GameStop Bundle

Can GameStop Navigate the Ever-Changing Gaming World?

The video game industry is a battlefield, and GameStop, once a retail titan, has found itself in the thick of the fight. From its unexpected rise as a meme stock to its ongoing struggle to adapt, GameStop's story is a compelling case study in market dynamics. This analysis dives deep into the GameStop SWOT Analysis, exploring its competitive landscape and future prospects.

Understanding the GameStop competitive landscape requires a close look at its rivals, market share, and strategic positioning within the gaming market. This comprehensive GameStop market analysis examines the company's performance against its GameStop competitors, evaluating its competitive advantages of GameStop and challenges in the face of digital distribution. We'll explore how GameStop is attempting to compete in the Video game retail sector and what strategies it's employing to stay relevant in the GameStop industry.

Where Does GameStop’ Stand in the Current Market?

The core operations of GameStop revolve around the retail sale of video games, consoles, and related accessories. It operates primarily through physical stores, offering a tangible shopping experience. GameStop's value proposition includes the sale of new and pre-owned games, trade-in programs, and a selection of collectibles and merchandise.

GameStop's strategic focus has been on adapting to the shift towards digital distribution while maintaining a presence in the physical retail space. The company aims to cater to a customer base that values physical game ownership and the in-store experience. The company has expanded its offerings to include digital content and merchandise, attempting to diversify its revenue streams.

For the fiscal year ending February 3, 2024, GameStop reported net sales of $5.928 billion. This figure reflects the ongoing challenges in the video game retail industry. The company's financial performance, including a net income of $6.3 million for the same period, indicates an effort to adapt its business model to the evolving market.

GameStop has historically held a dominant position in the physical video game retail market. However, with the rise of digital distribution, its market share has been impacted. The company competes with both physical and online retailers, as well as digital storefronts.

GameStop's primary market is the United States, where it maintains a significant number of retail stores. Its customer base consists mainly of gamers and collectors who value physical game ownership and the in-store experience. The company has reduced its international footprint in recent years.

GameStop's financial performance reflects the challenges and opportunities within the gaming market. Net sales for the fiscal year ended February 3, 2024, were $5.928 billion, a decrease from the previous year. The company reported a net income of $6.3 million, demonstrating efforts to improve financial health.

GameStop has been focusing on diversifying its offerings and enhancing its e-commerce capabilities. These initiatives are aimed at adapting to the evolving preferences of consumers. The company is also expanding its product categories to include collectibles and merchandise.

GameStop's competitive landscape is shaped by the shift towards digital distribution and the rise of online retailers. The company faces challenges in maintaining its market share and adapting its business model. Understanding the GameStop competitive landscape is crucial for assessing its future prospects.

- GameStop's main rivals include major online retailers like Amazon, digital storefronts such as the PlayStation Store and Xbox Store, and other physical retailers.

- The impact of digital distribution on GameStop's challenges in the gaming industry is significant, as it reduces the demand for physical game copies.

- GameStop's brick-and-mortar store strategy is essential for providing an in-store experience, trade-in programs, and customer service.

- GameStop's efforts to enhance its e-commerce capabilities and expand its product categories are part of its strategy to compete effectively, as discussed in this article about GameStop by analyzing its market position.

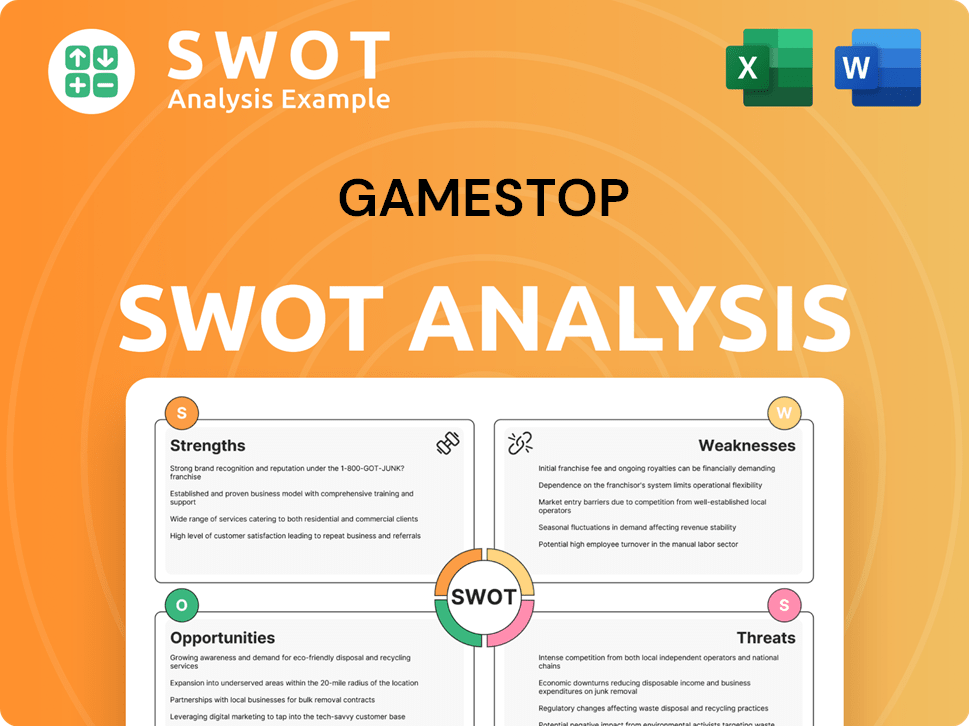

GameStop SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging GameStop?

The GameStop competitive landscape is complex, with a mix of direct and indirect rivals vying for market share in the video game retail and gaming market. The company faces challenges from various sources, including established retailers, digital platforms, and emerging technologies. A thorough GameStop market analysis reveals the need for strategic adaptation to maintain its position in the evolving GameStop industry.

GameStop's main rivals include both traditional retailers and digital distributors. Understanding these competitors is crucial for assessing GameStop's financial performance compared to competitors and its ability to navigate the changing landscape. The company must continuously evaluate its strategies to stay competitive.

Who are GameStop's biggest competitors in 2024? The competitive environment continues to shift. The company must adapt to the changing preferences of consumers.

Direct competitors offer similar products, such as video games, consoles, and accessories. These rivals often compete on price, convenience, and product selection. GameStop's competitive landscape includes both online and brick-and-mortar stores.

Indirect competitors offer alternative ways to access video games, such as digital downloads and subscription services. These competitors often challenge GameStop's brick-and-mortar store strategy. The rise of digital distribution has significantly impacted the industry.

Best Buy is a major direct competitor, offering a wide range of electronics, including video games and consoles. Best Buy's broad product selection and established retail presence make it a formidable competitor. They often compete on price and offer in-store services.

GameStop vs. Amazon gaming is a key battleground, with Amazon leveraging its massive e-commerce platform and logistics network. Amazon offers a vast selection of games, consoles, and accessories, often at competitive prices. Its online presence and delivery capabilities pose a significant challenge.

Sony (PlayStation Store), Microsoft (Xbox Games Store), and Nintendo (Nintendo eShop) are significant indirect competitors. These platforms offer digital versions of games, bypassing physical retail. The shift towards digital downloads challenges GameStop's traditional business model. These platforms have grown in popularity.

Steam (Valve) and Epic Games Store are also key competitors, focusing on PC game sales. They often offer exclusive titles and competitive pricing. These platforms directly compete for digital game sales. They are constantly evolving.

GameStop's challenges in the gaming industry include adapting to the rise of digital distribution, maintaining relevance in a changing market, and competing with larger retailers. The company must innovate to stay competitive. For more information on the company's stakeholders, consider reading the article about Owners & Shareholders of GameStop.

Competitive advantages of GameStop include its established retail presence, pre-owned game business, and loyalty programs. However, the company faces significant challenges. GameStop's strategies to compete with digital downloads involve expanding its e-commerce capabilities and offering exclusive merchandise.

- Enhancing e-commerce: Improving online presence and user experience.

- Expanding merchandise: Offering a wider range of collectibles and accessories.

- Loyalty programs: Retaining customers through rewards and exclusive offers.

- Partnerships and collaborations: Working with game developers and publishers.

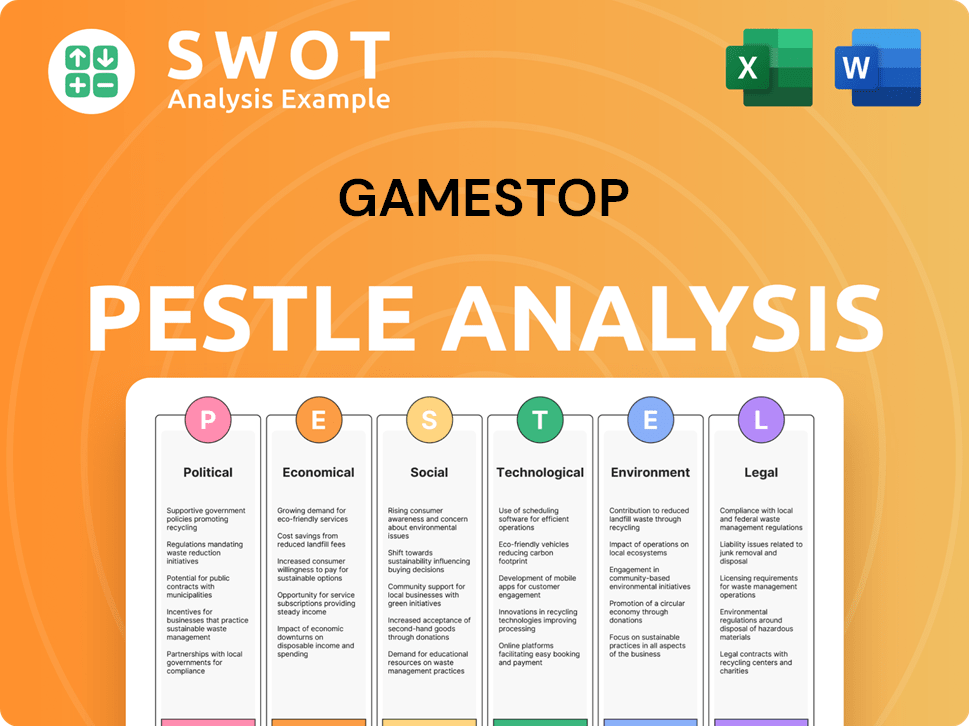

GameStop PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives GameStop a Competitive Edge Over Its Rivals?

Examining the GameStop competitive landscape reveals a company navigating significant industry shifts. Its core strengths, despite challenges, include brand recognition, a unique pre-owned game market, and a physical store presence. These factors have historically provided a competitive edge in the video game retail sector, but the rise of digital distribution and online competitors has reshaped the landscape.

GameStop's ability to adapt and innovate is crucial for its future. The company has been working to diversify its offerings and enhance its e-commerce capabilities. Understanding its competitive advantages and how they stack up against rivals is essential for investors and industry observers alike. A thorough GameStop market analysis is necessary to assess its position.

The company's strategy focuses on leveraging its existing strengths while embracing new opportunities. This includes expanding into PC gaming hardware, collectibles, and apparel. The goal is to transform into a broader destination for gaming enthusiasts and pop culture fans. This evolution is critical for maintaining relevance in the face of digital competition and changing consumer preferences.

GameStop benefits from strong brand recognition among gamers, cultivated over decades. This has fostered customer loyalty, especially among those who prefer physical media or the trade-in model. The company's brand recognition is a key factor in the GameStop competitive landscape, providing a degree of resilience against newer competitors.

The pre-owned game segment is a significant differentiator. It offers consumers a more affordable option and provides higher margins compared to new game sales. The trade-in model creates a circular economy within stores, encouraging repeat visits and customer engagement. This model is difficult for digital-only competitors to replicate, providing a competitive advantage.

GameStop's extensive network of physical stores offers an in-person shopping experience. This includes the ability to browse products, receive immediate gratification, and interact with knowledgeable staff. Stores often serve as community hubs, hosting events and fostering a sense of belonging. The in-store experience supports impulse purchases, which are difficult to replicate online.

The company is diversifying its product offerings beyond games to include PC gaming hardware, collectibles, and apparel. This strategy aims to become a broader destination for pop culture and gaming enthusiasts. This diversification is a key element of its strategy to remain competitive in the evolving gaming market.

GameStop's competitive advantages are rooted in brand recognition, its pre-owned game business, and its physical store network. These factors, combined with strategic diversification, position the company in the video game retail space. However, the company faces challenges from digital distribution and online retailers.

- Brand Recognition: Decades of presence in the gaming community have built strong brand equity.

- Pre-Owned Market: High-margin revenue stream and a circular economy model that encourages repeat business.

- Physical Stores: In-person shopping experience, community hubs, and support for impulse purchases.

- Diversification: Expansion into PC gaming hardware, collectibles, and apparel to broaden appeal.

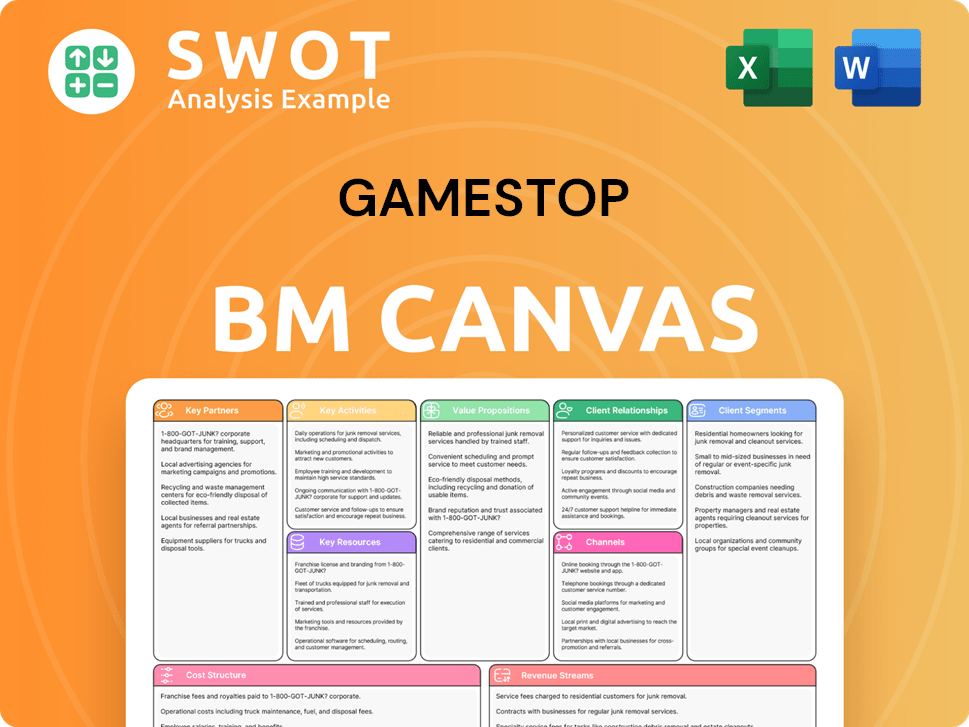

GameStop Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping GameStop’s Competitive Landscape?

The GameStop competitive landscape is significantly influenced by the evolving dynamics of the video game industry. The company faces intense competition from both traditional and digital retailers. Understanding the current market trends and future challenges is crucial for assessing GameStop's position and potential for growth.

GameStop's market analysis reveals a shift towards digital distribution, impacting its core business model. The rise of subscription services and cloud gaming further complicates the competitive environment. The company must adapt to these changes to maintain its relevance and profitability.

The video game industry is experiencing a surge in digital game sales, with consumers increasingly favoring downloads over physical copies. Subscription services like Xbox Game Pass and PlayStation Plus are gaining popularity, offering extensive game libraries for a recurring fee. Cloud gaming is emerging as a potential disruptor, enabling gameplay without the need for powerful hardware.

GameStop faces challenges including declining foot traffic in physical stores and reduced demand for physical game sales. Intense competition from e-commerce giants and digital storefronts poses a threat. Regulatory changes impacting data privacy or digital content ownership could also create difficulties.

GameStop can expand its e-commerce platform and diversify its product offerings to include PC gaming hardware, collectibles, and apparel. Leveraging brand recognition and community aspects to create unique in-store experiences is another opportunity. Strategic partnerships with game developers or hardware manufacturers could open new revenue streams.

GameStop's future likely involves a hybrid model, balancing its retail strengths with a digital presence and a diversified product portfolio. This approach is vital for remaining competitive in a rapidly changing industry. The company's ability to adapt will determine its long-term success.

GameStop's GameStop competitive landscape is complex, requiring a strategic approach to navigate industry shifts. The company must leverage its strengths while addressing weaknesses and capitalizing on opportunities. The goal is to mitigate threats and secure a sustainable position in the market. A detailed look at the GameStop's market share analysis reveals both challenges and potential for growth.

- Strengths: Strong brand recognition, established retail presence, and a loyal customer base.

- Weaknesses: Reliance on physical game sales, declining foot traffic, and high operating costs.

- Opportunities: Expansion into e-commerce, diversification of product offerings, and strategic partnerships.

- Threats: Digital distribution, competition from online retailers, and changing consumer preferences.

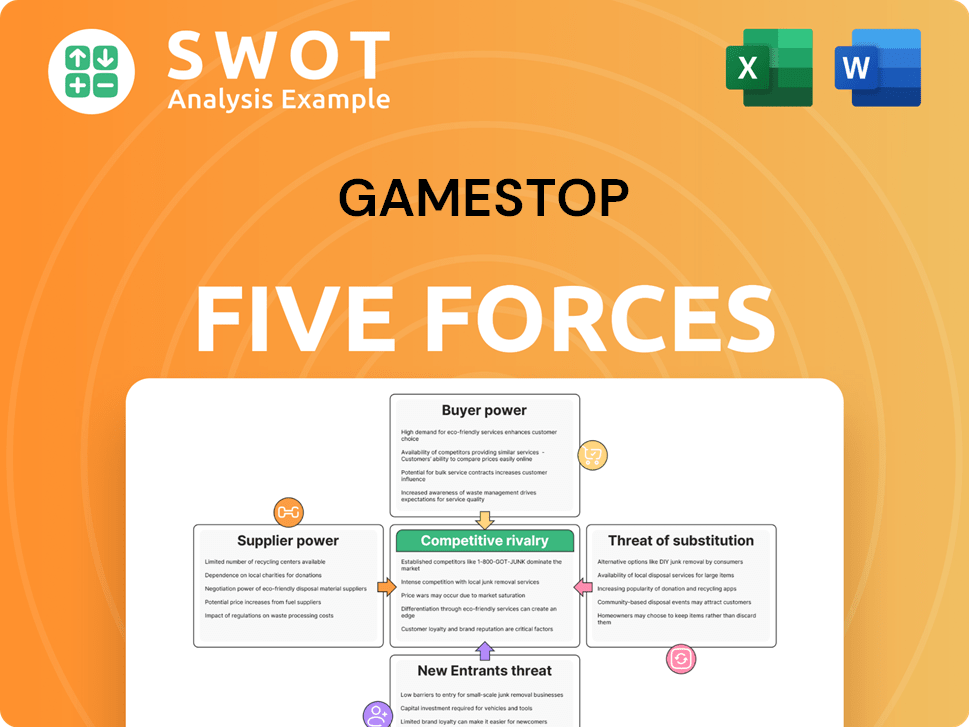

GameStop Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of GameStop Company?

- What is Growth Strategy and Future Prospects of GameStop Company?

- How Does GameStop Company Work?

- What is Sales and Marketing Strategy of GameStop Company?

- What is Brief History of GameStop Company?

- Who Owns GameStop Company?

- What is Customer Demographics and Target Market of GameStop Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.