CoreWeave Bundle

Can CoreWeave's Growth Strategy Outpace the AI Revolution?

CoreWeave has rapidly become a dominant force in cloud computing, specifically for high-performance computing (HPC) workloads. Their strategic focus on AI infrastructure has positioned them perfectly within a booming market. Securing a $7.5 billion debt facility in May 2024 highlights their crucial role in supporting the AI industry's explosive growth. This report dives into the CoreWeave SWOT Analysis to understand their market position.

From its inception in 2017, CoreWeave has consistently adapted to meet the evolving needs of compute-intensive applications. Their specialized cloud infrastructure, offering powerful GPUs, is designed to accelerate AI and machine learning. This company analysis explores CoreWeave's journey, its current market share, and the innovative strategies driving their future prospects, including expansion plans and potential for significant revenue growth.

How Is CoreWeave Expanding Its Reach?

The expansion initiatives of CoreWeave are primarily focused on capitalizing on the growing demand for AI infrastructure. This involves strategic investments in new data centers and broadening service offerings. The company's growth strategy hinges on providing high-performance computing (HPC) solutions tailored for compute-intensive tasks, setting it apart from generalist cloud providers. This approach allows CoreWeave to cater to specific industry needs, driving its expansion plans.

A key element of CoreWeave’s strategy is the aggressive expansion of its data center footprint, particularly within the United States. This expansion is crucial for accessing new customer bases and providing localized, high-performance computing resources. CoreWeave’s focus on specialized cloud services, especially for AI and machine learning, positions it well to capture a significant share of the growing market. The company's future prospects look promising, driven by its ability to meet the evolving demands of AI-driven workloads.

CoreWeave’s commitment to innovation and strategic partnerships, such as its collaboration with NVIDIA, further strengthens its market position. By offering cutting-edge GPU technology, CoreWeave is well-equipped to serve companies developing advanced AI models. This dedication to providing specialized cloud solutions and its proactive approach to expansion are key factors in its continued growth and success.

In early 2024, CoreWeave announced plans for a new data center in Plano, Texas, representing a $1.6 billion investment. This project is expected to create approximately 150 new jobs. This expansion follows a significant growth period in 2023, during which CoreWeave increased its data center count from three to 14 across North America. This rapid expansion is a key component of its Owners & Shareholders of CoreWeave strategy.

CoreWeave's collaboration with NVIDIA is a cornerstone of its strategy, ensuring access to cutting-edge GPU technology. This partnership is essential for supporting AI and machine learning workloads. The ability to offer NVIDIA's H100 Tensor Core GPUs positions CoreWeave as a preferred provider for companies developing advanced AI models.

CoreWeave is broadening its service offerings to diversify its revenue streams and extend its global reach. This includes ventures in new product categories, such as its recent expansion into the UK. The company's focus on providing a dedicated and specialized cloud for compute-intensive tasks differentiates it from generalist cloud providers.

CoreWeave's focus on providing a dedicated and specialized cloud for compute-intensive tasks differentiates it from generalist cloud providers. This allows it to cater to specific industry needs. The company is well-positioned to capitalize on the surging demand for AI infrastructure, driving its expansion plans and future prospects.

CoreWeave's expansion strategy includes significant investments in new data centers and strategic partnerships. The company is focused on providing specialized cloud solutions for compute-intensive tasks, differentiating itself from generalist cloud providers. This approach allows CoreWeave to cater to specific industry needs and drive its growth.

- Rapid data center expansion to meet growing demand.

- Strategic partnerships to ensure access to cutting-edge technology.

- Diversification of service offerings to capture new revenue streams.

- Focus on specialized cloud solutions for AI and machine learning workloads.

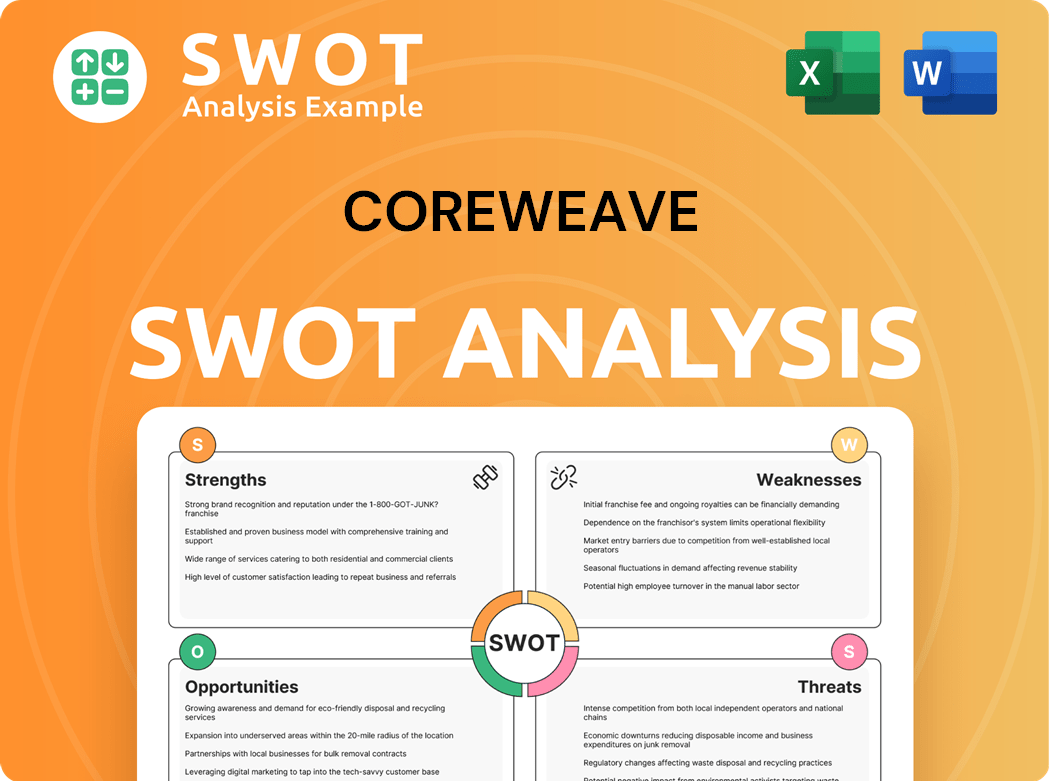

CoreWeave SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does CoreWeave Invest in Innovation?

CoreWeave's innovation and technology strategy centers on providing specialized cloud infrastructure tailored for AI and machine learning workloads. This approach directly addresses the needs of developers and researchers working on computationally intensive tasks. The company's focus on high-performance computing (HPC) differentiates it from traditional cloud providers, positioning it as a key player in the rapidly evolving AI landscape.

The company's core technological advantage lies in offering bare-metal access to powerful GPUs, including NVIDIA's H100 Tensor Core GPUs. This allows for accelerated performance in demanding applications, a critical factor for attracting and retaining clients with significant compute requirements. CoreWeave's commitment to technological leadership is evident in its continuous deployment of cutting-edge hardware, often ahead of broader market availability.

CoreWeave heavily invests in its infrastructure to ensure low-latency and high-throughput connections, essential for complex AI model training and deployment. Strategic partnerships, particularly with NVIDIA, are integral to its innovation strategy, ensuring it remains at the forefront of hardware advancements. This focus on a scalable and flexible platform contributes directly to its growth objectives.

CoreWeave provides bare-metal access to powerful GPUs, including NVIDIA's H100 Tensor Core GPUs. This allows for accelerated performance in demanding applications, a critical factor for attracting and retaining clients with significant compute requirements.

The company's focus on HPC differentiates it from traditional cloud providers. This specialization caters directly to the needs of AI developers and researchers. This focus is a key element of its Marketing Strategy of CoreWeave.

CoreWeave's strategic partnerships, particularly with NVIDIA, are integral to its innovation strategy. These partnerships ensure it remains at the forefront of hardware advancements, providing access to the latest technologies.

The company invests heavily in its infrastructure to ensure low-latency and high-throughput connections. These investments are essential for complex AI model training and deployment, supporting the demanding needs of its clients.

CoreWeave focuses on providing a scalable and flexible platform that can adapt to evolving AI demands. This adaptability contributes directly to its growth objectives by attracting and retaining clients with significant compute requirements.

The continuous deployment of cutting-edge NVIDIA GPUs demonstrates CoreWeave's commitment to technological leadership. This allows the company to offer advanced capabilities to its clients, often ahead of broader market availability.

CoreWeave's technological advantages are centered on its ability to provide specialized cloud infrastructure for AI and machine learning workloads. This includes bare-metal access to high-performance GPUs and optimized cloud environments.

- Bare-Metal Access: Provides direct access to powerful GPUs like NVIDIA's H100, crucial for AI acceleration.

- High-Performance Computing: Focuses on HPC to meet the specific needs of AI developers and researchers.

- Strategic Partnerships: Collaborates with NVIDIA to stay at the forefront of hardware advancements.

- Infrastructure Investments: Ensures low-latency and high-throughput connections for complex AI tasks.

- Scalability and Flexibility: Offers a platform that adapts to the evolving demands of AI workloads.

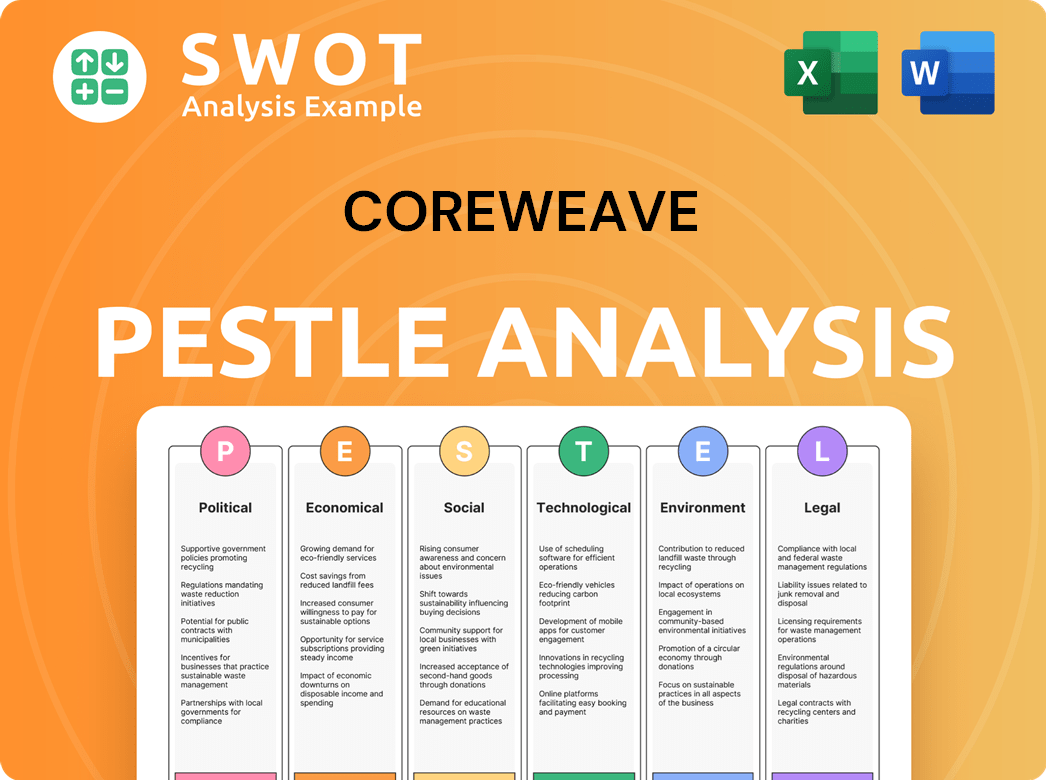

CoreWeave PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is CoreWeave’s Growth Forecast?

The financial outlook for CoreWeave is robust, primarily fueled by the surging demand for AI infrastructure and cloud computing services. CoreWeave's growth strategy is heavily reliant on attracting significant investment to expand its operational capabilities. The company's ability to secure substantial funding underscores investor confidence in its business model and its pivotal role within the AI ecosystem.

In May 2024, CoreWeave secured a massive $7.5 billion debt facility, a testament to its strong financial trajectory and market position. This funding round, supported by major financial institutions like Blackstone and BlackRock, is a clear indicator of the company's potential for long-term value. This infusion of capital allows for rapid expansion of data center infrastructure and acquisition of high-demand GPUs, crucial for meeting the growing needs of its clients.

CoreWeave's financial strategy is centered on aggressive expansion and market capture within the specialized cloud computing sector. While specific revenue figures and profit margins are not always publicly disclosed, the scale of recent debt financing and previous equity rounds suggests a period of hyper-growth. This growth is driven by the insatiable demand for AI compute, making CoreWeave a key player in the high-performance computing (HPC) and AI infrastructure markets.

CoreWeave's financial strategy relies heavily on securing significant funding to support its growth. The recent $7.5 billion debt facility, announced in May 2024, is a prime example of this strategy. This funding, combined with prior equity rounds, allows CoreWeave to expand its data center footprint and acquire the necessary hardware to meet client demands.

While specific revenue figures are not always public, the scale of CoreWeave's funding rounds indicates strong revenue growth projections. Analyst forecasts suggest a period of hyper-growth, driven by the increasing demand for AI compute and cloud computing services. The company is well-positioned to capitalize on these trends within the cloud computing market.

CoreWeave is rapidly establishing itself as a key player in the specialized cloud computing sector. Its focus on high-performance computing (HPC) and AI infrastructure differentiates it from competitors. The company's ability to secure significant funding in a competitive market reflects its perceived long-term value and potential for market dominance.

CoreWeave's expansion plans involve increasing its data center capacity and acquiring high-demand GPUs. The company's future prospects are promising, driven by the continued growth of the AI market and the increasing need for specialized cloud solutions. CoreWeave's strategic investments position it for sustained growth in the coming years.

CoreWeave's financial success is built on strategic investments and strong market demand. The company's ability to secure large-scale funding rounds is a key indicator of its growth potential.

- $7.5 Billion: Debt facility secured in May 2024.

- $7 Billion: Valuation from a December 2023 funding round.

- Hyper-growth: Projected due to rising demand for AI compute.

- Aggressive Expansion: Strategy focused on market capture.

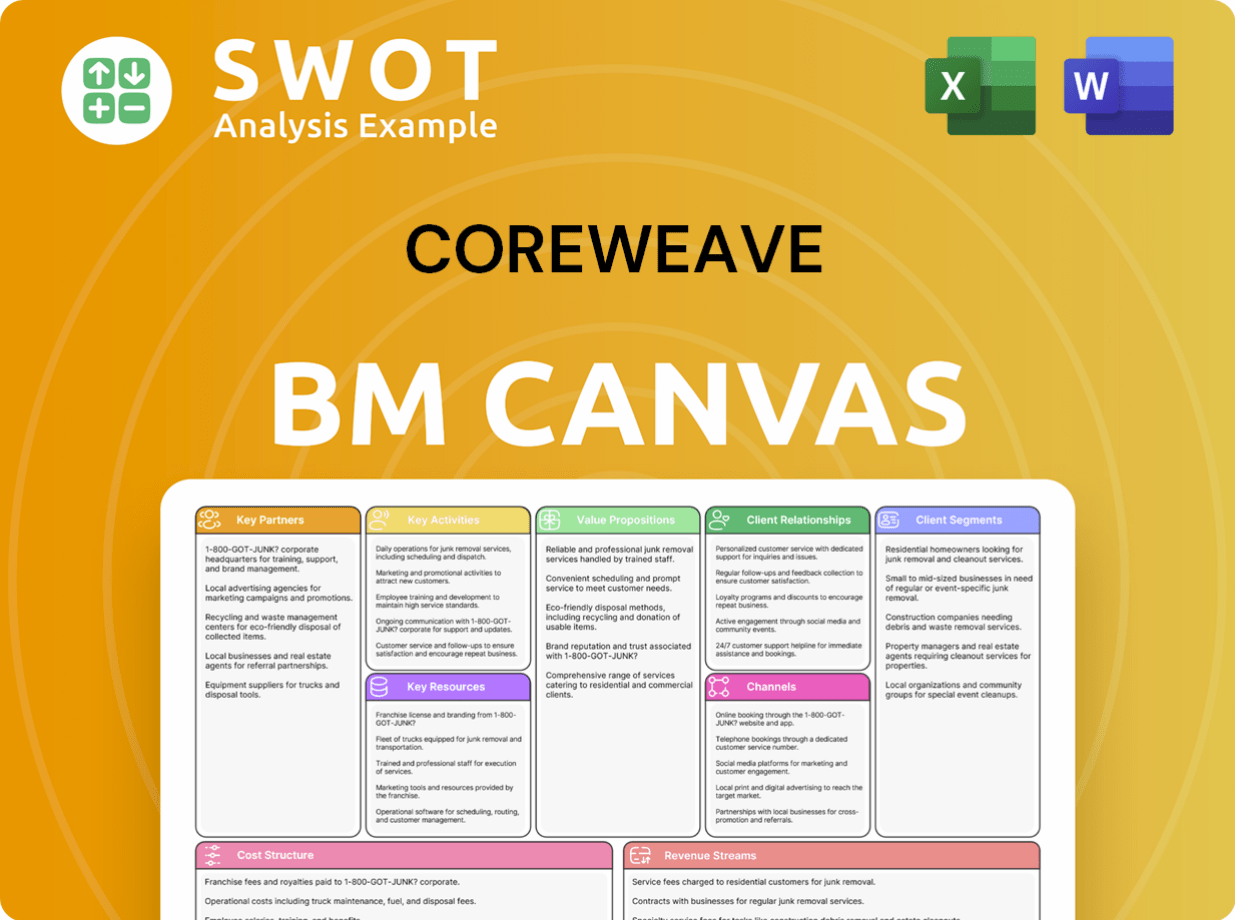

CoreWeave Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow CoreWeave’s Growth?

The rapid expansion of CoreWeave, a company specializing in high-performance computing, faces several potential risks and obstacles. The competitive landscape in cloud computing is intense, with established players like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud vying for market share. Furthermore, CoreWeave's reliance on specific hardware, particularly GPUs, introduces supply chain vulnerabilities that could hinder its ability to meet growing demand.

Regulatory changes and technological advancements also pose challenges. Increased scrutiny of data privacy, energy consumption, and AI governance could impact CoreWeave's operations and expansion plans. The emergence of new, more efficient chip architectures could necessitate significant ongoing investment to maintain a competitive edge in the rapidly evolving AI hardware market.

CoreWeave's success hinges on its ability to navigate these challenges effectively. The company must continuously adapt to market dynamics, manage supply chain risks, and invest in innovation to sustain its growth trajectory. Understanding the potential pitfalls is crucial for assessing CoreWeave's long-term viability and future prospects within the cloud computing and AI infrastructure sectors.

CoreWeave operates in a highly competitive market. Major cloud providers like AWS, Azure, and Google Cloud have substantial resources and established customer bases. These competitors are also investing heavily in AI infrastructure, potentially impacting CoreWeave's ability to gain and retain market share.

CoreWeave's dependence on NVIDIA for GPUs creates a supply chain risk. Any disruption in NVIDIA's production or changes in allocation policies could limit CoreWeave's ability to scale and meet customer demand. This dependence is a critical factor in the company's operational resilience.

Regulatory changes in data privacy, energy consumption, and AI governance could affect CoreWeave. The energy-intensive nature of AI compute centers could lead to increased scrutiny and potential regulatory hurdles. Compliance with evolving standards is essential for continued operations.

The rapid evolution of AI hardware, including the emergence of new chip architectures, poses a risk. CoreWeave must continually invest in research and development to maintain a competitive edge. Failure to adapt to new technologies could erode its market position.

CoreWeave relies on funding rounds to fuel its expansion. Economic downturns or shifts in investor sentiment could impact its ability to secure capital. The company's financial health is crucial for its long-term growth and sustainability.

Scaling operations to meet increasing demand presents logistical and operational challenges. CoreWeave must effectively manage its data center infrastructure, customer service, and workforce. Efficient operations are key to profitability and customer satisfaction.

CoreWeave mitigates some risks through strategic partnerships, such as its close relationship with NVIDIA, which helps ensure access to critical hardware. These partnerships are vital for maintaining a competitive advantage and ensuring a stable supply chain. These partnerships can also help in navigating regulatory landscapes.

The company likely employs robust risk management frameworks to assess and prepare for market shifts and operational challenges. While specific details are not publicly available, such frameworks are essential for identifying and mitigating potential threats to its business. These frameworks can help to proactively address supply chain issues and regulatory changes.

Understanding the competitive landscape is crucial for CoreWeave. A detailed analysis of competitors like AWS, Azure, and Google Cloud, as well as emerging players, is necessary. This analysis should consider pricing, service offerings, and market strategies. For more insights, see Competitors Landscape of CoreWeave.

Continuous investment in research and development is essential for staying ahead of technological advancements. CoreWeave must allocate resources to develop new solutions and adapt to evolving customer needs. This includes exploring new chip architectures and optimizing existing infrastructure for maximum efficiency.

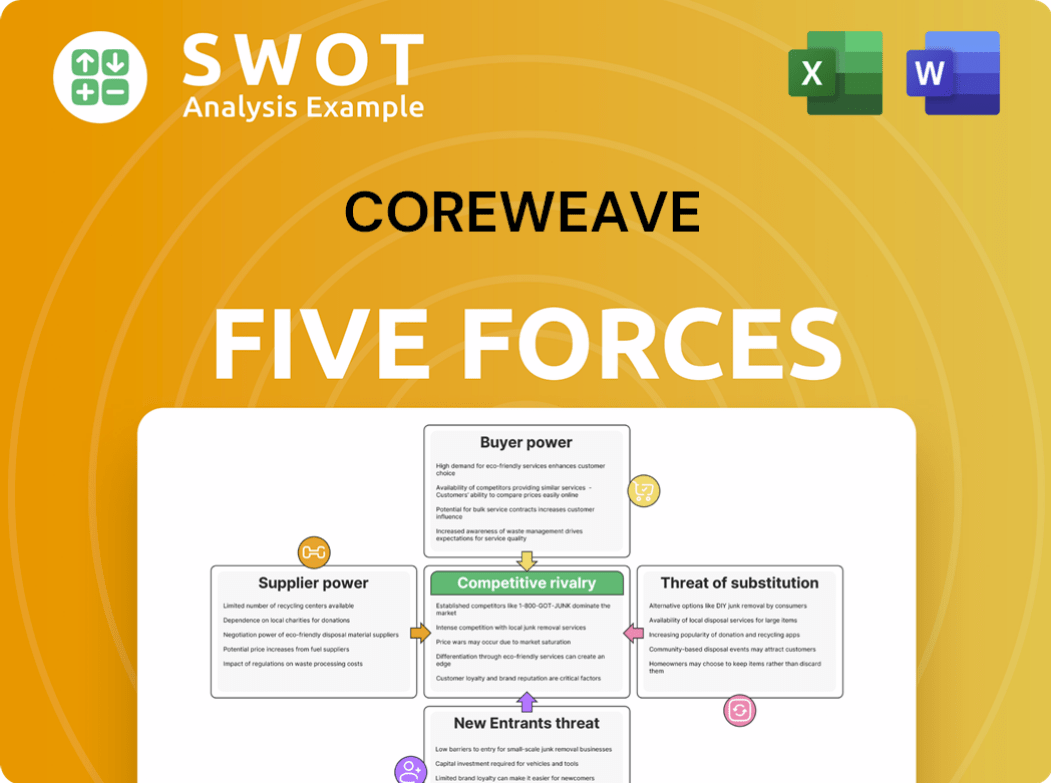

CoreWeave Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CoreWeave Company?

- What is Competitive Landscape of CoreWeave Company?

- How Does CoreWeave Company Work?

- What is Sales and Marketing Strategy of CoreWeave Company?

- What is Brief History of CoreWeave Company?

- Who Owns CoreWeave Company?

- What is Customer Demographics and Target Market of CoreWeave Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.