Extendicare Bundle

How Does Extendicare Shape the Future of Senior Care?

Extendicare, a leading Canadian provider, is at the forefront of addressing the growing needs of an aging population. Offering a wide array of services, including long-term care, home healthcare, and retirement living, Extendicare significantly impacts the well-being of seniors across Canada. With the demand for senior care services on the rise, understanding Extendicare's operations is more critical than ever.

Extendicare's extensive network of Extendicare SWOT Analysis and facilities, including numerous nursing homes and home health services, highlights its substantial role in the Canadian healthcare system. This in-depth analysis will explore Extendicare's business model, including its core operations, revenue streams, and strategic positioning within the senior care market. Whether you're researching

What Are the Key Operations Driving Extendicare’s Success?

Extendicare delivers value through its integrated senior care services, focusing on long-term care, home healthcare, and retirement living. The company caters to seniors needing various levels of assistance, from independent living to complex medical care. Its core offerings include 24-hour nursing and personal care in long-term care homes, in-home medical and support services, and independent or assisted living options in retirement communities.

The operational processes are multifaceted. For long-term care, this involves managing facilities, staffing with healthcare professionals, and adhering to regulations. Home healthcare relies on a network of caregivers, efficient scheduling, and logistical support. Retirement living focuses on a supportive environment. The supply chain includes medical supplies, food services, and facility maintenance. The distribution networks are its physical care facilities and home care professionals.

What sets Extendicare apart is its integrated approach, offering a continuum of care that adapts to residents' changing needs. This comprehensive capability provides continuity of care and peace of mind for seniors and their families, differentiating it in a competitive market. In 2024, the senior care market in North America was valued at over $300 billion, with continued growth expected due to the aging population.

Extendicare provides a range of services, including long-term care, home healthcare, and retirement living. These services are designed to meet the varying needs of seniors. The company's integrated approach allows for a seamless transition between different care settings, ensuring continuity of care.

Operations involve managing facilities, staffing with qualified healthcare professionals, and adhering to regulations. Home healthcare relies on a network of skilled caregivers and efficient scheduling. The supply chain manages medical supplies and food services. The distribution network includes physical care facilities and home care professionals.

Extendicare's value lies in its integrated approach, offering a continuum of care. This provides continuity and peace of mind for seniors and their families. The company aims to offer a seamless transition between different care settings. This integrated approach distinguishes Extendicare in the senior care market.

Customers benefit from the continuity of care and peace of mind. Families appreciate the comprehensive services and support provided. Extendicare's focus on integrated care offers a supportive environment for seniors. The company's facilities and services are designed to meet the evolving needs of its residents.

Extendicare's integrated approach to senior care is a key differentiator. This allows for a seamless transition between different care settings, providing continuity of care. The company's focus on a continuum of care sets it apart. Learn more about the company's history in Brief History of Extendicare.

- Integrated Care Model: Offers a continuum of care.

- Comprehensive Services: Includes long-term care, home healthcare, and retirement living.

- Focus on Continuity: Ensures a smooth transition between care settings.

- Customer-Centric Approach: Prioritizes the needs of seniors and their families.

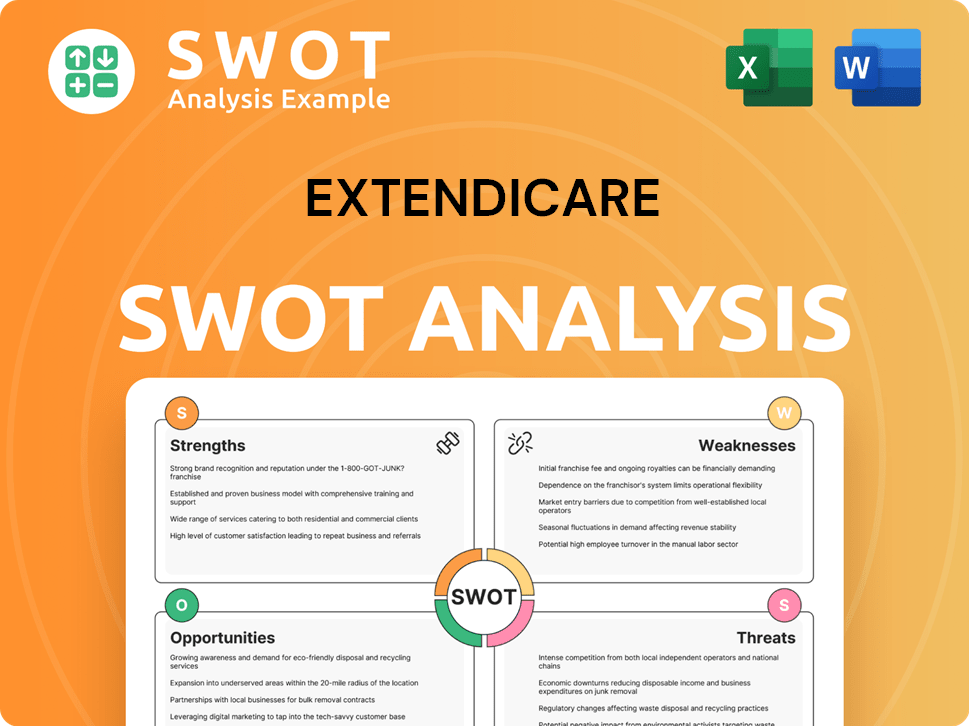

Extendicare SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Extendicare Make Money?

The revenue streams and monetization strategies of Extendicare are multifaceted, reflecting its diverse offerings in the senior care sector. These strategies are crucial for understanding how Extendicare generates income and sustains its operations within the healthcare market. The company leverages a combination of government funding, resident fees, and service charges to maintain its financial health.

Extendicare's primary revenue sources include funding from provincial governments for long-term care services, fees from residents in retirement living communities, and payments for home healthcare services. The specific contribution of each revenue stream to the total revenue can fluctuate, but long-term care funding typically constitutes a significant portion. This is due to the regulated nature and high demand for these services within the senior care industry.

The monetization strategies employed by Extendicare are primarily service-based. Revenue for long-term care is largely derived from per diem funding rates set by provincial governments, with additional revenue from resident co-payments for accommodation. Retirement living generates income through monthly rental fees and charges for extra services, often structured in tiered pricing models. Home healthcare revenue is based on hourly rates, varying depending on the type of care and funding source. Extendicare may also use cross-selling strategies to encourage residents to transition between different care settings as their needs evolve, thereby retaining them within the Extendicare ecosystem.

Extendicare's financial model is built on several key revenue streams and monetization strategies. These approaches are designed to maximize revenue while providing quality care. For more information on who the target market is, read this article about Target Market of Extendicare.

- Long-Term Care: Revenue is primarily generated from per diem funding from provincial governments, supplemented by resident co-payments. The amount varies based on the level of care required and the specific provincial regulations.

- Retirement Living: Revenue comes from monthly rental fees and charges for additional services. Pricing often follows a tiered system, depending on the level of care and amenities.

- Home Healthcare: Revenue is generated through hourly rates for services, with rates varying based on the type of care and funding source. This can include private insurance, direct client payments, or government programs.

- Cross-Selling and Service Integration: Extendicare may encourage residents to transition between its different care settings as their needs evolve. This strategy helps retain residents within the Extendicare ecosystem.

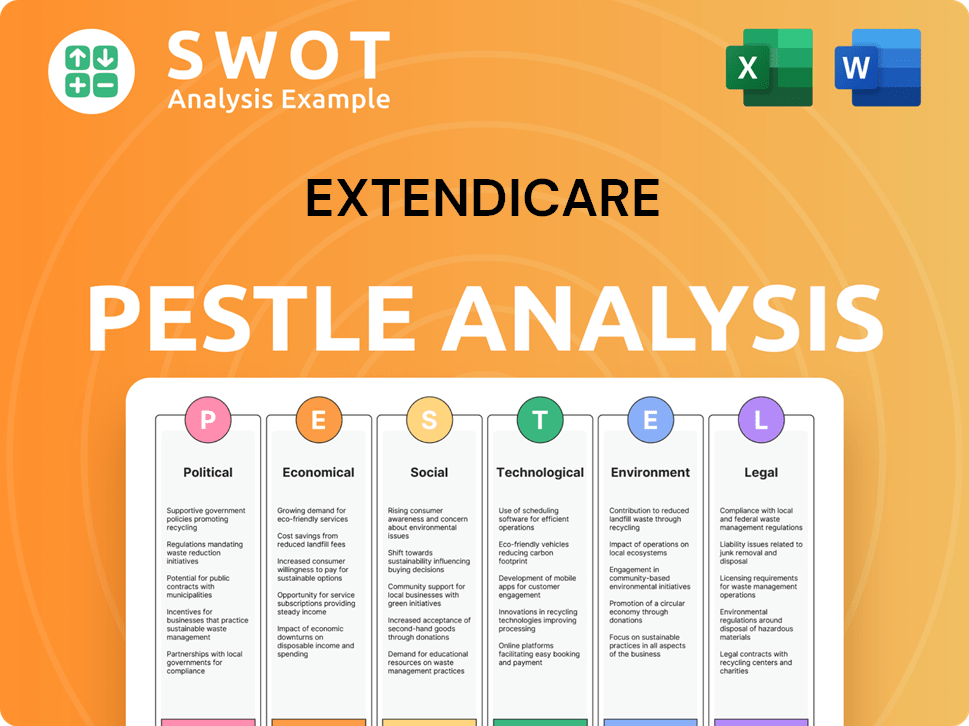

Extendicare PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Extendicare’s Business Model?

Extendicare's journey has been marked by significant milestones and strategic shifts, primarily focused on its core operations within the Canadian senior care market. A key strategic move involved divesting its U.S. operations, largely completed by 2022, to streamline its focus on the Canadian market. This strategic realignment allowed the company to concentrate on its strengths in providing senior care services.

The company has also strategically expanded and enhanced its home healthcare division, ParaMed, recognizing the growing demand for in-home services. This expansion reflects a strategic pivot towards community-based care, catering to the evolving needs of seniors. These strategic moves have positioned Extendicare to adapt to the changing landscape of senior care.

Operational and market challenges have included the complexities of the COVID-19 pandemic, which significantly impacted long-term care facilities. Extendicare responded by implementing stringent infection control measures and actively participating in vaccination efforts. Staffing shortages, particularly the shortage of healthcare professionals, remain a persistent hurdle, addressed through recruitment initiatives and retention programs. Understanding these challenges is crucial for investors and stakeholders.

The divestiture of U.S. operations, largely completed by 2022, streamlined Extendicare's focus on the Canadian market. Expansion of the ParaMed home healthcare division reflects a strategic pivot towards community-based care. These moves have helped the company adapt to market changes.

Focusing on the Canadian market allowed for streamlined operations and resource allocation. Enhancing ParaMed reflects a response to the growing demand for in-home care. These strategic moves have positioned Extendicare to adapt to evolving market dynamics.

Extendicare's established brand and extensive operational footprint across Canada provide economies of scale and recognition. The integrated care model, offering a continuum of services, caters to diverse senior needs. The company's adaptability is key to maintaining its market position.

The COVID-19 pandemic presented significant challenges, including increased costs and staffing shortages. Extendicare responded with stringent infection control measures and vaccination efforts. Staffing shortages continue to be addressed through recruitment and retention programs.

Extendicare's competitive advantages stem from its established brand and operational footprint across Canada, providing economies of scale and widespread recognition. Its integrated care model, offering a continuum of services, provides a competitive edge. The company continues to adapt to new trends and regulatory frameworks.

- Brand Strength and Footprint: Extendicare benefits from its established brand and extensive operations across Canada, enhancing its market presence.

- Integrated Care Model: The ability to offer a continuum of services, from independent living to long-term care, caters to a wide range of senior needs.

- Adaptability: The company's focus on technological advancements and evolving regulations ensures it maintains its market position.

- Market Dynamics: The senior care market is influenced by demographic shifts, regulatory changes, and technological advancements.

- Financial Performance: Investors can find detailed financial data and analysis in the Owners & Shareholders of Extendicare.

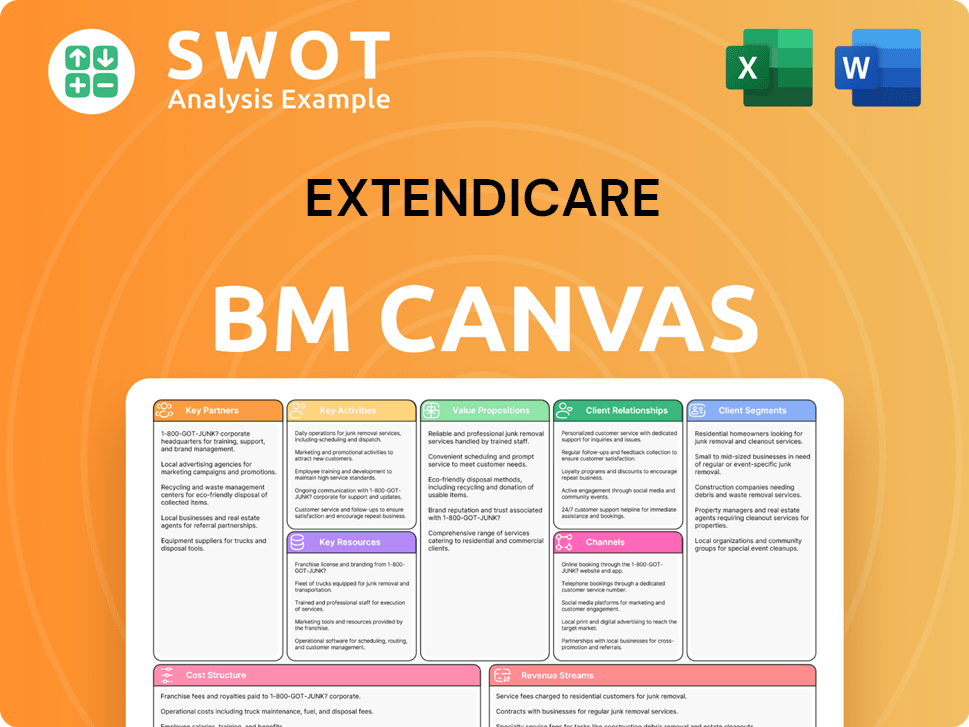

Extendicare Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Extendicare Positioning Itself for Continued Success?

The company holds a significant position in the Canadian senior care industry, operating numerous long-term care homes and providing extensive home healthcare services across several provinces. While specific market share data for 2024-2025 isn't readily available, its long-standing presence and comprehensive service offerings establish it as a leading provider of senior care.

Customer loyalty is often driven by the essential nature of the services offered and the trust developed over time, even though the industry faces ongoing scrutiny regarding care quality. The company's strategic focus includes continued investment in its home healthcare division, exploring facility redevelopment and expansion opportunities, and leveraging technology to improve care delivery and operational efficiency, which are all critical for its future outlook.

The company is a key player in the Canadian senior care market, with a strong presence in long-term care homes and home healthcare services. Its extensive network and service offerings position it as a leading provider, though specific market share figures for 2024-2025 are not readily available. The company's operations are spread across various provinces, enhancing its reach and impact.

Key risks include evolving regulations, especially regarding funding and quality standards in long-term care. The shortage of healthcare professionals, like nurses and personal support workers, poses operational challenges. Competition from new entrants and technological disruptions could also impact the company. Consumer preference shifts towards community-based care also present a risk.

The future depends on its ability to provide high-quality, in-demand services while managing operational challenges. Strategic initiatives include investments in home healthcare, facility expansion, and technology integration. The company aims to adapt to demographic changes, optimize service offerings, and navigate regulatory and labor environments to sustain growth. The company's success will rely on its ability to maintain and expand its services.

The company offers a range of services, including long-term care, home healthcare, and rehabilitation. It operates Extendicare facilities across multiple locations, providing care for seniors with varying needs. The services are designed to meet the diverse needs of its residents and clients, ensuring comprehensive care.

The company's success hinges on its ability to navigate regulatory changes, manage labor shortages, and adapt to evolving consumer preferences. Its strategic initiatives, such as investment in home healthcare and technological advancements, are crucial for sustained growth. Understanding the competitive landscape and the company's response to market dynamics is vital for assessing its long-term potential. For more information about the company's services, you can read this article about Extendicare.

- Regulatory compliance and funding models significantly impact operations.

- Labor costs and availability of skilled healthcare professionals are critical.

- Technological advancements and innovative care delivery methods are reshaping the industry.

- Consumer preferences for home-based care and community services are increasing.

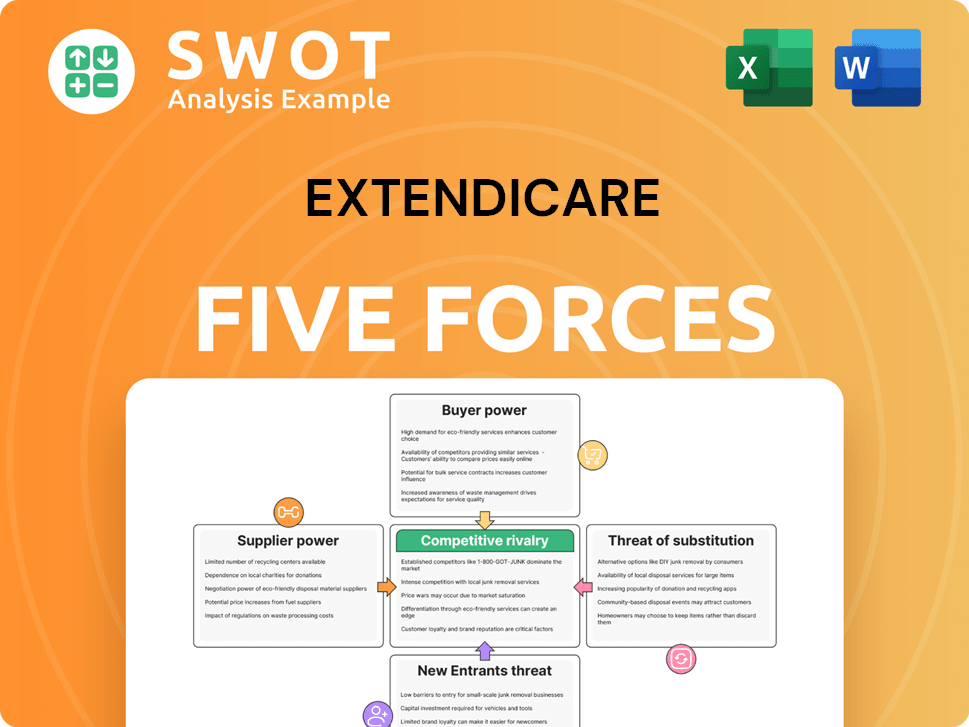

Extendicare Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Extendicare Company?

- What is Competitive Landscape of Extendicare Company?

- What is Growth Strategy and Future Prospects of Extendicare Company?

- What is Sales and Marketing Strategy of Extendicare Company?

- What is Brief History of Extendicare Company?

- Who Owns Extendicare Company?

- What is Customer Demographics and Target Market of Extendicare Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.