Exchange Income Bundle

How Does Exchange Income Company Fly High in Sales and Marketing?

Exchange Income Corporation (EIC) has soared to impressive heights since its 2004 launch, transforming from a small aviation player into a diversified powerhouse. With record revenues and a history of delivering substantial shareholder returns, EIC's success story is a testament to its strategic prowess. But how does this Canadian company, with its focus on niche markets, actually sell and market its diverse portfolio of businesses?

This article explores the Exchange Income SWOT Analysis and the core of EIC's Sales Strategy and Marketing Strategy, revealing the tactics behind its impressive growth. We'll dissect its unique approach to Marketing Exchange Income Company properties, including its sales process and how it targets its audience. Understanding EIC's approach offers valuable insights for investors and business strategists alike, especially those interested in Investment Strategy within the Real Estate Investment (REIT) sector.

How Does Exchange Income Reach Its Customers?

The sales and marketing strategy of Exchange Income Company (EIC) centers on a direct sales and service model. This approach is implemented through its various operating subsidiaries, each maintaining its distinct business identity. Given its focus on business-to-business (B2B) operations, EIC's sales channels are primarily contract-driven, rather than relying heavily on e-commerce or physical retail locations.

EIC's sales channels are tailored to the specific needs of its diverse business segments, including aerospace, aviation, and manufacturing. The company's strategy is designed to foster direct engagement with clients, ensuring personalized service and building long-term relationships. This approach is crucial for securing contracts and providing essential services in its core markets.

The acquisition of Canadian North for C$205 million, expected to close in 2025, exemplifies this strategy. This move will significantly expand EIC's presence across Canada's northern regions, adding jet services and access to previously underserved areas. This expansion highlights EIC's commitment to growth and its ability to adapt its sales channels to meet evolving market demands. For more insights, explore the Target Market of Exchange Income.

Sales in this segment involve long-term government contracts, direct provision of air services, and the sale/leasing of aircraft parts. Subsidiaries like Calm Air and PAL Airlines directly offer crucial transportation and surveillance services. The expansion into northern Canada with Canadian North is a key strategic move.

The manufacturing segment focuses on direct engagement with various industries. The Environmental Access Solutions business line, for example, uses a direct sales approach, providing turnkey services. Strong demand for Spartan composite mats in 2024 indicates the effectiveness of these channels.

EIC's sales strategy emphasizes direct engagement and contract-driven business. This approach allows for tailored solutions and strong customer relationships, especially in B2B markets.

- Direct Sales Model: Focused on building relationships and providing customized solutions.

- Contract-Driven: Securing long-term agreements with government and industry clients.

- Strategic Acquisitions: Expanding market reach and service offerings through targeted acquisitions like Canadian North.

- Capacity Expansion: Responding to market demand by increasing production capabilities, as seen with Spartan mats.

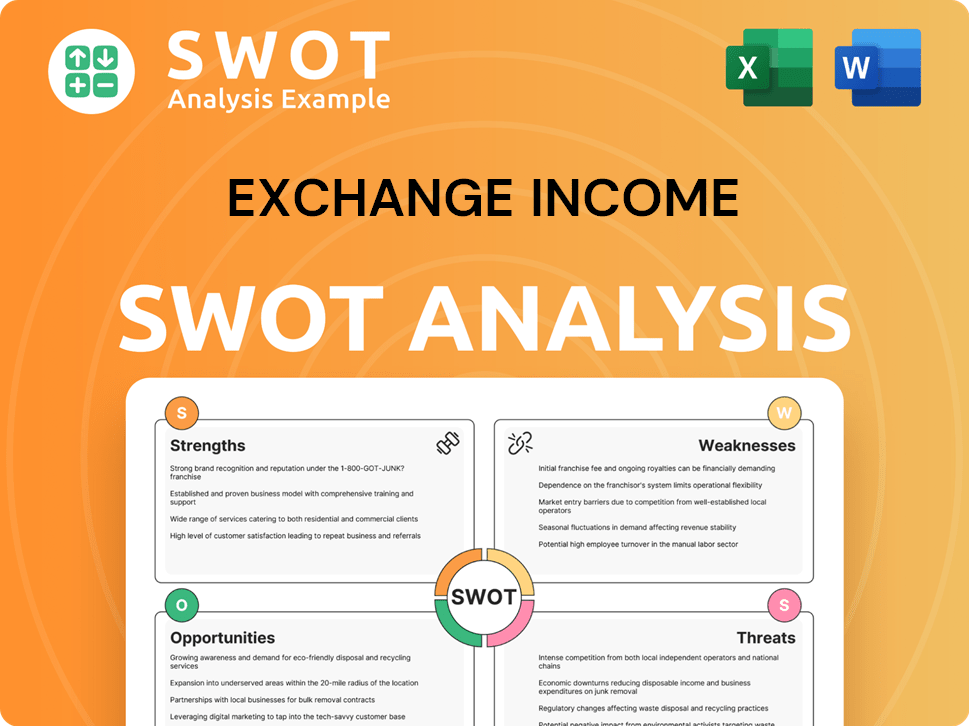

Exchange Income SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Exchange Income Use?

The marketing tactics of Exchange Income Company are primarily geared towards a business-to-business (B2B) model, supporting its acquisition-focused strategy. The core of the strategy revolves around investor relations, building a strong industry reputation, and direct engagement rather than broad consumer campaigns. This approach is crucial for attracting and retaining shareholders, as the company operates within the financial sector.

A significant aspect of their marketing strategy involves transparent financial reporting and consistent investor communication. This includes regular conference calls to discuss financial results and the release of press releases regarding financial performance, dividends, and strategic acquisitions. These efforts ensure that investors and the market receive timely and comprehensive information.

Digital tactics are also important, with a comprehensive investor relations section on the company website, www.ExchangeIncomeCorp.ca. This section serves as a central hub for detailed information, including annual reports, financial statements, and public filings, catering to financially-literate decision-makers. Given their focus on aerospace, aviation, and manufacturing, the company likely utilizes industry-specific publications, trade shows, and direct outreach to potential acquisition targets.

Exchange Income Company prioritizes clear and consistent communication with investors. This includes regular conference calls to discuss financial results, such as the Q4 2024 results call on February 27, 2025, and the Q1 2025 results call on May 13, 2025. Press releases are issued to announce key financial data and strategic moves.

The company maintains a comprehensive investor relations section on its website, www.ExchangeIncomeCorp.ca. This section provides access to essential documents like the 2024 Annual Report, released on February 26, 2025, financial statements, and public filings.

The company's marketing efforts are directed towards identifying and engaging with potential acquisition targets. Their focus on acquiring 'already profitable, well-established companies that have strong management teams' suggests a targeted approach to business development.

EIC emphasizes the stability and resilience of its diversified business model, especially during economic uncertainty. This is evident in their communication about the successful upsize and extension of their credit facility to $3.0 billion in April 2025.

Given their involvement in aerospace, aviation, and manufacturing, the company likely uses industry-specific publications, trade shows, and direct outreach to connect with potential acquisition targets and major clients.

The key marketing messages focus on the company's financial strength and disciplined capital allocation. The successful upsize and extension of their credit facility to $3.0 billion in April 2025, which provides over $1 billion in liquidity, is a key message to investors.

The evolution of Exchange Income Company's marketing mix highlights the stability and resilience of its diversified business model, especially during economic uncertainty. This is evident in their communication regarding the successful upsize and extension of their credit facility to $3.0 billion in April 2025, which provides over $1 billion in liquidity for strategic growth capital investments and accretive acquisitions. This financial strength and disciplined capital allocation are key marketing messages to investors. To understand more about the competitive landscape, you can read about the Competitors Landscape of Exchange Income.

The primary focus is on investor relations and direct engagement, rather than mass advertising. The company uses a variety of tactics to communicate with investors and potential acquisition targets.

- Investor Relations: Regular financial reporting, conference calls, and press releases.

- Digital Presence: Comprehensive investor relations section on the company website.

- Targeted Outreach: Focus on identifying and engaging with potential acquisition targets.

- Financial Strength: Emphasizing financial stability and disciplined capital allocation, such as the $3.0 billion credit facility.

- Industry Engagement: Utilizing industry-specific publications and trade shows.

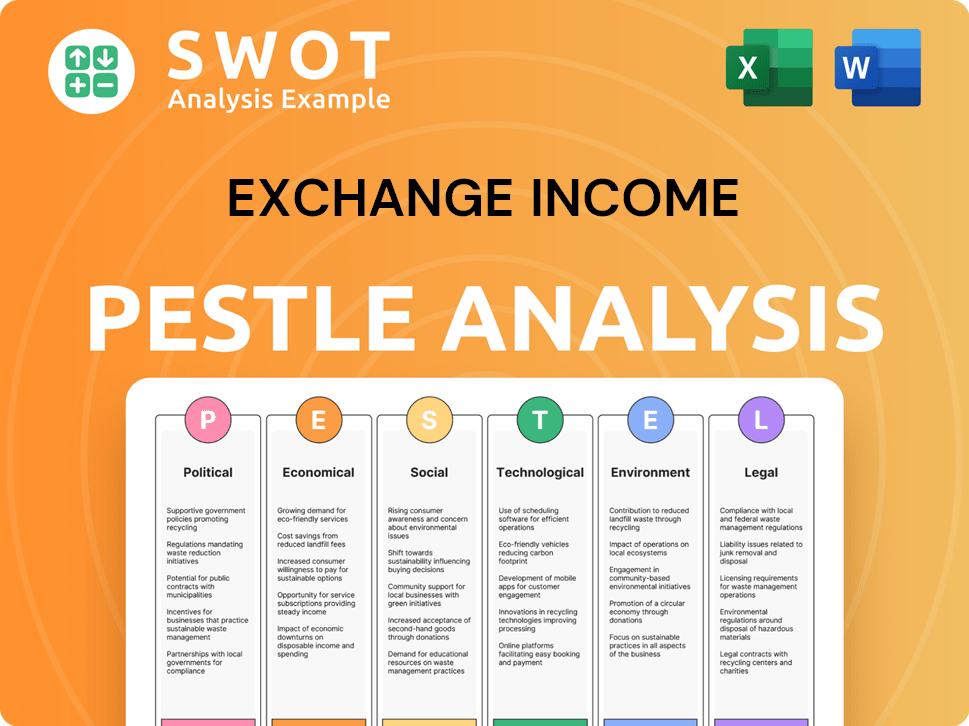

Exchange Income PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Exchange Income Positioned in the Market?

The brand positioning of Exchange Income Company centers on its identity as a diversified, acquisition-focused entity within the aerospace, aviation, and manufacturing sectors. The core message is built around delivering consistent and growing cash distributions to shareholders. This is achieved through a disciplined acquisition strategy, targeting profitable, well-established businesses with strong management and consistent cash flow, operating in niche markets. The company emphasizes the collective strength of its subsidiaries, which maintain individual identities while contributing to a resilient business model.

Exchange Income Company (EIC) aims to attract financially-literate decision-makers, including investors and business strategists. This is achieved by highlighting its consistent financial performance and commitment to shareholder returns. The company's track record includes increasing its monthly dividend 17 times since its inception in 2004, distributing over $1 billion in cash dividends by the end of 2024. Its average annual return of 20% over the past two decades significantly outperforms the TSX, demonstrating a strong investment strategy.

The brand communicates dependability and a conservative approach to balance sheet management, particularly appealing in volatile markets. The successful upsize of its credit facility to $3.0 billion in April 2025, providing over $1 billion in liquidity, reinforces this image of financial prudence and capacity for strategic growth. This approach is crucial for maintaining investor confidence and supporting the company's growth trajectory. For a deeper dive into the company's growth strategies, consider reading Growth Strategy of Exchange Income.

EIC's brand consistency is maintained by emphasizing the essential nature of services provided by its subsidiaries. These include medevac, passenger, charter, and freight services, particularly to northern and remote communities. This focus highlights the critical role these services play.

EIC engages in partnerships, such as recognizing Orange Shirt Day with Indigenous organizations and collaborating with the Winnipeg Blue Bombers Football Club. These initiatives enhance its brand image as a responsible corporate citizen. This approach fosters positive relationships.

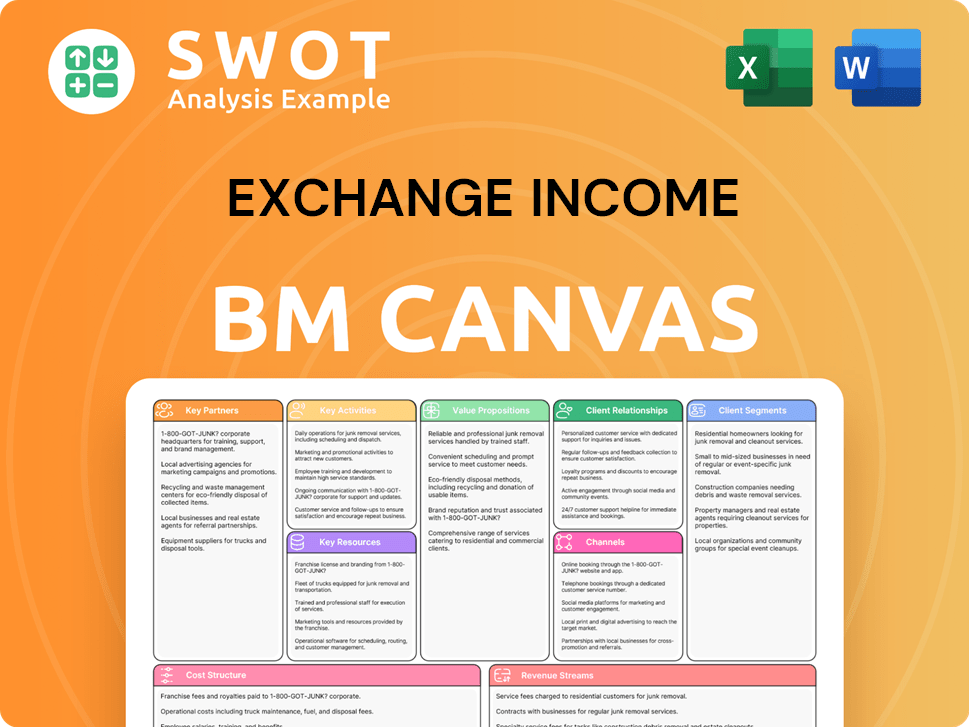

Exchange Income Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Exchange Income’s Most Notable Campaigns?

The "campaigns" of Exchange Income Company are primarily centered around strategic financial and business development initiatives. Unlike traditional consumer marketing, the focus is on disciplined acquisitions, financial structure optimization, and consistent shareholder returns. These efforts are designed to drive growth and solidify the company's position in the market. This approach is crucial for Exchange Income Company's sales strategy and overall investment strategy.

A key aspect of Exchange Income Company's marketing strategy involves the strategic acquisition of businesses to expand its essential services portfolio. This includes investments in aviation and aerospace, as seen with the recent acquisition of Canadian North. Furthermore, the company's commitment to maintaining a strong financial structure, including managing its credit facilities and dividend policy, is a core element of its long-term plan. Understanding these campaigns is vital for anyone looking into how to invest in Exchange Income Company.

These strategic moves not only drive growth but also aim to enhance shareholder value, which is a key component of Exchange Income Company's investment opportunities. The company's commitment to providing stable and growing cash distributions, even during market volatility, highlights the strength and dependability of its business model, making it attractive to income-focused investors. For more information about the company's approach, consider reading about Owners & Shareholders of Exchange Income.

A primary focus is the strategic acquisition of companies that align with its core business model. The acquisition of Canadian North for C$205 million, announced in February 2025, is a prime example. This strategy aims to expand its essential air services business across Canada's Arctic.

Continuous optimization of its financial structure is another key campaign. The upsize and extension of its credit facility to $3.0 billion in April 2025, extending maturity to April 30, 2029, provides over $1 billion in liquidity. This supports strategic growth capital investments and acquisitions.

A consistent dividend policy is a significant ongoing "campaign" to attract and retain investors. Over $1 billion in cumulative dividends have been paid to shareholders since inception. This commitment highlights the strength and dependability of its business model.

The company celebrated its 20th anniversary, with revenues reaching $2.7 billion and Adjusted EBITDA of $628 million in 2024. This showcases the long-term success of its core strategy. These figures demonstrate the effectiveness of its sales and marketing strategy.

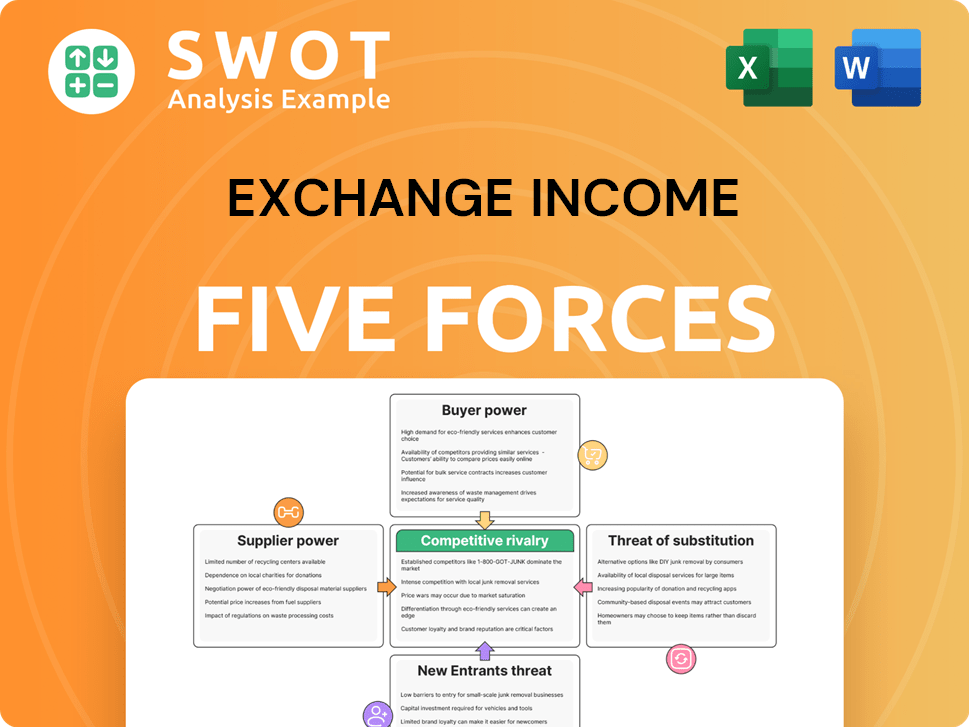

Exchange Income Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Exchange Income Company?

- What is Competitive Landscape of Exchange Income Company?

- What is Growth Strategy and Future Prospects of Exchange Income Company?

- How Does Exchange Income Company Work?

- What is Brief History of Exchange Income Company?

- Who Owns Exchange Income Company?

- What is Customer Demographics and Target Market of Exchange Income Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.