Blade Air Mobility Bundle

Who Really Owns Blade Air Mobility?

Blade Air Mobility, a pioneer in urban air mobility, has captured the attention of investors and aviation enthusiasts alike. Its journey from a startup to a publicly traded company has reshaped its ownership landscape, making it essential to understand the key players. Unraveling the Blade Air Mobility SWOT Analysis is just the beginning; knowing who controls the company's destiny is paramount.

Since its IPO in May 2021, understanding the Blade company ownership is vital for anyone tracking the Blade stock. The Blade helicopter service and Blade air charter offerings are just part of the story; the ownership structure dictates strategic decisions. Examining Who owns Blade provides insight into its long-term vision and its capacity to compete in the rapidly evolving urban air mobility market, including its future plans.

Who Founded Blade Air Mobility?

The genesis of Blade Air Mobility, often referred to as Blade, traces back to its co-founding by Rob Wiesenthal and Steve Martocci in 2014. This marked the beginning of a venture aimed at transforming short-distance travel through on-demand air mobility solutions. The company's early structure and ownership were pivotal in setting the stage for its future growth within the urban air mobility sector.

Rob Wiesenthal, who currently serves as the CEO of Blade, brought valuable experience from the media and entertainment industries, having held executive positions at Warner Music Group and Sony Corporation of America. Steve Martocci, co-founder of GroupMe, contributed his expertise in technology and product development. Their combined skills were crucial in shaping Blade's initial strategy and operational framework.

While precise details on the initial equity distribution among the founders are not publicly available, it is common practice for co-founders to hold significant ownership stakes, often subject to vesting schedules. This structure aligns incentives and ensures long-term commitment to the company's success. Understanding the early ownership dynamics provides insight into the foundational decisions that have influenced Blade's trajectory.

Early backing for Blade Air Mobility came from angel investors and high-net-worth individuals. These early investors provided the essential capital for initial operations and technology development.

The founders' vision focused on making short-distance air travel accessible and efficient. This vision attracted early supporters keen on disrupting traditional transportation methods, setting the stage for the company's growth.

In the early stages, control primarily rested with Wiesenthal and Martocci, along with their initial angel investors. They collectively guided the company's foundational strategy and growth.

Any specific buy-sell clauses or early ownership disputes are not widely publicized. This suggests a relatively smooth initial phase of capital raising and operational setup.

Early investors recognized the potential of on-demand urban air mobility, providing crucial capital for market penetration. This early support was critical for Blade's initial operations.

The founding team, led by Wiesenthal and Martocci, played a central role in setting the company's direction. Their combined expertise in media, entertainment, and technology was essential.

The early ownership structure of Blade Air Mobility, which includes the founders and early investors, was crucial in shaping its initial strategy and securing the necessary resources for growth. The company's focus on on-demand air mobility and its ability to attract early investment were key factors in its early success. For more insights into the company's strategic moves, you can explore the Growth Strategy of Blade Air Mobility.

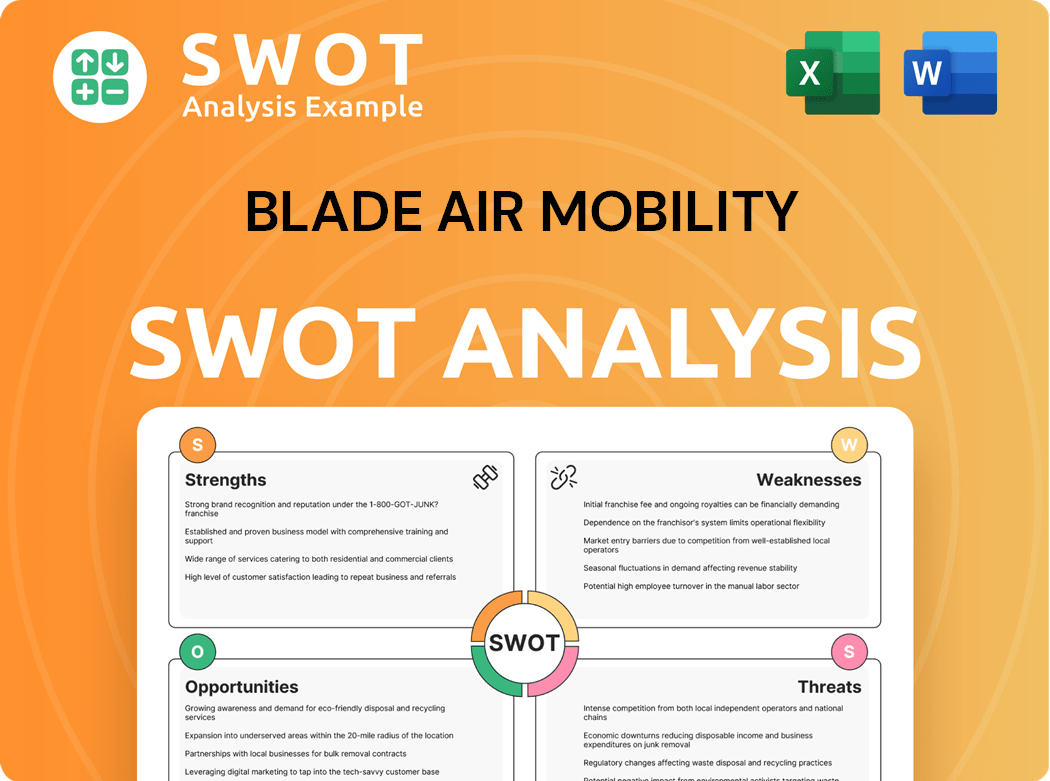

Blade Air Mobility SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Blade Air Mobility’s Ownership Changed Over Time?

The ownership structure of Blade Air Mobility significantly evolved with its public debut. The company, which provides helicopter services and air charter options, began trading on the Nasdaq on May 7, 2021, under the ticker 'BLDE'. This followed a business combination with Experience Investment Corp., a Special Purpose Acquisition Company (SPAC). The transaction valued Blade at approximately $363 million, allowing the company to raise capital and broaden its shareholder base. This shift marked a transition from private to public ownership, impacting the company's governance and financial reporting requirements.

The initial public offering (IPO) of Blade Air Mobility was a pivotal moment, transforming its ownership landscape. The move to become a publicly traded company introduced new stakeholders and increased the need for transparency. This change also meant that the company's financial performance and strategic decisions would be subject to greater public and regulatory scrutiny.

| Key Event | Date | Impact on Ownership |

|---|---|---|

| Business Combination with Experience Investment Corp. | May 7, 2021 | Blade Air Mobility began trading on the Nasdaq; broadened shareholder base. |

| Public Listing | May 7, 2021 | Raised substantial capital; increased institutional investor involvement. |

| Ongoing SEC Filings | Various Dates | Provides detailed ownership information, including holdings of institutional investors. |

As of early 2025, Blade Air Mobility's major stakeholders include institutional investors and individual insiders. Vanguard Group Inc. held a significant stake, owning approximately 3.48% of the company as of March 31, 2024. BlackRock Inc. also holds a notable position, with approximately 3.29% of the company. Other major institutional holders include Renaissance Technologies LLC, Millennium Management LLC, and Geode Capital Management, LLC. The founders, particularly Rob Wiesenthal, maintain significant individual stakes, which aligns their interests with public shareholders. For more insights, you can explore the Competitors Landscape of Blade Air Mobility.

Blade Air Mobility's ownership is a mix of institutional and individual investors.

- Institutional investors like Vanguard and BlackRock hold significant shares.

- Founders, such as Rob Wiesenthal, maintain influential stakes.

- Public listing brought increased scrutiny and reporting requirements.

- Ownership details are available through SEC filings.

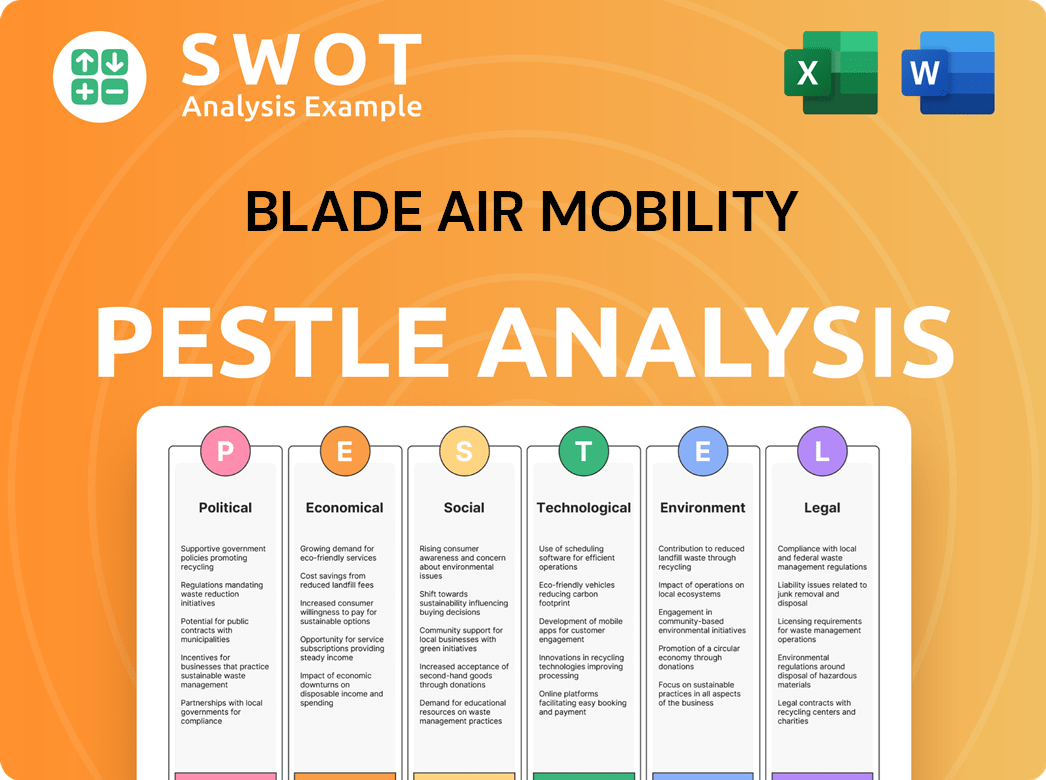

Blade Air Mobility PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Blade Air Mobility’s Board?

The current Board of Directors of Blade Air Mobility, as of early 2025, includes a blend of major shareholder representation, founders, and independent members. This structure is designed to provide comprehensive oversight and strategic guidance. The board includes Rob Wiesenthal, co-founder and CEO, who represents the founding ownership. Other board members bring expertise from finance, technology, and transportation. This diverse composition aims to ensure robust governance and varied perspectives. Eric Freeland serves as the Lead Independent Director.

The board's role is crucial. It oversees management, approves major strategic initiatives, and ensures the company operates in the best interests of its shareholders. The presence of independent directors helps to mitigate potential conflicts of interest and ensures a balanced approach to governance. Understanding who owns Blade and how the board functions is vital for anyone interested in Blade Air Mobility company ownership structure.

| Board Member | Title | Background |

|---|---|---|

| Rob Wiesenthal | Co-founder and CEO | Founding Ownership |

| Eric Freeland | Lead Independent Director | Finance |

| Other Board Members | Various | Technology, Transportation |

The voting structure of Blade Air Mobility generally follows a one-share-one-vote principle, which is common for publicly traded companies. Each share of common stock typically grants its holder one vote on matters presented to shareholders, such as the election of directors or approval of corporate actions. There are no publicly disclosed details of dual-class shares or special voting rights that would grant disproportionate control to specific individuals or entities, promoting equitable representation among shareholders. This structure is essential for understanding Blade company ownership and how decisions are made.

The board includes a mix of founders, major shareholders, and independent directors to provide oversight. The voting structure is primarily one-share-one-vote, ensuring equitable shareholder representation. For more insights, check out the Growth Strategy of Blade Air Mobility.

- Diverse board composition ensures varied perspectives.

- One-share-one-vote voting structure promotes fairness.

- Independent directors help mitigate conflicts of interest.

- Understanding governance is key for investors.

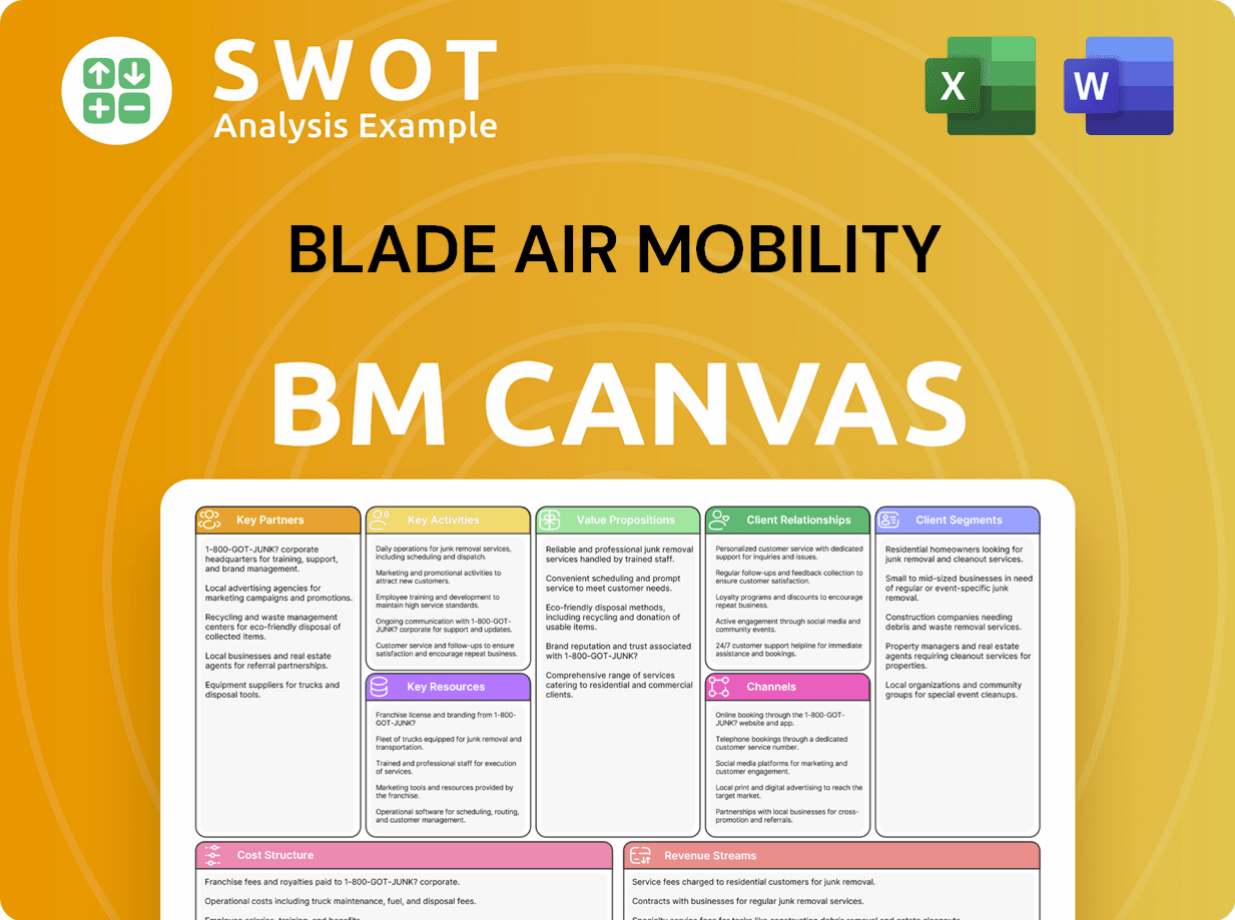

Blade Air Mobility Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Blade Air Mobility’s Ownership Landscape?

Over the last few years, Blade Air Mobility has seen significant shifts in its ownership structure, largely due to its public listing. The initial public offering (IPO) in 2021 opened the door for a broader investor base, changing the dynamics from private to public ownership. Subsequent strategic acquisitions, such as the purchase of Helijet's commercial passenger routes in September 2021 and Trinity Air Medical in May 2022, have also influenced ownership, potentially through share issuances or shifts in investor sentiment. These moves reflect the company's efforts to expand its services and market reach, which can impact who owns Blade.

Industry trends indicate a rise in institutional ownership as the urban air mobility sector matures. Founder dilution is a common occurrence post-IPO, yet founders often maintain influence through board seats. Environmental, social, and governance (ESG) investing is also playing a role, with investors increasingly focused on companies like Blade that are committed to sustainability, particularly with its focus on electric vertical aircraft. Understanding the Blade company ownership structure is key to assessing its future trajectory.

Public statements and analyst reports frequently highlight Blade's growth strategy, market expansion, and the development of its electric vertical aircraft (EVA) infrastructure. The company's financial performance in 2024 and 2025 will be critical in shaping investor confidence and ownership dynamics. For the fiscal year ending September 30, 2024, analysts project revenues of approximately $222.09 million, which will be a key factor in influencing the Blade stock and overall market perception. This projected revenue growth is a key indicator for potential investors looking at how to invest in Blade Air Mobility.

The urban air mobility sector is attracting increasing institutional investment. Blade Air Mobility's focus on strategic acquisitions and market expansion is designed to capture a larger market share. This growth strategy is influencing the company's financial performance and investor confidence.

Analysts project Blade Air Mobility to achieve revenues of approximately $222.09 million for the fiscal year ending September 30, 2024. This revenue growth is crucial for investor confidence. The company's progress towards profitability is a key factor in influencing ownership trends.

Blade's acquisitions, such as Helijet and Trinity Air Medical, have expanded its service offerings. These strategic moves can impact the Blade company ownership structure. The company's commitment to sustainability also plays a role.

Founder dilution is a common trend after a company goes public, though founders often retain influence. ESG investing is also influencing ownership. The company's future plans include expanding its market share.

Blade Air Mobility Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Blade Air Mobility Company?

- What is Competitive Landscape of Blade Air Mobility Company?

- What is Growth Strategy and Future Prospects of Blade Air Mobility Company?

- How Does Blade Air Mobility Company Work?

- What is Sales and Marketing Strategy of Blade Air Mobility Company?

- What is Brief History of Blade Air Mobility Company?

- What is Customer Demographics and Target Market of Blade Air Mobility Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.