EZCORP Bundle

How is EZCORP Dominating the Alternative Financial Services Market?

EZCORP, a leader in pawn loans across the US and Latin America, is experiencing remarkable growth, especially in its Pawn Loan Outstandings (PLO) and merchandise sales, as seen in its impressive Q1 and Q2 fiscal 2025 results. This success highlights the critical role of its EZCORP SWOT Analysis, sales, and marketing strategy in a competitive market. Analyzing EZCORP's approach reveals how they're navigating economic pressures and achieving substantial revenue increases.

This deep dive into EZCORP's EZCORP sales strategy and EZCORP marketing strategy will explore their EZCORP business model and how they've adapted to the evolving financial landscape. We'll examine their EZCORP financial performance, including the impressive growth in PLO, and analyze their customer acquisition methods, brand positioning, and digital marketing initiatives. Furthermore, we'll investigate EZCORP pawn shop operations, competitive landscape, and future growth plans to understand their sustained success.

How Does EZCORP Reach Its Customers?

The sales and marketing strategy of EZCORP centers on a multi-channel approach, primarily leveraging its extensive network of physical retail locations. These locations serve as the core of its operations, facilitating pawn loan originations, merchandise sales, and other financial services. Simultaneously, the company is strategically developing digital channels to enhance customer engagement and operational efficiency. This strategy reflects a broader Competitors Landscape of EZCORP that adapts to changing consumer behaviors and market dynamics.

As of September 30, 2024, EZCORP operated a total of 1,279 pawn stores. This network included 542 stores in the U.S., 565 in Mexico, and 172 across Guatemala, El Salvador, and Honduras. By Q2 fiscal 2025, the total store count increased to 1,284, with 542 stores in the U.S. and 742 in Latin America. The company's physical presence is a key component of its EZCORP sales strategy, providing direct access to customers and facilitating transactions.

The company's EZCORP business model benefits from fast inventory turnover, as inventory is sourced directly from customers. Physical stores are crucial for pawn loan originations, merchandise sales, and other financial services. The company is also expanding its digital presence, including online platforms for loan applications and account management, to enhance customer engagement and operational efficiency.

EZCORP's primary sales channel is its network of physical retail locations, which are essential for pawn loan originations and merchandise sales. These stores are strategically located to maximize market reach and customer accessibility. The company's expansion and optimization of its store network are critical to its growth strategy.

EZCORP is evolving its digital distribution channels to enhance customer engagement and operational efficiency. This includes online platforms for loan applications and account management. The company aims to capture younger, tech-savvy customers through online pawn services and luxury e-commerce platforms.

Strategic partnerships, such as a 43.7% equity interest in Cash Converters International Limited, contribute to EZCORP's market presence and distribution. These collaborations help expand the company's reach and enhance its competitive position. These partnerships are an important part of EZCORP's marketing strategy.

EZCORP is focused on omnichannel integration to provide a seamless customer experience across both physical and digital channels. This strategy aims to enhance customer engagement and operational efficiency. The company's digital growth, including a 15% increase in online transactions in 2024, reflects this focus.

EZCORP's sales and marketing strategies include expanding its store count through acquisitions and new openings, particularly in Latin America. The company is also optimizing its store footprint by consolidating underperforming locations. Digital initiatives are being expanded to enhance customer engagement and operational efficiency.

- Expansion of store network through acquisitions and de novo openings.

- Strategic consolidation of underperforming locations.

- Development of online platforms for loan applications and account management.

- Enhancement of customer engagement through digital channels.

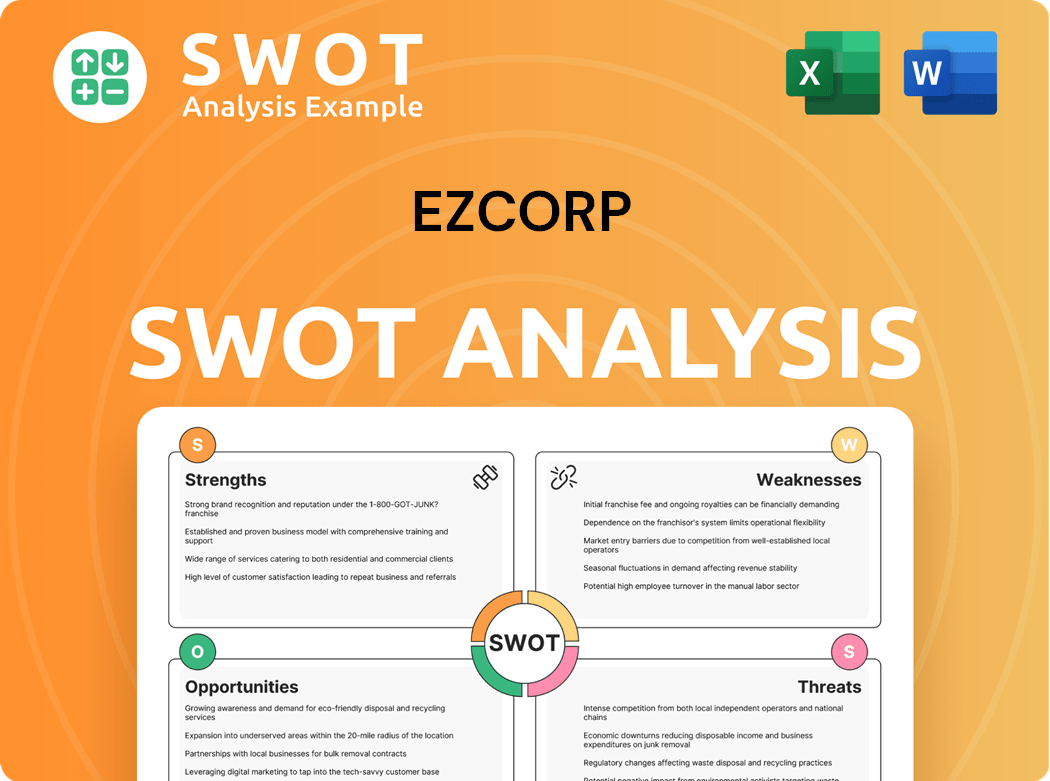

EZCORP SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does EZCORP Use?

The company's marketing strategy involves a blend of digital and traditional tactics, focusing on reaching cash and credit-constrained consumers. This approach emphasizes accessibility and providing immediate financial solutions. The company aims to leverage its physical presence and enhance digital integration to drive sales and build brand awareness.

Digital channels play a crucial role, with online platforms for loan applications and account management. The company is actively expanding its digital presence and rewards programs to boost customer engagement and retention. The company's marketing efforts are increasingly data-driven, focusing on customer segmentation and personalization to cater to the underbanked and financially flexible consumer segment.

The company's marketing strategy is designed to evolve with the changing financial landscape. The goal is to streamline processes, cut costs, and improve customer experience. The company is committed to digital transformation, aiming to have 75% of its transactions online by 2027. This shift is expected to enhance efficiency and customer satisfaction.

The company uses online platforms for loan applications and account management. The digital marketing initiatives have contributed to a 15% increase in online transactions in 2024. The company focuses on expanding digital channels and rewards programs to enhance customer engagement and retention.

The EZ+ Rewards program is a key element of customer retention. In Q1 fiscal 2025, the EZ+ Rewards program accounted for 77% of all transacting customers. The program's effectiveness is evident in the high percentage of customer participation and its contribution to overall sales.

The company uses social media platforms such as Facebook, Instagram, and LinkedIn to connect with customers. These platforms are used to build brand awareness and engage with the target audience. Social media marketing plays a role in the company's overall marketing strategy.

The company's marketing mix emphasizes data-driven marketing, customer segmentation, and personalization. This approach is particularly focused on serving the underbanked and financially flexible consumer segment. Data-driven strategies enable the company to refine its marketing efforts and improve customer targeting.

The company aims to have 75% of its transactions online by 2027, indicating a strong commitment to digital transformation. Online loan applications saw a 20% rise in usage in 2024. This digital shift is designed to streamline processes and improve customer experience.

In Latin America, the EZ+ Rewards program has 6.2 million global members, boosting customer loyalty and driving Pawn Loan Outstandings (PLO) growth. This highlights the importance of the Latin American market in the company's overall strategy. The company's expansion in this region is supported by strong customer engagement.

The company's marketing tactics are designed to reach its target market effectively. These tactics include a mix of digital and traditional methods, with a growing emphasis on digital channels. The focus is on customer engagement and driving sales. For more details, see Target Market of EZCORP.

- Digital Marketing: Utilizes online platforms for loan applications and account management.

- Rewards Programs: The EZ+ Rewards program is a key customer retention tool, with 77% of transacting customers in Q1 fiscal 2025 participating.

- Social Media: Uses platforms like Facebook, Instagram, and LinkedIn to connect with customers.

- Data-Driven Marketing: Employs data-driven strategies, customer segmentation, and personalization.

- Online Sales: Aims for 75% of transactions online by 2027, with a 20% rise in online loan applications in 2024.

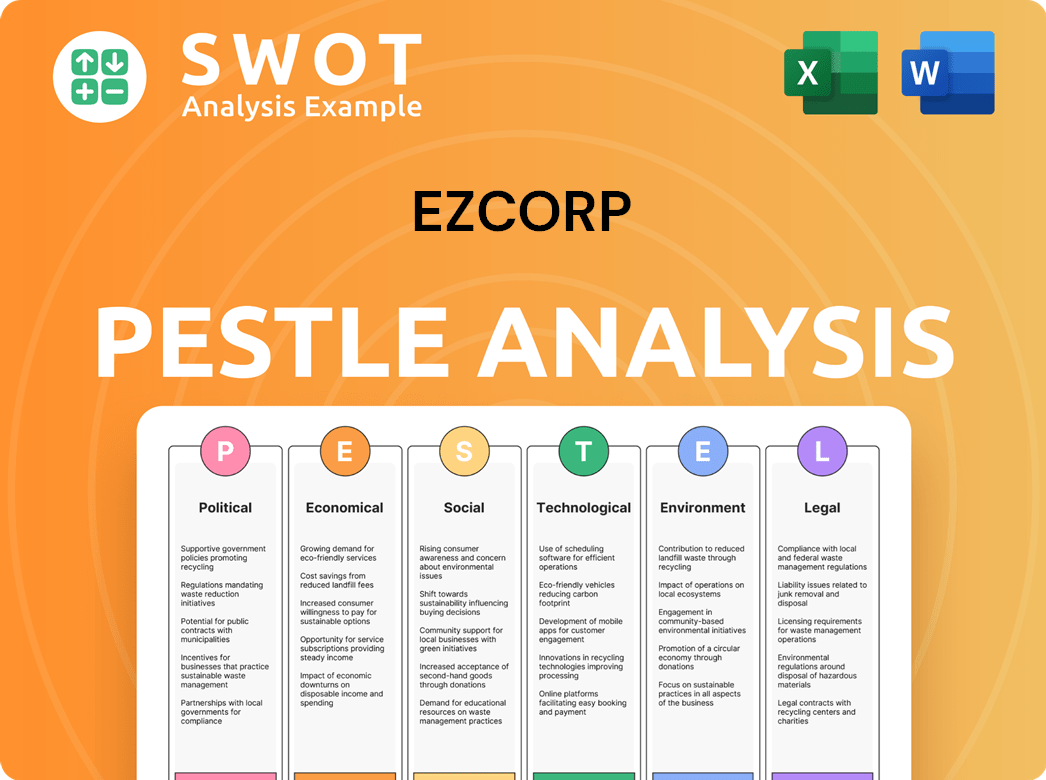

EZCORP PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is EZCORP Positioned in the Market?

The brand positioning of the company centers on providing quick financial solutions, primarily through pawn loans, and offering value on pre-owned merchandise. This positions them as a crucial financial resource, especially for those with limited access to traditional banking. Their ability to offer immediate cash and the option to retain ownership of pawned items differentiates them from competitors, strengthening their appeal during economic stress.

The core message of the company focuses on helping customers convert valuables into instant cash and providing exceptional value on second-hand goods. The visual identity and tone likely reflect trust and approachability, catering to a demographic that may not have access to traditional banking services. Their business model, which benefits from countercyclical trends, further strengthens their appeal during economic stress. This strategic approach is a key component of their overall EZCORP sales strategy.

Brand consistency is maintained across their extensive network of over 1,280 stores in the U.S. and Latin America. As an established player since 1989, the company benefits from existing brand recognition and customer trust, which is crucial in the lending industry. The company's commitment to its core values of 'People, Pawn and Passion' also underpins its brand identity and customer-focused strategy. This is a critical element of their EZCORP marketing strategy.

Offers instant cash through pawn loans and value on pre-owned merchandise. This provides a quick financial solution for cash-strapped customers. The focus is on convenience and accessibility, particularly for those who may not have access to traditional banking services.

Targets cash and credit-constrained consumers. This includes individuals who may need immediate cash and those looking for affordable second-hand goods. The demographic often includes those with limited access to traditional financial services.

Focuses on turning valuables into instant cash and providing exceptional value on second-hand goods. The tone is likely to be trustworthy and approachable. The messaging emphasizes the immediate nature of the services and the ability to retain ownership of pawned items.

Differentiates itself through its customer experience and the ability to offer pawn loans. This allows customers to retain ownership of their items, a key differentiator. The business model benefits from countercyclical trends, strengthening its appeal during economic stress.

The company’s brand positioning is further supported by its commitment to opportunistic acquisitions and strategic expansion, especially in Latin America. This is a key element of their EZCORP growth strategy. For a deeper dive into their strategies, consider reading about the Growth Strategy of EZCORP. Their success is also influenced by factors such as EZCORP financial performance and their presence as an EZCORP pawn shop.

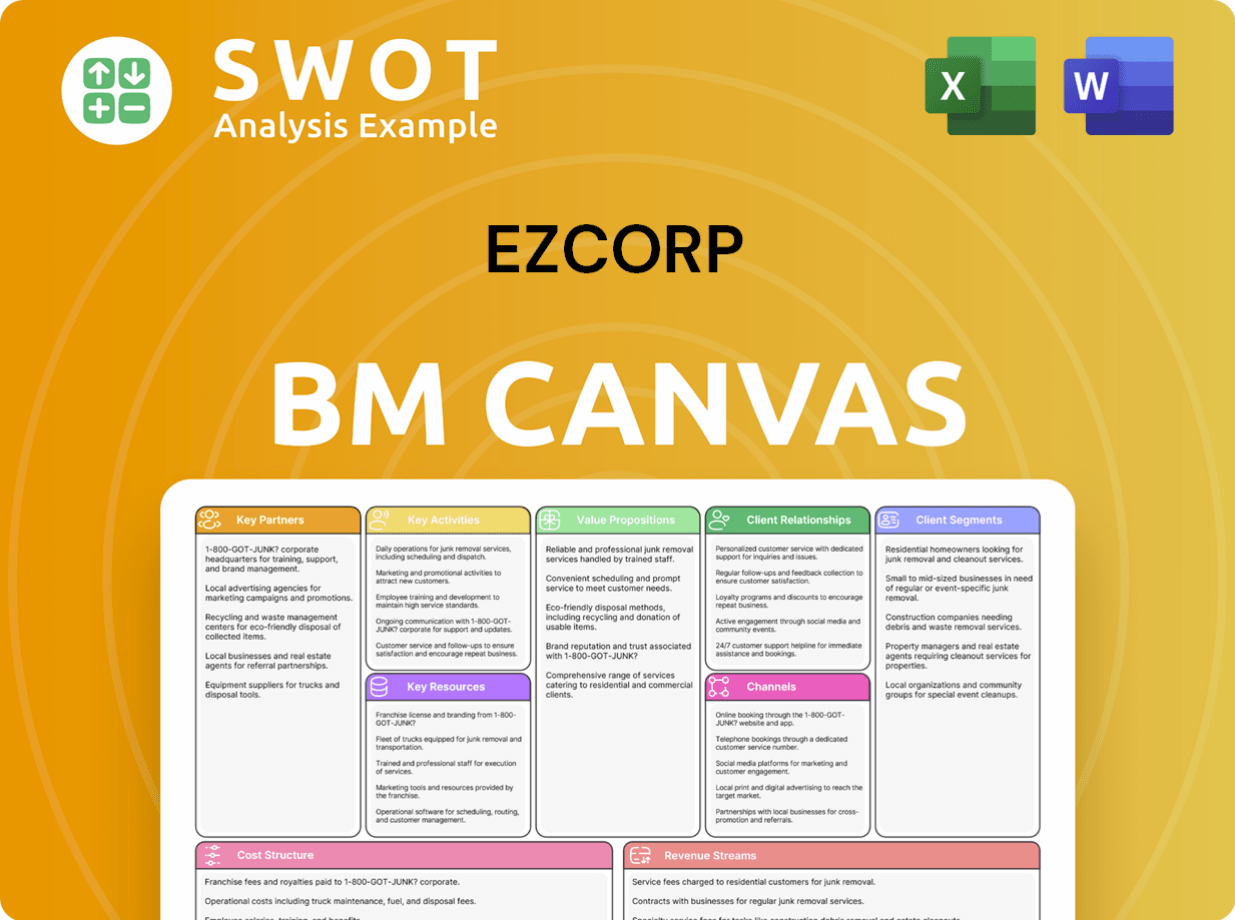

EZCORP Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are EZCORP’s Most Notable Campaigns?

The sales and marketing strategy of EZCORP, a prominent player in the pawn shop industry, revolves around several key campaigns aimed at driving growth and enhancing customer engagement. While specific marketing campaign details for 2024-2025 are not extensively disclosed, the company's overarching strategic initiatives serve as ongoing efforts. These initiatives focus on store expansion, digital channel enhancement, and customer loyalty programs, all contributing to the company's financial success and market positioning.

EZCORP's approach to sales and marketing is multifaceted, encompassing both traditional and digital strategies. The company leverages its physical store presence while simultaneously investing in digital platforms to reach a wider audience. The company's focus on customer retention and acquisition is evident through its rewards program and digital transformation efforts. These efforts have been crucial in maintaining and expanding its customer base, especially in the face of economic challenges.

The company's strategic initiatives are a crucial part of its success and are reflected in its financial performance. The company's focus on these areas has allowed it to adapt to changing market conditions and consumer preferences, ensuring its continued growth and market leadership. For more insights into the company’s overall approach, consider reading about the Growth Strategy of EZCORP.

A significant ongoing 'campaign' involves the continuous expansion and optimization of its store footprint, especially in Latin America. In fiscal year 2024, EZCORP added 40 de novo stores in Latin America and 13 in the U.S. In Q2 fiscal 2025, they opened 9 new stores in Latin America while consolidating 9 underperforming locations in Mexico.

The 'EZ+ Rewards program' accounts for 77% of all transacting customers in Q1 fiscal 2025 and boasts 6.2 million global members. The company's investment in IT and data modernization aims for 75% online transactions by 2027. This has led to a 15% increase in online transactions and a 20% rise in online loan application usage in 2024.

Strong financial results serve as a powerful testament to EZCORP's operational effectiveness and market appeal. In fiscal year 2024, total revenues increased 11% to $1,161.6 million, and net income soared 116% to $83.1 million. In Q1 fiscal 2025, adjusted diluted EPS increased 17% to $0.42.

In Q2 fiscal 2025, adjusted EBITDA surged 23% to $45.1 million, highlighting the success of strategic initiatives. The company plans to add 30-40 new stores in Latin America by the end of 2025, showcasing its commitment to expansion and market diversification.

EZCORP Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of EZCORP Company?

- What is Competitive Landscape of EZCORP Company?

- What is Growth Strategy and Future Prospects of EZCORP Company?

- How Does EZCORP Company Work?

- What is Brief History of EZCORP Company?

- Who Owns EZCORP Company?

- What is Customer Demographics and Target Market of EZCORP Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.