CoreWeave Bundle

Can CoreWeave Conquer the AI Cloud?

The specialized cloud infrastructure market is booming, fueled by the explosive growth of AI and machine learning. CoreWeave, a company that transformed from a crypto mining operation, has rapidly emerged as a major player in this dynamic sector. With its valuation soaring to $23 billion in late 2024 and an ambitious IPO planned for 2025, understanding the CoreWeave SWOT Analysis and its competitive position is crucial.

To truly grasp CoreWeave's potential, we must dissect its competitive landscape. This involves a thorough CoreWeave market analysis, identifying CoreWeave competitors, and evaluating its unique strengths. This exploration will provide critical insights into the company's growth strategy, financial performance, and ability to navigate the challenges within the high-performance computing and GPU cloud providers arena.

Where Does CoreWeave’ Stand in the Current Market?

CoreWeave has established a strong market position by specializing in GPU-accelerated workloads within the cloud industry. This focus allows it to cater to compute-intensive tasks such as AI, machine learning, and visual effects rendering, setting it apart from general-purpose cloud providers. The company's strategy is centered around providing high-performance computing solutions, making it a key player in the high-performance computing segment.

The company's value proposition lies in its ability to offer optimized infrastructure for demanding workloads, attracting a diverse clientele including AI developers, enterprises, and film studios. This specialization allows CoreWeave to provide tailored services, ensuring efficient performance and cost-effectiveness for its customers. This targeted approach has fueled significant revenue growth and expanded its infrastructure.

CoreWeave's rapid expansion is evident in its financial performance and infrastructure development. With a strong focus on GPU-accelerated computing, CoreWeave has positioned itself as a key player in the cloud market, as highlighted in this Marketing Strategy of CoreWeave analysis.

CoreWeave's revenue reached $1.9 billion in 2024, marking a substantial 737% increase from the previous year. In Q1 2025, revenue further surged to $982 million, reflecting a 420% year-over-year growth. This rapid expansion underscores its strong market traction and ability to capture significant market share.

By the end of 2024, CoreWeave operated 32 data centers, housing over 250,000 Nvidia GPUs, and had contracted 1.3 gigawatts of power. By 2025, the company expanded to 33 data centers across the U.S. and Europe. This extensive infrastructure supports its high-performance computing services.

While experiencing net losses, reaching $863 million in 2024 and $150 million in Q1 2025, due to high capital expenditures, CoreWeave's adjusted EBITDA surged to $606 million in Q1 2025. The adjusted EBITDA margin was 62%, indicating strong operational efficiency despite the investments. The company's aggressive expansion strategy is evident in its financial metrics.

CoreWeave's valuation increased from $19 billion in May 2024 to $23 billion in November 2024, with a target IPO valuation exceeding $35 billion in 2025. The company's strong market position is supported by its substantial revenue backlog of $25.9 billion as of Q1 2025, including a significant $11.9 billion multi-year contract with OpenAI.

CoreWeave's market position is influenced by several key factors, including its specialized focus, rapid growth, and significant investments in infrastructure. The company's ability to secure large contracts and maintain operational efficiency are crucial for its continued success.

- Concentration Risk: Microsoft accounted for 62% of its revenue in 2024.

- Customer Base: The top two customers contributed 77% of total revenue.

- OpenAI Deal: The OpenAI deal is expected to reduce Microsoft's share of future committed contract revenue to below 50%.

- Competitive Landscape: The company's market analysis reveals a competitive environment with other cloud computing competitors.

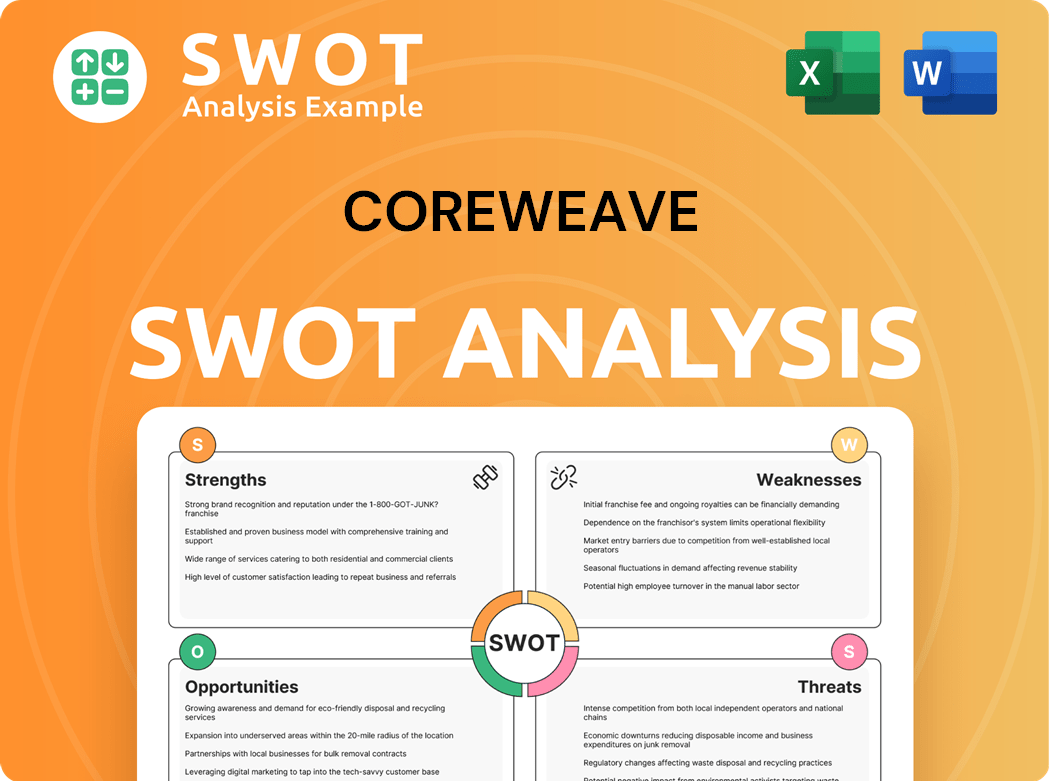

CoreWeave SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging CoreWeave?

The CoreWeave competitive landscape is shaped by its focus on high-performance computing, particularly GPU-accelerated workloads. This specialization places it in direct competition with both established cloud giants and emerging players in the GPU cloud providers market. Understanding CoreWeave competitors is crucial for assessing its market position and growth potential. A thorough CoreWeave market analysis reveals a dynamic environment where strategic alliances and technological advancements constantly reshape the competitive dynamics.

CoreWeave faces significant competition from large, diversified cloud providers and smaller, specialized AI infrastructure companies. The hyperscale cloud providers offer a wide range of services and possess extensive resources. Specialized providers focus on GPU cloud solutions and AI infrastructure, creating a diverse and competitive landscape.

The competitive environment is further complicated by the involvement of hardware manufacturers and strategic acquisitions. These factors collectively influence CoreWeave's market position, growth trajectory, and strategic decisions.

CoreWeave competes with major cloud providers like Amazon Web Services (AWS), Google Cloud, and Microsoft Azure. These companies offer a broad spectrum of cloud services, including GPU-accelerated instances for high-performance computing. These providers have significant market share and global infrastructure.

A growing number of specialized providers focus on GPU cloud solutions and AI infrastructure. These include companies like Lambda, Crusoe, and RunPod. These companies often target specific niches and offer competitive pricing and performance for AI workloads.

NVIDIA, a key investor and hardware supplier to CoreWeave, also provides cloud services for GPU-accelerated workloads. NVIDIA's cloud offerings leverage its expertise in GPU hardware and software, creating direct competition.

CoreWeave's acquisition of Weights & Biases for approximately $1.7 billion aims to integrate its cloud computing infrastructure with Weights & Biases' development tools. This strategic move enhances its competitive stance.

The cloud computing market is experiencing significant growth, with a projected value of over $1.6 trillion by 2027. CoreWeave is positioned to capitalize on this growth by focusing on specialized GPU cloud solutions. The company's growth strategy includes expanding its infrastructure and service offerings.

CoreWeave's competitive advantages include its focus on GPU-accelerated workloads, its strategic partnerships, and its ability to offer competitive pricing. The company’s focus on specific use cases, such as AI and machine learning, allows it to provide specialized services.

Several factors influence the competitive landscape, including pricing, performance, infrastructure, and service offerings. CoreWeave must continually innovate and adapt to maintain its competitive edge. Understanding these factors is critical for assessing CoreWeave's long-term prospects.

- Pricing: Competitive pricing is crucial for attracting and retaining customers. CoreWeave offers competitive pricing compared to hyperscalers, particularly for GPU instances.

- Performance: The performance of GPU instances is a key differentiator. CoreWeave focuses on providing high-performance infrastructure optimized for AI and machine learning workloads.

- Infrastructure: The availability and location of data centers are important. CoreWeave has data center locations in the United States and Europe, with plans for further expansion.

- Service Offerings: The range of services offered, including support for various AI frameworks and tools, impacts competitiveness. CoreWeave offers specialized services tailored for AI workloads.

- Customer Reviews: Positive customer reviews and testimonials build trust and credibility. CoreWeave has received positive feedback for its performance and customer support.

- Financial Performance: Understanding CoreWeave's financial performance, including revenue and funding, provides insights into its growth potential. The company has secured significant funding to support its expansion.

- Market Share: Analyzing CoreWeave's market share compared to competitors helps assess its position in the cloud computing market. While specific market share data is not always available, CoreWeave is a growing player in the GPU cloud space.

For a deeper dive into CoreWeave's strategic direction, consider exploring the Growth Strategy of CoreWeave.

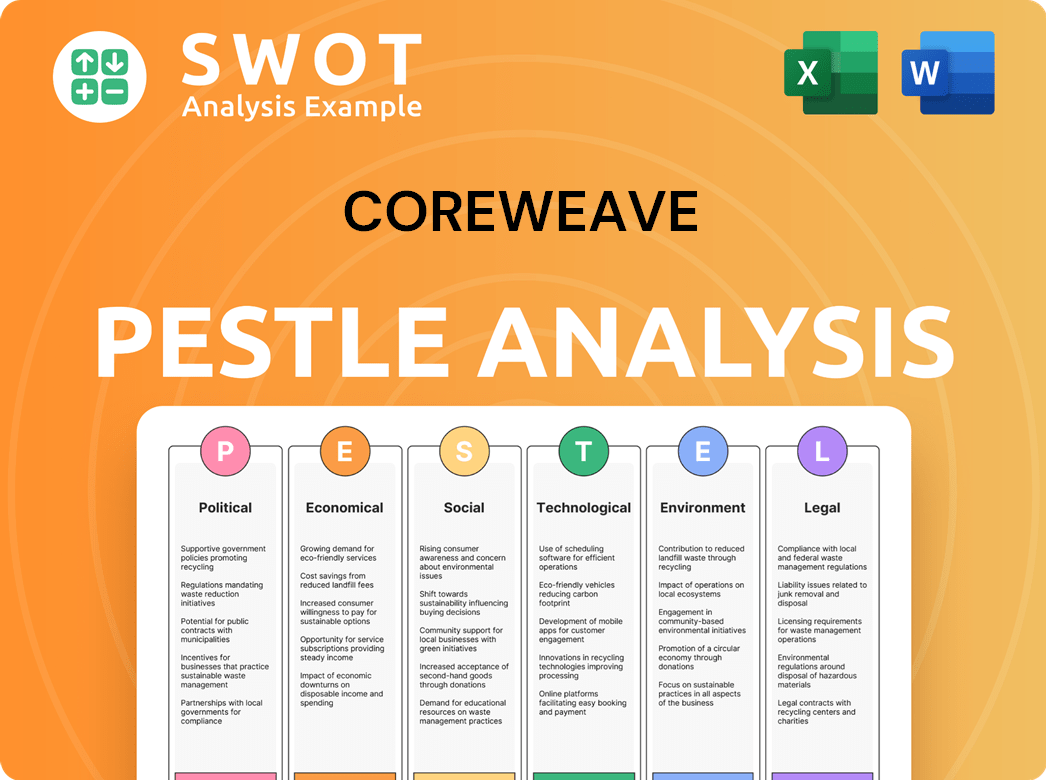

CoreWeave PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives CoreWeave a Competitive Edge Over Its Rivals?

Understanding the CoreWeave competitive landscape requires a deep dive into its strengths. The company has carved a niche by focusing on specialized AI and compute-intensive workloads. Its infrastructure, designed specifically for GPU-intensive computing, sets it apart from traditional cloud providers.

CoreWeave's strategic moves, including early adoption of cutting-edge technology, have been pivotal. The company's ability to quickly deploy and scale NVIDIA's latest GPUs, like the H100s and H200, gives it a significant edge. Furthermore, its commitment to delivering performance and reliability, combined with competitive pricing, enhances its appeal.

The company's focus on securing long-term contracts with major AI enterprises and hyperscalers provides exceptional revenue visibility. This approach, combined with strategic partnerships, strengthens its ecosystem. For a detailed look at who CoreWeave targets, check out this article on the Target Market of CoreWeave.

CoreWeave's data centers are specifically designed for GPU-intensive computing. This specialization leads to superior performance and cost efficiency compared to providers retrofitting existing facilities. This focus allows for optimized hardware and software integration for AI and machine learning workloads.

CoreWeave is quick to adopt and scale the latest technology, including NVIDIA's H100s, H200, and GB200 NVL72 instances. This rapid deployment ensures customers have access to the most powerful hardware available. They began to ramp Blackwell revenue in Q1 2025.

CoreWeave has formed partnerships with key industry players, including NVIDIA, IBM, and Microsoft. These collaborations expand its service offerings and strengthen its position in the market. The acquisition of Weights & Biases further enhances its ecosystem.

The company's ability to secure long-term contracts with major AI enterprises offers exceptional revenue visibility. In 2024, 96% of CoreWeave's revenue came from committed contracts, demonstrating a stable revenue stream. This stability supports infrastructure investments and future growth.

CoreWeave's competitive advantages include a specialized infrastructure, rapid technology adoption, and strategic partnerships. These strengths enable the company to offer superior performance, cost-effectiveness, and access to cutting-edge hardware. CoreWeave's focus on AI and compute-intensive workloads differentiates it from competitors.

- Specialized Infrastructure: Designed for GPU-intensive workloads.

- Rapid Technology Adoption: Early access to the latest NVIDIA GPUs.

- Strategic Partnerships: Collaborations with key industry players.

- Financial Stability: High percentage of revenue from committed contracts.

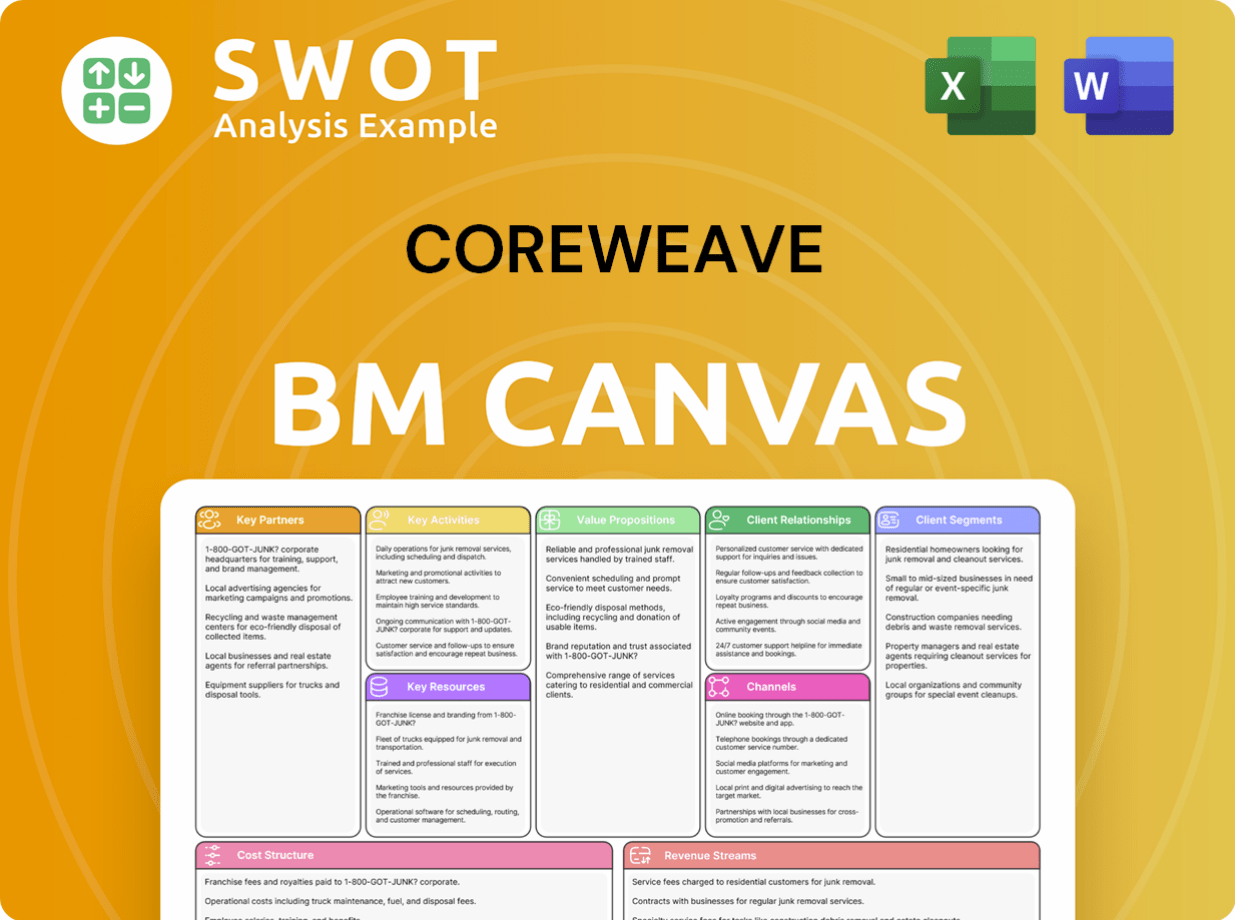

CoreWeave Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping CoreWeave’s Competitive Landscape?

The CoreWeave competitive landscape is heavily influenced by the rapid expansion of the AI market and the increasing demand for high-performance computing. This creates both significant opportunities and challenges for the company. Understanding the industry trends, potential risks, and future prospects is crucial for evaluating its position in the market.

The company faces substantial financial hurdles, including high capital expenditures and considerable debt. Despite these challenges, CoreWeave is positioned to capitalize on the growth of AI, provided it can effectively manage its resources, expand its offerings, and maintain a competitive edge in the market. This analysis provides a detailed view of the company's position, its risks, and its future outlook.

The primary industry trend is the explosive growth of the AI market, which is driving the demand for high-performance computing and specialized GPU infrastructure. Technological advancements in GPU development by companies like NVIDIA directly impact CoreWeave's offerings. The increasing complexity of AI models and the shift towards compute-intensive inference workloads also favor the company's infrastructure.

The capital-intensive nature of building and expanding data centers and procuring the latest GPUs poses a significant challenge. Customer concentration is another risk, with a large portion of revenue coming from a few key clients. Supply chain bottlenecks and managing substantial debt are also critical challenges for the company.

Expanding its geographic presence, particularly in emerging AI markets, can diversify its customer base and revenue streams. Strategic acquisitions and continued product innovation, focusing on optimizing its cloud platform for complex AI workloads, can unlock new growth avenues. Exploring new services beyond core GPU compute is also a key opportunity.

The CoreWeave competitive landscape includes established cloud computing competitors like AWS and Google Cloud. The company differentiates itself by focusing on specialized GPU infrastructure tailored for AI workloads. Key factors in this competitive environment include pricing, performance, and the ability to support the latest GPU technology.

CoreWeave's ability to navigate supply chain bottlenecks, manage its debt, and maintain agility will be crucial for its sustained resilience. The company's focus on high-performance computing for AI gives it a competitive advantage in a rapidly growing market. For more insights into the business model, see Revenue Streams & Business Model of CoreWeave.

- The total addressable market for AI infrastructure is projected to reach $400 billion by 2028.

- Net losses widened to $863 million in 2024 and $150 million in Q1 2025.

- Microsoft accounted for 62% of CoreWeave's 2024 revenue.

- The company's debt reached nearly $8 billion by the end of 2024.

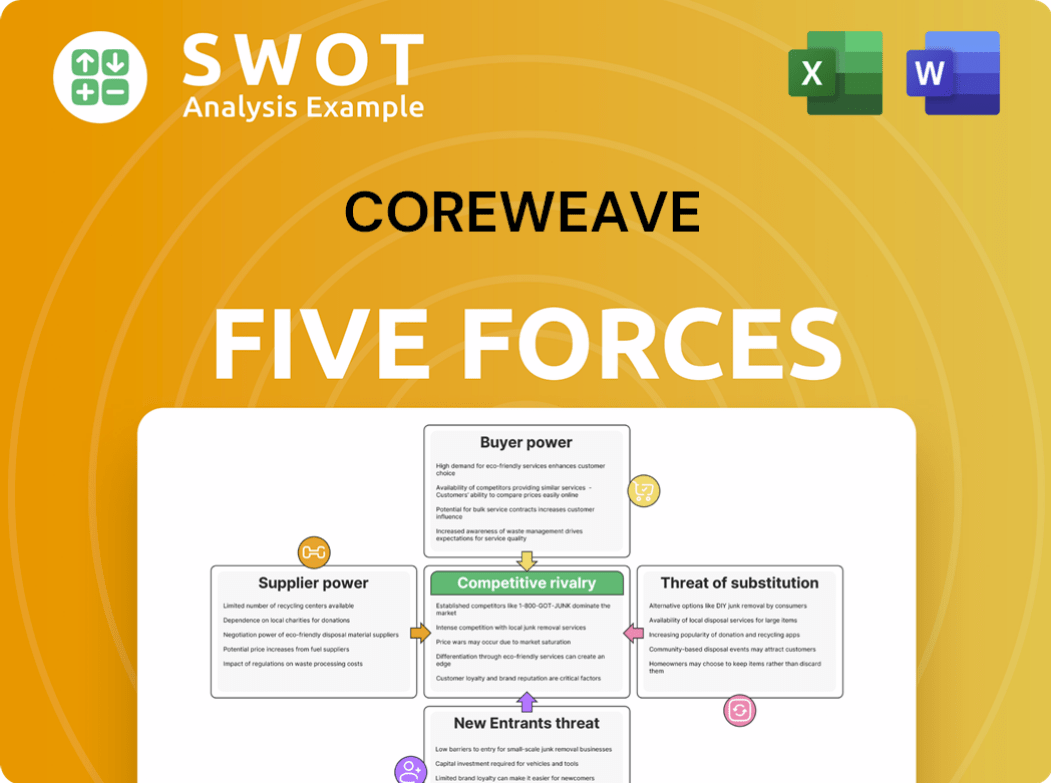

CoreWeave Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CoreWeave Company?

- What is Growth Strategy and Future Prospects of CoreWeave Company?

- How Does CoreWeave Company Work?

- What is Sales and Marketing Strategy of CoreWeave Company?

- What is Brief History of CoreWeave Company?

- Who Owns CoreWeave Company?

- What is Customer Demographics and Target Market of CoreWeave Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.