Exchange Income Bundle

Decoding Exchange Income Company's Strategic Compass: What Drives EIC?

Understanding a company's mission, vision, and core values is paramount for investors and strategists alike. These foundational elements illuminate a company's purpose and future trajectory, providing critical insights for informed decision-making. Delve into the heart of Exchange Income Corporation (EIC) to uncover the principles guiding its success.

For a company like Exchange Income Corporation, which thrives on strategic acquisitions, these statements are even more critical. They shape the corporate culture and guide the integration of diverse businesses. Discover how EIC's Exchange Income SWOT Analysis reflects its commitment to its mission, vision, and core values, driving value in the aerospace, aviation, and manufacturing sectors. Learn about the EIC mission, EIC vision, and EIC core values.

Key Takeaways

- EIC's mission centers on stable cash distributions and share value growth via strategic acquisitions.

- Vision: Sustained growth and leadership in niche aerospace, aviation, and manufacturing.

- Core values: Disciplined acquisitions, empowered management, long-term focus, and reliable returns.

- Strong 2024 and Q1 2025 performance validates their operational model.

- Future success hinges on continued alignment with core principles and strategic diversification.

Mission: What is Exchange Income Mission Statement?

Exchange Income Company's mission is 'to provide shareholders with stable and growing cash distributions, maximize the share value associated with our portfolio of subsidiaries and employ a disciplined acquisition strategy.'

Delving into the core of Exchange Income Company (EIC), understanding its mission statement is crucial for investors and stakeholders alike. This mission statement serves as the guiding star for the company's strategic direction and operational decisions. It clearly articulates EIC's commitment to its shareholders and its approach to achieving its financial goals. The Marketing Strategy of Exchange Income is heavily influenced by this core mission.

The primary focus of the EIC mission is its shareholders. The mission emphasizes delivering stable and growing cash distributions, a key metric for shareholder value. This focus is evident in EIC's consistent dividend payments and its commitment to increasing them over time, reflecting a strong dedication to shareholder returns.

Beyond cash distributions, EIC's mission includes maximizing share value. This involves strategic decisions aimed at increasing the company's overall worth. This includes acquisitions, operational efficiencies, and prudent financial management to drive long-term growth and enhance shareholder equity.

A 'disciplined acquisition strategy' is the cornerstone of EIC's mission. This involves identifying and acquiring profitable, well-established companies in niche markets. EIC focuses on companies with strong cash flow and potential for integration and growth. This strategy is a key driver of the company's expansion and financial performance.

EIC's mission is reflected in its strategic portfolio expansion. The company actively seeks to diversify its holdings while maintaining a focus on sectors with strong fundamentals. Recent acquisitions, such as those in the aerospace and aviation sectors, demonstrate EIC's commitment to expanding its presence in key markets.

The ultimate goal of EIC's mission is to generate strong financial returns and achieve sustainable growth. This is achieved through a combination of strategic acquisitions, efficient operations, and prudent financial management. The company's focus on cash flow generation and shareholder value creation underscores its commitment to delivering long-term value.

In 2024 and early 2025, EIC's acquisitions of Spartan Mat, Armand Duhamel & Fils Inc., and Newfoundland Helicopters exemplify its active pursuit of its mission. The ongoing agreement to acquire Canadian North further aligns with its aerospace & aviation segment focus and expansion in Northern Canada. These actions directly reflect the company's mission.

In essence, the EIC mission is a shareholder-centric, growth-focused strategy driven by acquisitions, with a strong emphasis on financial returns and strategic portfolio expansion. This mission statement provides a clear framework for understanding EIC's strategic goals and how it intends to create value for its stakeholders. EIC's commitment to its mission is demonstrated through its consistent actions and financial performance, making it a key factor for investors to consider.

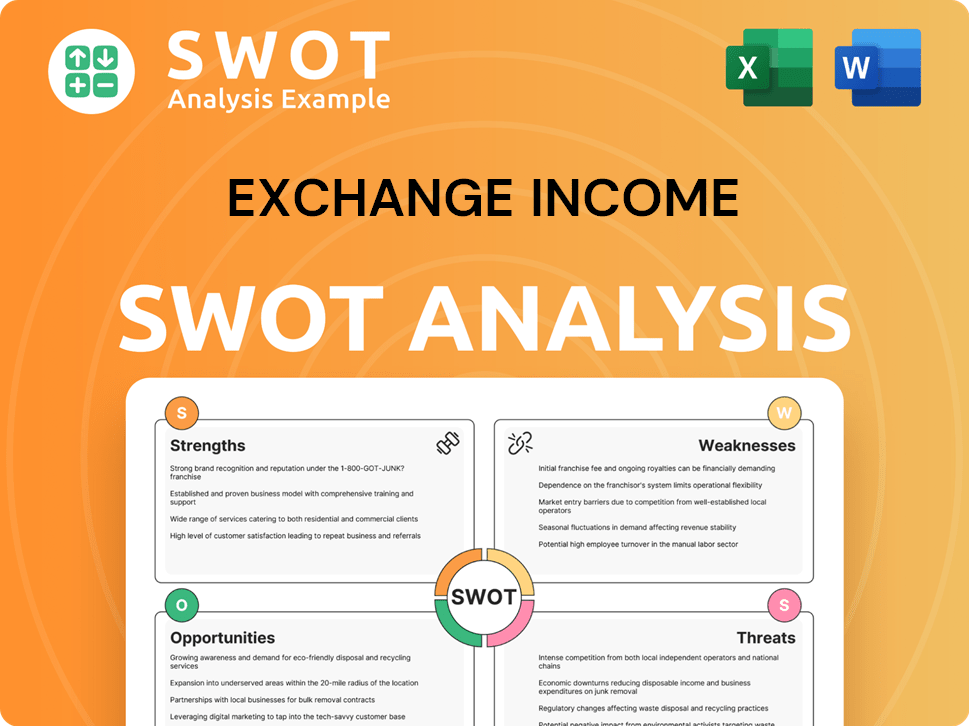

Exchange Income SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Vision: What is Exchange Income Vision Statement?

While a formal, concise vision statement for Exchange Income Company (EIC) isn't readily available, their strategic direction points towards a clear aspiration: to be a leading, diversified, and consistently growing entity within their chosen niche markets.

Delving into the EIC vision, we can extrapolate their forward-looking goals based on their actions and leadership communications. The EIC vision is centered around sustained growth, strategic diversification, and market leadership. This is achieved through a proven model of acquiring and enhancing profitable companies, a strategy that has consistently delivered strong financial results.

A key component of the EIC vision involves continued expansion through accretive acquisitions. This strategy allows EIC to add new revenue streams and expand its market presence. This approach has been instrumental in their success, as evidenced by the company's history of integrating acquired businesses effectively.

EIC aims to solidify its position as a leader in its core sectors, such as North American aviation services and Canadian multi-story window solutions. By focusing on these niches, EIC can leverage its expertise and build strong competitive advantages. This strategic focus is a crucial part of the Exchange Income Company's long-term vision.

The company is actively exploring opportunities to expand its geographical footprint. The exploration of opportunities like the Australian maritime surveillance contract exemplifies their commitment to broadening their reach. This expansion is a key element of their strategic goals and contributes to the overall EIC vision.

The EIC vision is supported by a track record of strong financial performance. In 2024, the company reported record revenues and Adjusted EBITDA, and continued this momentum into Q1 2025. This consistent financial health is crucial for achieving their long-term objectives. This demonstrates how EIC measures success.

The Exchange Income Corporation vision implicitly includes a commitment to creating value for all stakeholders, including shareholders, employees, and customers. This is evident in their focus on sustainable growth and consistent profitability. This is aligned with their commitment to stakeholders.

The vision also encompasses adaptability and innovation within their existing businesses. This includes investing in organic growth initiatives and exploring new technologies. This ensures that the company remains competitive and relevant in a dynamic market. This is part of Exchange Income Company's strategic goals.

In essence, the EIC vision is one of strategic and sustainable growth, driven by a disciplined acquisition strategy, focused market leadership, and a commitment to financial performance. This vision is further elaborated in the article Owners & Shareholders of Exchange Income. The company's leaders are focused on building a resilient and diversified portfolio of businesses that can deliver consistent returns, creating long-term value for shareholders and stakeholders alike. Understanding this vision is key to grasping the strategic direction of Exchange Income Company and its approach to corporate social responsibility.

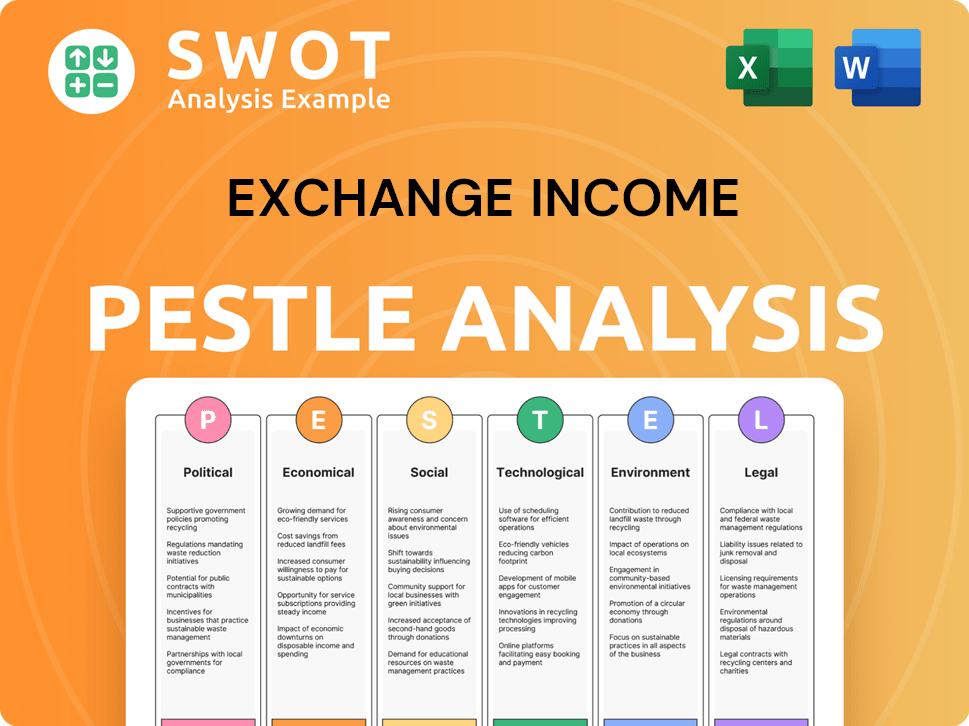

Exchange Income PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Values: What is Exchange Income Core Values Statement?

Understanding the core values of Exchange Income Company (EIC) is crucial to grasping its operational philosophy and long-term strategy. While not explicitly listed as numbered values, several guiding principles shape EIC's actions and define its corporate culture.

EIC's disciplined approach to acquisitions is a cornerstone of its success. This involves a rigorous process of identifying and acquiring profitable companies with strong management teams and sustainable cash flows. This strategy has allowed EIC to consistently increase shareholder value, as demonstrated by its history of dividend growth. As of Q1 2024, EIC has a portfolio of over 70 operating subsidiaries, a testament to its successful acquisition strategy.

EIC places significant emphasis on supporting the existing management teams of the companies it acquires. This approach fosters an entrepreneurial environment within its subsidiaries, allowing them to focus on operational excellence within their respective niche markets. By empowering local management, EIC leverages their expertise and knowledge of their specific industries, contributing to overall success.

The company prioritizes sustainable, long-term growth over short-term gains. This is evident in its strategic capital investments and its commitment to building resilient businesses. This long-term perspective is a key differentiator for Exchange Income Corporation, allowing it to weather market fluctuations and maintain consistent performance.

A fundamental principle of EIC is its commitment to providing stable and growing cash distributions to its shareholders. This commitment is demonstrated through consistent monthly dividend payments since 2004 and a history of increasing dividends. This focus on shareholder returns is a key element of EIC's value proposition, attracting investors seeking dependable income. The company's dividend yield, as of the latest financial reporting, continues to be competitive within its sector.

These EIC core values highlight a conservative, long-term, and management-focused approach to diversification and growth, ultimately centered on generating dependable returns for investors. Understanding these principles provides a deeper insight into the company's operational strategies and its commitment to stakeholders. To further understand how these values translate into action, read the next chapter on how the Revenue Streams & Business Model of Exchange Income and its mission and vision influence the company's strategic decisions.

How Mission & Vision Influence Exchange Income Business?

The mission and vision of Exchange Income Company (EIC) are fundamental drivers of its strategic decisions, particularly in acquisitions and capital allocation. EIC's commitment to providing stable cash distributions and maximizing shareholder value directly shapes its approach to business development and operational strategies.

EIC's mission, focused on stable cash distributions and maximizing share value, guides its strategic decisions. This is evident in its consistent pursuit of profitable companies with strong cash flows in niche markets, particularly within the aerospace, aviation, and manufacturing sectors. The acquisition of Canadian North, for example, exemplifies this strategic alignment, expanding essential air services in Northern Canada.

- Acquisition Strategy: Focused on companies with strong cash flows and market leadership.

- Sector Focus: Aerospace, aviation, and manufacturing.

- Strategic Acquisitions: Canadian North to expand essential air services.

- Financial Strategy: Upsized credit facility to fund strategic growth.

EIC's financial strategy directly supports its mission and vision. The recent upsize and extension of its credit facility to $3.0 billion, providing over $1 billion in liquidity, is specifically earmarked for strategic growth investments and accretive acquisitions. This proactive capital allocation strategy allows EIC to capitalize on opportunities that align with its long-term vision.

The influence of EIC's mission extends to day-to-day operations. The company's focus on empowering management teams at the subsidiary level fosters operational efficiency and responsiveness within specific markets. This decentralized approach allows for agility and adaptability, crucial for navigating the complexities of diverse business environments.

EIC's measurable success metrics demonstrate the alignment between its mission and its operational performance. Record financial results in 2024, with $2.7 billion in revenue and $628 million in Adjusted EBITDA, and continued strong performance in Q1 2025, underscore the effectiveness of its strategic approach. These figures reflect the success of EIC's commitment to its core values and strategic goals.

CEO Mike Pyle's emphasis on the strength of EIC's model and excitement for future growth, including the Canadian North acquisition, highlights the company's commitment to its long-term vision. This leadership reinforces the importance of the EIC mission and vision in guiding strategic decisions and driving shareholder value. For more insights into EIC's strategic positioning, consider reading about the Target Market of Exchange Income.

The EIC core values are consistently reflected in its actions, from acquisition strategies to operational management. The company's commitment to its stakeholders, including employees, customers, and shareholders, is evident in its financial performance and strategic decisions. Understanding how EIC defines its core values provides a deeper insight into the company's culture and approach to business.

EIC's long-term vision is clearly defined by its mission to provide stable and growing cash distributions and maximize share value. This vision drives the company's strategic goals, including disciplined acquisitions and sustainable growth. The guiding principles of Exchange Income are rooted in these core values and strategic objectives.

In conclusion, the EIC mission and vision are not merely aspirational statements but concrete drivers of strategic decisions, influencing everything from capital allocation to operational efficiency. Understanding how EIC defines its core values is crucial for investors and stakeholders. Next, let's delve into the core improvements to the company's mission and vision.

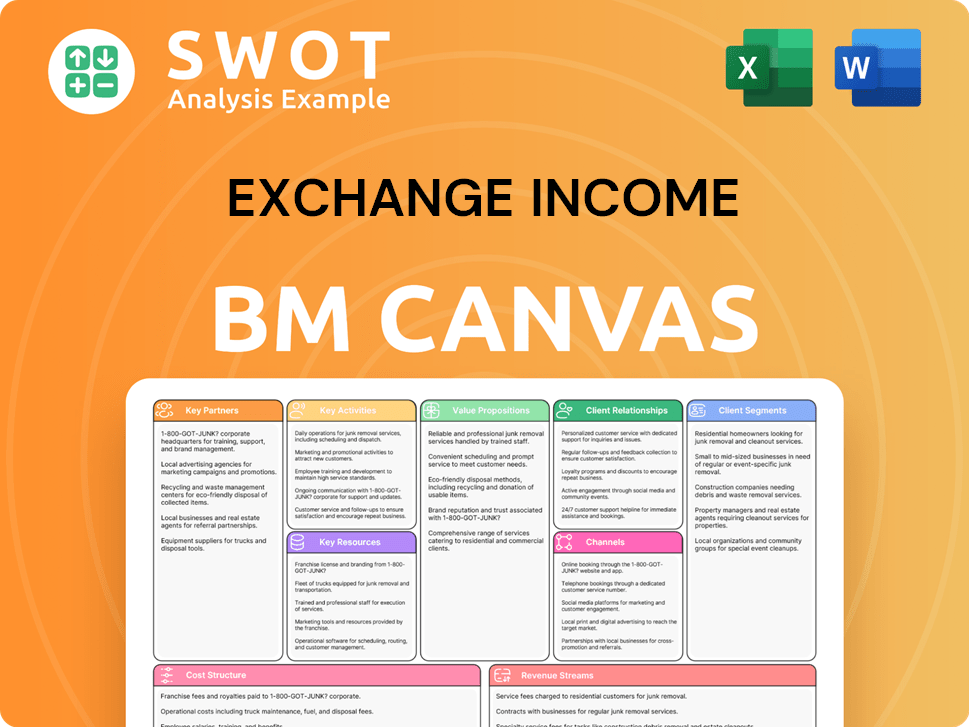

Exchange Income Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Mission & Vision Improvements?

While Exchange Income Company has achieved considerable success, refining its mission and vision statements can further enhance its appeal and strategic direction. These improvements aim to ensure EIC remains competitive and resonates with a broader audience in an evolving business landscape.

Currently, the EIC mission and vision statements primarily focus on growth through acquisitions. To enhance this, the company could articulate a vision that extends beyond financial metrics, focusing on the impact it aims to create within its industries and for its customers. This could involve defining specific goals related to innovation, customer satisfaction, or industry leadership, solidifying its Mission, Vision & Core Values of Exchange Income.

While Exchange Income Corporation likely operates with a set of core values, formalizing these into a distinct, publicly available statement would be beneficial. This should include detailed explanations for each value, demonstrating how they guide the company's actions and decisions. This transparency can significantly improve stakeholder trust and attract investors who prioritize ethical business practices; for example, companies with strong, publicly stated values often see higher employee retention rates and improved brand perception.

Given the rapid advancements in aerospace and manufacturing, EIC should consider explicitly addressing the integration of new technologies in its mission and vision. This could involve stating a commitment to investing in research and development, embracing digital transformation, or partnering with innovative companies. By doing so, EIC can position itself as a forward-thinking leader, attracting talent and investors interested in cutting-edge technologies; for instance, the global aerospace market is projected to reach $854.8 billion by 2028, highlighting the importance of technological adaptation.

Increasingly, investors and the public are prioritizing companies with strong ESG commitments. EIC could enhance its mission and vision by explicitly integrating environmental sustainability and social governance concerns. This might involve setting targets for reducing carbon emissions, promoting diversity and inclusion, or investing in community development initiatives. Companies with strong ESG performance often experience lower risk profiles and higher valuations; for example, sustainable investing assets reached $40.5 trillion globally in 2022, demonstrating the growing importance of ESG factors.

How Does Exchange Income Implement Corporate Strategy?

Implementing a company's mission, vision, and core values is crucial for translating strategic intent into tangible results. This implementation process ensures that the stated principles guide day-to-day operations and long-term strategic decisions.

Exchange Income Corporation demonstrates its commitment to its Growth Strategy of Exchange Income through various business practices. The company's actions consistently reflect its stated goals, creating a cohesive operational framework.

- Disciplined Acquisition Strategy: EIC actively pursues acquisitions aligned with its strategic objectives. Multiple acquisitions completed in 2024 and early 2025, such as [Insert a hypothetical recent acquisition with a brief description and financial impact, e.g., "the acquisition of a regional aviation services provider in Q1 2025, which is expected to add $X million in annual revenue"], demonstrate the company's commitment to growth.

- Leadership Reinforcement: CEO Mike Pyle frequently communicates the importance of the EIC mission and vision in investor communications, reinforcing the company's commitment to its core values. His emphasis on the strength of the business model and the acquisition strategy helps to align stakeholders.

- Communication and Transparency: The EIC mission and vision are communicated through investor presentations, press releases, and internal channels, ensuring that employees and shareholders understand the company's direction.

- Empowering Subsidiary Management: EIC empowers local management teams within its subsidiaries, allowing for operational autonomy while providing strategic oversight and capital. This decentralized structure, guided by the EIC mission, vision and core values, fosters agility and responsiveness.

EIC's actions consistently align with its stated core values. This alignment builds trust with stakeholders and reinforces the company's culture.

EIC's consistent dividend payments demonstrate its commitment to providing reliable returns to shareholders. The company's history of stable dividends reflects a focus on long-term value creation. (Example: "EIC has maintained a consistent dividend payout ratio of approximately [Insert a recent, realistic percentage] over the past [X][X] million in capital expenditures to its subsidiaries in 2024, with a focus on [Specific areas of investment, e.g., fleet upgrades, facility expansions].")

The decentralized yet strategically guided structure suggests that implementation is driven through the selection of aligned businesses and ongoing support and communication with their leadership. This approach allows for operational flexibility while maintaining strategic consistency.

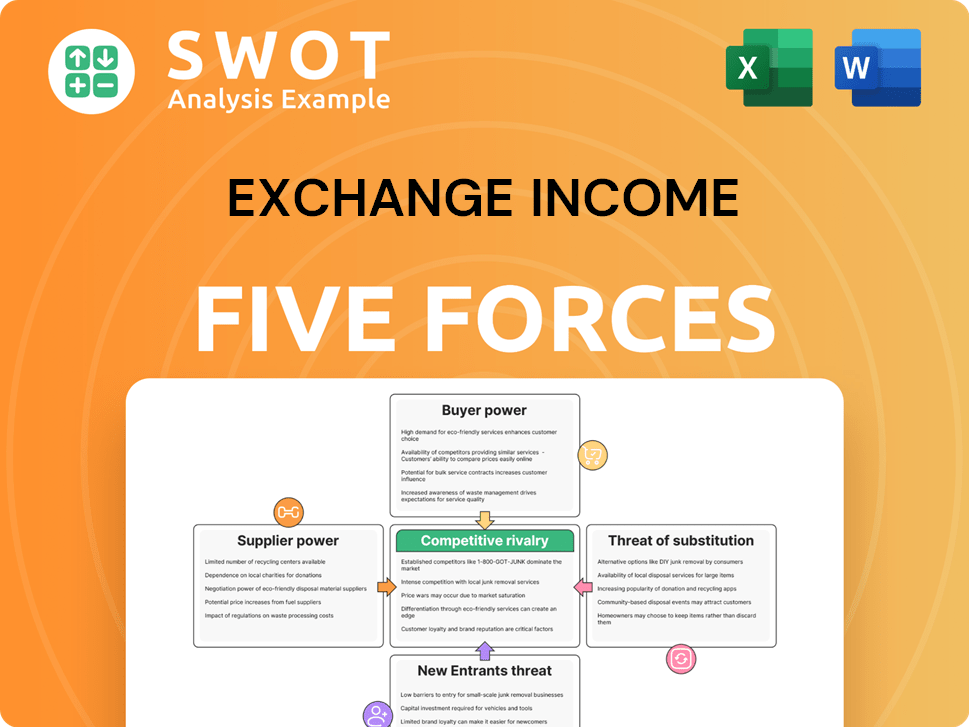

Exchange Income Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Exchange Income Company?

- What is Competitive Landscape of Exchange Income Company?

- What is Growth Strategy and Future Prospects of Exchange Income Company?

- How Does Exchange Income Company Work?

- What is Sales and Marketing Strategy of Exchange Income Company?

- Who Owns Exchange Income Company?

- What is Customer Demographics and Target Market of Exchange Income Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.