Public Power Bundle

How is PPC Navigating the Shifting Energy Landscape?

The Greek power industry is undergoing a dramatic transformation, and at the heart of it all is Public Power Corporation S.A. (PPC). From its origins as a state-run monopoly, PPC is now facing a new reality shaped by market liberalization and the push for decarbonization. This evolution has brought forth fierce competition, particularly in the renewable energy sector and retail electricity supply.

As PPC adapts, understanding its competitive landscape is crucial for investors and industry watchers alike. This Public Power SWOT Analysis offers a deep dive into the challenges and opportunities facing PPC, providing a comprehensive market analysis of the utility companies and key players in the energy sector. Examining the competitive analysis of public power companies reveals the strategies employed to maintain market share and navigate the changing dynamics of the power industry.

Where Does Public Power’ Stand in the Current Market?

Public Power Corporation S.A. (PPC), a key player in the Greek power industry, maintains a dominant market position despite ongoing liberalization. As of early 2024, it held a significant share of the retail electricity market. Its operations span electricity generation, transmission, distribution, and supply to residential, commercial, and industrial customers. This integrated approach allows for significant control over the value chain.

PPC's core operations are primarily concentrated in Greece, where it operates an extensive network. This includes serving a broad range of customer segments from households to large industrial complexes. Over time, PPC has shifted its focus towards a more market-oriented entity, emphasizing customer retention and attracting new clients with competitive tariffs and green energy offerings. This strategic shift is vital for maintaining its competitive edge.

The company's value proposition revolves around its integrated services and extensive infrastructure. This includes its ability to generate, transmit, and distribute electricity across the Greek mainland and islands. The company is also focusing on renewable energy initiatives to meet evolving market demands and regulatory requirements. For more insights, consider exploring the Revenue Streams & Business Model of Public Power.

PPC's market share in electricity supply to end consumers was approximately 55.7% in January 2024. This represents a decrease from around 60.5% in January 2023. This decline reflects increasing competition in the energy sector.

PPC's geographic presence is primarily in Greece, operating across the mainland and numerous islands. This extensive network allows it to serve a diverse customer base. The company's widespread infrastructure is a key competitive advantage.

Adjusted EBITDA for the first nine months of 2023 reached €1.1 billion. This indicates improved profitability and operational efficiency. This strong financial performance supports PPC's market position.

PPC serves a broad range of customer segments, including households, commercial entities, and large industrial complexes. This diversification helps in maintaining a stable revenue stream. The company's ability to cater to various needs is crucial.

PPC's enduring market strength is underpinned by its control over critical infrastructure and its growing renewable energy portfolio. This combination of assets positions it well in the competitive landscape. The company is adapting to the evolving energy sector.

- Dominant position in generation and distribution infrastructure.

- Focus on customer retention through competitive tariffs and services.

- Strategic shift towards renewable energy to meet market demands.

- Strong financial performance with increasing adjusted EBITDA.

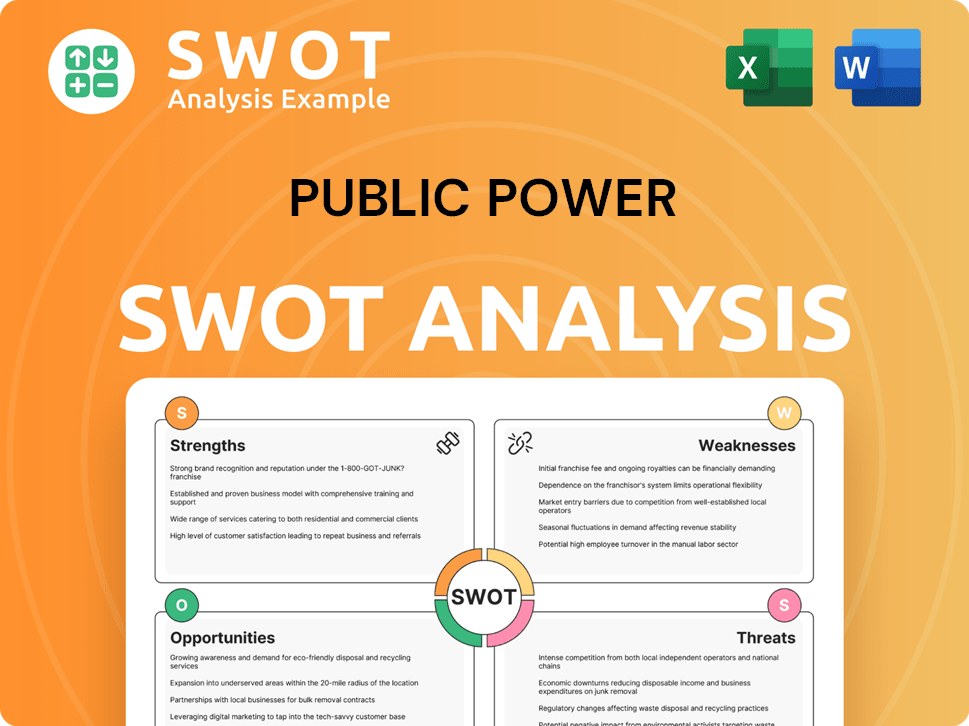

Public Power SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Public Power?

The competitive landscape for a Public Power Company is shaped by a diverse array of players in the Greek and broader Southeast European energy markets. The power industry is dynamic, with both direct and indirect competitors vying for market share in both retail electricity supply and electricity generation. Understanding these competitors is crucial for strategic planning and maintaining a strong market position.

The energy sector is experiencing significant shifts, driven by technological advancements, regulatory changes, and evolving consumer preferences. This necessitates continuous adaptation and innovation to stay competitive. The following analysis examines the key competitors and the strategies they employ to challenge the Public Power Company.

The competitive landscape is also influenced by the increasing focus on renewable energy sources and the push for sustainable energy solutions. This trend is creating new opportunities and challenges for all participants in the market.

In the retail electricity supply segment, the Public Power Company faces competition from several key players. These competitors often offer more agile pricing strategies and digital customer services.

Protergia has aggressively expanded its customer base by providing competitive pricing and integrated energy solutions. They have a strong presence in both residential and commercial markets.

Elpedison, a joint venture, leverages its diversified energy portfolio to compete effectively. They focus on offering a range of energy products and services.

Heron is a strong contender, particularly in the commercial and industrial segments. They often provide bundled offerings, including natural gas and renewable energy options.

NRG is another significant player in the retail market, offering competitive pricing and customer service. They focus on attracting and retaining customers through various incentives.

These competitors challenge the Public Power Company through agile pricing, digital customer services, and bundled offerings. The competitive landscape is intense, requiring continuous innovation.

In electricity generation, while the Public Power Company remains the largest producer, it faces increasing competition from independent power producers (IPPs), especially in the renewable energy sector. These companies are rapidly expanding their installed capacity, directly competing with the Public Power Company's own renewable energy ambitions. The competitive landscape is also being shaped by new entrants focusing exclusively on green energy solutions and energy storage. Mergers and alliances, such as strategic partnerships between energy companies and technology providers, are further intensifying competition by creating more integrated and efficient market players, pushing the Public Power Company to accelerate its own transformation and investment in new technologies.

The Public Power Company faces competition from IPPs, particularly in renewable energy. These companies are rapidly increasing their capacity.

- Terna Energy: A significant player in wind and solar farm development.

- Mytilineos: Involved in renewable energy projects, expanding its generation capacity.

- Eunice Energy Group: Focuses on renewable energy solutions and energy storage.

- New Entrants: Companies specializing in green energy solutions and energy storage are also emerging.

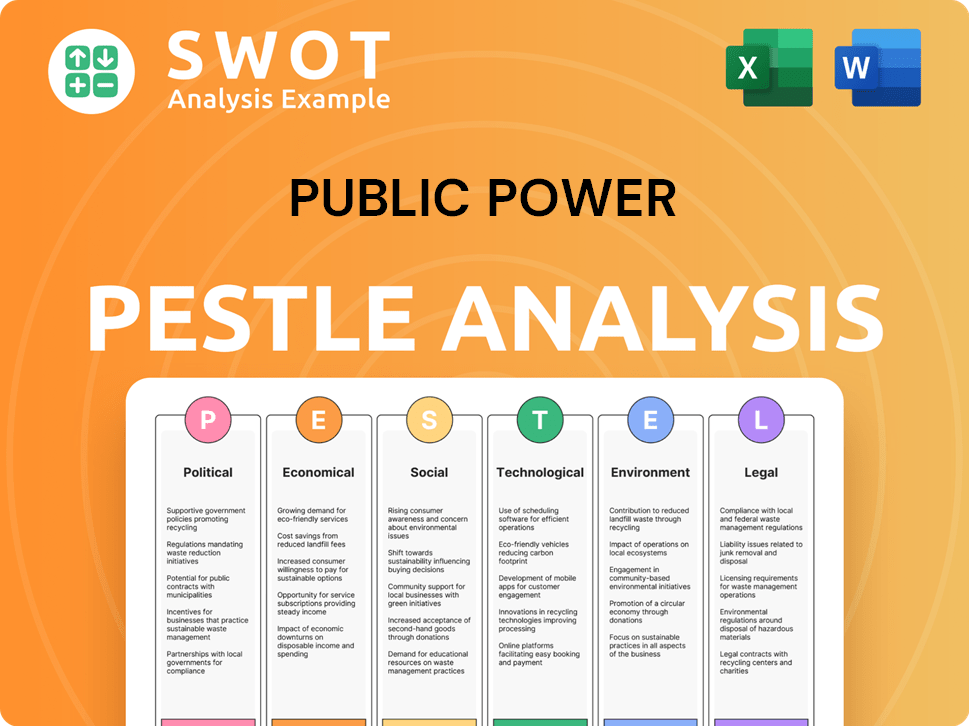

Public Power PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Public Power a Competitive Edge Over Its Rivals?

The competitive advantages of a public power company are largely built on its substantial infrastructure, strong brand recognition, and strategic focus on renewable energy sources. This company has a long history of providing electricity, which has allowed it to build a vast network and gain a strong presence in the Greek market. Its established position and customer loyalty are key strengths in the competitive power industry.

The company's ongoing investments in renewable energy are also boosting its competitive edge. With a large investment plan, the company aims to significantly increase its green energy capacity by 2026. This strategic shift is designed to meet the rising demand for clean energy and support national decarbonization goals. The company's experience in handling large-scale energy projects and its access to funding are crucial for this expansion.

The company is also working on digital transformation projects to improve operational efficiency and customer experience. These efforts are designed to strengthen its competitive position further. While facing competition and industry changes, the company's ability to integrate different energy sources, manage complex grid operations, and maintain its customer base provides a sustainable advantage in the energy sector.

The company's extensive infrastructure, including generation capacity and transmission networks, provides a significant barrier to entry for new utility companies. Its widespread reach across Greece ensures a stable revenue stream. This established infrastructure is a key element in the competitive landscape of public power companies.

Decades of operation as the national electricity provider have built strong brand equity, fostering customer trust and recognition. This brand loyalty gives the company an edge over competitors. The company's established customer base is a significant advantage in the market analysis of the energy sector.

The company is investing heavily in renewable energy sources (RES) to capitalize on the growing demand for clean energy. With a €9 billion investment plan by 2026, the company aims to increase its green energy capacity. This strategic move is crucial for meeting national decarbonization targets and staying competitive.

Ongoing digital transformation initiatives aim to enhance operational efficiencies and improve customer experience. These projects are designed to improve service delivery and strengthen the company's market position. Digital advancements are key for public power company strategic planning.

The company's competitive advantages include its vast infrastructure, strong brand recognition, and significant investments in renewable energy. These factors allow it to maintain a strong position in the power industry. The company's strategic focus on digital transformation further enhances its ability to compete effectively.

- Extensive Infrastructure: The company’s generation, transmission, and distribution networks provide a significant barrier to entry.

- Brand Equity: Decades of service have built strong customer trust and recognition.

- Renewable Energy Investments: A €9 billion investment plan by 2026 aims to increase green energy capacity to 8.9 GW.

- Digital Transformation: Initiatives to enhance operational efficiency and improve customer experience. For more insights, check out the Marketing Strategy of Public Power.

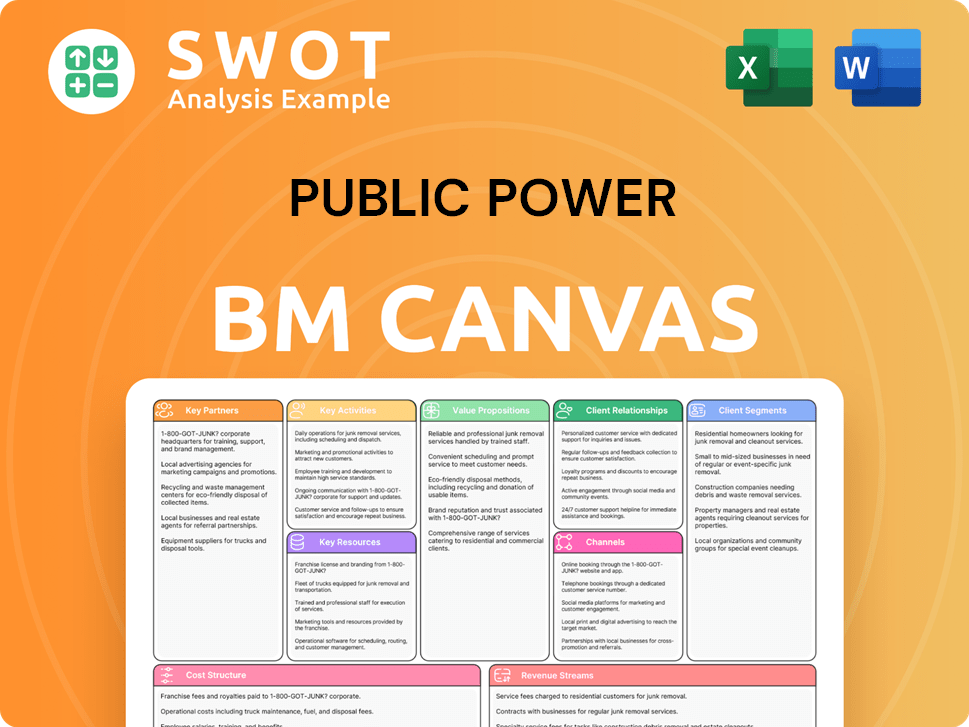

Public Power Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Public Power’s Competitive Landscape?

The competitive landscape for a public power company is undergoing significant transformation, driven by the global push for sustainable energy and evolving market dynamics. The power industry is experiencing heightened competition from both established utility companies and new entrants in the energy sector. This shift demands strategic adaptation and innovation to maintain market share and ensure long-term viability, as highlighted in a recent Target Market of Public Power analysis.

Key risks include regulatory changes, volatile commodity prices, and the need for substantial capital investments in renewable energy infrastructure. The future outlook hinges on the successful transition to a low-carbon energy system, the ability to integrate advanced technologies, and the development of customer-centric services. Public power companies must navigate these challenges by embracing digital transformation, enhancing operational efficiency, and fostering strategic partnerships.

The energy transition is a primary driver, with a focus on renewable energy sources (RES) and decarbonization. Regulatory changes, particularly from the EU, impact market liberalization and environmental standards. Geopolitical shifts and fluctuating commodity prices also play a significant role in the power industry.

Managing the transition from fossil fuels, especially coal-fired plants, is a major challenge. Compliance with stricter environmental regulations requires significant investment. Adapting to evolving consumer preferences for green energy and digital services is also crucial.

Aggressive investment in RES, such as the goal of 8.9 GW of installed RES capacity by 2026. Development of smart grid technologies, energy storage, and electric vehicle charging infrastructure. Regional expansion into neighboring markets offers growth potential.

Accelerated decarbonization, digital transformation, and customer-centricity are key strategies. The aim is to evolve from a traditional utility into a diversified, sustainable, and technologically advanced energy provider. Strategic partnerships and acquisitions are becoming increasingly important for growth.

The global renewable energy market is projected to reach $1.977.7 billion by 2030, growing at a CAGR of 9.8% from 2023 to 2030. Investments in smart grids are expected to reach $60 billion by 2027. The electric vehicle market is rapidly expanding, with sales of EVs expected to reach over 14 million units globally by 2025.

- The European Union aims to reduce greenhouse gas emissions by at least 55% by 2030.

- Many public power companies are increasing their investments in solar and wind energy projects.

- The demand for energy storage solutions is growing rapidly to support grid stability.

- Digitalization and smart technologies are transforming the power industry.

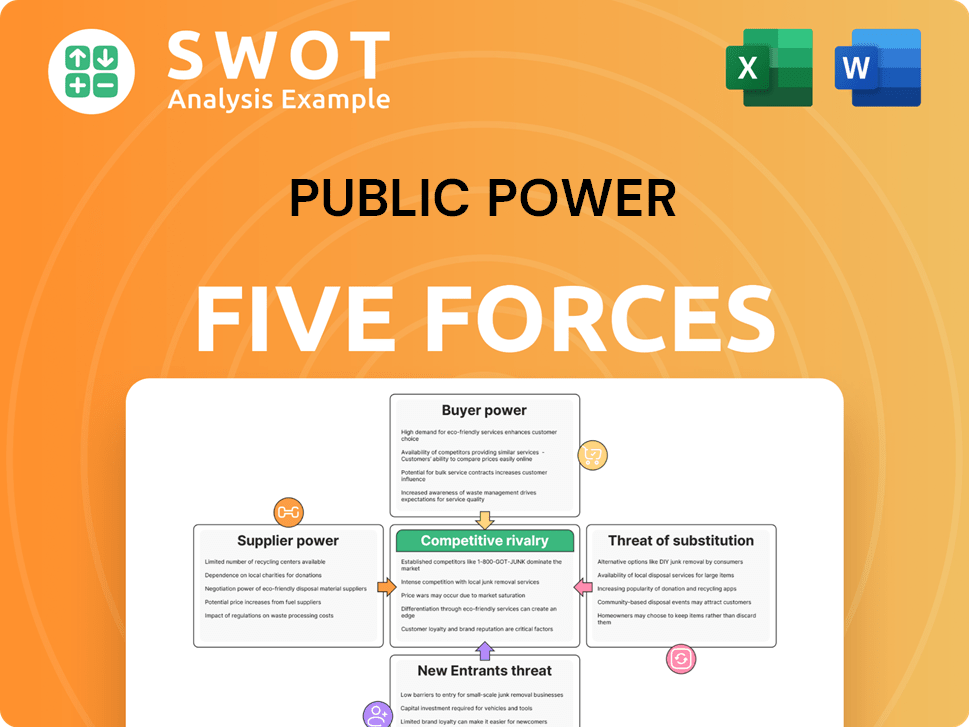

Public Power Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Public Power Company?

- What is Growth Strategy and Future Prospects of Public Power Company?

- How Does Public Power Company Work?

- What is Sales and Marketing Strategy of Public Power Company?

- What is Brief History of Public Power Company?

- Who Owns Public Power Company?

- What is Customer Demographics and Target Market of Public Power Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.