Public Power Bundle

How is PPC Navigating the Energy Transition?

Greece's Public Power Corporation (PPC) is at the forefront of a major energy transformation, making it a compelling case study for investors and industry watchers. As a leading Public Power SWOT Analysis reveals, PPC is strategically shifting its focus to renewable energy sources, moving away from traditional fossil fuels. This bold move is critical for understanding the future of energy provision in Southeastern Europe and beyond.

This exploration into the Public Power SWOT Analysis of PPC will dissect its operational structure, from electricity generation to customer supply, revealing how this public power company is adapting to the evolving demands of the global energy market. Understanding the utility services offered by PPC, and comparing it to other energy provider models, provides valuable insights into the challenges and opportunities facing municipal utility companies worldwide. The following sections will provide a detailed overview, addressing key questions like "How do public power companies generate electricity?" and exploring the public power company's commitment to renewable energy sources.

What Are the Key Operations Driving Public Power’s Success?

A public power company like the one in Greece, creates and delivers value by managing the entire electricity process. This includes generating power, moving it across high-voltage lines, distributing it to homes and businesses, and providing customer service. As a major energy provider, it plays a crucial role in the nation's infrastructure, serving a vast customer base.

The operational aspects are complex and highly integrated. The company manages different types of power plants, including those using thermal, hydroelectric, and renewable energy sources. They also maintain a large network of transmission lines and substations to ensure electricity reaches everyone efficiently. Furthermore, they focus on the distribution networks that deliver power to end-users, requiring constant maintenance and the implementation of smart grid technologies.

The company's effectiveness stems from its established infrastructure and deep market presence, built over decades. Ongoing investments in digitalization and smart grid technologies aim to boost efficiency, reduce losses, and improve customer service. For example, the company is implementing smart meters to enable more efficient energy management for its customers. If you're interested in learning more about the history of such entities, you can read a Brief History of Public Power.

The company generates electricity from various sources, including thermal (lignite, natural gas), hydroelectric, and renewable energy facilities. It manages power plants and ensures a diverse energy mix to meet demand. This diversified approach helps in managing risks associated with fuel prices and environmental regulations.

The company operates a vast network of high-voltage lines and substations for transmission, ensuring electricity moves efficiently across the country. It also manages lower-voltage distribution networks that deliver electricity to homes and businesses. This involves continuous maintenance and the integration of smart grid technologies.

Customer service and billing are critical components. The company supplies electricity to residential, commercial, and industrial customers. Efficient customer service and billing systems are essential for customer satisfaction and operational effectiveness.

The supply chain for thermal power generation involves sourcing fuels. For renewable energy expansion, partnerships are crucial for equipment procurement and project development. Managing these supply chains effectively is vital for cost control and sustainability.

The company's value proposition is built on reliable electricity supply, efficient operations, and customer-focused services. It focuses on delivering affordable and sustainable energy solutions to its customers. This includes investing in renewable energy sources and smart grid technologies to improve efficiency.

- Reliable Electricity: Ensuring a consistent and dependable power supply to meet the needs of its customers.

- Efficient Operations: Optimizing its generation, transmission, and distribution processes to reduce costs and improve performance.

- Customer Focus: Providing excellent customer service and implementing technologies like smart meters for better energy management.

- Sustainable Energy: Increasing the use of renewable energy sources to reduce its environmental impact and promote sustainability.

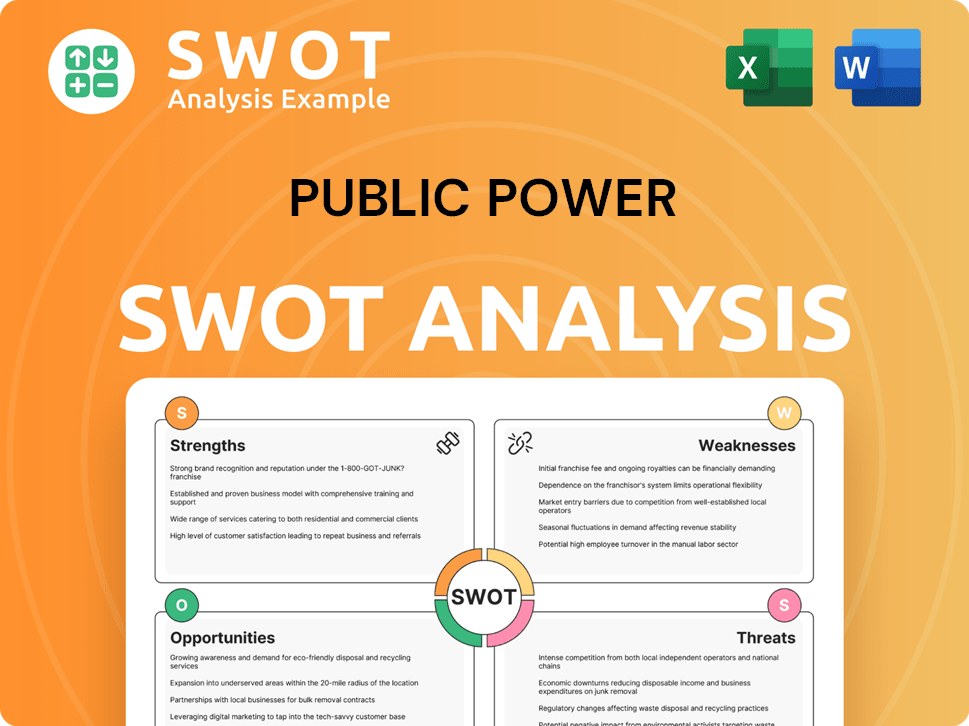

Public Power SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Public Power Make Money?

The revenue streams and monetization strategies of a Public Power Company are primarily centered on the sale of electricity. This includes providing electricity to residential, commercial, and industrial customers. The company's financial performance is significantly influenced by these core operations.

The main source of revenue for a Public Power Company is the sale of electricity to its diverse customer base. This revenue is generated through regulated tariffs, which are set by the Greek regulatory authority (RAE). In 2023, the company reported total revenues of €10.2 billion, highlighting its substantial financial scale and market presence.

Beyond basic electricity sales, the company is expanding its monetization strategies to include other areas. These strategies involve network charges for electricity transmission and distribution, which are also regulated. The company is also increasing revenue from its growing portfolio of renewable energy assets.

The company is exploring new revenue opportunities through energy services, such as smart home solutions, energy efficiency services, and electric vehicle (EV) charging infrastructure. This diversification aims to increase revenue streams and provide additional value to customers.

- Revenue from network charges for electricity transmission and distribution.

- Sales of electricity generated from renewable energy sources, often under long-term power purchase agreements (PPAs).

- Revenue from energy services, including smart home solutions and energy efficiency programs.

- Income from EV charging stations, contributing to the development of sustainable energy solutions.

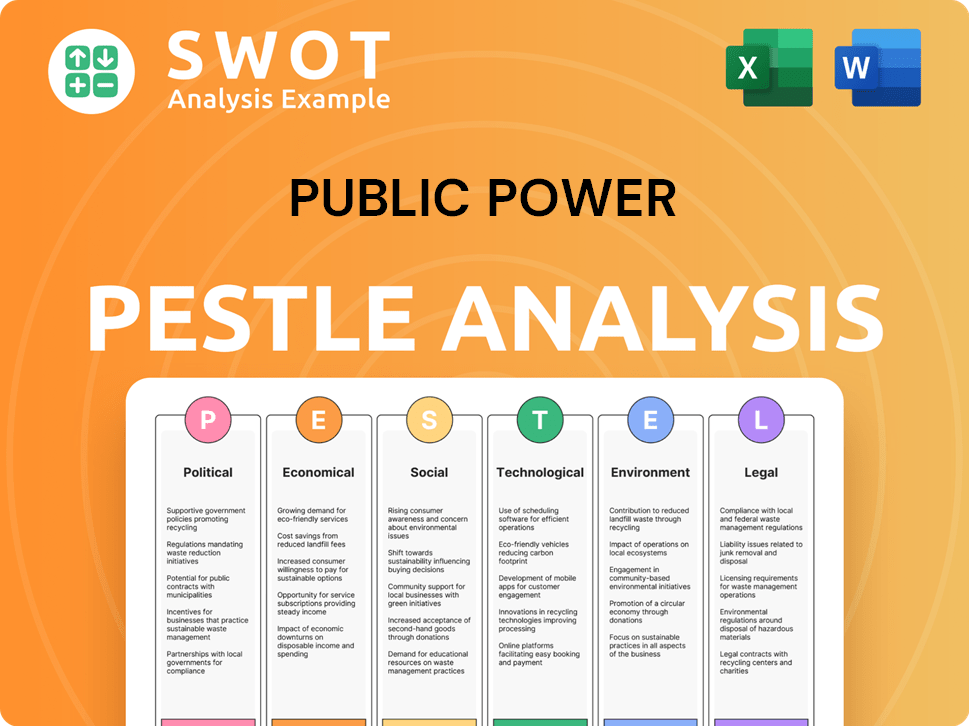

Public Power PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Public Power’s Business Model?

The focus on key milestones, strategic moves, and competitive advantages is crucial for understanding the trajectory of a Public Power Company. Recent years have seen significant shifts, especially in the realm of decarbonization. This involves the accelerated closure of lignite-fired power plants, a strategic decision aimed at leading the green energy transition within the region.

A notable strategic move was the acquisition of Enel Romania in 2023 for €1.26 billion. This expansion into the Southeastern European market significantly boosted its customer base and renewable energy capacity. Operational challenges include managing the transition away from lignite and ensuring energy supply security. The company's competitive advantages stem from its dominant market position and strong brand recognition.

The company is actively adapting to new trends by focusing on renewable energy development, energy storage solutions, and expanding its presence in the broader Balkan region. These strategic actions position the company for long-term growth and sustainability in a rapidly evolving energy landscape.

The company's decarbonization plan is a key milestone, aiming to largely phase out lignite-fired power plants. The acquisition of Enel Romania in 2023 for €1.26 billion was a major strategic expansion. These moves highlight the company's commitment to both environmental sustainability and market growth.

The accelerated closure of lignite plants and the acquisition of Enel Romania are strategic moves. Diversifying the generation mix and investing in renewables are also key. These actions are aimed at enhancing grid resilience and expanding the company's footprint.

The company's dominant market position in Greece and strong brand recognition provide a competitive edge. Ongoing investments in digital transformation and smart grid technologies enhance operational efficiency. Focusing on renewable energy and energy storage further strengthens its position.

Managing the transition from lignite and ensuring energy supply security pose operational challenges. Navigating volatile energy markets is also a concern. The company addresses these challenges through diversification and investments in grid resilience.

The acquisition of Enel Romania in 2023 added 3.1 million customers and 600 MW of renewable energy capacity. The company is actively adapting to new trends, focusing on renewable energy development and energy storage solutions. This expansion and focus are critical for maintaining a competitive edge in the evolving energy market.

- The company's strategic shift includes a strong emphasis on renewable energy sources.

- Investments in digital transformation and smart grid technologies are ongoing.

- The company aims to expand its presence in the broader Balkan region.

- The company's focus is on long-term growth and sustainability.

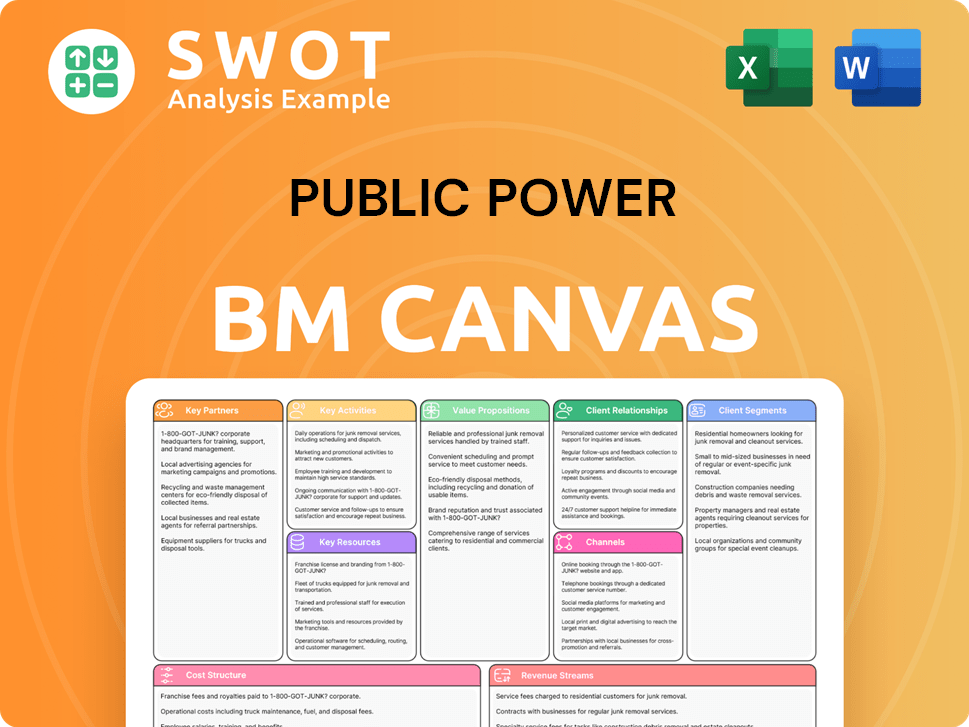

Public Power Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Public Power Positioning Itself for Continued Success?

In the Greek electricity market, the public power company holds a dominant position. It has a significant market share across generation, transmission, distribution, and supply. Customer loyalty remains high due to its long-standing presence and integrated services. The acquisition of Enel Romania has expanded its reach into Southeastern Europe, making it a regional player. If you're interested in understanding the target market of public power, this is a great place to start.

The company faces several key risks, including regulatory changes and supply chain disruptions. Technological advancements in renewable energy and storage present both opportunities and challenges. Increasing competition from independent power producers and energy retailers could also impact its market share. The company's strategic initiatives include investments in renewable energy, targeting 8.9 GW of installed RES capacity by 2030, and expanding into telecommunications through PPC Telecom.

The public power company is a major player in the Greek electricity market, controlling generation, transmission, distribution, and supply. It benefits from strong customer loyalty and a long-standing presence. The acquisition of Enel Romania has broadened its scope in Southeastern Europe, establishing it as a regional energy provider.

Key risks include regulatory changes in Greece and Romania, and potential supply chain disruptions. The energy sector's technological advancements, especially in renewable energy, bring both opportunities and risks. Competition from independent power producers and retailers could also affect its market share.

The company plans to sustain and expand profitability through its green energy transition and operational efficiency. It aims to leverage its expanded regional footprint to capture new market opportunities. The company is focused on further investments in renewable energy and digital services.

The company is investing in renewable energy, targeting 8.9 GW of installed RES capacity by 2030. It is expanding into telecommunications through PPC Telecom. The focus is on enhancing digital services and improving customer experience to drive future growth and market share.

The company's financial performance is closely tied to its ability to manage operational costs and adapt to market changes. The company's market share in Greece remains significant, influenced by its extensive infrastructure and customer base. The expansion into Romania is expected to contribute to overall revenue growth and market diversification.

- The company aims to increase its renewable energy capacity, with a goal of 8.9 GW by 2030.

- The company's digital transformation initiatives include enhancing customer service and operational efficiency.

- The company is focused on sustainable practices and reducing its carbon footprint.

- The company's strategic investments are geared towards long-term growth and market leadership.

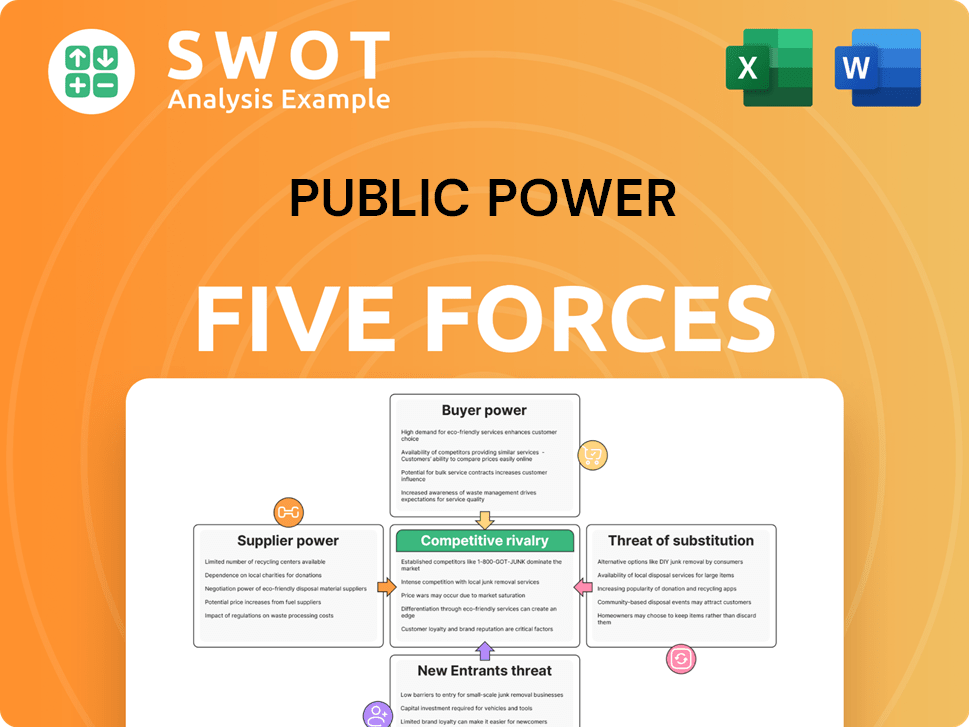

Public Power Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Public Power Company?

- What is Competitive Landscape of Public Power Company?

- What is Growth Strategy and Future Prospects of Public Power Company?

- What is Sales and Marketing Strategy of Public Power Company?

- What is Brief History of Public Power Company?

- Who Owns Public Power Company?

- What is Customer Demographics and Target Market of Public Power Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.