CBOE Global Markets Bundle

How Does CBOE Global Markets Thrive in the Financial World?

Cboe Global Markets, a titan in the exchange industry, posted impressive results in 2023, with net revenue soaring to $1.85 billion, a 10% increase year-over-year. This growth showcases Cboe's pivotal role in facilitating transparent and efficient trading across various asset classes. As the operator of the largest options exchange in the U.S. and a leader in European equities and exchange-traded products (ETPs), Cboe offers a diverse suite of products, including options, futures, and global FX.

To truly understand the dynamics of the financial markets, it's essential to dissect CBOE Global Markets SWOT Analysis. This analysis will explore CBOE operations, including its strategic acquisitions and product innovations, such as new derivatives and the expansion of its global FX network, which have fueled its market leadership. By examining its core operations, revenue streams, and technological advancements, we gain valuable insights into how Cboe not only survives but thrives in the ever-evolving landscape of global financial markets, including options trading and the volatility index.

What Are the Key Operations Driving CBOE Global Markets’s Success?

CBOE Global Markets (CBOE) generates value by offering a wide array of trading and investment solutions across various asset classes. It serves a diverse clientele including institutional investors, retail traders, and financial intermediaries. The company's core business revolves around options, futures, U.S. and European equities, exchange-traded products (ETPs), global FX, and multi-asset volatility products.

A key aspect of CBOE's value proposition is its position as a leading options exchange in the U.S., providing significant liquidity and a broad selection of products, including its flagship S&P 500 Index (SPX) options. CBOE also plays a major role in European equities and ETP trading. This comprehensive approach allows CBOE to cater to a wide range of trading needs and risk management strategies.

CBOE's operations are supported by advanced proprietary technology, enabling high-speed, low-latency trading. This includes robust trading platforms, real-time market data dissemination, and sophisticated risk management systems. The operational framework ensures secure and resilient exchange infrastructure, innovative trading tools, and regulatory compliance across multiple jurisdictions. Its distribution network is global, providing access to its marketplaces through direct connectivity, independent software vendors (ISVs), and various financial service providers.

CBOE utilizes advanced proprietary technology to facilitate high-speed, low-latency trading. These platforms are designed to handle large volumes of transactions efficiently. This technology is crucial for maintaining competitive advantages in the fast-paced world of financial markets.

Real-time market data dissemination and sophisticated risk management systems are integral to CBOE's operations. These systems ensure that market participants have access to the most current information. Robust risk management is essential for maintaining market integrity and protecting investors.

CBOE's distribution networks are global, offering access to its marketplaces via direct connectivity, ISVs, and financial service providers. This global reach allows for a broad base of participation. The company’s ability to integrate diverse marketplaces into a cohesive global network is a key differentiator.

CBOE focuses on product innovation, particularly in the derivatives space. This includes the development of new options contracts and volatility products. The CBOE Global FX platform provides a comprehensive suite of FX products and services.

CBOE's unique approach lies in its product innovation and the integration of diverse marketplaces. This integrated approach enhances liquidity and provides diversified trading opportunities. CBOE's commitment to innovation and a global network differentiates it in the competitive exchange landscape.

- Options Trading: CBOE is the largest options exchange in the U.S., offering a wide range of options contracts, including SPX options.

- Volatility Index (VIX): CBOE created and maintains the VIX, a key benchmark for market volatility. The VIX is widely used by investors to gauge market risk.

- Global FX Platform: The CBOE Global FX platform provides a comprehensive suite of FX products and services. This platform supports a wide range of FX trading activities.

- Technology and Infrastructure: CBOE's advanced technology ensures high-speed, low-latency trading. This technology is crucial for maintaining competitive advantages.

The company's history, as detailed in Owners & Shareholders of CBOE Global Markets, shows that CBOE has consistently adapted and innovated to meet the evolving needs of the financial markets. For instance, CBOE's market capitalization as of early 2024 was approximately $20 billion, reflecting its significant presence in the financial markets. In 2023, CBOE reported record trading volumes in several products, including options and futures, demonstrating its continued growth and relevance. Furthermore, CBOE's commitment to technology and product innovation has allowed it to maintain a strong position in the financial markets, providing enhanced liquidity, diversified trading opportunities, and efficient price discovery for its customers.

CBOE Global Markets SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does CBOE Global Markets Make Money?

CBOE Global Markets generates revenue through a diverse set of streams, reflecting its significant role in the financial markets. These streams include transaction fees, access and capacity fees, market data fees, and other revenue sources. The company's ability to diversify its revenue is a key aspect of its financial strategy.

In 2023, CBOE reported net revenue of $1.85 billion, demonstrating a 10% increase from 2022. This growth highlights the company's ability to maintain and expand its revenue base. The revenue streams are designed to capture value from various aspects of its operations.

CBOE operations are structured to maximize revenue generation through multiple channels. Transaction fees, market data fees, and access fees are critical components of its financial model. The company's strategic approach to revenue generation is a key factor in its success.

CBOE employs several strategies to monetize its services and products effectively. These strategies are designed to optimize revenue generation across its various platforms and offerings. A key aspect of its strategy is the ability to attract liquidity and order flow.

- Transaction Fees: Derived from the volume and value of trades executed on its exchanges. For instance, in Q1 2024, Derivatives net revenue was $327.0 million, and North American Equities net revenue was $146.6 million.

- Access and Capacity Fees: Generated from participants connecting to and using CBOE's trading platforms and infrastructure.

- Market Data Fees: Earned by providing real-time and historical trading data to market participants.

- Tiered Pricing: Incentivizes higher trading volumes.

- Cross-selling: Offering a broad range of products across different asset classes.

- Strategic Acquisitions: Such as EuroCCP, to diversify revenue streams.

The company's focus on expanding its global footprint, especially in Europe and the Asia Pacific region, and introducing new products like European equity options, is designed to further diversify and grow its revenue streams. To understand more about their marketing approach, consider reading about the Marketing Strategy of CBOE Global Markets.

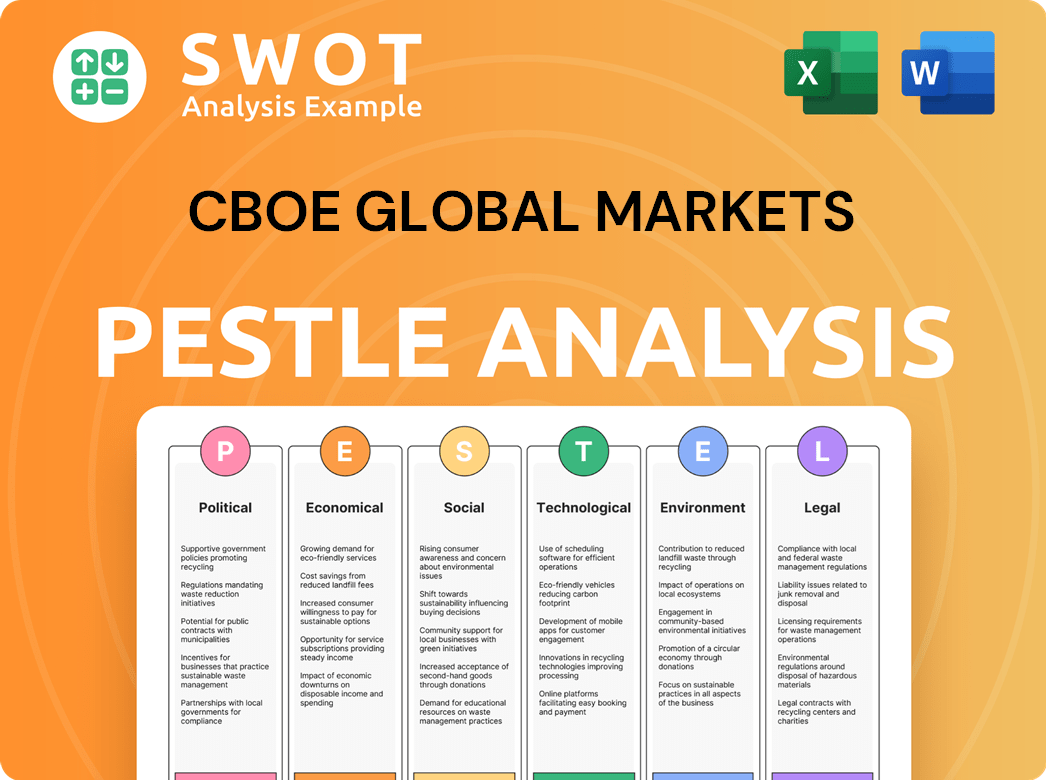

CBOE Global Markets PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped CBOE Global Markets’s Business Model?

Cboe Global Markets (Cboe) has a rich history marked by strategic moves and significant milestones that have shaped its position in the financial markets. The company's evolution reflects its adaptability and commitment to innovation, particularly in options trading and the development of key financial products. Understanding Cboe's journey provides valuable insights into its operations and competitive advantages.

A pivotal moment for Cboe was the acquisition of Bats Global Markets in 2017, which significantly broadened its global footprint, especially in U.S. equities and European markets. More recently, Cboe has expanded into digital assets with Cboe Digital, demonstrating its responsiveness to emerging market trends. These strategic moves, along with technological advancements, have been critical to Cboe's growth and market leadership.

Cboe's operational strategies and competitive strengths are essential to understanding its market dynamics. The company's strong brand recognition, particularly in the U.S. options market, and its technological leadership are key differentiators. Cboe's ability to leverage network effects and economies of scale further strengthens its market position, making it a significant player in global financial markets.

The acquisition of Bats Global Markets in 2017 was a transformative event, expanding Cboe's reach in equities and European markets. The launch of Cboe Digital in 2022 marked a strategic entry into the digital assets space. The acquisition of EuroCCP in 2020 enhanced its European clearing capabilities.

Cboe's strategic moves include expanding into digital assets to meet evolving market demands. Continuous investment in technology infrastructure ensures low-latency trading and robust cybersecurity. The company focuses on expanding its global FX offerings and exploring new asset classes.

Cboe's strong brand recognition in the U.S. options market and technological leadership provide a competitive edge. High-performance trading systems and data analytics are key differentiators. Network effects and economies of scale contribute to increased liquidity and market position.

Navigating evolving regulatory landscapes across different jurisdictions is a key challenge. Adapting to rapid technological advancements requires continuous investment and innovation. Maintaining low-latency trading and robust cybersecurity are critical operational priorities.

Cboe's market capitalization reflects its strong position in the financial markets. The company's revenue streams include transaction fees, market data services, and access and capacity fees. Cboe's financial performance is closely tied to trading volumes and market volatility, especially in the options market.

- In Q1 2024, Cboe reported a revenue of approximately $578.6 million.

- Cboe's options trading volume remains a significant driver of its revenue.

- The VIX (Volatility Index), a key Cboe product, is closely watched by investors.

- Cboe's strategic investments in technology and new markets continue to drive growth.

CBOE Global Markets Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is CBOE Global Markets Positioning Itself for Continued Success?

CBOE Global Markets (CBOE) holds a significant position in the global exchange industry, particularly as the largest options exchange in the U.S. and a leading player in European equities and ETPs. Its market share in these segments provides considerable competitive advantages, supported by strong customer loyalty. The company's global reach spans North America, Europe, and Asia Pacific, with ongoing expansion plans. CBOE's target market includes a wide range of financial participants, from individual investors to institutional traders.

Despite its strong position, CBOE faces several risks, including regulatory changes, especially in derivatives and digital assets. Increased competition from other exchanges and new entrants, along with technological disruptions, also pose challenges. Broader economic downturns or geopolitical instability can reduce trading volumes, affecting revenue. The company's performance is closely tied to the overall health and activity of financial markets.

CBOE is the largest options exchange in the U.S. and a major player in European equities and ETPs. Its market share gives it a competitive edge, with strong customer loyalty. CBOE's global presence includes North America, Europe, and Asia Pacific, with plans for further expansion.

CBOE faces risks from regulatory changes, especially in derivatives and digital assets. Competition from other exchanges and technological disruptions are also challenges. Economic downturns and geopolitical instability can reduce trading volumes, impacting revenue.

CBOE is focused on expanding its global derivatives franchise and enhancing data solutions. The company aims for the continued growth of CBOE Digital. Innovation, global expansion, and technology are key to creating more efficient markets.

CBOE's operations involve trading in options, futures, and other financial instruments. The company makes money through transaction fees, market data, and access solutions. CBOE’s strategy includes product innovation and strategic acquisitions to grow its global footprint.

CBOE's strategic initiatives include expanding its global derivatives business, particularly in Europe and Asia Pacific, and enhancing its data and access solutions. The company is also focused on the growth of CBOE Digital, aiming to provide a regulated marketplace for digital assets. Leadership is committed to innovation, global expansion, and leveraging technology.

- CBOE plans to innovate in product development.

- Strategic acquisitions complement existing businesses.

- Expansion into high-growth areas like climate and ESG markets is a priority.

- Adapting to market evolution and leveraging core strengths is key.

CBOE Global Markets Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CBOE Global Markets Company?

- What is Competitive Landscape of CBOE Global Markets Company?

- What is Growth Strategy and Future Prospects of CBOE Global Markets Company?

- What is Sales and Marketing Strategy of CBOE Global Markets Company?

- What is Brief History of CBOE Global Markets Company?

- Who Owns CBOE Global Markets Company?

- What is Customer Demographics and Target Market of CBOE Global Markets Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.