Public Power Bundle

Can PPC Power Its Way to Future Dominance?

Public Power Corporation (PPC), a cornerstone of the Greek energy sector, has undergone a remarkable transformation since its inception. From its humble beginnings electrifying Greece, it has evolved into a major player in the Public Power SWOT Analysis, actively expanding its footprint across Southeastern Europe. This evolution sets the stage for an exciting exploration of its future.

This analysis delves into the Public Power SWOT Analysis, exploring PPC's strategic initiatives, including its recent international acquisitions and ambitious renewable energy projects. We'll examine the Public Power SWOT Analysis, the Public Power SWOT Analysis, and the Public Power SWOT Analysis, to determine how PPC plans to navigate the evolving energy sector and achieve its Public Power SWOT Analysis and Public Power SWOT Analysis in the face of challenges. The Public Power SWOT Analysis will provide actionable insights into the Public Power SWOT Analysis and Public Power SWOT Analysis.

How Is Public Power Expanding Its Reach?

The Mission, Vision & Core Values of Public Power company is aggressively pursuing expansion, focusing on renewable energy and international markets to bolster its growth strategy. This strategic approach aims to capitalize on the evolving energy landscape and meet the growing demand for sustainable power solutions. These initiatives are critical for the company's future prospects and long-term success.

A key component of the expansion strategy involves significant investments in renewable energy projects. By increasing its capacity in this sector, the company aims to diversify its revenue streams and reduce its carbon footprint. This focus aligns with global trends and regulatory changes that favor cleaner energy sources. The utility company is strategically positioning itself to become a leader in the energy sector.

The company's expansion plans are designed to create value for stakeholders, including investors, customers, and the environment. These initiatives support the company's commitment to sustainability and responsible growth. The strategic planning process includes detailed market analysis to identify the most promising investment opportunities and mitigate potential challenges.

A major step in international growth was the acquisition of Enel Group's Romanian assets in 2023 for €1.3 billion. This included a 3.1 GW solar PV pipeline and 2.3 GW of wind projects. This move expanded the company's footprint in Southeast Europe, bringing its total enterprise value to around €1.9 billion.

The company is also targeting expansion into Italy and Croatia. It signed a cooperation framework agreement with Mytilineos Energy and Metals in April 2024. This agreement is to develop and construct 2 GW of solar PV assets across Southeastern Europe, valued at up to €2 billion.

Domestically, the company is undertaking substantial projects, including the second stage of constructing a 490 MW solar power plant in Megalopolis. The first 125 MW phase is due for completion in 2025, with the second 125 MW phase having begun in March 2025, and the final 240 MW phase scheduled for 2026.

In September 2024, the company acquired 66.6 MW of operational renewable energy sources (RES) and a pipeline of up to 1.7 GW under development in Greece. This was from the Copelouzos and Samaras groups for a total consideration of €106 million in cash and €70 million in shares. This includes wind and PV parks.

These initiatives are driven by a strategy to access new customers, diversify revenue streams, and stay ahead of industry changes. The company aims to nearly double its renewable energy capacity to 11.8 GW by 2027. The company also plans to invest €10 billion by 2027 to upgrade its distribution network.

- Expansion into Italy, Croatia, and other Southeastern European countries.

- Development of large-scale solar and battery storage projects in Greece.

- Significant investment in upgrading the distribution network.

- Focus on renewable energy to meet sustainability goals.

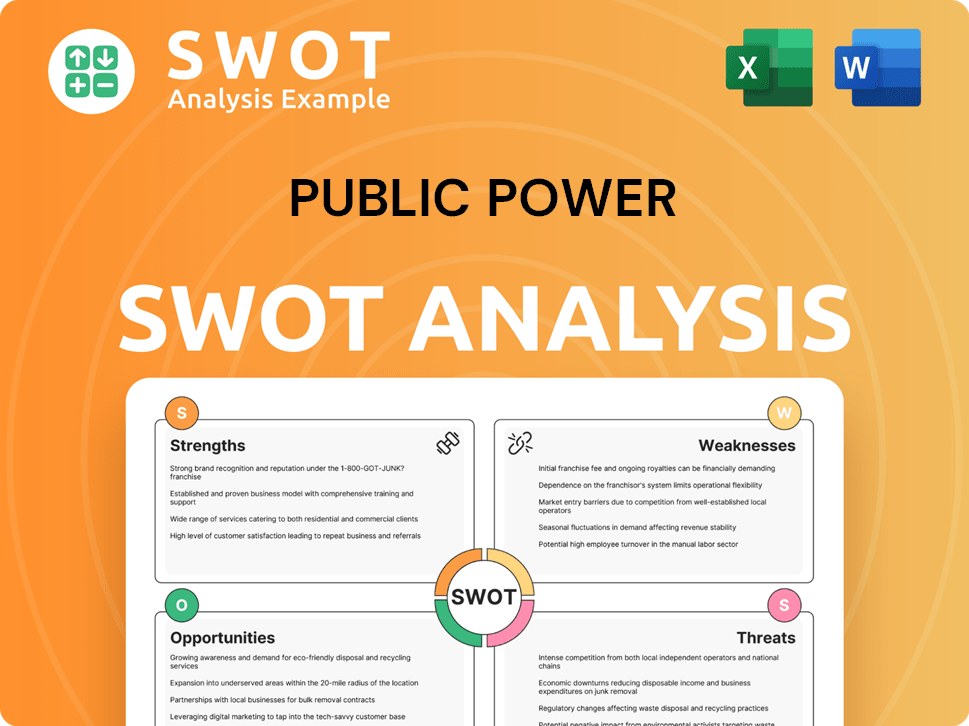

Public Power SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Public Power Invest in Innovation?

The strategic focus of a Public power company on innovation and technology is crucial for its growth strategy and future success. This involves significant investments in digital transformation, automation, and advanced technologies, particularly in renewable energy and data infrastructure. This approach is essential for adapting to evolving market demands and regulatory changes within the energy sector.

The Future prospects of the company are closely tied to its ability to integrate new technologies and expand into emerging markets. This includes developing data centers, investing in e-mobility, and modernizing its grid infrastructure. These initiatives are designed to enhance operational efficiency, increase customer satisfaction, and drive sustainable growth.

The company's commitment to innovation is demonstrated by its substantial R&D investments and collaborations. As part of its strategic plan, the company aims to become a leading 'powertech group' by raising investments to €3 billion with a focus on renewable energy.

The company is heavily investing in the data center and artificial intelligence (AI) market. A €5 billion project is underway to develop data centers in former lignite mines in Western Macedonia. The first large data center is planned to have a 300 MW capacity, with potential expansion to 1 GW.

The planned mega data center at the Agios Dimitrios power plant will be powered entirely by behind-the-meter green energy. The company is investing €2.3 billion into this initiative, pending final agreements with hyperscalers. This project leverages advantages like land ownership, existing grid infrastructure, cooling water supply, and ultra-fast connectivity via PPC FiberGrid.

The company is developing Battery Energy Storage Systems (BESS) in Western Macedonia. Facilities like Melitis 1 have a 48 MW capacity and 96 MWh of storage. This integration of renewable energy and storage is crucial for the company's sustainable growth strategy.

Digital transformation efforts include integrating smart meters and e-mobility solutions to enhance operational efficiency and customer satisfaction. The acquisition of Kotsovolos, an electronics retailer, positions the company as an integrated provider of energy-related products and services.

Strategic partnerships, such as the joint venture with RWE to build a 450 MWp solar project in Greece, contribute significantly to the company's growth objectives. These collaborations support the company's leadership in the energy transition and expand its renewable energy projects.

The company is also investing in e-mobility, energy storage, and grid modernization. This includes the development of Battery Energy Storage Systems (BESS) and integrating smart meters. These investments are crucial for the company's long-term sustainability initiatives.

The company's technological advancements are central to its Public power company growth strategies. These advancements are designed to improve efficiency, reduce costs, and enhance the customer experience. The company's strategic investments in renewable energy and data infrastructure are key to its future success.

- Data Center Development: A €5 billion project for data centers in Western Macedonia, with the first center planned at 300 MW capacity.

- Renewable Energy: A joint venture with RWE to build a 450 MWp solar project in Greece.

- Energy Storage: Development of Battery Energy Storage Systems (BESS) in Western Macedonia, such as Melitis 1.

- Digital Transformation: Integration of smart meters and e-mobility solutions to improve operational efficiency.

- Strategic Partnerships: Collaborations to expand renewable energy projects and enhance market presence.

These initiatives align with the company's broader strategic goals, as discussed in Brief History of Public Power. The company's focus on innovation and technology is a key driver for its Public power company's market analysis and investment opportunities.

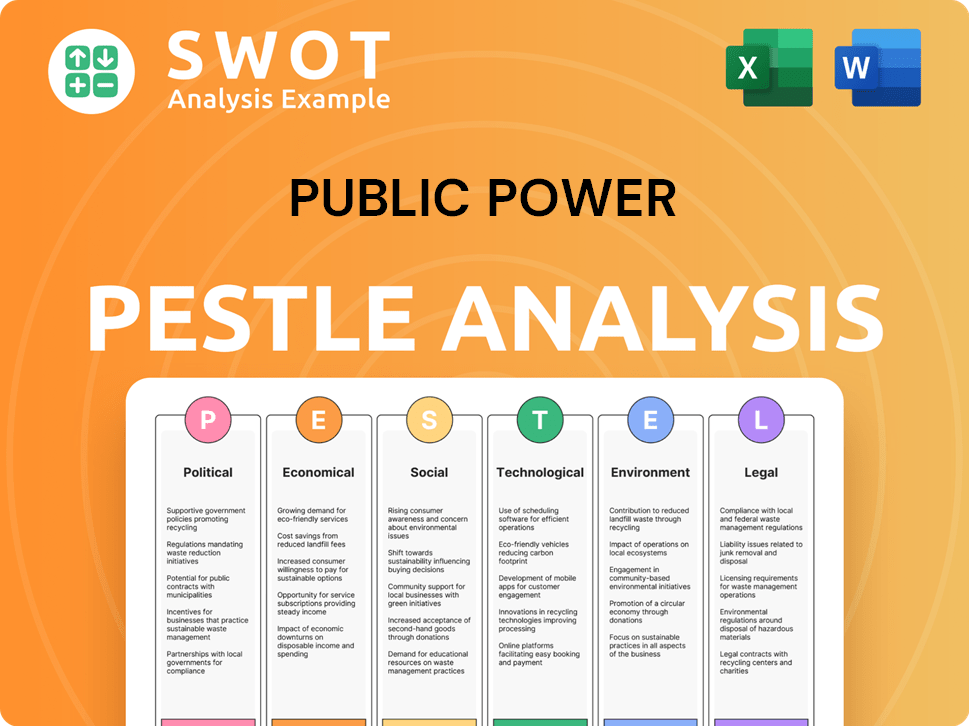

Public Power PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Public Power’s Growth Forecast?

The financial outlook for a Public power company is promising, driven by substantial investments and ambitious growth targets. The company's strategic focus on renewable energy and network modernization is expected to fuel significant financial improvements in the coming years. This commitment to sustainable energy sources and infrastructure upgrades positions the company well for long-term success in the evolving energy sector.

The company's 2025 financial goals include achieving an adjusted EBITDA of €2 billion and an adjusted net income exceeding €400 million. These targets reflect a strong performance trajectory, building upon the €1.8 billion adjusted EBITDA reported for 2024, which represented a considerable increase from the previous year. The company's strategic planning emphasizes financial prudence while pursuing aggressive expansion and sustainability goals.

In the first quarter of 2025, the company invested €480 million, with approximately 89% allocated to renewable energy projects and grid enhancements. The company aims to invest an additional €3.5 billion in 2025, with a total investment of €10 billion planned by 2027, primarily for upgrading its distribution network and increasing renewable power capacity to 11.8 GW. These investments are crucial for achieving its strategic objectives and ensuring future growth.

The company's financial strategy includes a commitment to shareholder returns. The company plans to distribute a dividend of €0.6 per share for 2024, a 140% increase compared to the previous year. This follows a proposed dividend of €0.40 per share for 2024, a 60% rise from 2023.

Capital expenditure for 2024-2026 is forecast to accelerate to an average of €2.5 billion-€3.0 billion per year, with 44% dedicated to renewables and 27% to the distribution network, and about 38% of investments outside of Greece.

Despite increased investments, the company maintains a solid financial position, with leverage (Net debt/EBITDA) at 2.8x in 2024, well below its self-imposed ceiling of 3.5x. Adjusted debt is projected to reach about €10.2 billion by 2026 from €6.1 billion in 2023.

Funds From Operations (FFO) to debt is expected to remain stable at approximately 14.5% over 2024-2026, reflecting the company's ability to manage its financial obligations effectively while pursuing its growth strategy.

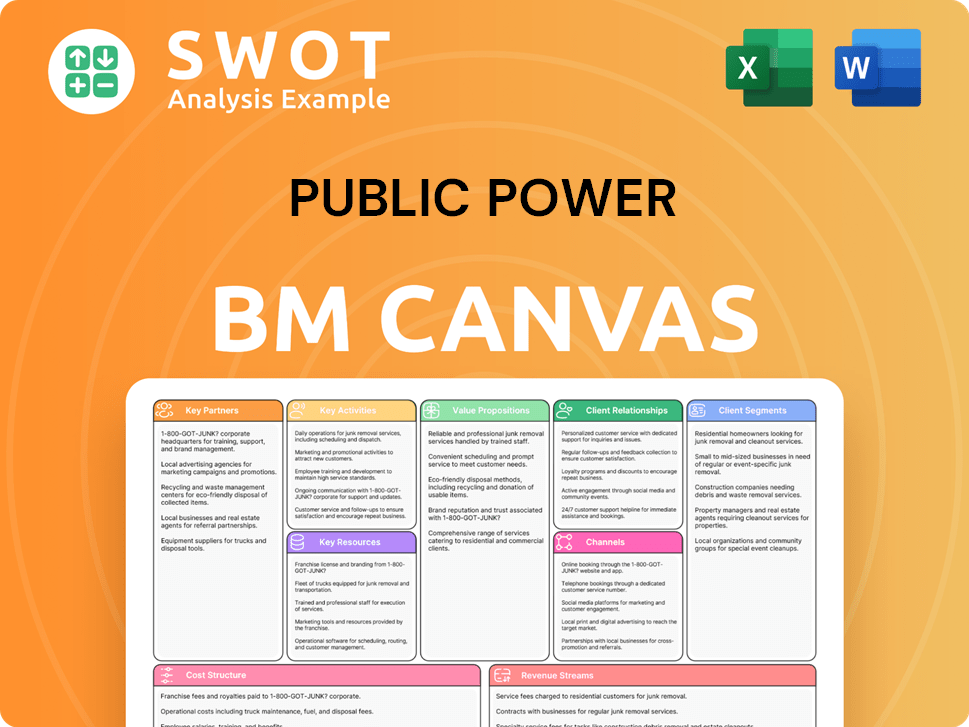

Public Power Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Public Power’s Growth?

The Public Power Company's (PPC) growth strategy faces several risks and obstacles. These challenges range from market competition and regulatory changes to supply chain issues and technological disruptions. Understanding these potential pitfalls is crucial for assessing the future prospects of this utility company.

Market competition is intensifying, with independent renewable energy producers offering consumers alternative options. Regulatory changes, geopolitical unrest, and technological advancements also pose significant challenges. The company must navigate these complexities to ensure sustainable growth and maintain its position in the energy sector.

PPC's strategic and operational risks include market competition, regulatory changes, and supply chain vulnerabilities. These factors can impact freight costs, production continuity, and project delays. The company's ability to adapt and mitigate these risks will be critical for its long-term success and growth strategy. Check out Revenue Streams & Business Model of Public Power to learn more.

Independent renewable energy producers are gaining ground, offering consumers alternative electricity options. This increased competition challenges PPC's market share and requires strategic adaptation to remain competitive in the energy sector. The rise of these competitors impacts the public power company's ability to maintain its customer base.

The regulatory landscape is dynamic, with measures like price caps being implemented to address energy prices. PPC has faced interventions and investigations by European authorities, highlighting the need for continuous adaptation to evolving regulations. These changes can affect the public power company's operations and financial performance.

Geopolitical unrest can impact freight costs, availability, and production continuity. Supply chain disruptions can lead to increased costs and project delays. These vulnerabilities underscore the need for robust supply chain management and diversification strategies for the utility company.

The development of renewable projects, grids, and storage faces permitting and grid connection constraints, leading to delays. These delays can impact the timeline and financial viability of projects. Addressing these constraints is critical for the public power company's renewable energy expansion plans.

The rapid pace of innovation requires continuous investment in new solutions. Staying ahead of technological advancements is crucial for maintaining competitiveness. The public power company must allocate resources to research and development to remain at the forefront of the energy sector.

As operations become increasingly digitalized, enhanced cybersecurity measures are needed to protect against threats. Cybersecurity threats, such as hacking attempts and data breaches, can disrupt operations and compromise sensitive information. Investing in robust cybersecurity infrastructure is essential for the public power company's long-term security.

High implementation costs associated with digital technologies and infrastructure projects can strain financial resources. The transition away from lignite requires significant capital allocation for plant conversions and land restoration. PPC aims to be lignite-free by 2026, two years earlier than the government's target, which requires significant investment.

Lower rainfall and weak wind conditions can impact renewable energy output and profitability. These conditions can affect the performance of renewable energy projects. The public power company must consider the impact of weather patterns on its renewable energy projects.

PPC addresses these risks through diversification, investing heavily in renewables, and modernizing its infrastructure. The company's diversified energy portfolio, including investments in storage and flexible generation, is expected to mitigate the impact of curtailments in renewable energy sources. Strategic planning and maintaining a strong financial position are essential for managing these challenges.

PPC manages risks through strategic planning, maintaining a strong financial position, and keeping leverage below its self-imposed ceiling. The company's financial health is crucial for navigating challenges and supporting its expansion plans. A strong financial foundation is essential for the public power company's long-term sustainability.

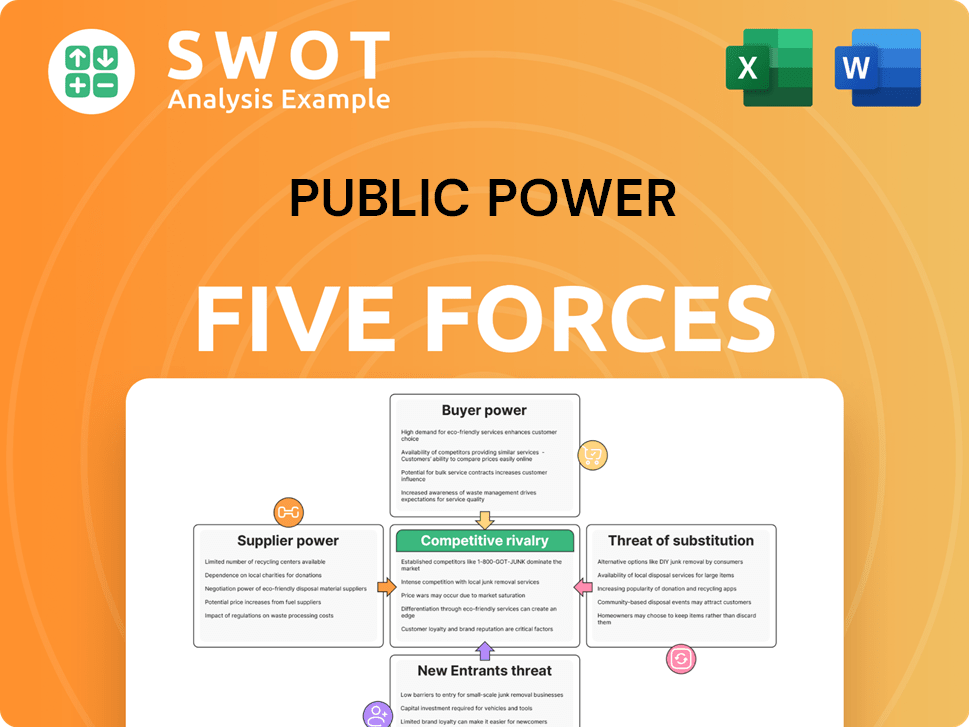

Public Power Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Public Power Company?

- What is Competitive Landscape of Public Power Company?

- How Does Public Power Company Work?

- What is Sales and Marketing Strategy of Public Power Company?

- What is Brief History of Public Power Company?

- Who Owns Public Power Company?

- What is Customer Demographics and Target Market of Public Power Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.