Extendicare Bundle

How is Extendicare Redefining Senior Care Sales and Marketing?

Extendicare, a leading name in Canadian senior care, is undergoing a remarkable transformation in its sales and marketing approach. From expanding home healthcare services to redeveloping long-term care facilities, the company is adapting to the evolving needs of an aging population. Discover how Extendicare's Extendicare SWOT Analysis reveals its strategic shifts and market positioning.

This analysis dives deep into Extendicare's Extendicare sales and Extendicare marketing strategies, examining how they've built a national presence through acquisitions like Revera Home Health and the ParaMed brand. We'll explore the Extendicare strategy behind its diversified service offerings, including long-term care, home healthcare, and consulting services. Furthermore, we'll assess the impact of these strategies on its financial performance, including its impressive revenue growth in 2024, providing actionable insights for anyone interested in Healthcare marketing and Senior care sales.

How Does Extendicare Reach Its Customers?

The sales and marketing strategy of Extendicare relies on a diversified approach, utilizing various channels to reach its target audience effectively. This strategy encompasses direct service provision through its long-term care homes and home healthcare services, as well as strategic partnerships. The company's sales channels are designed to maximize reach and cater to the evolving needs of the senior care market.

Extendicare's primary sales channels include its network of long-term care homes, direct home healthcare services, and managed services through Extendicare Assist and the SGP Purchasing Partner Network. These channels allow the company to offer a comprehensive suite of services. The company's approach to Extendicare's growth strategy is evident in its sales and marketing efforts.

As of December 31, 2024, the company operated 122 long-term care homes, with 51 wholly owned and 71 under management contracts through Extendicare Assist. Extendicare Assist also provides consulting and other services to an additional 24 homes. The SGP Purchasing Partner Network services approximately 146,300 third-party and joint venture beds as of Q4 2024, showcasing a significant wholesale distribution and partnership model.

Extendicare's network of long-term care homes is a core sales channel, providing direct care services to residents. The company focuses on both owned and managed homes. This channel is critical for senior care sales and contributes significantly to the company's revenue.

The ParaMed division provides extensive home health care services across six provinces in Canada. This channel allows Extendicare to offer services to seniors who prefer to age in place. This is a key component of their Extendicare marketing strategy.

Extendicare Assist provides consulting and management services to other homes, expanding the company's reach without direct ownership. The SGP Purchasing Partner Network further extends Extendicare's influence through wholesale distribution. These managed services are integral to the Extendicare strategy.

Extendicare leverages partnerships, such as joint ventures with Axium, to expand its presence and share resources. These collaborations are essential for growth and market penetration. The company's strategic approach includes various partnerships.

Extendicare's sales and marketing strategy is designed to adapt to market changes and capitalize on growth opportunities. The focus is on both direct service provision and strategic partnerships. The company's approach includes a capital-light business model and an emphasis on managed services.

- Capital-Light Business Model: Redeveloping Class C long-term care homes through joint ventures, reducing capital outlay.

- Home Healthcare Expansion: Expanding the ParaMed division to meet the growing demand for home healthcare services.

- Managed Services Growth: Increasing the reach of Extendicare Assist and the SGP Purchasing Partner Network.

- Strategic Acquisitions: Acquiring companies like Revera Home Health to expand market presence.

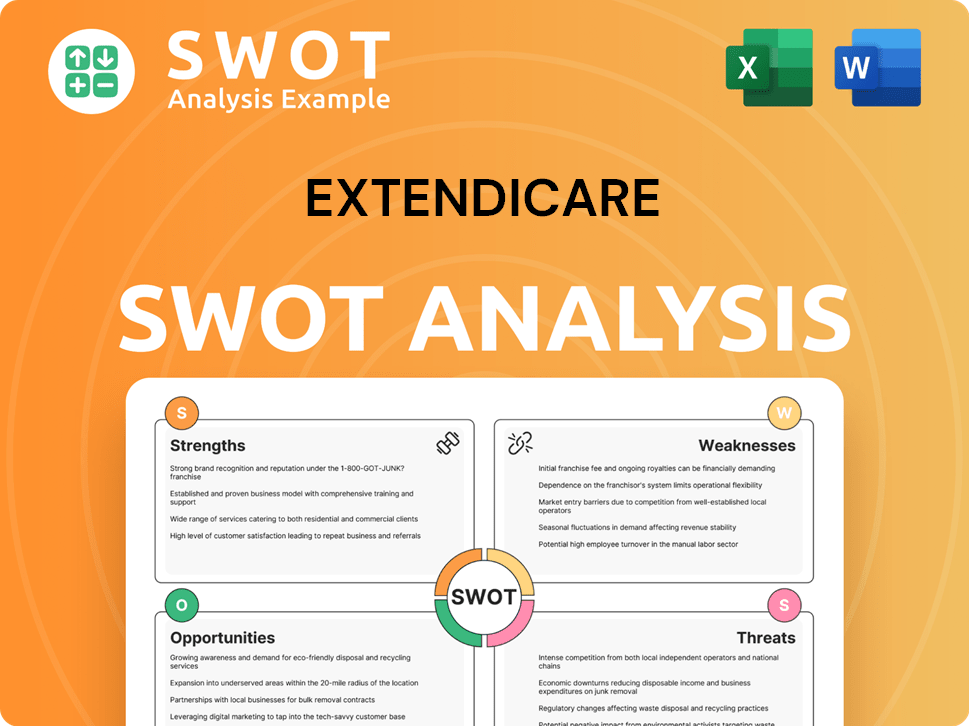

Extendicare SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Extendicare Use?

The marketing tactics employed by Extendicare focus on a blend of digital and traditional methods. These tactics aim to increase brand awareness, generate leads, and drive sales across their diverse service offerings. The company's approach is often reflected in its investor communications and strategic initiatives, highlighting a data-driven approach to marketing.

Extendicare's strategy emphasizes strategic acquisitions and partnerships as a significant marketing tactic. These efforts expand its service footprint and client base. The company's consistent reporting of financial results also indicates a robust underlying marketing and communication strategy.

The company's core message centers around quality care and support for seniors. This message is consistently articulated through its various brands. Technology platforms, such as the implementation of Workday, support overall marketing and service delivery efficiency.

Extendicare leverages data to improve operational efficiency and track key metrics. In Q4 2024, home health care average daily volume (ADV) increased by 10.1%. In Q1 2025, ADV further increased to 31,603, an 8.9% increase from Q1 2024, showing successful lead generation.

Acquisitions are a key part of Extendicare's marketing strategy. The acquisition of nine Class C long-term care homes from Revera Inc. for approximately $60.3 million in June 2025 expanded its market position. The agreement to acquire Closing the Gap Healthcare Group Inc. for $75.5 million in Q1 2025 will further expand its home health care segment.

Extendicare maintains a strong investor relations program, consistently reporting financial results. Consolidated revenue increased by 12.4% to $1.466 billion in Q4 2024. This supports investor confidence and helps attract new capital.

The company's marketing efforts emphasize quality care and support for seniors. This message is communicated through its various brands. This focus helps to build trust and attract clients.

Extendicare uses technology platforms to improve internal operations. Implementation of Workday for finance and HR aims to improve data-backed decision-making. This supports overall marketing and service delivery efficiency.

The marketing mix includes strategic acquisitions and partnerships. These tactics expand service offerings and client reach. Extendicare's approach to Revenue Streams & Business Model of Extendicare is a key part of its strategy.

Extendicare's sales and marketing strategy is multifaceted, encompassing digital and traditional methods. The company focuses on data-driven decision-making to improve operational efficiency. Strategic acquisitions and partnerships are crucial to expand service offerings.

- Extendicare sales strategies focus on increasing brand awareness and generating leads.

- Extendicare marketing efforts are supported by strong investor relations and consistent financial reporting.

- The company's Extendicare strategy emphasizes quality care and support for seniors.

- Healthcare marketing and senior care sales are enhanced through technology integration.

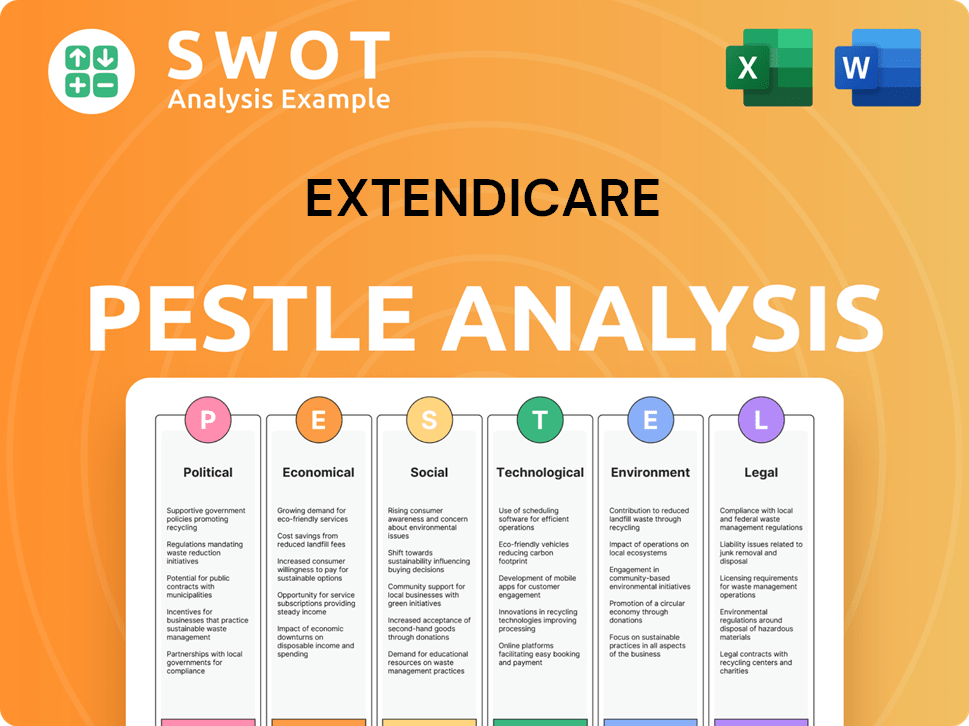

Extendicare PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Extendicare Positioned in the Market?

Extendicare strategically positions itself as a leading provider of senior care services across Canada, emphasizing quality and comprehensive support. Their brand identity is built on a diverse service portfolio, including long-term care, home healthcare, and retirement living. This multi-brand approach, utilizing entities like Extendicare, ParaMed, and Extendicare Assist, allows them to cater to various segments of the senior care market while maintaining a unified commitment to quality. This approach forms a key part of the overall Extendicare marketing strategy.

The core message revolves around meeting the growing needs of Canada's aging population through high-quality, person-centered care. This is reinforced by its operational scale, including 122 long-term care homes and approximately 10.7 million hours of home healthcare services annually, serving around 144,000 seniors nationwide. Extendicare appeals to its target audience through reliability, expertise, and a commitment to enhancing the well-being of residents and clients. The company's consistent dividend payments, with a 5% increase to C$0.042 per share in March 2025, signal financial stability, indirectly contributing to brand perception among stakeholders.

Extendicare differentiates itself from competitors through its integrated service model and strategic focus on both owned and managed facilities. The ability to share scale economies and expertise with third-party long-term care homes via Extendicare Assist provides a unique selling proposition. Brand consistency is maintained across various channels through a unified mission of providing quality senior care. Their responsiveness to shifts in consumer sentiment is evident in the expansion of home healthcare services, addressing the growing preference among seniors to age in their homes. Understanding the Target Market of Extendicare is crucial for effective Extendicare sales and Extendicare strategy.

Extendicare's integrated service model is a key differentiator, offering a comprehensive range of senior care options. This model allows for a continuum of care, catering to various needs and preferences of seniors, from long-term care to home healthcare.

The company strategically focuses on both owned and managed facilities, providing flexibility and scalability. This approach allows Extendicare to optimize resources and expand its reach in the senior care market. This is a core element of their healthcare marketing plan.

Extendicare Assist provides a unique selling proposition by sharing scale economies and expertise with third-party long-term care homes. This expands Extendicare's influence and supports the quality of care across the industry.

Brand consistency is maintained across all channels through a unified mission of providing quality senior care. This ensures that the brand message remains clear and resonates with the target audience. This is a vital part of their retirement home strategy.

The expansion of home healthcare services reflects responsiveness to changing consumer preferences. This allows seniors to age in their homes, aligning with the growing demand for in-home care solutions. This is a key focus of their senior care sales efforts.

Consistent dividend payments, including a 5% increase in March 2025, signal financial stability. This enhances brand perception among stakeholders, building trust and confidence in the company's long-term viability.

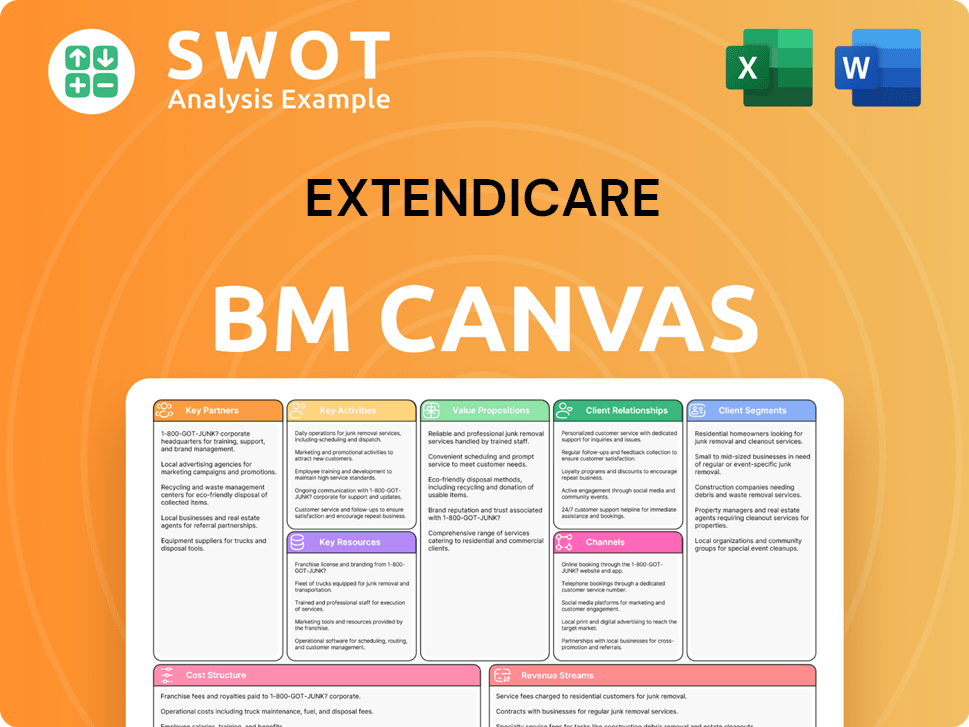

Extendicare Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Extendicare’s Most Notable Campaigns?

The sales and marketing strategy of Extendicare is primarily driven by its strategic initiatives and operational developments. These efforts are designed to expand service capacity and reach a wider market. Several key campaigns underscore this approach, focusing on facility modernization, strategic acquisitions, and effective service integration to drive growth in the senior care sector.

A significant part of Extendicare's marketing is embedded within its strategic growth initiatives and operational announcements. This approach highlights the company's commitment to improving the quality of care and expanding its market presence. By focusing on these key areas, Extendicare aims to attract new residents and investors while enhancing its operational efficiency.

Extendicare's long-term care redevelopment program is a crucial ongoing 'campaign'. For example, in November 2024, construction began on two new long-term care homes in Ontario, set to open in 2027. These new facilities are designed to replace existing beds, aiming to modernize facilities and improve care quality. This directly supports future occupancy and resident acquisition, reflecting a strategic approach to senior care sales.

Extendicare's redevelopment program involves constructing new long-term care homes to replace older facilities. This initiative aims to modernize facilities and improve care quality. Opening these homes in 2027 will replace existing beds, supporting future occupancy and resident acquisition, which is a key part of its Growth Strategy of Extendicare.

The acquisition of other senior care providers, particularly in home healthcare, forms another defining campaign. The integration of Revera Home Health under the ParaMed banner doubled home healthcare service volumes. This demonstrates successful integration and expansion, contributing significantly to revenue growth.

Consistent communication of financial performance and strategic advancements is a powerful marketing tool. The Q4 2024 earnings call highlighted significant growth, which reflects the positive results of these strategic campaigns. This approach supports investor relations and attracts potential clients.

The acquisition of nine Class C long-term care homes from Revera Inc. expanded Extendicare's footprint. Rebranding Revera Home Health under the ParaMed banner effectively doubled home healthcare service volumes and revenue. This is a key strategy in the Extendicare marketing plan for 2024.

Extendicare's strategic initiatives have yielded positive results, as demonstrated by key financial and operational metrics. These metrics reflect the effectiveness of the company's sales and marketing strategies.

- Adjusted EBITDA (excluding out-of-period items) increased by 43.5% to $33.4 million in Q4 2024.

- Home healthcare average daily volume increased by 10.1%, showcasing growth in this segment.

- The home healthcare segment's revenue grew by 16.2% to $147.8 million in Q4 2024, driven by volume and rate increases.

- The sale of three LTC projects under construction to Axium JV in Q1 2025 for net cash proceeds of $56.3 million, demonstrating a strategy to recycle capital into redevelopment and growth.

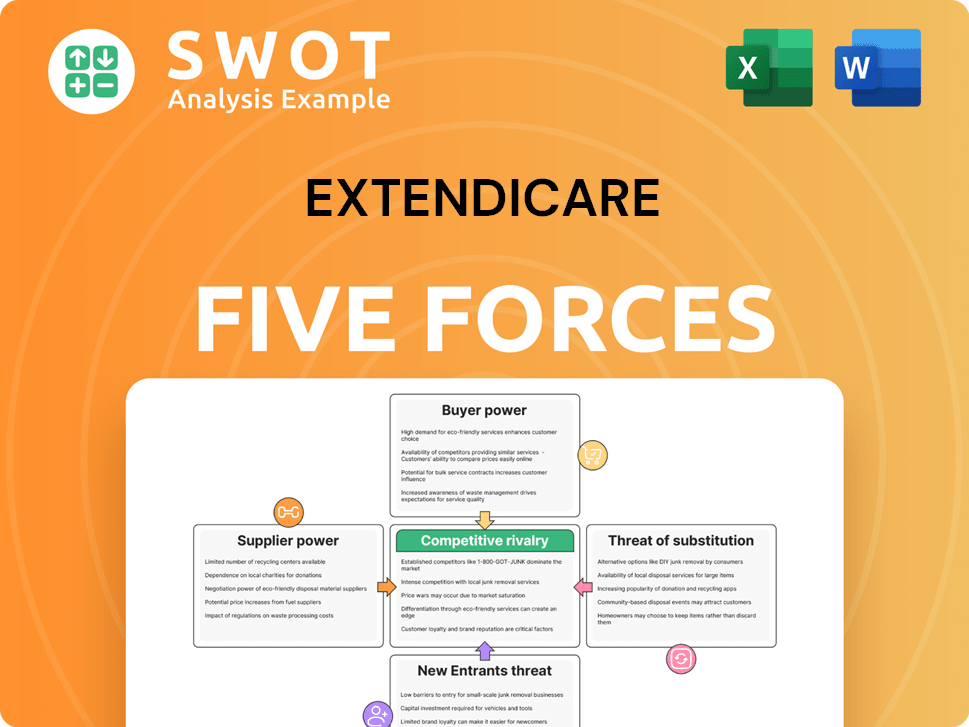

Extendicare Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Extendicare Company?

- What is Competitive Landscape of Extendicare Company?

- What is Growth Strategy and Future Prospects of Extendicare Company?

- How Does Extendicare Company Work?

- What is Brief History of Extendicare Company?

- Who Owns Extendicare Company?

- What is Customer Demographics and Target Market of Extendicare Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.