Blade Air Mobility Bundle

Can Blade Air Mobility Revolutionize Urban Travel?

Blade Air Mobility, a pioneering Air Mobility Company, has redefined urban transportation with its on-demand helicopter and seaplane services. Founded in 2014, Blade quickly established itself as a leader by offering convenient short-haul air mobility solutions, sidestepping traditional traffic woes. This innovative approach has positioned Blade at the forefront of the Urban Air Mobility landscape.

From its inception, Blade Air Mobility has expanded its services, offering scheduled flights and charter options across various regions. As Blade Air Mobility continues to grow, understanding its Growth Strategy is crucial for investors and industry watchers alike. To delve deeper, consider exploring the Blade Air Mobility SWOT Analysis to gain a comprehensive understanding of its strengths, weaknesses, opportunities, and threats, and its future plans.

How Is Blade Air Mobility Expanding Its Reach?

The growth strategy of Blade Air Mobility centers on expanding its services and geographical footprint. This expansion is crucial for the company's long-term success in the urban air mobility market. The company is actively pursuing multiple initiatives to strengthen its position and capitalize on emerging opportunities.

A key aspect of Blade's expansion strategy involves entering new markets and broadening its service offerings beyond core helicopter and seaplane operations. This includes strategic acquisitions and partnerships to enhance its capabilities and reach. The company's focus on integrating Electric Vertical Aircraft (EVA) services further positions it as a leader in the future of urban air mobility.

Blade's approach to growth is multifaceted, aiming to increase revenue streams and customer base. The company's strategic moves are designed to adapt to the evolving demands of the air mobility sector, ensuring it remains competitive and innovative. Understanding Blade Air Mobility's expansion initiatives is vital for investors and stakeholders assessing its potential.

Blade Air Mobility is expanding its services into new urban centers and leisure destinations. This expansion is driven by the high demand for expedited travel in these areas. The company has been growing its presence in key markets, including the West Coast and internationally in regions like Vancouver and India.

Blade is broadening its service portfolio beyond its core helicopter and seaplane operations. This includes an increased focus on jet charter services and strategic acquisitions. For instance, the acquisition of Trinity Air Medical in 2021 expanded its medical organ transport business.

The company is actively pursuing partnerships to expand its reach and service offerings. An example is its collaboration with JetBlue to offer seamless airport transfers for premium passengers. These partnerships help Blade reach a wider customer base and provide enhanced services.

Blade's future expansion plans include the development and integration of Electric Vertical Aircraft (EVA) services. The projected timeline for commercialization is in the 2025-2028 timeframe. This proactive approach positions Blade to be a first-mover in the next generation of urban air mobility.

Blade Air Mobility's expansion strategy is designed to capitalize on the growing demand for urban air mobility. The company's focus on geographical expansion, service diversification, strategic partnerships, and EVA integration positions it for sustained growth. For more insights, explore the Mission, Vision & Core Values of Blade Air Mobility.

Blade's expansion strategy is multifaceted, focusing on geographical growth, service diversification, strategic partnerships, and the integration of EVAs. These initiatives aim to increase revenue streams and customer base. The company's strategic moves are designed to adapt to the evolving demands of the air mobility sector.

- Geographical expansion into new urban centers and leisure destinations.

- Diversification of services, including jet charter and medical transport.

- Strategic partnerships to broaden reach and service offerings.

- Development and integration of Electric Vertical Aircraft (EVA) services.

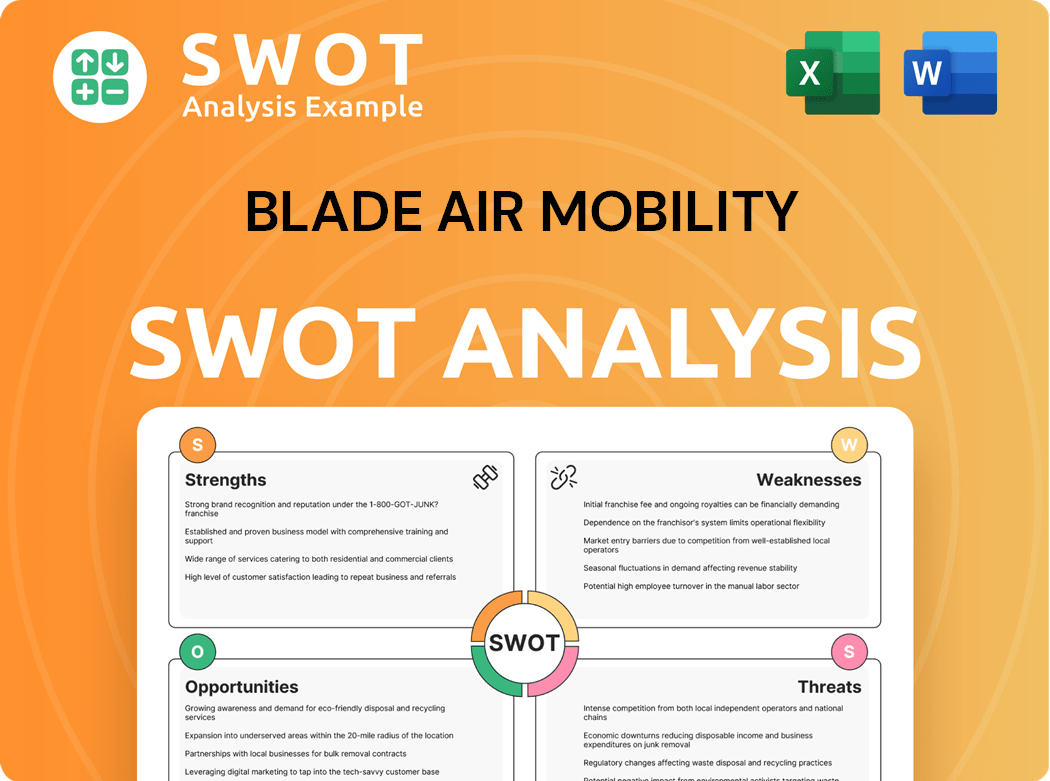

Blade Air Mobility SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Blade Air Mobility Invest in Innovation?

Blade Air Mobility's innovation and technology strategy is central to its growth as an Air Mobility Company, focusing heavily on Electric Vertical Aircraft (EVA) technology. This strategy involves substantial investments in infrastructure and partnerships, particularly in developing vertiports and charging stations, which are crucial for expanding Urban Air Mobility.

The company strategically invests in technology to improve operational efficiency and customer experience. This includes the development of proprietary booking platforms and operational software designed to optimize flight scheduling, passenger management, and logistics.

Blade's commitment to technological advancement is further demonstrated through its partnerships with leading aerospace companies and EVA manufacturers. These collaborations ensure access to cutting-edge technology and expertise, essential for the future of air travel.

Blade Air Mobility is not involved in manufacturing EVAs but is deeply invested in the infrastructure needed for their operation. This includes vertiports, charging stations, and the necessary operational frameworks to support EVA integration.

The company has developed proprietary booking platforms and operational software. These tools are designed to streamline flight scheduling, manage passenger logistics, and provide real-time operational data, enhancing efficiency and customer satisfaction.

Blade collaborates with leading aerospace companies and EVA manufacturers. These partnerships are crucial for accessing the latest technology and expertise in the rapidly evolving Urban Air Mobility sector.

Blade has secured commitments for EVAs from manufacturers like Beta Technologies and Wisk Aero. The company aims to transition a significant portion of its fleet to electric aircraft by 2028, aiming for sustainability and cost reduction.

Technology plays a critical role in Blade's medical organ transport business. The company uses advanced logistics and operational software to optimize the efficiency of urgent medical deliveries.

The transition to EVAs is expected to lower operational costs and promote sustainability. This aligns with the growing demand for environmentally friendly transport options, appealing to a broader customer base.

Blade's focus on technological advancements and strategic collaborations highlights its dedication to leading the Urban Air Mobility revolution. The company's approach to integrating EVAs and optimizing its operational capabilities positions it for continued growth and innovation in the air taxi market. For more details, you can read a Brief History of Blade Air Mobility.

Blade's technology strategy includes several key initiatives aimed at enhancing its market position and operational efficiency. These initiatives are designed to support the company's growth strategy and improve its financial performance.

- Infrastructure Development: Investing in vertiports and charging infrastructure to support EVA operations.

- Fleet Transition: Aiming to transition a significant portion of its fleet to electric aircraft by 2028.

- Digital Platforms: Utilizing proprietary booking and operational software for efficient flight management.

- Strategic Partnerships: Collaborating with EVA manufacturers to access cutting-edge technology and expertise.

- Medical Logistics: Employing technology to optimize urgent medical transport services.

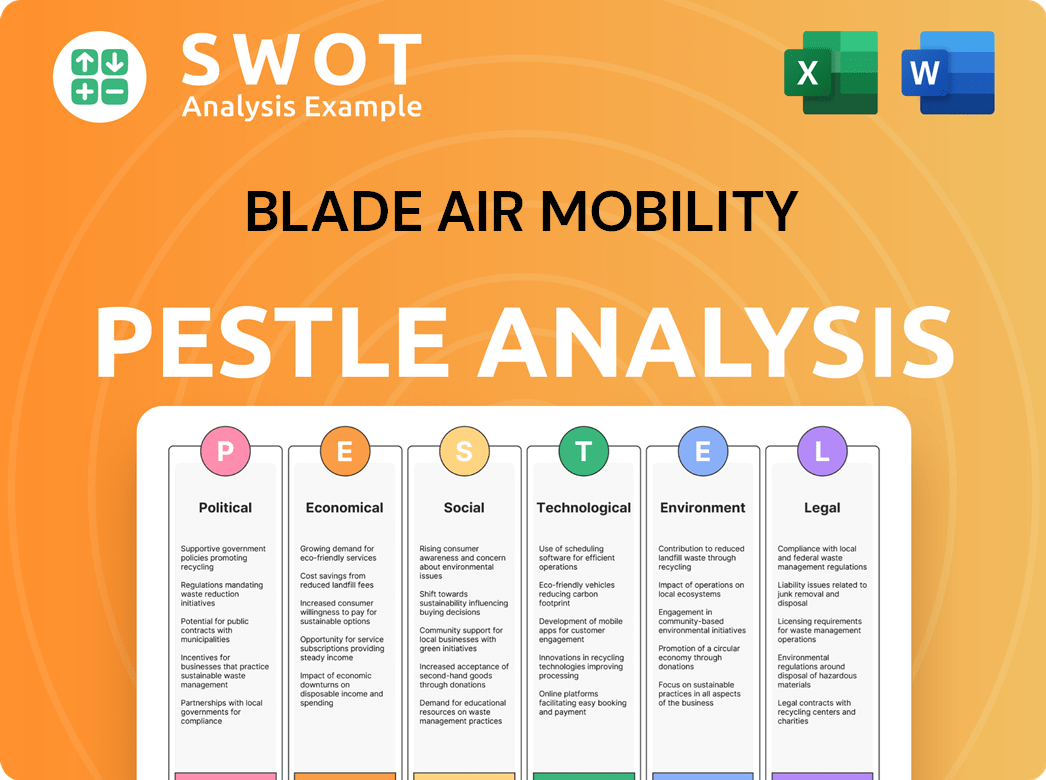

Blade Air Mobility PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Blade Air Mobility’s Growth Forecast?

The financial outlook for Blade Air Mobility is focused on sustained growth and profitability within the evolving urban air mobility market. The company's strategic approach is designed to capitalize on increasing demand for its services. This includes both passenger transport and medical organ transport, which are key drivers of its revenue growth.

For the fiscal year 2023, Blade reported a total revenue of $61.7 million, demonstrating a strong year-over-year increase. This growth trajectory is expected to continue, with analysts projecting substantial revenue increases in the coming years. The company's focus on operational efficiency and strategic partnerships is crucial for achieving its financial goals.

In the first quarter of 2024, Blade saw a 56% increase in revenue, reaching $19.9 million. This growth was fueled by robust demand in both passenger and medical transport services. The company is also focused on improving its gross profit margins, which stood at 19% in Q1 2024, indicating a commitment to enhancing profitability alongside revenue growth. This financial performance underscores Blade's potential for long-term value creation.

Blade's revenue increased by 57% in 2023, reaching $61.7 million. In Q1 2024, revenue rose by 56% to $19.9 million, driven by strong demand in both passenger and medical organ transport businesses. This growth highlights the company's ability to expand its market presence and meet customer needs.

Analysts project Blade's revenue to reach $83.4 million in 2024 and $107.5 million in 2025. These projections reflect confidence in the company's expansion strategy and its ability to capture a larger share of the urban air mobility market. The company's financial outlook remains positive.

Blade is focused on improving its gross profit margins, which were at 19% in Q1 2024. Improving margins is a key element of Blade's financial strategy. This focus is critical for achieving sustainable profitability and long-term financial health.

As of March 31, 2024, Blade had $127.3 million in cash and short-term investments. This strong cash position provides the company with ample liquidity to fund its strategic initiatives and support its growth plans. This financial stability is a key advantage.

Blade's financial strategy is underpinned by its asset-light model, reducing capital expenditure on aircraft ownership. This approach, combined with strategic acquisitions and a focus on high-margin services, positions Blade for continued financial expansion. The company's future plans include scaling operations and integrating cost-efficient eVTOL technology to enhance profitability. The company's commitment to innovation and strategic partnerships will be key to its success.

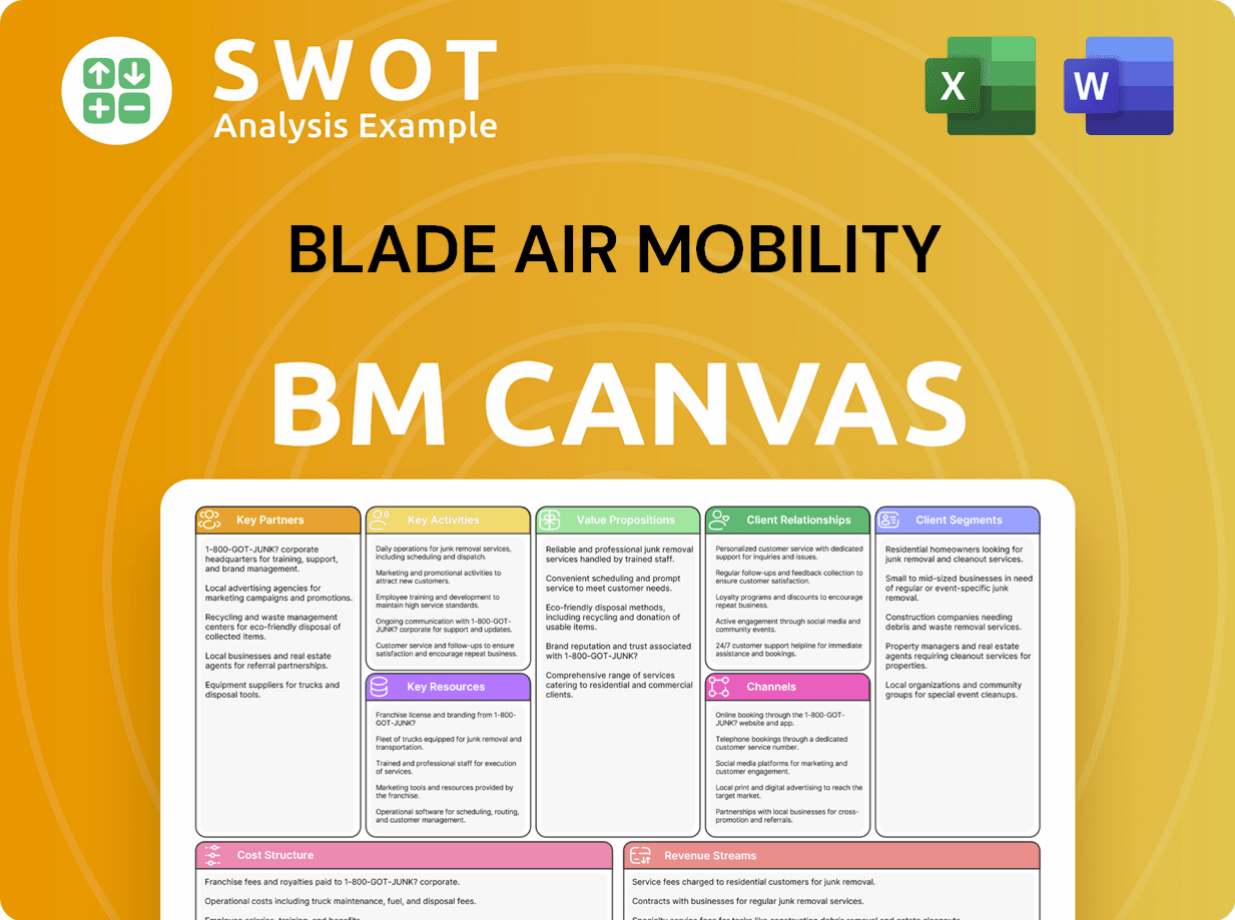

Blade Air Mobility Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Blade Air Mobility’s Growth?

The Air Mobility Company, faces several potential risks and obstacles as it pursues its Growth Strategy. These challenges could influence the company's ability to expand its operations and achieve its financial goals. Understanding these potential pitfalls is crucial for investors and stakeholders.

One major concern is the competitive landscape of the Urban Air Mobility (UAM) market. Numerous companies are vying for a share of this emerging sector, which could lead to increased pressure on pricing and market share. Additionally, regulatory uncertainties and supply chain vulnerabilities pose significant hurdles.

Technological disruptions and internal resource constraints also present risks. The rapid pace of innovation in the aviation industry means that competitors could introduce superior technologies. Securing and retaining skilled personnel, especially for the operation and maintenance of Electric Vertical Takeoff and Landing (eVTOL) aircraft, is critical for expansion.

The UAM market is becoming increasingly crowded, with both established aviation companies and startups competing. This intense competition could affect Blade Air Mobility's profitability and market share. Competitors include companies like Joby Aviation and Archer Aviation, which are also developing air taxi services.

The regulatory environment for UAM is still evolving, particularly regarding the certification and operation of eVTOL aircraft. Delays or unfavorable regulations could hinder Blade Air Mobility's transition to eVTOL services. The Federal Aviation Administration (FAA) is working on establishing safety standards and operational guidelines.

Supply chain disruptions, especially for specialized aircraft parts and charging infrastructure, could cause operational bottlenecks. Blade Air Mobility's reliance on third-party operators and aircraft availability makes it vulnerable to external factors. Securing a reliable supply chain is essential for maintaining service levels.

Unforeseen innovations or rapid advancements by competitors could erode Blade Air Mobility's competitive advantage. The aviation industry is known for its rapid technological advancements. Blade Air Mobility needs to stay ahead of the curve to remain competitive.

Securing enough skilled personnel for eVTOL operations and maintenance can be a challenge. This includes pilots, maintenance technicians, and operational staff. This is a potential obstacle for Blade Air Mobility's expansion plans, as the company needs to ensure it has the necessary workforce to support its growth.

Blade Air Mobility's financial performance could be affected by fluctuations in fuel prices, economic downturns, and changes in consumer demand. The company's revenue and profitability are subject to these external factors. Analyzing the Blade Air Mobility financial performance is crucial for investors.

Blade Air Mobility is addressing these risks through diversification of its service offerings, such as expanding into medical organ transport, which provides a more stable revenue stream. The company is also actively engaging with regulatory bodies to shape favorable policies for UAM. Partnering with multiple eVTOL manufacturers and operators helps mitigate supply chain and technological risks.

The successful and timely rollout of eVTOL technology and infrastructure will be crucial for overcoming these potential obstacles and ensuring Blade Air Mobility's continued growth. The company's ability to adapt to market changes, secure necessary resources, and navigate regulatory hurdles will determine its long-term success. Understanding the Blade Air Mobility business model is key for assessing its future prospects.

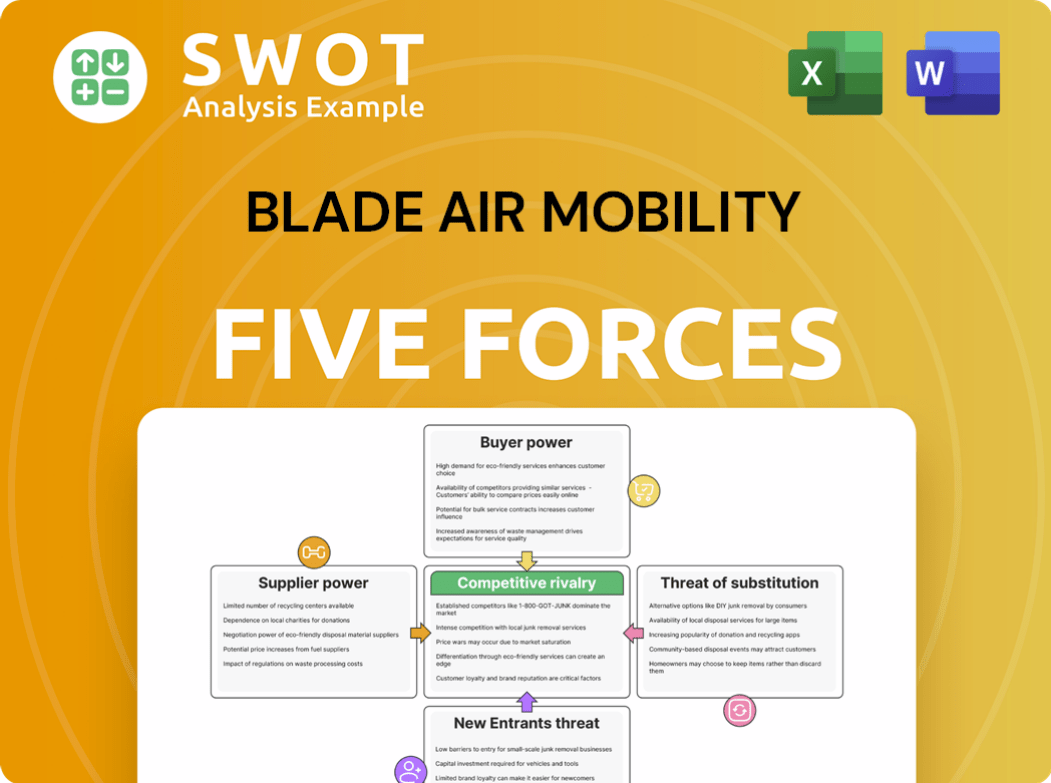

Blade Air Mobility Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Blade Air Mobility Company?

- What is Competitive Landscape of Blade Air Mobility Company?

- How Does Blade Air Mobility Company Work?

- What is Sales and Marketing Strategy of Blade Air Mobility Company?

- What is Brief History of Blade Air Mobility Company?

- Who Owns Blade Air Mobility Company?

- What is Customer Demographics and Target Market of Blade Air Mobility Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.