Blade Air Mobility Bundle

How Does Blade Air Mobility Navigate the Urban Air Mobility Race?

The Blade Air Mobility SWOT Analysis reveals a company at the forefront of a revolution. The urban air mobility (UAM) sector is buzzing with innovation and investment, and Blade Air Mobility is a key player. Founded in 2014, Blade initially focused on democratizing helicopter travel, and it has since expanded its vision to include fixed-wing aircraft and prepare for the integration of electric vertical aircraft (EVA).

This exploration delves into the Blade Air Mobility competitive landscape, dissecting its strategies and positioning within the dynamic air mobility market. Understanding the competitive dynamics of Blade Air Mobility, including its rivals and market share, is crucial for investors and industry watchers. We'll examine the company's business model, recent news, and future plans, along with its partnerships and route network, providing a comprehensive Blade Air Mobility competitive analysis.

Where Does Blade Air Mobility’ Stand in the Current Market?

Blade Air Mobility has carved a significant niche within the burgeoning urban air mobility (UAM) sector, particularly in the short-haul aviation and last-mile transportation segments. The company's core operations revolve around providing helicopter and seaplane services for both consumer and business travelers. This includes scheduled flights and on-demand charter services, focusing on routes where time savings are critical.

The company's value proposition centers on offering premium, time-efficient transportation solutions. Blade targets high-net-worth individuals, business travelers, and leisure travelers, providing them with expedited and convenient travel options. By focusing on asset-light operations and leveraging third-party operators, Blade enhances its scalability and financial agility, setting it apart in the air mobility market.

Blade Air Mobility's market position is particularly evident in its ability to attract and retain high-value customers, making it a key player in the premium segment of urban air mobility. The company's strategic investments and increasing demand for its services are reflected in its financial performance. For instance, in fiscal year 2023, Blade reported an increase in total revenue to $56.7 million from $46.8 million the previous year, demonstrating a strong growth trajectory. Considering the Growth Strategy of Blade Air Mobility, the company plans to convert existing routes to electric vertical aircraft (EVA) operations as the technology matures and regulatory approvals are secured.

Blade offers scheduled by-the-seat flights and on-demand charter services using helicopters and fixed-wing aircraft. These services primarily cater to high-net-worth individuals and business travelers. The company focuses on routes where time savings are a priority, such as those between Manhattan and the Hamptons.

The primary customer segments for Blade include high-net-worth individuals, business travelers, and leisure travelers. These customers seek expedited and convenient transportation solutions. Blade's services are tailored to meet the needs of those who value time and luxury in their travel experiences.

Blade's geographic presence is concentrated in high-demand corridors. Key markets include the Northeastern United States, Southern California, and the French Riviera. These areas offer significant opportunities for premium air mobility services due to high traffic and affluent populations.

Blade is strategically shifting its positioning to emphasize its future-readiness for electric vertical aircraft (EVA). This involves investing in infrastructure and partnerships. The company plans to convert existing routes to EVA operations as technology advances and regulatory approvals are secured, aiming for sustainable and efficient air travel.

Blade's financial performance reflects its strategic investments and the increasing demand for its services. The company's asset-light model contributes to its scalability and financial agility. This approach allows Blade to adapt quickly to market changes and maintain a competitive edge.

- Revenue Growth: Blade reported an increase in total revenue to $56.7 million in fiscal year 2023.

- Strategic Investments: The company is investing in infrastructure and partnerships to transition to electric vertical aircraft (EVA) operations.

- Market Position: Blade has established itself as a leading provider of helicopter and seaplane services in key markets.

- Customer Focus: Blade focuses on high-net-worth individuals, business travelers, and leisure travelers seeking premium transportation.

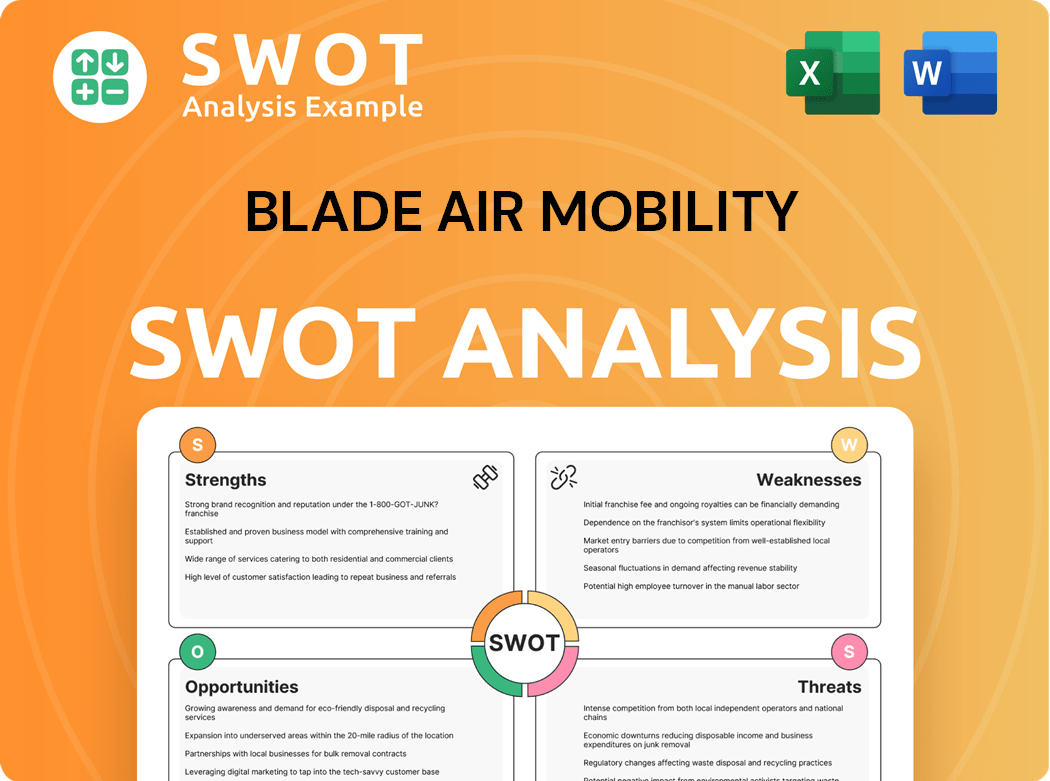

Blade Air Mobility SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Blade Air Mobility?

The Target Market of Blade Air Mobility operates within a complex competitive landscape. This landscape includes both direct and indirect competitors, influencing its market position and strategic decisions. Understanding these competitive dynamics is crucial for evaluating its potential and future prospects within the air mobility market.

Direct competitors primarily consist of established players in the private aviation sector and emerging urban air mobility (UAM) companies. Indirect competition arises from various transportation alternatives, including ground-based services and commercial airlines. The competitive environment necessitates a focus on service differentiation, operational efficiency, and strategic partnerships to maintain a competitive edge.

The competitive dynamics in the air mobility market are constantly evolving, driven by technological advancements, regulatory changes, and shifting consumer preferences. This requires continuous adaptation and innovation to stay ahead of the competition and capitalize on emerging opportunities.

Traditional charter helicopter and private jet operators represent direct competition. These companies offer similar services to Blade, targeting high-net-worth individuals and corporate clients. NetJets and Wheels Up, while focused on fractional ownership and private jet services, indirectly compete for the same customer base seeking premium air travel options.

Emerging urban air mobility companies developing and operating eVTOL (electric Vertical Take-off and Landing) aircraft are direct competitors. These companies aim to provide air taxi services, potentially disrupting Blade's market share. Joby Aviation, Archer Aviation, and Lilium are key players in this space, with their own aircraft development and operational plans.

High-speed ground transportation alternatives offer indirect competition. Premium car services, high-speed rail, and commercial airlines compete for the same customers, particularly on routes where Blade offers fixed-wing services. Ride-sharing services and luxury car services also provide alternatives for airport transfers.

Emerging players in the drone delivery and logistics space represent indirect competition. While not directly competing for passenger transport, these companies contribute to the broader innovation in air mobility. Their activities influence public perception and regulatory frameworks, affecting the overall air mobility market.

Key competitive factors include time savings, convenience, and cost. Blade competes on these factors, offering time-efficient travel solutions. The ability to provide a seamless and cost-effective travel experience is critical for attracting and retaining customers in this competitive market.

Mergers and alliances are likely to reshape the competitive dynamics. Consolidation within the UAM industry is expected as the market matures. Strategic partnerships and acquisitions will play a significant role in determining market share and competitive positioning.

Blade Air Mobility's competitive landscape includes both established aviation companies and emerging eVTOL manufacturers. The company's asset-light model, focusing on partnerships and infrastructure, differs from the vertically integrated approach of some competitors. Understanding the strengths and weaknesses of each competitor is essential for strategic planning.

- NetJets and Wheels Up: Strong brand recognition and extensive fleets, but Blade focuses on shorter routes and urban mobility.

- Joby Aviation, Archer Aviation, and Lilium: Developing and operating eVTOL aircraft, aiming for vertical integration, which could offer cost advantages.

- Ride-sharing and Luxury Car Services: Offer ground-based alternatives for airport transfers, competing on cost and convenience.

- Commercial Airlines: Serve longer routes, competing with Blade's fixed-wing services.

- Drone Delivery and Logistics Companies: Influence public perception and regulatory frameworks, indirectly impacting the air mobility market.

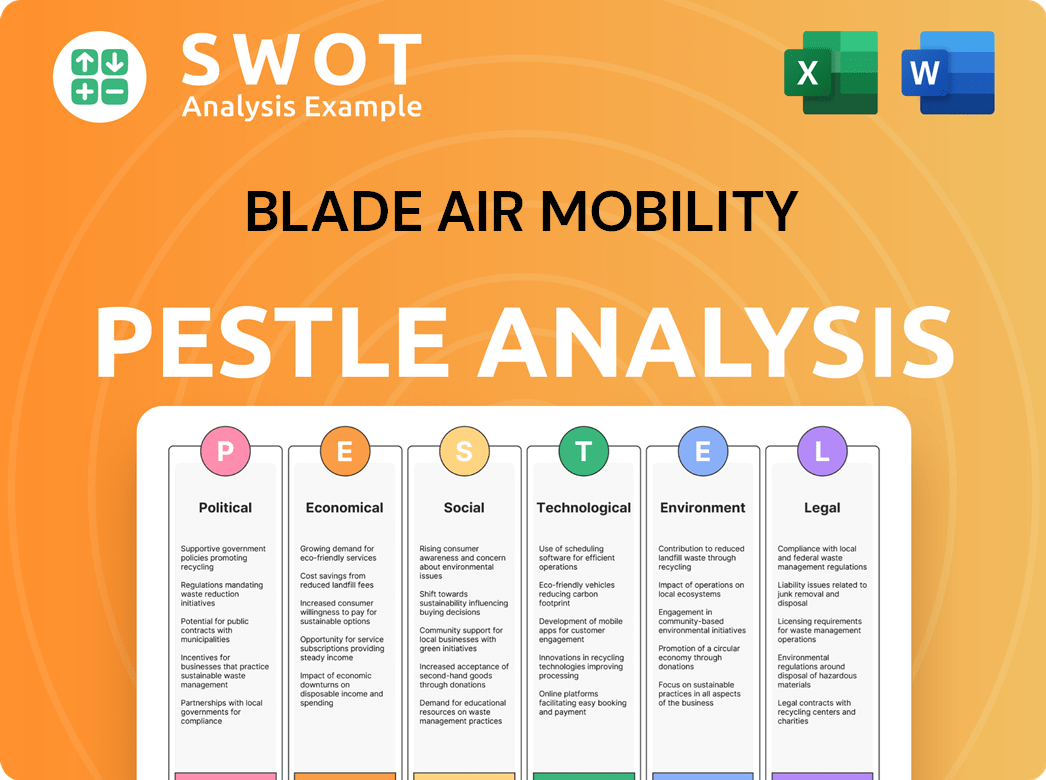

Blade Air Mobility PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Blade Air Mobility a Competitive Edge Over Its Rivals?

The competitive landscape of the air mobility market is dynamic, with several players vying for dominance. Understanding the competitive advantages of companies like is crucial for investors and industry analysts. Key factors include business model, brand recognition, technological innovation, and strategic infrastructure development. The company's approach to urban air mobility has positioned it uniquely in the market.

The company distinguishes itself through a combination of strategic moves and a focus on customer experience. By leveraging an asset-light model and building a strong brand, the company has carved out a niche in the urban air mobility sector. This approach allows for scalability and adaptability in a rapidly evolving market. The company's success hinges on its ability to navigate the complexities of the air mobility market.

The company’s competitive edge is further enhanced by its partnerships and its forward-thinking approach to the future of air travel. The company is preparing for the transition to electric vertical aircraft (eVTOLs) by focusing on infrastructure development and securing key landing rights. This proactive strategy positions the company well for long-term growth and sustainability in the air mobility market.

The company's asset-light model is a key differentiator, reducing capital expenditure and enabling rapid scaling. This strategy allows the company to focus on technology, logistics, and customer experience. The company partners with third-party aircraft operators, minimizing the need for significant investments in aircraft ownership.

The company has built a strong brand, particularly among high-net-worth individuals and business travelers. Its reputation for seamless and efficient air travel translates into repeat business and positive referrals. This brand recognition provides a competitive advantage in attracting and retaining customers.

The company's proprietary technology platform enhances the customer experience and optimizes flight operations. This includes its booking app and operational software, which streamline flight scheduling and logistics. The technology platform is crucial for maintaining operational efficiency and customer satisfaction.

The company's strategic focus on developing infrastructure for future eVTOL operations gives it a first-mover advantage. This includes securing key landing rights and developing ground infrastructure, positioning the company to be a primary operator when eVTOLs become commercially viable. This proactive approach is crucial for future growth.

The company's competitive advantages are multifaceted, encompassing its business model, brand strength, and technological capabilities. The company's strategy allows it to adapt to market changes and capitalize on emerging opportunities in the air mobility market. The company's approach to urban air mobility is detailed in the Growth Strategy of Blade Air Mobility.

- Asset-light business model: Reduces capital expenditure and enables scalability.

- Strong brand and customer loyalty: Attracts high-value customers and fosters repeat business.

- Proprietary technology platform: Enhances customer experience and optimizes operations.

- Strategic infrastructure development: Positions the company for future eVTOL operations.

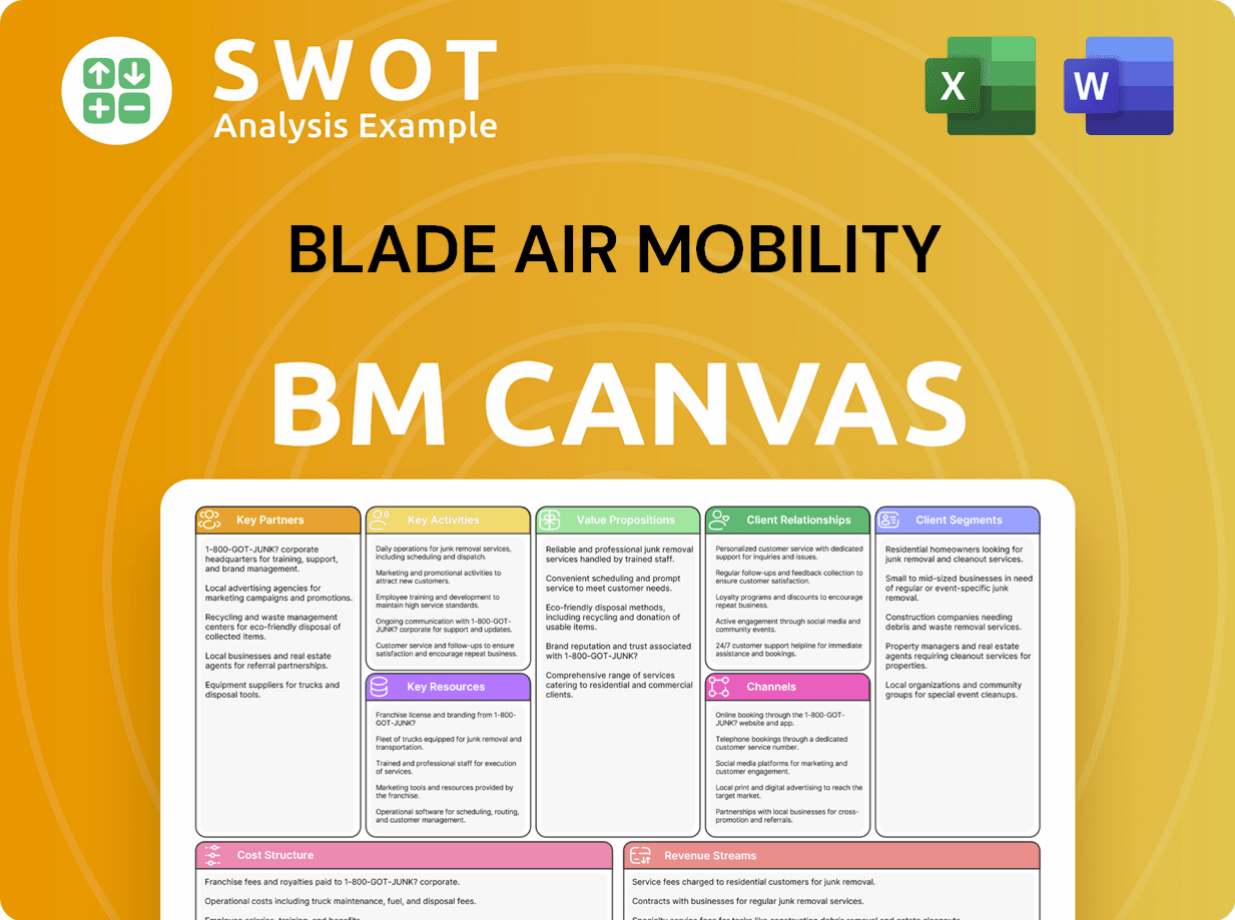

Blade Air Mobility Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Blade Air Mobility’s Competitive Landscape?

The competitive landscape for Blade Air Mobility is evolving rapidly within the urban air mobility (UAM) sector. The company faces opportunities and challenges as it navigates industry trends. Technological advancements, regulatory changes, and shifting consumer preferences are reshaping the air mobility market, influencing Blade's strategic positioning and future prospects.

Blade's position is characterized by its asset-light model, which offers adaptability in a dynamic environment. However, the company must address potential risks from new entrants, regulatory delays, and the need to scale operations effectively. The future outlook depends on successful eVTOL integration, geographic expansion, and strategic partnerships, all critical for maintaining a competitive edge.

The UAM industry is driven by technological advancements, particularly in eVTOL development. Regulatory changes, including eVTOL certification and air traffic management, are critical. Consumer demand for sustainable and efficient transport is growing, creating opportunities for air taxi services like Blade.

Potential threats include aggressive new entrants with significant capital and consolidation within the aerospace or transportation sectors. Delays in eVTOL certification and infrastructure development could impact growth. Maintaining a competitive edge requires navigating these challenges effectively.

Expanding its geographic presence, diversifying services, and forming strategic partnerships are key opportunities. Blade can capitalize on the eVTOL transition, aiming to maintain its market position as the UAM industry evolves. These strategies are critical to the company's future success.

Blade's strategy centers on eVTOL infrastructure development and strategic partnerships. The company aims to be an early adopter and operator of eVTOL aircraft. This approach positions Blade to capitalize on the evolving UAM landscape and maintain its competitive advantage.

Blade Air Mobility's competitive analysis involves understanding industry trends, future challenges, and available opportunities. The company's asset-light model offers flexibility, but it must address potential threats from new entrants and regulatory delays. For more insights into the company, consider exploring the perspectives of Owners & Shareholders of Blade Air Mobility.

- Technological Advancements: Focus on eVTOL integration and infrastructure.

- Regulatory Environment: Adapt to evolving certification and air traffic management standards.

- Market Expansion: Explore new urban corridors and service diversification.

- Strategic Partnerships: Forge alliances with real estate developers and technology providers.

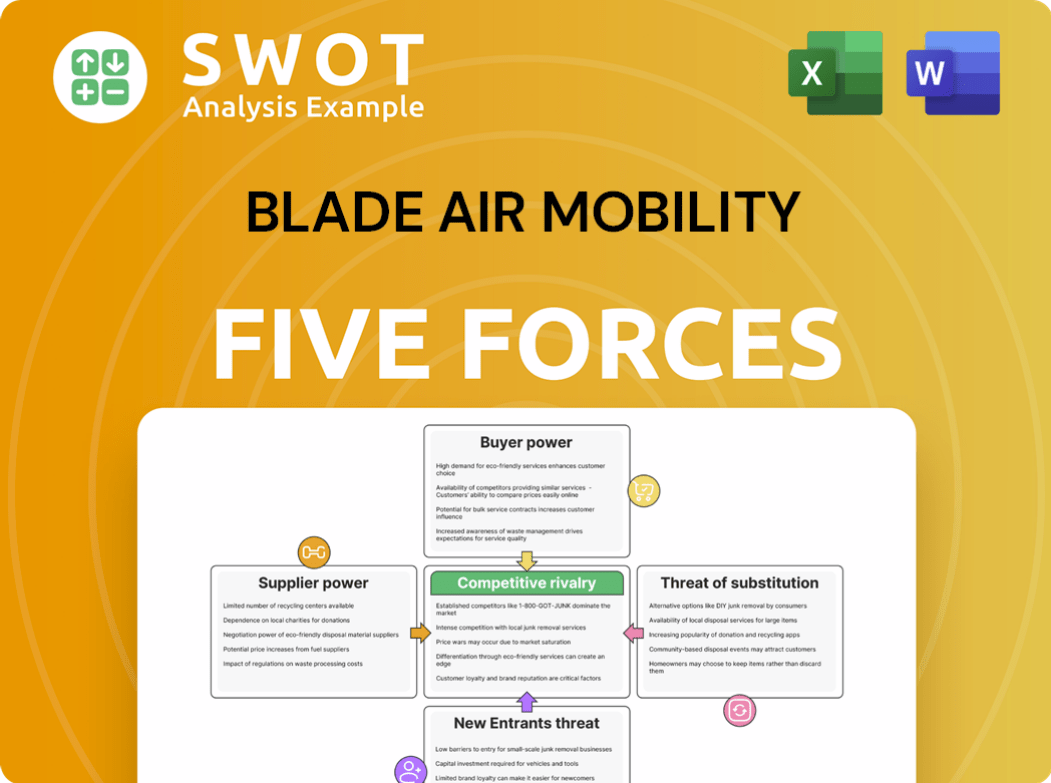

Blade Air Mobility Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Blade Air Mobility Company?

- What is Growth Strategy and Future Prospects of Blade Air Mobility Company?

- How Does Blade Air Mobility Company Work?

- What is Sales and Marketing Strategy of Blade Air Mobility Company?

- What is Brief History of Blade Air Mobility Company?

- Who Owns Blade Air Mobility Company?

- What is Customer Demographics and Target Market of Blade Air Mobility Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.