Exchange Income Bundle

Who Does Exchange Income Company Serve?

Understanding the Exchange Income SWOT Analysis is crucial for grasping its customer base. EIC's success hinges on a deep understanding of its customer demographics and the specific needs of its target market. From strategic acquisitions to operational adjustments, EIC consistently demonstrates its commitment to serving a diverse range of clients.

This exploration delves into the specifics of EIC's customer profile, examining factors like Exchange Income Company customer age range, income levels, and geographic location. We'll analyze how EIC identifies its target market and adapts its services to meet the evolving demands of its clients, providing valuable insights for investors and business strategists alike. This market analysis will help you understand the characteristics of Exchange Income Company's customer base and its customer acquisition strategy.

Who Are Exchange Income’s Main Customers?

Understanding the customer demographics and target market for Exchange Income Corporation (EIC) is crucial for investors and analysts. EIC operates primarily in a business-to-business (B2B) model, focusing on two main segments: Aerospace & Aviation and Manufacturing. This structure shapes its customer profile, emphasizing organizational clients with significant operational needs and capital expenditure capabilities. The Growth Strategy of Exchange Income highlights how these segments drive the company's expansion.

The company's target market is segmented based on industry and service offerings. In Aerospace & Aviation, key customers include government entities and resource sector clients. The Manufacturing segment serves various industries, including telecommunications, healthcare, and transportation. This B2B focus means that the customer base is primarily composed of businesses and organizations rather than individual consumers.

EIC's strategic acquisitions play a vital role in expanding its customer base and market reach. For instance, the acquisition of Spartan Mat, LLC and Spartan Composites, LLC in November 2024 expanded the Environmental Access Solutions business line. These acquisitions contribute to the company's growth and diversification, attracting new customers and strengthening its position in the market.

The Aerospace & Aviation segment serves government entities for specialized services and large resource sector clients. PAL Aerospace, an EIC subsidiary, provides customized special mission aircraft solutions to governments worldwide. Essential Air Services cater to communities in regions like Manitoba, Ontario, and Nunavut, offering scheduled airline, charter, and emergency medical services.

The Manufacturing segment serves a diverse range of industries, including telecommunications, healthcare, and transportation. Offerings include specialized stainless-steel tanks, heavy-duty pressure washing systems, and custom tanks. The Environmental Access Solutions business line, enhanced by acquisitions like Spartan Mat, LLC, serves the transmission and distribution sector.

EIC's financial performance reflects its customer base's strength and the effectiveness of its market strategy. In Q1 2025, the Aerospace & Aviation segment saw a revenue increase of $14 million. The Manufacturing segment also showed strong growth, with revenue increasing by $53 million, or 23%, to $286 million in the same period.

- The Aerospace & Aviation segment experienced a 17% increase in Adjusted EBITDA, reaching $130 million in Q1 2025.

- Strategic acquisitions, such as the planned acquisition of Canadian North, are aimed at expanding services and reaching new customer segments.

- The company's focus on B2B clients with significant operational needs and capital expenditure capabilities drives its financial performance.

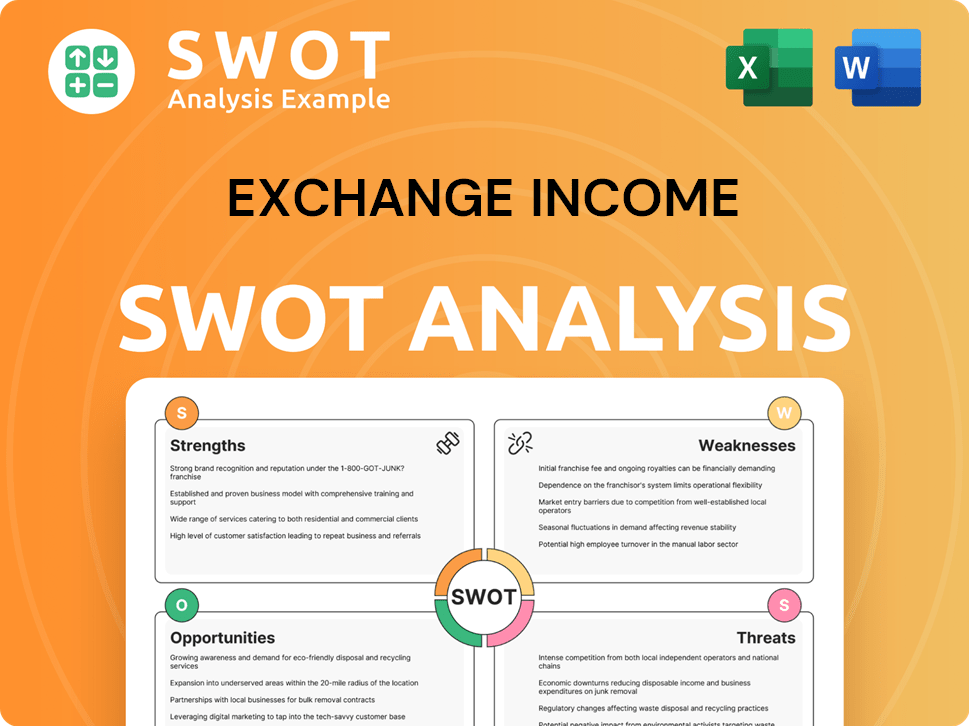

Exchange Income SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Exchange Income’s Customers Want?

Understanding the customer needs and preferences is crucial for Owners & Shareholders of Exchange Income. The company's success hinges on its ability to meet the diverse requirements of its customers across various segments. This involves providing reliable services, specialized products, and customized solutions tailored to specific industry demands.

The company's customer base is primarily driven by operational needs, reliability, and specialized service requirements. These customers often prioritize dependable, efficient, and safe services, especially in critical sectors like aerospace, aviation, and manufacturing. The company's approach focuses on addressing common pain points and adapting to specific market requirements through a decentralized yet supportive model.

The company's customer profile varies across its segments, each with distinct needs and preferences. For example, in the Aerospace & Aviation segment, customers such as governments and resource companies prioritize dependable and efficient air services. In contrast, the Manufacturing segment customers, seek specialized products and engineering solutions that meet specific industry demands.

These customers, including governments and resource companies, need dependable, efficient, and safe air services. They prioritize consistent access to remote communities and timely emergency medical transport. The psychological driver is often the assurance of uninterrupted, life-sustaining, or mission-critical support.

Customers in this segment seek specialized products and engineering solutions. They require durable and reliable equipment for telecommunications, healthcare, and construction. Decision-making criteria involve product quality, customization, timely delivery, and cost-effectiveness.

The core needs revolve around consistent access to remote communities and timely emergency medical transport. Governments require highly customized and integrated solutions, emphasizing advanced technology, operational effectiveness, and adherence to stringent regulatory standards.

Customers prefer robust environmental access solutions. They also value product quality, customization capabilities, timely delivery, and cost-effectiveness. The company's investments in medevac operations in Manitoba and British Columbia address the crucial need for reliable healthcare access.

The psychological driver is the assurance of uninterrupted, life-sustaining, or mission-critical support. This includes the need for reliable healthcare access and the confidence in highly customized and integrated solutions. The company's approach focuses on addressing common pain points and adapting to specific market requirements.

Decision-making criteria often involve product quality, customization capabilities, timely delivery, and cost-effectiveness. For aerospace and maritime surveillance, governments require advanced technology and operational effectiveness. The company's acquisition strategy focuses on well-established businesses that already generate steady cash flow.

The company's approach to meeting customer needs involves providing integrated solutions and investing in its subsidiaries. The acquisition strategy focuses on well-established businesses that generate steady cash flow. Feedback and market trends directly influence product development and service expansion. The company tailors its approach by supporting its subsidiaries with capital and strategic guidance, allowing them to adapt to specific market requirements while retaining their established cultures. This decentralized yet supportive model enables flexibility in tailoring marketing, product features, and customer experiences to the distinct needs of each segment.

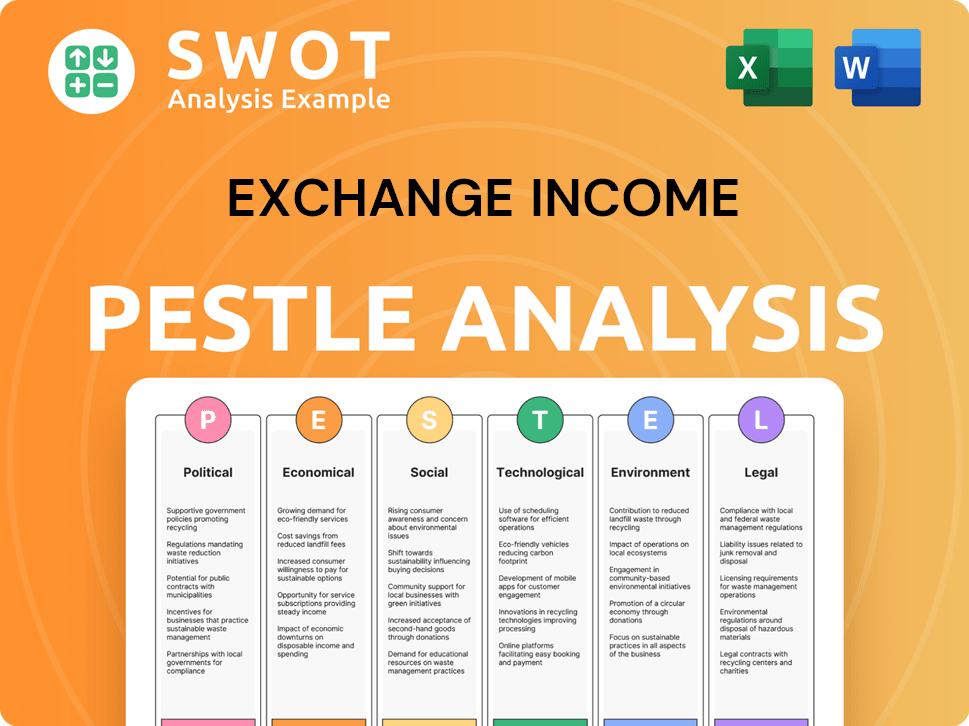

Exchange Income PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Exchange Income operate?

The geographical market presence of the company is primarily concentrated in Canada and the United States. The company's strategic focus is on these two key markets, with a significant portion of its revenue derived from them. A detailed market analysis reveals a strong foundation in North America, which is crucial for understanding the company's customer demographics and target market.

In 2024, the company generated a substantial portion of its sales from Canada and the United States. Canada represented the largest market, followed by the United States. The company's expansion and acquisition strategies are often influenced by opportunities within these regions, allowing for a targeted approach to its customer profile.

The company also has a presence in Europe and other international markets, although to a lesser extent. This diversification helps in mitigating risks and exploring new growth avenues. The company's approach to these markets is often driven by acquisition opportunities, aligning with its strategy of investing in profitable businesses.

In 2024, Canada accounted for approximately $1.73 billion in sales. This strong performance highlights the importance of the Canadian market to the company's overall revenue. The company's success in Canada is a key factor in understanding its target market and customer demographics.

The United States contributed $599 million in sales during 2024. This significant contribution demonstrates the company's strong presence and customer base in the US market. Understanding the customer demographics in the US is crucial for the company's growth strategies.

Europe generated $155 million in sales, while other international markets contributed $175 million in 2024. These figures indicate a growing presence in international markets. The company's expansion in these regions is part of its strategy to diversify its customer base.

The Aerospace & Aviation segment has a significant presence in Northern communities, particularly in Manitoba, Ontario, Nunavut, British Columbia, and Alberta. This segment provides essential air services, including scheduled flights, charter services, and emergency medical services. The planned acquisition of Canadian North in February 2025 further strengthens the company's position in the Canadian Arctic.

The acquisition of Spartan Mat, LLC and Spartan Composites, LLC in November 2024 expanded the Environmental Access Solutions business into the US. Similarly, the acquisition of Armand Duhamel & Fils Inc. in June 2024, a Quebec-based company, further diversified its manufacturing capabilities within Canada. These acquisitions are key to understanding the company's customer acquisition strategy.

The company's decentralized structure allows acquired companies to retain their strong management teams and local expertise. This approach enables localized offerings and marketing strategies tailored to specific regional needs. This strategy helps in defining the company's target audience.

Strategic withdrawals or market entry strategies are typically driven by acquisition opportunities that align with the company's approach of investing in profitable, well-established businesses in niche markets. This disciplined approach is crucial for understanding the characteristics of the company's customer base.

The need for housing driven by immigration in Canada influences demand in the multi-story window solutions business line. This demonstrates how external factors impact the company's customer needs and investment preferences. Understanding these trends is essential for effective market analysis.

The company's customer base is diverse, with varying needs and preferences across different regions. The company's ability to adapt to these differences is a key factor in its success. For more insights, you can read a Brief History of Exchange Income.

Demographic segmentation for the company involves understanding the specific needs and preferences of customers in different geographic locations. This approach allows for targeted marketing and product offerings, maximizing customer lifetime value. This segmentation strategy is vital for identifying the ideal customer.

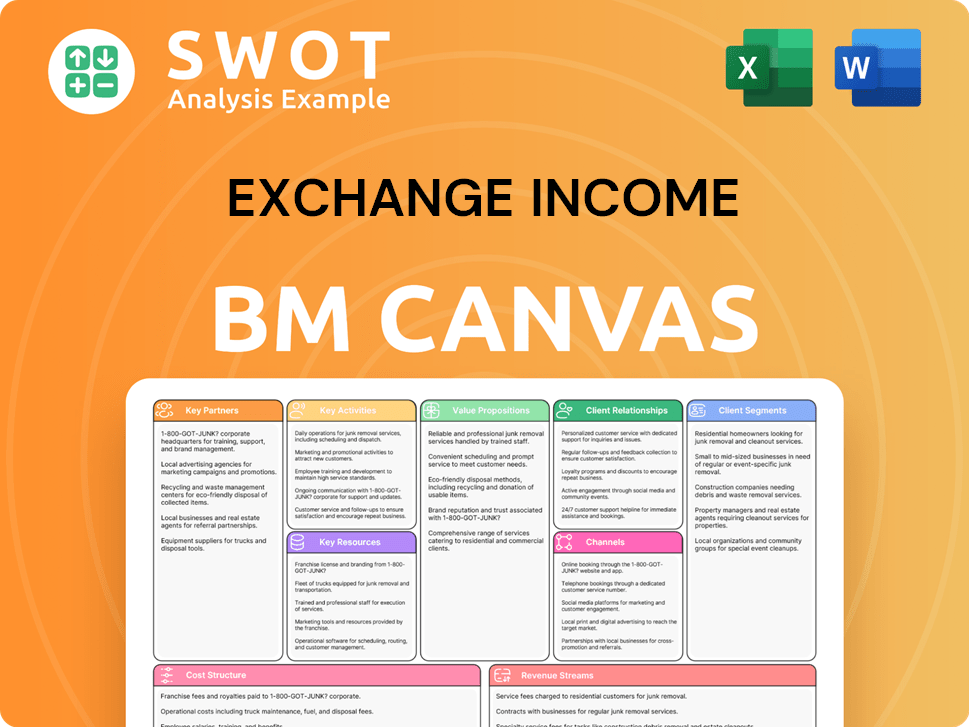

Exchange Income Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Exchange Income Win & Keep Customers?

The customer acquisition and retention strategies of the company are deeply rooted in its acquisition-focused business model and the operational excellence of its subsidiaries. A significant portion of customer acquisition occurs through the strategic purchase of existing, profitable companies. This approach immediately provides a customer base without the need for extensive marketing efforts. The company then supports these acquired businesses with capital and guidance, fostering growth while preserving their successful operational cultures.

For the Aerospace & Aviation segment, acquiring new contracts, particularly with government entities and resource companies, is a primary acquisition strategy. Subsidiaries secure contracts through competitive bidding, showcasing specialized capabilities. Retention in this segment relies on dependable service delivery, operational excellence, and adherence to contractual obligations. In the Manufacturing segment, customer acquisition is driven by the reputation of acquired businesses for quality and specialized products. Marketing channels are likely more B2B focused, including industry-specific trade shows, direct sales, and strong referral networks within their niche markets.

Overall, the company's retention strategy emphasizes strong banking partner relationships and maintaining over $1 billion in liquidity. This financial strength enables continued capital investments and strategic acquisitions. The focus on retaining experienced staff and investing in employees, such as through the EIC University and mentorship programs in 2023, suggests an indirect retention strategy. By fostering a strong internal culture and empowering management teams, the company aims to ensure consistent, high-quality service delivery, which in turn drives customer loyalty.

The company's primary method of customer acquisition involves acquiring existing, profitable companies. This strategy provides immediate access to an established customer base, bypassing the need for initial marketing efforts. This approach is a cornerstone of their growth model, allowing them to expand their reach efficiently.

Securing new contracts with government entities and resource companies is key for the Aerospace & Aviation segment. Recent contract wins, such as deploying a second aircraft under the UK Home Office contract, demonstrate successful acquisition efforts. These wins highlight the company's specialized capabilities.

In the Manufacturing segment, customer acquisition is driven by the acquired businesses' reputations for quality and specialized products. This segment relies on B2B marketing strategies, including trade shows and direct sales. The success of products like Spartan Mat's composite products showcases this.

The company's financial strength, including over $1 billion in liquidity, supports its retention strategy. This financial stability enables continued capital investments and strategic acquisitions. Consistent dividend payments for 22 consecutive years and raising dividends for the past 3 years also demonstrate a commitment to shareholder returns, which is a reflection of its stable and profitable operations, indirectly supporting long-term business stability and customer confidence.

The company's approach to customer acquisition and retention hinges on several key elements. These include strategic acquisitions, operational excellence, and financial stability. Understanding the Revenue Streams & Business Model of Exchange Income provides further insights into the company's overall strategy.

- Strategic Acquisitions: Acquiring profitable companies with established customer bases.

- Contract Wins: Securing new contracts, particularly in the Aerospace & Aviation segment.

- Operational Excellence: Delivering consistent, high-quality service.

- Financial Strength: Maintaining over $1 billion in liquidity for continued investments.

- Employee Investment: Initiatives like the EIC University and mentorship programs to retain staff.

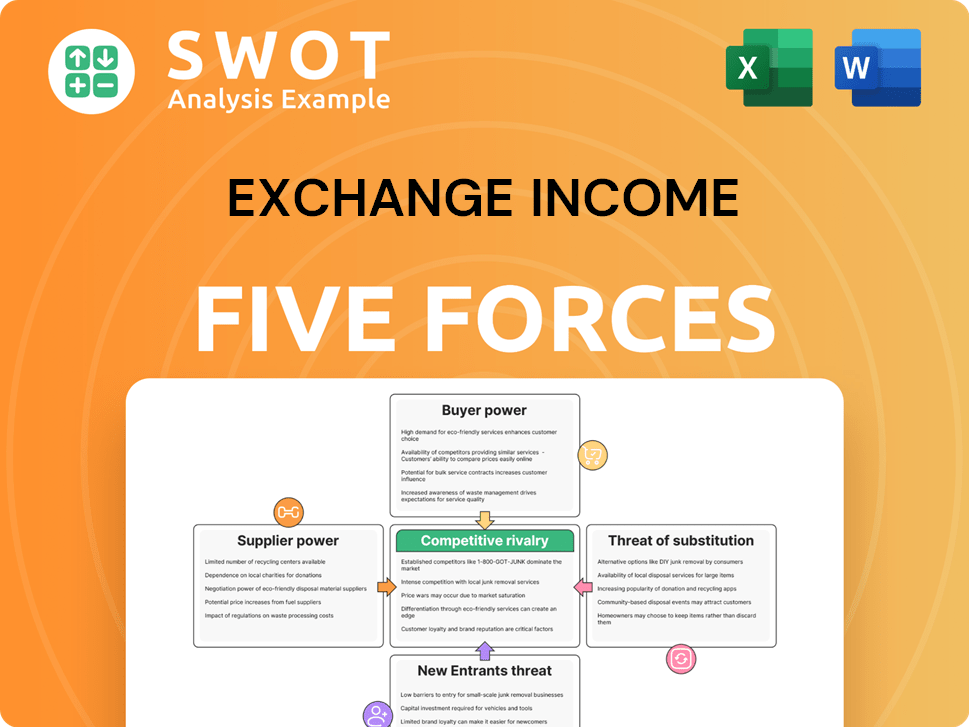

Exchange Income Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Exchange Income Company?

- What is Competitive Landscape of Exchange Income Company?

- What is Growth Strategy and Future Prospects of Exchange Income Company?

- How Does Exchange Income Company Work?

- What is Sales and Marketing Strategy of Exchange Income Company?

- What is Brief History of Exchange Income Company?

- Who Owns Exchange Income Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.