Eni Bundle

How Does Eni Navigate the Shifting Energy Terrain?

The energy sector is in constant flux, shaped by geopolitical dynamics and the push for sustainable solutions. As a major player, Eni S.p.A. faces a complex competitive landscape, balancing traditional fossil fuel operations with investments in renewables. Understanding Eni's position requires a deep dive into its rivals and strategic moves.

This analysis will explore the Eni SWOT Analysis to provide a comprehensive understanding of its strengths and weaknesses. We'll dissect the Eni competitive landscape, pinpointing Eni competitors and evaluating Eni market share within the context of the broader Eni industry analysis and the intense competition among oil and gas companies in the energy sector competition. Furthermore, we will address questions like: Who are Eni's main rivals? How does Eni's global presence and competition shape its strategic choices? What are Eni's competitive advantages and challenges in the dynamic energy market?

Where Does Eni’ Stand in the Current Market?

Eni S.p.A. holds a strong market position as a diversified global energy company. Its operations span upstream oil and gas, refining, marketing, and a growing presence in renewable energy. The company's integrated model allows it to navigate the complexities of the energy sector, including the ongoing transition to cleaner energy sources. Eni's competitive landscape includes a variety of players, from major international oil companies to specialized renewable energy firms.

Eni's value proposition centers on providing energy solutions while investing in sustainable practices. This involves the exploration, development, and production of oil and natural gas, alongside the supply, trading, and marketing of gas, LNG, and power. Furthermore, Eni is expanding its portfolio in renewable energy sources and sustainable mobility. This diversification helps to mitigate risks associated with fluctuating oil prices and evolving environmental regulations, making Eni a key player in the competitive landscape.

Eni's global presence is extensive, with operations in Europe, Africa, the Americas, and Asia. Its strategic investments in renewable energy and sustainable technologies position it well for future growth. The company's financial performance, with an adjusted net profit of €8.2 billion in 2023, reflects its resilience and strategic adaptability within the dynamic energy market. For a deeper understanding of the company's origins and evolution, consider reading a Brief History of Eni.

Eni's upstream operations are a core part of its business, involving the exploration, development, and production of oil and natural gas. In 2023, Eni's average hydrocarbon production was approximately 1.62 million barrels of oil equivalent per day. These operations are geographically diverse, with significant activities in Africa, Europe, and the Americas.

Downstream operations include refining and marketing of petroleum products. Eni is also expanding its presence in renewable energy sources, such as solar and wind power. The company is investing in sustainable aviation fuel production and biorefining to reduce its carbon footprint. These initiatives are crucial for Eni's long-term competitiveness.

Eni operates globally, with a significant presence in Europe, Africa, the Americas, and Asia. Its strong position in key African markets, such as Egypt, Algeria, and Angola, provides a solid foundation for hydrocarbon production. The company's strategic approach to geographic diversification helps mitigate risks and capitalize on growth opportunities.

In 2023, Eni reported an adjusted net profit of €8.2 billion. This demonstrates the company's financial health and its ability to navigate volatile energy markets. Eni's integrated business model and strategic investments in renewables contribute to its resilience and long-term value creation.

Eni's competitive advantages include its integrated business model, global presence, and strategic investments in renewable energy. The company's strong position in natural gas supply to Europe and its growing LNG market presence are also key. These factors contribute to Eni's resilience and ability to compete effectively in the energy sector.

- Integrated Business Model: Eni's operations span the entire value chain, from exploration and production to refining and marketing.

- Global Presence: Eni operates in numerous countries across Europe, Africa, the Americas, and Asia, diversifying its geographic risk.

- Strategic Investments in Renewables: Eni is actively investing in renewable energy projects to reduce its carbon footprint and adapt to the energy transition.

- Strong Natural Gas Position: Eni holds a strong position in natural gas supply to Europe, which is critical for energy security.

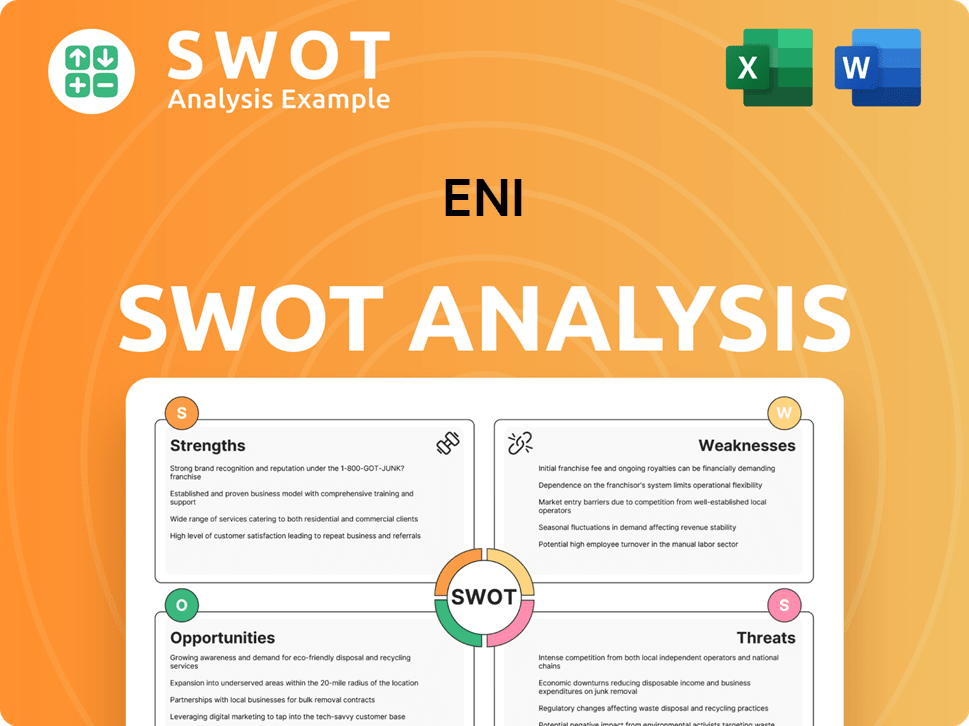

Eni SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Eni?

The Eni competitive landscape is shaped by a diverse set of rivals across its various business segments. Eni's position in the oil market is influenced by the strategies and performance of these competitors. Understanding Eni's main rivals is crucial for assessing its market position and future prospects. The company's strategic alliances and partnerships also play a key role in navigating the competitive environment.

Eni's industry analysis reveals a complex interplay of established and emerging players. The energy sector competition is intensifying due to the transition to renewable energy sources and the evolving geopolitical landscape. This dynamic environment presents both challenges and opportunities for Eni, impacting its financial performance compared to competitors.

The competitive analysis of Eni necessitates a look at its core operations and its expansion into new energy markets. The company faces competition from both integrated energy majors and specialized renewable energy developers. Eni's global presence and competition are further complicated by regional variations in market dynamics and regulatory frameworks. For a deeper dive into how Eni approaches its market, consider reading about the Marketing Strategy of Eni.

In the upstream (exploration and production) and downstream (refining and marketing) sectors, Eni competes with supermajors and national oil companies. These include Shell, BP, TotalEnergies, ExxonMobil, Chevron, and Saudi Aramco. These rivals have significant scale and extensive global portfolios.

Eni faces competition from major gas producers and traders in the gas and LNG sector. Key competitors include QatarEnergy and Equinor. Competition revolves around securing long-term supply contracts and developing infrastructure.

The rapidly growing renewable energy segment introduces new competitors. This includes companies like Ørsted, Iberdrola, and NextEra Energy. These companies specialize in solar, wind, and other renewable technologies.

New players focused on hydrogen, carbon capture, and advanced energy storage are disrupting the landscape. These companies are influencing the competitive dynamics. Mergers and alliances also impact the competitive environment.

Geopolitical shifts and the demand for diversified gas supplies have intensified competition. This has led to increased competition in the gas and LNG sector. The ongoing shifts are impacting the competitive dynamics.

Eni's sustainability initiatives also influence its competitive position. The company's renewable energy competitors are driving the shift towards green energy. These initiatives are crucial for long-term competitiveness.

Several factors determine Eni's competitive position. These include technological capabilities, financial performance, and strategic partnerships. Eni's competitive advantages and challenges are shaped by these factors.

- Scale and Portfolio: Competitors like Shell and TotalEnergies have vast global portfolios.

- Technological Capabilities: Expertise in complex exploration and production is crucial.

- Refining and Marketing Networks: Established networks provide a competitive edge.

- Renewable Energy Development: Aggressive expansion into renewables is a key factor.

- Geopolitical Risks: These risks impact supply contracts and market access.

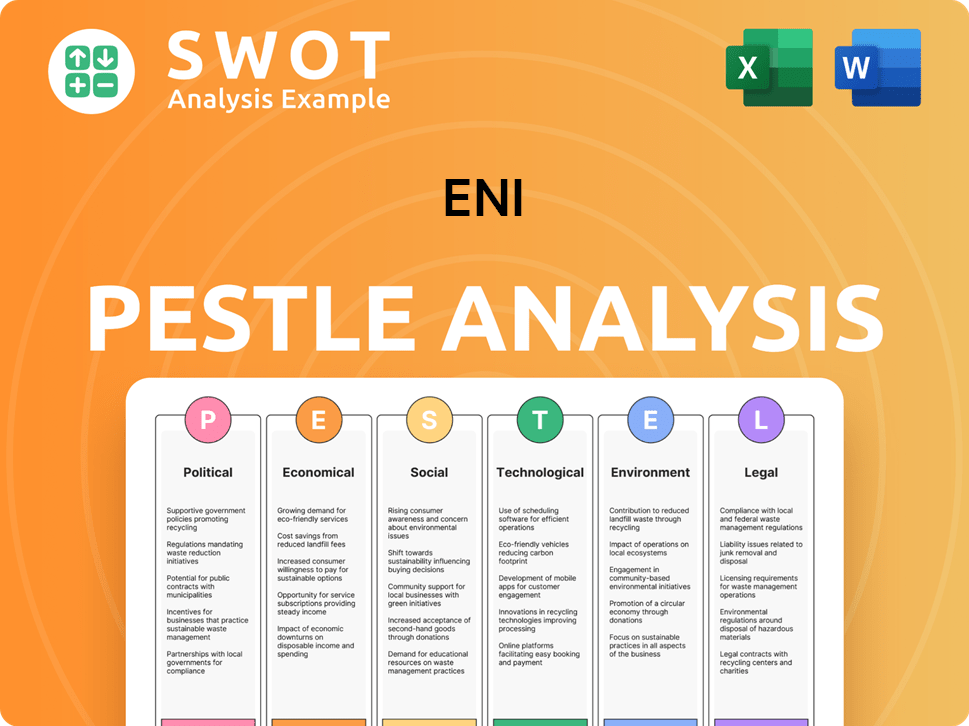

Eni PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Eni a Competitive Edge Over Its Rivals?

Examining the Eni competitive landscape reveals several key strengths that position the company within the energy sector. The company's integrated business model, spanning the entire energy value chain, offers significant advantages. This structure allows for diversification and resilience against market fluctuations, a crucial factor in the volatile oil and gas companies environment. Eni's strategic focus on natural gas and renewable energy further enhances its competitive edge.

Eni's deep expertise in complex hydrocarbon exploration and production, particularly in challenging environments, is a core competitive advantage. This technical prowess is essential for maintaining production levels and accessing new reserves. Its long-standing international presence, especially in Africa, provides established relationships and access to significant resources. This global footprint offers a degree of geopolitical and operational stability compared to newer entrants, impacting its Eni market share.

The company is actively building a competitive advantage in renewable energy and sustainable mobility. Its investments in biorefineries and sustainable aviation fuel position it at the forefront of the circular economy. These strategic initiatives are vital for long-term sustainability and attracting environmentally conscious investors. For more information on Eni's target audience, you can read about the Target Market of Eni.

Eni's integrated model, from upstream to downstream, enhances its ability to manage risks and capitalize on market opportunities. This structure allows for synergies between different segments, such as upstream production supporting downstream refining. This integration is a key differentiator in the energy sector competition.

Eni's technical capabilities in complex hydrocarbon exploration and production are a significant advantage. This expertise enables the company to operate in challenging environments and access new reserves. This is a critical factor in maintaining production levels and competitiveness.

Eni's strong presence in key international markets, particularly in Africa, provides established relationships and access to significant resources. This long-standing international footprint offers a degree of geopolitical and operational stability. This global reach is crucial for its competitive positioning.

The company's investments in renewable energy and sustainable mobility, such as biorefineries, position it at the forefront of the circular economy. These investments are crucial for long-term sustainability and attracting environmentally conscious investors. This focus is becoming increasingly important in the industry.

Eni's competitive advantages include its integrated business model, technical expertise, global presence, and renewable energy initiatives. These factors contribute to its resilience and ability to compete in the evolving energy market. These advantages are essential for understanding Eni's competitive advantages within the industry.

- Integrated operations across the energy value chain.

- Advanced exploration and production capabilities.

- Established international presence, particularly in Africa.

- Strategic investments in renewable energy and sustainable technologies.

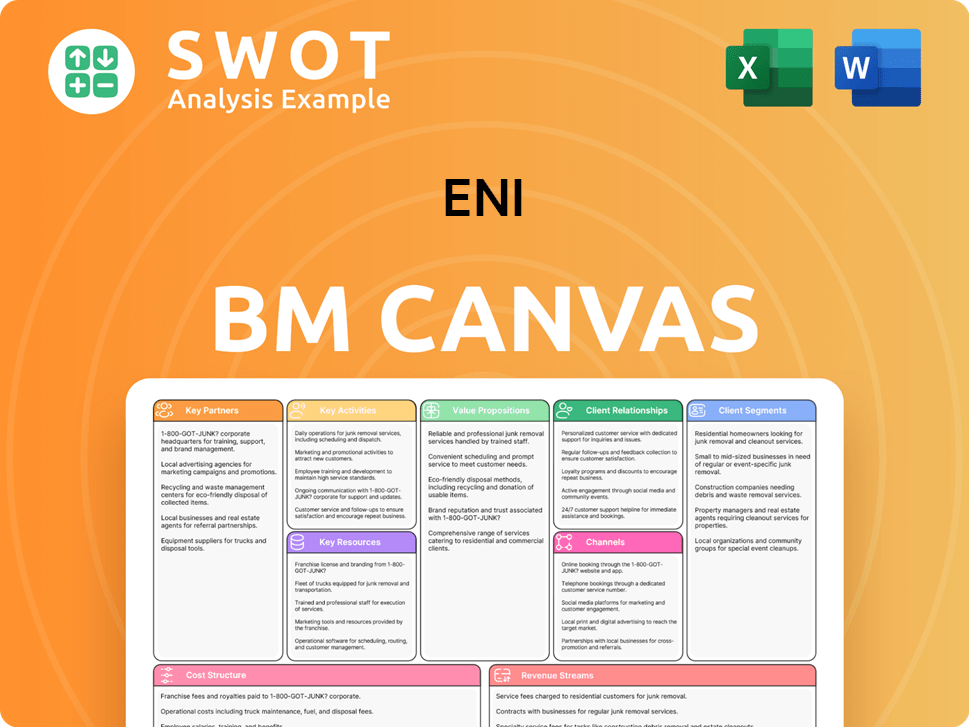

Eni Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Eni’s Competitive Landscape?

The global energy industry, including the sector where Eni operates, is undergoing significant transformation driven by the energy transition, technological advancements, and geopolitical shifts. Understanding the Owners & Shareholders of Eni and the competitive landscape is crucial for assessing its future prospects. The industry is characterized by intense competition, with companies vying for market share and adapting to evolving consumer preferences and regulatory pressures. The energy sector's future outlook is shaped by the need for sustainable practices, the adoption of new technologies, and the ability to navigate complex geopolitical and economic environments.

Eni's competitive position is influenced by its integrated business model, financial strength, and global presence. However, the company faces challenges from the declining demand for fossil fuels and the increasing competition from renewable energy companies. Eni's ability to adapt to these challenges and capitalize on emerging opportunities will determine its long-term success in the energy market. The company's strategic initiatives and partnerships play a vital role in maintaining its competitive edge.

The energy transition is accelerating, driven by climate concerns and policy changes. Renewable energy sources are gaining prominence, influencing investment decisions and operational strategies. Digitalization and technological advancements are disrupting traditional business models, creating new avenues for growth. Geopolitical instability and supply chain disruptions impact energy prices and supply security.

Declining demand for fossil fuels requires a managed decline of traditional assets. Increased regulatory scrutiny and substantial capital expenditure in renewables pose financial hurdles. Intense competition from renewable energy companies and tech giants demands rapid innovation. Navigating geopolitical risks and supply chain disruptions remains a significant challenge.

Eni can invest in large-scale renewable projects and expand its gas and LNG portfolio. Emerging markets offer new growth avenues, particularly those focused on sustainable development. Strategic partnerships and acquisitions in renewable energy and advanced technologies can accelerate diversification. Leveraging existing infrastructure and expertise supports the integrated energy transition.

Eni aims to transform into a leader in the integrated energy transition, ensuring long-term resilience. The company focuses on leveraging its existing infrastructure, technical expertise, and global presence. Strategic investments in renewable energy and sustainable technologies are key. Eni's approach involves adapting its offerings and operational practices to meet evolving consumer preferences.

Eni's strategic focus includes significant investments in renewable energy and sustainable technologies. The company has been actively expanding its renewable energy portfolio through acquisitions and partnerships. The global energy market is witnessing a surge in demand for sustainable aviation fuel and bio-products, presenting opportunities for Eni's innovation efforts.

- In 2024, Eni's renewable energy capacity reached approximately 6 GW.

- Eni plans to increase its renewable energy capacity to over 15 GW by 2027.

- The company is investing heavily in sustainable aviation fuel (SAF) production, with a target to produce 1 million tons of SAF by 2030.

- Eni's strategic partnerships include collaborations with technology companies to develop advanced carbon capture and storage solutions.

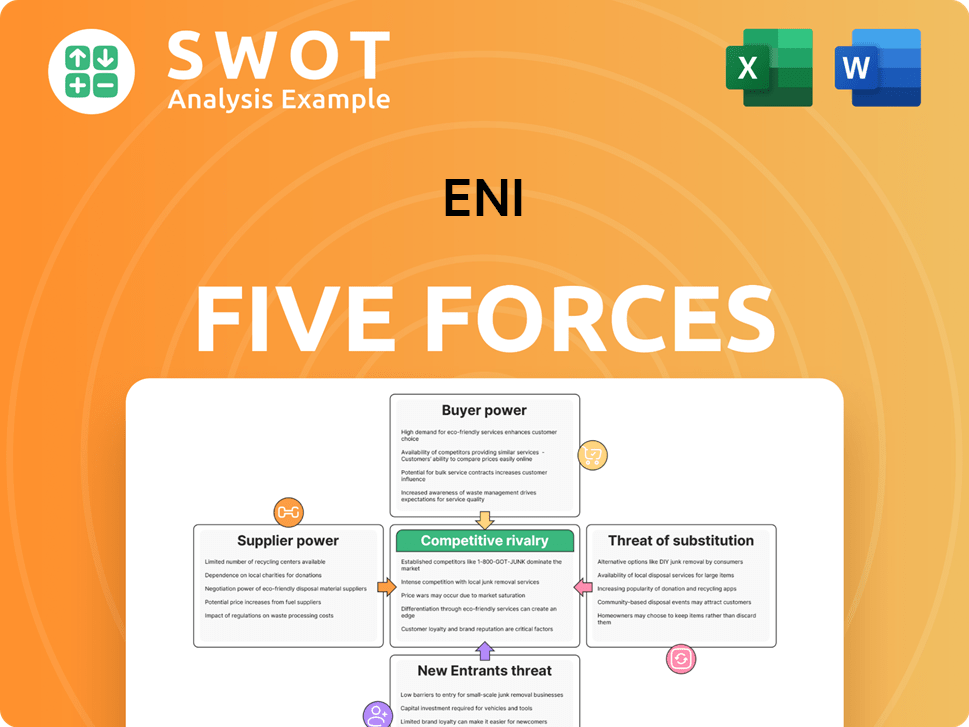

Eni Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Eni Company?

- What is Growth Strategy and Future Prospects of Eni Company?

- How Does Eni Company Work?

- What is Sales and Marketing Strategy of Eni Company?

- What is Brief History of Eni Company?

- Who Owns Eni Company?

- What is Customer Demographics and Target Market of Eni Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.