CBOE Global Markets Bundle

Who Really Controls CBOE Global Markets?

Unraveling the ownership structure of CBOE Global Markets is key to understanding its strategic direction and future potential. From its inception as a member-owned exchange to its current status as a publicly traded giant, the evolution of CBOE's ownership tells a compelling story. This exploration dives deep into the key players and pivotal moments that have shaped this financial powerhouse.

Understanding CBOE Global Markets SWOT Analysis is just the beginning; knowing who holds the reins is crucial for investors and market watchers alike. The shift from a member-owned structure to a publicly traded entity fundamentally altered the landscape of CBOE ownership, impacting its strategic decisions and market performance. This analysis will examine the major shareholders, the influence of institutional investors, and the overall impact on CBOE's long-term growth trajectory, providing a comprehensive view of who owns CBOE and how it impacts the company's future. Exploring CBOE's history, from its early days to its current market capitalization, reveals a dynamic evolution in ownership, influencing everything from CBOE stock performance to its strategic initiatives.

Who Founded CBOE Global Markets?

The foundation of CBOE Global Markets (CBOE) differs significantly from typical corporate startups. The Chicago Board of Trade (CBOT) established the Chicago Board Options Exchange in 1973. This unique origin meant that the initial ownership structure was not based on individual founders with equity stakes, but rather a member-owned exchange.

This structure meant that ownership was distributed among its members, primarily individual traders and trading firms. These members acquired 'seats' on the exchange, which granted trading privileges and a share in the exchange's governance and profits. There were no traditional 'founders' holding initial equity percentages. Instead, the CBOT facilitated its creation, and early ownership was tied to membership.

Early agreements and rules within the member-owned structure governed how seats could be bought, sold, or transferred, effectively acting as early buy-sell clauses. The value of these seats fluctuated with the exchange's profitability and the demand for trading access. There were no angel investors or friends and family acquiring stakes in the traditional sense; instead, the capital to establish and operate the exchange came from member contributions and fees.

CBOE's inception was a departure from conventional startups. It was founded by the Chicago Board of Trade (CBOT) in 1973. This initial structure shaped its ownership and operational dynamics.

Ownership of CBOE was distributed among its members. These members were primarily individual traders and trading firms. They held 'seats' that provided trading rights and a share in the exchange's governance.

Unlike typical startups, CBOE didn't have individual founders with equity. The CBOT facilitated its creation. Ownership was linked to membership rather than individual equity stakes.

Early agreements and rules governed seat transactions. The value of seats changed with profitability and trading demand. Capital came from member contributions and fees.

The CBOT aimed to create an efficient options trading marketplace. This vision was reflected in the distributed control among its members. This ensured the exchange operated in the collective interest of its trading community.

Any ownership disputes would have manifested as disagreements among members. These disagreements would have involved exchange rules, fees, or strategic direction. They were resolved through internal governance mechanisms.

The initial structure of CBOE, as a member-owned exchange, set the stage for its future. The evolution of CBOE ownership is a key aspect of its history. For more insights, consider reading about the Growth Strategy of CBOE Global Markets. As of early 2024, the company's market capitalization is approximately $16 billion, reflecting its growth since its inception. The organizational structure has evolved, but understanding the early ownership model provides context for its current operations and shareholder base. In 2024, CBOE's trading volume reached record highs, indicating the continued importance of its exchanges in the financial markets.

CBOE's unique founding by the CBOT shaped its early ownership.

- Ownership was initially distributed among members.

- Members held 'seats' that conferred trading privileges.

- Capital came from member contributions and fees.

- Early agreements governed seat transactions and value.

CBOE Global Markets SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has CBOE Global Markets’s Ownership Changed Over Time?

The ownership structure of Cboe Global Markets, a prominent player in the financial markets, has evolved significantly since its inception. The company's journey began as a member-owned organization before undergoing demutualization in 2006. This pivotal move set the stage for its initial public offering (IPO) on June 15, 2010, under the ticker symbol 'CBOE.' This transition from a privately held, member-governed entity to a publicly traded company opened its ownership to a diverse group of investors, including both institutional and individual shareholders. Understanding the shifts in CBOE ownership is key to grasping its strategic direction and market position.

Since the IPO, CBOE ownership has been subject to the dynamics typical of publicly traded companies. Institutional investors currently hold a substantial portion of Cboe's outstanding shares. Prominent institutional shareholders include major asset management firms, mutual funds, and index funds. As of March 31, 2024, firms like Vanguard Group Inc., BlackRock Inc., and State Street Corp. are among the top institutional holders, often possessing significant percentages of the company's shares. These holdings are regularly updated in SEC filings, such as 13F reports, and in the company's annual and quarterly reports (Form 10-K and Form 10-Q, respectively). This widespread institutional ownership reflects the company's integration into the broader financial market ecosystem.

| Event | Impact on Ownership | Date |

|---|---|---|

| Demutualization | Transition from member-owned to shareholder-owned | 2006 |

| Initial Public Offering (IPO) | Public offering of shares, opening ownership to a broader investor base | June 15, 2010 |

| Acquisition of Bats Global Markets | Potential dilution of existing shareholders or introduction of new institutional investors | 2017 |

Key events have reshaped the ownership landscape, including strategic acquisitions. The acquisition of Bats Global Markets in 2017 was a transformative event, broadening Cboe's global reach and diversifying its product offerings. Such acquisitions can lead to changes in ownership structure, often involving the issuance of new shares or a combination of cash and stock. These shifts in ownership have a direct impact on company strategy, aligning the interests of a broader investor base with the company's long-term growth and profitability. This alignment often leads to a greater focus on shareholder value and market expansion, as highlighted in the Growth Strategy of CBOE Global Markets.

Cboe Global Markets' ownership structure has evolved from a member-owned entity to a publicly traded company, with significant institutional investor involvement.

- Demutualization and the IPO were pivotal in opening ownership to a wider investor base.

- Major institutional holders include Vanguard, BlackRock, and State Street.

- Strategic acquisitions, such as Bats Global Markets, have reshaped the ownership landscape.

- Understanding CBOE ownership is crucial for grasping its strategic direction.

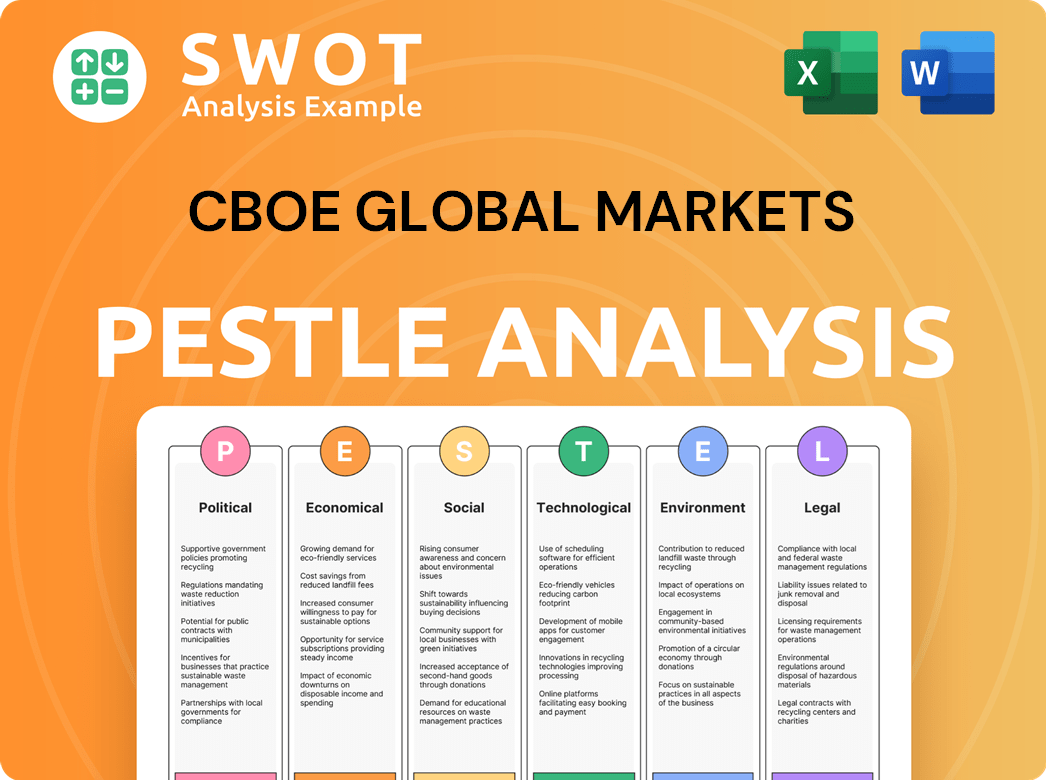

CBOE Global Markets PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on CBOE Global Markets’s Board?

As of early 2025, the CBOE Global Markets board of directors is composed of a mix of independent directors and those with significant industry experience. This structure reflects a commitment to strong corporate governance. The board includes individuals with leadership experience in other major financial institutions, bringing a broad perspective on market dynamics and strategic direction. The emphasis on independent directors helps ensure that decisions are made in the best interest of all shareholders.

The composition of the board is regularly updated, with members bringing diverse expertise in finance, technology, and market operations. While specific representation of major shareholders can fluctuate, the majority of board members are typically independent. This structure helps maintain a balance between the interests of management, shareholders, and other stakeholders. The board's role is crucial in overseeing the company's strategy, risk management, and overall performance, ensuring that the company operates efficiently and ethically.

| Board Member | Title | Relevant Experience |

|---|---|---|

| Ed Tilly | Executive Chairman | Former CEO, extensive experience in exchange operations |

| Fredric H. (Rick) Bright | Director | Former CEO of the Biomedical Advanced Research and Development Authority (BARDA) |

| Jill M. Considine | Director | Former CEO of the Depository Trust Company |

CBOE Global Markets operates under a one-share-one-vote structure, which is common for most publicly traded companies. This means that each common share typically entitles its holder to one vote on matters brought before shareholders, such as the election of directors. There are no publicly disclosed dual-class share structures granting disproportionate voting rights. This structure ensures that voting power is generally proportional to economic ownership, promoting fairness among shareholders. The absence of significant proxy battles suggests a relatively stable governance environment.

CBOE Global Markets' one-share-one-vote structure ensures that voting power aligns with economic ownership. Major institutional shareholders can significantly influence outcomes due to the volume of shares they hold.

- The company's governance structure is designed to be transparent and equitable.

- Shareholder proposals on ESG matters and executive compensation are common.

- The board and management generally maintain alignment with the broader shareholder base.

CBOE Global Markets Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped CBOE Global Markets’s Ownership Landscape?

Over the past few years, the ownership structure of CBOE Global Markets has seen shifts, primarily driven by market dynamics and strategic initiatives. A key trend is the increasing presence of institutional investors, including large asset managers and index funds. These entities are expanding their investments across major market infrastructure providers like CBOE. The company's approach to returning value to shareholders often includes share repurchase programs, which can incrementally increase the ownership stake of existing shareholders.

Mergers and acquisitions have also influenced the CBOE ownership landscape. While the acquisition of Bats Global Markets occurred earlier, its integration continues to affect the investor base. Furthermore, as CBOE expands into new areas, such as European equities and digital assets, it may attract specialized investors. The company's focus on ESG (Environmental, Social, and Governance) factors is also impacting its investor relations, as institutional investors increasingly consider these aspects in their decisions.

| Metric | Value (as of Q1 2024) | Source |

|---|---|---|

| Market Capitalization | Approximately $21 Billion | Company Filings |

| Institutional Ownership | Around 90% | Company Filings |

| Trading Volume (Average Daily) | Approximately $16 Billion | Company Filings |

CBOE's leadership consistently emphasizes growth strategies, technological innovation, and market expansion, which are key factors influencing investor sentiment and, consequently, ownership trends. As of the latest reports, there are no public statements indicating a planned privatization or significant changes to its public listing status. If you're interested in the company's history, you can find more information in this article about CBOE Global Markets.

Major institutional investors hold significant stakes in CBOE. These include large asset managers and index funds, reflecting a trend towards increased institutional ownership. These investors often influence the company's strategic direction and financial performance.

CBOE has utilized share repurchase programs to return value to shareholders. These programs reduce the outstanding share count, potentially increasing the ownership percentage of remaining shareholders. This is a common strategy for publicly traded companies.

Institutional investors are increasingly considering ESG factors. CBOE is enhancing its disclosures and practices in these areas to align with investor expectations. This focus reflects broader industry trends.

CBOE's expansion into new markets, like European equities and digital assets, is attracting specialized investors. These initiatives are part of the company's growth strategy and influence ownership trends.

CBOE Global Markets Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CBOE Global Markets Company?

- What is Competitive Landscape of CBOE Global Markets Company?

- What is Growth Strategy and Future Prospects of CBOE Global Markets Company?

- How Does CBOE Global Markets Company Work?

- What is Sales and Marketing Strategy of CBOE Global Markets Company?

- What is Brief History of CBOE Global Markets Company?

- What is Customer Demographics and Target Market of CBOE Global Markets Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.