EZCORP Bundle

How Does EZCORP Stack Up in the Alternative Financial Services Arena?

In a financial landscape shaped by economic pressures, understanding the EZCORP SWOT Analysis is crucial. EZCORP, a key player in the pawn industry, has demonstrated resilience and growth. This analysis explores the company's competitive position, financial health, and strategic moves.

This deep dive into the EZCORP competitive landscape will dissect its performance, focusing on its EZCORP SWOT analysis, and the strategies employed to maintain its market position. We will examine EZCORP's competitors, analyze its financial performance, and assess the impact of industry trends. This comprehensive EZCORP market analysis will provide valuable insights for investors and stakeholders alike.

Where Does EZCORP’ Stand in the Current Market?

EZCORP holds a strong market position, particularly in the pawn loan sector. As of April 2025, the company operates a significant network of stores, with 542 locations in the U.S. and 742 in Latin America. This extensive presence allows EZCORP to serve a broad customer base seeking accessible financial solutions.

The company's core operations revolve around providing pawn loans, secured by items like jewelry and electronics. Additionally, EZCORP generates revenue from retail sales of forfeited collateral and pre-owned goods. This dual approach allows the company to cater to value-conscious consumers, offering short-term loans without traditional credit checks.

EZCORP ranks as the second-largest pawn shop operator in the U.S. after FirstCash. The company's substantial store network and strong financial performance reflect its competitive position. The Growth Strategy of EZCORP highlights the company's expansion efforts.

EZCORP has a strong presence in both the U.S. and Latin America. The company's Latin American operations, particularly in Mexico, Guatemala, Honduras, and El Salvador, have been a primary driver of expansion. The Latin American store count has surpassed the U.S. since 2021.

In fiscal year 2024, EZCORP's total revenues reached $1.16 billion. The company's financial health is further demonstrated by its net income, which rose to $83.1 million. The first quarter of fiscal 2025 saw total revenues increase to $320.2 million.

EZCORP's pawn loans outstanding (PLO) reached a record $274.8 million in Q1 fiscal 2025. The company's debt-to-equity ratio was 0.69 as of December 31, 2024, and it boasts a strong current ratio of 2.91. Adjusted EBITDA increased 23% to $45.1 million in Q2 fiscal 2025.

The EZCORP competitive landscape includes other pawn shop operators and businesses offering similar financial services. The company's market position is supported by its extensive store network and strong financial performance. EZCORP's growth strategies are focused on expanding its store count and increasing revenue.

- EZCORP's primary competitors include FirstCash.

- The company's revenue breakdown shows a strong performance in both the U.S. and Latin American markets.

- EZCORP's financial performance, including ROE and ROA, surpasses industry averages.

- The company's expansion plans include the acquisition of 53 additional stores in Mexico in 2025.

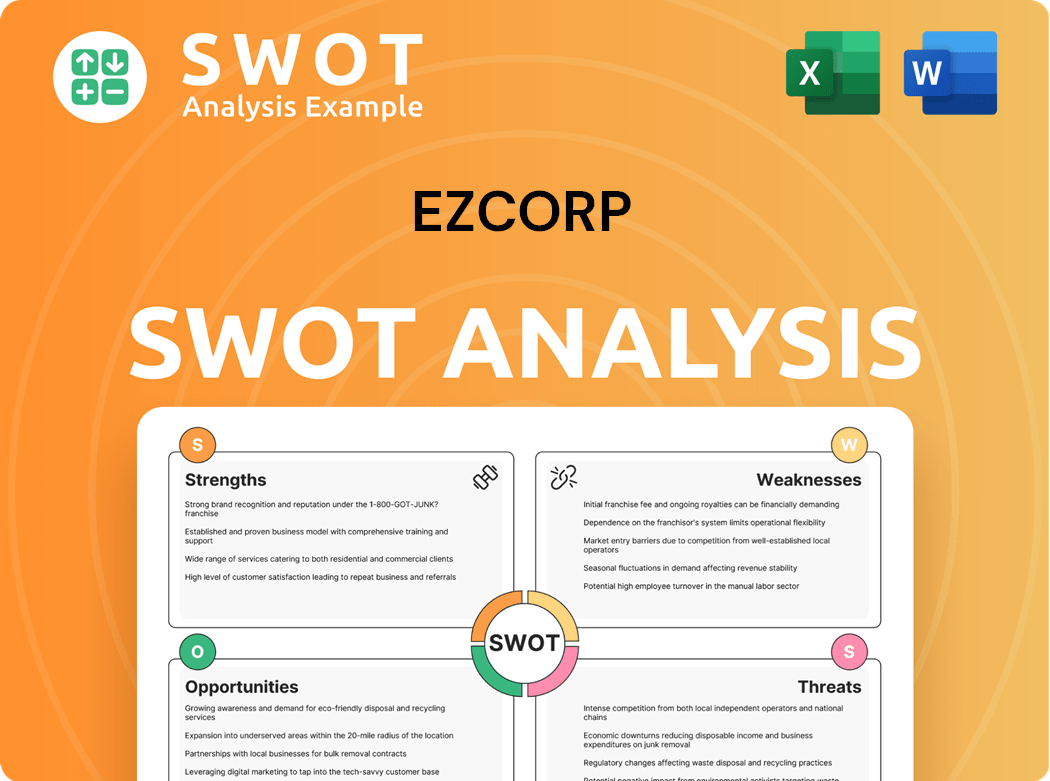

EZCORP SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging EZCORP?

Understanding the EZCORP competitive landscape is crucial for grasping its position within the consumer finance and pawn industry. The company faces competition from both direct and indirect players, each vying for market share. Analyzing these competitors provides insights into EZCORP's strategic challenges and opportunities.

The EZCORP market analysis reveals a dynamic environment shaped by traditional pawnbrokers, emerging online services, and broader consumer finance providers. This competitive pressure influences EZCORP's strategic decisions, including expansion plans and operational adjustments. A comprehensive understanding of these competitors is essential for evaluating EZCORP's financial performance and growth potential.

For a deeper dive into the company's operations, consider exploring Revenue Streams & Business Model of EZCORP.

EZCORP's most significant direct competitor is FirstCash, a major player in the international pawnbroking market. Other direct competitors include regional and national pawn shop chains. These competitors directly challenge EZCORP in the pawn loan and retail sales sectors.

Indirect competitors include companies in the broader consumer finance industry, such as Regional Management, Attain Finance, and Goeasy. These companies offer alternative financial products and services. These companies compete for the same customer base as EZCORP.

Emerging online pawn services, such as Pawnhero and Pawngo, are also competing with EZCORP. These services offer convenience and potentially more affordable options. The online pawn market is experiencing significant growth, with mobile apps accounting for 59% of transactions.

Internationally, EZCORP faces competition from companies like H&T Group, Arohan, and BHG Money. These competitors operate in various international markets. EZCORP's expansion plans, such as the acquisition of 53 additional stores in Mexico in 2025, will further intensify competition in Latin America.

Fintech partnerships and mobile app-based pawn transactions are driving shifts in the market. Online services are growing by 39%. Major players are increasing investment in technology upgrades to enhance operational efficiency. These technological advancements are reshaping the competitive landscape.

Mergers and acquisitions significantly impact competitive dynamics. EZCORP's own acquisitions, like the expansion in Mexico, reflect the ongoing consolidation within the industry. These strategic moves influence market share and competitive positioning. The industry is constantly evolving through these activities.

The EZCORP industry is characterized by a mix of direct and indirect competitors, each employing different strategies to capture market share. Understanding these strategies is crucial for assessing EZCORP's position and future prospects. The competitive environment is shaped by technological advancements, regulatory changes, and economic conditions.

- FirstCash: A major pawnbroking competitor with a significant international presence.

- Regional Management, Attain Finance, Goeasy: Providers of alternative financial products.

- Online Pawn Services: Emerging players offering convenience and potentially lower costs.

- International Competitors: Companies like H&T Group and Arohan challenge EZCORP in various global markets.

- Technology and Fintech: Mobile apps and online platforms are transforming the industry, with mobile apps accounting for a significant portion of transactions.

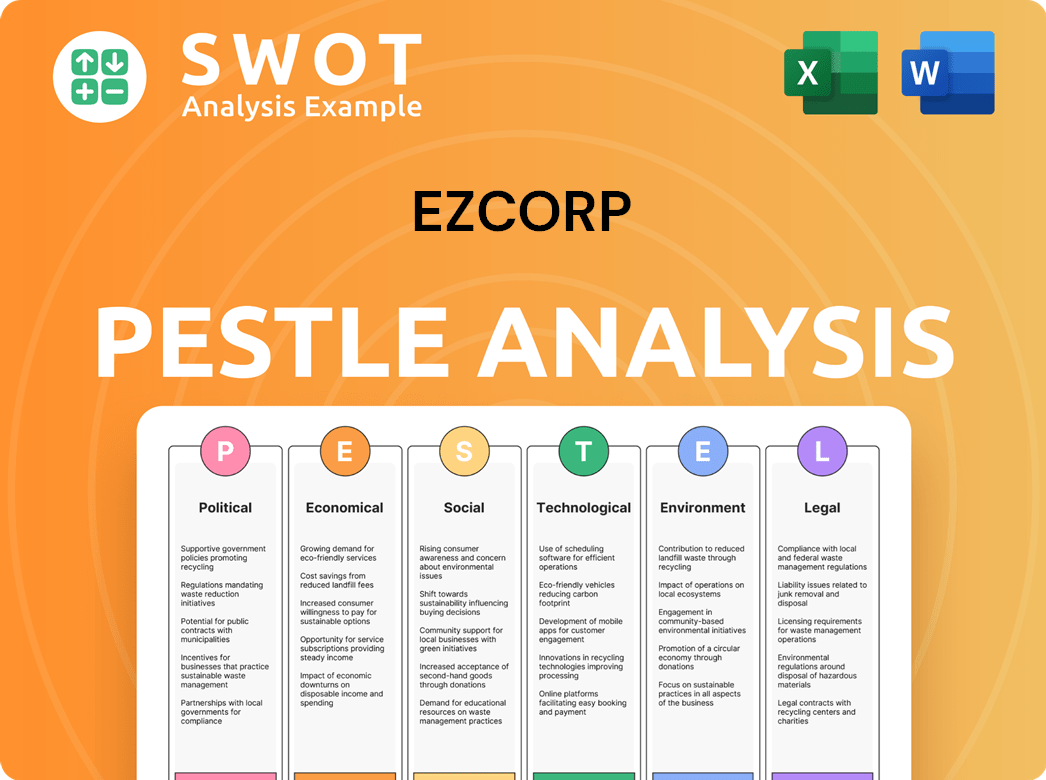

EZCORP PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives EZCORP a Competitive Edge Over Its Rivals?

The competitive landscape of EZCORP is shaped by its strategic advantages, including its extensive physical presence and established brand recognition. With a network of 1,284 stores across the U.S. and Latin America, the company has a significant geographical reach, making it accessible to a wide customer base. This widespread presence, combined with strong brand recognition, positions EZCORP favorably within the EZCORP industry.

EZCORP's business model, centered around short-term pawn loans, offers a crucial service to value-conscious consumers, particularly those underserved by traditional financial institutions. This model is further strengthened by the high profitability of its pawn service charge (PSC) revenue. The company's strategic moves, such as the recent $300.0 million private offering of senior notes in March 2025, enhance its financial flexibility, supporting continued growth and strategic maneuvers within the EZCORP market analysis.

The company's commitment to technological advancements also contributes to its competitive edge. The EZ+ web-based application allows customers to manage transactions online, while the EZ+ Rewards program has shown exceptional performance, accounting for 77% of all transacting customers in Q1 fiscal 2025. This focus on technology, combined with a disciplined capital allocation strategy, underscores EZCORP's ability to adapt and thrive in a dynamic market. Understanding the Target Market of EZCORP is key to appreciating its competitive advantages.

EZCORP operates a vast network of stores, providing significant geographical reach and accessibility. This widespread presence is a key factor in its market share analysis, allowing it to serve a broad customer base across the U.S. and Latin America. The company's store count is a critical element in its competitive landscape.

EZCORP benefits from strong brand recognition through its established brands. These brands, including EZPAWN and Value Pawn & Jewelry, have built customer trust and loyalty. This brand recognition is a crucial advantage in the EZCORP competitive landscape, helping to attract and retain customers.

The company's focus on short-term, non-recourse pawn loans provides a valuable service. These loans require no credit checks and are attractive to customers needing immediate cash. This business model is particularly effective in the EZCORP industry, catering to a specific customer segment.

EZCORP leverages technology to enhance customer experience and operational efficiency. The EZ+ web-based application and the EZ+ Rewards program are examples of how technology drives customer engagement. This technological integration contributes to the company's growth strategies.

EZCORP's financial strength is demonstrated by its disciplined capital allocation and a strong cash position. The company completed a $300.0 million private offering of senior notes in March 2025, which enhanced its financial flexibility. This financial health supports EZCORP's expansion plans and strategies.

- A strong cash position of $505.2 million as of March 31, 2025.

- Disciplined capital allocation for organic growth and strategic acquisitions.

- Strategic maneuvers supported by a solid financial foundation.

- Focus on rapid consolidation in fragmented markets, particularly in Latin America.

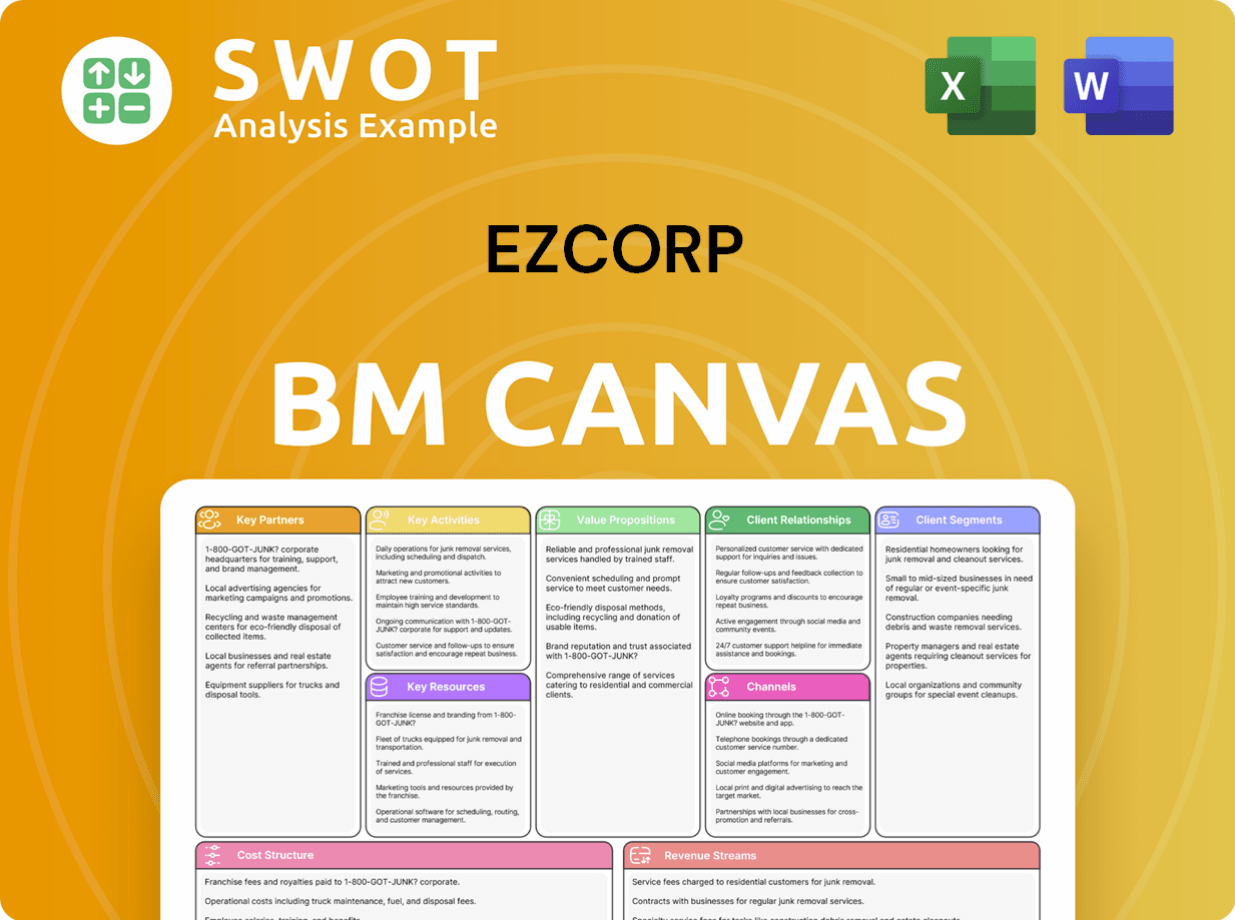

EZCORP Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping EZCORP’s Competitive Landscape?

The pawn industry, where EZCORP operates, is currently shaped by several key trends, presenting both challenges and opportunities. The market is driven by the increasing need for short-term credit and the demand for secondhand goods, especially among underbanked populations. The global pawnbroking market is valued at approximately $38.65 billion in 2025 and is projected to experience steady growth, with projections showing the global pawn market reaching $63.06 billion by 2033.

Technological advancements are another major trend, with online and mobile pawn services expanding to cater to a wider customer base. Digital transformation is on the rise, with mobile apps playing a significant role in transactions. EZCORP's digital efforts, such as its EZ+ Rewards program and online layaway options, are important for attracting tech-savvy consumers, particularly millennials and Gen Z. For a deeper look at how digital strategies are being implemented, consider exploring the Marketing Strategy of EZCORP.

The pawn industry is experiencing growth due to the demand for short-term credit and secondhand goods. The global pawn market is projected to reach $63.06 billion by 2033. Digital transformation, including mobile apps, is increasing, with over 61% of pawn operators expanding into e-commerce-backed lending.

The industry faces challenges such as stricter regulations and the rise of alternative lending platforms. Potential threats include declining demand, increased regulation, and competition. Volatile collateral values and the risk of counterfeit goods are also ongoing concerns.

Growth opportunities exist in emerging markets, especially in Latin America, where EZCORP is expanding. Product innovations such as luxury item pledges and crypto-loans represent avenues for diversification. Strategic partnerships and acquisitions also offer growth potential.

EZCORP is focusing on digital integration and geographic expansion to enhance customer engagement and explore new market opportunities. The company's strong financial health, with $505.2 million in cash as of March 31, 2025, supports strategic acquisitions.

EZCORP’s competitive landscape is influenced by industry trends, challenges, and opportunities. The company must adapt to digital transformation and regulatory changes while leveraging its financial strength for expansion.

- Digital Integration: Enhance online and mobile services to meet customer demands.

- Geographic Expansion: Focus on growth in emerging markets, particularly Latin America.

- Financial Strategy: Utilize strong cash position for strategic acquisitions and expansion.

- Risk Management: Address regulatory changes and manage volatile collateral values.

EZCORP Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of EZCORP Company?

- What is Growth Strategy and Future Prospects of EZCORP Company?

- How Does EZCORP Company Work?

- What is Sales and Marketing Strategy of EZCORP Company?

- What is Brief History of EZCORP Company?

- Who Owns EZCORP Company?

- What is Customer Demographics and Target Market of EZCORP Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.