Cox Enterprises Bundle

Can Cox Enterprises Continue Its Century-Long Growth Trajectory?

From its roots in the media industry to its current status as a global powerhouse, Cox Enterprises has consistently adapted and expanded. The recent acquisition of Spiro by Cox Automotive signals a bold step into the burgeoning EV market, underscoring the company's commitment to innovation. This strategic move, along with its diversified portfolio spanning telecommunications and media, positions Cox Enterprises for continued growth and market leadership.

This deep dive into the Cox Enterprises SWOT Analysis will examine the company's strategic initiatives, including its expansion plans for Cox Communications and the revenue streams driving Cox Automotive. We'll explore the Cox Enterprises business model, analyze its financial performance, and assess its future prospects, considering the competitive landscape and potential investment opportunities within this diversified conglomerate. The analysis will also touch upon Cox Enterprises' digital transformation strategy and its impact on local communities.

How Is Cox Enterprises Expanding Its Reach?

The Cox Enterprises growth strategy is heavily focused on expansion initiatives across its diverse business segments. This strategy includes entering new markets, launching innovative products and services, and strategic mergers and acquisitions to drive growth. A key aspect of this strategy involves a deep dive into the electric vehicle (EV) ecosystem, capitalizing on the rising demand and market potential.

Cox Enterprises future prospects are significantly influenced by its ability to adapt to evolving market dynamics and technological advancements. The company's approach involves focusing on key sectors such as telecommunications and automotive services, where it aims to maintain a competitive edge. By strategically investing in these areas, Cox aims to secure long-term growth and profitability.

The Cox Enterprises company is committed to diversifying its revenue streams. The company is actively pursuing opportunities to expand its market presence and enhance its service offerings. This approach is designed to solidify its position in the industry and ensure sustained success.

One of the most significant expansion initiatives is the focus on the electric vehicle (EV) market. This includes the acquisition of Spiro by Cox Automotive in early 2024, which broadened its offerings in EV charging and fleet management software. This move is designed to capitalize on the rapid growth of the EV sector.

Cox Communications continues to invest in expanding its broadband network and services. This involves extending fiber optic infrastructure to new residential and business areas, thereby enhancing internet speeds. The goal is to attract and retain customers in competitive telecommunications markets.

Strategic mergers and acquisitions are a key component of Cox's growth strategy. These moves are aimed at expanding its market reach and service offerings. The company consistently evaluates new business models and partnership strategies to leverage its existing strengths.

Cox Automotive has a more global presence, with operations and partnerships extending across various international markets. This supports its automotive logistics and digital retailing solutions. The company is focused on synergistic opportunities that enhance its market reach.

The Cox Enterprises business model is evolving to meet the demands of a changing market. This includes strategic investments in high-growth sectors and a focus on digital transformation. The company is also exploring new business models and partnerships to enhance its market reach.

- Cox Communications expansion plans include extending fiber optic infrastructure and enhancing internet speeds to meet the growing demand for high-speed internet.

- Cox Automotive revenue streams are being diversified through acquisitions like Spiro, which expands offerings in the EV charging and fleet management software sectors.

- The company's focus on sustainability efforts and digital transformation is integral to its long-term goals.

- Strategic initiatives are driven by the need to stay ahead of technological advancements and meet customer demands. For more insights, explore Owners & Shareholders of Cox Enterprises.

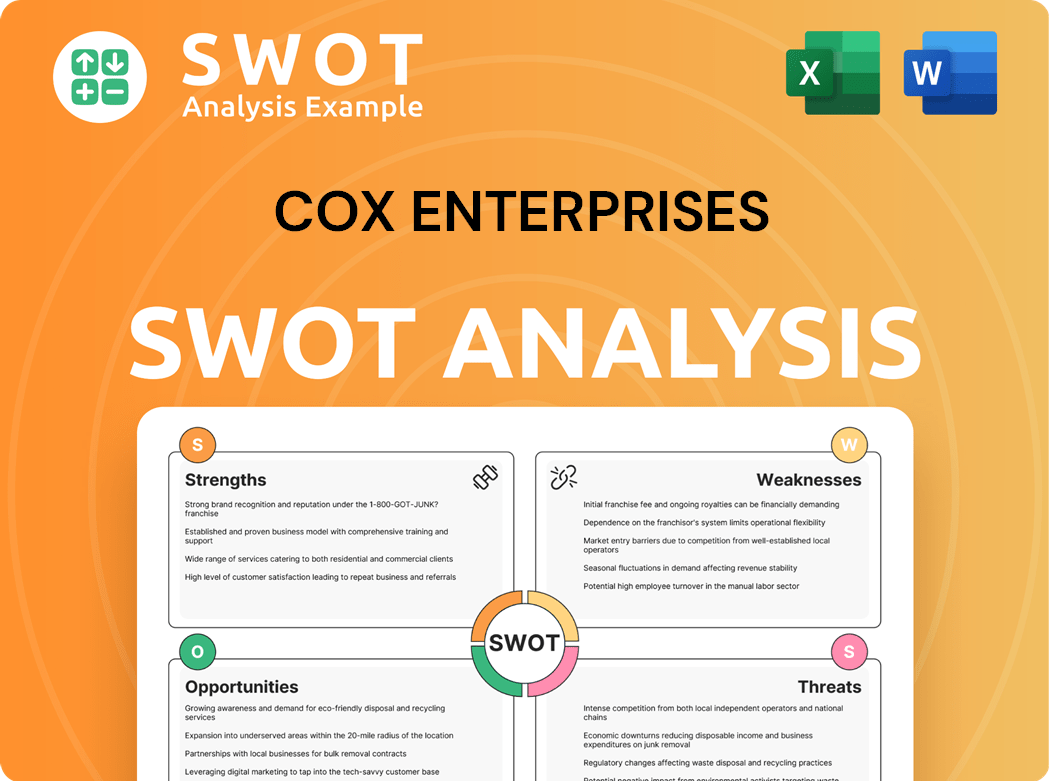

Cox Enterprises SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Cox Enterprises Invest in Innovation?

The innovation and technology strategy of Cox Enterprises is central to its Cox Enterprises growth strategy. The company consistently invests in research and development (R&D) and actively seeks collaborations to stay at the forefront of technological advancements. This approach ensures that Cox Enterprises remains competitive and adaptable in evolving markets.

A key aspect of Cox Enterprises' strategy involves digital transformation across its various divisions. This includes upgrading infrastructure, enhancing customer experiences through digital platforms, and integrating automation. The use of advanced technologies like artificial intelligence (AI) and the Internet of Things (IoT) is also a significant part of their operational strategy.

Sustainability is another area where technology plays a critical role for Cox Enterprises. The company leverages technology to develop more energy-efficient operations and solutions, aligning with its commitment to environmental responsibility. This focus enhances operational efficiency and supports the company's long-term goals.

Cox Enterprises allocates substantial resources to R&D across its divisions. These investments fuel innovation and the development of new products and services. The company's financial performance review reflects these strategic allocations.

Cox Enterprises actively seeks partnerships with external innovators to accelerate technology adoption. These collaborations enable the company to integrate cutting-edge solutions quickly. This approach supports Cox Enterprises' market analysis and competitive landscape.

The company focuses on enhancing customer experiences through digital platforms and automated processes. This includes upgrading network infrastructure and introducing advanced services. This strategy is key to Cox Communications expansion plans.

Cox Enterprises integrates AI and IoT into its operations to optimize performance and personalize customer interactions. AI-driven analytics are used to predict customer needs. This is a part of Cox Enterprises' digital transformation strategy.

The company leverages technology to develop energy-efficient operations and solutions. This supports Cox Enterprises' sustainability efforts and aligns with its long-term goals. This is a key element of Cox Enterprises' strategic initiatives 2024.

Cox Automotive invests in software solutions for EV fleet management. This demonstrates a forward-thinking approach in the automotive sector. This approach boosts Cox Automotive's revenue streams.

Cox Enterprises' technology strategy encompasses several key areas, including network infrastructure, customer experience, and operational efficiency. These efforts are designed to drive growth and maintain a competitive edge. The company's commitment to innovation is evident in its strategic investments.

- Network Upgrades: Continuous enhancements to network infrastructure to support higher bandwidths and advanced services.

- AI and Automation: Integration of AI and automation to optimize operations and personalize customer interactions.

- Sustainability Technologies: Development and implementation of energy-efficient solutions to reduce environmental impact.

- Strategic Partnerships: Collaborations with external innovators to accelerate technology adoption and integration.

- Digital Platforms: Enhancing customer experiences through digital platforms and automated processes.

Cox Enterprises PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Cox Enterprises’s Growth Forecast?

The financial outlook for Cox Enterprises is shaped by its position as a privately-held entity and its strategic focus on long-term value creation. While specific financial details aren't publicly available in the same way as for publicly traded companies, the company's actions and investments provide insights. Recent moves, such as the 2024 investment in Spiro by Cox Automotive, highlight a commitment to growth and a healthy financial standing.

Cox Enterprises' financial health is further indicated by its consistent acquisitions and expansions across its core business segments. These strategic investments suggest a focus on long-term value creation rather than short-term gains. The company's business model, which includes Cox Communications and Cox Automotive, is designed to capitalize on market trends. This approach supports a positive financial narrative.

Industry analysts often point to the stability and growth potential of Cox's core businesses, such as Cox Communications and Cox Automotive. The ongoing demand for high-speed internet and the evolving automotive industry, including the EV market, are key drivers. The company's strategic capital allocation towards high-growth areas like EVs and advanced telecommunications indicates a confident financial outlook.

The company's growth strategy involves strategic investments and expansions in key sectors. This includes focusing on high-growth areas like electric vehicles (EVs) and advanced telecommunications. These initiatives aim to secure future market share and profitability, reflecting a forward-thinking approach to Marketing Strategy of Cox Enterprises.

Future prospects for Cox Enterprises are promising, driven by its strong market positions in Cox Communications and Cox Automotive. The company is well-positioned to capitalize on the ongoing demand for high-speed internet and the evolving automotive industry. Continued investment in infrastructure and technology supports its long-term goals.

Cox Communications continues to invest in expanding its broadband infrastructure to meet the growing demand for high-speed internet. This expansion is crucial for maintaining its competitive edge in the telecommunications sector. These expansion efforts are key to driving revenue growth and market share.

Cox Automotive generates revenue through various streams, including vehicle auctions, software solutions, and digital marketing services. The company's diversified revenue streams allow it to adapt to changing market conditions. The growth of the EV market presents significant opportunities for Cox Automotive.

While specific figures aren't public, the company's consistent investments suggest a strong financial position. The focus on long-term value creation indicates a stable financial narrative. The strategic capital allocation towards high-growth areas demonstrates a confident financial outlook.

- Strategic investments in high-growth sectors.

- Focus on long-term value creation.

- Adaptation to market changes.

- Diversified revenue streams.

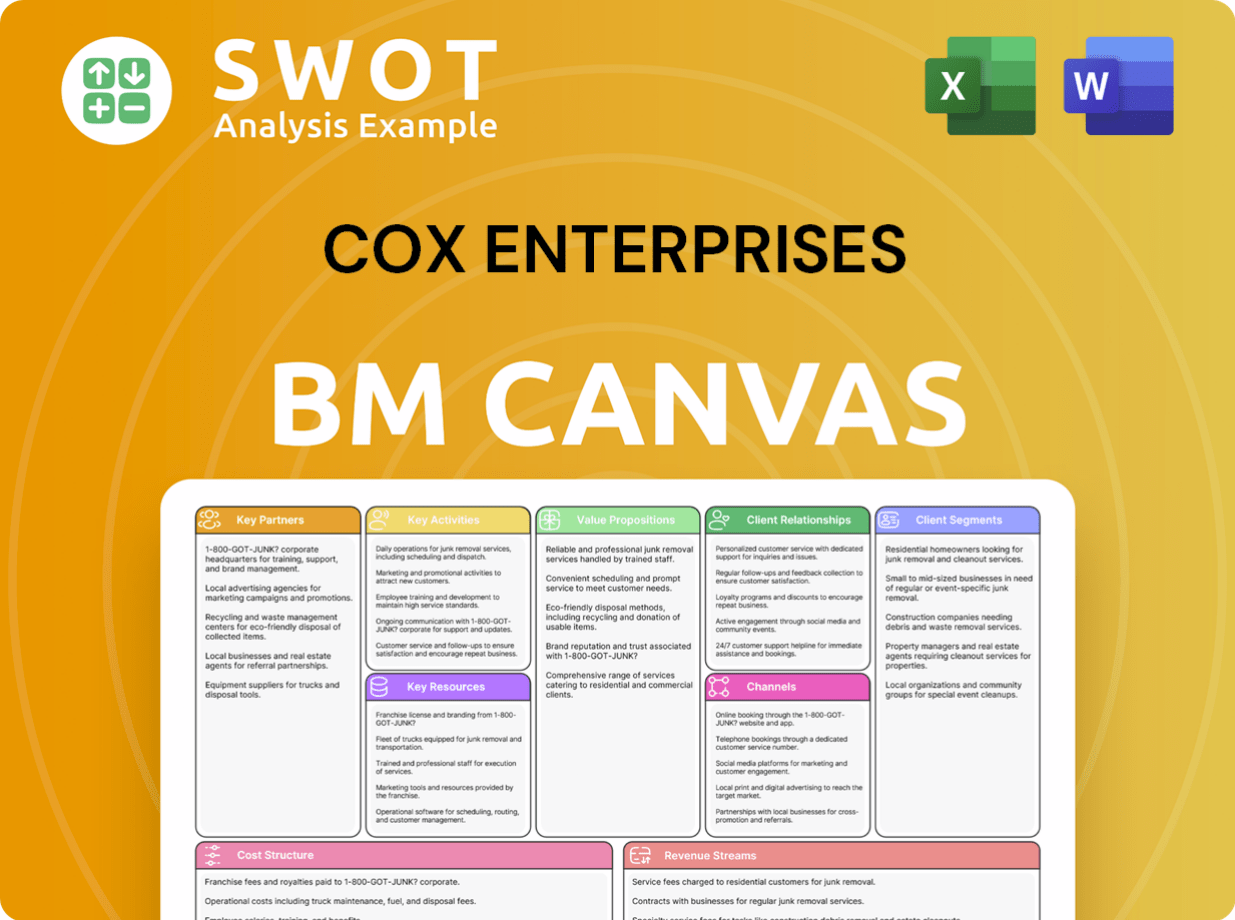

Cox Enterprises Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Cox Enterprises’s Growth?

The future prospects of the company, while promising, are intertwined with potential risks. Several factors could impact the company's growth trajectory, spanning competitive pressures, regulatory changes, and technological disruptions. Understanding these challenges is crucial for assessing the sustainability and success of the company's strategic initiatives.

Market dynamics in the telecommunications and automotive sectors, where the company operates, are highly competitive. Additionally, evolving technological advancements and shifts in consumer behavior pose ongoing challenges. The company's ability to navigate these risks will be critical to achieving its long-term goals and maintaining its position in the market.

The company's ability to maintain its competitive edge is also influenced by its capacity to adapt to these challenges. This includes its ability to innovate, manage its resources effectively, and respond to changes in the market environment. For a deeper understanding of the company's core values and mission, consider reading Mission, Vision & Core Values of Cox Enterprises.

The telecommunications sector, where Cox Communications operates, faces intense competition from major national and regional providers. Constant pressure on pricing and service innovation is a significant challenge. In the automotive sector, Cox Automotive contends with numerous players offering diverse automotive solutions.

Evolving regulations around net neutrality, data privacy, and spectrum allocation can directly affect operational costs and service offerings, particularly in the telecommunications sector. These changes require the company to adapt its strategies and operations to remain compliant. The impact of these changes can be substantial.

Supply chain issues can influence the automotive sector through vehicle availability and parts, impacting Cox Automotive's clients. While not as pronounced as in other sectors, disruptions can still affect performance. These vulnerabilities need to be carefully managed.

Rapid technological advancements could render existing technologies or business models obsolete. The acceleration of autonomous vehicles or new mobility solutions could disrupt traditional automotive service models. The company must stay ahead of these trends.

The availability of skilled talent in specialized areas like AI and cybersecurity could hinder innovation and growth. Attracting and retaining skilled employees is essential. Addressing these constraints is crucial for future success.

The company mitigates risks through diversification across its business units, providing insulation from downturns in any single sector. Risk management frameworks and scenario planning help anticipate and prepare for potential disruptions. Proactive investments in EV technology demonstrate an awareness of emerging market shifts.

The company is focused on expanding its fiber-optic network to provide faster and more reliable internet services. This expansion is crucial for remaining competitive in the telecommunications market. These plans require significant capital investment and careful execution to ensure success.

Cox Automotive generates revenue through various channels, including digital retailing, wholesale services, and financial services. The company continues to innovate and expand its offerings. The ability to adapt to changing consumer behaviors is essential for maintaining and growing these revenue streams.

The company is investing in digital transformation to enhance its operational efficiency and customer experience. This includes adopting advanced technologies like AI and data analytics. These initiatives are designed to improve the company's competitiveness and drive growth.

The company's long-term goals include sustainable growth, market leadership, and creating value for stakeholders. The company aims to achieve these goals through strategic investments, innovation, and operational excellence. These goals are supported by a clear vision and a commitment to execution.

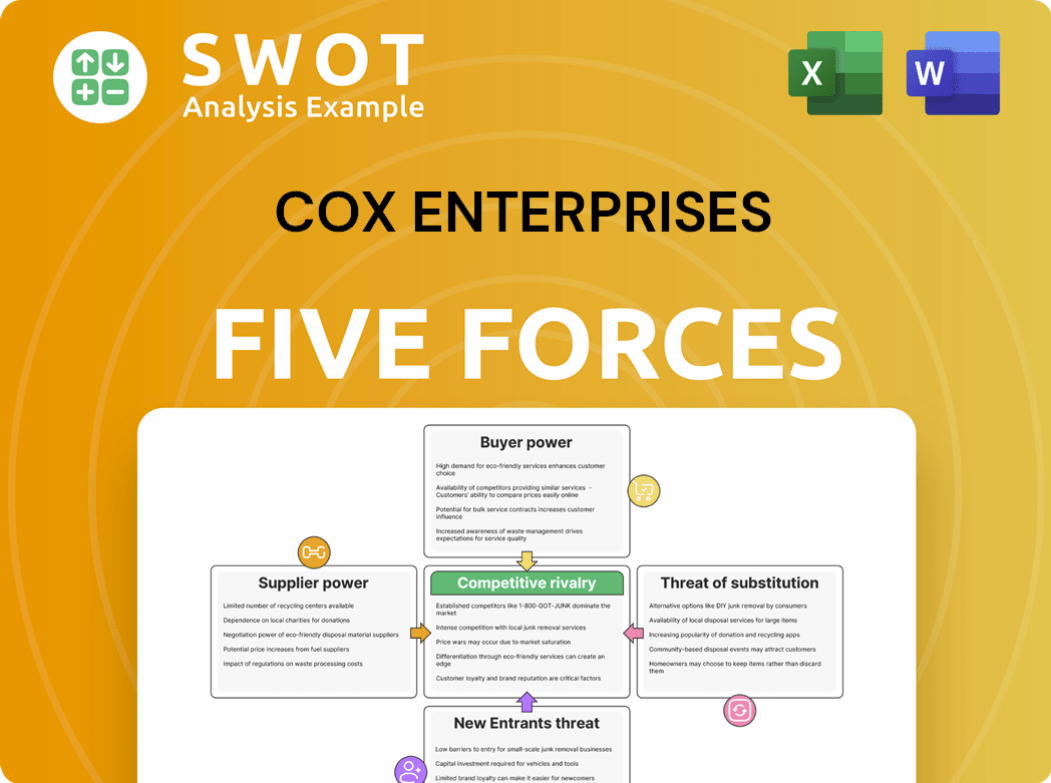

Cox Enterprises Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Cox Enterprises Company?

- What is Competitive Landscape of Cox Enterprises Company?

- How Does Cox Enterprises Company Work?

- What is Sales and Marketing Strategy of Cox Enterprises Company?

- What is Brief History of Cox Enterprises Company?

- Who Owns Cox Enterprises Company?

- What is Customer Demographics and Target Market of Cox Enterprises Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.