DSM-Firmenich Bundle

How Does DSM-Firmenich Dominate its Market?

The 2023 merger of DSM and Firmenich created a powerhouse in the nutrition, health, and beauty sectors, reshaping the DSM-Firmenich SWOT Analysis. This strategic combination positioned the company as a leading innovator, ready to meet evolving consumer demands. Understanding the competitive landscape is crucial for investors and strategists alike.

This Company analysis delves into DSM-Firmenich's competitive environment, examining its market share, industry rivals, and business strategy. We'll explore DSM-Firmenich's key competitors, financial performance, and market position to understand its strengths and weaknesses. Furthermore, the analysis will cover DSM-Firmenich's strategic alliances, product portfolio, and recent acquisitions, offering insights into its growth prospects and market challenges.

Where Does DSM-Firmenich’ Stand in the Current Market?

DSM-Firmenich holds a strong market position, especially within the nutrition, health, and beauty sectors. Its core operations revolve around providing ingredients and solutions for various industries, including food, beverages, dietary supplements, pharmaceuticals, and personal care. The company's value proposition lies in its comprehensive product portfolio and global presence, serving a wide array of customer segments.

The company's strategic focus is on high-growth segments, with the Perfumery & Beauty (P&B), Taste, Texture & Health (TTH), and Health, Nutrition & Care (HNC) divisions being key. This strategic shift is further emphasized by the planned separation of the Animal Nutrition & Health (ANH) segment by 2025, allowing DSM-Firmenich to concentrate on its core strengths and growth areas.

In Q1 2025, DSM-Firmenich reported sales of €3.274 billion, reflecting an 8% organic sales growth compared to Q1 2024. The company's adjusted EBITDA for Q1 2025 was €650 million, a 40% increase from Q1 2024, with an adjusted EBITDA margin of 19.9%. This financial performance underscores the company's robust market position and operational efficiency. Furthermore, the company's full-year 2025 outlook anticipates an Adjusted EBITDA of at least €2.4 billion.

DSM-Firmenich is recognized as a top player in the flavor and fragrance market. As of 2023, the company held an approximate market share of 12% in this sector. This strong position highlights its competitive advantage and influence within the industry.

The company boasts an extensive geographic presence, operating in nearly 60 countries worldwide. This global footprint is supported by a robust infrastructure including 88 manufacturing sites, 78 application labs, and 40 creation centers. This widespread presence allows DSM-Firmenich to effectively serve its diverse customer base.

DSM-Firmenich is committed to innovation, as demonstrated by its significant investments in research and development. A notable example is the €700 million R&D investment, including the new Princeton Baking Innovation Center opened in May 2025. These investments are aimed at capturing premium pricing for health-focused ingredients.

In 2024, the Perfumery and Beauty, and Taste, Texture, and Health segments collectively accounted for 56% of DSM-Firmenich's total revenue. This highlights the importance of these segments to the company's financial performance and strategic direction.

DSM-Firmenich has undertaken significant strategic initiatives to strengthen its market position. The merger itself consolidated its presence, and the planned separation of the ANH segment is a key move. These actions aim to streamline operations and focus on higher-growth areas.

- Focus on P&B, TTH, and HNC segments for growth.

- Divestment of the ANH segment to reduce exposure to the volatile vitamin market.

- Continued investments in innovation and R&D to maintain a competitive edge.

- Expansion of its global footprint and customer base.

For a deeper understanding of the company's strategies, consider reading about the Marketing Strategy of DSM-Firmenich.

DSM-Firmenich SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging DSM-Firmenich?

The DSM-Firmenich operates within a highly competitive global market, particularly in the nutrition, health, and beauty sectors. Its competitive landscape includes both direct and indirect rivals. The company's strategic positioning is continuously evaluated against industry rivals to maintain and grow its market share.

Key factors influencing the DSM-Firmenich's business strategy include innovation, pricing, branding, and distribution. Technological advancements and strategic partnerships also play crucial roles in shaping its competitive dynamics. The company's performance is also influenced by external factors such as supply chain issues and geopolitical pressures, especially in markets like vitamins.

The company's focus on innovation and its strategic alliances are key components of its long-term growth strategy. The company's commitment to sustainability and its geographic presence also contribute to its competitive advantages. For a deeper understanding of the company's ownership structure, you can refer to Owners & Shareholders of DSM-Firmenich.

DSM-Firmenich faces significant competition from companies such as Givaudan, Symrise, and International Flavors & Fragrances (IFF). These companies offer similar portfolios of flavors, fragrances, and ingredients.

Innovation is a critical battleground, with competitors investing heavily in research and development. This includes developing novel ingredients and solutions, particularly in health-driven and sustainable food solutions.

The vitamin market, for example, has experienced volatility due to supply chain issues and geopolitical pressures. New entrants could bring price pressures in Q2 2025.

Mergers and alliances are common strategies to consolidate market positions, as seen with the IFF and DuPont Nutrition & Biosciences merger. The planned separation of the Animal Nutrition & Health business by 2025 is another strategic move.

Artificial Intelligence (AI) and the Internet of Things (IoT) are accelerating advancements across industries. Companies are leveraging AI for a competitive edge.

DSM-Firmenich's geographic presence and sustainability initiatives contribute to its competitive advantages, allowing it to cater to diverse regional demands.

The DSM-Firmenich's competitive landscape is shaped by several key factors, including:

- Innovation: Continuous investment in research and development to create new ingredients and solutions.

- Price Competition: Offering competitive pricing to maintain and grow market share.

- Branding: Building strong brand recognition and customer loyalty.

- Distribution Networks: Efficient and extensive distribution channels to reach customers globally.

- Technological Advancements: Leveraging technology to improve products and processes.

- Strategic Partnerships: Forming alliances to expand market reach and capabilities.

DSM-Firmenich PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives DSM-Firmenich a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of DSM-Firmenich requires a deep dive into its core strengths. The company has built a robust foundation through strategic moves, including significant investments in intellectual property and a focus on sustainable solutions. This approach has positioned DSM-Firmenich as a leader in the market, influencing its market share and overall business strategy.

DSM-Firmenich's competitive advantages are multifaceted, stemming from its extensive intellectual property portfolio, strong brand equity, and global reach. The merger of DSM and Firmenich has further enhanced its capabilities, providing a wide range of specialized ingredients and solutions. This positions the company to effectively navigate the complex dynamics of the industry and maintain a strong market position.

The company's commitment to innovation and sustainability is evident through its R&D investments and strategic partnerships. This dedication drives its ability to adapt to market changes and maintain a competitive edge. By focusing on these key areas, DSM-Firmenich continues to solidify its position within the industry and drive future growth.

DSM-Firmenich holds a substantial intellectual property portfolio, with over 16,000 active patents as of February 2025. This includes around 2,600 patent families, many of which are focused on sustainable solutions. This extensive portfolio enables the company to maintain premium pricing strategies and protect its unique formulations.

DSM-Firmenich's brand value is estimated at approximately $2.9 billion, which cultivates strong customer trust and loyalty. The merger of DSM and Firmenich has strengthened this by integrating complementary capabilities. This combined strength provides a compelling proposition for multinational customers, offering a broad spectrum of specialized ingredients and solutions.

The combined entity benefits from a global market reach, with access to 15 R&D centers, 78 application labs, and 40 creation centers worldwide. This extensive network allows DSM-Firmenich to better meet diverse customer needs and ensure secure supply chains. This global footprint enables the company to serve customers worldwide.

DSM-Firmenich consistently invests in R&D, allocating approximately 6.5% of its revenues annually towards R&D initiatives. This commitment drives innovation, particularly in plant-based solutions and natural ingredients. The company's recognition as a 'Top 100 Global Innovator' in the LexisNexis 2025 Innovation Momentum Report highlights this dedication.

DSM-Firmenich's competitive advantages are multifaceted, encompassing intellectual property, brand equity, and a global presence. The company's focus on innovation, sustainability, and strategic alliances further strengthens its position in the market. These advantages are crucial for understanding the competitive landscape.

- Extensive Intellectual Property: A robust patent portfolio protects unique formulations and processes.

- Strong Brand Equity: Fosters customer trust and loyalty, supporting premium pricing.

- Global Market Reach: Extensive distribution networks and R&D centers for diverse customer needs.

- Innovation and Sustainability: Significant R&D investments drive advancements in plant-based solutions.

DSM-Firmenich Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping DSM-Firmenich’s Competitive Landscape?

The DSM-Firmenich competitive landscape is shaped by evolving industry trends, including technological advancements, changing consumer preferences, and global economic dynamics. The company faces both challenges and opportunities in this dynamic environment. Understanding its market position, risks, and future outlook is crucial for assessing its long-term performance and strategic direction. This company analysis explores the key factors influencing DSM-Firmenich's trajectory.

The nutrition, health, and beauty sectors are undergoing significant transformations driven by digitalization, sustainability demands, and the pursuit of functional improvements. These trends influence value creation and competitive advantages, affecting DSM-Firmenich's strategic focus. The global flavor and fragrance market is projected to reach €36 billion by 2026, and the dietary supplements market is estimated at around €140 billion in 2023, highlighting the growth potential in these areas.

Key trends include increased demand for healthier, natural products and preventative healthcare. Technological advancements and sustainability are also major drivers. The company is positioned to capitalize on these trends through innovation and a focus on sustainable solutions.

Challenges include raw material price volatility, geopolitical tensions impacting supply chains, and softness in the beauty and care segment. Navigating these challenges requires strategic agility and cost management. The company is addressing these through various initiatives.

Significant opportunities exist in growing consumer demand for sustainable and health-oriented products. Innovation in biosciences and biotechnology, along with strategic partnerships, are key to future growth. Emerging markets and product innovations offer further avenues for expansion.

The company focuses on innovation-led growth, digital transformation, and sustainability initiatives. It is also streamlining its portfolio and targeting cost synergies. These strategies aim to enhance operational agility and customer experience.

To maintain resilience and drive growth, DSM-Firmenich is accelerating innovation, targeting cost and sales synergies, and completing its vitamin transformation program. The planned exit from the Animal Nutrition & Health business by 2025 will allow the company to focus on higher-margin segments. The company has also initiated a €1 billion share buyback program in April 2024.

- Focus on innovation-led organic sales growth.

- Deliver cost and sales synergies, aiming for approximately €100 million in Adjusted EBITDA in 2025.

- Complete the vitamin transformation program.

- Exit the Animal Nutrition & Health business by 2025.

- Initiate a €1 billion share buyback program.

For a deeper dive into DSM-Firmenich's strategic moves and growth prospects, consider reading about the Growth Strategy of DSM-Firmenich.

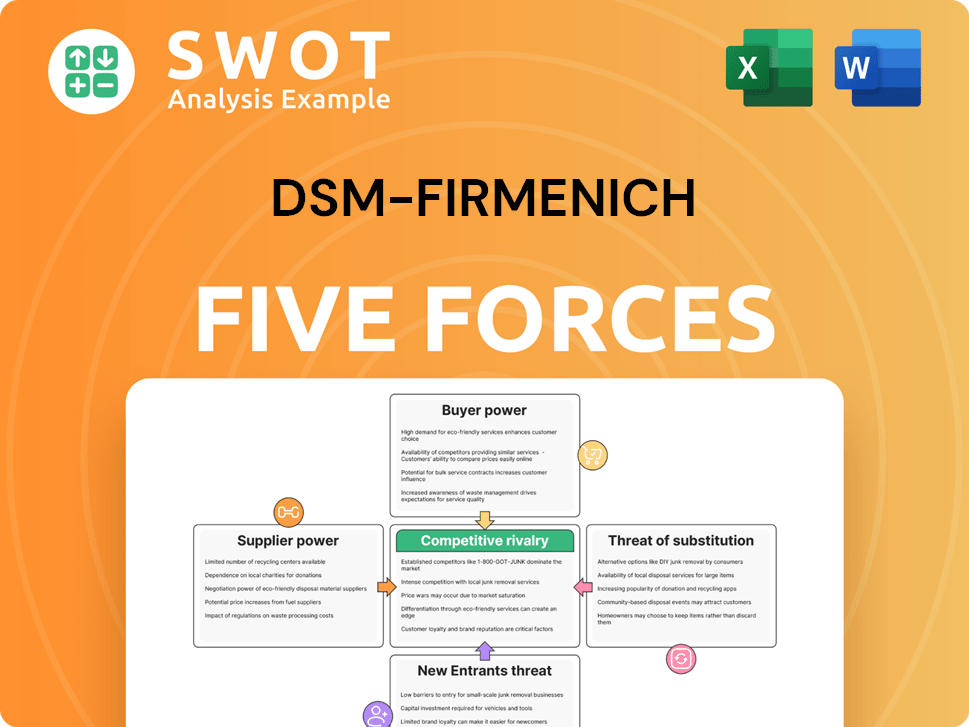

DSM-Firmenich Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of DSM-Firmenich Company?

- What is Growth Strategy and Future Prospects of DSM-Firmenich Company?

- How Does DSM-Firmenich Company Work?

- What is Sales and Marketing Strategy of DSM-Firmenich Company?

- What is Brief History of DSM-Firmenich Company?

- Who Owns DSM-Firmenich Company?

- What is Customer Demographics and Target Market of DSM-Firmenich Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.