EZCORP Bundle

How Does EZCORP Thrive in the Financial Services Sector?

In a world grappling with economic uncertainty, how does a company like EZCORP not only survive but flourish? EZCORP, a leading player in the pawn shop industry, recently posted impressive Q2 fiscal 2025 results, showcasing its resilience. With pawn loans outstanding soaring and revenues climbing, understanding the inner workings of EZCORP is more critical than ever.

This exploration into the EZCORP SWOT Analysis will uncover the secrets behind EZCORP's success, from its innovative EZCORP business model to its strategic positioning within the financial services landscape. We'll dissect its revenue streams, analyze its response to market pressures, and evaluate its potential for future growth. Whether you're curious about the EZCORP stock, or want to know how does EZCORP make money, this analysis provides a comprehensive view of this fascinating company.

What Are the Key Operations Driving EZCORP’s Success?

The core operations of EZCORP revolve around providing short-term, non-recourse pawn loans. These loans are secured by personal property, such as jewelry and electronics, offering immediate cash access to consumers. The company's value proposition also includes generating revenue from merchandise sales, primarily forfeited pawn collateral and items purchased directly.

The EZCORP business model involves customers bringing in items to retail locations for appraisal. Loans are then offered based on the collateral's value. If a loan isn't repaid, the collateral is sold in-store, creating a second revenue stream. The company focuses on providing an 'industry-leading customer experience' to attract and retain clients, which is a key part of its financial services.

EZCORP's operational process is designed to serve cash and credit-constrained consumers efficiently. The company's extensive retail footprint and strategic initiatives, like the EZ+ Rewards program, contribute to its operational effectiveness and customer loyalty. This approach helps EZCORP maintain a strong position within the pawn shop industry.

As of Q2 fiscal 2025, EZCORP operated 542 stores in the U.S. and 742 in Latin America. This extensive physical presence allows for broad market reach and accessibility for customers seeking financial services.

EZCORP generates revenue through pawn loans and merchandise sales. Merchandise sales include forfeited collateral and items purchased directly from customers. This dual-revenue model provides stability and diversification.

The EZ+ Rewards program plays a crucial role in customer engagement. In Q1 fiscal 2025, 77% of all transacting customers participated in the program, indicating strong customer loyalty and repeat business.

The company demonstrates consistent performance across different regions. In Q2 fiscal 2025, U.S. PLO (Pawn Loan Originations) increased by 15%, and Latin America PLO grew by 17% on a constant currency basis, showcasing robust operational capabilities.

EZCORP's competitive advantage stems from its extensive physical presence, disciplined cost management, and enhanced operational efficiency. These factors, combined with strategic initiatives like the EZ+ Rewards program, contribute to its success in the pawn shop industry.

- Extensive Retail Network: A wide network of stores ensures accessibility for customers.

- Cost Management: Disciplined cost control enhances profitability.

- Operational Efficiency: Streamlined processes improve overall performance.

- Customer Loyalty Programs: Initiatives like EZ+ Rewards boost customer retention.

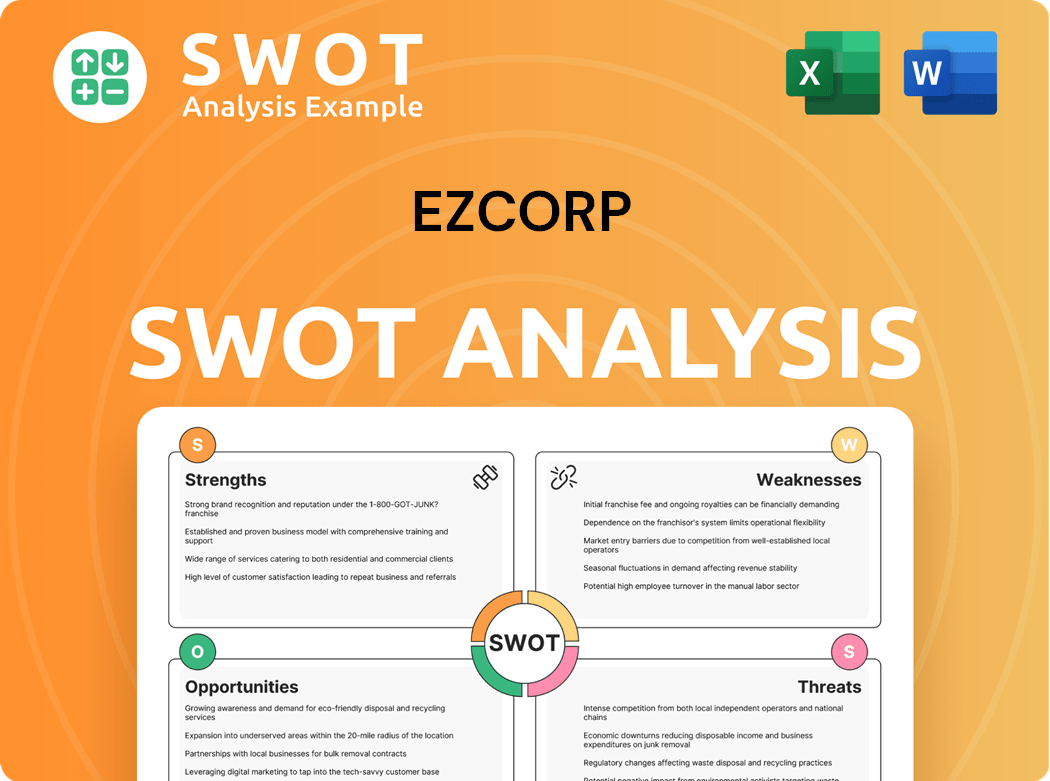

EZCORP SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does EZCORP Make Money?

The company, a prominent player in the financial services and pawn shop industry, primarily generates revenue through pawn service charges (PSC) and merchandise sales. This dual-stream approach forms the core of the company's business model, contributing to its financial performance. The company's ability to effectively manage these revenue streams is crucial for its overall financial health and growth.

In Q2 fiscal 2025, the company experienced a 7% increase in total revenues, reaching $306.3 million. This growth highlights the effectiveness of its revenue model. The expansion of pawn loans outstanding (PLO) directly boosted pawn service charges by 8% in Q2 fiscal 2025.

Merchandise sales, derived from forfeited pawn collateral and items purchased, also significantly contribute to the company's revenue. While merchandise sales gross margins slightly decreased from 35% to 34% in Q2 fiscal 2025, the overall revenue growth demonstrates the effectiveness of this dual-stream model. For the full fiscal year 2024, total revenues increased 11% to $1,161.6 million, with merchandise sales gross margin remaining stable at 36%.

The company employs several monetization strategies to maximize its revenue streams. These strategies include offering short-term, non-recourse loans, which cater to cash and credit-constrained consumers. The company also leverages its operational efficiency and customer-focused approach, as demonstrated by the success of its EZ+ Rewards program. For a detailed look at the competitive landscape, you can explore the Competitors Landscape of EZCORP.

- Pawn Loans: Providing short-term loans secured by personal property, generating revenue through interest and fees.

- Merchandise Sales: Selling forfeited collateral and purchased items, contributing to revenue through retail sales.

- Customer Loyalty Programs: Utilizing programs like EZ+ Rewards to drive repeat business and customer retention.

- Digital Channel Expansion: Exploring growth in digital channels to unlock potential future monetization opportunities.

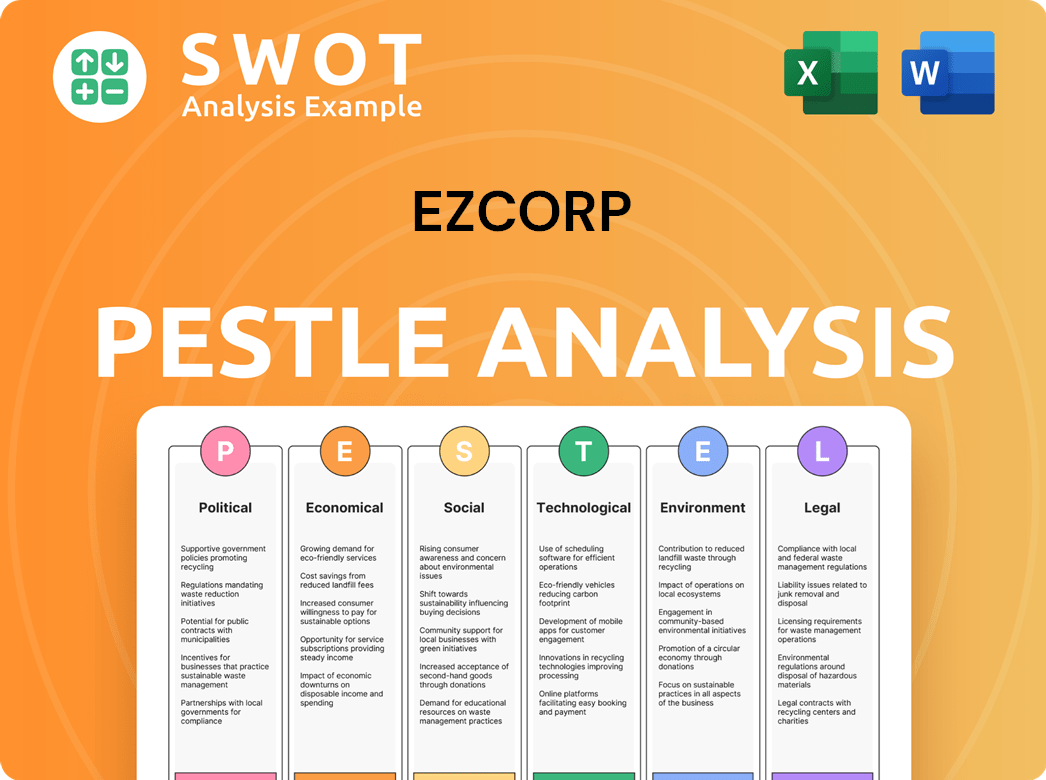

EZCORP PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped EZCORP’s Business Model?

EZCORP has navigated significant milestones, strategic moves, and competitive landscapes. A key strategic move was the completion of a $300 million private offering of senior notes due 2032 in March 2025. This offering significantly strengthened the company's capital structure and financial flexibility, particularly as the company prepared to retire its 2025 convertible notes maturing on May 1st. This was described as the company's largest financing transaction to date.

Operationally, the company has faced challenges such as persistent inflation impacting consumer behavior. However, this has also driven increased demand for their services as value-conscious consumers seek short-term cash and secondhand goods. The company has responded by strengthening its operating model, focusing on disciplined cost management, and enhancing operational efficiency, which has led to a material increase in adjusted EBITDA.

EZCORP's competitive advantages stem from its extensive network of stores across the U.S. and Latin America, providing broad market reach and accessibility. Its countercyclical business model thrives in challenging economic conditions, differentiating it from traditional financial institutions. The company also maintains a strong focus on customer service and loyalty programs, such as the EZ+ Rewards program, which accounted for 77% of all transacting customers in Q1 fiscal 2025. EZCORP continues to adapt to new trends by growing its digital channels and exploring strategic acquisitions to expand its footprint, particularly in Latin America, despite terminating a recent agreement to acquire 53 stores in Mexico.

The recent financing through senior notes demonstrates EZCORP's proactive approach to financial management, ensuring stability and flexibility. The company's focus on cost management and operational efficiency is crucial for maintaining profitability, particularly in an environment of economic uncertainty. The expansion of digital channels and exploration of acquisitions reflect its commitment to adapting to evolving market dynamics.

- The $300 million senior notes offering enhanced capital structure.

- Disciplined cost management led to increased adjusted EBITDA.

- EZ+ Rewards program accounted for 77% of transacting customers.

- Focus on digital channels and strategic acquisitions.

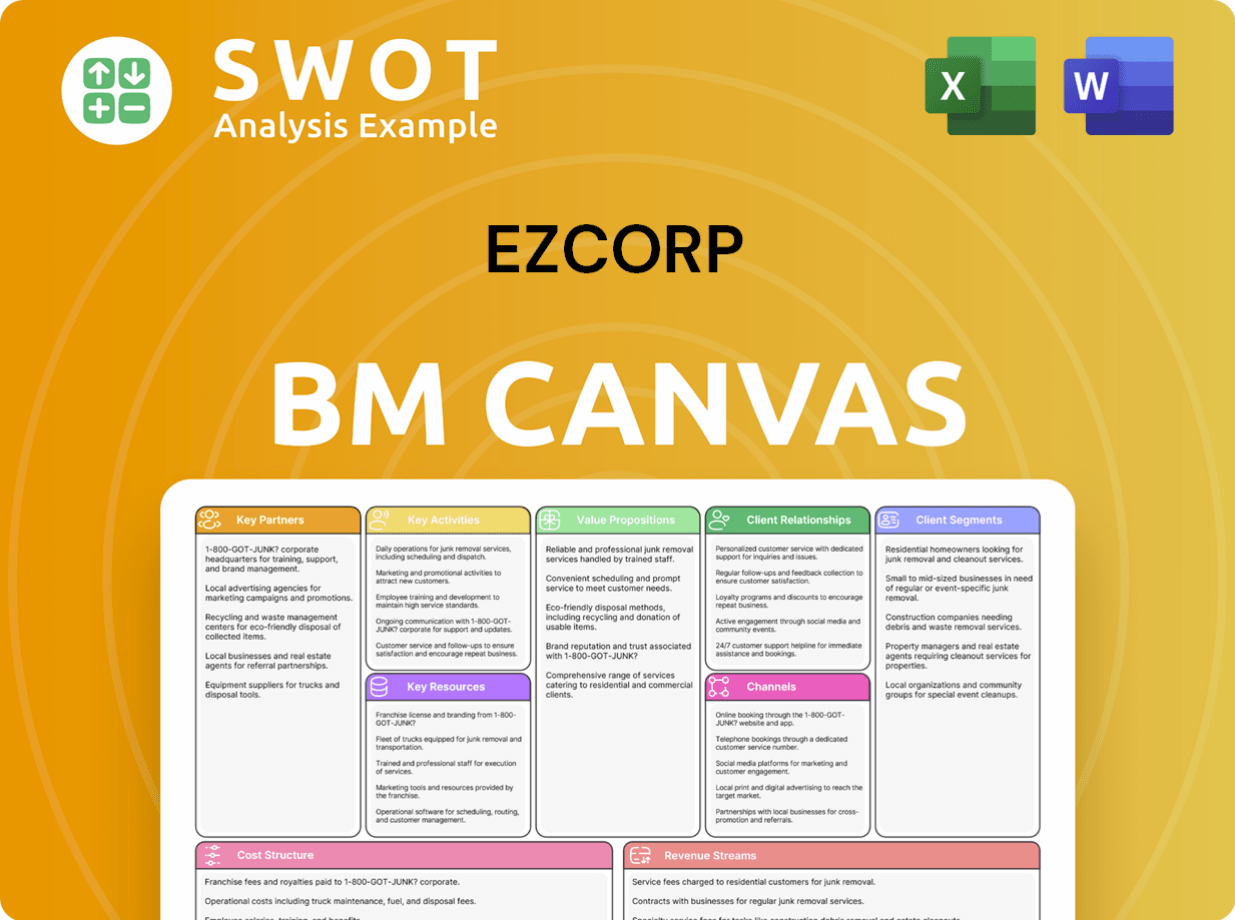

EZCORP Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is EZCORP Positioning Itself for Continued Success?

The company, a prominent player in the pawn transaction industry, holds a leading position in both the United States and Latin America. With a significant footprint of 542 stores in the U.S. and 742 locations in Latin America, the company shows substantial market penetration. Its customer loyalty program, EZ+ Rewards, is a key factor, with 77% of transacting customers participating in Q1 fiscal 2025.

Despite its strong revenue growth and gross profit, the company faces challenges, as indicated by net margins that may be below industry averages. This suggests areas for improvement in cost management. Understanding the company's operations is crucial to assessing its potential, and a Brief History of EZCORP provides further insights into its evolution and business model.

The company is a leading entity within the pawn shop industry in the United States and Latin America. It has a strong presence with numerous store locations, demonstrating significant market reach. Customer loyalty is high, as evidenced by the EZ+ Rewards program, which is a key factor in its operations.

Key risks include potential regulatory changes and the emergence of new competitors. Economic shifts, such as an upswing, could decrease demand for pawn services. Operational challenges are indicated by decreasing merchandise sales gross margins and lower inventory turnover.

The company is focused on expanding Pawn Loan Outstanding and effective inventory management. It plans to develop its digital channels and explore mergers and acquisitions. Analysts project continued EPS growth, with forecasts of $0.35 for Q3 and $0.37 for Q4 of 2025.

The company is committed to delivering strong financial performance and enhancing shareholder value. CEO Lachie Given attributes recent growth to increased demand from value-conscious consumers and improved operational performance. Strategic initiatives and robust execution position it for continued growth in fiscal 2025 and beyond.

The company's financial performance is closely tied to its ability to manage costs and navigate regulatory changes. The company's strategic focus on digital channels and potential mergers and acquisitions is designed to drive future growth. Projected EPS growth for Q3 and Q4 2025 is a significant indicator of its financial health and future potential.

- Strong presence in U.S. and Latin America.

- Focus on Pawn Loan Outstanding and inventory management.

- Anticipated EPS growth in Q3 and Q4 2025.

- Commitment to shareholder value.

EZCORP Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of EZCORP Company?

- What is Competitive Landscape of EZCORP Company?

- What is Growth Strategy and Future Prospects of EZCORP Company?

- What is Sales and Marketing Strategy of EZCORP Company?

- What is Brief History of EZCORP Company?

- Who Owns EZCORP Company?

- What is Customer Demographics and Target Market of EZCORP Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.