CBOE Global Markets Bundle

How Does CBOE Global Markets Stack Up in Today's Financial Arena?

Cboe Global Markets (CBOE) isn't just another player in the financial world; it's a pioneer that revolutionized trading. From its roots in options trading, Cboe has grown into a global powerhouse, but how does it fare against its rivals? This exploration delves into the CBOE Global Markets SWOT Analysis to uncover its strengths and weaknesses within the competitive landscape.

The financial exchange sector is a battlefield of innovation and strategic maneuvering, and understanding the competitive landscape of CBOE Global Markets is crucial for anyone involved in market analysis. This includes examining CBOE's market share, comparing it with other trading platforms, and analyzing its various revenue streams. Knowing who CBOE's main competitors are and how it differentiates itself offers valuable insights into its future outlook and stock performance, especially when considering its trading products, including options trading and index futures.

Where Does CBOE Global Markets’ Stand in the Current Market?

Cboe Global Markets (CBOE) holds a prominent position in the financial exchange industry, particularly in options trading. The company operates as a multi-asset class exchange operator, offering a wide array of products and services. Its core operations revolve around providing trading platforms for options, futures, equities, exchange-traded products (ETPs), global FX, and volatility products, along with market data solutions.

The value proposition of CBOE lies in its comprehensive offerings and its ability to serve diverse customer segments. CBOE's trading platforms cater to institutional investors, retail traders, and market makers. By providing access to various asset classes and market data, CBOE enables participants to manage risk, execute trades, and gain insights into market dynamics. A recent market analysis shows the company’s strong focus on innovation and technology to enhance trading efficiency and expand its product offerings.

Geographically, CBOE has a strong presence in North America and Europe, with operations in major financial hubs. Its European equities and ETPs business has established it as a leading market for trading these instruments in the region. The company has strategically diversified its offerings, moving beyond its core options business to become a multi-asset class exchange operator. This expansion has been driven by both organic growth and strategic acquisitions, allowing CBOE to serve a broader range of customer segments.

CBOE remains the largest options exchange in the U.S., solidifying its dominance in this crucial market segment. This position is a testament to its enduring strength and market penetration. The company consistently leads in terms of trading volume and open interest, which is a key indicator of market share. According to recent data, CBOE commands a significant percentage of the options market volume.

CBOE's revenue streams are diversified, with a significant portion derived from trading fees, market data services, and access and capacity fees. The company's derivatives business, particularly U.S. options and futures, remains a significant revenue driver. Market data solutions also contribute substantially to its financial performance. The company's financial statements show that trading fees and market data services are key revenue drivers.

For the full year 2023, CBOE reported record net revenue of $1.86 billion, marking a 9% increase compared to 2022. Diluted earnings per share (EPS) for 2023 were $5.90, reflecting strong operational performance. These figures underscore CBOE's scale and profitability, solidifying its standing as a major player. These strong financial results highlight CBOE's robust financial health and its ability to generate consistent revenue growth.

CBOE holds a particularly strong position in volatility products, notably through its proprietary VIX index and related futures and options. These products are widely recognized benchmarks for market volatility. The VIX index and related products are crucial tools for investors to gauge market risk and make informed decisions. The company continuously innovates in this area, offering new volatility-related products.

CBOE's competitive advantages include its strong brand recognition, diverse product offerings, and advanced technology infrastructure. These factors contribute to its leading market position. The company’s strategic acquisitions and organic growth initiatives have expanded its reach and capabilities. By focusing on innovation and customer service, CBOE maintains its competitive edge.

- Leading market share in U.S. options trading.

- Strong presence in European equities and ETPs.

- Diverse revenue streams from trading fees and market data.

- Proprietary VIX index and volatility products.

For a more detailed look at the company's target market, consider reading this article: CBOE's Target Market.

CBOE Global Markets SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging CBOE Global Markets?

The CBOE Global Markets operates in a highly competitive environment, facing rivals across its diverse business segments. Understanding the competitive landscape is crucial for assessing its market position and future prospects. This market analysis will delve into the key players challenging CBOE Global Markets.

CBOE's success depends on its ability to differentiate itself through technology, pricing, and product offerings. The company's performance is often compared to its peers, such as Nasdaq and the NYSE, to evaluate its market share and trading volume. For a deeper dive into CBOE's strategic direction, consider reading about the Growth Strategy of CBOE Global Markets.

CBOE generates revenue through transaction fees, market data services, and listings. Its ability to attract and retain trading volume is directly tied to its competitive standing. Examining CBOE's financial statements and comparing them with those of its competitors provides insights into its financial health and growth potential. The competitive advantages of CBOE include its established brand, innovative products, and robust technology infrastructure.

In the U.S. options market, CBOE's primary rivals include Nasdaq and NYSE Group. These exchanges compete through competitive pricing, technological advancements, and efforts to attract order flow. The competition focuses on attracting order flow and providing efficient trading platforms.

In the equities space, CBOE competes with major stock exchanges like NYSE, Nasdaq, and Euronext. These exchanges offer broad listing services and equities trading, leveraging their extensive networks and deep liquidity pools. Competition centers on attracting high-profile company listings and increasing trading volume.

Within the futures market, CME Group is a dominant force and a significant competitor to CBOE's futures offerings. ICE (Intercontinental Exchange) is another major competitor, especially in energy and agricultural futures. These competitors differentiate themselves through the breadth of their product suites and global reach.

In the global FX market, CBOE competes with interbank FX platforms and electronic communication networks (ECNs) such as Refinitiv (LSEG), EBS (CME Group), and FXall (Refinitiv). These platforms vie for institutional FX volume through speed, liquidity, and diverse execution protocols. The rise of new, technology-driven trading venues and dark pools represents an ongoing challenge.

The competitive landscape is also influenced by mergers and alliances, such as LSEG's acquisition of Refinitiv. This consolidation intensifies competition in data and multi-asset trading solutions. These changes impact market dynamics and the strategies of CBOE and its rivals.

The regulatory environment also plays a significant role, with oversight from bodies like the SEC in the U.S. and similar agencies globally. Changes in regulations can impact trading practices and the competitive dynamics of the market. Compliance with these regulations is crucial for all financial exchange operators.

Understanding the strategies of CBOE's competitors is crucial for assessing its position. For instance, Nasdaq and NYSE often compete for high-profile company listings, which drives trading volume and market share. CME Group focuses on a broad range of futures products, while ICE emphasizes energy and agricultural futures. Refinitiv, EBS, and FXall concentrate on institutional FX trading, with speed and liquidity being key differentiators.

- Nasdaq: Focuses on options and equities, leveraging technology and competitive pricing.

- NYSE Group: Competes in options and equities, emphasizing its brand and network.

- CME Group: Dominates the futures market with a wide array of products.

- ICE: Specializes in energy and agricultural futures, as well as global data services.

- Refinitiv, EBS, FXall: Concentrate on institutional FX trading, offering speed and liquidity.

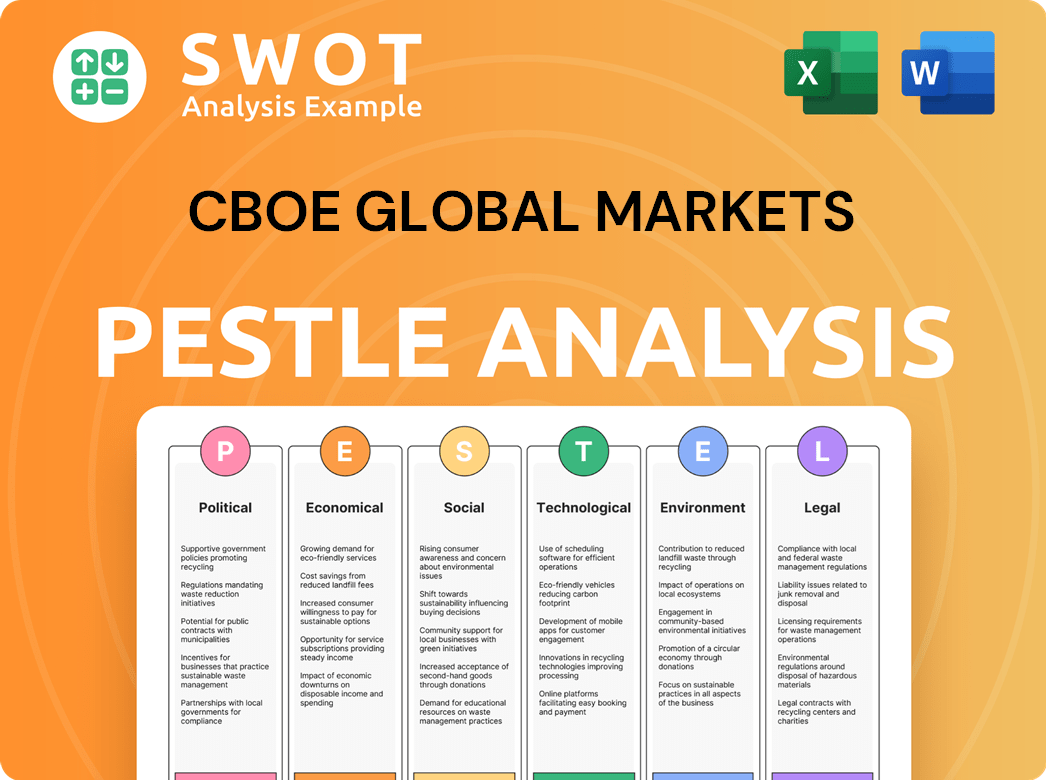

CBOE Global Markets PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives CBOE Global Markets a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of CBOE Global Markets requires a deep dive into its core strengths. CBOE, a prominent financial exchange, has cultivated several key advantages that set it apart in a dynamic market. These advantages are critical for maintaining its leadership position, especially in the face of evolving market dynamics and increasing competition. A comprehensive market analysis reveals the strategic moves and competitive edge that define CBOE's success.

CBOE's competitive advantages are multifaceted, encompassing proprietary technology, brand equity, and economies of scale. These elements work in concert to create a robust and resilient business model. The company's strategic acquisitions and continuous investments in technology have further solidified its position. The financial exchange's ability to innovate and adapt is crucial for its long-term success in the financial markets.

The Brief History of CBOE Global Markets highlights its evolution and strategic decisions that have contributed to its current competitive advantages. These advantages have been built over time through a combination of innovation, strategic acquisitions, and a focus on customer needs. This has allowed CBOE to maintain its position as a leading financial exchange.

CBOE's advanced trading infrastructure is a major competitive advantage. This technology enables high-speed trade execution, reliability, and capacity for large trading volumes. These capabilities are essential for attracting high-frequency trading firms and institutional clients. This technological edge is critical in the competitive landscape.

CBOE's long history and reputation are significant strengths. The company's brand is synonymous with innovation and market integrity. This strong brand translates into high customer trust and loyalty, particularly in the U.S. options market. This customer loyalty is a key factor in CBOE's market share.

CBOE's ownership of the VIX index provides a unique competitive differentiator. The VIX and its related products are proprietary to CBOE. This creates a significant revenue stream and attracts global investors. This intellectual property is difficult for competitors to replicate.

Economies of scale play a crucial role, especially in market data and clearing services. As a large exchange operator, CBOE can leverage its extensive network and infrastructure. This allows for competitive pricing for data and trading services. This helps maintain healthy profit margins.

CBOE's competitive advantages are multifaceted, including technological prowess, brand recognition, and strategic acquisitions. These factors have allowed CBOE to maintain a strong position in the market. The company's ability to adapt and innovate is key to its sustained success.

- Proprietary Technology: High-speed execution and robust infrastructure attract high-frequency traders.

- Brand Equity: Strong reputation and customer loyalty, particularly in options trading.

- VIX Index Ownership: Exclusive ownership of the 'fear gauge' generates significant revenue.

- Economies of Scale: Competitive pricing for data and trading services due to its size.

CBOE Global Markets Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping CBOE Global Markets’s Competitive Landscape?

The competitive landscape for CBOE Global Markets is dynamic, shaped by technological advancements, regulatory changes, and evolving market demands. Understanding the industry trends, future challenges, and opportunities is crucial for assessing its long-term viability and growth potential. This analysis provides a comprehensive overview of the factors influencing Cboe's position in the financial exchange industry.

The company faces both risks and opportunities. Declining demand for legacy products, aggressive new competitors, and cybersecurity threats pose challenges. However, growth opportunities exist in emerging markets, product innovation, and strategic partnerships. Cboe's ability to adapt, innovate, and expand its global footprint will be critical to its success.

Technological advancements, such as AI and blockchain, are revolutionizing trading. Regulatory changes and shifting consumer preferences drive the need for personalized data and new asset classes. The rise of retail investing presents opportunities for expanding the user base and educational offerings.

Declining demand for legacy products, aggressive new competitors, and cybersecurity risks are potential threats. Maintaining deep and efficient markets amid liquidity fragmentation poses a challenge. Increased regulatory scrutiny could impact operational costs and business models.

Significant growth exists in emerging markets, particularly Asia and Latin America. Product innovations, such as ESG derivatives and digital assets, could unlock new revenue streams. Strategic partnerships with fintech firms can enhance capabilities and expand the ecosystem.

Cboe's strategy involves diversifying revenue beyond transaction fees. The company is increasing its focus on data and analytics and making strategic acquisitions. Expanding its global footprint, especially in Europe and Asia, and investing in advanced technology are crucial.

Cboe's competitive position in the financial exchange market is influenced by several factors. The company's ability to adapt to technological advancements and regulatory changes is crucial. Strategic initiatives and global expansion are essential for capturing future growth. The company must also manage risks related to competition and cybersecurity.

- Technological Innovation: Continuous investment in AI, machine learning, and blockchain.

- Regulatory Compliance: Adapting to evolving market structure and data fee regulations.

- Product Diversification: Developing new products like ESG derivatives and digital asset trading.

- Global Expansion: Targeting growth in emerging markets, particularly in Asia.

CBOE Global Markets Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CBOE Global Markets Company?

- What is Growth Strategy and Future Prospects of CBOE Global Markets Company?

- How Does CBOE Global Markets Company Work?

- What is Sales and Marketing Strategy of CBOE Global Markets Company?

- What is Brief History of CBOE Global Markets Company?

- Who Owns CBOE Global Markets Company?

- What is Customer Demographics and Target Market of CBOE Global Markets Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.