Eni Bundle

How Does the Eni Company Navigate the Global Energy Landscape?

Eni S.p.A., the Italian energy company, is a global powerhouse, deeply involved in both traditional oil and gas and the burgeoning renewable energy sector. Understanding the Eni SWOT Analysis reveals the strategic complexities and opportunities within this integrated energy giant. With a significant global footprint, Eni influences energy markets worldwide, making its operations and strategies critical for anyone tracking the industry.

This exploration into the Eni business model will dissect how this major player generates revenue, examining its diverse business segments from exploration and production to refining and marketing. We'll delve into Eni's commitment to renewable energy sources and its role in the energy transition, providing insights into its financial performance and strategic direction. Discover how Eni operates, its global presence, and its approach to sustainable energy, making it a crucial company to understand in today's evolving energy market.

What Are the Key Operations Driving Eni’s Success?

The core operations of the Eni company are designed to create value throughout the entire energy chain. This integrated approach serves a diverse customer base, including industrial clients and individual consumers. Eni's primary offerings include crude oil, natural gas, liquefied natural gas (LNG), refined petroleum products, and a growing portfolio of renewable energy sources and biofuels.

Eni's business model is built on optimizing value extraction from its resources, starting with the exploration and production (E&P) of hydrocarbons. The company focuses on discovering and developing oil and gas reserves globally, utilizing advanced technologies for efficient extraction and minimizing environmental impact. This integrated model allows Eni to adapt to evolving energy demands and maintain a competitive edge in the oil and gas industry.

A key aspect of Eni's value proposition is its commitment to technological innovation, particularly in enhancing recovery rates and developing cleaner energy solutions. Eni is investing in carbon capture and storage (CCS) projects and advanced bio-refining technologies to produce sustainable aviation fuel (SAF) and hydrotreated vegetable oil (HVO). This focus on sustainability differentiates Eni from many competitors.

Eni's upstream segment focuses on the exploration and production of oil and gas. This involves discovering and developing reserves worldwide. The company utilizes advanced technologies to improve efficiency and reduce environmental impact.

Midstream operations involve the transportation and trading of gas, LNG, and power. This ensures a reliable supply to various markets. Eni manages its midstream activities to optimize distribution and meet market demands.

Downstream operations involve refining crude oil into petroleum products. These products are then distributed and marketed through Eni's extensive retail network. This segment ensures products reach consumers efficiently.

Eni is expanding its portfolio to include electricity from renewable sources and biofuels. This includes investments in solar, wind, and bio-refining technologies. The company is actively contributing to sustainable energy solutions.

Eni's integrated approach, coupled with a growing emphasis on sustainability, differentiates it from many competitors. The company's supply chain is globally integrated, supported by strategic partnerships and a robust distribution network.

- Technological Innovation: Investing in carbon capture and storage (CCS) and advanced bio-refining.

- Global Presence: Operating in numerous countries with a wide distribution network.

- Sustainability Focus: Commitment to cleaner energy solutions, including SAF and HVO production.

- Strategic Partnerships: Collaborating with various entities to enhance operations and market reach.

Eni SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Eni Make Money?

The Eni company, an Italian energy company, operates through a diversified business model, generating revenue from various segments within the oil and gas industry and renewable energy sectors. Its financial performance is driven by a mix of hydrocarbon production, natural gas and power sales, and refining and marketing activities. Understanding the revenue streams and monetization strategies of Eni operations is crucial for assessing its overall financial health and future prospects.

Eni's primary revenue streams are segmented across Exploration & Production (E&P), Global Gas & LNG Portfolio (GGP), Refining & Marketing, and Chemicals. The E&P segment focuses on the exploration, development, and production of oil and natural gas, which historically has been a major contributor to the company's earnings. The GGP segment handles the supply, trading, and marketing of gas and LNG, while the Refining & Marketing and Chemicals segments generate revenue through the sale of refined products and chemicals.

Monetization strategies involve long-term supply agreements, spot market sales, and bundled services. Eni is also increasingly focused on monetizing its renewable energy assets through power purchase agreements (PPAs) and the sale of green certificates. The company's bio-refining initiatives, such as biofuel production, represent an expanding revenue source, aligning with global decarbonization trends. Eni's strategy also includes optimizing its asset portfolio through divestments of non-core assets and strategic acquisitions.

Focuses on oil and gas exploration, development, and production.

Involves the supply, trading, and marketing of gas and LNG.

Deals with the sale of refined petroleum products.

Focuses on the production and sale of chemical products.

Monetizes assets through PPAs and green certificates.

Involves the production of biofuels.

Eni's monetization strategies are multifaceted, designed to optimize revenue across its diverse business segments. These strategies include a mix of long-term contracts, spot market sales, and the development of new revenue streams in renewable energy and bio-refining.

- Long-Term Supply Agreements: Securing stable revenue through long-term contracts for oil, gas, and LNG.

- Spot Market Sales: Capitalizing on market fluctuations to maximize revenue from spot sales.

- Bundled Services: Offering integrated services to industrial clients.

- Power Purchase Agreements (PPAs): Generating revenue from renewable energy projects.

- Sale of Green Certificates: Monetizing environmental benefits through the sale of green certificates.

- Biofuel Production: Expanding revenue streams through bio-refining initiatives.

Eni PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Eni’s Business Model?

The Eni company has navigated significant shifts in the energy landscape, marked by key milestones and strategic pivots. A central focus has been the acceleration of its energy transition plan, aiming for carbon neutrality by 2050. This strategy involves substantial investments in renewable energy, bio-refining, and carbon capture technologies. The company has also adapted to operational challenges, including geopolitical instability impacting oil and gas production and market volatility in commodity prices.

Eni's strategic moves include a strong emphasis on diversifying its supply sources, optimizing its portfolio, and strengthening its resilience through cost efficiencies and technological advancements. The company's commitment to research and development, particularly in innovative energy technologies, provides a technological leadership advantage. Furthermore, the company has expanded its operations through strategic acquisitions and partnerships to bolster its presence in key markets, such as renewable energy and sustainable mobility solutions.

Eni's business model is characterized by its integrated approach, spanning the energy value chain, which provides operational synergies and risk mitigation. Its long-standing expertise in complex upstream projects, coupled with a strong global presence, offers significant economies of scale. The company's strong brand recognition and established customer relationships across various markets also contribute to its sustained business model. Eni continues to adapt to new trends by investing in digitalization across its operations to enhance efficiency and decision-making, and by actively participating in the development of new energy markets, such as hydrogen and offshore wind.

Eni has achieved significant milestones, including major discoveries in the oil and gas sector and strategic expansions into renewable energy. For instance, the company has increased its renewable energy capacity to 1.5 GW by the end of 2023, with plans to reach over 15 GW by 2030. The company's bio-refineries in Gela and Porto Marghera are pivotal in its sustainable mobility initiatives.

Eni has made strategic moves to enhance its portfolio and operational efficiency. This includes the acquisition of Neptune Energy's assets in the North Sea, expanding its exploration and production capabilities. Also, the company has invested significantly in carbon capture and storage projects, targeting 10 million tons per year of CO2 storage capacity by 2030. The company's focus on digitalization has led to improvements in operational efficiency.

Eni's competitive edge is rooted in its integrated business model and technological innovation. The company's expertise in complex upstream projects and its global presence offer significant advantages. Eni has a strong brand recognition and established customer relationships across various markets. The company's commitment to research and development, particularly in innovative energy technologies, provides a technological leadership advantage. Further insights into Eni's marketing strategies can be found in this article: Marketing Strategy of Eni.

Eni's financial performance reflects its strategic adjustments and market conditions. In 2023, the company reported revenues of approximately €125 billion. The company has demonstrated resilience, adapting to market volatility and maintaining profitability. The company's investments in renewable energy and sustainable projects are expected to contribute to long-term value creation.

Eni's global presence is highlighted by its involvement in several key projects worldwide. The company has substantial operations in Africa, the Mediterranean, and the Americas. Eni's exploration and production activities are concentrated in key regions, including the Mediterranean and Africa. The company is actively involved in the development of new energy markets, such as hydrogen and offshore wind.

- Exploration and production in the Mediterranean and Africa.

- Investments in renewable energy projects globally.

- Development of carbon capture and storage facilities.

- Expansion into new energy markets, including hydrogen and offshore wind.

Eni Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Eni Positioning Itself for Continued Success?

The Growth Strategy of Eni positions it as a leading integrated energy company. It competes with other major players in the oil and gas industry. Eni's diversified portfolio includes both traditional hydrocarbons and new energy solutions, which helps it manage market changes. Its extensive retail network supports customer loyalty.

However, Eni faces several risks. Regulatory changes related to climate policies could impact its business. The volatility of oil and gas prices is a financial risk. New competitors in renewable energy and technological disruptions also pose challenges. Geopolitical instability in areas where Eni operates adds operational and security risks.

Eni, an Italian energy company, holds a significant market share in key exploration and production regions. It has a strong presence in the European gas and power markets. This integrated model allows Eni to optimize both its traditional and new energy businesses.

Eni is exposed to regulatory changes, particularly those related to climate policies. Volatility in oil and gas prices presents a financial risk. New competitors in the renewable energy sector and technological disruptions could challenge its market position.

Eni is focused on accelerating its energy transition. The company plans to expand its renewable energy capacity and increase biofuel production. It aims to achieve net-zero emissions by 2050.

Eni's business model is based on an integrated approach, combining exploration and production, refining, and marketing. This diversification helps the company manage risks and capitalize on opportunities across the energy value chain. It aims to sustain and expand its ability to generate revenue.

Eni is actively investing in renewable energy sources and expanding its biofuel production. The company is developing carbon capture and storage projects to reduce its environmental impact. These initiatives support Eni's role in the energy transition.

- Expansion of renewable energy capacity, including solar and wind power projects.

- Increase in biofuel production through strategic partnerships and facility upgrades.

- Development of carbon capture and storage projects to reduce emissions from existing operations.

- Investment in technologies to enhance energy efficiency and reduce environmental footprint.

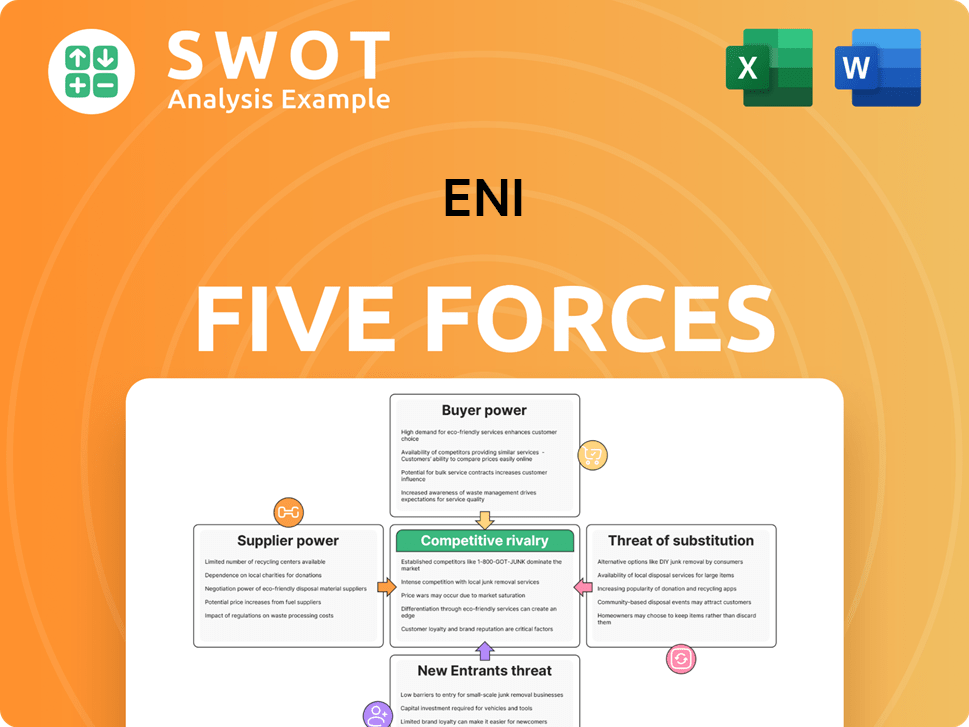

Eni Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Eni Company?

- What is Competitive Landscape of Eni Company?

- What is Growth Strategy and Future Prospects of Eni Company?

- What is Sales and Marketing Strategy of Eni Company?

- What is Brief History of Eni Company?

- Who Owns Eni Company?

- What is Customer Demographics and Target Market of Eni Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.