Extendicare Bundle

Can Extendicare Continue Its Growth Surge?

Extendicare Inc., a major player in Canadian senior care, is making significant moves. Their recent acquisition of nine long-term care homes from Revera Inc., expected to close in Q2 2025, signals ambitious Extendicare SWOT Analysis and expansion plans. This strategic move is set to reshape their market presence.

This analysis delves into the

How Is Extendicare Expanding Its Reach?

The Extendicare growth strategy is focused on expanding its less capital-intensive, higher-margin business segments. This involves developing new long-term care (LTC) homes through joint venture partnerships, alongside strategic acquisitions.

A key component of Extendicare's future prospects includes significant expansion initiatives to strengthen its market position within the healthcare industry. These strategic moves aim to enhance service offerings and increase operational capacity.

Extendicare's company analysis reveals a proactive approach to growth, driven by acquisitions and new developments designed to meet the evolving needs of the senior care market.

In May 2025, Extendicare announced the acquisition of Closing the Gap Healthcare Group Inc. for $75.5 million. This acquisition, expected to close in Q3 2025, will add approximately 1.1 million service hours annually to Extendicare's home healthcare segment.

The Closing the Gap acquisition is projected to generate $84.2 million in revenue based on 2024 performance. Extendicare anticipates approximately $1.1 million in annualized cost synergies within the first year following the acquisition.

Extendicare is set to acquire nine LTC homes from Revera, encompassing 1,396 beds. This includes 574 private pay retirement beds and 361 funded LTC Class C beds. The deal is expected to close in Q2 2025.

The Revera acquisition allows for the redevelopment of seven Class C homes. This will add a proposed 1,088 LTC beds to Extendicare's redevelopment pipeline. This will increase the total operated homes to 101 with over 14,500 beds.

Extendicare opened Crossing Bridge, a new 256-bed LTC home in Stittsville, Ontario, in February 2025, as part of an Axium joint venture. Further expansion includes construction commencing in December 2024 on two new LTC projects in Port Stanley and London, Ontario.

- Total development costs for the new projects are estimated at $130.4 million.

- These projects are anticipated to open in the first half of 2027.

- The company sold three LTC projects under construction to Axium JV for net cash proceeds of $56.3 million, retaining a 15% managed interest.

- These initiatives reflect Extendicare’s commitment to quality of care and strategic growth in the senior care market.

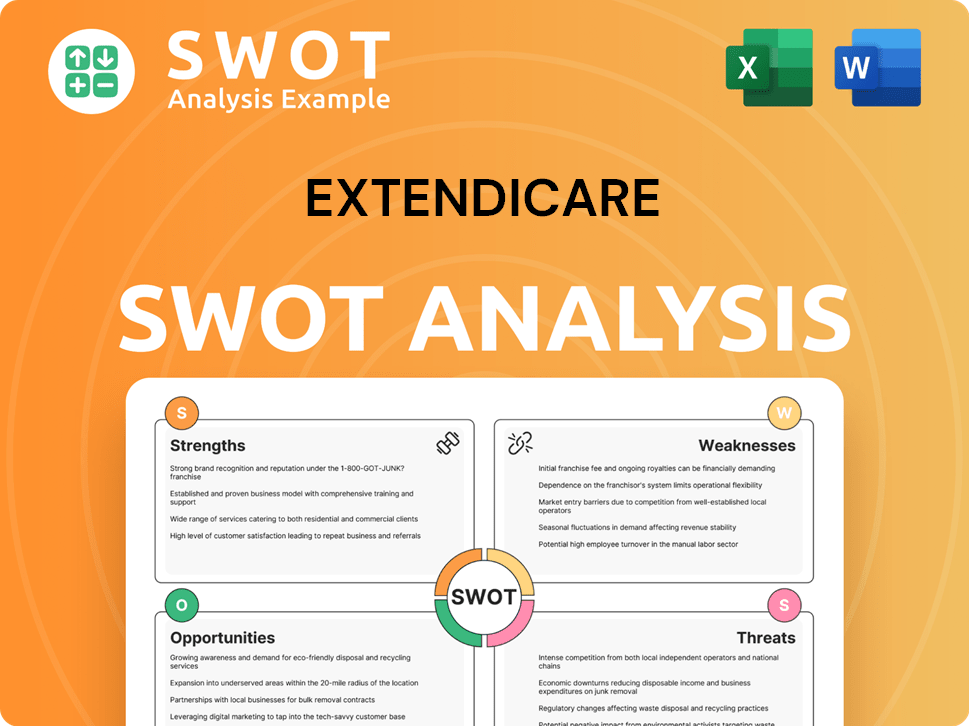

Extendicare SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Extendicare Invest in Innovation?

The company is actively using technology and innovation to improve how it delivers care and runs its operations. A key part of this is the transformation of its old finance and HR systems. This involves using Workday to make information more accessible and streamline processes.

This digital shift aims to standardize operations, support data-driven decision-making, and boost accuracy across its many care locations. The implementation of Workday also strengthens Extendicare's technology infrastructure, particularly in data security and best practices across various departments.

The senior care market is seeing a rise in technologies like telemedicine and remote patient monitoring. These are used to enhance patient outcomes and cut healthcare costs. While specific details on Extendicare's direct R&D investments in cutting-edge technologies are not explicitly detailed in recent reports, the company's focus on technological enhancements in its operational backbone suggests a foundational approach to digital transformation. For more details on the company's market focus, you can read about the Target Market of Extendicare.

Extendicare is focused on improving operational efficiency through technology. This includes strengthening processes in areas like payroll, scheduling, and IT services.

The company is undergoing a digital transformation to modernize its systems. This involves adopting new technologies to streamline operations and improve data management.

Extendicare aims to use data to make better decisions. This approach helps in improving accuracy and reliability across its care locations.

The company is enhancing its technology infrastructure. This includes improving data security and adopting leading practices in finance and HR.

The senior care sector is increasingly adopting technologies like telemedicine. These technologies aim to improve patient care and reduce costs.

The company's efforts are concentrated on areas like payroll, scheduling, and human resources. These improvements are designed to boost operational efficiency.

Extendicare's strategic initiatives include a significant focus on technology to enhance care delivery and streamline operations, directly impacting its 22,000 team members and over 100 care locations.

- Implementation of Workday for finance and HR operations.

- Focus on data security through encryption.

- Adoption of leading practices in Finance, HR, Payroll, Absence Management, and Time Tracking.

- Ongoing efforts to strengthen processes and procedures, particularly in payroll and scheduling.

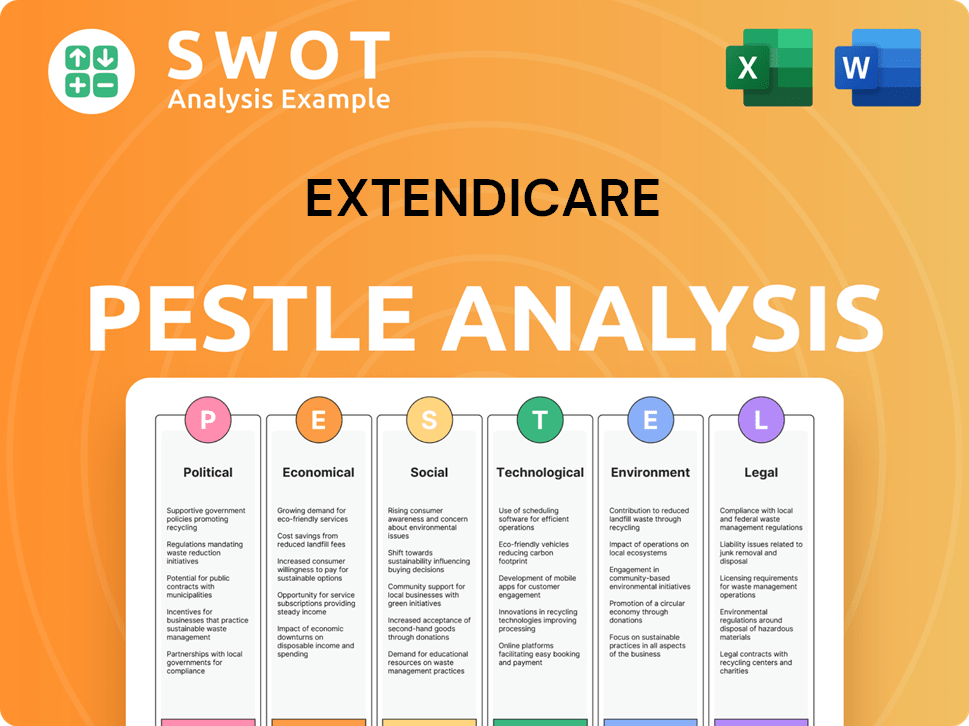

Extendicare PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Extendicare’s Growth Forecast?

Extendicare's financial performance in Q1 2025 demonstrated significant improvement, driven by gains across all business segments. The company's strategic focus on operational efficiency and market expansion has yielded positive results, positioning it favorably within the healthcare industry. This positive trend reflects the effectiveness of the company's growth strategy.

The company's revenue for Q1 2025 reached $374.7 million, exceeding analyst expectations, indicating strong demand and effective service delivery. Net income improved by 15% to $15.0 million, with a profit margin of 4.0%, up from 3.6% in Q1 2024. This financial performance underscores the company's ability to navigate the senior care market successfully.

Adjusted EBITDA excluding out-of-period items increased by 42.7% to $29.0 million.

Revenue for Q1 2025 reached $374.7 million, exceeding analyst expectations.

Net income improved by 15% to $15.0 million, with a profit margin of 4.0% in Q1 2025, up from 3.6% in Q1 2024.

Average daily volume (ADV) increased 8.9% year-over-year to 31,603 in Q1 2025.

For the full year 2024, the company's revenue increased by 11.8% to $391.6 million, primarily due to increased government funding and higher home healthcare volumes. The gross profit margin for fiscal years ending December 2020 to 2024 averaged 14.3%, with the latest twelve months at 13.7%. The company's dividend increase to 4.2 cents per month, effective March 2025, reflects confidence in its financial outlook. The company's conservative balance sheet approach is evident, with $121.8 million in cash and cash equivalents and access to a further $108.5 million under its new $275.0 million senior secured credit facility as of December 31, 2024. The Marketing Strategy of Extendicare plays a crucial role in driving these financial results.

Increased government funding and higher home healthcare volumes and rates contributed to revenue growth in 2024.

A 5.0% dividend increase to 4.2 cents per month, effective March 2025, demonstrates financial health and confidence.

The company maintains a strong liquidity position with $121.8 million in cash and cash equivalents and access to additional credit.

Revenue is forecast to grow 5.3% per annum on average over the next three years, indicating positive future prospects.

The company's strategic initiatives, including operational improvements and market expansion, are key to its financial success.

The company is adapting to changing regulations and healthcare industry trends to maintain its competitive advantage.

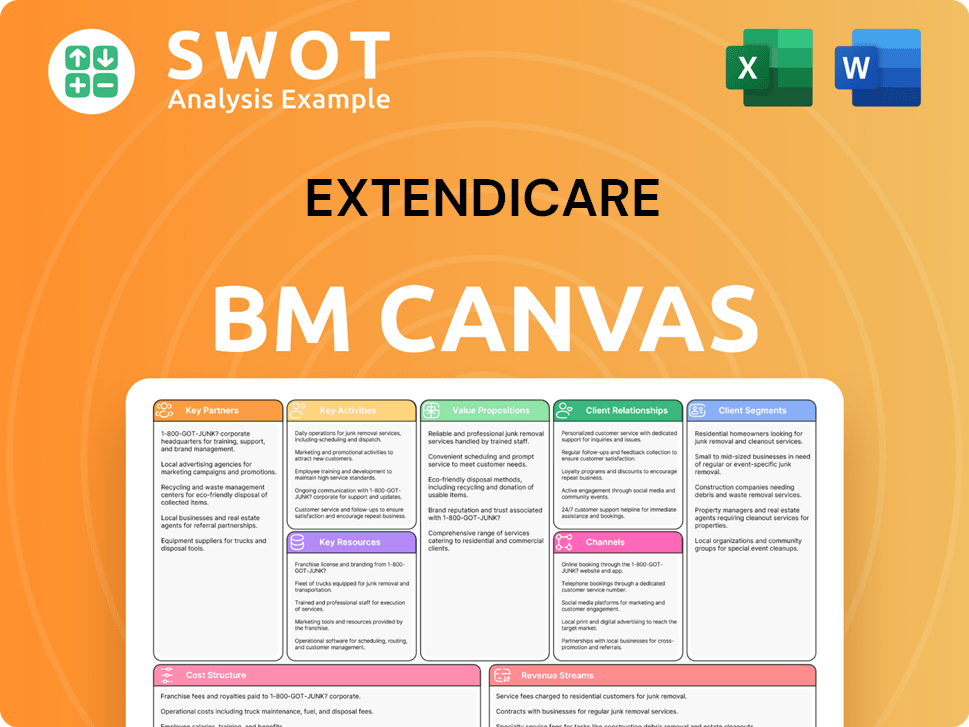

Extendicare Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Extendicare’s Growth?

The senior care sector, including Extendicare, faces several risks that could impede its growth strategy. Economic downturns and shifts in government funding significantly impact financial performance. The company's reliance on government programs and the competitive home healthcare market pose ongoing challenges.

Execution risks associated with acquisitions and persistent labor shortages further complicate operations. Regulatory challenges, such as those faced by the Countryside nursing home, highlight the potential for temporary operational disruptions. These factors necessitate careful strategic planning and risk management.

The company must navigate these obstacles to achieve its future prospects. A multi-service approach and maintaining a strong financial position are crucial for mitigating these risks. Addressing these challenges is essential for sustaining and growing the business.

Economic downturns can decrease consumer spending and impact government healthcare funding. This can directly affect the financial performance of Extendicare and its ability to invest in its Extendicare growth strategy. Reduced funding could limit expansion plans and the quality of care provided.

Extendicare is heavily reliant on government funding and reimbursement programs. Changes in government policies, especially in provinces like Ontario, can materially affect the company's business. These changes can lead to financial instability and uncertainty.

The home healthcare market is fragmented and competitive. This competition can affect Extendicare's market share in long-term care and profitability. Intense competition requires continuous innovation and strategic differentiation.

New acquisitions pose execution risks related to integration. Successfully integrating new acquisitions into existing operations is crucial. Poor integration can lead to operational inefficiencies and financial losses.

Labor shortages and rising labor costs are persistent headwinds. The senior care sector faces ongoing challenges in attracting and retaining staff. Increased operating costs due to high employee absenteeism can impact profitability.

Specific facilities may face regulatory challenges, such as non-compliance issues. The 'Cease Admissions' order at the Countryside nursing home highlights potential disruptions. Addressing regulatory issues is essential for maintaining operational capacity.

Extendicare addresses these risks through diversification. This includes a multi-service approach across long-term care, home health care, and managed services. Maintaining a strong financial position is crucial for navigating challenges and ensuring financial stability. This approach helps to mitigate the impact of economic fluctuations and policy changes.

The company's strategic initiatives, including potential acquisitions and partnerships, are key to its Extendicare future prospects. These initiatives require careful planning and execution to ensure successful integration and alignment with the company's overall goals. Further insights can be found in Revenue Streams & Business Model of Extendicare.

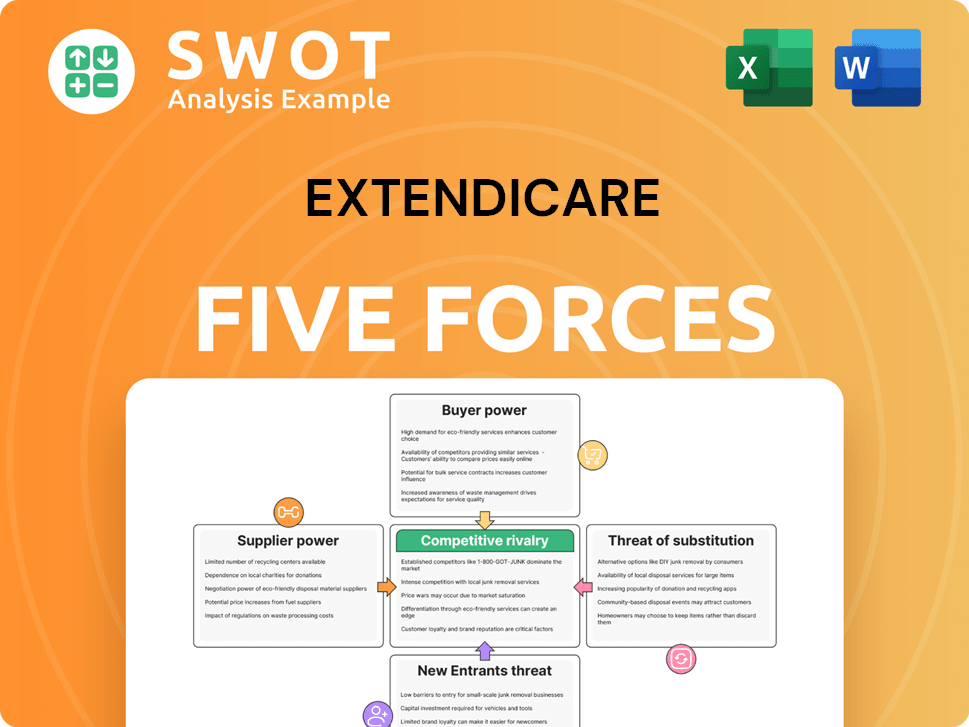

Extendicare Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Extendicare Company?

- What is Competitive Landscape of Extendicare Company?

- How Does Extendicare Company Work?

- What is Sales and Marketing Strategy of Extendicare Company?

- What is Brief History of Extendicare Company?

- Who Owns Extendicare Company?

- What is Customer Demographics and Target Market of Extendicare Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.