Dollar Tree Bundle

How Does Dollar Tree Stack Up in Today's Retail Wars?

In a retail world battling inflation and shifting consumer habits, Dollar Tree's strategic moves are under the microscope. The company's bold shift to a $1.25 price point has redefined its market position, making it a key player in the discount variety sector. This decision has sparked intense interest in its competitive standing, making a deep dive into the Dollar Tree SWOT Analysis crucial for understanding its future.

This analysis delves into the Dollar Tree competition, examining its rivals and the strategies that define its place in the dollar store industry. We'll explore the Dollar Tree market analysis, focusing on its competitive advantages and disadvantages within the discount retail landscape. Understanding Dollar Tree's business model and how it navigates the challenges of the market is key to grasping its potential for sustained success against its competitors.

Where Does Dollar Tree’ Stand in the Current Market?

Dollar Tree, Inc. carves out a significant market position within the discount retail sector, primarily targeting budget-conscious consumers. The company operates under the Dollar Tree, Family Dollar, and Dollar Tree Canada banners, boasting an extensive network of stores across North America. This broad presence allows it to cater to a wide range of customers in various geographic settings, solidifying its place in the dollar store industry.

The company's core offerings include a mix of consumables, variety merchandise, and home décor items. The Dollar Tree brand is known for its fixed-price model, with most items priced at $1.25, while Family Dollar offers a wider range of price points. This value-oriented approach is particularly appealing to consumers seeking affordability, a factor that has become increasingly important in the current economic climate. For a detailed look at their growth strategy, you can read about the Growth Strategy of Dollar Tree.

Dollar Tree's strategic decisions, such as raising its core price point and introducing multi-price point items, reflect its efforts to adapt to changing market conditions and enhance profitability. These moves, along with its vast store network, are key elements of its competitive strategy in the discount retail landscape.

As of February 3, 2024, Dollar Tree, Inc. operated a total of 16,774 stores across the U.S. and Canada. This includes 8,416 Dollar Tree stores and 8,358 Family Dollar stores. This expansive network is a key factor in its market reach and competitive advantage.

Dollar Tree's pricing strategy has evolved, with most items now priced at $1.25. The introduction of multi-price point items, including products up to $7, reflects an adaptation to rising costs and a broader merchandise assortment. This flexibility is crucial for competing in the discount retail landscape.

For fiscal year 2023, Dollar Tree, Inc. reported consolidated net sales of $31.0 billion, an 8.0% increase from the prior year. This financial performance demonstrates the company's resilience and ability to maintain its competitive edge in the face of challenges.

The company's primary product lines include consumables, variety merchandise, and home décor. Consumables are a significant part of their sales, with food, health and beauty, and everyday chemicals. Variety merchandise includes party supplies, seasonal decorations, stationery, toys, and gifts.

Dollar Tree's market position is characterized by its extensive store network, value-oriented pricing, and diverse product offerings. The company's ability to adapt its pricing and merchandise strategies is crucial for maintaining its competitive edge. This is especially true in the face of competition within the discount retail landscape.

- Extensive store network across the U.S. and Canada.

- Adaptable pricing strategy with a core focus on value.

- Diverse product offerings catering to various consumer needs.

- Strong financial performance, with increasing net sales.

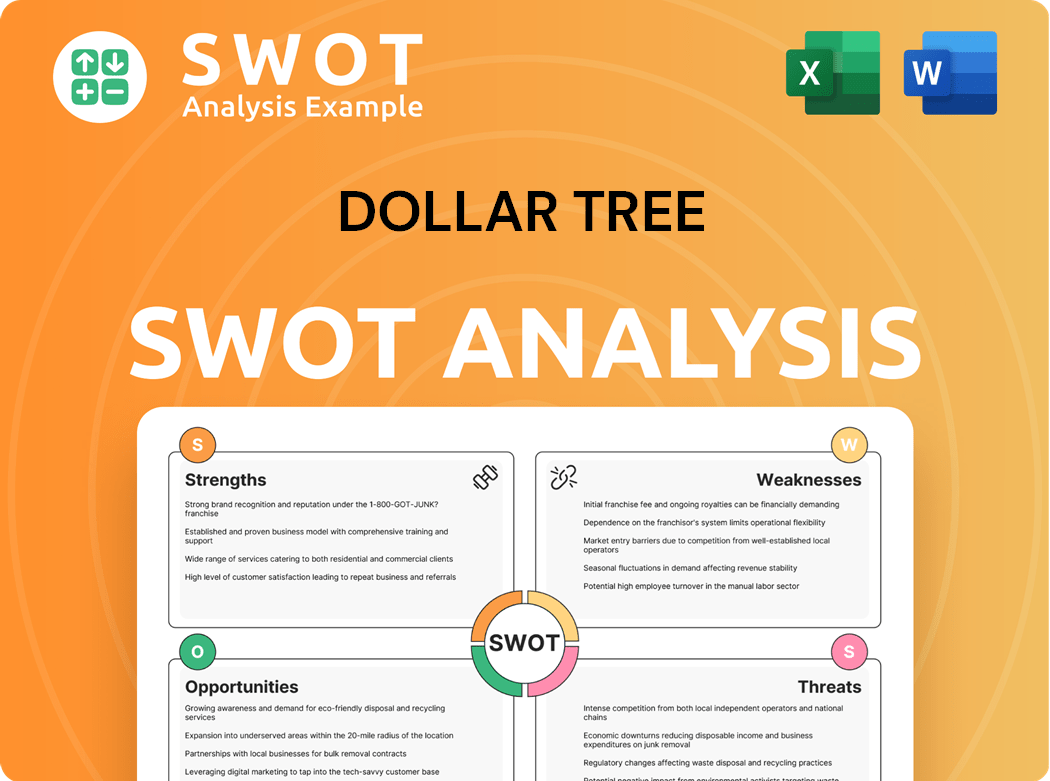

Dollar Tree SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Dollar Tree?

The competitive landscape for Dollar Tree, Inc. is multifaceted, encompassing a range of direct and indirect rivals within the discount retail sector. Understanding these competitors is crucial for a thorough Dollar Tree market analysis and assessing its strategic positioning. The company's ability to navigate this environment significantly impacts its financial performance and future growth.

The Dollar store industry is characterized by intense competition, particularly as consumers seek value-driven options. This environment necessitates continuous innovation in merchandising, pricing strategies, and operational efficiency. The discount retail landscape is dynamic, with evolving consumer preferences and economic conditions influencing the competitive dynamics.

Dollar Tree's business model, centered on a fixed-price strategy, faces challenges and opportunities within this competitive framework. The company's ability to adapt to changing market conditions and consumer demands is critical for maintaining and expanding its market share against its rivals.

Dollar Tree's most direct competitors include Dollar General and Five Below. These rivals directly compete for the same customer base.

Dollar General operates a vast network of stores, primarily in rural and suburban areas. It offers a wide range of products, including consumables, home goods, and apparel, at competitive prices. In 2024, Dollar General's net sales were approximately $37.8 billion.

Five Below targets a younger demographic with trendy items priced mostly between $1 and $5. This strategy provides a different approach to the discount retail landscape. As of early 2024, Five Below had over 1,600 stores.

Beyond direct rivals, Dollar Tree faces indirect competition from mass merchandisers, grocery stores, drugstores, and online retailers. These competitors impact Dollar Tree's market share.

Walmart and Target, with their larger formats and broader product assortments, pose a significant indirect threat. They leverage economies of scale and aggressive pricing strategies. Walmart's revenue in fiscal year 2024 was around $648 billion.

Grocery stores and drugstores compete for the consumables market, often offering promotions and loyalty programs. These strategies can divert customers from dollar stores. The grocery sector is highly competitive, with major players like Kroger and Albertsons.

Recent market dynamics, including inflation, have intensified competition. Both Dollar Tree and Dollar General are adjusting their strategies to capture more discretionary spending. Emerging players and private label brands further shape the competitive environment.

- Multi-Price Point Strategy: Dollar Tree has expanded its multi-price point offerings. This strategy aims to attract a broader customer base and increase sales.

- Fresh Produce: Dollar General has focused on offering fresh produce in some locations. This move directly competes with grocery stores and enhances its appeal.

- Private Label Brands: The increasing prevalence of private label brands across various retailers adds to the competitive pressure. These brands often offer lower prices.

- E-commerce: The rise of online discount retailers provides consumers with convenient alternatives. This increases the need for Dollar Tree to have a strong online presence. You can read more about the company's strategy in this article about Dollar Tree's competitive advantages and disadvantages.

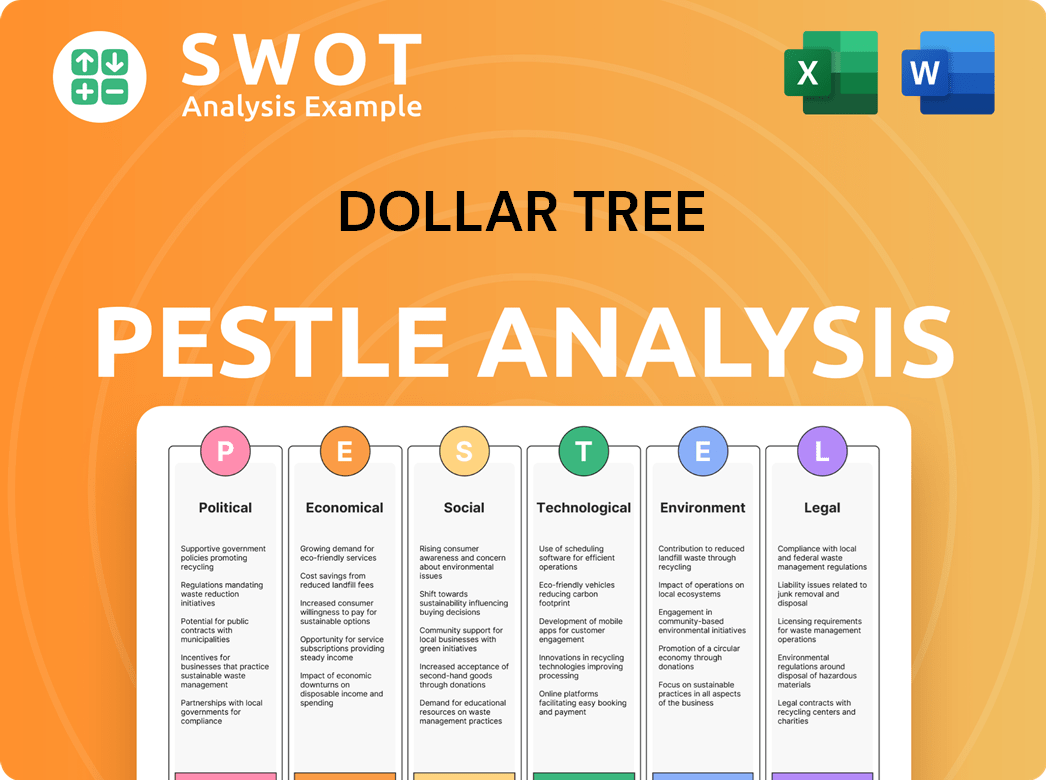

Dollar Tree PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Dollar Tree a Competitive Edge Over Its Rivals?

The competitive landscape for Dollar Tree is shaped by its unique business model and strategic initiatives. Key milestones include the acquisition of Family Dollar, which significantly broadened its market reach. Strategic moves focus on optimizing store formats and supply chains to enhance operational efficiency. These actions aim to strengthen Dollar Tree's competitive edge within the discount retail landscape.

Dollar Tree's primary competitive advantages stem from its pricing strategy, real estate footprint, and dual-brand approach. The company's focus on value, especially at its core Dollar Tree banner, has historically attracted budget-conscious consumers. Its extensive store network and efficient distribution system enable broad market penetration. These elements are crucial in the dynamic dollar store industry.

Understanding the Dollar Tree competition is vital for assessing its market position. The company faces competition from various discount retailers, including both dollar stores and larger retailers like Walmart. Analyzing its competitive strengths and weaknesses, alongside its financial performance, provides a comprehensive view of its market dynamics. The analysis of Target Market of Dollar Tree can help understand the company's customer base.

Dollar Tree's pricing strategy, initially centered on a $1 price point, has evolved to $1.25 and multi-price points, offering a clear value proposition. This strategy simplifies the shopping experience, fostering customer loyalty. The focus on affordability remains a key differentiator in the discount retail landscape.

The company's extensive real estate footprint, with thousands of stores, and efficient supply chain are significant strengths. This robust distribution network allows for efficient stocking and broad customer reach, including underserved areas. The ability to source merchandise at low costs enhances its competitive edge.

Dollar Tree's dual-brand strategy, encompassing both Dollar Tree and Family Dollar, provides a distinct advantage. Family Dollar offers a broader assortment of products, catering to a different demographic. This diversification allows Dollar Tree to capture a wider segment of the discount retail market.

Continuous efforts to optimize store formats, including 'Combo Stores,' aim to maximize sales and operational efficiencies. These efforts are designed to enhance the shopping experience and improve profitability. The company adapts to changing consumer preferences and economic conditions.

Dollar Tree's competitive advantages include its value-focused pricing, extensive store network, and the dual-brand strategy. These elements enable the company to compete effectively within the dollar store industry. The company's ability to source merchandise at low costs and its strategic store locations contribute to its market share.

- Pricing Strategy: The $1.25 price point, offering clear value.

- Store Network: Thousands of stores across the U.S. and Canada.

- Supply Chain: Efficient distribution and sourcing.

- Dual-Brand Strategy: Dollar Tree and Family Dollar.

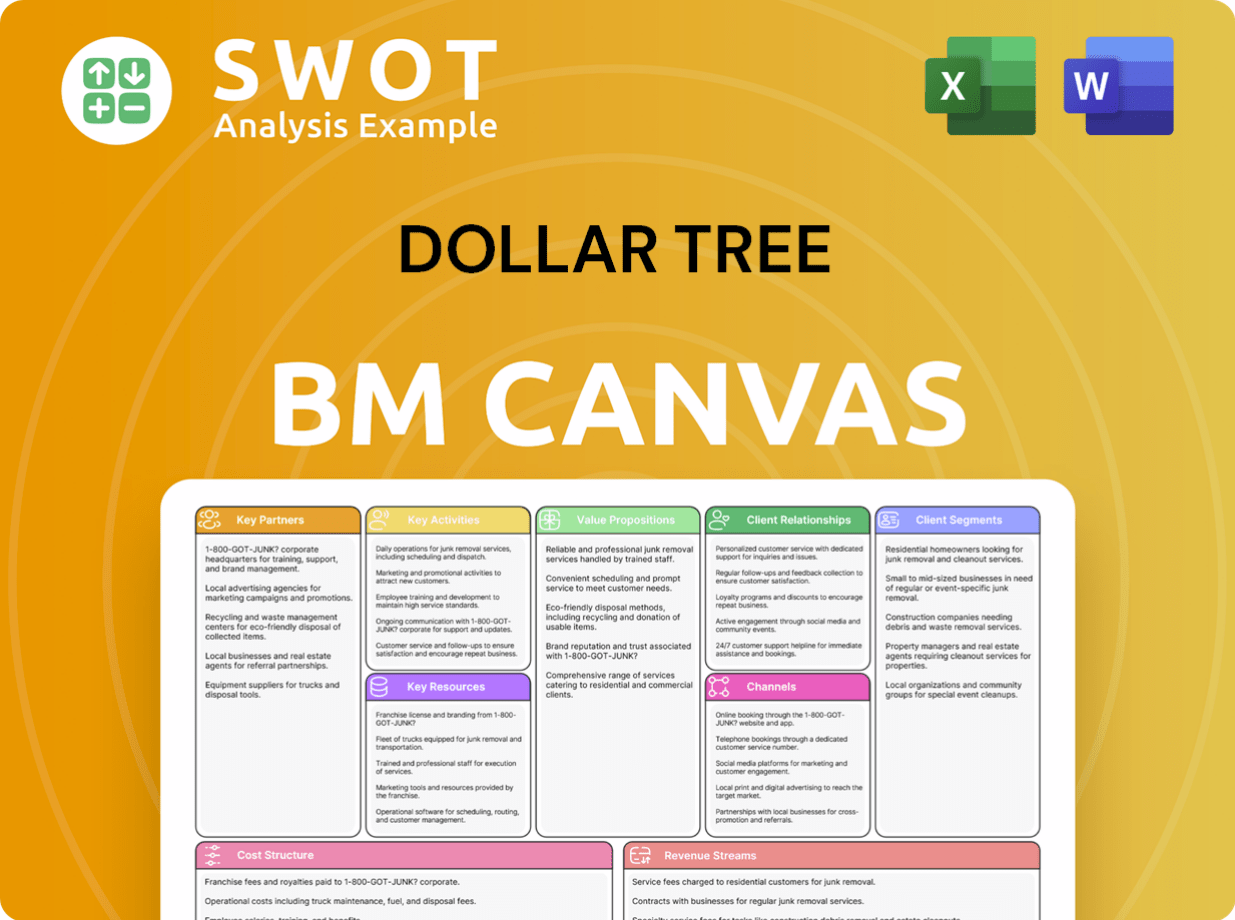

Dollar Tree Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Dollar Tree’s Competitive Landscape?

The discount retail sector is currently experiencing significant shifts, presenting both challenges and opportunities for Dollar Tree. Persistent inflation and evolving consumer preferences are key factors influencing the company's strategic decisions. Adapting to these trends is crucial for maintaining profitability and competitive positioning within the dynamic dollar store industry.

Looking ahead, Dollar Tree faces intensified competition and regulatory changes. However, opportunities exist in optimizing store formats, expanding into underserved markets, and leveraging data analytics. The company's ability to adapt its pricing strategies and innovate will be critical for future growth and maintaining its competitive resilience in the discount retail landscape.

Inflation continues to impact the discount retail landscape, affecting sourcing costs and profit margins. Changing consumer behaviors, including a demand for convenience and varied shopping experiences, are also crucial. The rise of e-commerce and omnichannel retail necessitates strategic integration for brick-and-mortar retailers.

Intensified competition from discount retailers, mass merchandisers, and grocery stores poses a challenge. Regulatory changes, especially those affecting labor costs and import tariffs, could impact profitability. The need to adapt and innovate store formats is critical for long-term success in the face of these challenges.

Optimizing store formats, such as 'Combo Stores', presents growth opportunities. Further expansion into underserved markets and refining the product mix to meet consumer needs are also key. Leveraging data analytics to enhance operational efficiency and personalize offerings can drive growth and improve market share.

Dollar Tree's move to a $1.25 price point and multi-price items provides flexibility in product assortment and potential margin improvements. Enhancing offerings, particularly within the Family Dollar banner, to include more consumables and better-for-you options is essential. Strategic partnerships or targeted online offerings can boost online presence.

Dollar Tree's ability to adapt to market dynamics is crucial for its competitive position. The company is working on enhancing its supply chain and store formats to navigate challenges. The company's strategic focus on value-conscious consumers and operational efficiency is vital.

- The discount retail landscape is highly competitive, with Dollar Tree competition coming from various sources.

- Strategic pricing adjustments and product assortment changes are vital for maintaining profitability.

- Enhancing the online presence and customer experience is essential for long-term success.

- For more details, you can read about the Brief History of Dollar Tree.

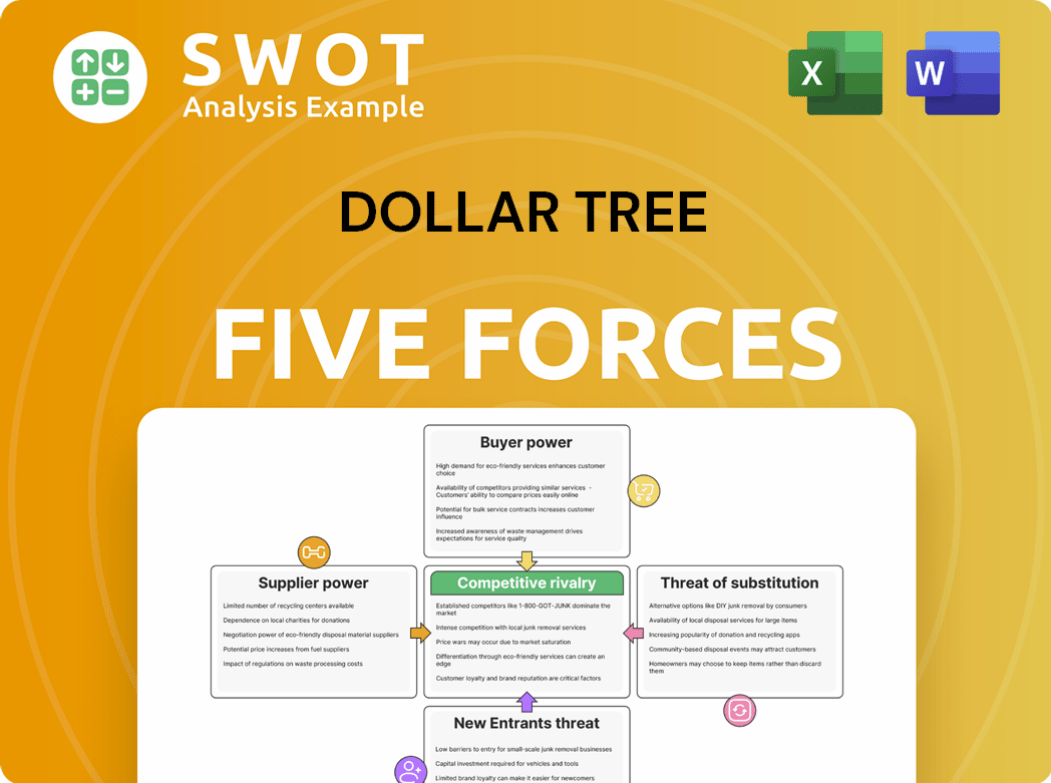

Dollar Tree Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Dollar Tree Company?

- What is Growth Strategy and Future Prospects of Dollar Tree Company?

- How Does Dollar Tree Company Work?

- What is Sales and Marketing Strategy of Dollar Tree Company?

- What is Brief History of Dollar Tree Company?

- Who Owns Dollar Tree Company?

- What is Customer Demographics and Target Market of Dollar Tree Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.