Dollar Tree Bundle

Who Really Owns Dollar Tree?

Understanding a company's ownership is crucial for grasping its strategic direction and potential for growth. The 2015 acquisition of Family Dollar by Dollar Tree, a deal valued at approximately $8.5 billion, fundamentally altered the discount retail landscape. This exploration provides a deep dive into the Dollar Tree SWOT Analysis, and the ownership structure that shapes its future.

Dollar Tree's journey, from its inception in 1986 as 'Only $1.00' to a publicly traded giant, offers valuable insights into corporate evolution. This analysis will uncover the Dollar Tree owner, the Dollar Tree parent company, and the key players influencing its trajectory. We'll examine the Dollar Tree history, including its strategic decisions and the impact of its Dollar Tree CEO and leadership on its Dollar Tree stock performance, providing a comprehensive view of this retail powerhouse.

Who Founded Dollar Tree?

The discount retail giant, now known as Dollar Tree, was founded in 1986. The company's origins trace back to a vision of offering a wide array of products, all priced at a single dollar, a concept that would redefine the discount retail landscape.

The founders of Dollar Tree, Macon F. Brock Jr., J. Douglas Perry, and H. Ray Compton, brought a wealth of experience to the venture. Their background in retail, particularly through their involvement with K&K Toys, provided a solid foundation for understanding consumer behavior and retail operations.

The initial focus was on closeout merchandise, but the company quickly evolved to offer a diverse selection of everyday items. This shift, coupled with the one-dollar price point, set Dollar Tree apart from competitors and fueled its early growth. The company's success is a testament to its founders' strategic vision and ability to adapt to market demands.

Dollar Tree was founded in 1986 as 'Only $1.00' by Macon F. Brock Jr., J. Douglas Perry, and H. Ray Compton.

The initial business model focused on offering a wide range of products, all priced at one dollar, a strategy that quickly proved successful.

Prior to Dollar Tree, Brock and Perry co-owned K&K Toys, a mall-based toy store chain. K.R. Perry's K&K 5&10 store was also a precursor.

The first 'Only $1.00' store opened in Dalton, Georgia.

In October 1991, the founders sold K&K Toys to focus on their discount operation.

The company rebranded to Dollar Tree Stores, Inc. in 1993, with Brock Jr. named CEO.

The early ownership of Dollar Tree was primarily held by the founders and a small group of investors. Macon Brock, J. Douglas Perry, and H. Ray Compton retained significant stakes, which gave them substantial control over the company's strategic direction. This structure allowed them to implement their vision and guide the company's growth during its formative years. Understanding the Target Market of Dollar Tree is crucial for appreciating the company's early success and its evolution.

The founders' experience in retail, particularly with K&K Toys, provided a solid foundation for Dollar Tree.

- The initial concept of selling everything for a dollar was a key differentiator.

- The founders' significant ownership stakes gave them control over strategic decisions.

- The company's early focus on closeout merchandise evolved into a broader assortment of goods.

- The sale of K&K Toys allowed the founders to concentrate fully on Dollar Tree.

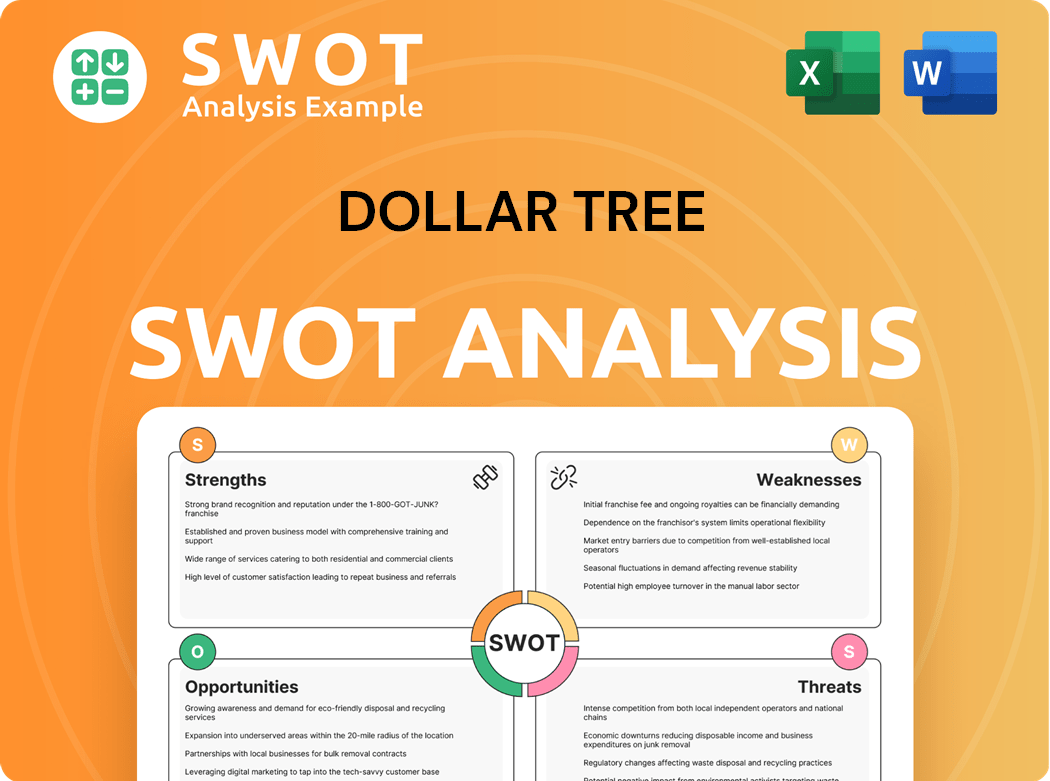

Dollar Tree SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Dollar Tree’s Ownership Changed Over Time?

The journey of Dollar Tree, Inc. into the public domain began on March 6, 1995. The company listed its shares on the NASDAQ exchange under the symbol 'DLTR', with an initial offering price of $15 per share. This IPO marked a significant shift, broadening the ownership base to include public shareholders and setting the stage for future growth. The initial market capitalization was approximately $225 million, which provided the company with capital for expansion and strategic initiatives.

As of June 2025, Dollar Tree, Inc. has a substantial institutional presence, with 1375 institutional owners and shareholders holding a total of 251,728,275 shares. The ownership structure includes a diverse mix of institutional investors, mutual funds, and individual investors. Key institutional shareholders include Vanguard Group Inc., BlackRock, Inc., Mantle Ridge LP, and T. Rowe Price Investment Management, Inc. These entities play a significant role in the company's strategic direction and financial performance.

| Year | Event | Impact |

|---|---|---|

| 1996 | Acquisition of Dollar Bill$, Inc. | Added 136 stores and expanded into three new states. |

| 1998 | Acquisition of 98-Cent Clearance Centers | Increased market presence in California. |

| 2000 | Purchase of Dollar Express and Greenbacks chains | Further expansion of store footprint. |

| 2006 | Acquisition of Deal$ from SuperValu, Inc. | Significant expansion of store count. |

| 2010 | Acquisition of Dollar Giant | Expansion into Canada, later rebranded as Dollar Tree Canada. |

| 2015 | Acquisition of Family Dollar | The largest acquisition, expanding market presence and diversifying offerings. |

The acquisition of Family Dollar in 2015 for $8.5 billion was a pivotal moment, reshaping the company's strategy and governance. This move led to a broader focus on multi-price point merchandise and a larger store footprint across North America. The evolution of Dollar Tree's ownership structure, driven by strategic acquisitions and its initial public offering, has significantly influenced its market position and operational approach. To understand how Dollar Tree markets itself, you can read about the Marketing Strategy of Dollar Tree.

Dollar Tree's ownership has evolved from its IPO in 1995 to include a diverse group of shareholders.

- Institutional investors hold a significant portion of the shares.

- Key acquisitions like Family Dollar have reshaped the company.

- The company's strategy has adapted to a multi-price point model.

- The company is listed on the NASDAQ exchange under the symbol 'DLTR'.

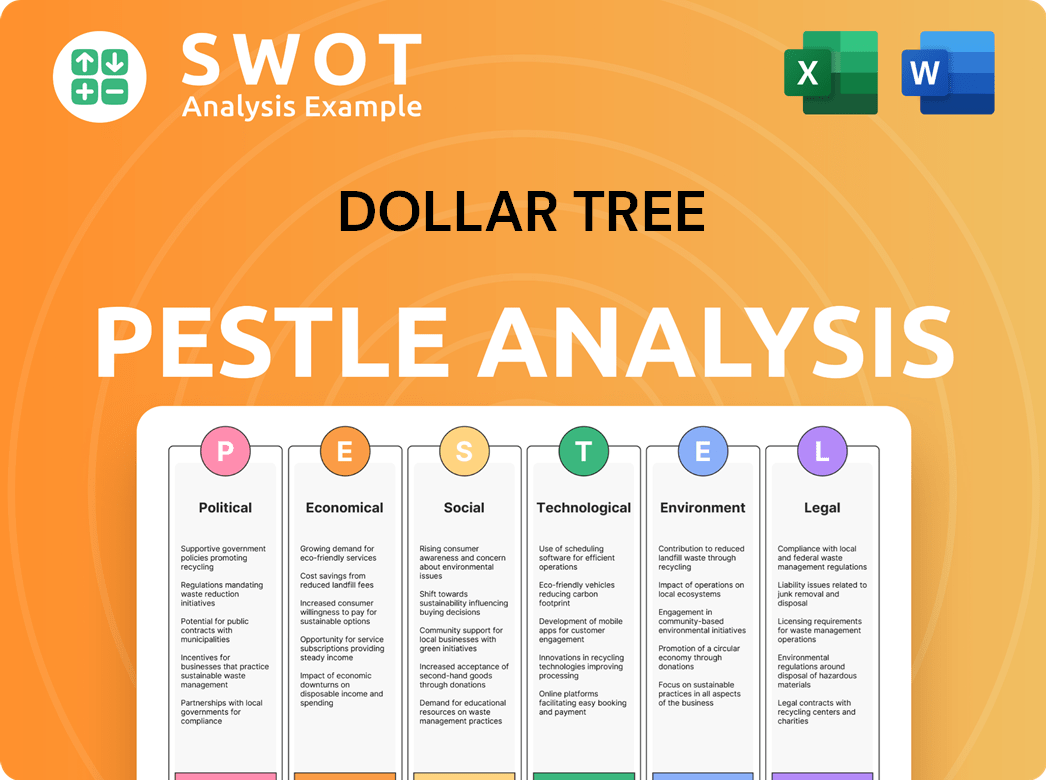

Dollar Tree PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Dollar Tree’s Board?

As of early 2025, the Board of Directors at Dollar Tree, Inc. is structured to ensure robust corporate governance and alignment with shareholder interests. The board is composed of a majority of independent directors, with ten out of eleven directors being independent. Edward (Ned) J. Kelly III serves as the Chairman of the Board. Recent appointments include CEO Michael C. Creedon Jr., William (Bill) W. Douglas III, and Timothy (Tim) Johnson.

The board's composition reflects a commitment to overseeing the company's strategic direction and ensuring accountability. These changes are part of Dollar Tree's strategy to maintain a strong leadership team and drive long-term shareholder value. The company's leadership transitions, including the appointment of Michael C. Creedon Jr. as CEO in December 2024, are designed to position Dollar Tree for continued success. Learn more about the Growth Strategy of Dollar Tree.

| Board Member | Title | Independent Director |

|---|---|---|

| Edward (Ned) J. Kelly III | Chairman of the Board | Yes |

| Michael C. Creedon Jr. | CEO | No |

| William (Bill) W. Douglas III | Director | Yes |

| Timothy (Tim) Johnson | Director | Yes |

The voting structure at Dollar Tree, a publicly traded company, typically operates on a one-share-one-vote basis for common stock. Directors are elected by a majority of the votes cast at a stockholder meeting, provided a quorum is present. Stockholders holding 15% or more of the voting power of outstanding common stock can request a special meeting. These mechanisms ensure that shareholders have a voice in the company's governance and strategic direction. The company's leadership changes, including the appointment of Stewart Glendinning as Chief Financial Officer in March 2025, are aimed at bolstering Dollar Tree's financial performance and strategic planning.

The Board of Directors at Dollar Tree is committed to strong corporate governance and aligning with shareholder interests.

- The board is composed of a supermajority of independent directors.

- Voting operates on a one-share-one-vote basis.

- Stockholders holding 15% or more of the voting power can request a special meeting.

- Recent leadership changes aim to drive long-term shareholder value.

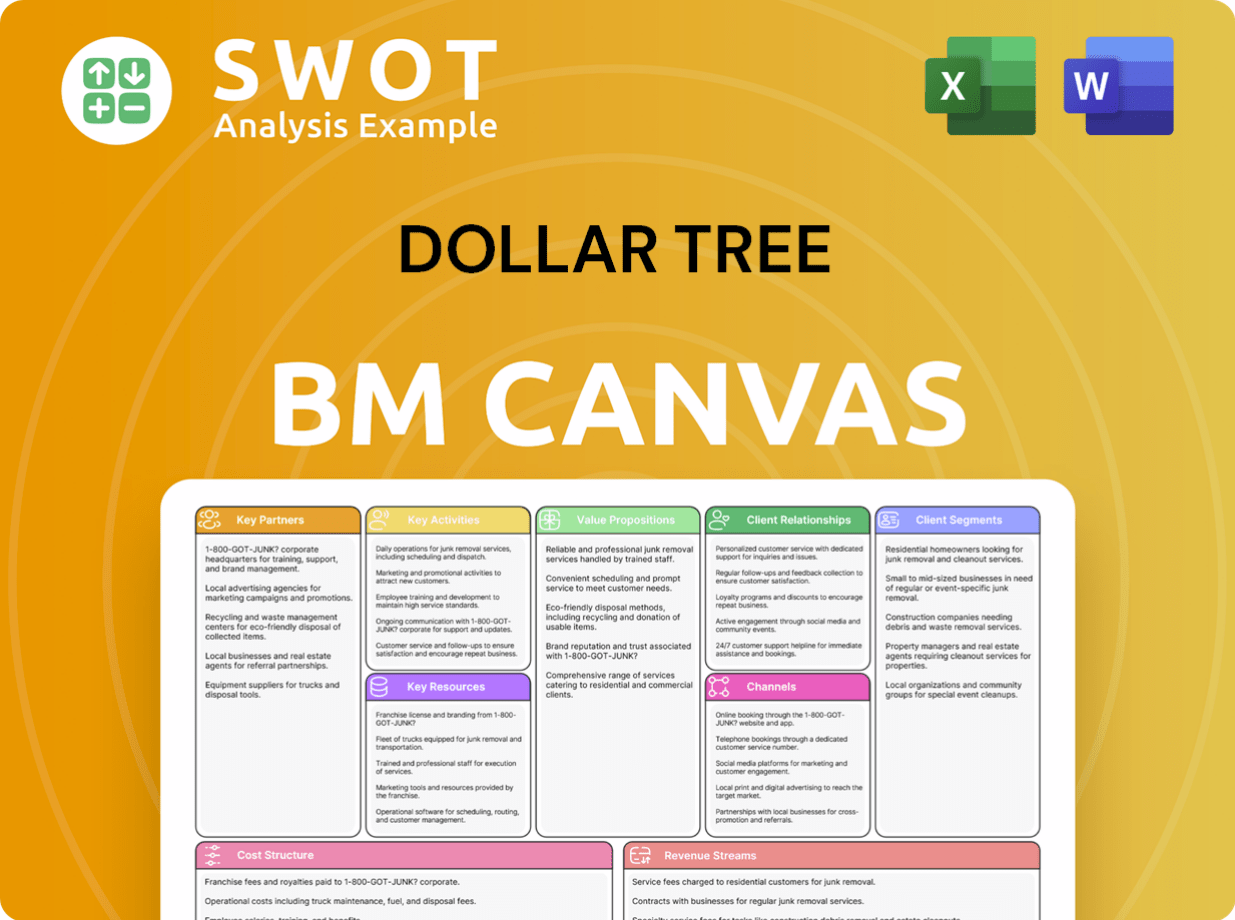

Dollar Tree Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Dollar Tree’s Ownership Landscape?

In recent years, significant developments have reshaped the Dollar Tree ownership landscape. A pivotal move was the decision to divest Family Dollar, a strategic shift aimed at streamlining operations. In March 2025, Dollar Tree finalized an agreement to sell Family Dollar to Brigade Capital Management, LP and Macellum Capital Management, LLC for approximately $1 billion. This strategic divestiture, expected to conclude in the second quarter of 2025, is designed to strengthen Dollar Tree's financial position and allow for a greater focus on its core Dollar Tree brand. Additionally, the company announced plans in March 2024 to close roughly 600 Family Dollar stores in the first half of fiscal 2024, with further closures planned as leases expire.

Dollar Tree has also been actively managing its store portfolio. In May 2024, the company secured designation rights for 170 leases from 99 Cents Only Stores across several states, providing opportunities for expansion of the Dollar Tree brand in the western United States. The company continues to evolve its pricing strategy, expanding its product offerings beyond the fixed $1.25 price point, which indicates a flexible approach to adapt to market dynamics and enhance profitability. These actions reflect a broader trend of strategic portfolio management within the retail sector, particularly in response to evolving consumer behaviors and economic pressures.

Leadership changes have also marked this period of transformation. In November 2024, Steve Schumacher was promoted to Executive Vice President and Chief People Officer, Jocelyn Konrad was named Chief of Dollar Tree Stores and Enterprise Store Operations, and Jason Nordin became President of Family Dollar Stores. These changes are part of the company's ongoing efforts to adapt to market demands and optimize its operational structure. The company's focus on its core brand and multi-price expansion aligns with efforts to adapt to market demands and enhance returns.

Dollar Tree is a publicly traded company, meaning its stock is available for purchase on the stock market. The company's ownership is distributed among various shareholders, including institutional investors, mutual funds, and individual investors. The board of directors oversees the company's strategic direction and is responsible for representing shareholder interests.

In November 2024, Dollar Tree saw significant leadership changes. Steve Schumacher was promoted to Executive Vice President and Chief People Officer. Jocelyn Konrad was named Chief of Dollar Tree Stores and Enterprise Store Operations, and Jason Nordin became President of Family Dollar Stores. These changes are part of the company's broader transformation journey.

Dollar Tree's financial performance is closely watched by investors. The company's annual revenue and stock price history are key indicators of its financial health. The divestiture of Family Dollar is expected to impact future financial results, with the company focusing on strengthening its core Dollar Tree brand. Investors can find detailed financial information in Dollar Tree's investor relations materials.

Dollar Tree's strategic initiatives include optimizing its store footprint and expanding its product assortment. The company's acquisition of leases from 99 Cents Only Stores reflects its focus on growth. The retail industry is experiencing trends such as increased focus on profitability and strategic portfolio management. The company's focus on its core brand and multi-price expansion aligns with efforts to adapt to market demands and enhance returns.

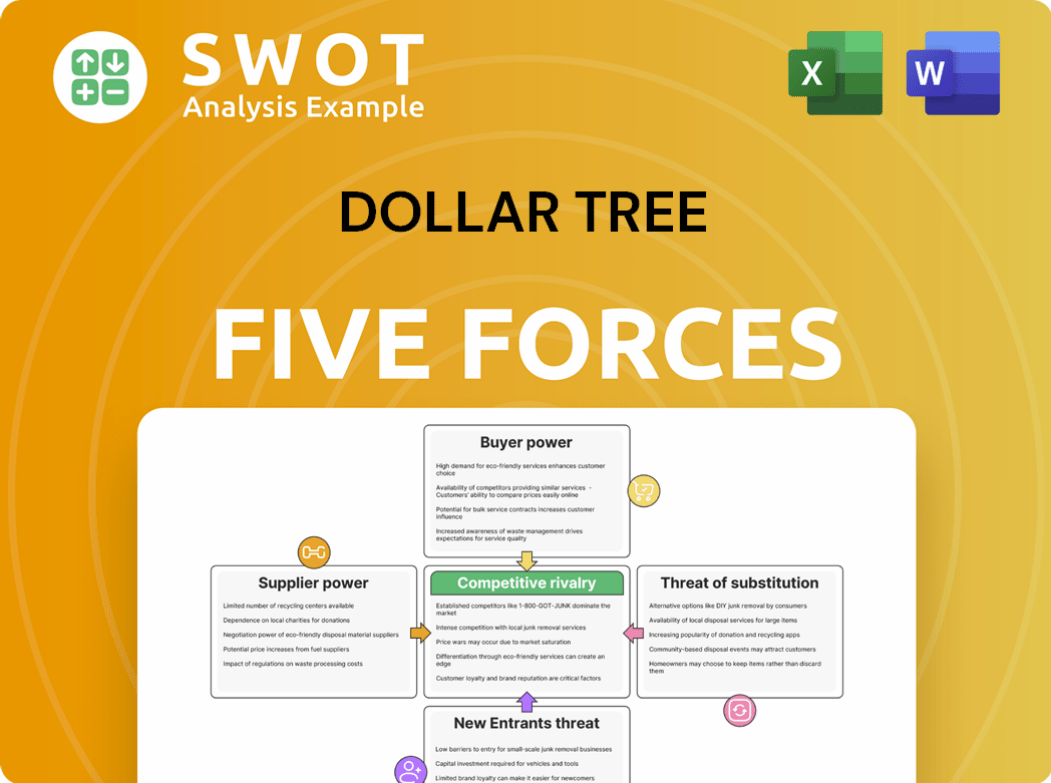

Dollar Tree Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Dollar Tree Company?

- What is Competitive Landscape of Dollar Tree Company?

- What is Growth Strategy and Future Prospects of Dollar Tree Company?

- How Does Dollar Tree Company Work?

- What is Sales and Marketing Strategy of Dollar Tree Company?

- What is Brief History of Dollar Tree Company?

- What is Customer Demographics and Target Market of Dollar Tree Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.