Extendicare Bundle

How Does Extendicare Stack Up in the Senior Care Arena?

The Canadian senior care sector is undergoing a significant transformation, driven by an aging population and evolving healthcare needs. Extendicare Inc., a key player since 1968, has evolved from its commitment to quality care into a diversified leader in long-term care, home healthcare, and retirement living. This article explores Extendicare's journey within the dynamic senior care industry.

This deep dive into the Extendicare SWOT Analysis will dissect the Extendicare competitive landscape, examining its key Extendicare competitors and strategic positioning. We'll conduct a thorough Extendicare market analysis to understand its strengths, weaknesses, opportunities, and threats within the senior care industry. Understanding the Extendicare market share analysis and Extendicare financial performance competitors is essential for anyone interested in the long-term care facilities landscape.

Where Does Extendicare’ Stand in the Current Market?

Extendicare's core operations center on providing senior care services, primarily through long-term care facilities and home healthcare. As of December 31, 2023, the company operated 68 long-term care homes, boasting a capacity of 10,037 beds. This positions Extendicare as a significant player in the Canadian senior care industry. The company's value proposition lies in offering a comprehensive suite of services designed to meet the diverse needs of seniors, from institutional care to in-home support.

The company's dual focus on long-term care and home healthcare allows it to cater to a broad spectrum of senior care requirements. ParaMed, its home healthcare division, delivers over 8.8 million hours of care annually, supported by approximately 9,000 regulated and unregulated healthcare professionals. This integrated approach aims to provide continuity of care and support for seniors, whether they reside in a facility or their own homes. Extendicare's strategic diversification has expanded its offerings.

Extendicare holds a substantial market position within the Canadian senior care industry, particularly in long-term care and home healthcare. It is one of the largest private sector providers of long-term care services in Canada. The company's broad service portfolio and established presence continue to underpin its market standing. The Brief History of Extendicare reveals the company's evolution.

Extendicare's geographic presence spans across several Canadian provinces. Its long-term care operations are strongly concentrated in Ontario, Alberta, Manitoba, and Quebec. ParaMed's home healthcare services have a national reach. This wide geographic coverage allows Extendicare to serve a diverse population of seniors across the country.

Extendicare has diversified its offerings beyond traditional long-term care. It now includes retirement living options and expanded home health services. This diversification reflects a shift towards a more integrated care model. It responds to evolving consumer preferences for aging in place and a wider range of care settings.

Extendicare reported an adjusted EBITDA of $133.0 million for the year ended December 31, 2023. This indicates the company's substantial scale and financial health within the industry. The company faces ongoing operational pressures, but its financial performance remains solid. This is a key factor in the Extendicare competitive landscape.

Extendicare's competitive advantages include its large scale, diversified service offerings, and established presence in the Canadian senior care industry. The company faces industry challenges such as rising operational costs and increasing competition. Extendicare's market analysis reveals its position within the senior care industry.

- Strong Market Position: One of the largest private sector providers of long-term care services in Canada.

- Diversified Services: Offers both long-term care and home healthcare services.

- Geographic Reach: Operates across several Canadian provinces with a strong presence in key markets.

- Financial Health: Reported an adjusted EBITDA of $133.0 million for the year ended December 31, 2023.

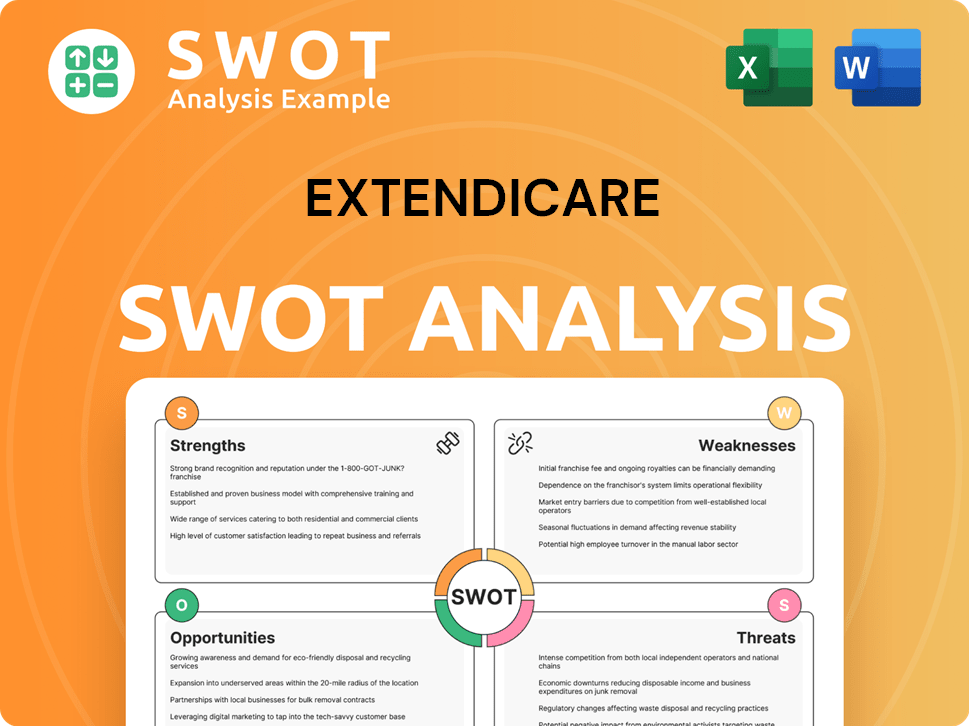

Extendicare SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Extendicare?

The Growth Strategy of Extendicare involves navigating a complex competitive landscape within the Canadian senior care industry. Understanding the key players and their strategies is crucial for assessing Extendicare's position and future prospects. This analysis provides insights into the main competitors and the dynamics shaping Extendicare's market environment.

Extendicare faces competition across its service lines, including long-term care and home healthcare. The competitive landscape is influenced by factors such as facility size, geographic reach, service quality, and technological integration. Analyzing these aspects helps to understand Extendicare's competitive advantages and the challenges it faces in the market.

In the long-term care sector, Extendicare's primary competitors include large private operators. These competitors often have significant scale and resources, allowing them to invest in facility upgrades and new developments. The competition focuses on providing high-quality care and attracting residents.

Sienna Senior Living Inc. is a major competitor, operating seniors' living residences across Ontario, British Columbia, and Saskatchewan. In 2023, Sienna reported revenues of approximately $870 million. This financial performance highlights its significant presence in the senior care market. Chartwell Retirement Residences is another key player with a vast portfolio of retirement and long-term care communities across Canada.

Extendicare's ParaMed competes with numerous regional and national providers in the home healthcare segment. Bayshore Home Health offers a wide range of in-home services across Canada. SE Health (Saint Elizabeth Health Care) is a prominent not-for-profit organization providing home care services.

Competition in home healthcare often revolves around care quality, caregiver availability, and the use of technology. The ability to integrate technology for efficient service delivery is a key differentiator. The home healthcare market is also influenced by regional variations in demand and service offerings.

Extendicare faces indirect competition from smaller, independent care providers, not-for-profit organizations, and family caregivers, particularly in the home care market. These entities can offer specialized services or cater to specific regional needs. The senior care industry is also subject to consolidation and strategic alliances.

Emerging players leveraging technology for remote monitoring and virtual care could disrupt traditional service delivery models. These innovations can improve efficiency and expand service reach. The senior care industry is constantly evolving, with new technologies and business models emerging.

Analyzing Extendicare's competitive landscape involves evaluating its market share, financial performance relative to competitors, and service offerings. Understanding the company's strategic partnerships and acquisition history provides insights into its growth strategies. Examining patient satisfaction ratings and quality of care comparisons is also essential.

Several factors influence Extendicare's competitive position. These include geographic presence, service quality, and pricing strategies. The ability to adapt to changing market demands and technological advancements is crucial for long-term success. Extendicare's strategic partnerships also play a significant role in its competitive strategy.

- Geographic Reach: Extendicare's presence across Canada, compared to competitors.

- Service Quality: Patient satisfaction and care outcomes.

- Pricing and Cost Analysis: Competitive pricing strategies.

- Expansion Strategies: Extendicare's plans for growth.

- Technological Integration: Use of technology for service delivery.

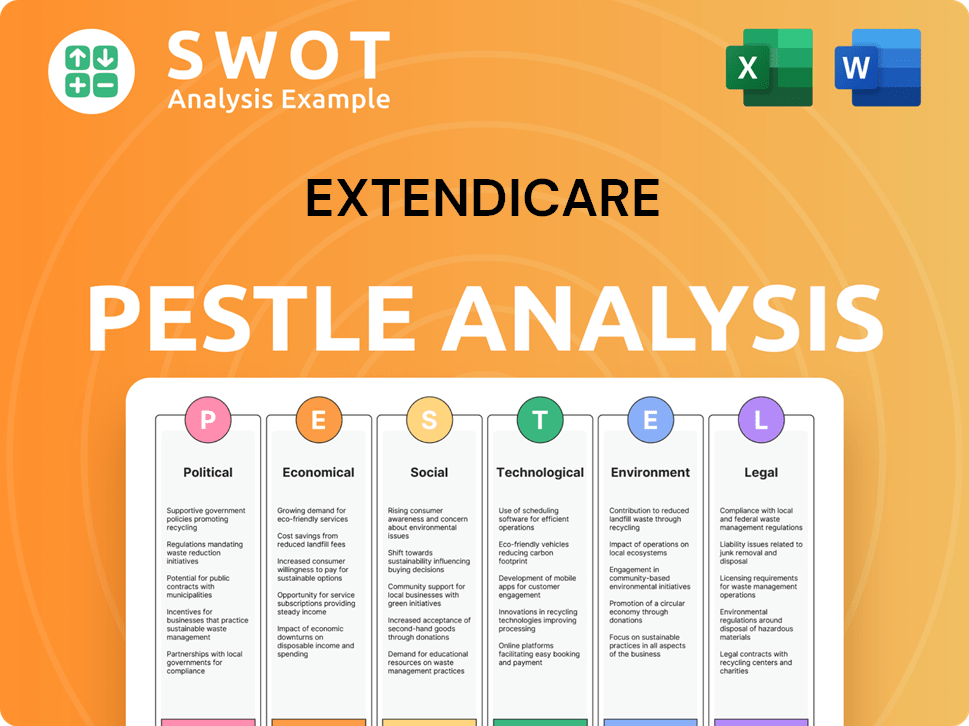

Extendicare PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Extendicare a Competitive Edge Over Its Rivals?

Analyzing the Target Market of Extendicare reveals several key competitive advantages that position it favorably within the Canadian senior care industry. These advantages stem from its operational scale, diversified service offerings, and long-standing presence in the healthcare sector. Understanding these strengths is crucial for a comprehensive Extendicare competitive landscape and market analysis.

Extendicare's competitive edge is further enhanced by its strategic focus on quality improvement and staff training, which directly impacts patient satisfaction and the overall quality of care. The company’s ability to adapt to industry challenges, such as staffing shortages and funding constraints, also plays a significant role in maintaining its market position. The following sections will delve deeper into these key areas.

The company's strategic moves and recent developments, including facility upgrades and service expansions, are aimed at strengthening its competitive position. Extendicare's history of acquisitions and partnerships has also contributed to its growth and market share, making it a key player among healthcare providers in Canada. The following sections will provide more detail on these areas.

Extendicare's extensive operational scale is a primary competitive advantage. With 68 long-term care homes and 10,037 beds, the company benefits from economies of scale in procurement, administrative functions, and staffing. This large footprint provides significant market penetration and brand recognition across multiple provinces, supporting its position in the senior care industry.

Extendicare's diversified service offerings, encompassing long-term care, home healthcare (ParaMed), and retirement living, provide a significant advantage. This integrated approach allows Extendicare to cater to a wider spectrum of senior care needs, potentially creating a continuum of care for clients. The ParaMed home healthcare division, with over 8.8 million hours of care annually, is a strong asset.

Extendicare's long-standing presence and reputation in the Canadian healthcare system are valuable assets. This experience translates into stronger relationships with provincial health authorities and a trusted brand among seniors and their families. This long-standing presence can translate into stronger relationships with provincial health authorities, a deeper understanding of regulatory frameworks, and a trusted brand among seniors and their families.

Extendicare's ongoing investment in quality improvement initiatives and staff training aims to enhance its service delivery. This focus helps maintain its competitive edge in a sector where quality of care is paramount. The company's commitment to these initiatives is a key factor in its ability to maintain and improve patient satisfaction ratings.

Extendicare's competitive advantages are multifaceted, contributing to its strong position in the senior care industry. These advantages include its operational scale, diversified services, and long-standing reputation. The company's strategic focus on quality and staff training further enhances its ability to compete effectively within the market.

- Extensive network of long-term care homes and beds, providing economies of scale.

- Integrated service offerings, including long-term care, home healthcare, and retirement living.

- Strong relationships with provincial health authorities and a trusted brand reputation.

- Ongoing investment in quality improvement and staff training to enhance service delivery.

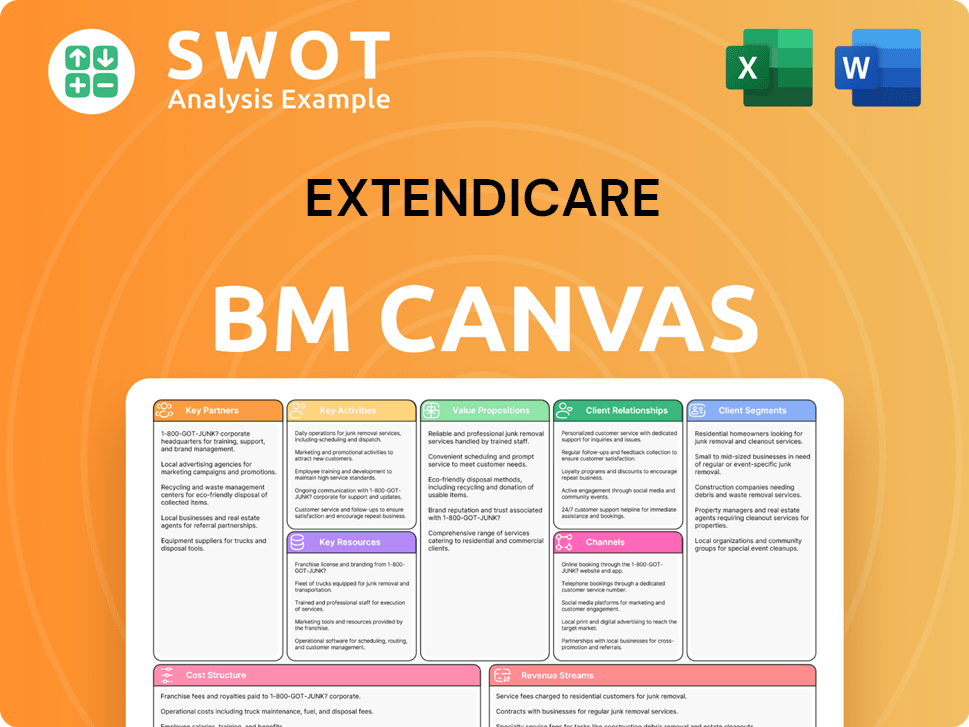

Extendicare Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Extendicare’s Competitive Landscape?

The Canadian senior care industry is experiencing significant changes, largely driven by an aging population, advancements in technology, and evolving regulations. These factors shape the competitive landscape for companies like Extendicare, creating both challenges and opportunities. Understanding these trends is crucial for assessing Extendicare's market position and future prospects. This analysis will delve into the industry's key dynamics, potential risks, and opportunities, offering insights into Extendicare's strategic direction.

The senior care industry is dynamic, influenced by various factors. The increasing demand for senior care services and technological advancements are key drivers. Regulatory changes and the need to manage operational costs are also significant. This environment requires companies to adapt and innovate to remain competitive and provide quality care. Companies must navigate these complexities to maintain financial health and meet the needs of an aging population.

The senior care industry is seeing a rise in demand due to an aging population, with a preference for home and community care. Technological advancements like remote monitoring and telehealth are transforming care delivery. Regulatory changes and government funding also play a crucial role in shaping the sector. These trends significantly impact the Owners & Shareholders of Extendicare.

Persistent staffing shortages, particularly for nurses and personal support workers, are a major challenge. Managing increasing operational expenses while dealing with funding constraints from provincial governments is also difficult. Adapting to technological advancements and maintaining quality of care are ongoing concerns. These challenges require strategic solutions to ensure sustainability.

Strategic partnerships with technology providers can enhance care delivery and efficiency. Expansion into underserved regions and diversification of service offerings meet the diverse needs of seniors. Government funding for home care presents significant growth opportunities. These strategies can improve Extendicare's competitive position and financial performance.

Extendicare faces competition from other healthcare providers, including long-term care facilities and home healthcare services. The company's ability to innovate in care delivery, attract skilled staff, and respond to policy changes will determine its success. Market share analysis and financial performance are key indicators of its competitive standing. Understanding the competitive landscape is critical.

Extendicare's strategic choices will shape its future. The company must address staffing shortages, manage operational costs, and adapt to technological advancements. Partnerships, expansion, and diversified services are key strategies. These actions will influence its market share and financial outcomes.

- Staffing and Retention: Addressing and retaining skilled staff is critical for service quality.

- Technological Integration: Implementing telehealth and remote monitoring can improve efficiency.

- Strategic Partnerships: Collaborating with technology providers and other healthcare services can expand reach.

- Financial Management: Managing operational costs and navigating funding constraints is essential.

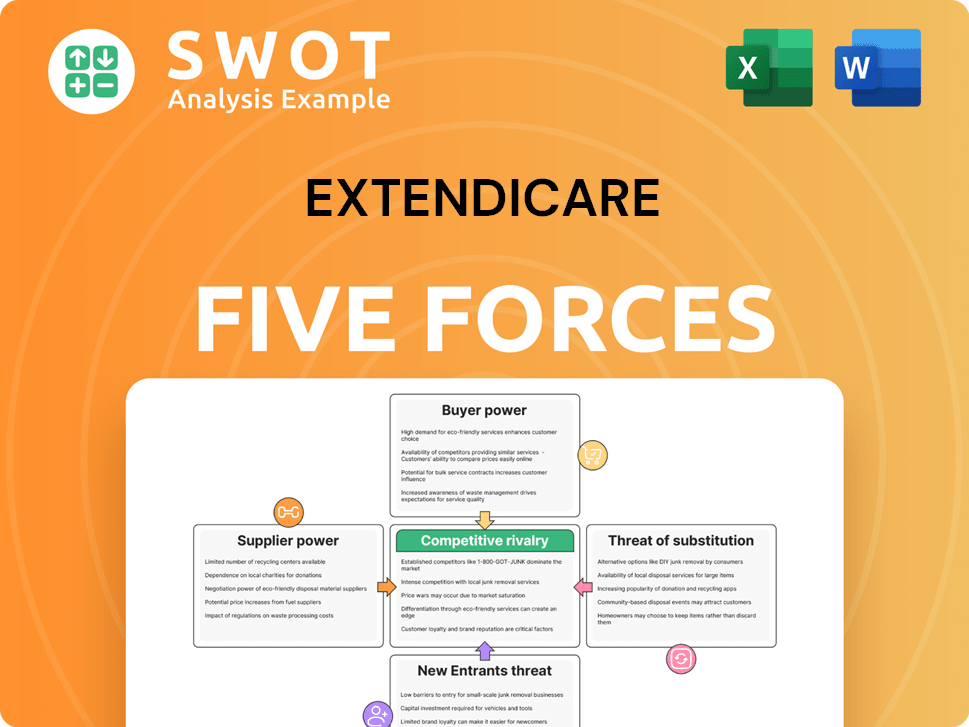

Extendicare Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Extendicare Company?

- What is Growth Strategy and Future Prospects of Extendicare Company?

- How Does Extendicare Company Work?

- What is Sales and Marketing Strategy of Extendicare Company?

- What is Brief History of Extendicare Company?

- Who Owns Extendicare Company?

- What is Customer Demographics and Target Market of Extendicare Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.