. These projections are supported by the company's diversified business model and strategic expansions. The company's focus on higher-margin sales and operational efficiencies is expected to contribute to sustained financial performance.

- Stable revenue growth driven by new and used vehicle sales.

- Strong profitability through higher-margin sales and cost efficiencies.

- Continued capital allocation to enhance shareholder value.

- Strategic investments in technology and infrastructure.

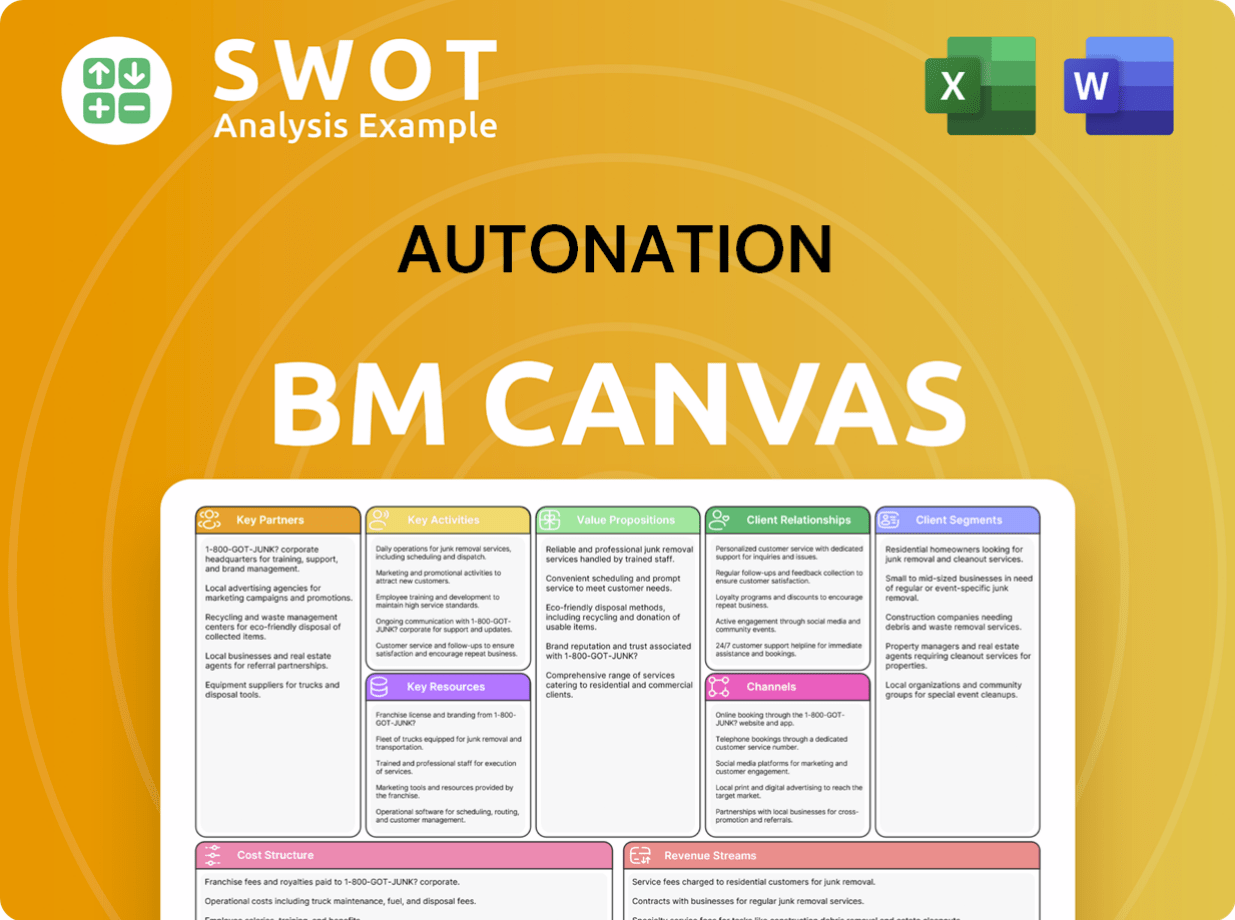

AutoNation Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow AutoNation’s Growth?

The path to growth for AutoNation, like any major player in the automotive retail sector, isn't without its hurdles. The company's ambitions face several strategic and operational risks inherent in the competitive automotive retail industry. Understanding these potential obstacles is critical for evaluating the company's long-term viability and investment potential.

A primary concern is the intensely competitive market landscape. AutoNation operates in an environment with numerous established dealerships and the increasing presence of online automotive retailers. This competition can squeeze profit margins and necessitate significant marketing investments to maintain or grow market share. Furthermore, external factors, such as economic downturns and evolving regulations, pose additional challenges.

The company's ability to navigate these challenges will significantly influence its future performance and market position. Adapting to industry trends, managing supply chain disruptions, and effectively responding to economic fluctuations are essential for AutoNation to achieve its growth objectives and maintain its competitive edge. A thorough understanding of these risks is essential for any analysis of AutoNation's potential.

The automotive retail sector is highly competitive, with numerous dealerships vying for market share. New online retailers further intensify competition, potentially impacting profit margins. AutoNation's AutoNation market share is constantly challenged by these dynamics.

Changes in regulations, especially those related to vehicle emissions, safety standards, and consumer protection, can affect operations and profitability. The evolving landscape of electric vehicle regulations and infrastructure requires significant capital investment. Compliance costs can impact AutoNation financial performance.

Supply chain disruptions, such as semiconductor shortages, can disrupt vehicle availability and sales. While the industry is recovering, global supply chain issues remain a potential risk. These disruptions can directly affect AutoNation's revenue growth drivers.

The rapid shift to electric vehicles and autonomous driving presents both opportunities and threats. AutoNation must adapt its business model, invest in new technologies, and train its workforce. This adaptation is crucial for AutoNation's future prospects.

Economic downturns, rising interest rates, or decreased consumer confidence can decrease vehicle demand. These factors can negatively impact sales and financing revenues. The resilience of AutoNation company analysis is tested during economic fluctuations.

The growth of electric vehicles necessitates investments in charging infrastructure and service capabilities. AutoNation must adapt its service departments and sales strategies to accommodate EVs. Understanding how AutoNation is adapting to electric vehicles is key.

AutoNation mitigates risks through diversification across new and used vehicle sales, parts and service, and a broad geographic footprint. The company employs robust risk management frameworks and scenario planning to anticipate potential obstacles. These strategies aim to maintain operational resilience.

Strategic partnerships and acquisitions can strengthen AutoNation's market position and expand its capabilities. The company has been involved in recent acquisitions to enhance its service offerings and geographic reach. These actions can impact AutoNation's recent acquisitions and their impact.

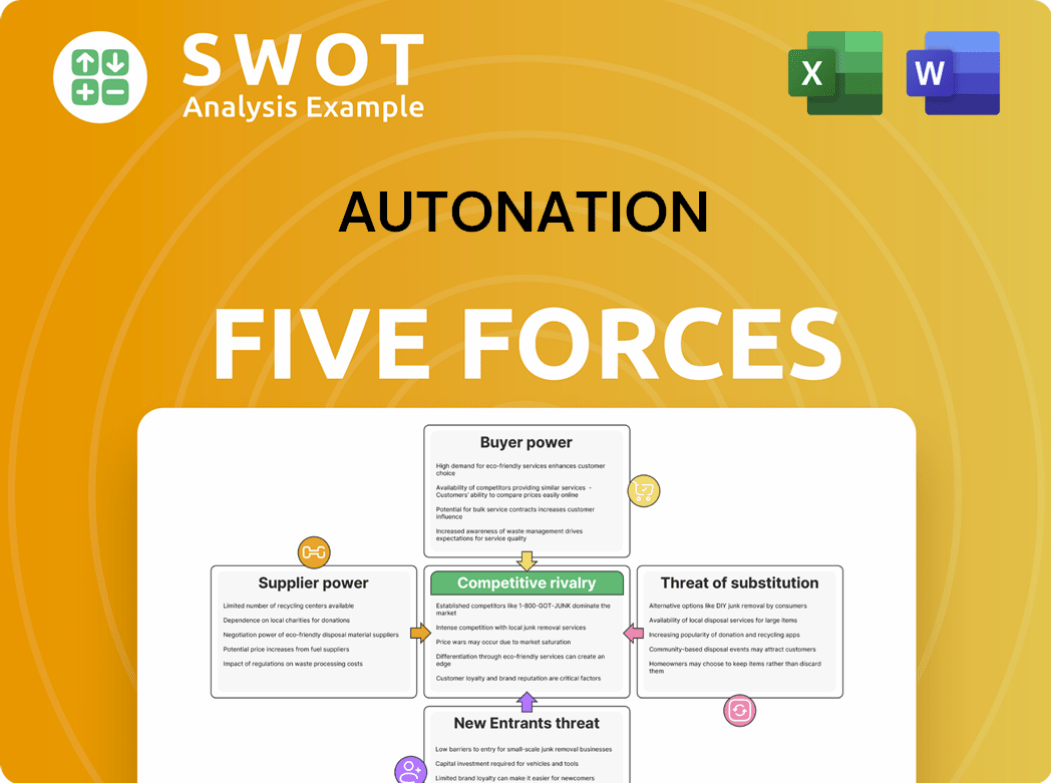

AutoNation Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AutoNation Company?

- What is Competitive Landscape of AutoNation Company?

- How Does AutoNation Company Work?

- What is Sales and Marketing Strategy of AutoNation Company?

- What is Brief History of AutoNation Company?

- Who Owns AutoNation Company?

- What is Customer Demographics and Target Market of AutoNation Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.