Public Power Bundle

Who Really Controls Public Power Corporation?

The energy sector is constantly evolving, and understanding who owns a Public Power SWOT Analysis is critical. The recent acquisition of Enel Romania by Public Power Corporation S.A. (PPC) for €1.24 billion highlights the importance of utility ownership. This strategic move underscores the dynamic shifts in the power company structure and its implications for the future of energy providers.

From its origins as a state-owned entity to its current mixed ownership model, PPC's journey reflects the broader trends in the energy market. Exploring the evolution of a Public Power SWOT Analysis helps us understand the benefits of public power companies. Analyzing how a Public Power SWOT Analysis affects investment decisions and strategic direction is key to grasping the intricacies of the energy landscape. This exploration will reveal the key players influencing PPC's future and its role as a municipal utility.

Who Founded Public Power?

The Public Power Corporation (PPC), a prominent public power company, was established in 1950. The Hellenic Republic, representing the Greek state, was its sole founder and initial owner. This structure was a direct result of post-World War II nationalization efforts.

At its inception, the Greek government held 100% ownership of PPC. This meant the state controlled all aspects of the company, from investments to operational directives. The primary goal was to develop and manage the country's electricity system, ensuring widespread access to power and supporting economic recovery.

There were no individual founders or early investors with equity stakes. PPC was created as a state-owned enterprise, not a private entity seeking external capital. Early agreements were governmental decrees that defined PPC's scope and responsibilities.

PPC was founded by the Greek state. The Hellenic Republic was the sole owner at the beginning.

Initially, the Greek government held 100% ownership. This allowed for centralized control and decision-making.

The company was created to develop and operate the country's electricity system. This was part of a broader effort to nationalize vital infrastructure.

Early agreements were primarily governmental decrees. These defined PPC's scope, responsibilities, and financial framework.

The government appointed the company's board and executive management. This ensured state control over the energy sector.

Any early 'ownership disputes' were political debates. These debates focused on energy policy and resource allocation.

The initial structure of PPC reflects the broader trend of publicly owned utility models. This model ensured that the power company structure was aligned with national interests.

- State Control: The Greek government held complete control.

- Centralized Management: All decisions were made by the state.

- No Private Investment: There were no early investors.

- Policy Focus: The primary goal was to ensure universal access to electricity.

- Funding: Public power companies are funded through a variety of means, including government allocations and revenue generated from electricity sales.

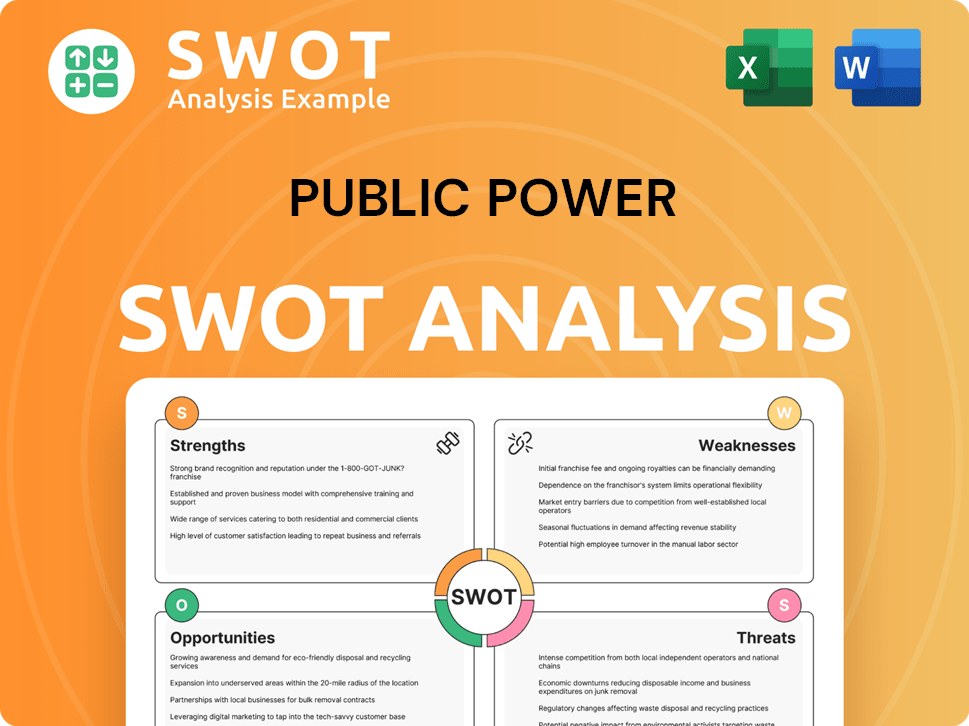

Public Power SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Public Power’s Ownership Changed Over Time?

The ownership of Public Power Corporation (PPC), a key energy provider, has evolved significantly. The initial public offering (IPO) in December 2001 marked a crucial shift, beginning the privatization process. This IPO allowed PPC to raise capital and modernize its operations, setting the stage for future changes in its ownership structure. The initial market capitalization after the IPO reflected PPC's importance in the Greek economy.

A major turning point occurred in November 2021, when the Greek state reduced its stake from 51.1% to 34.1% through a share capital increase and a private placement. This move aimed to enhance operational flexibility and align PPC with private sector governance standards. As of early 2025, the Hellenic Republic Asset Development Fund (HRADF), representing the Greek state, remains the largest shareholder with a 34.1% stake, demonstrating the ongoing transformation of utility ownership.

| Event | Date | Impact |

|---|---|---|

| Initial Public Offering (IPO) | December 2001 | Began privatization; raised capital for modernization. |

| Share Reduction by Greek State | November 2021 | Reduced state ownership to 34.1%; increased operational flexibility. |

| Acquisition of Enel Romania | Late 2023 | Expansion into international markets, reflecting strategic shifts. |

The current major stakeholders include a diverse group of institutional investors. CVC Capital Partners, a private equity firm, acquired a 10% stake in 2021, showing strategic interest in the Greek energy market. Other significant shareholders include various mutual funds and index funds. These changes have driven PPC towards greater financial discipline, increased focus on renewable energy investments, and international expansion, as highlighted by the Enel Romania acquisition in late 2023.

The shift in ownership of a public power company reflects broader trends in the energy sector. Key events, such as the IPO and subsequent stake reductions, have reshaped the company's strategic direction.

- Initial Public Offering (IPO) in 2001 started the privatization process.

- The Greek state reduced its stake in 2021, increasing private sector involvement.

- Institutional investors now hold significant shares, influencing strategic decisions.

- The acquisition of Enel Romania demonstrated international expansion.

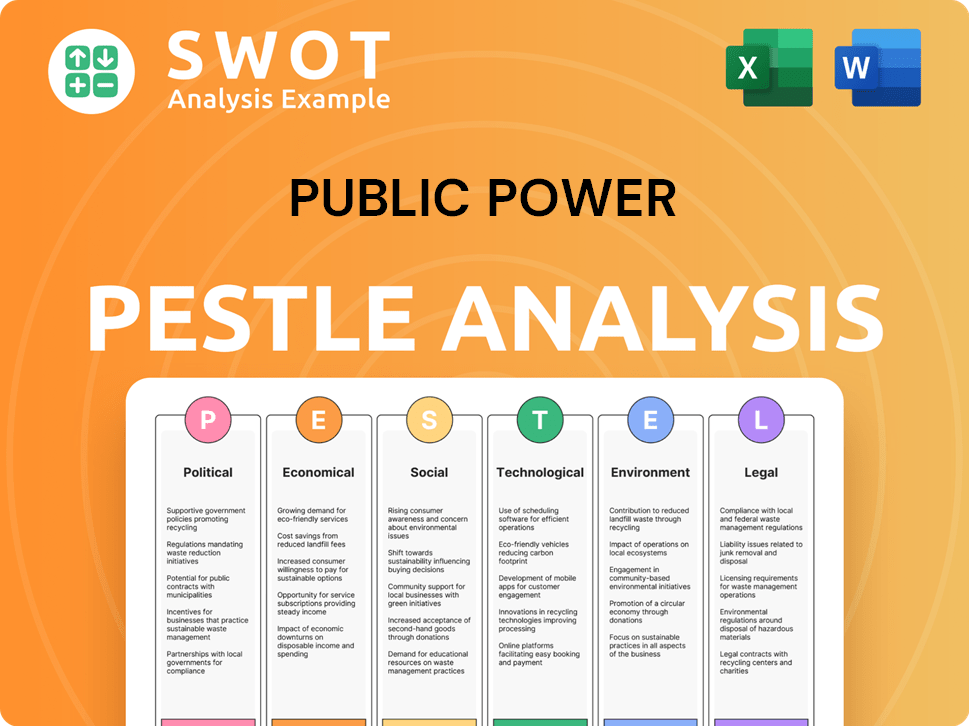

Public Power PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Public Power’s Board?

As of early 2025, the Board of Directors of the Public Power Corporation (PPC) reflects its mixed ownership model, with representatives from major shareholders, independent members, and executive directors. The board typically has between 11 and 13 members. The Greek state, through the Hellenic Republic Asset Development Fund (HRADF), holds the largest stake at 34.1%, significantly influencing board appointments, often holding seats proportional to its stake or through specific governance agreements. The Chairman of the Board is frequently a state appointee.

Key board members include those representing institutional investors such as CVC Capital Partners, which, with its 10% stake, would typically have a representative or significant influence on at least one board member's appointment. Independent directors are also appointed to ensure balanced perspectives and adherence to corporate governance best practices. Executive directors, including the CEO, are usually chosen for their industry expertise and strategic vision. Understanding the Marketing Strategy of Public Power can offer further insights into the company's operational framework.

| Board Member Category | Representation | Influence |

|---|---|---|

| Greek State (HRADF) | Largest Shareholder (34.1%) | Significant influence on appointments, strategic decisions |

| Institutional Investors (e.g., CVC Capital Partners) | Shareholder Representation (approx. 10%) | Board seat(s), influence on strategic direction |

| Independent Directors | Independent of Major Shareholders | Ensuring balanced perspectives, corporate governance |

PPC primarily operates under a one-share-one-vote structure for its ordinary shares. While the Greek state holds a substantial stake, no publicly disclosed special voting rights exist that grant disproportionate control beyond the 34.1% ownership. The state's strategic importance as the largest shareholder means its influence extends beyond voting power, often shaping long-term strategic decisions and regulatory interactions. The partial privatization in 2021 aimed to enhance corporate governance and reduce political interference, leading to a more market-oriented approach to management and investment decisions.

The board comprises representatives from major shareholders like the Greek state and institutional investors, alongside independent directors and executive directors. This structure aims to balance shareholder interests with independent oversight and operational expertise.

- The Greek state's significant stake ensures its influence on strategic direction.

- Independent directors provide oversight and ensure adherence to best practices.

- Executive directors bring industry expertise and strategic vision.

- The one-share-one-vote structure maintains a degree of shareholder equity.

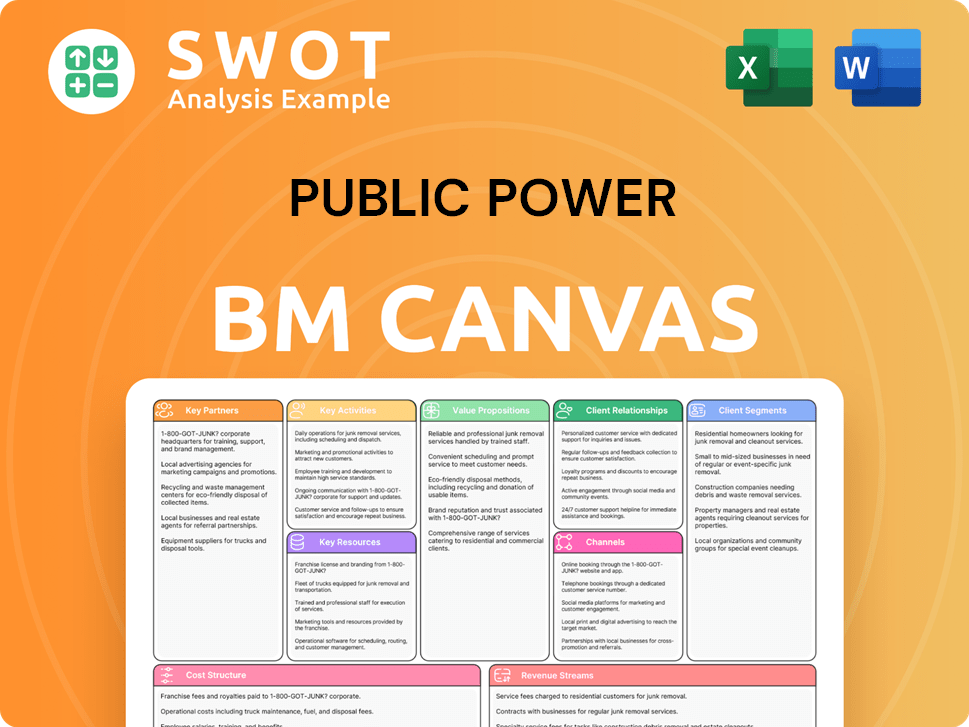

Public Power Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Public Power’s Ownership Landscape?

Over the past few years, the ownership structure of the Public Power Corporation (PPC) has seen significant shifts. A notable change was the share capital increase and private placement in November 2021, which reduced the Greek state's direct ownership from 51.1% to 34.1%. This move paved the way for increased institutional ownership, with major international funds and private equity firms becoming more prominent shareholders. This shift signaled a move towards a more market-driven corporate governance model for the public power company.

In October 2023, PPC acquired Enel Romania for €1.24 billion. This strategic expansion into the Romanian market aims to grow its presence in Southeast Europe and diversify its revenue streams. Such moves are likely to attract further investor interest and could lead to future capital raises or adjustments in ownership. The increasing trend of institutional ownership in utility companies, driven by stable cash flows and a focus on renewable energy, aligns with ESG investment mandates, further influencing the power company structure.

| Ownership Change | Details | Impact |

|---|---|---|

| Share Capital Increase (Nov 2021) | Greek state ownership reduced from 51.1% to 34.1% | Increased institutional ownership; more market-driven governance. |

| Acquisition of Enel Romania (Oct 2023) | Acquisition for €1.24 billion | Expansion in Southeast Europe; potential for further investment and ownership adjustments. |

| Industry Trend | Growing institutional ownership in utilities | Driven by stable cash flows and focus on renewable energy |

The utility ownership landscape is evolving. The company's commitment to a green energy transition, with significant investments in renewable energy sources, is expected to attract long-term institutional investors focused on sustainable investments. While no immediate plans for further significant ownership changes or full privatization have been announced as of early 2025, the company's strategic growth and financial performance will continue to shape its shareholder base. For more information on how these companies operate, consider reading about the Target Market of Public Power.

Institutional investors are increasingly attracted to utility companies. This is due to their stable financial performance and focus on renewable energy. This trend is expected to continue.

The energy sector is seeing consolidation through mergers and acquisitions. This can lead to changes in major shareholders. Activist investors may also become a factor.

PPC's focus on renewable energy is a key strategic direction. This attracts investors who prioritize sustainable investments. This is a long-term strategic goal.

The company's strategic growth and financial performance will shape its shareholder base. Further ownership changes are possible. This is a dynamic situation.

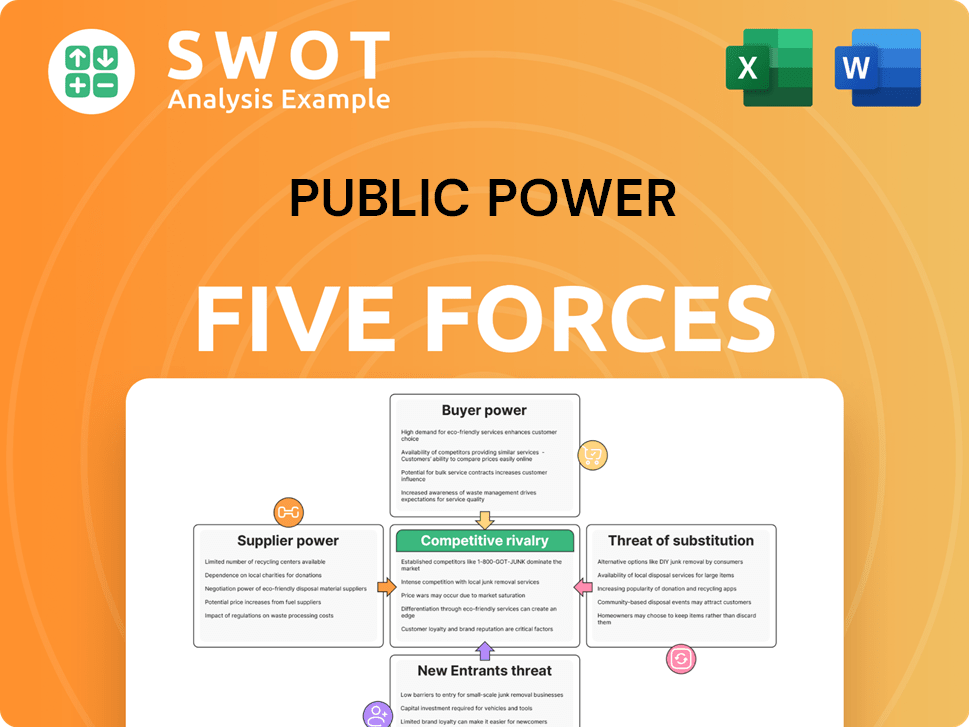

Public Power Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Public Power Company?

- What is Competitive Landscape of Public Power Company?

- What is Growth Strategy and Future Prospects of Public Power Company?

- How Does Public Power Company Work?

- What is Sales and Marketing Strategy of Public Power Company?

- What is Brief History of Public Power Company?

- What is Customer Demographics and Target Market of Public Power Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.