CBOE Global Markets Bundle

How Does CBOE Global Markets Dominate the Financial Exchange Landscape?

In the dynamic world of finance, understanding the sales and marketing strategies of industry leaders is crucial. Cboe Global Markets, a titan in the derivatives and securities exchange network, recently rebranded its technology platform, Cboe Titanium, signaling a strategic shift. This move highlights the importance of a robust CBOE Global Markets SWOT Analysis, and its approach to sales and marketing in a competitive global market.

From its origins in options trading to its current status as a global financial exchange, CBOE's evolution is a testament to its effective CBOE sales strategy and CBOE marketing strategy. This analysis will delve into how CBOE Global Markets delivers its products and services, examining its marketing tactics, brand positioning, and key campaigns. We'll explore how CBOE leverages market data and other resources to reach its target audience, including retail traders and institutional investors, to understand the company's success in the financial exchange sector.

How Does CBOE Global Markets Reach Its Customers?

Cboe Global Markets leverages a multifaceted sales and marketing strategy to reach its diverse customer base. This approach primarily involves its global exchange network and direct engagement with market participants. The company's extensive global footprint, including operations in the U.S., Europe, and Asia Pacific, serves as a primary sales channel, providing access to diverse markets and trading solutions worldwide.

The evolution of Cboe's sales channels has been marked by strategic acquisitions and technological advancements. These initiatives have broadened Cboe's reach and enhanced its ability to serve a global clientele. The company continues to adapt its sales strategies to capitalize on opportunities in the evolving financial landscape.

Cboe's sales strategy focuses on both direct and indirect channels, ensuring comprehensive market coverage. This includes direct sales teams and partnerships to meet the needs of various customer segments. The company's approach is designed to maximize market penetration and revenue generation.

Cboe operates 27 markets across five asset classes, including leading equity trading venues. This extensive network is a primary sales channel, offering access to diverse markets and trading solutions. Cboe's global presence is a key element of its CBOE sales strategy, facilitating trading across the U.S., Europe, and Asia Pacific.

Acquisitions like BIDS Trading and MATCHNow have expanded Cboe's reach in block trading and Canadian equities. These strategic moves contribute significantly to its global network and revenue growth. In Q1 2024, Cboe's international revenue reached $173.9 million, demonstrating its global reach.

Cboe Titanium offers a unified trading experience across its global markets. This platform enhances accessibility and efficiency for customers trading options, equities, and futures. Cboe Canada is expected to migrate to this platform in March 2025, furthering technological integration.

Cboe engages in direct sales, particularly for its Data Vantage business, providing market data and analytics. In May 2025, Cboe announced the expansion of its Data Vantage business with new Sales Directors in APAC. Market data is available through multiple channels, including Cboe Global Cloud and Snowflake Marketplace.

Cboe's approach to market data sales is crucial for its growth, with over 75% of Global Cloud customers taking U.S. data feeds residing outside the U.S. This highlights the global demand for its market data. To understand the specific customer groups that Cboe focuses on, you can explore the Target Market of CBOE Global Markets.

Cboe's sales strategy includes its global exchange network, strategic acquisitions, and technological advancements. Direct sales teams and partnerships play a vital role in reaching various customer segments. The company focuses on providing market data through multiple channels.

- Global Exchange Network: 27 markets across five asset classes.

- Strategic Acquisitions: BIDS Trading and MATCHNow.

- Technological Advancements: Cboe Titanium platform.

- Direct Sales: Data Vantage business with new Sales Directors in APAC.

CBOE Global Markets SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does CBOE Global Markets Use?

The marketing tactics of Cboe Global Markets are designed to boost brand awareness, generate leads, and drive sales within the financial services sector. This strategy includes a mix of digital and traditional methods to reach a broad audience. The company focuses on data-driven marketing to enhance customer experience and inform product development.

Digital marketing is a key component of Cboe's strategy, with a strong emphasis on its website and social media platforms. Content marketing plays a significant role, providing market insights and educational resources. Furthermore, Cboe utilizes email marketing and paid advertising to engage with its target audience effectively.

Cboe's approach to marketing is also evident in its investor relations efforts, including earnings calls and releases, which are a key part of its promotion strategy to enhance trust and transparency. The company’s focus on accessibility and education, particularly for options trading, is evident in its new products and enhancements designed to meet the needs of various investors.

Cboe Global Markets actively uses its website and social media to connect with its audience, which is a key element of its digital strategy. Social media engagement saw a 25% increase in 2024, demonstrating the effectiveness of these platforms.

Content marketing is a crucial element of Cboe's approach, with a focus on providing market insights and educational content. This strategy has led to a 15% rise in leads and a 20% growth in educational content downloads in 2024.

Cboe uses data analytics to improve product development and customer experience. The Data Vantage business generated $143.3 million in Q1 2024, showing the value of its data offerings. The company also provides tailored data solutions.

Cboe participates in industry events and conferences to build relationships and increase visibility. Investor relations, including earnings calls, are also part of this strategy. The Options Institute expansion in Europe supports educational efforts.

Cboe's marketing emphasizes accessibility and education, particularly for options trading, with new products and enhancements designed to meet the needs of various investors. This includes tailored solutions for different investor groups.

The company made its Global Indices Feed available on Snowflake Marketplace, making it easier for global customers to access market data. This enhances the company's ability to serve a worldwide customer base.

Cboe's marketing strategy is multi-faceted, incorporating digital tactics, content marketing, data analytics, and traditional methods to reach its target audience effectively. For a deeper understanding of how Cboe positions itself within the competitive landscape, consider exploring the Competitors Landscape of CBOE Global Markets.

Cboe Global Markets uses a variety of tactics to build awareness and drive sales within the financial services industry, focusing on digital and traditional methods.

- Website and social media engagement to connect with the target audience.

- Content marketing, providing market insights and research on derivatives.

- Email marketing and paid advertising to reach a diverse audience.

- Data-driven marketing to enhance customer experience and inform product development.

- Participation in industry conferences and events.

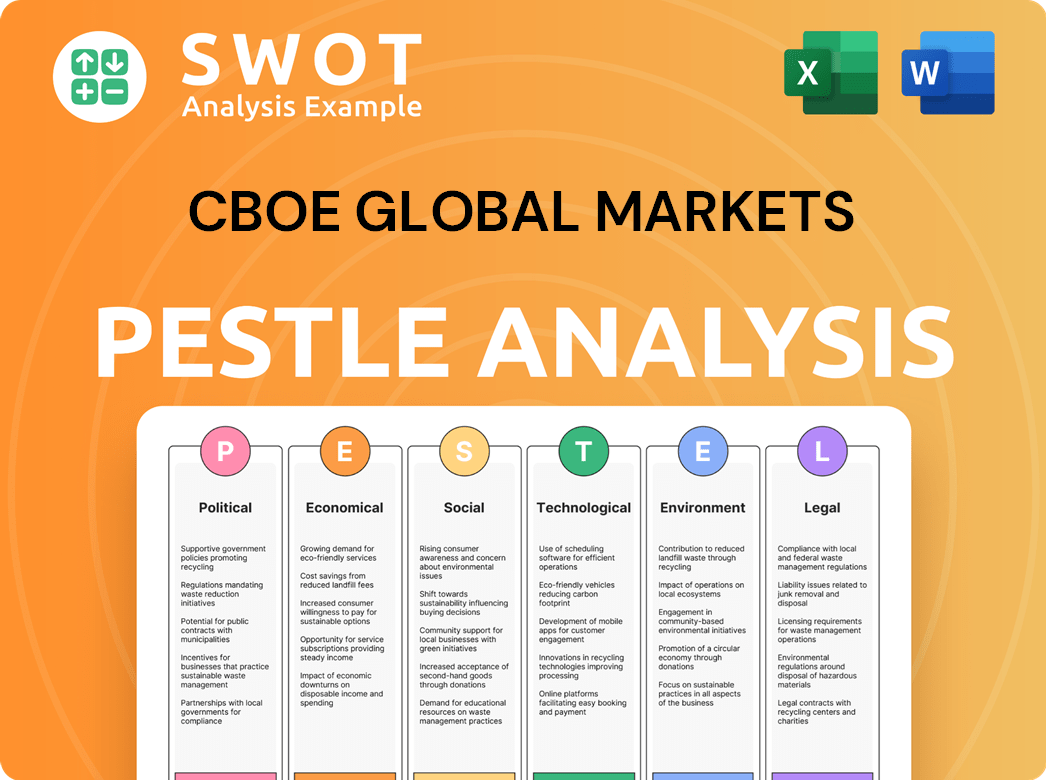

CBOE Global Markets PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is CBOE Global Markets Positioned in the Market?

Cboe Global Markets positions itself as 'The Exchange for the World Stage,' a strategy emphasizing its global reach and leadership in derivatives and securities. This branding highlights its extensive network, operating exchanges in key global markets across North America, Europe, and the Asia Pacific. The company's visual identity and tone of voice reflect its dedication to innovation, reliability, and an inclusive global marketplace.

The company differentiates itself through its diverse product offerings, particularly its proprietary products like the VIX Index, a globally recognized benchmark for equity market volatility. Its focus on innovative offerings, such as the launch of options on VIX futures in October 2024 and new MSCI indices in March 2024, appeals to its target audience seeking advanced risk management and trading tools. The robust technology platform, Cboe Titanium, provides a unified trading experience worldwide, reflecting its commitment to efficiency and performance. This is a key element of their CBOE Global Markets sales and marketing analysis.

Brand consistency is maintained across various channels, from digital platforms to investor communications. A recent brand refresh in 2023, coinciding with its 50th anniversary, reinforced its identity and vision. Despite a downgrade to 'Neutral' by Bank of America in April 2025, the company's strong interest and recent volatility in the VIX index may help support its performance. Cboe's brand strength is also acknowledged through industry recognition, such as Cboe Clear Europe winning the inaugural Clearing House of the Year at the 2024 Trade Awards.

Cboe operates exchanges in 7 of the top 10 global equities markets. This extensive presence is a cornerstone of their global brand positioning, solidifying its role as a leading financial exchange.

The launch of options on VIX futures in October 2024 and new MSCI indices in March 2024 demonstrate Cboe's commitment to innovation. These initiatives attract traders seeking advanced risk management tools.

Cboe Titanium provides a unified and consistent trading experience globally. This platform supports efficiency and performance, crucial for attracting and retaining users.

Cboe Clear Europe winning the inaugural Clearing House of the Year at the 2024 Trade Awards highlights their industry recognition. This recognition reinforces their brand's strength and reliability.

CBOE Global Markets Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are CBOE Global Markets’s Most Notable Campaigns?

Cboe Global Markets has launched several key campaigns to boost its CBOE sales strategy and CBOE marketing strategy, especially in 2024 and 2025. These initiatives focus on strengthening brand recognition, expanding product offerings, and enhancing technological capabilities. The firm's approach includes both global advertising and targeted product launches to reach a wide audience of investors and traders.

One of the primary goals of these campaigns is to increase the visibility of Cboe as a leading financial exchange. This is achieved through strategic placements in major cities worldwide and through the introduction of new products designed to meet evolving market needs. The campaigns aim to improve both institutional and retail investor engagement with Cboe's offerings, driving growth in options trading and market data.

These strategic efforts are a part of Cboe's broader plan to maintain a competitive edge in the financial markets. The company’s initiatives aim to enhance its market presence, attract new clients, and provide value to existing stakeholders. These campaigns highlight Cboe's dedication to innovation and its commitment to meeting the needs of a dynamic global market.

In 2024, Cboe launched a global campaign to enhance brand equity. This initiative included digital billboards in Times Square, transit signage in Sydney, Melbourne, and Hong Kong, and placements in London, Tokyo, and Amsterdam. The campaign was recognized with a bronze award at the 31st Annual Financial Communications Society (FCS) Portfolio Awards in May 2025.

Cboe expanded its product offerings in 2024. This included the launch of options on VIX futures in October 2024 and Cboe MSCI World Index Options, Cboe MSCI ACWI Index Options, and Cboe MSCI USA Index Options in March 2024. These launches provided investors with new tools for managing volatility and global equity exposure.

In January 2025, Cboe unveiled a new brand identity for its exchange technology platform, Cboe Titanium. This rebranding is part of a multi-year initiative to unify all Cboe's equities and derivatives markets onto a consistent technology platform. The goal is to reinforce Cboe's commitment to best-in-class trading technology.

The Options Institute expanded its educational offerings to Europe in 2024. This expansion supported the growth of derivatives trading and provided resources for investors to better understand and utilize Cboe's products. These initiatives are crucial for driving adoption and usage.

These campaigns underscore Cboe's strategic objectives, including product innovation, global accessibility, and brand strengthening. The focus is on delivering value to customers and stakeholders. Cboe aims to solidify its position as a leading financial exchange through these targeted efforts.

- Enhance brand recognition through strategic global placements.

- Expand product offerings to meet diverse investor needs.

- Provide educational resources to support derivatives trading.

- Unify technology platforms for improved efficiency.

- Drive growth in CBOE Global Markets.

CBOE Global Markets Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CBOE Global Markets Company?

- What is Competitive Landscape of CBOE Global Markets Company?

- What is Growth Strategy and Future Prospects of CBOE Global Markets Company?

- How Does CBOE Global Markets Company Work?

- What is Brief History of CBOE Global Markets Company?

- Who Owns CBOE Global Markets Company?

- What is Customer Demographics and Target Market of CBOE Global Markets Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.