Cox Enterprises Bundle

How Does Cox Enterprises Thrive in Today's Competitive Markets?

Cox Enterprises, a privately-held giant, operates at the intersection of dynamic industries like automotive services, telecommunications, and media. Founded in 1898, Cox has evolved from a single newspaper into a multi-billion dollar enterprise. Its strategic diversification and commitment to innovation have been key to its enduring success, making it a fascinating case study in business strategy.

This exploration delves into the Cox Enterprises SWOT Analysis to dissect its competitive landscape. We'll identify Cox Communications' main rivals, analyze its unique strengths, and examine the strategies that help it maintain its market position. Through detailed market analysis, we'll uncover how Cox Enterprises navigates its competitive environment, addressing challenges and capitalizing on opportunities within the industry overview.

Where Does Cox Enterprises’ Stand in the Current Market?

Cox Enterprises maintains a significant market position across its key operating divisions. The company's diverse portfolio, encompassing telecommunications and automotive services, allows for a broad reach and a robust competitive stance. A detailed Growth Strategy of Cox Enterprises reveals how the company leverages its strengths to navigate the industry landscape.

In the telecommunications sector, Cox Communications is a leading provider of broadband internet, video, and voice services. Cox Automotive is a dominant force in the automotive services industry, offering a comprehensive suite of solutions for vehicle buyers and sellers. This diversified approach helps mitigate risks and capitalize on various market opportunities.

While specific market share data for 2024-2025 is not publicly available due to its private ownership, Cox Communications consistently ranks among the top cable and broadband providers in the U.S. Cox Automotive holds a substantial market share in automotive wholesale, retail, and media.

Cox Communications is a major player in the telecommunications market, providing broadband internet, video, and voice services. It operates primarily in 18 states, competing with major industry players. Its focus on high-speed internet and customer service helps it maintain a strong position.

Cox Automotive is a comprehensive ecosystem for vehicle buyers and sellers. It includes brands like Autotrader, Kelley Blue Book, Manheim, and Dealertrack. Manheim, the world's largest wholesale vehicle marketplace, is a key component of its success.

Cox Enterprises' market position is characterized by strong performance in both telecommunications and automotive services. The company's financial health allows it to invest in core businesses and strategic acquisitions.

- Cox Communications: Strong presence in the broadband market.

- Cox Automotive: Dominant in automotive wholesale, retail, and media.

- Financial Strength: Enables continued investment and strategic growth.

- Geographic Focus: Primarily North America, with digital platforms extending reach.

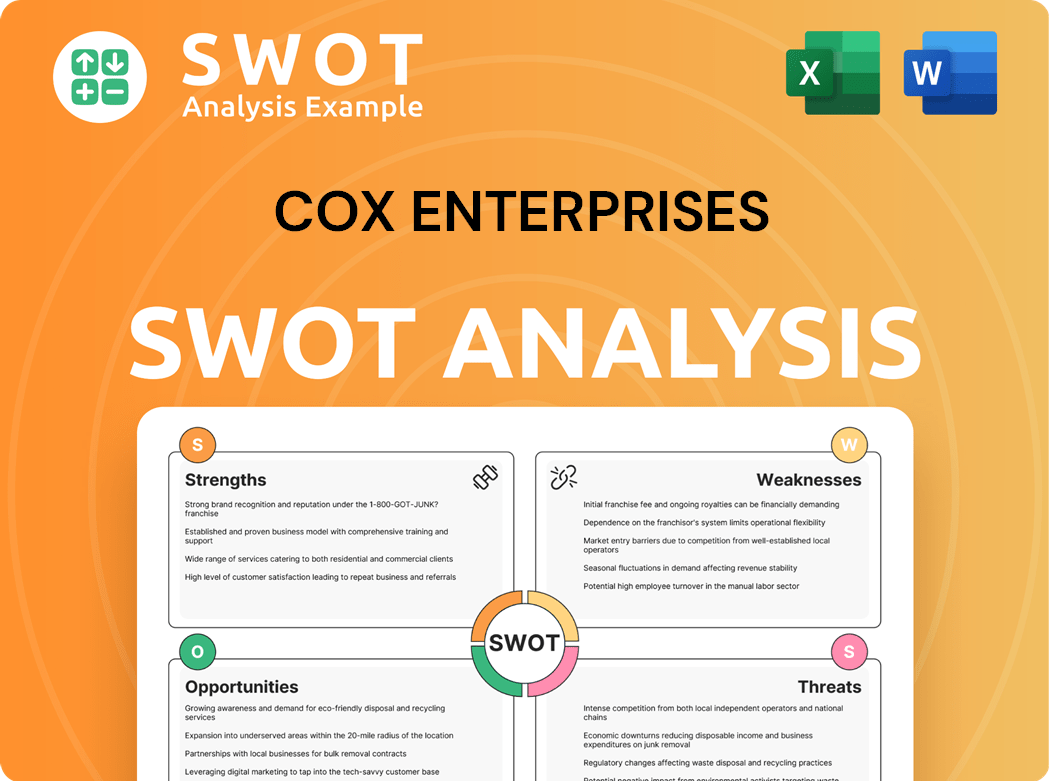

Cox Enterprises SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Cox Enterprises?

Understanding the competitive landscape is crucial for assessing the position of Cox Enterprises. The company operates in diverse sectors, each with its own set of rivals and market dynamics. This analysis provides a comprehensive overview of the key competitors across Cox Enterprises' main business segments, offering insights into the challenges and opportunities the company faces.

The competitive environment for Cox Enterprises is dynamic, shaped by technological advancements, evolving consumer preferences, and strategic moves by both established players and new entrants. A thorough Marketing Strategy of Cox Enterprises reveals how the company navigates these complexities to maintain and grow its market share.

Cox Enterprises' success depends on effectively competing in these markets. The company must continually adapt its strategies to stay ahead of its rivals and capitalize on emerging trends. A deep dive into the competitive landscape provides a foundation for understanding Cox Enterprises' strategic positioning and future prospects.

In the telecommunications sector, Cox Communications faces intense competition. Its primary rivals include major players like Comcast (Xfinity), Charter Communications (Spectrum), and AT&T. These companies offer similar bundled services, putting constant pressure on pricing and service offerings.

The broadband market is particularly competitive, with AT&T and Verizon expanding their fiber optic networks. Furthermore, fixed wireless access (FWA) from T-Mobile and Verizon is gaining traction. These alternatives challenge Cox Communications' market share and require ongoing investment in infrastructure and service improvements.

Cox Automotive's competitive landscape is diverse, reflecting its varied offerings. For wholesale marketplaces like Manheim, KAR Global (ADESA) is a key competitor. Online classifieds and media businesses, such as Autotrader and Kelley Blue Book, compete with CarGurus and Cars.com.

In the dealer software and solutions segment, Cox Automotive faces competition from CDK Global and Reynolds and Reynolds. The emergence of digital-first car buying platforms and online marketplaces is also disrupting the traditional automotive retail landscape, adding new dimensions to the competitive environment.

Cox Media Group competes with other local broadcast television and radio station groups, along with digital media platforms and national news organizations. The fragmented nature of the media industry means competition comes from both traditional and new media outlets.

Cox Media Group competes for advertising revenue and audience share. The media landscape is highly competitive, with traditional and digital media outlets vying for consumer attention and advertising dollars. Understanding these competitive dynamics is essential for Cox Enterprises' strategic planning.

Several factors drive competition in Cox Enterprises' markets. These include pricing strategies, service quality, technological innovation, and the ability to offer bundled services. The company must continually adapt to these factors to maintain its market position.

- Pricing and Bundling: Competitors often offer aggressive pricing and bundled services to attract customers.

- Network Infrastructure: The quality and reach of broadband networks are critical.

- Digital Transformation: The shift towards online and digital platforms impacts all segments.

- Customer Experience: Providing excellent customer service and support is essential.

Cox Enterprises PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Cox Enterprises a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of Cox Enterprises involves recognizing its key strengths and how they position the company against its rivals. The company's success is built on a foundation of strategic advantages that span its diverse business segments, from telecommunications to automotive services. A deep dive into these advantages reveals how Cox Enterprises maintains its industry position and navigates market dynamics.

A crucial aspect of Cox Enterprises' strategy is its ability to adapt and innovate. This adaptability is evident in its investments in new technologies and services, ensuring it remains competitive. Examining these strategic moves provides insights into how Cox Enterprises aims to stay ahead in its respective markets. The company continually seeks to improve its offerings and expand its reach.

The competitive edge of Cox Enterprises is multifaceted, encompassing both operational efficiencies and customer-focused strategies. These elements work together to create a strong market presence. By understanding these components, stakeholders can better appreciate the company's long-term prospects and its ability to thrive in a dynamic business environment. To learn more about the company's growth strategy, you can read Growth Strategy of Cox Enterprises.

Cox Communications benefits from its extensive hybrid fiber-coaxial (HFC) network, providing reliable high-speed internet. Ongoing investments in network upgrades, including fiber deeper into neighborhoods, enhance service capabilities. This infrastructure allows Cox to deliver competitive speeds and services, crucial in today's market.

Cox Automotive's integrated ecosystem spans the entire automotive lifecycle, offering a one-stop shop for dealers. This includes wholesale auctions, inventory management, digital marketing, and financing solutions. The breadth of offerings creates significant network effects, making it a comprehensive solution for the automotive industry.

Private ownership allows Cox Enterprises to take a longer-term strategic outlook. This financial flexibility enables investments in innovation and infrastructure that public companies might defer. This long-term perspective is a key differentiator, allowing for sustained growth and market adaptation.

Cox Communications emphasizes localized customer service and long-standing relationships. This customer-focused approach contributes to high customer loyalty. The company's commitment to customer satisfaction is a significant advantage in a competitive market.

Cox Enterprises' competitive advantages are multifaceted, ensuring its strong position in the market. These advantages include robust infrastructure, an integrated ecosystem, and a long-term strategic outlook. These elements enable Cox to adapt to market changes and maintain a competitive edge.

- Extensive HFC network for reliable internet services.

- Comprehensive automotive solutions across the entire lifecycle.

- Long-term strategic focus due to private ownership.

- Strong brand equity with names like Autotrader and Kelley Blue Book.

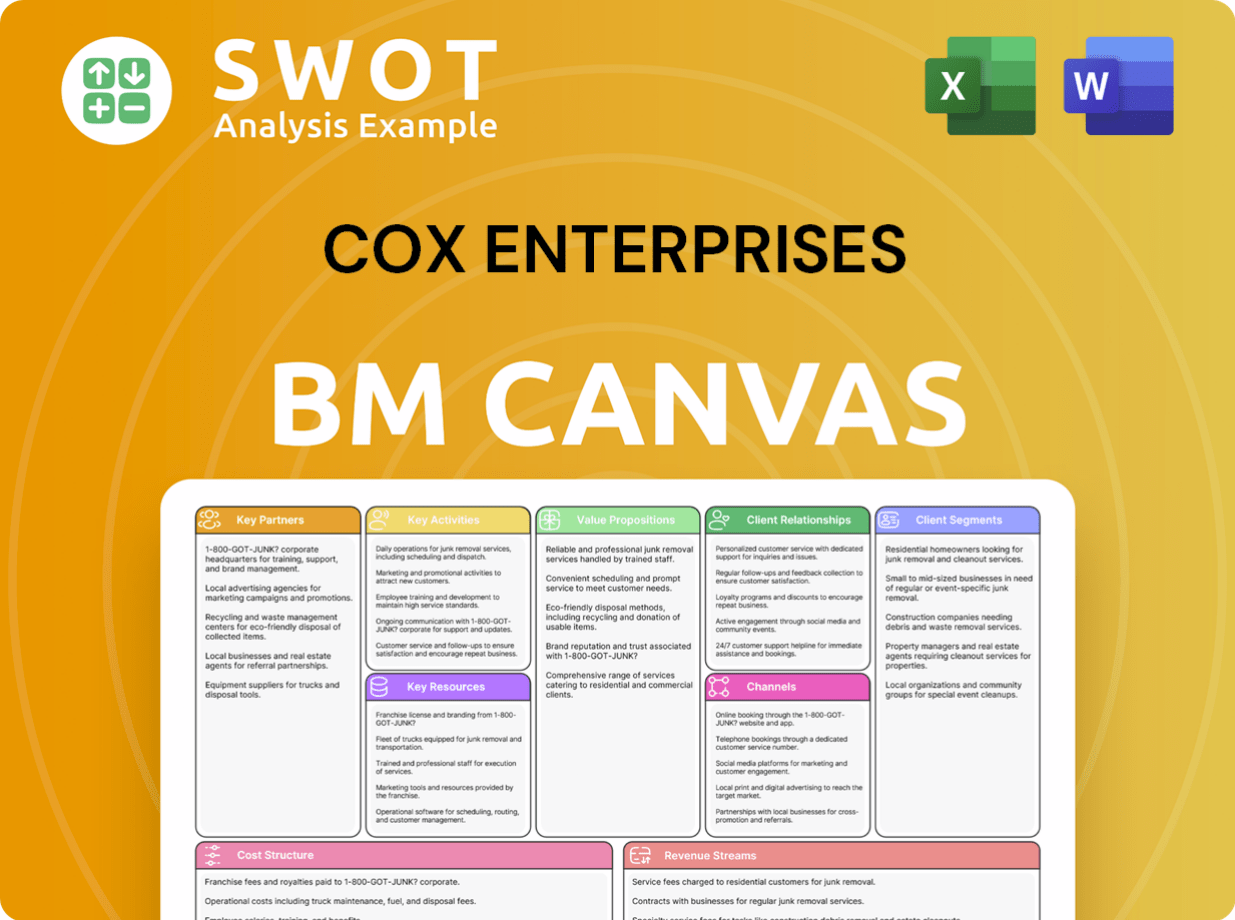

Cox Enterprises Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Cox Enterprises’s Competitive Landscape?

Understanding the competitive landscape of Cox Enterprises involves assessing its position within dynamic industries. The company faces challenges and opportunities shaped by technological advancements, evolving consumer preferences, and regulatory changes. A comprehensive market analysis reveals the need for strategic adaptation to maintain and enhance its market share.

The future outlook for Cox Enterprises depends on its ability to navigate these shifts effectively. The company's business strategy must address risks while capitalizing on emerging trends. This includes focusing on core competencies and exploring diversification opportunities to ensure sustained growth and competitiveness. For more insights into the ownership structure, you can read about Owners & Shareholders of Cox Enterprises.

The telecommunications industry is experiencing significant changes. The demand for higher broadband speeds and the expansion of fiber-to-the-home (FTTH) networks are key trends. Competition from 5G fixed wireless access and streaming services is also increasing.

The automotive sector is undergoing a transformation driven by the rise of electric vehicles (EVs), autonomous driving technologies, and the digitalization of car buying and selling. These trends impact existing infrastructure and create new opportunities for data analytics and digital solutions.

Ongoing challenges include the need for heavy investment in network upgrades to compete with fiber providers and 5G. Data privacy regulations and cybersecurity threats require continuous investment in robust security measures and compliance. Adapting to the rapid evolution of EVs and autonomous driving technologies in the automotive sector is also a key challenge.

Opportunities include expanding the fiber footprint and enhancing service offerings to cater to bandwidth-intensive applications. In the automotive sector, there's potential for developing new solutions for EV remarketing, battery recycling, and data analytics. Strategic partnerships and diversification into adjacent markets are also key.

Cox Enterprises must focus on several key strategies to maintain its competitive edge. These include strategic investments in network infrastructure, particularly fiber optic networks, to enhance broadband capabilities and meet growing consumer demand for high-speed internet. The company needs to expand its digital platforms and data analytics capabilities.

- Prioritize network upgrades and expansion, focusing on fiber deployment to enhance broadband services.

- Develop and integrate digital solutions for dealerships, including online car sales platforms and data analytics.

- Form strategic partnerships in emerging technology areas, such as EV solutions and cybersecurity.

- Continue diversification into adjacent markets, leveraging core competencies in connectivity, mobility, and media.

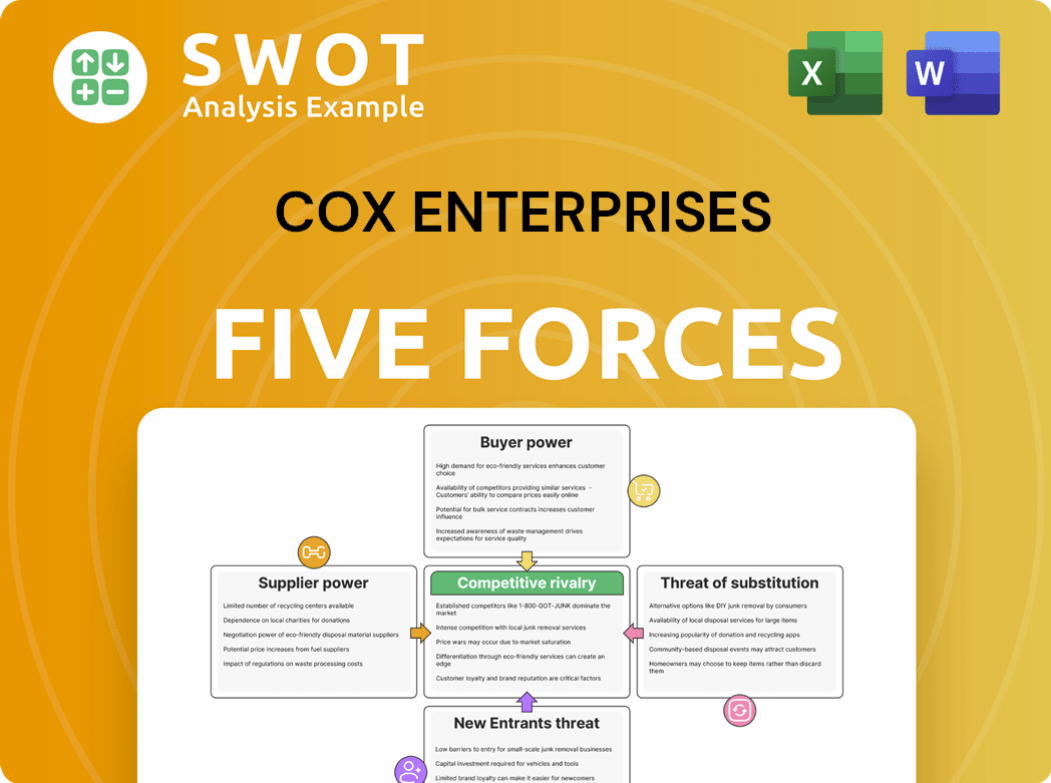

Cox Enterprises Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Cox Enterprises Company?

- What is Growth Strategy and Future Prospects of Cox Enterprises Company?

- How Does Cox Enterprises Company Work?

- What is Sales and Marketing Strategy of Cox Enterprises Company?

- What is Brief History of Cox Enterprises Company?

- Who Owns Cox Enterprises Company?

- What is Customer Demographics and Target Market of Cox Enterprises Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.