DSM-Firmenich Bundle

Can DSM-Firmenich Continue Its Ascent in the Global Market?

The 2023 merger of DSM and Firmenich created a powerhouse in nutrition, health, and beauty, now known as DSM-Firmenich. This strategic combination, built on a foundation of innovation, has rapidly transformed the landscape of consumer chemicals. With a market capitalization of nearly $30 billion USD as of June 2025, the company’s trajectory warrants a closer look at its ambitious DSM-Firmenich SWOT Analysis.

This article will dissect DSM-Firmenich's Growth Strategy, offering a deep dive into its Company Future prospects. We'll explore the company's strategic initiatives, including Business Development plans and Market Analysis, to understand how it plans to navigate the complexities of the global market. From its Corporate Strategy to its financial performance, we'll examine the factors that will shape DSM-Firmenich's long-term success, including its DSM-Firmenich growth strategy analysis and Future prospects of DSM-Firmenich in the fragrance market.

How Is DSM-Firmenich Expanding Its Reach?

The expansion initiatives of DSM-Firmenich are primarily centered on reinforcing its position in high-growth, high-margin sectors within nutrition, health, and beauty. This strategic approach involves divesting from non-core assets to focus on core innovation-driven activities. The company is actively pursuing organic sales growth and leveraging strategic partnerships to drive its Growth Strategy.

A significant aspect of this strategy includes the planned separation of its Animal Nutrition & Health (ANH) business, which is slated for divestment by 2025. This move is designed to reduce exposure to volatile vitamin earnings and capital intensity. The company is also focusing on developing value-added products that combine its strengths in enzymes, cultures, dietary supplements, and biotechnology with Firmenich's flavor and taste modulation capabilities.

The company is also leveraging strategic partnerships and customer collaborations to drive growth. Furthermore, a €1 billion share buyback program was launched in April 2025, signaling confidence in the company's financial health and commitment to shareholder returns. For more information on the company's ownership structure, you can read about Owners & Shareholders of DSM-Firmenich.

The separation of the ANH business is a key strategic move. This is expected to reduce the company's exposure to volatile vitamin earnings. The ANH business reported over €3 billion in revenues in 2023 and €3.32 billion in 2024.

The company has set midterm strategic targets of 5%-7% organic sales growth. In 2024, dsm-firmenich achieved a 6% organic sales growth. For 2025, the company anticipates mid-single-digit organic growth.

Partnerships are crucial for driving growth. Collaborations include alliances in the animal protein value chain, and advancements in infant nutrition offerings. Regulatory approvals for human milk oligosaccharides have been secured in over 170 countries.

A €1 billion share buyback program was launched in April 2025. This program reflects confidence in the company's financial health. It also demonstrates a commitment to shareholder returns.

The company's expansion focuses on high-growth segments within Perfumery & Beauty (P&B), Taste, Texture & Health (TTH), and Health, Nutrition & Care (HNC). These areas are expected to benefit from innovation and strategic synergies.

- Focus on value-added products combining strengths in enzymes, cultures, and biotechnology.

- Strong performance in Perfumery & Beauty and Health, Nutrition & Care.

- Emphasis on strategic partnerships and customer collaborations.

- Mid-single-digit organic growth anticipated for 2025.

DSM-Firmenich SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does DSM-Firmenich Invest in Innovation?

At the core of its Growth Strategy, dsm-firmenich prioritizes innovation and technology. The company is heavily investing in research and development (R&D) to drive organic sales growth. This commitment is evident in its global network of over 2,000 scientists focused on creating new products and solutions.

The company's approach is designed to meet evolving consumer demands for healthier, more nutritious, and natural products. This focus is a key element of their Corporate Strategy. They are leveraging cutting-edge technologies to achieve their strategic and financial targets.

A key area of focus for dsm-firmenich is the application of artificial intelligence (AI). This technology is being used to develop new cultures for the dairy industry. This digital transformation is a crucial component of their roadmap for achieving strategic and financial targets. The company is also expanding its R&D efforts to improve its plant-based offerings, exploring taste receptors and developing better mouthfeel for plant-based meat analogues. This includes a focus on using plant-based protein as a specialized ingredient.

dsm-firmenich is using AI to develop new cultures for the dairy industry. This digital transformation is a key part of their strategy. This is a significant step towards achieving their financial goals.

The company is expanding R&D for plant-based products. They are working on improving taste and texture. This includes using plant-based protein as a specialized ingredient.

Sustainability is deeply integrated into dsm-firmenich's innovation strategy. They are committed to reducing their environmental footprint. This includes ambitious climate targets.

dsm-firmenich has set ambitious climate targets, externally validated by the Science Based Targets initiative (SBTi). They are working towards being carbon positive in operations. They aim for 100% renewable electricity and fragrances.

The 2024 Integrated Annual Report includes sustainability statements in accordance with the European Sustainability Reporting Standards. This demonstrates their commitment to transparency. This is a significant step towards achieving their financial goals.

The company's sustainability leadership is further evidenced by a Gold Medal from EcoVadis and an 'AA' rating from MSCI. These recognitions highlight their commitment to sustainable practices. This is a significant step towards achieving their financial goals.

dsm-firmenich's innovation strategy is multifaceted, focusing on both technological advancements and sustainability. Their commitment to R&D, AI integration, and plant-based solutions showcases their forward-thinking approach. The company's sustainability efforts are also crucial. To understand more about the company's financial structure, you can read this article about Revenue Streams & Business Model of DSM-Firmenich.

- R&D Investment: Continued investment in research and development to create new products.

- AI Integration: Using AI to develop new solutions, such as in the dairy industry.

- Plant-Based Expansion: Expanding R&D efforts to improve plant-based offerings.

- Sustainability Goals: Ambitious climate targets, including carbon positivity and zero waste.

DSM-Firmenich PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is DSM-Firmenich’s Growth Forecast?

The financial outlook for DSM-Firmenich in 2025 is positive, with expectations of continued growth and enhanced profitability. The company's strong financial performance in 2024, marked by robust organic sales growth and cash flow, sets a solid foundation for future success. This positive trajectory is supported by strategic initiatives and a focus on sustainable business practices.

In 2024, the company achieved sales of €12,799 million, with an organic sales growth of 6%. Adjusted EBITDA for 2024 reached €2,118 million, reflecting a 19% increase from 2023, and an Adjusted EBITDA margin of 16.5%. These results highlight the company's ability to drive revenue growth and improve operational efficiency, which are crucial for its long-term success. The company's focus on innovation and market expansion has also contributed to its strong performance.

Looking ahead, the company projects an Adjusted EBITDA of at least €2.4 billion for 2025. This forecast is supported by an anticipated €200 million contribution from cost and revenue synergies, and the completion of the vitamin transformation program. The company anticipates mid-single-digit organic growth for 2025, focusing on anchoring its current business operations rather than pursuing major mergers or acquisitions. Further insights into the company's target market can be found in this article: Target Market of DSM-Firmenich.

In the first quarter of 2025, the company reported sales of €3,274 million, a 7% increase compared to Q1 2024. The Adjusted EBITDA for Q1 2025 was €650 million, marking a 40% year-on-year increase, with an Adjusted EBITDA margin of 19.9%. These figures demonstrate the company's strong start to the year and its ability to maintain profitability.

The midterm strategic targets include an EBITDA margin of 22%-23% (excluding the ANH segment) and a cash-to-sales conversion of over 10%. These targets highlight the company's commitment to sustainable financial performance and efficient cash management. Achieving these goals will be key to the company's long-term growth and value creation.

The company's net debt to adjusted EBITDA ratio was around 1.2 times in 2024, with a target range of 1.5-2.5 times. The company maintains a dividend payout ratio target of 40%-60% and initiated a €1 billion share buyback program in April 2025. These capital allocation strategies demonstrate the company's commitment to returning value to shareholders and maintaining a healthy financial position.

The company is prioritizing organic growth and operational efficiency. By focusing on its existing business lines and strategic initiatives, the company aims to achieve sustainable growth without relying on major acquisitions. This approach allows for better integration and a more focused allocation of resources.

DSM-Firmenich Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow DSM-Firmenich’s Growth?

The DSM-Firmenich faces several significant risks and obstacles that could affect its growth strategy and overall company future. These challenges span market dynamics, operational efficiencies, and regulatory environments. Understanding these potential pitfalls is crucial for assessing the long-term viability of the company's strategic initiatives.

Market competition, particularly in key segments like perfumery and beauty, presents a continuous hurdle. Additionally, the company must navigate the complexities of supply chain vulnerabilities and the ongoing need for digital transformation. These factors require proactive management and strategic adjustments to ensure sustainable growth.

Regulatory changes and compliance requirements, such as the European Sustainability Reporting Standards, also present ongoing challenges that require significant adaptation and compliance efforts. The company mitigates these risks through measures like reducing single-source positions, qualifying back-up manufacturing sites, optimizing safety stocks, and hedging exposure to price and currency fluctuations.

The perfumery and beauty segment, a major revenue driver, faces intense competition. The vitamin business, especially within the Animal Nutrition & Health (ANH) unit, is vulnerable to competition from lower-cost rivals, impacting earnings. This competitive pressure necessitates continuous innovation and strategic market positioning.

Supply chain disruptions and fluctuations in raw material and energy prices pose risks to margins. Input inflation is projected at 1.5-2% for 2025. Rising prices of natural ingredients may affect cost structures, requiring proactive risk management strategies.

The planned separation of the ANH business by 2025 aims to mitigate exposure to market volatility. The divestment process itself could lead to transitional challenges and potential value loss if not executed effectively. This strategic move has significant financial implications.

Increasing non-financial reporting requirements, such as the European Sustainability Reporting Standards, demand significant adaptation and compliance efforts. This necessitates investments in systems and expertise to meet evolving standards. The company needs to stay ahead of these regulatory changes.

Technological disruption and the complex implementation of the digital transformation roadmap pose risks. Potential data breaches or failure to deliver targeted benefits if not executed according to plan could impact operations. Effective execution is essential.

Softness in certain segments, such as sun care products within beauty and care, and market normalization in perfumery and beauty, could slow growth. The company must adapt to changing market dynamics and consumer preferences. This requires continuous market analysis.

DSM-Firmenich actively assesses and prepares for these risks through a systematic financial and risk management system. Continuous monitoring of potential disruptions helps in early detection and mitigation. This proactive approach is vital for sustainable financial performance.

While the company has shown advancements in achieving cost synergies from the merger, there remains skepticism regarding the full realization of planned revenue synergies. The successful integration of operations is key to achieving the expected financial outcomes. Further information can be found in the Mission, Vision & Core Values of DSM-Firmenich.

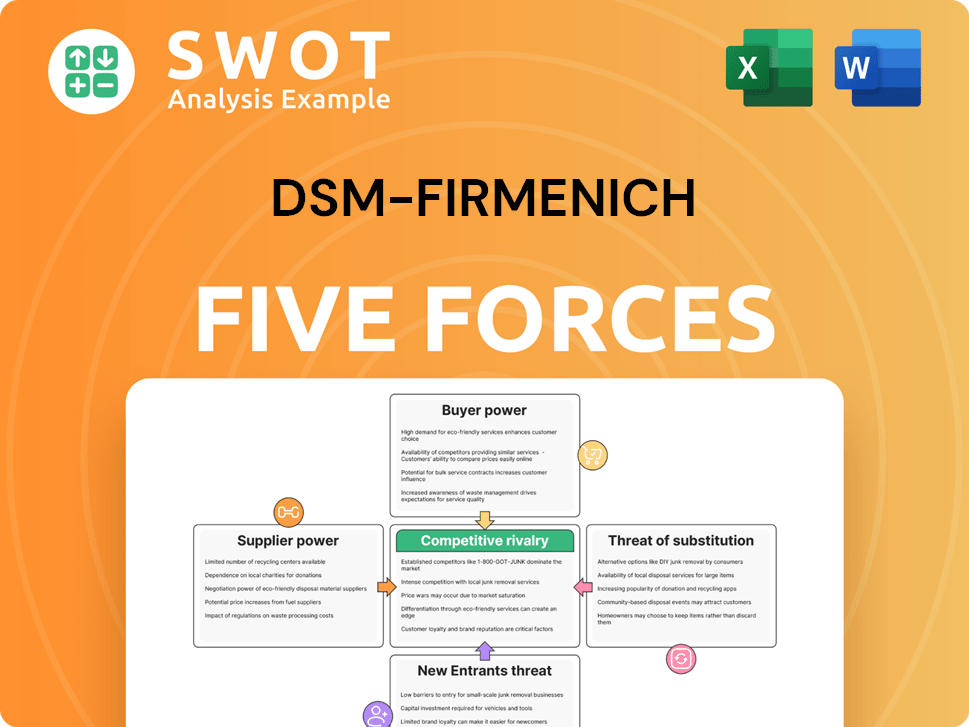

DSM-Firmenich Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of DSM-Firmenich Company?

- What is Competitive Landscape of DSM-Firmenich Company?

- How Does DSM-Firmenich Company Work?

- What is Sales and Marketing Strategy of DSM-Firmenich Company?

- What is Brief History of DSM-Firmenich Company?

- Who Owns DSM-Firmenich Company?

- What is Customer Demographics and Target Market of DSM-Firmenich Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.