Exchange Income Bundle

How Does Exchange Income Company Thrive in a Competitive Market?

Exchange Income Corporation (EIC) has established itself as a key player in North American aerospace, aviation, and manufacturing. Its success stems from a strategic acquisition model, focusing on acquiring and nurturing established businesses. Understanding the Exchange Income SWOT Analysis is crucial for grasping its position within its competitive landscape.

This market analysis will explore the competitive dynamics shaping Exchange Income Company's future, examining its rivals and dissecting its unique strengths. Investors and analysts alike need to understand the competitive landscape to assess the company's financial performance and long-term growth potential. We'll delve into the competitive advantages of Exchange Income Company, offering insights valuable for anyone evaluating investment strategies or conducting thorough research, including comparisons with peers and an assessment of the impact of interest rates.

Where Does Exchange Income’ Stand in the Current Market?

The Exchange Income Company (EIC) carves out a unique space in its target industries through a diversified portfolio strategy. This approach allows EIC to operate within various niches, often holding significant positions within their respective markets. The company's subsidiaries, such as Calm Air and Perimeter Aviation, are key regional carriers in Canada, providing essential air services to remote communities. Similarly, its manufacturing subsidiaries focus on specialized areas like precision machining and OEM, playing critical roles in their supply chains.

EIC's core operations are divided into two main segments: Aerospace & Aviation and Manufacturing. The Aerospace & Aviation segment includes scheduled and charter airline services, aircraft maintenance, repair, and overhaul (MRO), and aerospace manufacturing. The Manufacturing segment encompasses a wide range of specialized processes, from metal fabrication to the production of specialized equipment. Geographically, EIC's operations are mainly in North America, with a strong presence in Canada and a growing footprint in the U.S. The company serves diverse customer segments, including government agencies, industrial clients, and individual passengers.

EIC's strategy centers on acquiring and operating profitable, well-established businesses. Recent acquisitions have focused on enhancing existing capabilities and expanding into synergistic areas within its core segments. For the fiscal year 2024, EIC reported revenue of $2.3 billion and an adjusted EBITDA of $502 million, demonstrating strong financial performance. Its focus on free cash flow generation and dividend growth highlights its stable financial position, making it an interesting subject for a detailed analysis of Exchange Income Company.

In the aviation sector, EIC's subsidiaries are key regional players, particularly in Canada. They provide essential air services to remote communities, which gives them a significant advantage. The company's focus on MRO services further strengthens its position within the aerospace industry.

EIC's manufacturing segment benefits from its specialization in areas like precision machining and OEM. These capabilities allow EIC to serve critical roles within various supply chains. The company's strategic acquisitions continue to enhance its manufacturing portfolio.

EIC's operations are primarily concentrated in North America, with a strong presence in Canada. This geographic focus allows for targeted market strategies. The company's expanding footprint in the U.S. manufacturing sector is a key growth area.

EIC's strong financial performance, with $2.3 billion in revenue in 2024, supports its market position. The company's focus on free cash flow and dividend growth underscores its financial stability. This financial strategy is crucial for long-term growth potential.

EIC's competitive advantages stem from its diversified business model and strategic acquisitions. The company's focus on regional aviation and specialized manufacturing provides a solid foundation. Analyzing EIC's portfolio reveals strengths in niche markets.

- Diversified Business Model: Reduces risk and provides multiple revenue streams.

- Strategic Acquisitions: Enhance capabilities and expand market reach.

- Strong Financial Performance: Supports continued investment and growth.

- Focus on Free Cash Flow: Ensures financial stability and investor returns.

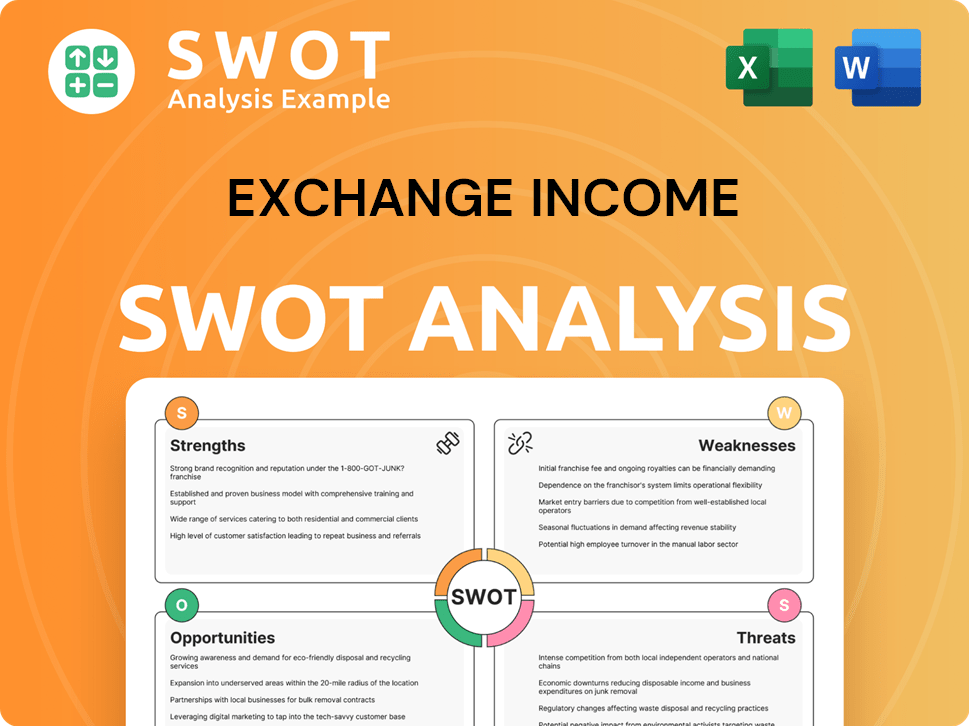

Exchange Income SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Exchange Income?

The Marketing Strategy of Exchange Income must consider the diverse competitive landscape across its business segments. The company faces varying degrees of competition in its Aerospace & Aviation and Manufacturing divisions. A thorough competitive analysis is essential for understanding the market dynamics and making informed investment decisions.

Understanding the competitive environment is crucial for assessing the long-term growth potential of Exchange Income Company. This involves identifying key competitors, evaluating their strengths and weaknesses, and analyzing market trends. A detailed market analysis helps to determine the company's position and potential for future success.

Exchange Income Corporation's competitive landscape is complex, with rivals varying significantly between its Aerospace & Aviation and Manufacturing segments. The company's strategic approach must consider these diverse challenges to maintain and enhance its market position.

In the Aerospace & Aviation sector, Exchange Income Company (EIC) competes with regional carriers and, to a lesser extent, larger national airlines. This competition is particularly relevant in the regional airline operations within Canada.

Key competitors include other regional carriers such as Canadian North and smaller independent charter operators. These entities compete for passenger and cargo services, particularly in remote regions.

In the MRO and aerospace manufacturing sub-segments, EIC's subsidiaries face competition from specialized MRO providers and aerospace component manufacturers. This competition comes from both domestic and international sources.

Specific competitors include companies like Magellan Aerospace and divisions of larger defense and aerospace contractors. These competitors challenge EIC through pricing, service quality, and specialized capabilities.

Within the Manufacturing segment, the competitive landscape is highly fragmented and diverse. EIC's subsidiaries compete with a multitude of specialized manufacturers across various industries.

Competitors range from small, privately owned shops specializing in niche products to larger, more diversified industrial conglomerates. This diversity complicates the competitive analysis.

In precision machining, EIC's manufacturing entities may compete with companies like Linamar Corporation or other contract manufacturers. In specific OEM markets, they might face competition from other component suppliers or even in-house manufacturing capabilities of their customers. Competition in manufacturing often revolves around technological expertise, production efficiency, quality control, and the ability to meet specific customer requirements and lead times.

- Technological Expertise: Advanced manufacturing techniques and innovation are crucial.

- Production Efficiency: Streamlined processes and cost-effectiveness are key.

- Quality Control: Meeting stringent standards is essential.

- Customer Requirements: Adapting to specific needs and lead times.

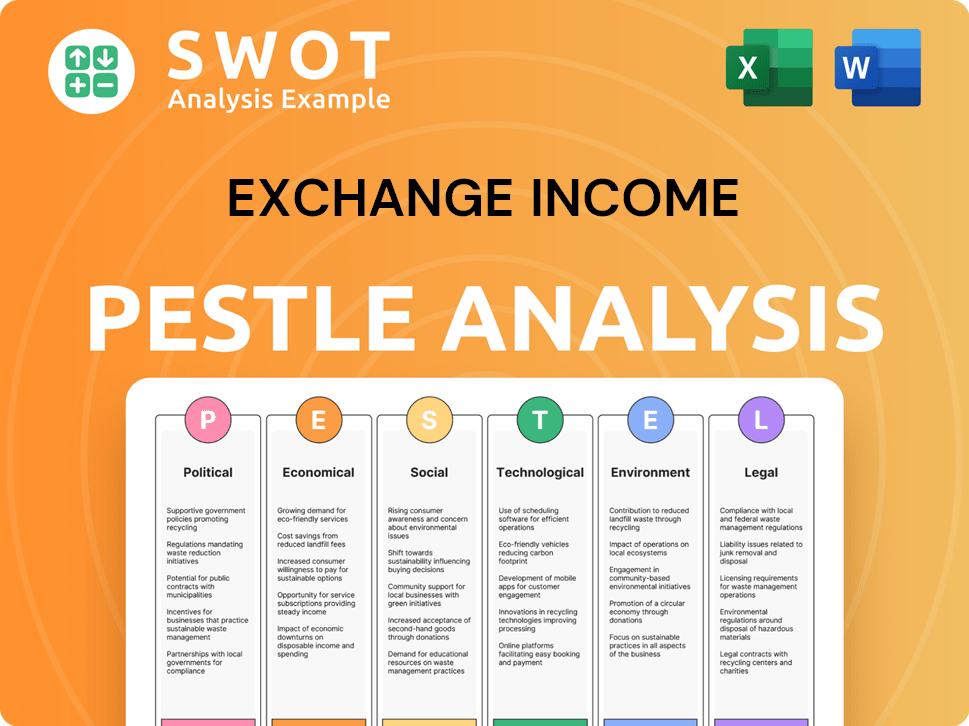

Exchange Income PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Exchange Income a Competitive Edge Over Its Rivals?

The competitive advantages of Exchange Income Company are built upon its unique acquisition strategy and operational synergies across its diverse portfolio. This approach allows the company to identify and integrate profitable businesses efficiently. The decentralized operating model fosters entrepreneurial spirit, while the company provides strategic oversight and capital support. A thorough market analysis reveals the company's strategic positioning.

Exchange Income Company's diversified portfolio, spanning Aerospace & Aviation and Manufacturing, provides a natural hedge against economic downturns. Subsidiaries often possess proprietary technologies or specialized certifications. The company's strong brand equity and customer loyalty, particularly in aviation, are key strengths. The company's financial performance is supported by its strong balance sheet.

The company's approach to acquisitions and integration has been continuously refined over time. This evolution, combined with the specialized nature of its acquired businesses and disciplined financial management, contributes to the sustainability of its competitive advantages. However, the company faces potential threats from new market entrants or technological disruptions.

Exchange Income Company excels at acquiring and integrating established businesses. This strategy allows the company to benefit from existing market positions and operational efficiencies. This approach reduces the risks associated with starting new ventures.

The company's diversification across Aerospace & Aviation and Manufacturing provides stability. This diversification acts as a hedge against economic fluctuations. This strategy helps to protect overall earnings and cash flow.

The decentralized operating model empowers acquired management teams. This fosters entrepreneurial spirit and agility. Exchange Income Company provides strategic oversight and capital support.

Exchange Income Company maintains a strong balance sheet and access to capital markets. This enables the company to pursue strategic acquisitions. It also supports investments in the growth of existing businesses.

Exchange Income Company's competitive advantages include its acquisition expertise, diversified portfolio, and operational independence. These strengths are further enhanced by its financial strength and access to capital. Analyzing the company's portfolio reveals these key strengths.

- Proven acquisition and integration capabilities.

- Diversified portfolio mitigating industry-specific risks.

- Decentralized operating model fostering agility.

- Strong balance sheet and access to capital markets.

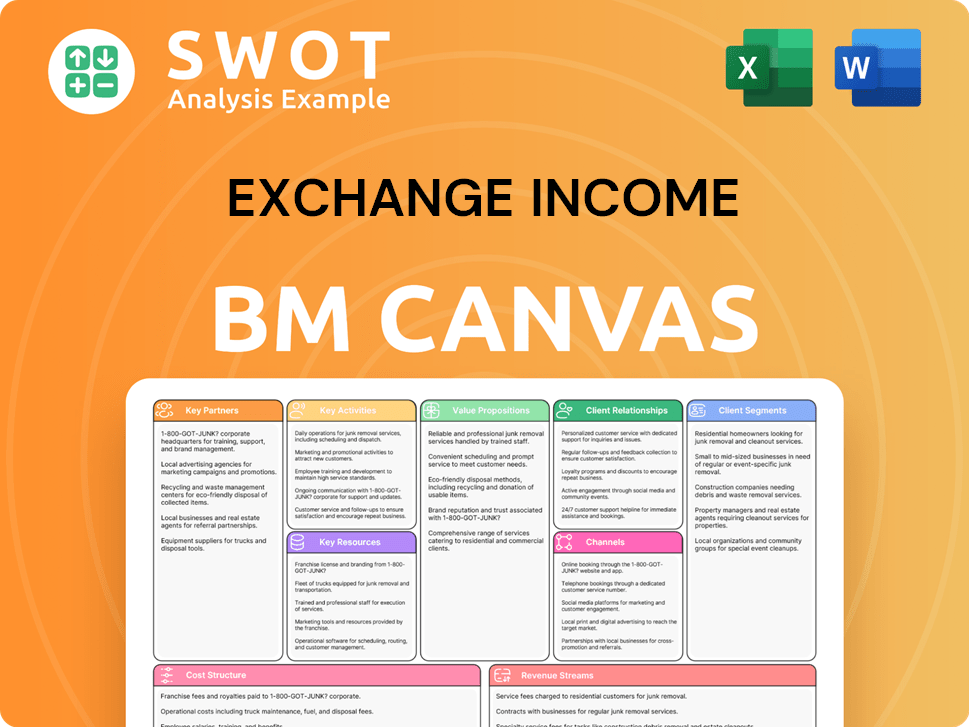

Exchange Income Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Exchange Income’s Competitive Landscape?

The competitive landscape for Exchange Income Company (EIC) is influenced by industry trends, presenting both challenges and opportunities. Understanding these dynamics is crucial for investors and stakeholders conducting a thorough market analysis. The firm's position is shaped by developments in its core segments, requiring strategic adaptation to maintain and enhance financial performance.

EIC faces potential risks, including economic downturns and increased regulatory burdens. However, it also has opportunities for growth in emerging markets and through strategic partnerships. This analysis will explore the industry trends, future challenges, and opportunities impacting EIC, offering insights for informed investment decisions and understanding the competitive environment.

Technological advancements like uncrewed aerial vehicles (UAVs) and sustainable aviation fuels (SAFs) are reshaping the aviation industry. While UAVs could challenge traditional cargo services, they also offer opportunities for EIC's MRO and manufacturing units. The growing focus on sustainability creates a need for adapting maintenance and developing components for more fuel-efficient aircraft.

Automation, digitalization (Industry 4.0), and the demand for customized components are significant trends in manufacturing. These trends require capital investments and workforce training. The reshoring or nearshoring of manufacturing in North America, driven by supply chain concerns, presents growth opportunities for EIC's domestic operations.

Economic downturns impacting travel and industrial demand pose a threat to EIC. Increased regulatory burdens in aviation and competition from new entrants with disruptive technologies are also significant challenges. Aggressive new competitors and prolonged economic recession could decrease passenger and cargo volumes.

Significant growth opportunities exist in emerging markets, particularly for specialized manufacturing components. Strategic partnerships can expand reach and capabilities. Product innovations within existing businesses, such as new MRO solutions and specialized manufacturing processes, offer further potential. Considering the company's investment strategy, acquisitions that align with these trends are crucial.

EIC's competitive position will evolve with strategic acquisitions and ongoing investment in operational efficiency and technological capabilities. These investments are crucial for remaining resilient and capitalizing on future growth avenues. Analyzing Exchange Income Company's portfolio and its financial statements is critical for investors.

- Adapt to emerging technologies in aerospace and manufacturing.

- Explore opportunities in emerging markets and strategic partnerships.

- Invest in operational efficiency and technological advancements.

- Conduct thorough market analysis and evaluate the competitive landscape.

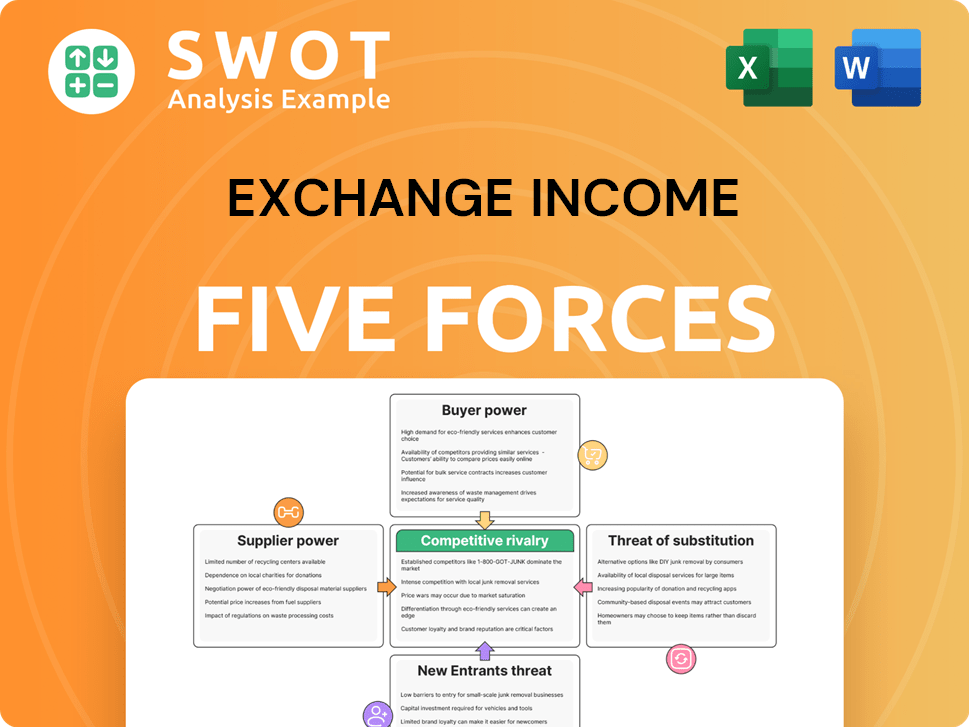

Exchange Income Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Exchange Income Company?

- What is Growth Strategy and Future Prospects of Exchange Income Company?

- How Does Exchange Income Company Work?

- What is Sales and Marketing Strategy of Exchange Income Company?

- What is Brief History of Exchange Income Company?

- Who Owns Exchange Income Company?

- What is Customer Demographics and Target Market of Exchange Income Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.