EZCORP Bundle

Can EZCORP Navigate the Future of Finance?

Founded in 1989, EZCORP has evolved from a pawn shop pioneer to a key player in alternative financial services. Its journey offers a fascinating look at how a company adapts to changing economic climates and consumer needs. This EZCORP SWOT Analysis will help us understand the company's strengths and weaknesses.

EZCORP's future prospects are closely tied to its ability to execute a robust EZCORP growth strategy and maintain a strong market position. Understanding the EZCORP business model and its financial performance is crucial for assessing its long-term growth potential. This EZCORP company analysis will delve into its expansion plans and strategies, considering the impact of economic downturns and the competitive landscape.

How Is EZCORP Expanding Its Reach?

The EZCORP growth strategy is significantly driven by its expansion initiatives, focusing on geographical reach and service diversification. The company continues to strengthen its presence in key markets within the United States and Latin America. Recent efforts include optimizing existing store performance and strategically opening new locations in underserved areas. This approach aims to enhance its market position and broaden its customer base.

EZCORP's future prospects are closely tied to its ability to execute these expansion plans effectively. The company has been actively acquiring independent pawn shops, integrating them into its operational framework to expand market share. This inorganic growth strategy complements its organic expansion, allowing for faster market penetration. The company is also exploring avenues to enhance its digital offerings.

A key element of EZCORP's business model involves a strong focus on Latin America, given the substantial unbanked and underbanked populations in the region. These initiatives are aimed at accessing new customer demographics and diversifying revenue streams beyond traditional pawn loans. The company's strategic moves are designed to maintain a competitive edge in a dynamic industry, ensuring long-term growth potential.

EZCORP focuses on expanding its footprint within the United States and Latin America. This includes opening new stores and acquiring existing pawn shops to increase its market presence. The company's growth strategy emphasizes strategic locations to reach underserved communities and capitalize on market opportunities. The company's expansion into Latin America is particularly significant, due to the large unbanked population.

To diversify revenue streams, EZCORP is enhancing its digital offerings. This includes exploring online pawn services and expanding e-commerce for merchandise sales. The company aims to reach a broader customer segment and provide convenient services. This approach helps EZCORP to maintain a competitive edge in the evolving financial services landscape.

EZCORP actively acquires independent pawn shops to accelerate its growth. Integrating these acquisitions into its operational framework allows for faster market penetration. This inorganic growth strategy complements its organic expansion efforts. This strategy is a key component of their overall EZCORP company analysis and future plans.

EZCORP is investing in digital platforms to enhance its services. This includes online pawn services and expanding e-commerce for merchandise sales. These initiatives aim to reach a wider customer base and adapt to changing consumer behavior. This approach is crucial for long-term growth and EZCORP's future revenue projections.

EZCORP's expansion strategy involves both organic and inorganic growth. The company focuses on strategic acquisitions and digital enhancements to drive growth. These initiatives are designed to increase market share and diversify revenue streams.

- Strategic acquisitions of independent pawn shops.

- Expansion of digital platforms for online services.

- Focus on key markets in the United States and Latin America.

- Optimizing existing store performance and opening new locations.

For more detailed insights into the strategies, you can explore the Marketing Strategy of EZCORP.

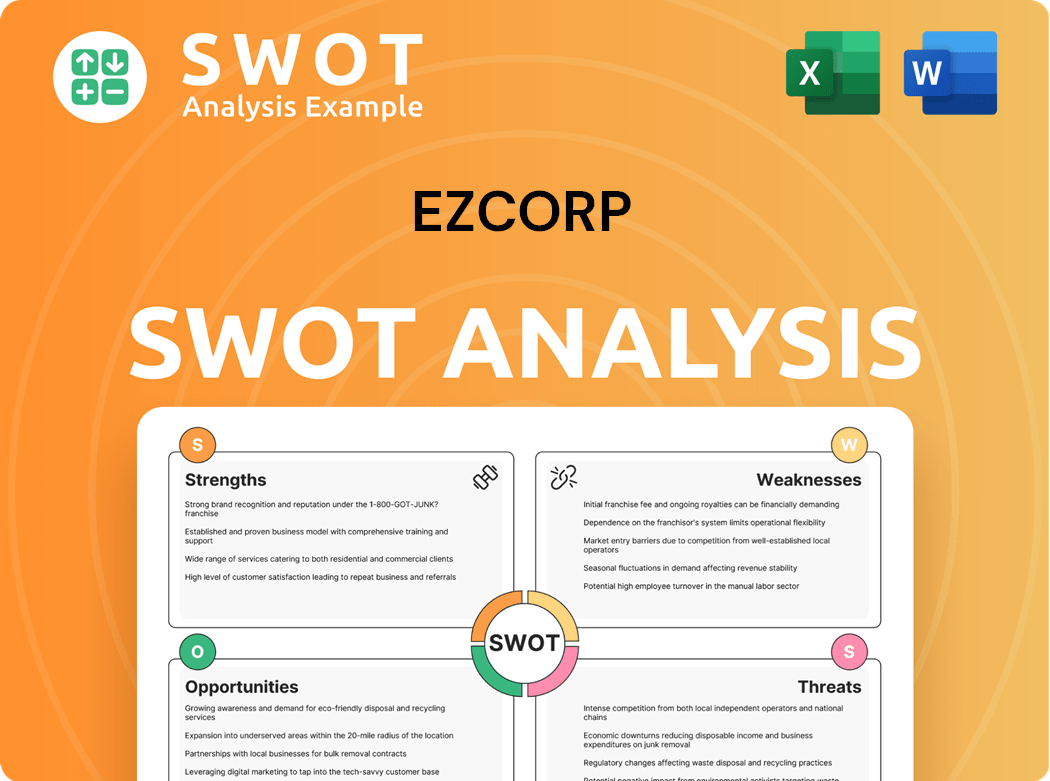

EZCORP SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does EZCORP Invest in Innovation?

The company focuses on leveraging technology and innovation to boost operational efficiency, improve customer experience, and foster sustainable growth. Digital transformation initiatives are central to the company's strategy, with investments aimed at enhancing service accessibility and streamlining processes.

The company is increasingly integrating digital tools to support in-store operations and potentially expand online functionalities, despite its traditional brick-and-mortar business model. This approach is crucial for staying competitive and meeting evolving customer expectations in the financial services sector. The company's innovation strategy also extends to enhancing its compliance infrastructure, leveraging technology to ensure adherence to evolving regulatory landscapes in the financial services sector.

These technological advancements are critical for optimizing operational costs, improving customer satisfaction, and ultimately contributing to the company's growth objectives in a competitive market. The focus on digital integration and technological innovation is a key component of the company's overall EZCORP growth strategy.

The company has invested in advanced point-of-sale systems and customer relationship management tools to improve efficiency. Data analytics are also utilized for better risk assessment, supporting informed decision-making. These initiatives are designed to enhance both operational effectiveness and customer service.

The company explores how technology can improve the appraisal process for pawned items. Inventory management is also being enhanced through technology to optimize merchandise sales. These improvements can lead to more accurate valuations and better inventory control.

The company leverages technology to ensure adherence to evolving regulatory landscapes. This includes using technology to streamline compliance processes and reduce the risk of non-compliance. This helps the company maintain its operational integrity.

The company is exploring the potential of online functionalities to complement its in-store operations. This includes examining online lending options and digital platforms for customer interaction. This expansion could increase accessibility and revenue streams.

The company uses enhanced data analytics for better risk assessment. This involves analyzing customer data and market trends to make informed decisions. This data-driven approach supports more effective risk management.

The company aims to improve customer satisfaction through technological advancements. This includes implementing user-friendly interfaces and providing better customer support. The goal is to create a more seamless and positive customer experience.

The company's strategic focus on technology and innovation is essential for its EZCORP future prospects. By continuously improving its technological infrastructure and integrating digital solutions, the company aims to enhance its EZCORP business model and maintain a strong EZCORP market position. For a deeper understanding of the competitive environment, consider the Competitors Landscape of EZCORP. These efforts are critical for achieving long-term growth and adapting to the changing dynamics of the financial services sector. The company's commitment to innovation is a key factor in its EZCORP company analysis and its ability to navigate the EZCORP competitive landscape analysis.

The company's investments in technology are designed to improve operational efficiency and enhance customer experiences. These initiatives are central to the company's growth strategy.

- Point-of-Sale Systems: Upgrading POS systems to streamline transactions and improve data capture.

- Data Analytics: Utilizing advanced analytics for better risk assessment and informed decision-making.

- Customer Relationship Management: Implementing CRM tools to enhance customer service and manage interactions.

- Inventory Management: Employing technology to optimize inventory control and merchandise sales.

- Compliance Technology: Leveraging technology to ensure adherence to regulatory requirements.

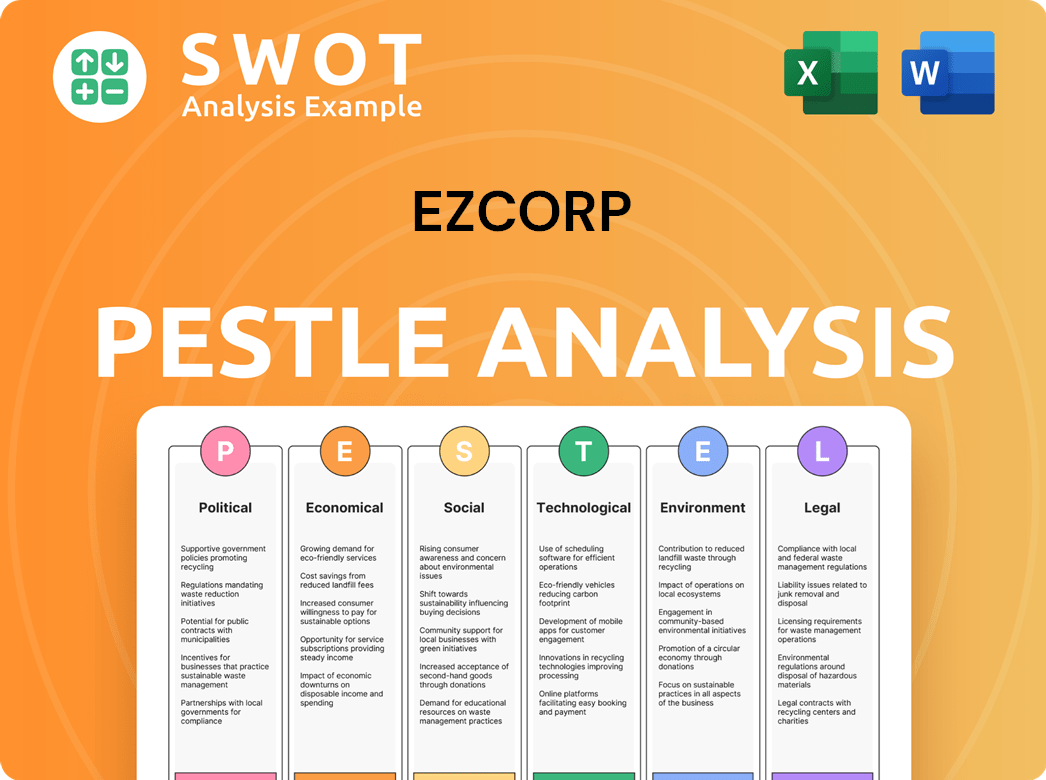

EZCORP PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is EZCORP’s Growth Forecast?

The financial outlook for EZCORP is centered on achieving sustainable growth and enhancing profitability. The company's revenue streams are primarily driven by its pawn loan business and merchandise sales, demonstrating a consistent ability to generate income. This financial performance is a key indicator of the company's stability and its capacity to invest in future growth initiatives. The company's strategic approach focuses on optimizing its loan portfolio, managing inventory effectively, and controlling operational costs to improve profit margins.

For the quarter that ended on December 31, 2024, EZCORP reported a consolidated revenue of $218.4 million, which is an increase compared to the previous year, and a net income of $15.5 million. This performance reflects the company's ability to navigate market dynamics and maintain a strong financial position. Furthermore, the management has expressed confidence in meeting its long-term financial goals, supported by the consistent demand for its services in both the U.S. and Latin American markets, which is crucial for its EZCORP growth strategy.

The company's investments are primarily directed towards expanding its store network, upgrading its technology infrastructure, and considering potential strategic acquisitions. Analyst forecasts generally anticipate continued revenue growth, driven by market expansion and the ongoing demand for alternative financial services. This financial narrative underscores EZCORP's dedication to delivering value to shareholders and broadening its market footprint. This is a key aspect of EZCORP future prospects.

EZCORP's revenue growth is driven by its core pawn loan business and merchandise sales. The company has shown consistent revenue generation, reflecting a stable business model. The increase in consolidated revenue to $218.4 million for the quarter ended December 31, 2024, shows positive momentum.

The company focuses on improving profit margins through strategic financial management. This includes optimizing the loan portfolio, managing inventory efficiently, and controlling operational expenses. The net income of $15.5 million for the quarter ended December 31, 2024, indicates effective cost management.

EZCORP is expanding its market presence in both the U.S. and Latin American markets. This expansion is supported by strong demand for its services in these regions. The company's growth strategy includes opening new stores and potentially acquiring other businesses to increase its market share.

Investment is directed towards store network expansion, technology upgrades, and potential strategic acquisitions. These investments are designed to enhance the company's operational capabilities and market reach. Strategic acquisitions may play a key role in the EZCORP company analysis.

EZCORP's financial strategy involves several key components aimed at maximizing profitability and shareholder value. These include optimizing the loan portfolio, managing inventory effectively, and controlling operational expenses. These strategies are crucial for enhancing the company's financial performance and ensuring long-term sustainability.

- Loan Portfolio Optimization: Focus on managing and improving the quality of the loan portfolio to reduce risk and increase returns.

- Inventory Management: Efficiently managing inventory levels to minimize costs and maximize sales of merchandise.

- Operational Expense Control: Implementing measures to control and reduce operational expenses to improve profit margins.

- Market Expansion: Expanding the business footprint through new store openings and strategic acquisitions.

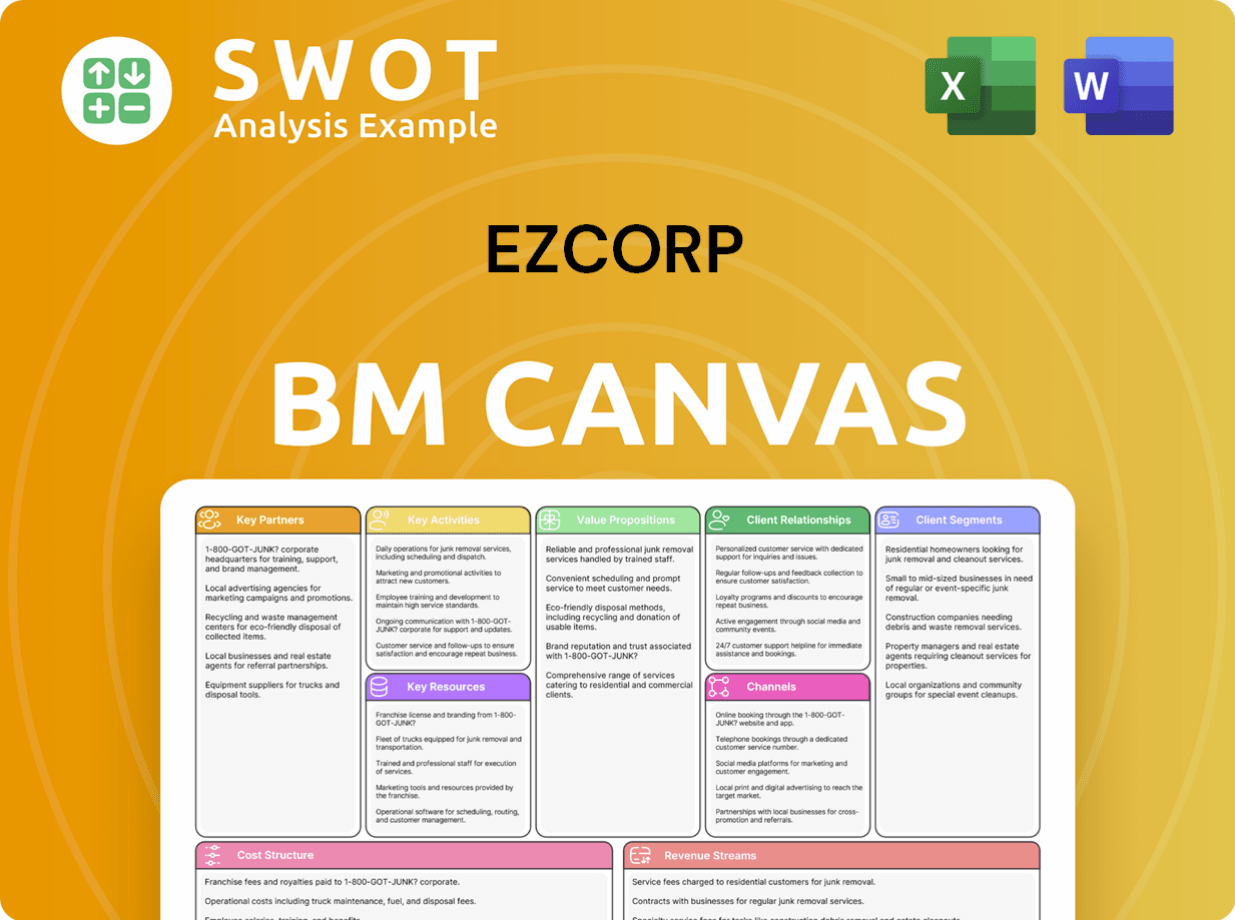

EZCORP Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow EZCORP’s Growth?

The EZCORP growth strategy faces several potential risks and obstacles that could impact its future. The company's expansion plans and strategies are subject to market competition and regulatory changes. Understanding these challenges is crucial for assessing the EZCORP future prospects and EZCORP company analysis.

Market competition, primarily from independent pawn shops and other alternative financial service providers, presents a significant hurdle. The pawn shop industry outlook is also sensitive to economic conditions, with economic downturns potentially leading to higher default rates. Regulatory changes, such as those concerning interest rates, loan terms, and disclosure requirements, also pose a risk to profitability.

Supply chain vulnerabilities, while less direct, could impact the availability and pricing of merchandise. The company must also navigate the evolving online lending market share and adapt to technological advancements. The ability to effectively manage these challenges will be critical for sustaining its long-term growth potential.

The pawn industry is highly competitive, with numerous independent pawn shops and other financial service providers vying for market share. This competition can squeeze profit margins and make it harder to attract and retain customers. The EZCORP competitive landscape analysis requires constant monitoring and strategic adjustments to maintain a competitive edge.

The pawn industry is subject to varying state and federal regulations, which can significantly impact operations. Changes in interest rate caps, loan terms, and disclosure requirements can directly affect EZCORP financial performance. The company must actively monitor and adapt to these changes to ensure compliance and maintain operational flexibility.

Economic downturns can affect customers' ability to repay loans, leading to higher default rates. This impacts the quality of collateral and can negatively affect EZCORP business model. The company's risk management frameworks must be robust enough to withstand economic fluctuations.

While not as direct as in other retail businesses, supply chain disruptions can affect the availability and pricing of merchandise for sale. This can impact the company's revenue and profitability. The company needs strategies to mitigate any potential supply chain vulnerabilities.

The rise of online lending and digital payment systems presents both opportunities and challenges. EZCORP's expansion plans and strategies must embrace these technologies to stay competitive. The company needs to invest in technology and adapt to evolving customer preferences.

Geopolitical events can indirectly affect operations through economic impacts or disruptions. The company's diversified geographical footprint can help mitigate these risks. The company's strategies must include contingency plans to address potential global instability.

EZCORP mitigates risks through a diversified geographical footprint, robust risk management frameworks, and continuous monitoring of regulatory developments. The company's ability to adapt to evolving market conditions and effectively manage these challenges will be crucial for sustaining its growth trajectory. For more context, consider reading a Brief History of EZCORP.

Analyzing EZCORP financial statements review and recent earnings reports is essential for understanding its current position. The company's EZCORP stock price forecast and EZCORP future revenue projections depend on its ability to navigate these risks. Investors should review EZCORP investor relations information for updates.

EZCORP Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of EZCORP Company?

- What is Competitive Landscape of EZCORP Company?

- How Does EZCORP Company Work?

- What is Sales and Marketing Strategy of EZCORP Company?

- What is Brief History of EZCORP Company?

- Who Owns EZCORP Company?

- What is Customer Demographics and Target Market of EZCORP Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.