EZCORP Bundle

Who are EZCORP's Customers, and How Does It Serve Them?

In the dynamic world of financial services, understanding your customer is key, and for EZCORP, it's the cornerstone of its business. Founded in 1989, EZCORP has carved a niche by offering immediate financial solutions, primarily through pawn loans. This focus has shaped its EZCORP SWOT Analysis and continues to influence its strategic direction.

This exploration delves into the specifics of EZCORP's customer demographics, providing a detailed market analysis. We'll examine the EZCORP customer age range, income levels, and geographic location to understand the target market and the specific needs driving their engagement with EZCORP's services. Understanding the customer profile is crucial for grasping the company's adaptability within the pawn shop industry.

Who Are EZCORP’s Main Customers?

The primary customer segments for EZCORP are primarily consumers (B2C) seeking immediate financial solutions. These individuals often require quick access to funds, frequently due to unexpected expenses or cash flow issues. This need drives their interaction with services like pawn loans.

The target market for EZCORP typically includes people with limited access to traditional credit options, such as bank loans or credit cards. This demographic often seeks discreet and straightforward ways to obtain funds without extensive credit checks. The company's business model is tailored to serve this specific customer profile, providing non-recourse, collateralized loans.

While specific data on age, gender, and income levels is not publicly detailed, industry trends suggest a broad spectrum. EZCORP's customer base often falls into lower to middle-income brackets. The Brief History of EZCORP highlights the company's focus on providing essential financial services, with a significant portion of revenue derived from pawn loans and the sale of forfeited merchandise.

EZCORP's customer base includes individuals from various backgrounds, united by their need for accessible financial services. These customers often face financial constraints and require immediate solutions. The company caters to a diverse group, united by their need for quick access to funds.

The target market is characterized by limited access to traditional credit and a preference for discreet financial transactions. EZCORP's services provide a crucial financial lifeline for those facing unexpected expenses. The business model is designed to meet the specific needs of this customer profile.

During economic downturns, the customer base can broaden to include individuals who might typically rely on traditional credit. EZCORP's services become even more vital during these periods. The company's focus remains on providing essential financial services to a wide range of customers.

EZCORP's primary revenue streams are pawn loans and the sale of forfeited merchandise. This business model directly serves the financial needs of its target market. The company's success is tied to its ability to meet the demands of its customer base.

EZCORP customers prioritize immediate access to funds, discretion, and straightforward transactions. They seek a quick and easy way to obtain financial assistance without extensive credit checks. Understanding these needs is crucial for EZCORP's continued success.

- Immediate Liquidity: Customers need fast access to cash, often for urgent expenses.

- Discreet Services: Privacy is a key factor, with customers valuing confidentiality.

- Simple Processes: Easy-to-understand loan terms and a hassle-free experience are essential.

- Fair Value: Customers expect fair appraisals and reasonable interest rates.

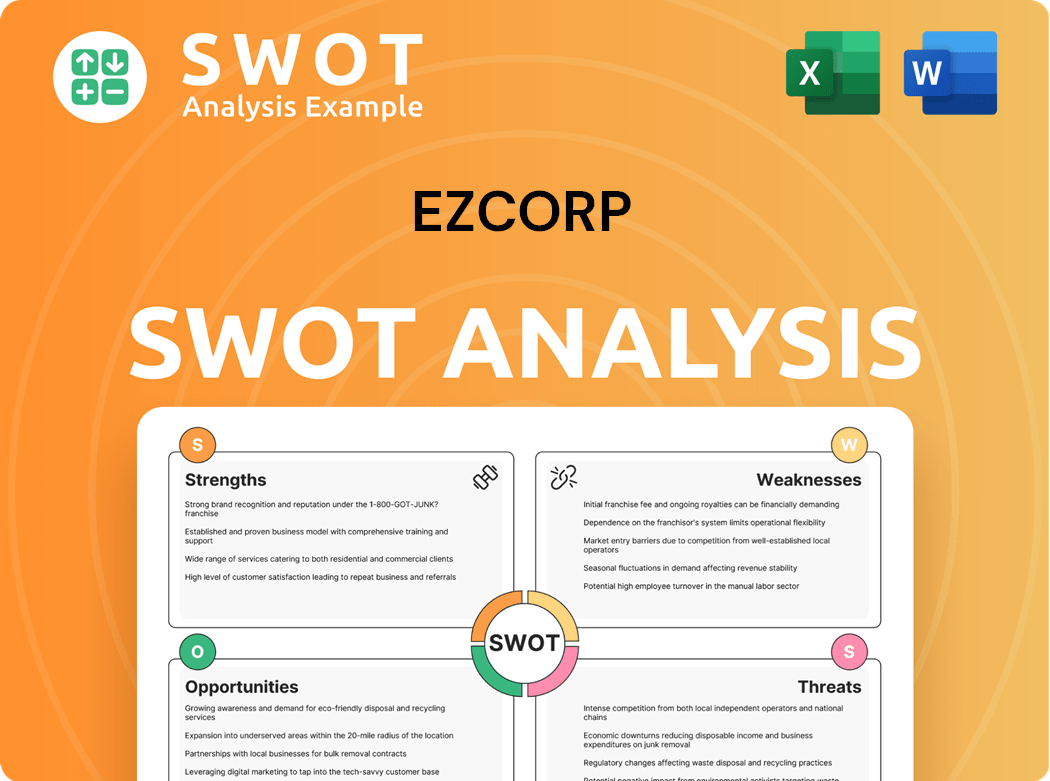

EZCORP SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do EZCORP’s Customers Want?

Understanding the customer needs and preferences is crucial for any business. For the company, the primary drivers for customer engagement are centered around immediate financial solutions. The company's services, such as pawn loans, directly address the need for quick access to cash, making it a key aspect of their customer interactions.

The target market for the company is primarily driven by the need for accessible financial services. This includes individuals seeking short-term financial assistance without the complexities of traditional lending. The non-recourse nature of pawn loans is a significant draw, offering security and a lower barrier to entry.

The customer profile for the company often includes individuals who may have limited access to conventional credit options. Their preferences lean towards convenient and straightforward transactions, valuing speed and ease of use. This focus helps the company tailor its services to meet these specific demands effectively.

Customers need quick access to funds for unexpected expenses or short-term financial gaps. This is a core need driving their use of the company's services.

Customers prefer loans where they are not personally liable beyond the collateral. This provides a sense of security and avoids credit score impacts.

Customers value the simplicity and speed of obtaining a loan. The straightforward process of pawning an item is a major draw.

Customers seek trustworthy and discreet financial solutions. Confidentiality and a professional service environment are important.

Customers often use pawn services for short-term financial needs, with the intention of redeeming their collateral when their situation improves.

Customers appreciate easily accessible locations, which makes it easier for them to conduct transactions and manage their financial needs.

The company addresses customer pain points by offering accessible, collateral-based lending. This approach caters to those who need immediate funds without extensive paperwork or credit checks. The physical store presence supports in-person transactions and immediate cash disbursement, meeting the needs of customers who prefer this method. For more detailed insights, you can refer to a comprehensive market analysis of the company.

Customers value convenience, speed, and discretion when seeking financial solutions. The company's services are designed to meet these needs effectively.

- Speed of Transaction: Customers prioritize quick access to funds.

- Loan Amount: The amount offered for collateral is a key factor.

- Trustworthiness: Customers seek reliable and discreet services.

- Accessibility: Convenient locations and easy processes are essential.

- Customer Service: Friendly and helpful service enhances the experience.

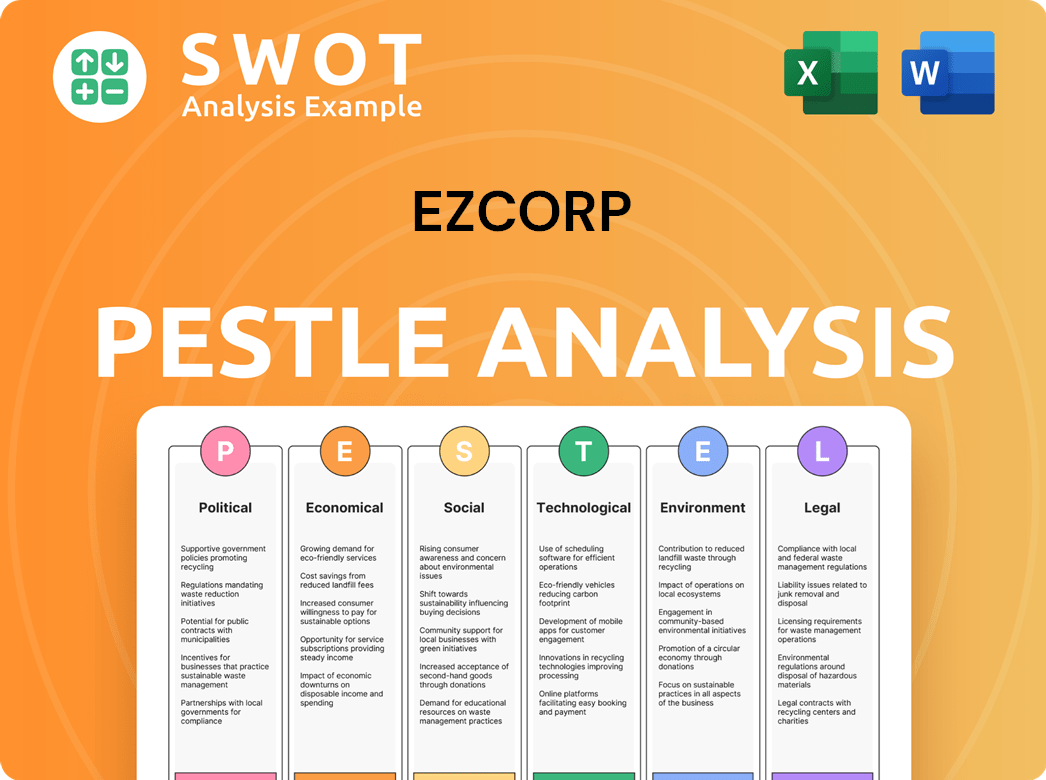

EZCORP PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does EZCORP operate?

The geographical market presence of EZCORP is primarily concentrated in the United States and Latin America. Within the U.S., the company operates a substantial network of pawn stores, with a strong presence in states like Texas, Florida, and California. These regions are characterized by diverse economic landscapes and populations, which contribute to the demand for pawn services. In Latin America, EZCORP has a notable footprint in Mexico and other Central American countries, where similar needs for alternative financial services exist.

The company's strategic approach involves adapting to the specific needs and regulatory environments of each market. This includes adjusting operational procedures, marketing messages, and merchandise offerings to align with local consumer preferences. This approach is crucial for effectively serving the diverse customer demographics and meeting the specific financial needs in each region.

The geographic distribution of sales and growth tends to reflect areas with higher demand for short-term financial solutions. This often includes urban and suburban areas with diverse populations and varying income levels. Understanding the nuances of each market is essential for EZCORP to maintain and grow its customer base.

EZCORP's target market is geographically focused on the United States and Latin America, with a significant presence in the U.S. and key countries like Mexico. This strategic placement allows the company to cater to specific regional demands. The company's primary customer demographics are influenced by the economic conditions and cultural norms of each area.

The company tailors its services and marketing to resonate with local needs and regulatory environments. This includes adapting operational procedures and merchandise offerings, reflecting the importance of localized strategies. This approach is crucial for effectively serving the diverse customer demographics and meeting the specific financial needs in each region.

The store distribution reflects areas with higher demand for short-term financial solutions. This often includes urban and suburban areas with diverse populations and varying income levels. Understanding the nuances of each market is essential for EZCORP to maintain and grow its customer base. For more details, you can explore Revenue Streams & Business Model of EZCORP.

EZCORP consistently manages its geographic portfolio, adjusting to market demands and economic conditions. This dynamic approach ensures the company can adapt to changing customer demographics and maintain a strong market position. The company's ability to adapt is crucial for its long-term success.

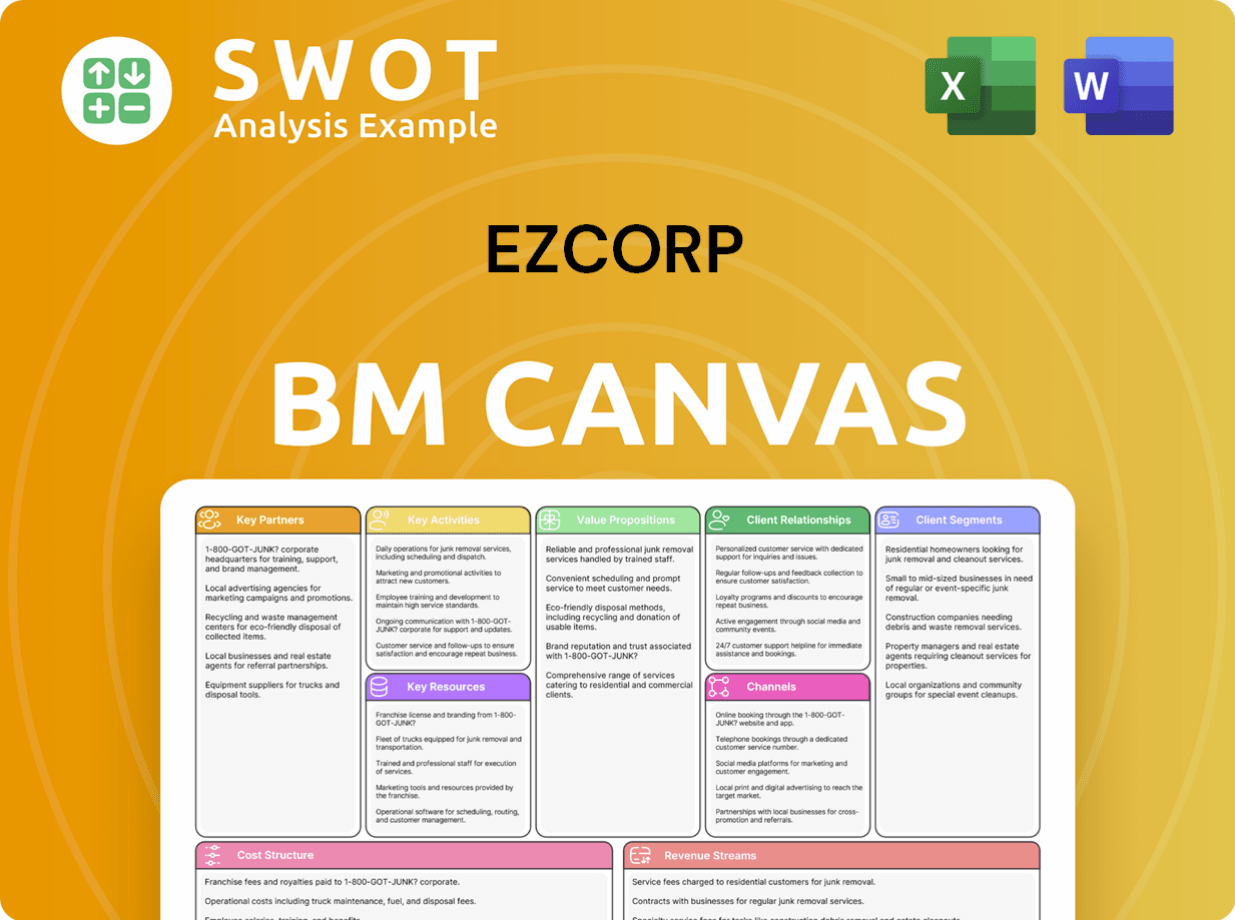

EZCORP Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does EZCORP Win & Keep Customers?

For the company, customer acquisition and retention hinge on accessibility, convenience, and building trust within local communities. The physical store locations act as primary acquisition channels, allowing walk-in access to financial services. Local advertising, such as flyers and community sponsorships, likely plays a role in attracting new customers. Understanding the customer demographics and tailoring services accordingly is crucial for success.

Retention strategies focus on providing consistent, reliable service and fostering customer loyalty through positive experiences. Fair appraisal practices, clear communication of loan terms, and respectful customer interactions are key. The recurring nature of pawn transactions encourages repeat business, emphasizing the importance of customer satisfaction. In an industry where trust and reputation are paramount, these strategies are essential.

Customer data and CRM systems are critical for understanding customer patterns, managing repeat business, and potentially tailoring offers. Adapting to regulatory changes, optimizing store locations, and exploring digital channels are ongoing strategic considerations. The success of these strategies is reflected in customer lifetime value and collateral redemption rates, indicating customer satisfaction and loan management effectiveness. To learn more about the company's business strategies, consider exploring the Growth Strategy of EZCORP.

Physical store locations are the primary acquisition channels, offering direct access to services. Local advertising, including flyers and sponsorships, helps attract new customers. Word-of-mouth referrals also play a significant role in acquiring customers within the local communities.

Consistent, reliable service and building customer loyalty are key. This includes fair appraisals, clear communication, and respectful interactions. Satisfied customers are likely to return for future financial needs. Building repeat business is crucial in the pawn industry.

Customer data and CRM systems are vital for understanding customer behavior and managing repeat business. Tailoring offers based on customer patterns can enhance engagement. This data-driven approach is essential for optimizing operations.

Adapting to regulatory changes and optimizing store locations are ongoing. Exploring digital channels for information or inquiries is a potential area for growth. The company must continually evolve to meet market demands.

Several metrics are used to measure the success of customer acquisition and retention efforts. These include customer lifetime value and the rate of collateral redemption. These indicators reflect customer satisfaction and the effectiveness of loan management.

- Customer Lifetime Value (CLTV): Measures the predicted revenue a customer will generate throughout their relationship with the company.

- Collateral Redemption Rate: The percentage of loans where the customer successfully repays and reclaims their collateral. A high rate indicates customer satisfaction and loan management.

- Repeat Customer Rate: The percentage of customers who return for multiple transactions, highlighting loyalty.

- Customer Acquisition Cost (CAC): The total cost of acquiring a new customer.

EZCORP Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of EZCORP Company?

- What is Competitive Landscape of EZCORP Company?

- What is Growth Strategy and Future Prospects of EZCORP Company?

- How Does EZCORP Company Work?

- What is Sales and Marketing Strategy of EZCORP Company?

- What is Brief History of EZCORP Company?

- Who Owns EZCORP Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.