Dollar Tree Bundle

Unpacking Dollar Tree: How Does This Retail Giant Thrive?

Dollar Tree, a dominant force in the discount retail sector, operates a vast network of stores across North America, captivating budget-conscious consumers. Its unique selling proposition, anchored by the $1.25 price point for most items, distinguishes it in a competitive landscape. With thousands of stores under the Dollar Tree, Family Dollar, and Dollar Tree Canada banners, the company's influence is undeniable.

This exploration into the Dollar Tree SWOT Analysis will uncover the intricacies of the Dollar Tree business model, from its operational strategies to its revenue generation. Understanding Dollar Tree operations, including its store layout and design, and how it sources its products, is essential for investors and anyone interested in the discount retail industry. We'll also examine key aspects like Dollar Tree profit margins and its expansion strategy.

What Are the Key Operations Driving Dollar Tree’s Success?

The Dollar Tree business model centers on providing value through discount retail. It operates primarily through a vast network of stores, offering a wide array of products at attractive price points. This approach focuses on delivering everyday essentials and discretionary items to a broad customer base at affordable prices, making it a prominent player in the value retailer market.

The core of Dollar Tree's operations involves sourcing a diverse range of merchandise, optimizing logistics and distribution, and providing a convenient shopping experience. The company's strategy is designed to handle high volumes efficiently, ensuring rapid inventory turnover and effective replenishment across its extensive store network. This operational efficiency, paired with its consistent low-price strategy, is a key differentiator.

Dollar Tree creates value by offering a wide variety of products at competitive prices. The company's primary banners, Dollar Tree and Family Dollar, cater to different customer needs. The Dollar Tree banner typically adheres to a fixed price point, while Family Dollar provides a broader range of price points and product categories. This dual-banner strategy allows the company to serve a wider customer base. The company's operations are designed to support this value proposition through streamlined processes and efficient supply chain management.

Dollar Tree sources merchandise from a global supplier base to ensure a wide selection and competitive pricing. The company leverages its scale to negotiate favorable terms with suppliers. This efficient sourcing strategy is crucial for maintaining low prices and high-profit margins.

Dollar Tree operates 26 distribution centers across the United States and Canada, totaling approximately 21.6 million square feet. These centers are strategically located to ensure timely and cost-effective delivery of products to its stores. Efficient logistics are essential for maintaining inventory levels and minimizing costs.

The store layout is designed for a quick and easy shopping experience. The focus is on providing accessibility and convenience for customers. This design contributes to efficient inventory turnover and a positive customer experience. The company's store layout and design are key components of its operational strategy.

Customer service is focused on providing a quick and easy shopping experience. The company aims to make the shopping process as efficient as possible. This customer-centric approach helps to build customer loyalty and drive repeat business.

Dollar Tree's success hinges on several key operational aspects. These include efficient sourcing, optimized logistics, and a customer-focused retail environment. The company's ability to manage its supply chain and maintain low prices is critical to its value proposition.

- Efficient Sourcing: Leveraging a global supplier network to secure competitive pricing.

- Optimized Logistics: Utilizing a network of distribution centers for timely product delivery.

- Customer-Focused Retail: Providing a convenient and accessible shopping experience.

- Inventory Management: Rapid inventory turns and efficient replenishment.

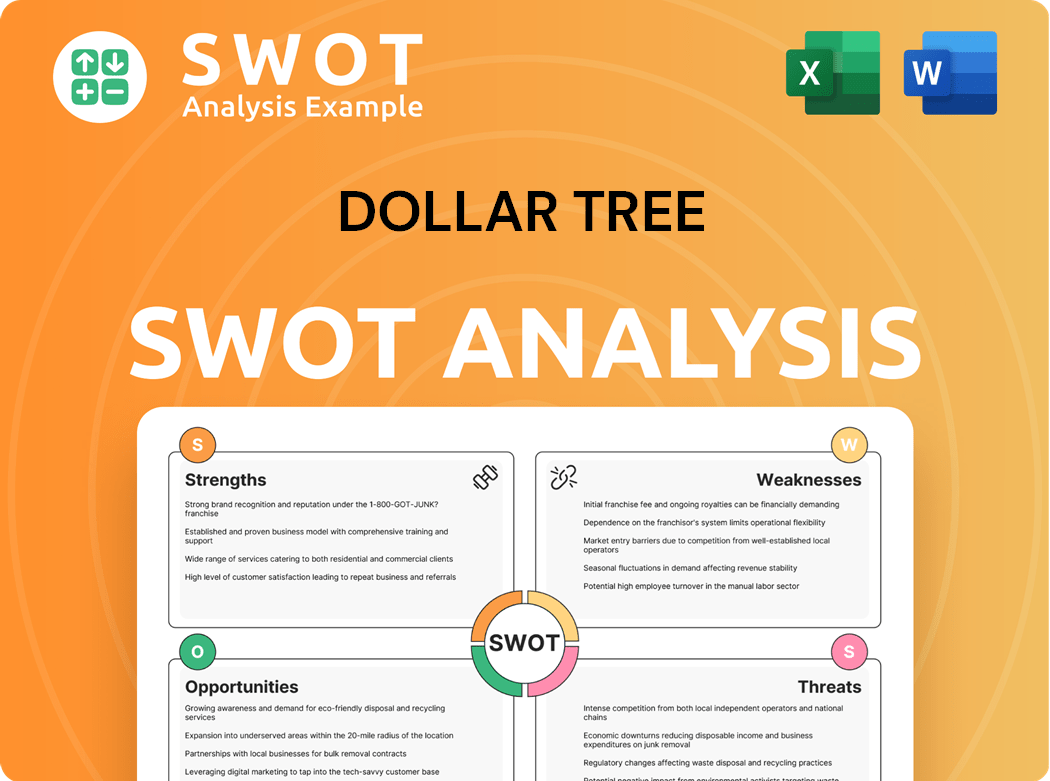

Dollar Tree SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Dollar Tree Make Money?

The primary revenue stream for the company comes from product sales within its retail stores. This includes sales from both its Dollar Tree and Family Dollar segments. The company's strategy focuses on offering a wide variety of products at competitive prices, attracting a broad customer base.

The company's monetization strategies are centered on its pricing models and merchandise assortment. The Dollar Tree segment utilizes a fixed-price model, while Family Dollar employs a more traditional discount retail approach. These strategies, along with seasonal offerings, drive sales and customer traffic.

In fiscal year 2023, the company reported consolidated net sales of $30.6 billion, an 8.0% increase compared to fiscal year 2022. The Dollar Tree segment generated $14.1 billion in net sales, and Family Dollar contributed $16.5 billion. This demonstrates the significant contribution of both segments to the company's overall revenue.

The company's revenue streams are primarily driven by product sales. The Dollar Tree business model relies on a fixed-price strategy, while Family Dollar uses a discount retail approach. Understanding these strategies is key to grasping how does Dollar Tree make money.

- Fixed-Price Model (Dollar Tree): The fixed price point, now primarily at $1.25, allows for a simplified pricing strategy and attracts customers looking for value.

- Discount Retail Model (Family Dollar): Family Dollar uses varied pricing to offer discounts, appealing to a different segment of the market.

- Seasonal Merchandise: Offering seasonal and holiday items drives incremental sales and boosts customer traffic.

- Online Sales: Limited direct-to-consumer online sales contribute, though the majority of revenue comes from brick-and-mortar stores.

The company's success is also influenced by its store layout and design, which is a key aspect of Dollar Tree operations. For a broader perspective on the competitive landscape, you can explore the Competitors Landscape of Dollar Tree. The company's ability to source products efficiently and manage its supply chain also plays a crucial role in its profitability. The company's expansion strategy and ability to adapt to changing consumer preferences are also important factors.

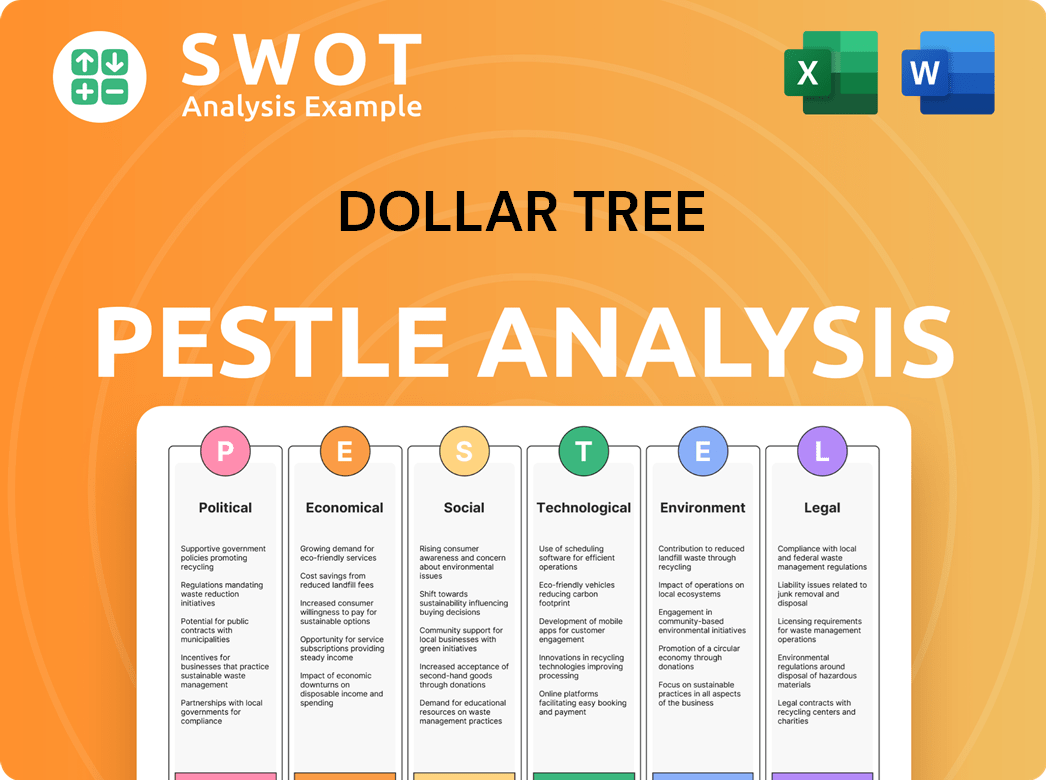

Dollar Tree PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Dollar Tree’s Business Model?

The evolution of the company has been marked by significant milestones and strategic shifts. A key move was the decision in 2021 to increase the price point from $1.00 to $1.25 across all stores, completed by the first quarter of fiscal 2022. This adjustment aimed to address rising costs and broaden product offerings. The acquisition of Family Dollar in 2015 was another pivotal event, expanding its market presence and diversifying its store formats.

The company's operations have faced challenges such as supply chain disruptions, particularly during the COVID-19 pandemic, which affected inventory and shipping expenses. Regulatory issues and evolving consumer preferences also pose ongoing hurdles. Understanding the Marketing Strategy of Dollar Tree is crucial for grasping its competitive dynamics.

The company's competitive advantages include strong brand recognition, especially for its fixed-price model, which fosters customer loyalty and value perception. Its economies of scale, derived from substantial purchasing power and an extensive distribution network, allow for competitive procurement. The company continues to adapt by optimizing store formats, such as introducing Dollar Tree Plus! stores with multi-price point items and renovating Family Dollar locations.

In 2021, the company announced it would raise its $1.00 price point to $1.25. The acquisition of Family Dollar in 2015 was a major expansion move. These events have significantly shaped the company's operations and financial performance.

The price increase to $1.25 was implemented to mitigate rising costs and expand product offerings. The company has been focused on optimizing store formats, including the introduction of Dollar Tree Plus! stores. Ongoing renovation efforts for Family Dollar stores are also part of the strategy.

Strong brand recognition, particularly for the fixed-price model, fosters customer loyalty. Economies of scale, due to large purchasing power and distribution networks, enable competitive pricing. The company continues to adapt to market trends.

Supply chain disruptions, especially during and after the COVID-19 pandemic, impacted inventory and shipping costs. Regulatory hurdles and changing consumer preferences present ongoing challenges for the company. Adapting to these challenges is crucial.

In the fiscal year 2024, the company reported net sales of approximately $7.7 billion in the first quarter. The company operates over 16,000 stores across the United States and Canada. The company's strategy focuses on value retail, aiming to provide affordable products to a broad customer base.

- Dollar Tree's revenue for fiscal year 2023 was about $30.6 billion.

- The company's gross profit margin in Q1 2024 was around 30.1%.

- The company's stock performance has been closely watched by investors.

- The company's supply chain continues to be a key focus area for operational efficiency.

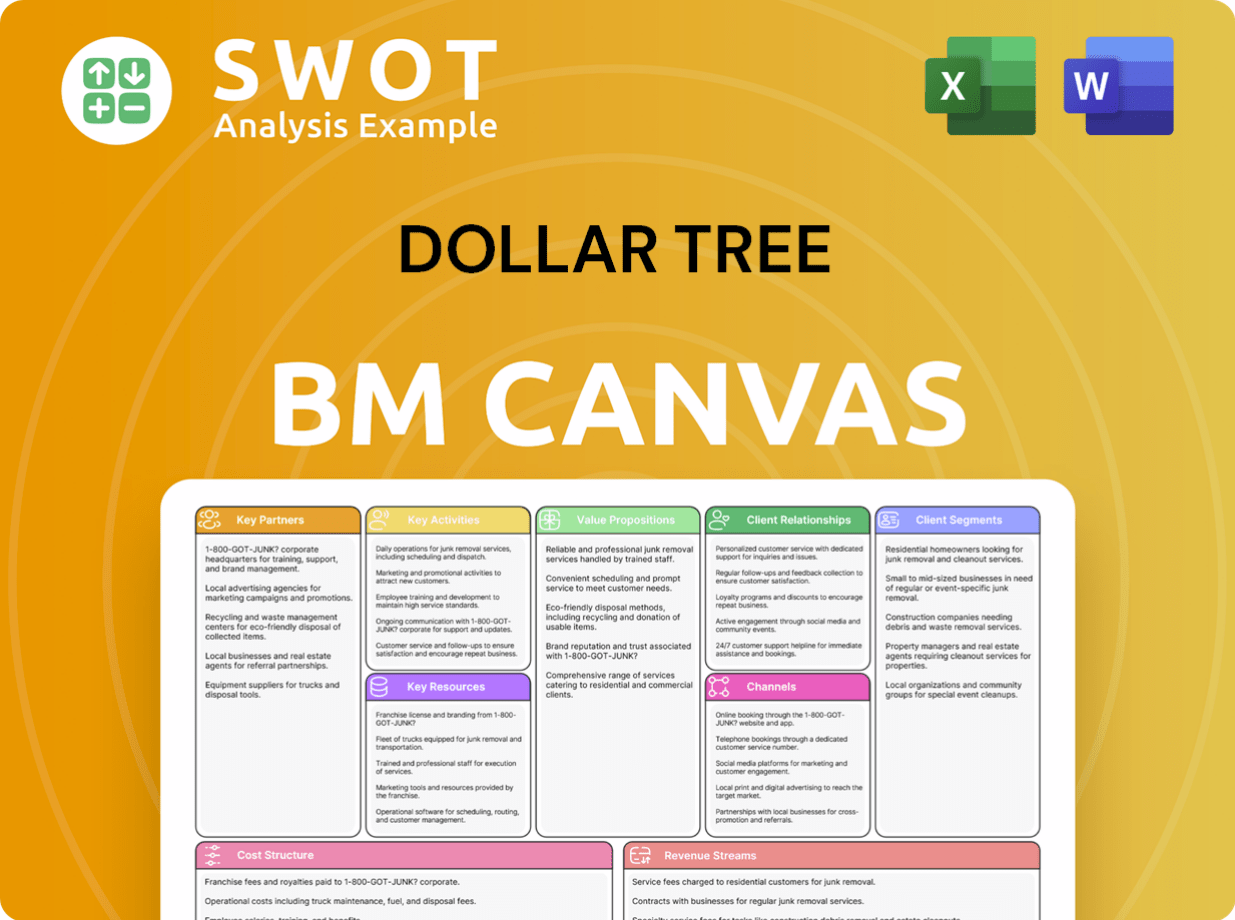

Dollar Tree Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Dollar Tree Positioning Itself for Continued Success?

The company maintains a strong position in the discount retail sector. As of February 3, 2024, it operated a vast network of 16,774 stores across 48 states and five Canadian provinces. This includes both Dollar Tree and Family Dollar locations, contributing to its significant market share and customer loyalty.

The company faces several risks, including inflationary pressures, shifts in consumer spending, and intense competition from online retailers. Regulatory changes and supply chain disruptions can also impact operations. Despite these challenges, the company is actively working on strategic initiatives to maintain its ability to make money and expand.

The company competes in the discount retail market, specifically within the dollar store segment. It competes with other dollar stores, mass merchandisers, grocery stores, and drug stores. The company’s extensive store network and distinct value propositions contribute to its market share.

Key risks include inflationary pressures, which can compress margins. Changes in consumer spending habits, especially during economic downturns, could affect sales. Intense competition from various retailers, including online platforms, poses a continuous challenge. Regulatory changes and import tariffs can also increase operational costs.

The company is focused on strategic initiatives to sustain and expand its business. These include optimizing its store portfolio through closures and new store openings. The company also plans to renovate existing stores and focus on supply chain efficiencies and merchandising strategies to enhance profitability.

The company is implementing several strategies to improve its performance. These include closing approximately 600 Family Dollar stores in the first half of fiscal 2024 and opening 650 new stores. The company is also renovating 1,300 Family Dollar stores in fiscal year 2024, demonstrating a commitment to adapting to market changes.

The Growth Strategy of Dollar Tree involves optimizing its store portfolio and expanding its footprint. This includes closing underperforming stores and opening new ones. The company also focuses on renovating existing stores to improve the shopping experience and efficiency.

- Closing approximately 600 Family Dollar stores in the first half of fiscal 2024.

- Opening 650 new stores in fiscal year 2024.

- Renovating 1,300 Family Dollar stores in fiscal year 2024.

- Focus on supply chain efficiency and merchandising strategies.

Dollar Tree Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Dollar Tree Company?

- What is Competitive Landscape of Dollar Tree Company?

- What is Growth Strategy and Future Prospects of Dollar Tree Company?

- What is Sales and Marketing Strategy of Dollar Tree Company?

- What is Brief History of Dollar Tree Company?

- Who Owns Dollar Tree Company?

- What is Customer Demographics and Target Market of Dollar Tree Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.