CoreWeave Bundle

Who Really Owns CoreWeave?

In the fast-paced world of AI and cloud computing, understanding a company's ownership is crucial. The recent valuation of specialized cloud providers, like CoreWeave, highlights the importance of knowing who controls the reins. This deep dive into CoreWeave SWOT Analysis will reveal how its ownership structure has fueled its remarkable growth.

Founded in 2017, CoreWeave, initially a cryptocurrency mining operation, quickly pivoted to become a key player in AI infrastructure. This strategic shift, driven by its CoreWeave owner, has led to a valuation of $19 billion as of May 2024. Examining the CoreWeave company ownership structure, including its CoreWeave investors and CoreWeave executives, provides invaluable insights into its future trajectory and market position. Understanding who owns CoreWeave is key to understanding its strategic direction.

Who Founded CoreWeave?

The story of CoreWeave begins in 2017 with its founders, Michael Intrator, Brian Venturo, and Brannin Beal. Initially operating under the name 'Core Scientific,' the company's primary focus was cryptocurrency mining. However, the founders quickly recognized the potential of their GPU-heavy infrastructure for more diverse applications, particularly in the burgeoning fields of AI and machine learning. This strategic pivot would be a defining moment for the company.

While specific equity splits at the company's inception are not publicly available, it's typical for co-founders to have relatively equal initial stakes. These stakes are often subject to vesting schedules, which help ensure the long-term commitment of the founders. This structure helps align the founders' interests with the long-term success of the company, especially during its critical early stages.

Early on, the company attracted angel investors and capital from friends and family. These early investments were crucial, providing the necessary financial resources to build the initial data centers and refine the operational model. The founders' vision of expanding beyond crypto mining was a key factor in attracting these early investments, setting the stage for CoreWeave's future growth.

The founders of CoreWeave are Michael Intrator, Brian Venturo, and Brannin Beal. They started the company in 2017.

Initially, the company focused on cryptocurrency mining. This provided the infrastructure that would later be repurposed.

The founders quickly recognized the potential of their GPU infrastructure for AI and machine learning. This led to a significant strategic pivot.

Early funding came from angel investors and friends and family. These investments helped build the initial data centers.

Specific equity splits at the start are not public, but it's common for founders to have equal stakes. Vesting schedules are often used.

There are no records of early ownership disputes, suggesting a cohesive team focused on the strategic shift. This focus was key to their success.

Understanding the early ownership structure of a company like CoreWeave offers insights into its foundation and strategic direction. The founders' vision and the support from early investors were crucial. For more details on the company's approach to the market, explore the Marketing Strategy of CoreWeave.

- The founders, Michael Intrator, Brian Venturo, and Brannin Beal, initially focused on crypto mining.

- Early investments from angel investors and family provided the capital for initial infrastructure.

- The strategic shift towards AI cloud services marked a pivotal moment for the company.

- The absence of early ownership disputes suggests a cohesive founding team.

- The company's growth has attracted significant investment, with a valuation reaching approximately $19 billion as of early 2024.

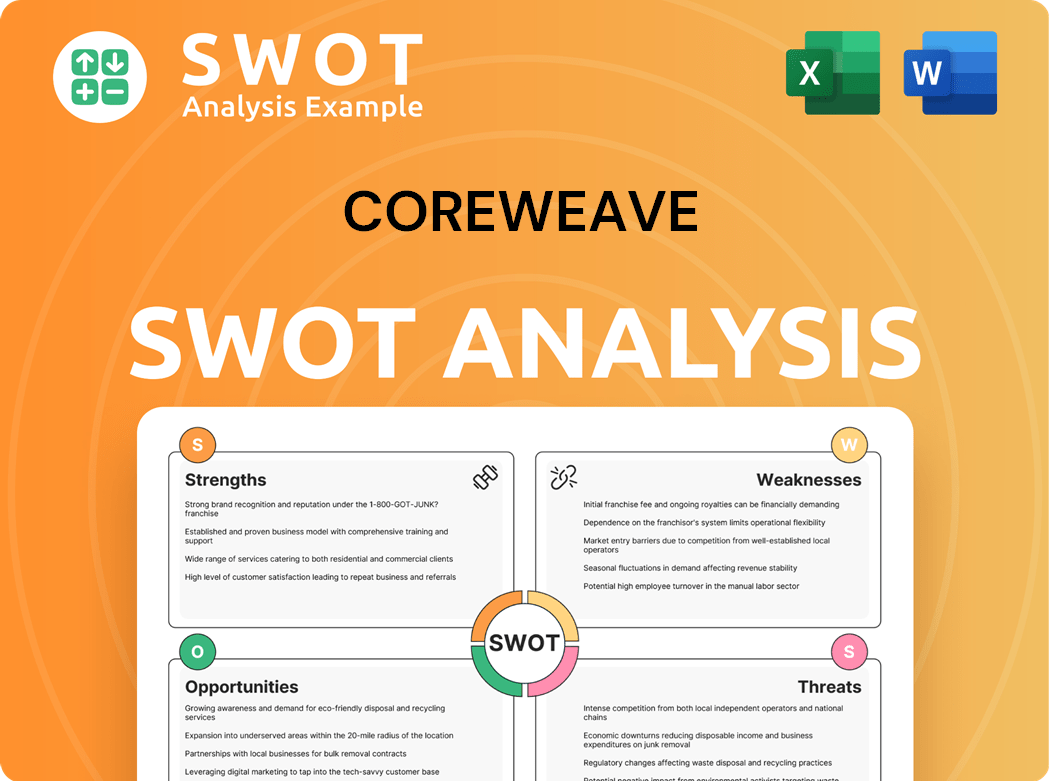

CoreWeave SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has CoreWeave’s Ownership Changed Over Time?

The ownership of the CoreWeave company has shifted considerably, largely due to significant investments from venture capital and private equity firms. These investments have been crucial in supporting the company's growth and its shift from cryptocurrency mining to a leading AI cloud provider. Understanding who owns CoreWeave involves tracing these major funding rounds and the resulting changes in the company's shareholder structure.

A major turning point occurred in May 2024, when CoreWeave secured $7.5 billion in debt financing from a group led by Blackstone, with participation from Magnetar Capital and Coatue. This followed a $1.1 billion equity raise in May 2024, which valued the company at $19 billion. Key investors in these rounds include Fidelity Management & Research Company, Coatue, and Magnetar Capital. Additionally, Nvidia, a key technology partner, holds a stake, having invested $100 million in August 2023. Other notable investors from earlier rounds include Decibel Partners, BlackRock, and Andreessen Horowitz. These financial moves have significantly shaped the CoreWeave ownership landscape.

| Investment Round | Date | Amount | Key Investors |

|---|---|---|---|

| Debt Financing | May 2024 | $7.5 billion | Blackstone, Magnetar Capital, Coatue |

| Equity Raise | May 2024 | $1.1 billion | Fidelity Management & Research Company, Coatue, Magnetar Capital |

| Investment | August 2023 | $100 million | Nvidia |

These investment rounds have diluted the original founders' stakes, but they likely still maintain significant influence. The founders, Michael Intrator, Brian Venturo, and Brannin Beal, continue to hold leadership roles. This influx of capital has allowed CoreWeave to acquire Nvidia's H100 GPUs, expand its data centers, and scale operations to meet the growing demand for AI infrastructure. This strategic funding has positioned CoreWeave as a strong competitor in the AI compute market. To learn more about the company's strategic positioning, consider exploring the Target Market of CoreWeave.

CoreWeave's ownership structure has evolved significantly through multiple funding rounds.

- Major investors include firms like Blackstone, Magnetar Capital, and Coatue.

- Nvidia, a key technology partner, also holds a stake in the company.

- The founders likely retain influence despite dilution from external investments.

- The company's growth is fueled by investments in AI infrastructure.

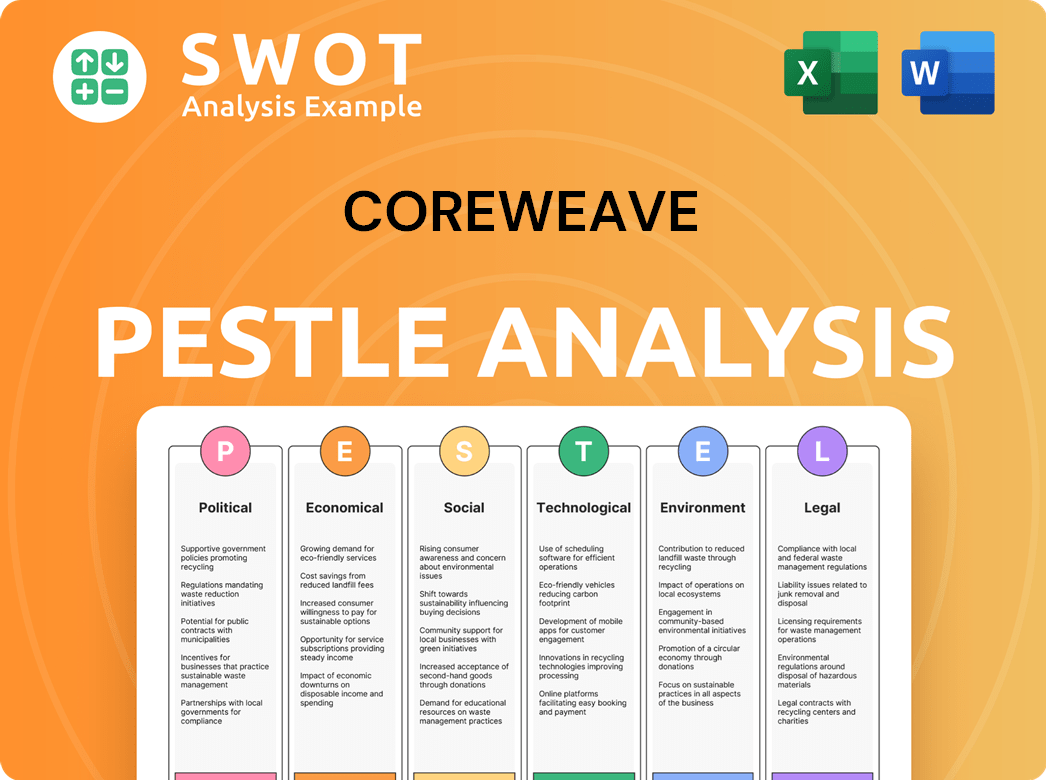

CoreWeave PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on CoreWeave’s Board?

The composition of the board of directors for the CoreWeave company reflects its evolving ownership and strategic partnerships. While a comprehensive, real-time list of all board members and their affiliations isn't publicly accessible, it's common for major investors to secure board seats. For example, representatives from significant investment firms like Blackstone, Magnetar Capital, and Coatue, given their substantial financial contributions, likely hold board positions or observer rights. As a strategic investor and technology partner, Nvidia may also have a representative on the board or a strong advisory role. Information about the CoreWeave executives and their roles is not widely available.

In privately held companies like CoreWeave, voting structures are governed by investor agreements. These agreements can include provisions for preferred shares with enhanced voting rights, protective provisions for certain investor actions, or board nomination rights tied to ownership thresholds. It's plausible that the founders, Michael Intrator, Brian Venturo, and Brannin Beal, maintain significant voting power, potentially through special founder shares or a voting agreement, allowing them to guide the company's long-term vision despite dilution from subsequent funding rounds. The board's decisions are primarily focused on accelerating CoreWeave's infrastructure build-out, securing GPU supply, and expanding its market share in the AI cloud sector, aligning with the interests of its major stakeholders. To learn more about the company's strategic direction, consider reading the Growth Strategy of CoreWeave.

| Key Stakeholders | Potential Board Representation | Notes |

|---|---|---|

| Blackstone | Likely | Significant financial investment |

| Magnetar Capital | Likely | Significant financial investment |

| Coatue | Likely | Significant financial investment |

| Nvidia | Possible | Strategic investor and technology partner |

The board of directors plays a crucial role in guiding CoreWeave's strategic direction. Major investors often have board representation, influencing key decisions. Voting rights are typically determined by investor agreements, potentially giving founders significant control.

- Major investors likely hold board seats.

- Voting structures are governed by investor agreements.

- Founders may retain significant voting power.

- Board decisions focus on infrastructure, GPU supply, and market share.

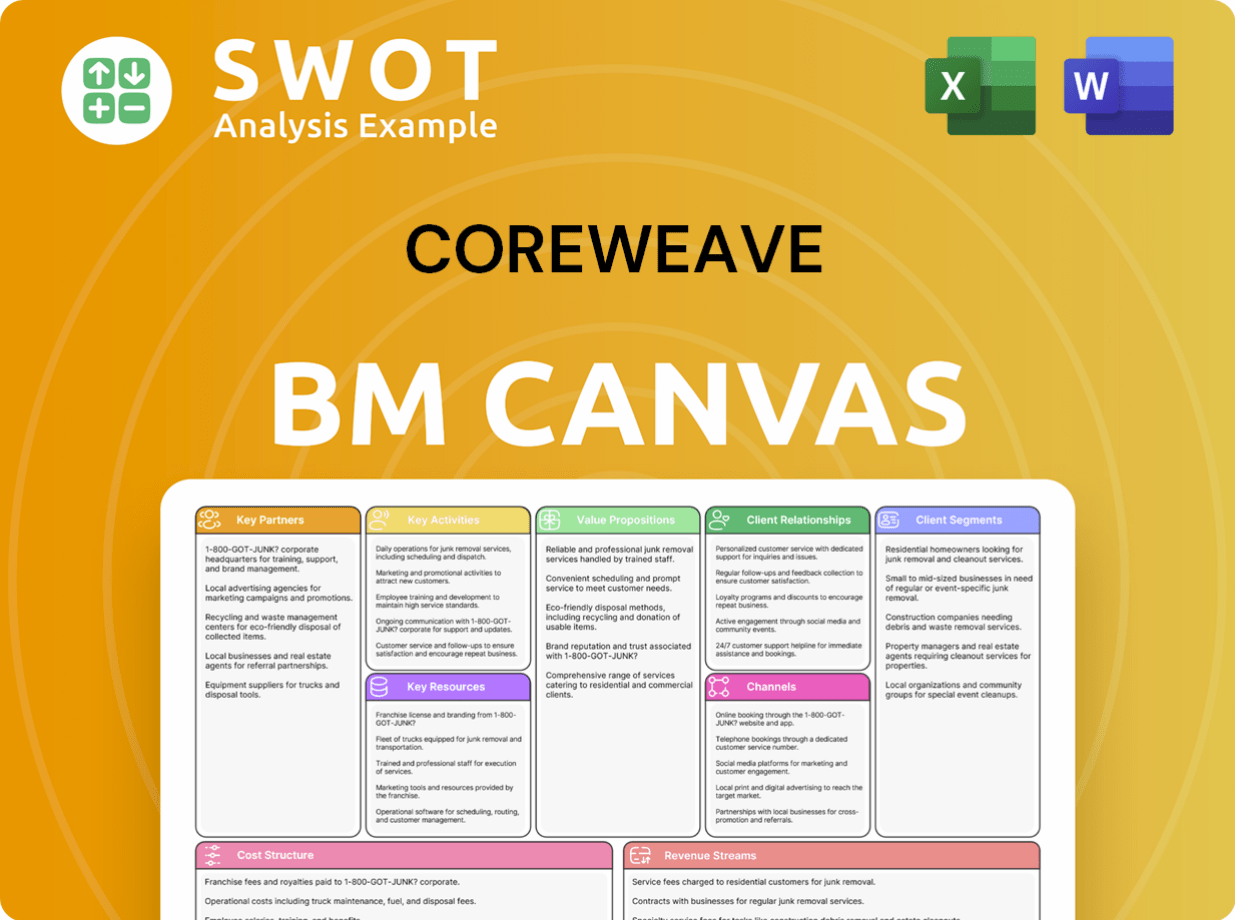

CoreWeave Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped CoreWeave’s Ownership Landscape?

Over the past few years, the ownership structure of CoreWeave has seen significant shifts, primarily driven by substantial capital infusions and strategic partnerships. This reflects the growing demand for AI infrastructure. A notable trend is the increasing institutional ownership through successive, large-scale funding rounds. In May 2024, the company secured $7.5 billion in debt financing, followed by a $1.1 billion equity raise, which pushed its valuation to $19 billion. These developments highlight considerable investment from private equity and venture capital firms, including Blackstone, Magnetar Capital, Coatue, and Fidelity Management & Research Company, all looking to capitalize on the AI boom. This demonstrates strong investor confidence in the Growth Strategy of CoreWeave.

A key development in CoreWeave's ownership is the strategic investment from Nvidia, a critical supplier of the GPUs essential to CoreWeave's services. Nvidia's $100 million investment in August 2023 not only provided capital but also solidified the strategic alliance between the two companies, potentially securing CoreWeave's access to vital GPU resources. While founder dilution is a natural outcome of such significant external funding, the founders likely remain deeply involved in the company's leadership and strategic direction. There have been no public statements regarding an imminent IPO or privatization. However, given the considerable private investments and high valuation, a public listing remains a potential future consideration as the company continues its aggressive expansion in the specialized cloud market.

CoreWeave's investors include prominent firms such as Blackstone, Magnetar Capital, Coatue, and Fidelity Management & Research Company. Nvidia also holds a strategic stake, enhancing the company's access to essential GPU resources.

The company has raised substantial capital through multiple funding rounds, including a $7.5 billion debt financing in May 2024 and a $1.1 billion equity raise that valued the company at $19 billion. These rounds reflect strong investor confidence.

Given the significant private investments and high valuation, a public listing remains a potential consideration. The company's continued expansion in the specialized cloud market suggests ongoing growth and investor interest.

CoreWeave's ownership is characterized by increasing institutional ownership through large-scale funding rounds. Strategic partnerships, such as Nvidia's investment, also play a significant role in shaping the company's ownership profile.

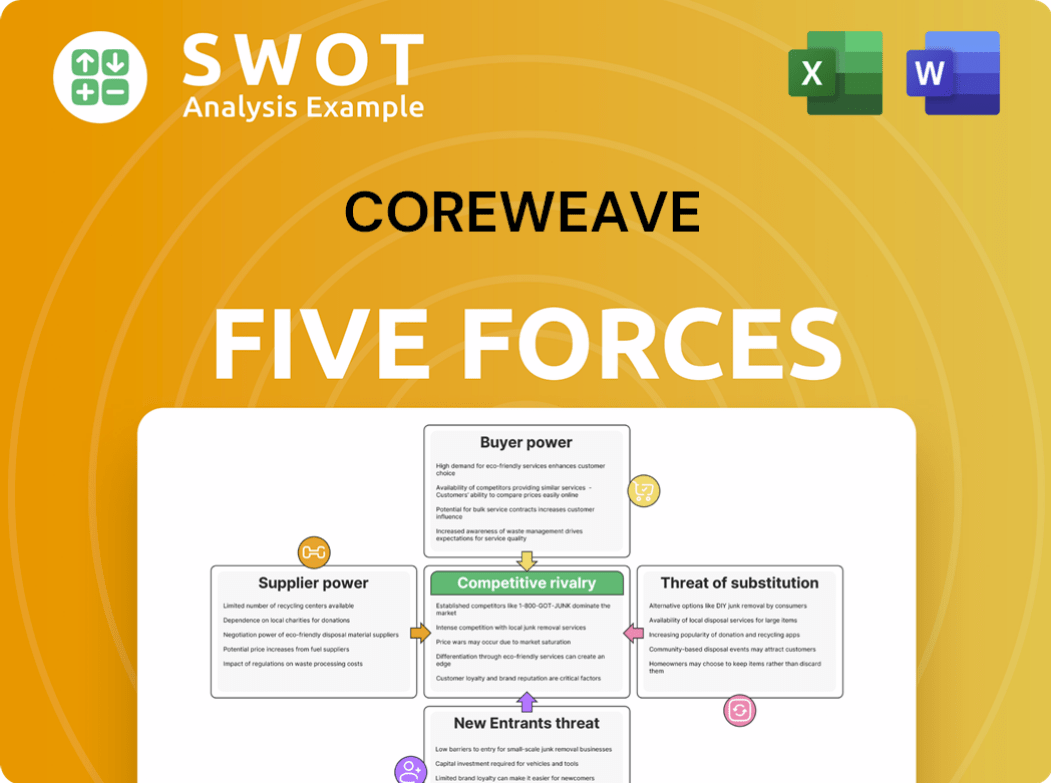

CoreWeave Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CoreWeave Company?

- What is Competitive Landscape of CoreWeave Company?

- What is Growth Strategy and Future Prospects of CoreWeave Company?

- How Does CoreWeave Company Work?

- What is Sales and Marketing Strategy of CoreWeave Company?

- What is Brief History of CoreWeave Company?

- What is Customer Demographics and Target Market of CoreWeave Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.