Blade Air Mobility Bundle

How is Blade Air Mobility Revolutionizing Travel?

Blade Air Mobility is reshaping urban travel, offering a glimpse into the future of short-distance aviation. With a 5.4% revenue increase in Q1 2025, the company is rapidly expanding its Blade Air Mobility SWOT Analysis. This innovative approach to air transportation is attracting attention from investors and travelers alike.

Blade's success stems from its asset-light model, focusing on customer experience and strategic partnerships. Offering scheduled Blade flights and on-demand charter services, Blade connects key destinations with speed and efficiency. Explore how this Blade helicopter service is setting new standards in the urban air mobility landscape, and learn about the company's financial health and future potential.

What Are the Key Operations Driving Blade Air Mobility’s Success?

operates by providing short-distance air travel services, including passenger flights and critical organ transport through its MediMobility division. Its customer base includes individuals seeking to bypass traffic between urban areas and airports, leisure travelers, and medical institutions requiring rapid organ delivery. This approach allows the company to focus on customer experience and operational efficiency.

The company's operational model is primarily 'asset-light,' utilizing third-party aircraft operators. This strategy offers flexibility and reduces capital expenditure. The core of its operations includes a proprietary technology stack, enabling real-time tracking, financial analysis, customer management, and scalability. This technology is also crucial for efficient logistics, especially for the MediMobility segment. The company's supply chain involves partnerships with various aircraft operators, ensuring a diverse fleet of helicopters and fixed-wing aircraft. Strategically located passenger terminals enhance the customer experience and streamline boarding processes.

What sets apart is its blend of an asset-light model with a strong emphasis on proprietary technology and premium terminal infrastructure. This allows it to offer a high-quality, convenient service without the heavy capital investment and maintenance burdens associated with direct aircraft ownership, though they have strategically acquired aircraft for their Medical segment to improve economies of scale and service reliability. This operational model translates into customer benefits such as significantly reduced travel times, enhanced convenience, and a seamless travel experience, differentiating it from traditional ground transportation and even other air travel options. For the MediMobility segment, its core capabilities ensure rapid and reliable transport of human organs, a critical factor for successful transplants.

The company's asset-light model relies on third-party aircraft operators, reducing capital expenditure and increasing operational flexibility. This allows for scalability and a focus on customer experience. The company's strategy allows it to adapt quickly to market demands and expand its services efficiently.

The company utilizes a proprietary technology stack for real-time tracking, financial analysis, and customer management. This technology supports efficient logistics, especially for the MediMobility segment, and enhances the overall customer experience. The technology also facilitates scalability and international expansion.

Strategically located passenger terminals enhance the customer experience and streamline boarding processes. These terminals provide a seamless travel experience, differentiating from traditional transportation options. The focus on premium infrastructure supports the company's brand and service quality.

The MediMobility segment focuses on the rapid and reliable transport of human organs, a critical factor for successful transplants. This service leverages the company's operational capabilities and technology to save lives. This segment highlights the company's commitment to essential services.

The company distinguishes itself through its asset-light model, proprietary technology, and premium terminal infrastructure. This combination allows for a high-quality, convenient service without the burdens of direct aircraft ownership. The company's focus on customer experience and operational efficiency sets it apart in the urban air mobility market.

- Reduced Travel Times: Significantly faster than ground transportation.

- Enhanced Convenience: Seamless travel experience with premium terminals.

- Reliable Organ Transport: Critical for successful transplants.

- Scalability: Asset-light model supports rapid expansion.

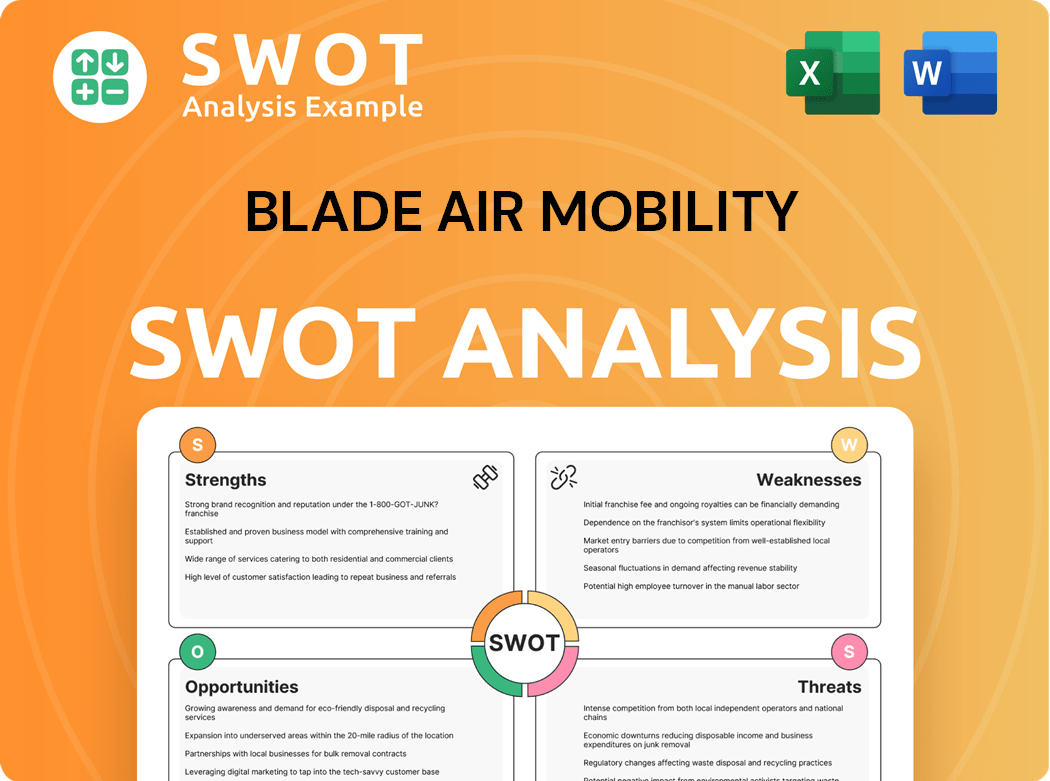

Blade Air Mobility SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Blade Air Mobility Make Money?

The revenue streams and monetization strategies of Blade Air Mobility are centered around two primary segments: Passenger and Medical (MediMobility Organ Transport). The company has shown consistent growth, with a focus on optimizing its services and expanding its market presence. This growth is supported by strategic pricing and operational efficiencies.

In Q1 2025, Blade Air Mobility's total revenue reached $54.3 million, marking a 5.4% increase compared to the prior year. For the full year 2024, total revenue was $248.7 million, a 10.4% increase from 2023. These figures highlight the company's ability to generate revenue and expand its market share in the urban air mobility sector.

Blade Air Mobility utilizes various monetization strategies to maximize profitability. The company's asset-light model, combined with dynamic pricing, allows for optimized utilization and revenue generation. Furthermore, the integration of Electric Vertical Aircraft (EVA) technology is expected to unlock new revenue opportunities and expand the company's service offerings.

The Passenger segment, which includes Short Distance flights (Blade helicopter and seaplane flights) and Jet and Other services, is a significant revenue driver for Blade. In Q1 2025, this segment's revenue grew by 42.0% year-over-year, excluding Canada. Passenger flight profit surged by 92% to $4.04 million in Q1 2025, with the segment margin expanding from 13.6% to 22%. This growth demonstrates the effectiveness of Blade's strategies in the urban air mobility market.

- Blade helicopter services and other passenger flights contribute significantly to revenue.

- Dynamic pricing is used to optimize flight utilization and revenue.

- The company focuses on expanding its passenger services and routes.

- Brand partnerships are another source of revenue within the Passenger segment.

The Medical segment, operating as MediMobility Organ Transport, focuses on transporting human organs and providing associated logistics services. This segment also includes Trinity Organ Placement Services (TOPS). While medical revenue remained relatively flat at $35.9 million in Q1 2025, medical trip volumes reached a new monthly record in April 2025. The Medical segment's Adjusted EBITDA improved by 119.6% to $5.5 million in Q4 2024, demonstrating improved profitability and operational efficiency.

- MediMobility Organ Transport is a critical part of Blade's business model.

- The segment includes services like TOPS for donor logistics coordination.

- The Medical segment contributed to overall revenue growth in 2024.

- Focus on improving operational and financial performance of the acquired fleet.

Blade Air Mobility employs various monetization strategies to ensure profitability. The company sells by-the-seat flights to optimize flight profitability. The asset-light model contributes to financial flexibility by minimizing capital expenditures. Blade is also exploring future revenue opportunities through the integration of Electric Vertical Aircraft (EVA) technology, which is expected to enable lower-cost air mobility and expand landing zones. To learn more about the company's origins, you can read a Brief History of Blade Air Mobility.

- By-the-seat sales are used to maximize flight profitability.

- The asset-light model helps manage capital expenditures.

- EVA technology is expected to create new revenue streams.

- Blade is focused on expanding its service offerings and market reach.

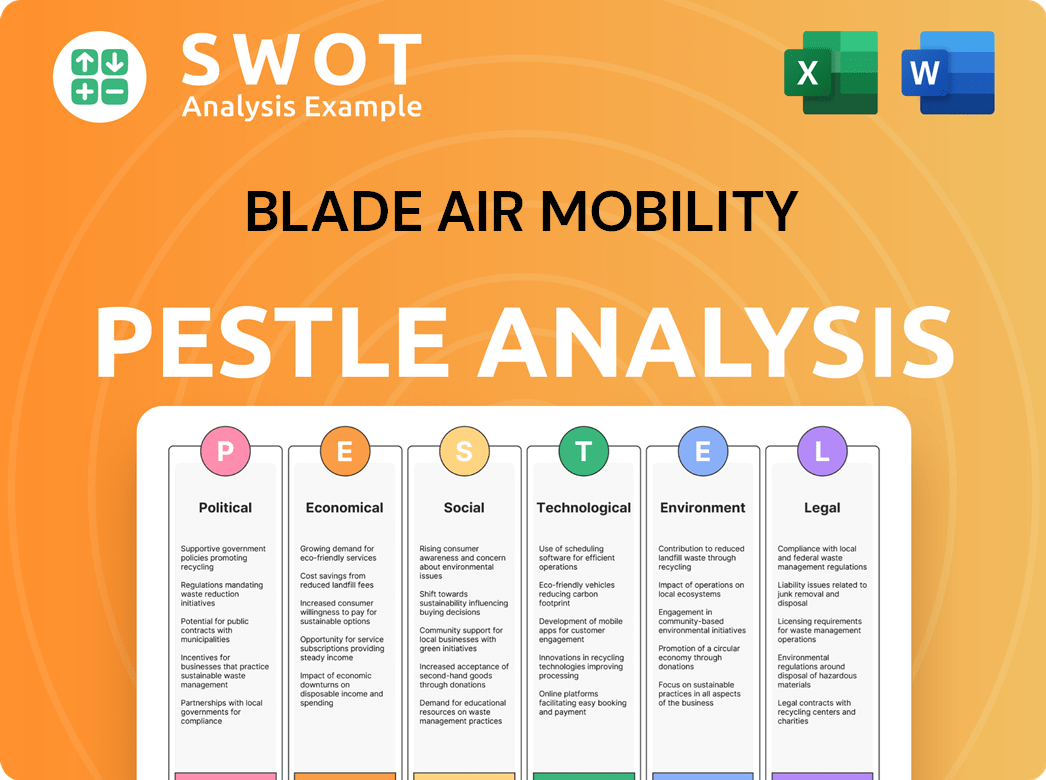

Blade Air Mobility PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Blade Air Mobility’s Business Model?

Key milestones, strategic moves, and the competitive edge of Blade Air Mobility are crucial for understanding its current market position and future prospects. The company, which facilitates short-distance air travel, has demonstrated significant progress in its financial performance and operational strategies. These elements are essential for investors, analysts, and anyone interested in the urban air mobility sector.

Blade Air Mobility has focused on expanding its service offerings and geographic reach while navigating operational challenges. The company's strategic decisions, including acquisitions and expansions, reflect its efforts to capitalize on market opportunities and improve efficiency. Simultaneously, Blade is addressing the complexities of aviation regulations and the need for innovative technological solutions.

Blade's competitive advantages stem from its asset-light model and proprietary technology. These factors enable operational flexibility and enhance the customer experience. As the company continues to evolve, its ability to adapt to new trends and technologies, particularly in the transition to Electric Vertical Aircraft (EVA), will be critical for its long-term success.

A notable financial achievement for Blade was reaching its first full year of positive Adjusted EBITDA in 2024, totaling $1.2 million. This marked a substantial improvement of $17.8 million compared to the previous year. Furthermore, the company reported its first Adjusted EBITDA profitable first quarter in the Passenger Segment since going public in Q1 2025.

Strategic initiatives included the acquisition of ten fixed-wing aircraft in 2024, dedicated to the Medical segment, aiming to enhance economies of scale and service reliability. Blade also introduced the Trinity Organ Placement Services (TOPS) at the end of 2023, broadening its capabilities in organ transport. Expansion in Southern Europe, through acquisitions, has enhanced its market reach.

Blade faces operational challenges, including reliance on third-party aircraft operators, which introduces risks. The company must also navigate complex aviation regulations and potential impacts from severe weather events. These factors can affect the reliability and cost-effectiveness of its services, including Blade Air Mobility's target market.

Blade's competitive advantages include its asset-light model, which provides operational flexibility, and its proprietary technology stack, which supports efficient operations and customer management. Its exclusive passenger terminal infrastructure contributes to brand strength and a differentiated customer experience. The company is actively adapting to new trends and technology shifts.

Blade is focusing on transitioning to Electric Vertical Aircraft (EVA), which is expected to enable lower-cost, quieter, and emission-free air mobility. Initial deployment of EVA is anticipated in the Middle East by late 2025 or early 2026. This strategic shift underscores Blade's commitment to innovation and sustainability in the urban air mobility sector.

- The company's focus on EVA is a key element of its long-term strategy.

- Blade's expansion into new markets and services is ongoing.

- The company aims to enhance its operational efficiency and customer experience.

- Blade's financial performance is expected to improve with strategic initiatives.

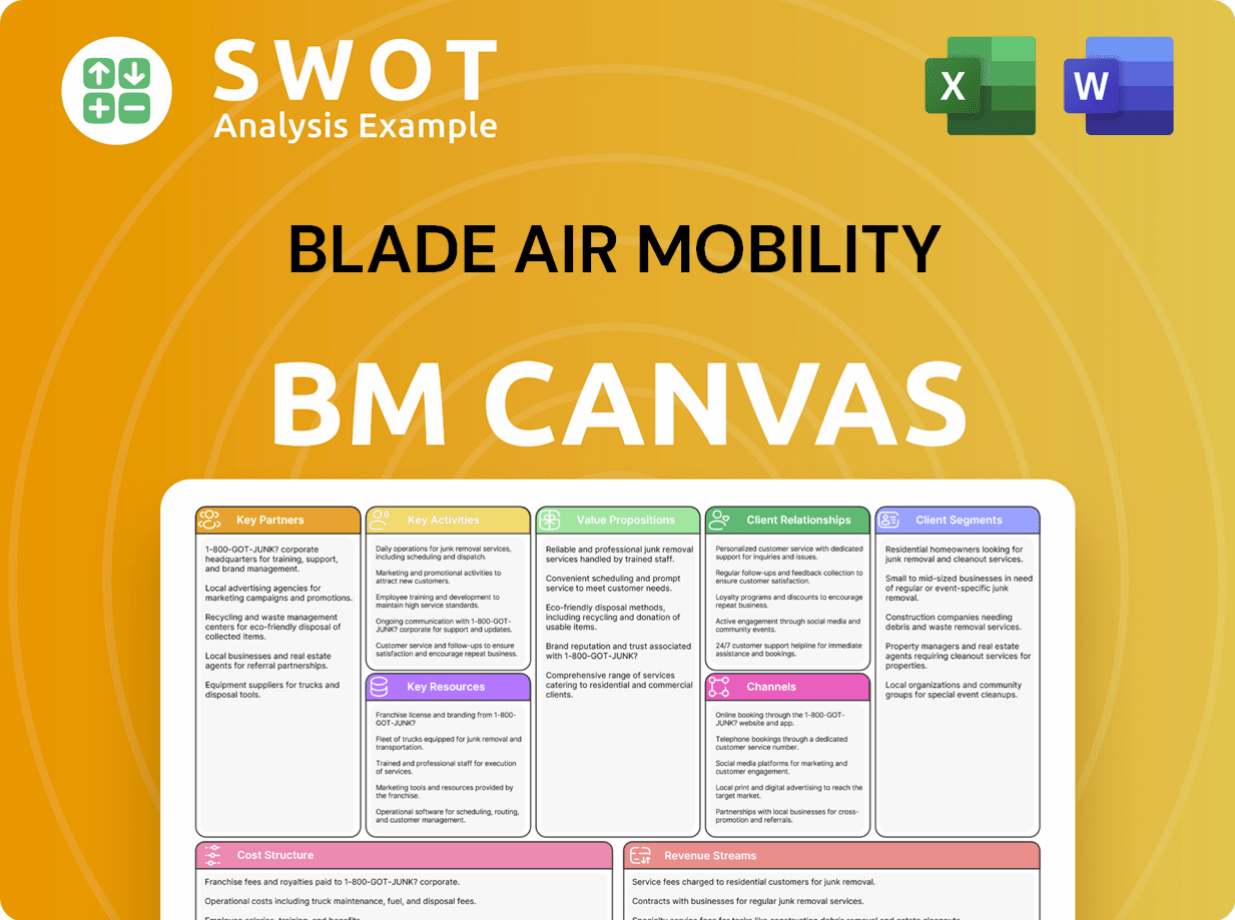

Blade Air Mobility Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Blade Air Mobility Positioning Itself for Continued Success?

The company, Blade Air Mobility, holds a significant position in the urban air mobility and short-distance aviation market. It utilizes an asset-light model and focuses heavily on its brand. Blade is a leading provider of air transportation in the Northeast US and a key player in Europe. It also serves as a major transporter of human organs for transplant in the U.S., highlighting its importance in healthcare logistics.

Several factors could impact Blade's operations and revenue. These include dependence on third-party aircraft operators, potential regulatory changes, and the effects of climate change. The company is also navigating challenges related to the adoption of Electric Vertical Aircraft (EVA) technology, such as certification timelines and infrastructure development.

Blade Air Mobility is a key player in urban air mobility and short-distance aviation. Its asset-light model and strong brand focus set it apart. It leads in air transportation in the Northeast US and has a significant presence in Europe.

Blade faces risks including reliance on third-party operators and regulatory changes. The adoption of Electric Vertical Aircraft (EVA) technology presents challenges. Climate change could also impact operations.

Blade aims to expand its high-margin medical transport business and build brand loyalty. The company is reaffirming its guidance for the full year 2025, expecting revenue of $245 million to $265 million. The transition to EVA is expected around 2026.

Blade ended Q1 2025 with $120.0 million in cash and short-term investments. The company anticipates double-digit Adjusted EBITDA for 2025. It plans to leverage its asset-light model for continued growth.

Blade's strategic initiatives focus on expanding its medical transport business and building brand loyalty. The company is focused on a seamless transition to Electric Vertical Aircraft (EVA). This transition is expected to reduce operating costs and broaden service offerings.

- Expansion of high-margin medical transport business.

- Building brand loyalty in key urban markets.

- Transition to Electric Vertical Aircraft (EVA) around 2026.

- Leveraging asset-light model and expanding into new markets.

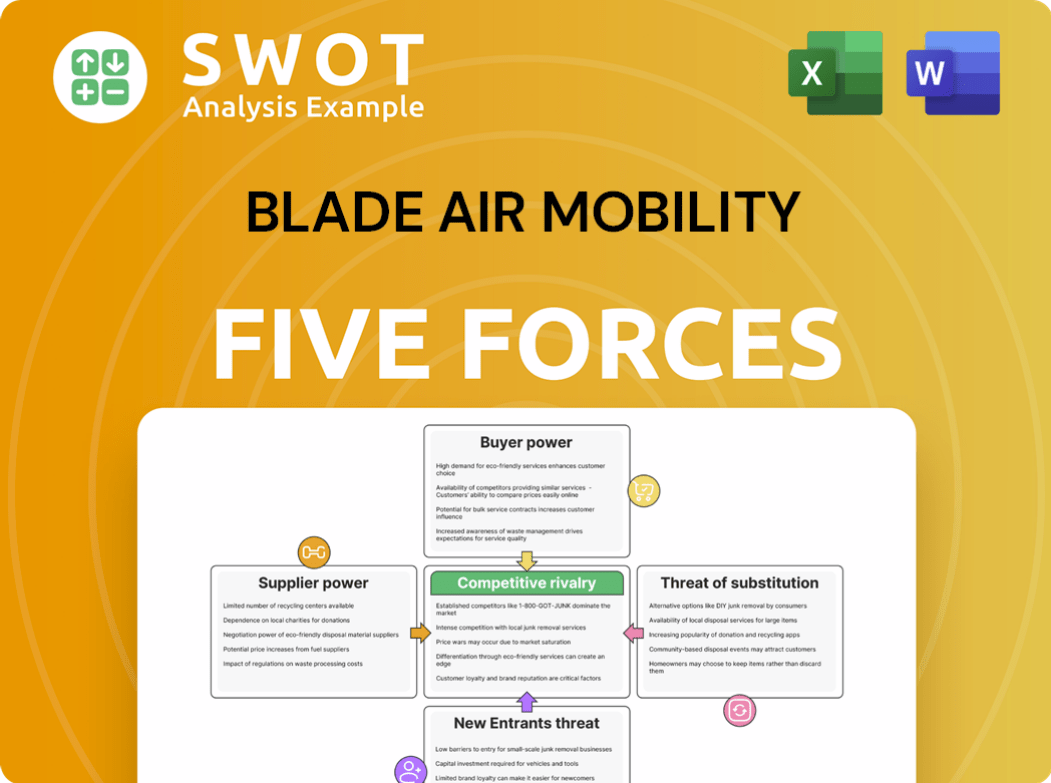

Blade Air Mobility Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Blade Air Mobility Company?

- What is Competitive Landscape of Blade Air Mobility Company?

- What is Growth Strategy and Future Prospects of Blade Air Mobility Company?

- What is Sales and Marketing Strategy of Blade Air Mobility Company?

- What is Brief History of Blade Air Mobility Company?

- Who Owns Blade Air Mobility Company?

- What is Customer Demographics and Target Market of Blade Air Mobility Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.