Exchange Income Bundle

How Does Exchange Income Company Thrive?

Exchange Income Corporation (EIC) is making waves, recently announcing record-breaking Q1 2025 revenue and Adjusted EBITDA. This financial powerhouse, operating in aerospace, aviation, and manufacturing, has demonstrated impressive growth. But how does this Exchange Income SWOT Analysis help them?

EIC's success hinges on a unique approach, acquiring established businesses and providing strategic support. Understanding the Exchange Income SWOT Analysis is key to understanding how Exchange Income Business Model works, generating income, and offering a compelling investment platform. This detailed exploration will uncover the secrets behind EIC's consistent profitability and its strategic moves within the financial services sector.

What Are the Key Operations Driving Exchange Income’s Success?

The core operations of Exchange Income Company (EIC) revolve around a diversified business model, creating value through two main segments: Aerospace & Aviation and Manufacturing. This structure allows EIC to generate income from various sources, enhancing its financial stability. Understanding the Growth Strategy of Exchange Income is crucial to grasping how the company operates and its potential for income generation.

In the Aerospace & Aviation segment, EIC offers essential air services, including passenger, freight, and medevac operations. The Manufacturing segment encompasses environmental access solutions, multi-story window solutions, and precision manufacturing. EIC's strategy focuses on acquiring profitable companies with strong management teams, which then operate with a degree of autonomy.

EIC's value proposition lies in its ability to provide reliable services and specialized solutions across its segments. The company supports its subsidiaries with capital and strategic guidance, fostering organic growth. This approach allows EIC to benefit from the expertise of its acquired businesses, creating a resilient and diversified investment platform.

Provides essential air services and aerospace solutions. Includes fixed-wing and rotary-wing operations, medevac, passenger, charter, freight, and auxiliary services. Also offers mission systems design, integration, aircraft modifications, and pilot training.

Focuses on Environmental Access Solutions, Multi-Storey Window Solutions, and Precision Manufacturing & Engineering. Includes portable hydronic climate-controlled equipment. Operates in niche markets with strong growth potential.

EIC's operational model is characterized by a disciplined acquisition strategy and decentralized management. This approach allows subsidiaries to maintain operational autonomy while benefiting from EIC's strategic guidance and financial resources. This model supports long-term success and provides a diversified income stream.

- Acquires businesses with strong management teams and steady cash flow.

- Provides capital and strategic guidance to acquired businesses.

- Maintains a decentralized management approach.

- Focuses on niche markets with growth potential.

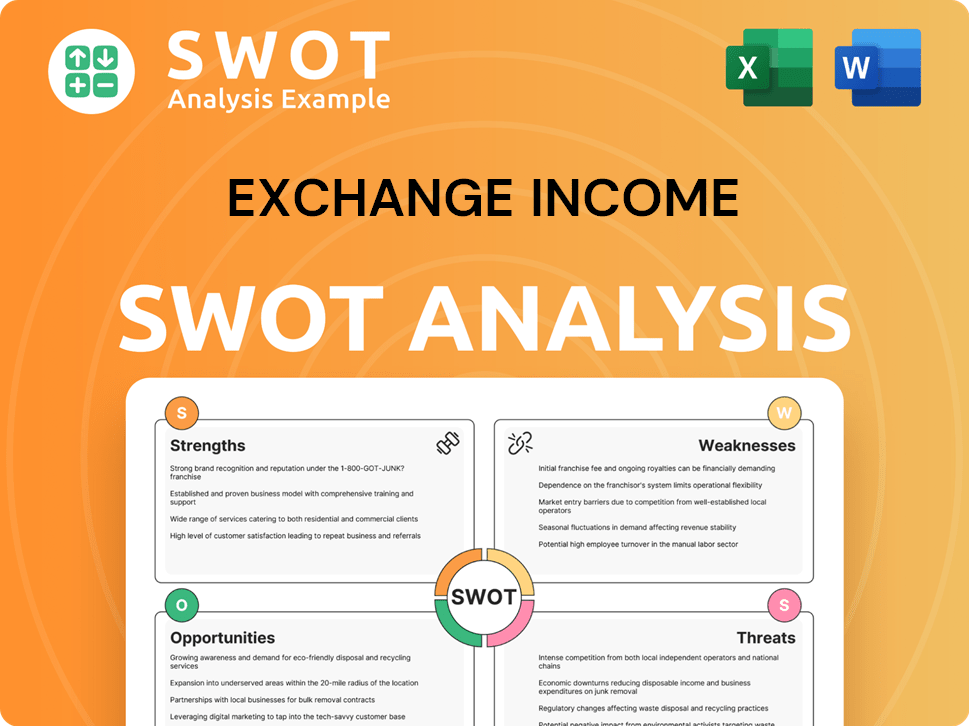

Exchange Income SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Exchange Income Make Money?

The focus of this section is on how Exchange Income Corporation generates revenue and its strategies for monetization. Understanding the Brief History of Exchange Income is key to grasping its current financial operations. The company's approach involves a diversified portfolio and a commitment to shareholder returns.

Exchange Income Corporation's revenue streams are primarily divided between two key segments: Aerospace & Aviation and Manufacturing. This structure allows for a diversified income base, which is crucial for financial stability and growth. The company's strategic acquisitions and operational efficiencies have played a significant role in boosting its financial performance.

For the full year 2024, Exchange Income Corporation reported a record revenue of $2.7 billion. In the first quarter of 2025, consolidated revenue reached $668 million, which is an 11% increase compared to the prior period. This demonstrates the company's ability to generate income and grow its business operations.

The Aerospace & Aviation segment is the largest revenue contributor. In 2024, this segment generated $1.64 billion, up from $1.50 billion in 2023. The Manufacturing segment also showed strong growth, with revenue increasing by $53 million or 23% to $286 million in Q1 2025. These figures highlight the company's income generation capabilities and its strategic focus on key sectors.

- Aerospace & Aviation: Revenue of $382 million in Q1 2025, a 4% increase.

- Manufacturing: Revenue of $286 million in Q1 2025, a 23% increase.

- Acquisitions: The Manufacturing segment's growth was boosted by the acquisitions of Spartan Mat, LLC, Spartan Composites, LLC, and Armand Duhamel & Fils Inc.

- Monetization Strategy: Focuses on identifying profitable businesses in niche markets.

- Financial Stability: Supported by a strong balance sheet and a $3.0 billion credit facility extended to April 2029.

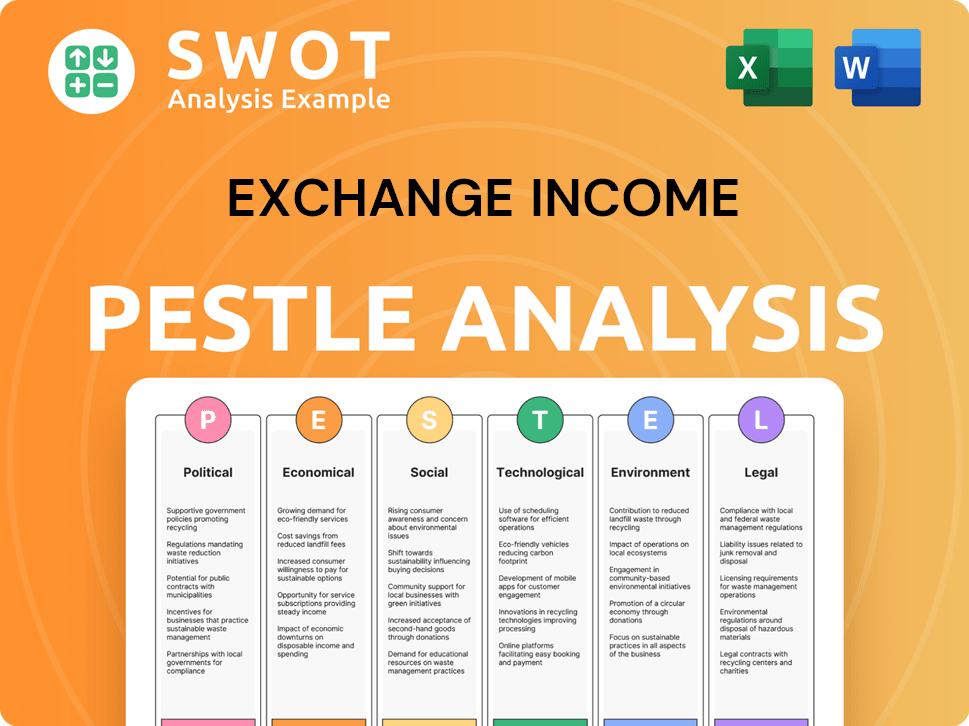

Exchange Income PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Exchange Income’s Business Model?

The success of Exchange Income Corporation (EIC) is significantly shaped by its strategic initiatives and key milestones. As of April 2025, EIC has strategically completed 19 acquisitions, demonstrating a consistent growth strategy. This disciplined approach, averaging nearly two acquisitions annually over the past three years, is a cornerstone of the company's expansion. These strategic moves are pivotal in understanding how Exchange Income works and its approach to income generation.

EIC's recent acquisitions and organic growth initiatives highlight its commitment to expanding its market presence. The acquisition of Newfoundland Helicopters Ltd. in May 2025 for $13.5 million, and the pending acquisition of Canadian North for C$205 million, underscore its focus on strategic expansion. Furthermore, investments in organic growth, such as deploying Q400 aircraft and expanding the Atik Mason Pilot Pathway Program, are integral to its long-term strategy. These moves are essential to understand the Exchange Income business model.

EIC's ability to adapt to operational challenges, such as addressing manufacturing gaps and project deferrals, further demonstrates its resilience. The company's proactive approach to integrating manufacturing footprints and investing in new aircraft, such as the eight to ten new King Air aircraft planned for 2025, showcases its commitment to operational efficiency and long-term growth. This adaptability is crucial for the company's sustained performance and the success of its investment platform.

EIC's competitive edge is rooted in its diversified business model, which provides stability against market fluctuations. The company's focus on niche markets and essential services, such as medevac and critical air services, ensures stable demand. Furthermore, EIC's strong financial position, including a $3.0 billion credit facility, enables strategic acquisitions and investments.

EIC prioritizes long-term success by empowering acquired management teams and consistently adapting to new trends. The company's exploration of new opportunities, such as potential expansion into Australian maritime surveillance, demonstrates its forward-thinking approach. This strategic focus is key to understanding how to earn money with Exchange Income.

EIC's financial health is supported by its strong balance sheet and access to significant liquidity. The company's $3.0 billion credit facility is a key enabler for strategic acquisitions and growth capital investments. This financial stability is essential for assessing the Exchange Income Company profitability.

- Acquisition of Newfoundland Helicopters Ltd. in May 2025 for $13.5 million.

- Binding purchase agreement to acquire Canadian North in February 2025 for C$205 million.

- Focus on niche markets and essential services, such as medevac and critical air services.

- Commitment to long-term success and empowering acquired management teams.

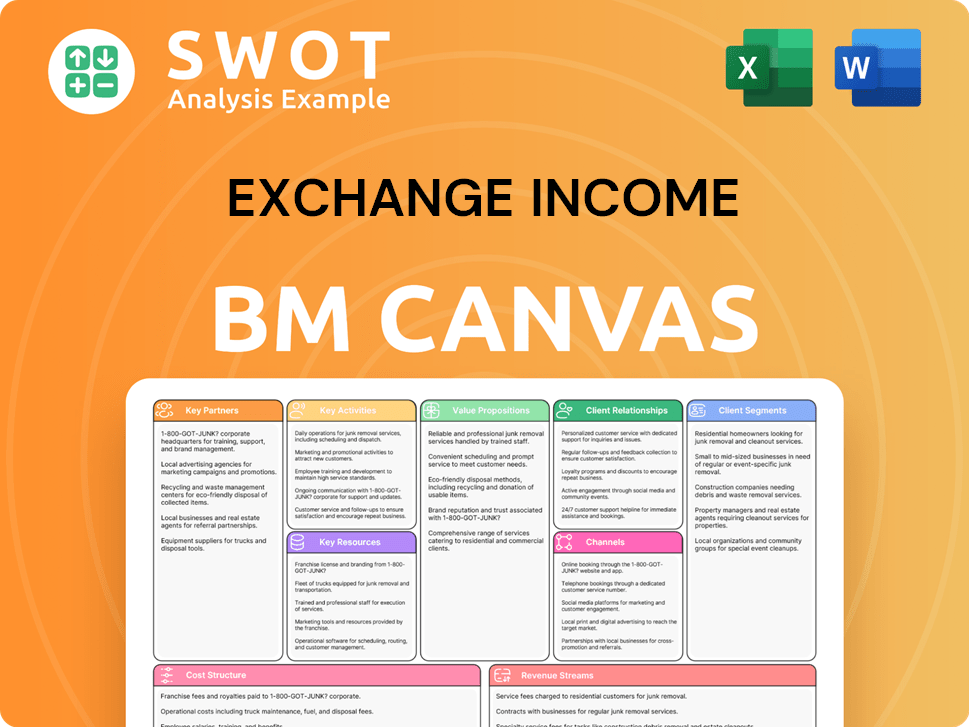

Exchange Income Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Exchange Income Positioning Itself for Continued Success?

The Exchange Income Company (EIC) maintains a strong market position across its aerospace, aviation, and manufacturing sectors. Its disciplined acquisition strategy, focusing on niche markets, contributes to customer loyalty and stable demand. EIC's operations span Canada and the United States, with plans for global expansion, reflecting its commitment to sustained growth. Find out more about the Target Market of Exchange Income.

Key risks include macroeconomic trends, regulatory changes, and interest rate impacts. EIC's diversified portfolio offers resilience, but external factors can still affect business confidence. Despite these challenges, the company is focused on expanding profitability and has a solid financial foundation to pursue strategic acquisitions and growth initiatives.

EIC's industry position is strengthened by its focus on essential services and niche markets. The company reported record revenue of $2.7 billion in 2024 and $668 million in Q1 2025. Its global reach is evident through operations in Canada and the United States, with aspirations for international expansion.

Risks include macroeconomic trends impacting project deferrals and manufacturing gaps. Regulatory changes and the approval process for acquisitions also pose risks. Increased interest costs due to acquisitions and growth capital expenditures affect profitability.

EIC is focused on sustaining and expanding its profitability. The company reconfirmed its fiscal 2025 Adjusted EBITDA guidance of $690 million to $730 million, an increase of 10% to 16% from 2024. The company's long-term outlook is optimistic.

Strategic initiatives include continued expansion in aerospace and manufacturing. The company plans to continue investing in growth capital expenditures. EIC's strong balance sheet, with over $1 billion in liquidity, supports strategic acquisitions.

EIC's financial health is demonstrated by its record revenue and strong liquidity. The company is focused on sustainable growth and strategic investments. Here are some key financial highlights:

- Record Revenue in 2024: $2.7 billion

- Q1 2025 Revenue: $668 million

- Fiscal 2025 Adjusted EBITDA Guidance: $690 million to $730 million

- Liquidity from Upsized Credit Facility: Over $1 billion

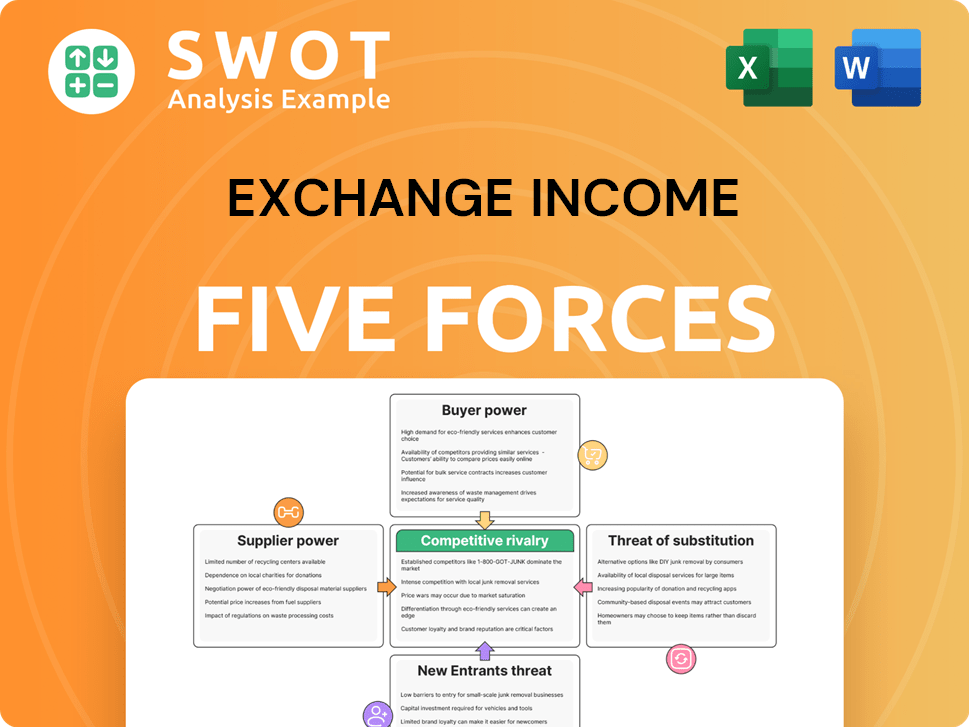

Exchange Income Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Exchange Income Company?

- What is Competitive Landscape of Exchange Income Company?

- What is Growth Strategy and Future Prospects of Exchange Income Company?

- What is Sales and Marketing Strategy of Exchange Income Company?

- What is Brief History of Exchange Income Company?

- Who Owns Exchange Income Company?

- What is Customer Demographics and Target Market of Exchange Income Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.