CoreWeave Bundle

What Makes CoreWeave a Cloud Computing Powerhouse?

CoreWeave has quickly become a key player in the specialized cloud infrastructure market, particularly for intensive workloads like AI and machine learning. Its recent IPO, though with a downsized valuation, signaled its importance as a pioneer in the AI cloud sector. This debut highlights the surging demand for AI computing resources and positions CoreWeave as a critical company to watch.

Driven by the AI revolution, the CoreWeave company experienced explosive revenue growth, making it essential to understand its operational model. This analysis will explore CoreWeave's value creation, revenue streams, and competitive positioning within the CoreWeave SWOT Analysis. Understanding the CoreWeave cloud and its services is vital for investors and anyone interested in the future of AI infrastructure, including how its pricing model details compare to competitors like AWS, and the specific CoreWeave use cases for AI.

What Are the Key Operations Driving CoreWeave’s Success?

The CoreWeave company specializes in cloud infrastructure, specifically designed for compute-intensive tasks. Their primary focus is on serving customers in AI, machine learning, and visual effects rendering. CoreWeave's core value proposition centers around providing high-performance, scalable, and cost-effective access to powerful GPUs, which are essential for accelerating demanding applications. This approach differentiates them from traditional cloud providers, making them a key player in the GPU cloud market.

As of December 31, 2024, CoreWeave operated 32 data centers, housing over 250,000 NVIDIA GPUs. They are supported by more than 260MW of active power. By the end of Q1 2025, they projected to have approximately 420 MW of active power and 1.6 GW of contracted power, showcasing their rapid expansion and commitment to meeting growing demand. This growth is a testament to their successful business model and the increasing need for specialized cloud solutions.

Their operational processes are built around meticulous data center design, strategic hardware procurement, and advanced software development. CoreWeave utilizes a Kubernetes-native architecture optimized for large-scale, GPU-intensive workloads. Their proprietary 'Mission Control' software enables customers to monitor and verify hardware performance. Solutions like CKS (managed Kubernetes for AI) and SUNK (Slurm on Kubernetes) further enhance GPU efficiency. This focus on bare metal computing resources, eliminating virtualization layers, maximizes performance for their clients.

CoreWeave designs and operates data centers optimized for GPU-intensive workloads. Their infrastructure is built on a Kubernetes-native architecture, ensuring efficient resource management. They focus on bare metal computing to maximize performance for AI and machine learning applications.

CoreWeave offers high-performance, scalable, and cost-effective access to GPUs. This allows customers to accelerate demanding applications. Their focus on specialized cloud solutions provides superior processing power and speed, which is crucial for AI and machine learning tasks.

CoreWeave has a deep specialization in GPU acceleration, providing customized solutions. Their customer-centric approach offers flexible and scalable cloud platforms. Strategic partnerships and a focus on innovation keep them at the forefront of the industry.

Customers benefit from superior processing power, speed, and cost-effectiveness. They can easily scale workloads to meet changing demands. CoreWeave's commitment to customer service ensures a positive experience.

CoreWeave's strategic partnership with NVIDIA, including a reported 5% stake, provides access to the latest GPUs like the H100, H200, GH200, and GB200 NVL72-based instances. This gives them a competitive edge in the cloud computing market. These partnerships enable them to stay ahead of the curve in terms of technology.

- Priority access to cutting-edge GPUs.

- Customized solutions for AI and machine learning workloads.

- Scalable infrastructure to meet growing demands.

- Focus on customer service and support.

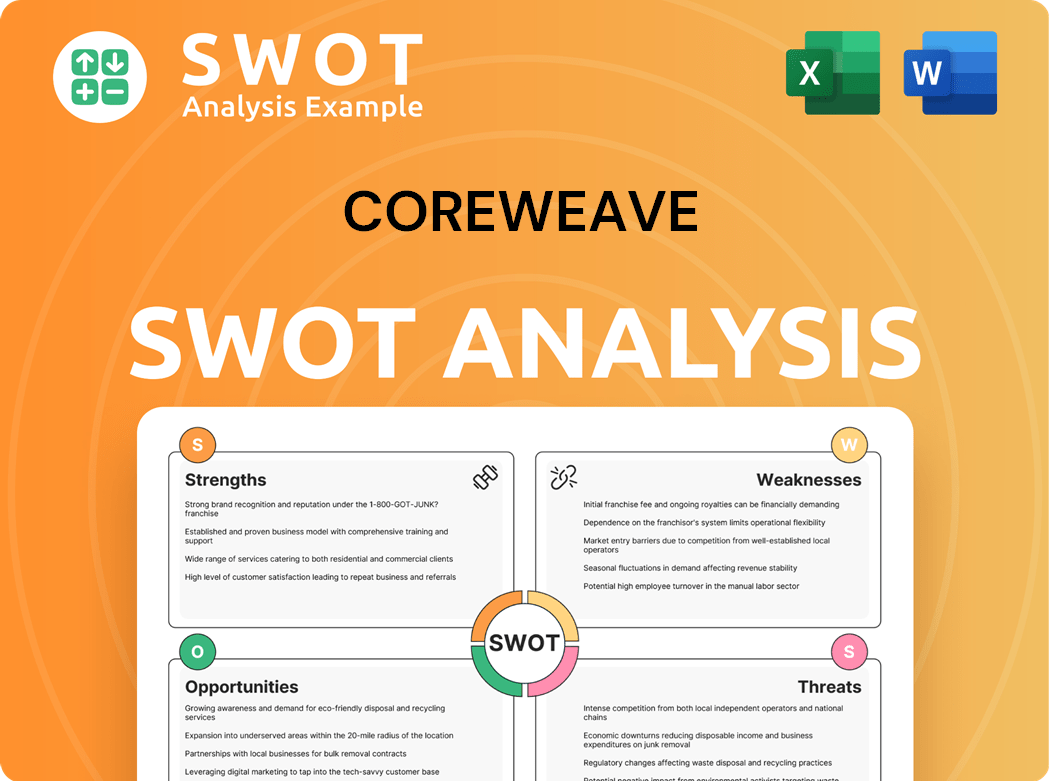

CoreWeave SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does CoreWeave Make Money?

The primary revenue stream for the CoreWeave company is providing AI-optimized cloud infrastructure and managed services through its CoreWeave Cloud Platform. The company primarily rents access to its extensive GPU infrastructure on a per-GPU-per-hour basis. This approach allows clients to access powerful computing resources for demanding AI workloads.

In 2024, CoreWeave's revenue reached $1.9 billion, a significant increase from $229 million in 2023, representing a remarkable year-over-year growth rate of 737%. This growth trajectory continued into Q1 2025, with revenue surging by 420% year-over-year to $982 million, surpassing consensus estimates.

The company projects its revenue for the full year 2025 to be between $4.9 billion and $5.1 billion, with Q2 revenue anticipated to be between $1.06 billion and $1.10 billion.

A key monetization strategy involves long-term commitments with enterprise customers. These contracts, typically spanning 2-5 years, provide high visibility into future earnings. This approach allows clients to secure substantial capacity for demanding AI workloads, ensuring a stable revenue stream for CoreWeave.

In 2024, approximately 77% of CoreWeave's total revenue came from its top two customers, with Microsoft alone accounting for 62% of sales. While this highlights customer concentration risk, the company has also secured significant new deals.

In March 2025, CoreWeave announced an $11.9 billion multi-year strategic partnership with OpenAI. Additionally, a $4 billion expansion with another leading AI enterprise customer was secured. These contracts reflect future spending commitments.

Despite rapid revenue growth, CoreWeave has been operating at a net loss. In 2024, the company reported a net loss of $863 million, following a loss of $594 million in 2023. For Q1 2025, the net loss widened to $315 million, compared to $129 million in Q1 2024. This is largely due to stock-based compensation expenses related to its IPO.

The company's adjusted operating income for Q1 2025 was $163 million, up 550% year-over-year, with a gross profit margin of 74.24%. However, CoreWeave faces a capital-intensive business model, with significant cash burn for building out its AI infrastructure.

The company plans to spend $20-$23 billion in CAPEX for FY25, reflecting its commitment to expanding its AI infrastructure. For more information on the target market of CoreWeave, you can read this article: Target Market of CoreWeave.

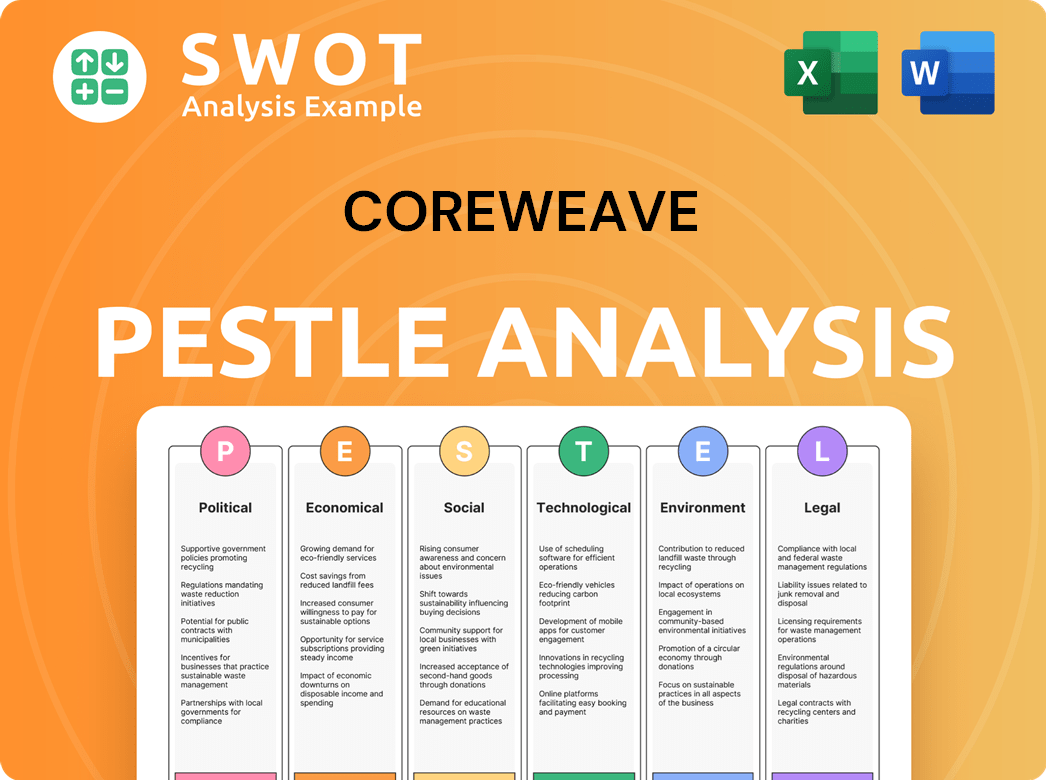

CoreWeave PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped CoreWeave’s Business Model?

The evolution of CoreWeave, a leading AI cloud provider, from its origins as a cryptocurrency mining operation in 2017 to its current status is marked by strategic pivots and significant investments. CoreWeave's ability to recognize and capitalize on the growing demand for AI infrastructure has been key to its success. The company's journey includes securing substantial funding rounds and forming strategic partnerships that have enabled it to expand its data center footprint and offer cutting-edge GPU-accelerated cloud services.

CoreWeave's strategic moves, including its acquisition of Weights & Biases and major contracts with industry leaders like OpenAI, have solidified its position in the AI cloud market. These moves, combined with its technological advantages and customer-centric approach, have allowed CoreWeave to differentiate itself from competitors. The company's focus on providing high-performance, scalable, and customizable solutions has attracted a diverse clientele, driving substantial revenue growth and establishing long-term commitments.

CoreWeave's competitive edge stems from its specialized infrastructure, strategic partnerships, and a business model focused on long-term contracts. These factors combine to provide a robust foundation for future growth and innovation in the rapidly evolving cloud computing landscape. This is a company whose growth strategy has been carefully planned and executed.

CoreWeave's journey began in 2017 as a cryptocurrency mining operation. After the 2018 crypto crash, the company pivoted in 2019 to cloud computing. A major milestone was NVIDIA's $100 million investment in April 2023.

In March 2025, CoreWeave acquired Weights & Biases for $1.7 billion. The company secured a $2.3 billion debt financing facility in August 2023 and a $1.1 billion Series C funding round in May 2024. CoreWeave went public in late March 2025.

CoreWeave offers high-performance, GPU-accelerated infrastructure. Its bare metal Kubernetes capabilities optimize AI workloads. The company has a deep partnership with NVIDIA. CoreWeave's business model relies on long-term contracts, with 96% of revenue from commitments of 2-5 years.

In May 2024, CoreWeave secured a $7.5 billion debt financing facility. The company's valuation reached $19 billion after the Series C funding round in May 2024. CoreWeave secured an $11.9 billion multi-year strategic partnership with OpenAI.

CoreWeave's growth is marked by strategic investments and partnerships, enabling rapid expansion in the cloud computing market. The company's focus on AI infrastructure and its ability to secure substantial funding have fueled its expansion. CoreWeave is well-positioned to capitalize on the increasing demand for GPU-accelerated cloud solutions.

- From 2022 to 2023, CoreWeave expanded its data center presence from three to 14 locations.

- The company anticipated doubling its data center footprint to 28 globally by the end of 2024.

- CoreWeave's acquisition of Weights & Biases expanded its client portfolio by 1,400 AI labs and enterprises.

- The company is integrating liquid cooling systems in its data centers to handle denser server configurations.

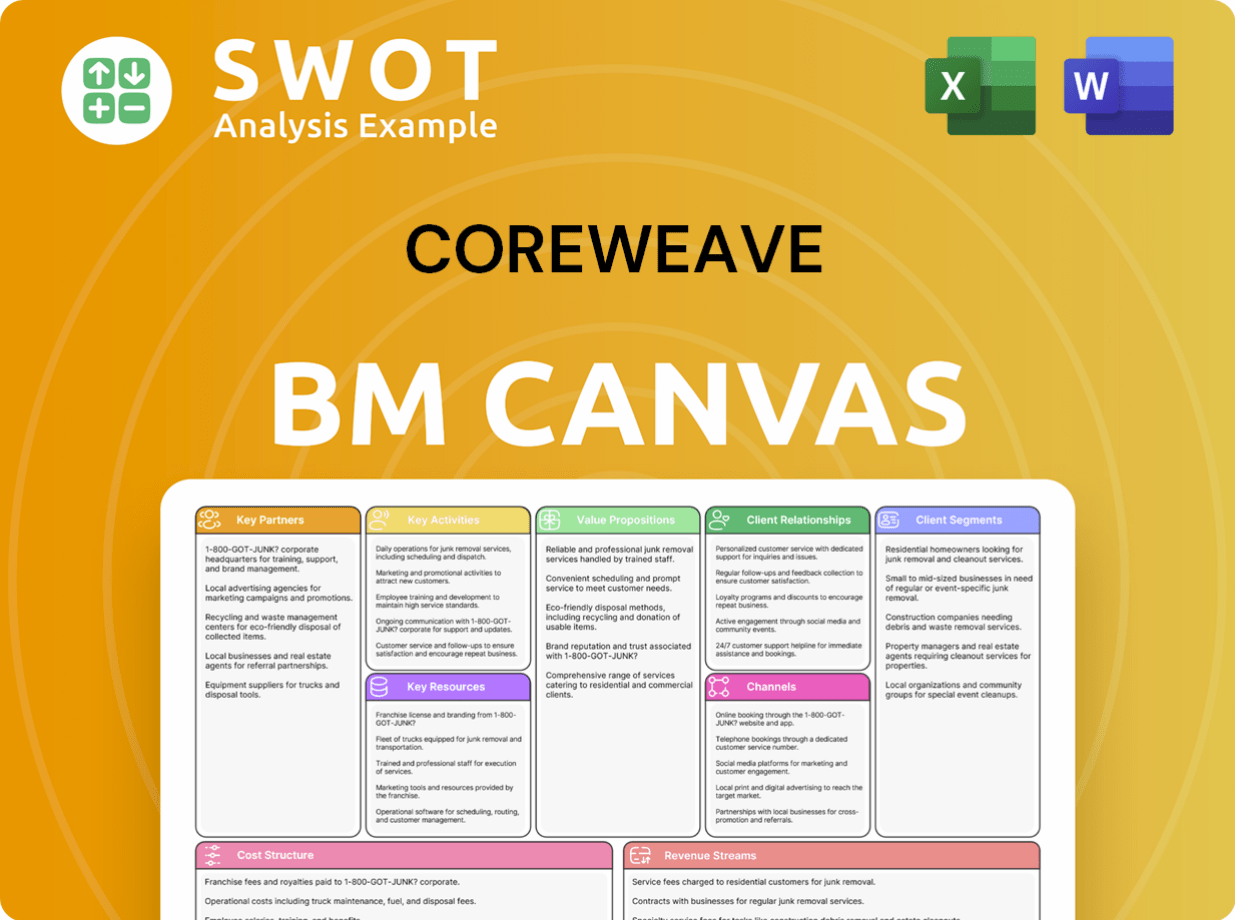

CoreWeave Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is CoreWeave Positioning Itself for Continued Success?

The CoreWeave company is positioned within the cloud computing market, focusing on GPU-accelerated infrastructure tailored for AI and compute-intensive workloads. It competes with other specialized GPU-focused cloud providers like Lambda and Paperspace. As of December 31, 2024, CoreWeave claimed to own over 250,000 NVIDIA GPUs across 32 data centers.

Despite its growth, CoreWeave faces risks, including customer concentration and high capital expenditures. The company reported a net loss of $863 million in 2024 and $315 million in Q1 2025. Analysts project a significant increase in net debt by 2027. The rapid technological advancements in AI chips also present ongoing challenges.

CoreWeave specializes in GPU-accelerated cloud infrastructure, focusing on high-performance computing for AI and other demanding workloads. This niche allows it to compete effectively with larger cloud providers in specific market segments. Its focus on GPUs differentiates it from general-purpose cloud services.

CoreWeave faces risks such as customer concentration, with a significant portion of revenue from a few key clients. Its capital-intensive model requires continuous investment in data centers and GPUs. Rapid technological advancements and the need for continuous infrastructure upgrades also pose challenges.

The future outlook for CoreWeave is optimistic, driven by the growing demand for AI computation. The company projects revenue between $4.9 billion and $5.1 billion for 2025. Key strategies include expanding within existing customers and entering new industries.

CoreWeave plans to enhance its cloud platform with proprietary software and aims for vertical integration. Securing large, long-term contracts, such as the $11.9 billion deal with OpenAI, is critical for sustained growth and profitability, which is projected to improve through fiscal 2028. The company is focused on scaling rapidly to capture demand.

CoreWeave reported a net loss of $863 million in 2024 and a loss of $315 million in Q1 2025. Stifel analysts project net debt to increase significantly. The company's revenue guidance for 2025 is between $4.9 billion and $5.1 billion, reflecting confidence in its growth trajectory.

- Revenue growth is driven by the increasing demand for AI infrastructure.

- CoreWeave is investing heavily in data center expansion and GPU purchases.

- The company's ability to secure large contracts is crucial for long-term success.

- CoreWeave's focus is on becoming a leading AI infrastructure provider.

To learn more about the company's journey, you can check out a Brief History of CoreWeave.

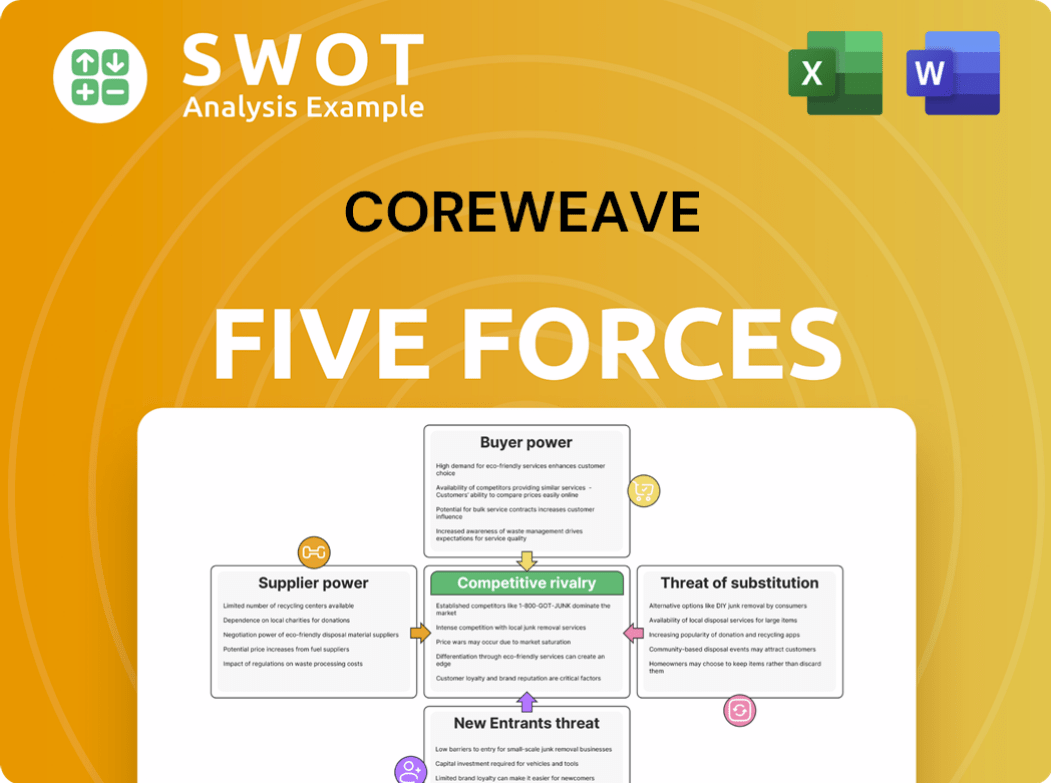

CoreWeave Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CoreWeave Company?

- What is Competitive Landscape of CoreWeave Company?

- What is Growth Strategy and Future Prospects of CoreWeave Company?

- What is Sales and Marketing Strategy of CoreWeave Company?

- What is Brief History of CoreWeave Company?

- Who Owns CoreWeave Company?

- What is Customer Demographics and Target Market of CoreWeave Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.